Beruflich Dokumente

Kultur Dokumente

Banks

Hochgeladen von

Madhukar ShyamCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Banks

Hochgeladen von

Madhukar ShyamCopyright:

Verfügbare Formate

Banks play a very useful and dynamic role in the economic life of every modern state.

It is

one of the many institutions that impinges on the economy and affect its performance.

Economists have expressed a variety of opinions on the effectiveness of the banking systems

in promoting or facilitating economic development. As an economic institution, the bank is

expected to be more directly and more positively related to the performance of the economy

than most non-economic institutions. Banks are considered to be the nerve centre of

economies and finance of a nation and the barometer of its economic perspective. They are

not merely dealers in money but are in fact dealers in development.

Banks are important agencies for the generation of savings of the community. They are also

the main agents of credit. They divert and employ the funds to make possible fuller utilization

of the resources of a nation. They transfer funds from regions where it is available in plenty

to where it can be efficiently utilized: the distribution of funds between regions pave the way

for the balanced development of the different regions. They are thus catalytic agents that

create opportunities for the development of the resources to speed up the tempo of economic

development.

The world of banking has assumed a new dimension at dawn of the 21 st century with the

advent of tech banking, thereby lending the industry a stamp of universality. In general,

banking may be classified as retail and corporate banking. Retail banking, which is designed

to meet the requirement of individual customers and encourage their savings, includes

payment of utility bills, consumer loans, credit cards, checking account and the like.

Corporate banking, on the other hand, caters to the need of corporate customers like bills

discounting, opening letters of credit, managing cash, etc. Metamorphic changes took place in

the Indian financial system during the eighties and nineties consequent upon deregulation and

liberalization of economic policies of the government. India began shaping up its economy

and earmarked ambitious plan for economic growth. Consequently, a sea change in money

and capital markets took place. Application of marketing concept in the banking sector was

introduced to enhance the customer satisfaction the policy of privatization of banking

services aims at encouraging the competition in banking sector and introduction of financial

services. Consequently, services such as Demat, Internet banking, Portfolio Management,

Venture capital, etc, came into existence to cater to the needs of public. An important agenda

for every banker today is greater operational efficiency and customer satisfaction.

Das könnte Ihnen auch gefallen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- New Installation Procedures - 2Dokument156 SeitenNew Installation Procedures - 2w00kkk100% (2)

- AWC SDPWS2015 Commentary PrintableDokument52 SeitenAWC SDPWS2015 Commentary PrintableTerry TriestNoch keine Bewertungen

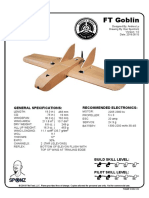

- FT Goblin Full SizeDokument7 SeitenFT Goblin Full SizeDeakon Frost100% (1)

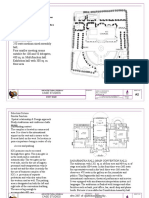

- International Convention Center, BanesworDokument18 SeitenInternational Convention Center, BanesworSreeniketh ChikuNoch keine Bewertungen

- ARMOR Winter-Spring 2018 EditionDokument84 SeitenARMOR Winter-Spring 2018 Editionmai100Noch keine Bewertungen

- C79 Service Kit and Parts List GuideDokument32 SeitenC79 Service Kit and Parts List Guiderobert100% (2)

- WelfareDokument1 SeiteWelfareMadhukar ShyamNoch keine Bewertungen

- The Effective Functioning of An OrganizationDokument1 SeiteThe Effective Functioning of An OrganizationMadhukar ShyamNoch keine Bewertungen

- Transport SectorDokument1 SeiteTransport SectorMadhukar ShyamNoch keine Bewertungen

- Human Resource ManagementDokument1 SeiteHuman Resource ManagementMadhukar ShyamNoch keine Bewertungen

- ResearchDokument1 SeiteResearchMadhukar ShyamNoch keine Bewertungen

- Effect of Globalization On IndiaDokument1 SeiteEffect of Globalization On IndiaMadhukar ShyamNoch keine Bewertungen

- From The Genesis of Civilization On EarthDokument1 SeiteFrom The Genesis of Civilization On EarthMadhukar ShyamNoch keine Bewertungen

- Human Beings Have Always Been CreativeDokument1 SeiteHuman Beings Have Always Been CreativeMadhukar ShyamNoch keine Bewertungen

- Ballarpur Industries LTD.: Paper Industry OverviewDokument3 SeitenBallarpur Industries LTD.: Paper Industry OverviewMadhukar ShyamNoch keine Bewertungen

- Pig PDFDokument74 SeitenPig PDFNasron NasirNoch keine Bewertungen

- Tata Group's Global Expansion and Business StrategiesDokument23 SeitenTata Group's Global Expansion and Business Strategiesvgl tamizhNoch keine Bewertungen

- Ralf Behrens: About The ArtistDokument3 SeitenRalf Behrens: About The ArtistStavros DemosthenousNoch keine Bewertungen

- Com 0991Dokument362 SeitenCom 0991Facer DancerNoch keine Bewertungen

- Server LogDokument5 SeitenServer LogVlad CiubotariuNoch keine Bewertungen

- UKIERI Result Announcement-1Dokument2 SeitenUKIERI Result Announcement-1kozhiiiNoch keine Bewertungen

- Cars Should Be BannedDokument3 SeitenCars Should Be BannedIrwanNoch keine Bewertungen

- Emperger's pioneering composite columnsDokument11 SeitenEmperger's pioneering composite columnsDishant PrajapatiNoch keine Bewertungen

- Piping ForemanDokument3 SeitenPiping ForemanManoj MissileNoch keine Bewertungen

- Advanced Real-Time Systems ARTIST Project IST-2001-34820 BMW 2004Dokument372 SeitenAdvanced Real-Time Systems ARTIST Project IST-2001-34820 BMW 2004كورسات هندسيةNoch keine Bewertungen

- Royalty-Free License AgreementDokument4 SeitenRoyalty-Free License AgreementListia TriasNoch keine Bewertungen

- Department of Labor: kwc25 (Rev-01-05)Dokument24 SeitenDepartment of Labor: kwc25 (Rev-01-05)USA_DepartmentOfLaborNoch keine Bewertungen

- KDL 23S2000Dokument82 SeitenKDL 23S2000Carlos SeguraNoch keine Bewertungen

- Lister LRM & SRM 1-2-3 Manual and Parts List - Lister - Canal WorldDokument4 SeitenLister LRM & SRM 1-2-3 Manual and Parts List - Lister - Canal Worldcountry boyNoch keine Bewertungen

- SE Myth of SoftwareDokument3 SeitenSE Myth of SoftwarePrakash PaudelNoch keine Bewertungen

- iec-60896-112002-8582Dokument3 Seiteniec-60896-112002-8582tamjid.kabir89Noch keine Bewertungen

- Micromaster 430: 7.5 KW - 250 KWDokument118 SeitenMicromaster 430: 7.5 KW - 250 KWAyman ElotaifyNoch keine Bewertungen

- Resume Ajeet KumarDokument2 SeitenResume Ajeet KumarEr Suraj KumarNoch keine Bewertungen

- Gerhard Budin PublicationsDokument11 SeitenGerhard Budin Publicationshnbc010Noch keine Bewertungen

- ADSLADSLADSLDokument83 SeitenADSLADSLADSLKrishnan Unni GNoch keine Bewertungen

- Las Q1Dokument9 SeitenLas Q1Gaux SkjsjaNoch keine Bewertungen

- Credentials List with Multiple Usernames, Passwords and Expiration DatesDokument1 SeiteCredentials List with Multiple Usernames, Passwords and Expiration DatesJOHN VEGANoch keine Bewertungen

- CCS PDFDokument2 SeitenCCS PDFАндрей НадточийNoch keine Bewertungen

- 3.4 Spending, Saving and Borrowing: Igcse /O Level EconomicsDokument9 Seiten3.4 Spending, Saving and Borrowing: Igcse /O Level EconomicsRingle JobNoch keine Bewertungen