Beruflich Dokumente

Kultur Dokumente

U66605 561785 458196

Hochgeladen von

Rashesh ShahOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

U66605 561785 458196

Hochgeladen von

Rashesh ShahCopyright:

Verfügbare Formate

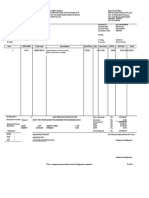

Original for Recipient

TAX - INVOICE

'ATULYAM' F-141

Ist floor, Azad Marg, C-Scheme Jaipur 302001

Ph. : 0141-4233000

E-mail : taxsoft@computaxonline.com

Visit us at: www.computax.in

GSTIN: 08AACCT4199G1Z1

HSN: 997331

CIN NO: U72200RJ2006PTC022284

Bill No.: SOFT/013606 Date : 27-Jan-2018

M/s. Excellent consultancy(u66605)

17 sevasadan Navabazar P.O. Miyagam karjan Distt. Vadodara VADODARA GUJARAT

Place of Supply: GUJARAT 24

GSTIN:Not Provided

S.No. PARTICULARS Qty Rate Amount

1 COMPUGST F.Y. 2018-2019 1 5750.00 5750.00

(As per terms laid down separately)

Update Charges will be charged for : -

CompuGst From Financial Year 2019 - 2020

IGST Tax @ 18.00% 1035.00

Order no. 458196

Rupees in Words

Six Thousand Seven Hundred Eighty Five Only Total 6785.00

Terms & Conditions:

1. Payment is to be made only through AT PAR A/c Payee Cheque/DD in favour of M/s. Taxsoft Marketing For Taxsoft Marketing Pvt. Ltd.

Pvt. Ltd. In case of payment by cheques, order will be executed after encashment of cheque(s).

2. In Case the cheque issued against this order gets BOUNCED. for any reason, Taxsoft will

charge Rs. 250/- cheque return charges from the customer.

3. In case of outstation cheque. bank charges of Rs. 150/- will be charged extra.

4. Software once bill will not be returned or cancelled

5. Commitments of sales executive are not binding on the company. Authorised Signatory

Digitally signed by: Rupesh Kumar Verma

Signing Date: 29/01/2018 05:21:51 PM

Serial No.: 1396945401

Issued by: (n)Code Solutions CA 2014

Das könnte Ihnen auch gefallen

- Disney Pixar Case AnalysisDokument4 SeitenDisney Pixar Case AnalysiskbassignmentNoch keine Bewertungen

- DATUMTOOLS PRIVATE LIMITED Sheet1Dokument1 SeiteDATUMTOOLS PRIVATE LIMITED Sheet1Archi joshi75% (4)

- Job Costing: True / False QuestionsDokument232 SeitenJob Costing: True / False QuestionsElaine GimarinoNoch keine Bewertungen

- Invoice 084979 2000152395 2019 11 07Dokument2 SeitenInvoice 084979 2000152395 2019 11 07Anandha Saravanan BNoch keine Bewertungen

- MGH GroupDokument2 SeitenMGH GroupEzaz Leo67% (3)

- Mcdonald's SCMDokument28 SeitenMcdonald's SCMMaria KerawalaNoch keine Bewertungen

- BUSS 207 Quiz 3 - SolutionDokument3 SeitenBUSS 207 Quiz 3 - Solutiontom dussekNoch keine Bewertungen

- Strategic ReportDokument14 SeitenStrategic ReportNayab MaqsoodNoch keine Bewertungen

- Tax Invoice: Customer Details Just Dial DetailsDokument2 SeitenTax Invoice: Customer Details Just Dial DetailsaashiyanacontractorsNoch keine Bewertungen

- EY Invoice - ORG - IN91MH3M016459Dokument1 SeiteEY Invoice - ORG - IN91MH3M016459AltafNoch keine Bewertungen

- Mangal Industries: InvoiceDokument4 SeitenMangal Industries: InvoicemangalindustriesNoch keine Bewertungen

- FingerprintDokument1 SeiteFingerprintatulkumar72960Noch keine Bewertungen

- Maruti Suzuki India Limited: Standard Draft Purchase Order Msil Gurgaon Plant Page No.: 1 of 1Dokument1 SeiteMaruti Suzuki India Limited: Standard Draft Purchase Order Msil Gurgaon Plant Page No.: 1 of 1Abhilash SinghNoch keine Bewertungen

- MacBook Pro M2 InvoiceDokument1 SeiteMacBook Pro M2 InvoiceAadisons Techno SolutionsNoch keine Bewertungen

- ZEE5 Invoice 07 01 2020Dokument1 SeiteZEE5 Invoice 07 01 2020pavan KumarNoch keine Bewertungen

- CN Sumandeep Vidyapeeth 21-22-20012 TriplicateDokument1 SeiteCN Sumandeep Vidyapeeth 21-22-20012 TriplicateLokeshNoch keine Bewertungen

- Lakshmi Agencies: Tax Invoice (Cash)Dokument2 SeitenLakshmi Agencies: Tax Invoice (Cash)srinivas kandregulaNoch keine Bewertungen

- Narayani Power Solution: M0153601300510727 Monogovind JiiDokument1 SeiteNarayani Power Solution: M0153601300510727 Monogovind JiiAraruna ku ParhiNoch keine Bewertungen

- Supertech Spares &servicesDokument1 SeiteSupertech Spares &servicesSoumilNoch keine Bewertungen

- Tax Invoice: Suman JainDokument1 SeiteTax Invoice: Suman Jainrajeev_snehaNoch keine Bewertungen

- Order FormDokument1 SeiteOrder Formrahulone8Noch keine Bewertungen

- Tax Invoice: Name Address State State Code Description AmountDokument1 SeiteTax Invoice: Name Address State State Code Description AmountArun UpadhyeNoch keine Bewertungen

- Rama Telecom: Billed To: Shipped ToDokument1 SeiteRama Telecom: Billed To: Shipped ToLila DeviNoch keine Bewertungen

- Credit Memo - MH3M300182Dokument1 SeiteCredit Memo - MH3M300182AltafNoch keine Bewertungen

- Tax Invoice: IXI0000011824324 Booking Id: IXITR203349678018Dokument1 SeiteTax Invoice: IXI0000011824324 Booking Id: IXITR203349678018charan kumarNoch keine Bewertungen

- Original For Recipient Tax Invoice: (Deepak Das)Dokument1 SeiteOriginal For Recipient Tax Invoice: (Deepak Das)Deepak DasNoch keine Bewertungen

- Gargi 4Dokument1 SeiteGargi 4kishandadhich05Noch keine Bewertungen

- Punjab State Power Corporation Limited (PSPCL) 1070Dokument1 SeitePunjab State Power Corporation Limited (PSPCL) 1070Sukhraj BatthNoch keine Bewertungen

- Invoice IXITRN4712391663216796Dokument1 SeiteInvoice IXITRN4712391663216796rahul swainNoch keine Bewertungen

- 37 - Submission of Invoice - RASHMI ISPAT LIMITEDDokument1 Seite37 - Submission of Invoice - RASHMI ISPAT LIMITEDTilak SenapatiNoch keine Bewertungen

- 18000869Dokument2 Seiten18000869Subramanyam ChodagamNoch keine Bewertungen

- Tax Inv No 004 KimplasDokument1 SeiteTax Inv No 004 KimplasserviceNoch keine Bewertungen

- Tax Invoice: Address: B-315, Shree Nand Dham, Sector-11, Plot.59, CBD Belapur, Navi Mumbai - 400614, MaharashtraDokument1 SeiteTax Invoice: Address: B-315, Shree Nand Dham, Sector-11, Plot.59, CBD Belapur, Navi Mumbai - 400614, MaharashtraSHANTANU PATHAKNoch keine Bewertungen

- MSIL - InvoiceDokument1 SeiteMSIL - Invoicevineet.tpsNoch keine Bewertungen

- Star Health ReceiptDokument2 SeitenStar Health ReceiptsgmintoogargNoch keine Bewertungen

- Invoice: Click Here To Download Seller InvoiceDokument2 SeitenInvoice: Click Here To Download Seller InvoicearyandjNoch keine Bewertungen

- Tax Invoice: Description of Services HSN Code Taxable Amount Igst Rate AmountDokument2 SeitenTax Invoice: Description of Services HSN Code Taxable Amount Igst Rate AmountSunil PatelNoch keine Bewertungen

- Invoice IXITRS185875952789718Dokument1 SeiteInvoice IXITRS185875952789718PatriotNoch keine Bewertungen

- RealmeDokument1 SeiteRealmePíyûshGuptaNoch keine Bewertungen

- Testing Instruments Manufacturing Co. Pvt. LTD.: Tim CDokument4 SeitenTesting Instruments Manufacturing Co. Pvt. LTD.: Tim Cabhjt629Noch keine Bewertungen

- Gargi 2Dokument1 SeiteGargi 2kishandadhich05Noch keine Bewertungen

- SM 13216inrDokument1 SeiteSM 13216inrImran SayeedNoch keine Bewertungen

- Oasis Renewables and Water Treatment LTD: Tax InvoiceDokument1 SeiteOasis Renewables and Water Treatment LTD: Tax InvoicejalkunjNoch keine Bewertungen

- HPVCZ683Dokument1 SeiteHPVCZ683Ankit SinghNoch keine Bewertungen

- True ValueDokument1 SeiteTrue ValueTonya SmithNoch keine Bewertungen

- SOA009005567079Dokument2 SeitenSOA009005567079Jeevan NJNoch keine Bewertungen

- Get Invoice Print 74Dokument2 SeitenGet Invoice Print 74jepsi007Noch keine Bewertungen

- EY Invoice - DUP - IN91MH3M015192Dokument1 SeiteEY Invoice - DUP - IN91MH3M015192AltafNoch keine Bewertungen

- Credit Memo - MH3M300858Dokument1 SeiteCredit Memo - MH3M300858AltafNoch keine Bewertungen

- InvoiceDokument1 SeiteInvoiceRamalingeswaraRao AmpalamNoch keine Bewertungen

- Bill 156623CS 12Dokument2 SeitenBill 156623CS 12chakri0019Noch keine Bewertungen

- RSs4RzhtcEw0akJJNC9EZHlPTmp4QT09 InvoiceDokument2 SeitenRSs4RzhtcEw0akJJNC9EZHlPTmp4QT09 InvoiceRavi Kant RohillaNoch keine Bewertungen

- Pci 22-23Dokument2 SeitenPci 22-23Wall Street Forex (WSFx)Noch keine Bewertungen

- Invoice Books 1Dokument1 SeiteInvoice Books 1Rizvan MasroorNoch keine Bewertungen

- IM BillDokument1 SeiteIM BillDeepakNoch keine Bewertungen

- Maa Durga Industries: C-1 Chandpole Anaj MandiDokument1 SeiteMaa Durga Industries: C-1 Chandpole Anaj Mandiragavaga453Noch keine Bewertungen

- NPA HC119i - QuotationDokument1 SeiteNPA HC119i - QuotationvikasNoch keine Bewertungen

- PI - Urbanscape PDFDokument1 SeitePI - Urbanscape PDFSanrachna ConsultantsNoch keine Bewertungen

- Tax Certificate: R MargabandhuDokument2 SeitenTax Certificate: R MargabandhuNaveen YadavNoch keine Bewertungen

- Samsung Invoice 11105923647-7144234991-27W6I0014459Dokument1 SeiteSamsung Invoice 11105923647-7144234991-27W6I0014459Abhinav ShrivastavaNoch keine Bewertungen

- Terms and Conditions: Atria Convergence Technologies Limited, Due Date: 10/ 05/2018Dokument2 SeitenTerms and Conditions: Atria Convergence Technologies Limited, Due Date: 10/ 05/2018Hima VeeramachaneniNoch keine Bewertungen

- Shankara Building Products Ltd-Mumbai Registered Office at Mumbai GSTIN Number: 27AACCS9670B1ZADokument1 SeiteShankara Building Products Ltd-Mumbai Registered Office at Mumbai GSTIN Number: 27AACCS9670B1ZAfernandes_j1Noch keine Bewertungen

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionVon EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNoch keine Bewertungen

- Taxmann Companies Act 2013: Taxmann Companies Act 2013Von EverandTaxmann Companies Act 2013: Taxmann Companies Act 2013Bewertung: 4.5 von 5 Sternen4.5/5 (7)

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionVon EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNoch keine Bewertungen

- City of Highland Park 2020 Affordable Housing PlanDokument6 SeitenCity of Highland Park 2020 Affordable Housing PlanJonah MeadowsNoch keine Bewertungen

- Re-Engineering Agricultural Education For Sustainable Development in NigeriaDokument5 SeitenRe-Engineering Agricultural Education For Sustainable Development in NigeriaPremier PublishersNoch keine Bewertungen

- DCF and Pensions The Footnotes AnalystDokument10 SeitenDCF and Pensions The Footnotes Analystmichael odiemboNoch keine Bewertungen

- Job Satisfaction and MoraleDokument21 SeitenJob Satisfaction and MoraleChannpreet ChanniNoch keine Bewertungen

- Sohail Copied Black Book ProjectDokument84 SeitenSohail Copied Black Book ProjectSohail Shaikh64% (14)

- Starting A Business in Germany For International StudentsDokument11 SeitenStarting A Business in Germany For International StudentsJohn AcidNoch keine Bewertungen

- Revised Corporation CodeDokument5 SeitenRevised Corporation CodekeithNoch keine Bewertungen

- Cocktail ReceptionDokument2 SeitenCocktail ReceptionSunlight FoundationNoch keine Bewertungen

- E-Procurement: MBA 7601 - Managing E-BusinessDokument31 SeitenE-Procurement: MBA 7601 - Managing E-BusinessPrateek Parkash100% (1)

- Capital and Return On CapitalDokument38 SeitenCapital and Return On CapitalThái NguyễnNoch keine Bewertungen

- Beyond Borders Global Biotechnology Report 2011Dokument104 SeitenBeyond Borders Global Biotechnology Report 2011asri.isbahaniNoch keine Bewertungen

- Conceptual Framework For Marketing Strategy in The Context of Small Business: A ReviewDokument13 SeitenConceptual Framework For Marketing Strategy in The Context of Small Business: A ReviewJerald MaglantayNoch keine Bewertungen

- Lecture 31 - 32 - 33 - 34 - Oligopoly MarketDokument8 SeitenLecture 31 - 32 - 33 - 34 - Oligopoly MarketGaurav AgrawalNoch keine Bewertungen

- SUMP Brochure FinalDokument12 SeitenSUMP Brochure FinalindraandikapNoch keine Bewertungen

- Working Capital Management at BEMLDokument20 SeitenWorking Capital Management at BEMLadharav malikNoch keine Bewertungen

- Income DeterminationDokument82 SeitenIncome DeterminationPaulo BatholomayoNoch keine Bewertungen

- Slides On Bangladesh Labor Standards.Dokument16 SeitenSlides On Bangladesh Labor Standards.Md. Jahid Hasan ShawonNoch keine Bewertungen

- Wedge Worksheet: Strategy Sector (Cost Challenges 1 2 3 4 5 6 7 8 TotalsDokument1 SeiteWedge Worksheet: Strategy Sector (Cost Challenges 1 2 3 4 5 6 7 8 Totals许凉发Noch keine Bewertungen

- iSave-IPruMF FAQsDokument6 SeiteniSave-IPruMF FAQsMayur KhichiNoch keine Bewertungen

- Inventory MCQDokument6 SeitenInventory MCQsan0z100% (2)

- The Fundamental Concepts of Macroeconomics: Erandathie PathirajaDokument69 SeitenThe Fundamental Concepts of Macroeconomics: Erandathie PathirajaDK White LionNoch keine Bewertungen

- Gaur Yamuna City - Runwayhub and SuitsDokument66 SeitenGaur Yamuna City - Runwayhub and SuitsMalkeet SinghNoch keine Bewertungen

- Munir Ahmed Nazeer Ahmed Khalid Town Manga: Web Generated BillDokument1 SeiteMunir Ahmed Nazeer Ahmed Khalid Town Manga: Web Generated BillAzamNoch keine Bewertungen

- Type YZ - FLO - 251123Dokument5 SeitenType YZ - FLO - 251123Oky Arnol SunjayaNoch keine Bewertungen