Beruflich Dokumente

Kultur Dokumente

SAP FICO Curriculum

Hochgeladen von

Mahesh Kamdey0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

169 Ansichten3 SeitenSAP FICO Curriculum

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenSAP FICO Curriculum

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

169 Ansichten3 SeitenSAP FICO Curriculum

Hochgeladen von

Mahesh KamdeySAP FICO Curriculum

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 3

SAP FI/CO Contents

INTRODUCTION OF ERP & SAP Vendor Line Item Display

Concept of ERP & ERP Software Partial & Residual Payment

Concept of SAP & SAP Software Clearing Vendor Invoice

Overview of other Modules within SAP Create GL Recon Account for Vendor

Career Prospects in SAP Create Vendor Master

Create No. Range For Vendor

ASAP METHODOLOGY & SAP LANDSCAPE Post Purchase Invoice

ASAP Methodology Define Tolerance for Invoice

RDS Methodology (New) Define Tolerance Range for Payment

SAP Landscapes Vendor Credit Memo

BASIC SETTINGS IN SAP

SAP Logon ACCOUNTS RECEIVABLE CONFIGURATION

SAP GUI Define Account Group for Customer

SAP Navigation Define No. Range for Customer Group

SAP Easy Access & IMG Screen Assign No. Range to Customer Group

Create GL Recon Account for Customer

GENERAL LEDGER CONFIGURATION Define Tolerance for Invoice

Chart of accounts Define Tolerance Range for Payment

Assign CoA to CC Create Customer Master

Define Posting Period Variant Create No. Range for Customer

Assign PPV to CC Post Sales Invoice

Define Company Post for Incoming Payment

Define Company code Display Customer Balance

Assign Company to Company code Customer Line Item Display

Maintain Posting Period Variant Partial & Residual Payment

Define Fiscal Year Variant

Assign FYV to CC

Define Field Status Variant BANK RECONCILIATION SETTINGS

Assign FSV to CC Define Bank Master

Define Tolerance Group Define House Bank

Define GL Account

General Posting CASH JOURNAL CONFIGURATION

Document Display

Document No. Range for Cash Journal

GL Balance

Define Cash Journal

Line Item Display

Define Cash Transaction (Expenses,

Define Account Group for G/L

Revenue, Cash from Bank and Cash to

Define Retain Earning Account

Bank)Post Cash Journal

Define Document No. Range

Overview of document structure (Document

AUTOMATIC PAYMENT PROGRAM

Type, Posting Key, Posting date, Document

date, Entry date and Baseline date. CONFIGURATION

Paying Company Code

ACCOUNTS PAYABLE CONFIGURATION Payment Method in Country

Define Account Group for Vendor Payment Method in Company Code

Define No. Range for Vendor Group Parameters Settings

Assign No. Range to Vendor Group Payment Proposal

Post for Outgoing Payment Payment Run

Display Vendor Balance Ranking Order etc..

Partial and Residual Payments

ASSETS ACCOUNTING CONFIGURATION EXTENDED WITHHOLDING TAX

CONFIGURATION

Copy Chart of Dep./Dep Area Check withholding tax country (in Basic

Description of COD Setting)

Delete/Copy Depreciation Area Withholding Tax Key (in Basic Setting)

Assign Input Tax indicator for non Define Reason for Exemption (in Basic

taxable acquisition Setting)

assign Chart of Dep to Company Code Check Recipient Type (in Basic Setting)

Specify account determination Define Withholding Tax Codes (in

Assign GL A/c for acquisitions and Calculation => withholding tax code)

retirements Define Certificate No. Range (Generic

Assets Acquisition withholding tax reporting=>print out)

Assets Retirement Maintain company code setting

Assets Explorer (Logistic=>Tax on good

Depreciation Key movements=>India=>Basic Setting)

Depreciation Calculation Assign Withholding Tax type to company

Create Screen layout rules code (Company code)

Define no. range interval Activate Extended Withholding Tax

Define Assets class (Company Code)

Define Assets Master Define Accounts for withholding tax to be

Post Asset Acquisition paid over (Posting=>Accounts for

Post Asset Retirement withholding tax)

Post Depreciation Define Withholding Tax type for Payment

Asset Explorer and Fixed assets Register (in Calculation => withholding tax type)

Define Rounding rule for Tax type (in

Calculation => withholding tax type)

AUTOMATIC DUNING CONFIGURATION & Define business places (in Basic

CORRESSPONDENCE Setting=>India)

Dunning Level Define Withholding Tax type for Invoice (in

Dunning Charges Calculation => withholding tax type)

Dunning Text

Dunning Minimum Amount Settings TAX ON SALE & PURCHASE

Dunning Parameters Define/ Assign Tax procedure to Country

Dunning Schedule / Print Dunning Create Input & Output tax Code

Letters Assign Tax Codes to company Code

DOWN PAYMENT FOR VENDOR &

CUSTOMER INTEGRATION WITH OTHER MODULES

GL ACCOUNT Materials management (Purchase cycle)

SP GL CONFIG Materials management (Production cycle)

ADVANCE TO VENDOR Sales and distribution (Sales cycle)

VENDOR INVOICE Human resource

CLEAR ADVANCE AGAINST VENDOR BASIS, etc

INVOICE Understanding of Procure to pay and Order

ADVANCE FROM CUSTOMER to cash cycles

CUSTOMER INVOICE

CLEAR ADVANCE AGAINST CONTROLLING

CUSTOMER INVOICE Cost center accounting

Profit center accounting

NEW GENERAL LEDGER COPA

Parallel Ledger Product costing

Document Splitting

Closing cockpit

COUNTRY INDIA VERSION

OTHER MISCELLANEOUS TOPICS

Financial Statement Version

New General Ledger (Parallel Ledger and Document Splitting)

Park Document, Hold Document

Month end and year end activities

Financial Tables and reports

Overview of ACL tool.

FULL LIFE CYCLE IMPLEMENTATION

Das könnte Ihnen auch gefallen

- Define The Costing Run NameDokument20 SeitenDefine The Costing Run NameMahesh KamdeyNoch keine Bewertungen

- General Ledger (GL) Account/ Commitment ItemDokument3 SeitenGeneral Ledger (GL) Account/ Commitment ItemMahesh KamdeyNoch keine Bewertungen

- Change Entries in SE16 in Debug ModeDokument2 SeitenChange Entries in SE16 in Debug ModeMahesh KamdeyNoch keine Bewertungen

- MM Reopen Posting PeriodDokument1 SeiteMM Reopen Posting PeriodMahesh KamdeyNoch keine Bewertungen

- Sap CinDokument68 SeitenSap CinManu TalwarNoch keine Bewertungen

- User Parameters For SAPDokument3 SeitenUser Parameters For SAPgurushreya27Noch keine Bewertungen

- CK40NDokument37 SeitenCK40NMahesh Kamdey100% (2)

- List of Companies That Use Sap/Erp in India: Annexure IDokument12 SeitenList of Companies That Use Sap/Erp in India: Annexure IShiven0% (1)

- CO Stepbystep Config PDFDokument251 SeitenCO Stepbystep Config PDFMahesh KamdeyNoch keine Bewertungen

- Creating Transaction and Screen VariantsDokument16 SeitenCreating Transaction and Screen VariantsChanagorn SombatsutinNoch keine Bewertungen

- Creating Transaction and Screen VariantsDokument16 SeitenCreating Transaction and Screen VariantsChanagorn SombatsutinNoch keine Bewertungen

- MM ConfigurationDokument50 SeitenMM Configurationgsamsr100% (3)

- SAP SD CurriculumDokument2 SeitenSAP SD CurriculumMahesh KamdeyNoch keine Bewertungen

- SAP PP Training Material: ConfidentialDokument13 SeitenSAP PP Training Material: ConfidentialMahesh Kamdey100% (1)

- GST Hsn-SacDokument535 SeitenGST Hsn-SacMahesh Kamdey100% (1)

- SAP MM Interview Questions Answers and ExplanationsDokument128 SeitenSAP MM Interview Questions Answers and ExplanationsAbhinav96% (28)

- Sample Sap PP Business BlueprintDokument36 SeitenSample Sap PP Business Blueprintsdhiraj173% (11)

- Sap PP 01 Organizational Structure Overview PDFDokument52 SeitenSap PP 01 Organizational Structure Overview PDFMahesh KamdeyNoch keine Bewertungen

- Beginners Guide To Variant Configuration in Sap PPDokument59 SeitenBeginners Guide To Variant Configuration in Sap PPMahesh KamdeyNoch keine Bewertungen

- SAP MM Interview Questions Answers and ExplanationsDokument128 SeitenSAP MM Interview Questions Answers and ExplanationsAbhinav96% (28)

- BDC & LSMW NewDokument132 SeitenBDC & LSMW NewVinodnarutoNoch keine Bewertungen

- CK40NDokument37 SeitenCK40NMahesh Kamdey100% (2)

- Catagory Piclist Pa QDokument18 SeitenCatagory Piclist Pa QMahesh KamdeyNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- PP On Fuel StationDokument20 SeitenPP On Fuel StationGurraacha Abbayyaa100% (2)

- Tax Based LeasingDokument6 SeitenTax Based LeasingKofikoduah100% (1)

- Worldwide Capital and Fixed Assets Guide 2016Dokument152 SeitenWorldwide Capital and Fixed Assets Guide 2016Victor TucoNoch keine Bewertungen

- Cash Flow Statements6Dokument28 SeitenCash Flow Statements6kimuli FreddieNoch keine Bewertungen

- Tutorial Questions: Topic 1: Introduction To AccountingDokument28 SeitenTutorial Questions: Topic 1: Introduction To AccountingBernard OwusuNoch keine Bewertungen

- FAUE InterpretationDokument4 SeitenFAUE InterpretationAnkit PatidarNoch keine Bewertungen

- Quiz 3Dokument5 SeitenQuiz 3Iryna VerbovaNoch keine Bewertungen

- New ExcelDokument83 SeitenNew Excelherlina sariNoch keine Bewertungen

- Unadjusted Trial Balance Adjustments Account Titles Debit Credit DebitDokument6 SeitenUnadjusted Trial Balance Adjustments Account Titles Debit Credit DebitAllen CarlNoch keine Bewertungen

- Accountancy Model Paper-2-1Dokument9 SeitenAccountancy Model Paper-2-1Hashim SethNoch keine Bewertungen

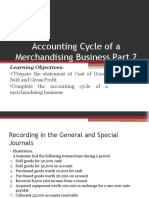

- Accounting Cycle of A Merchandising Business Part 2Dokument7 SeitenAccounting Cycle of A Merchandising Business Part 2Amie Jane MirandaNoch keine Bewertungen

- FM FormulasDokument24 SeitenFM FormulasMd. Nafiz ShahrierNoch keine Bewertungen

- TB Chapter02Dokument54 SeitenTB Chapter02Dan Andrei BongoNoch keine Bewertungen

- The Institute of Chartered Accountants of Nepal: Suggested Answers of Advanced AccountingDokument97 SeitenThe Institute of Chartered Accountants of Nepal: Suggested Answers of Advanced AccountingSujit DasNoch keine Bewertungen

- Accounting 101 Monopoly Game Practice Set Your Name CompanyDokument10 SeitenAccounting 101 Monopoly Game Practice Set Your Name CompanyjhouvanNoch keine Bewertungen

- Cash Flow EstimationDokument35 SeitenCash Flow EstimationAtheer Al-AnsariNoch keine Bewertungen

- Camping Facility: Profile No.: 09 NIC Code: 55200Dokument9 SeitenCamping Facility: Profile No.: 09 NIC Code: 55200AmitNoch keine Bewertungen

- HVAC Life Cycle CostingDokument18 SeitenHVAC Life Cycle CostingmajortayNoch keine Bewertungen

- Accounting Paper 2 Past Paper Practice QuestionsDokument16 SeitenAccounting Paper 2 Past Paper Practice QuestionsOmar BilalNoch keine Bewertungen

- So Assets Should Be Shown in The SOFP As 70,000$Dokument3 SeitenSo Assets Should Be Shown in The SOFP As 70,000$Abdullah Al Amin MubinNoch keine Bewertungen

- Module in Income Taxation by Jewelyn C. Espares-CioconDokument33 SeitenModule in Income Taxation by Jewelyn C. Espares-CioconmarkbagzNoch keine Bewertungen

- Depreciation - Worksheet - 3rd - May - 2021Dokument14 SeitenDepreciation - Worksheet - 3rd - May - 2021ValynNoch keine Bewertungen

- SAP Business Process FIDokument107 SeitenSAP Business Process FIsaithiru780% (1)

- Plant Assets: Created by Ina IndrianaDokument23 SeitenPlant Assets: Created by Ina IndrianadewiestiNoch keine Bewertungen

- Quiz 5Dokument7 SeitenQuiz 5Arjay CarolinoNoch keine Bewertungen

- Case1 Big Bull CapitalDokument75 SeitenCase1 Big Bull CapitalSakshi SharmaNoch keine Bewertungen

- Quiz Chapter 18Dokument5 SeitenQuiz Chapter 18Steve Smith FinanceNoch keine Bewertungen

- Making Investment Decisions With The NPV RuleDokument24 SeitenMaking Investment Decisions With The NPV RuleSebine MemmedliNoch keine Bewertungen

- GI IndexDokument12 SeitenGI IndexgeoanburajaNoch keine Bewertungen

- Problems & Solutions - RNSDokument27 SeitenProblems & Solutions - RNSSiddhant AggarwalNoch keine Bewertungen