Beruflich Dokumente

Kultur Dokumente

2017 Statement of Taxes

Hochgeladen von

JohnnyLarsonOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

2017 Statement of Taxes

Hochgeladen von

JohnnyLarsonCopyright:

Verfügbare Formate

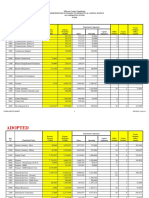

STATEMENT of TAXES & SUMMARY OF ASSESSMENT ROLL for Josephine County, Oregon

This summary is designed to assist you in understanding the property tax assessment in our county. The records and services of

Total assessed value of taxable property ASSESSMENT DATE

our office are open to you, the public, and you are encouraged to discuss your assessment questions or concerns with staff

$7,527,274,297 members. January 1, 2017

The Assessor values your property through methods prescribed by state laws and regulations. The Assessor does not determine EFFECTIVE LIEN DATE

Total taxes and assessments imposed in county the taxing districts your property may be in nor does the Assessor control the amount of money your taxing districts require. July 1, 2017

$78,947,073.31 Constance L. Roach, FISCAL YEAR ENDING

Josephine County Assessor June 30, 2018

October 6, 2017

2017-18 ASSESSED VALUES, TAX RATES, TAXES & ASSESSMENTS BY DISTRICT

Amount Extended Net of Amount to Urban Renewal

Permanent Local Total Permanent Total Amount M5 Compression Add'l Taxes Amount to be

District Assessed Value Rate Option Bonds Tax Rate Rate Local Option Bonds to be Raised Loss & Penalties Received

Josephine County 7,527,274,297 0.5867 1.0100 0.1405 1.7372 4,382,535.65 7,602,548.04 1,049,707.32 13,034,769.51 (10.75) 124,917.95 13,159,698.21

City of Grants Pass 3,151,138,925 4.1335 1.7900 0.3827 6.3062 12,787,323.64 5,640,539.95 1,205,941.45 19,633,787.30 (8.87) 24,229.47 19,658,025.64

City of Cave Junction 134,310,642 1.8959 1.8959 254,638.83 0.00 0.00 254,638.83 0.00 91.23 254,730.06

Three Rivers School Dist 4,243,449,618 3.7262 0.5252 4.2514 15,806,569.61 0.00 2,227,904.80 18,034,474.41 0.00 147,122.12 18,181,596.53

Grants Pass School Dist #7 3,283,824,679 4.5248 4.5248 14,604,722.45 0.00 0.00 14,255,029.77 (174,846.34) 12,350.60 14,442,226.71

Rogue Community College 7,527,274,297 0.5128 0.0555 0.5683 3,830,684.07 0.00 417,765.89 4,208,743.86 (19,853.05) 21,207.70 4,249,804.61

Southern Oregon ESD 7,527,274,297 0.3524 0.3524 2,632,446.32 0.00 0.00 2,605,160.96 (13,642.68) 13,148.38 2,631,952.02

Applegate RFPD #9 65,449,947 1.6787 0.9200 2.5987 109,870.86 60,214.02 0.00 170,084.88 0.00 576.40 170,661.28

Illinois Valley RFPD #1 637,726,972 1.8701 0.5000 0.2256 2.5957 1,192,613.70 318,877.95 143,871.36 1,655,358.09 (2.46) 46,387.80 1,701,748.35

Williams RFPD 182,726,031 1.0552 0.6500 1.7052 192,812.52 118,771.98 0.00 311,584.50 0.00 938.98 312,523.48

Wolf Creek RFPD 36,080,279 2.1865 0.5900 2.7765 78,889.57 21,287.31 0.00 100,174.76 (1.06) 68.02 100,243.84

Jos Co 4H/Ext Service 7,527,274,297 0.0459 0.0459 342,984.28 0.00 0.00 342,984.16 (0.06) 1,712.69 344,696.91

Kerby Water District 13,675,277 - 1.8281 1.8281 0.00 0.00 24,999.86 24,999.86 0.00 174.13 25,173.99

Josephine Comm. Library Dist 3,535,341,141 0.3900 0.3900 1,356,410.67 0.00 0.00 1,356,410.01 (0.33) 1,826.05 1,358,236.39

Grants Pass Urban Renewal** ** 0.00 0.00 0.00 613,934.68 (0.11) - 613,934.79

**Urban Renewal division of tax rate determined by formula outlined in Oregon law. Special Assessments:

Varies depending on code area. City of Grants Pass Delinquent Sewer 54,772.11

Permanent tax rates for the various taxing districts do not change. Districts may levy local option levies or bond Ft Vannoy Irrigation District 50,935.08

repayment levies in addition to the permanent rates with voter approval. Taxes are calculated on each individual Mfd Structure Community Resource Center Fee (338.73) 24,401.27

parcel to determine the applicable limitations of Article XI of Section 11 of the Oregon Constitution for each parcel. OR Forestry Fire, Timber & Surcharge 1,611,712.04

(208,704.44) 394,751.52 78,947,073.31

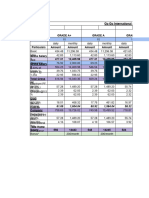

SUMMARY OF ASSESSMENT ROLL; JOSEPHINE COUNTY, OREGON; Fiscal Year Ending June 30, 2018

TAXABLE TAXABLE

REAL MARKET REAL MARKET

TAXABLE PROPERTY

VALUE

ASSESSED EXEMPT & SPECIALLY ASSESSED PROPERTY

VALUE

ASSESSED OFFICE OF JOSEPHINE COUNTY ASSESSOR

VALUE VALUE

Real Property Partially & Totally Exempt Constance L Roach, Assessor

Land $ 4,018,632,200 * Business/Housing/Misc. 136,678,222 70,962,788 Courthouse, 500 NW 6th Street, Dept 3

Improvements 5,605,121,320 * Commercial Facilities under Construction Grants Pass, Oregon 97526

Gross Real Property 9,623,753,520 7,146,288,463 Publicly Owned Property 929,433,520 839,970 Phone (541) 474-5260

Less Veteran's, Active Duty Exemptions ** (35,392,230) Social Welfare Exemptions 291,839,760 36,225,704 e-mail: assessor@co.josephine.or.us

TOTAL REAL PROPERTY 9,623,753,520 7,110,896,233 Total Partially & Totally Exempt 1,357,951,502 108,028,462

Manufactured Homes Specially Assessed Property

All Manufactured Homes 75,180,220 69,137,770 Farm Property 141,477,110 13,049,540

Less: Veteran's Exemptions ** (2,289,060) Forest Property 386,001,410 21,469,030

TOTAL MANUFACTURED HOMES 75,180,220 66,848,710 Open Space 3,745,880 635,070

NON-PROFIT HOUSING (billed to state) 2,944,140 2,155,620 Conservation Easements 1,711,180 103,560

PERSONAL PROPERTY 120,458,868 120,441,533 Low Income Rental Housing 33,157,200 6,340,830

PUBLIC UTILITIES 230,387,612 226,932,201 Total Specially Assessed Property $ 566,092,780 $ 41,598,030

TOTAL VALUE OF TAXABLE PROPERTY $ 10,052,724,360 $ 7,527,274,297 TOTAL EXEMPT & SPECIALLY ASSESSED PROPERTY $ 1,924,044,282 $ 149,626,492

* Under Measure 50, the assessed value of property is determined in total, and cannot be separated into component parts.

** Veteran's and Active Duty exemptions applied against assessed value only

Separate & Combined Tax Rates for the Various Taxing Districts in Josephine County - Tax Year 2017-18

Code 1; Grants Pass; School District #7; Library District; URA Code 10; Wolf Creek RFPD; 3Rivers School District

Josephine County 1.7240 Josephine County 1.7372

City of Grants Pass 6.2307 Wolf Creek Rural Fire Protection District 2.7765

Grants Pass School District #7 4.4338 Three Rivers School District 4.2514

Rogue Community College 0.5590 Rogue Community College 0.5683

Southern Oregon Education Service District 0.3460 Southern Oregon Education Service District 0.3524

4H/Extension Service District 0.0451 4H/Extension Service District 0.0459

Josephine Community Library District 0.3829 Total Tax Rate: 9.7317

Grants Pass Urban Renewal Plan-2016 0.2033 Code 11; Wolf Creek RFPD; 3Rivers School District; Library District

Total Tax Rate: 13.9248 Josephine County 1.7372

Code 2; Cave Junction; 3Rivers School District; Library District Wolf Creek Rural Fire Protection District 2.7765

Josephine County 1.7372 Three Rivers School District 4.2514

City of Cave Junction 1.8959 Rogue Community College 0.5683

Illinois Valley Rural Fire Protection District #1 2.5957 Southern Oregon Education Service District 0.3524

Three Rivers School District 4.2514 4H/Extension Service District 0.0459

Rogue Community College 0.5683 Josephine Community Library District 0.3900

Southern Oregon Education Service District 0.3524 Total Tax Rate: 10.1217

4H/Extension Service District 0.0459 Code 13; City of Grants Pass; School Dist #7; Library District; URA

Josephine Community Library District 0.3900 Josephine County 1.7240

Total Tax Rate: 11.8368 City of Grants Pass 6.2307

Code 3; Josephine County; School District #7 Grants Pass School District #7 4.4338

Josephine County 1.7372 Rogue Community College 0.5590

Grants Pass School District #7 4.5248 Southern Oregon Education Service District 0.3460

Rogue Community College 0.5683 4H/Extension Service District 0.0451

Southern Oregon Education Service District 0.3524 Josephine Community Library District 0.3829

4H/Extension Service District 0.0459 Grants Pass Urban Renewal Plan-2016 0.2033

Total Tax Rate: 7.2286 Total Tax Rate: 13.9248

Code 4; Illinois Valley RFPD; 3Rivers School District Code 14; Applegate RFPD; 3Rivers School District

Josephine County 1.7372 Josephine County 1.7372

Illinois Valley Rural Fire Protection District #1 2.5957 Applegate Rural Fire Protection District #9 2.5987

Three Rivers School District 4.2514 Three Rivers School District 4.2514

Rogue Community College 0.5683 Rogue Community College 0.5683

Southern Oregon Education Service District 0.3524 Southern Oregon Education Service District 0.3524

4H/Extension Service District 0.0459 4H/Extension Service District 0.0459

Total Tax Rate: 9.5509 Total Tax Rate: 9.5539

Code 5; Josephine County; 3Rivers School District Code 15; City of Grants Pass; 3Rivers Schl Dist; Library Dist; URA

Josephine County 1.7372 Josephine County 1.7240

Three Rivers School District 4.2514 City of Grants Pass 6.2307

Rogue Community College 0.5683 Three Rivers School District 4.2344

Southern Oregon Education Service District 0.3524 Rogue Community College 0.5590

4H/Extension Service District 0.0459 Southern Oregon Education Service District 0.3460

Total Tax Rate: 6.9552 4H/Extension Service District 0.0451

Code 6; Williams RFPD; 3Rivers School District; Library District Josephine Community Library District 0.3829

Josephine County 1.7372 Grants Pass Urban Renewal Plan-2016 0.1293

Williams Rural Fire Protection District 1.7052 Total Tax Rate: 13.6514

Three Rivers School District 4.2514 Code 16; City of Grants Pass; 3Rivers Schl Dist; Library Dist; URA

Rogue Community College 0.5683 Josephine County 1.7240

Southern Oregon Education Service District 0.3524 City of Grants Pass 6.2307

4H/Extension Service District 0.0459 Three Rivers School District 4.2344

Josephine Community Library District 0.3900 Rogue Community College 0.5590

Total Tax Rate: 9.0504 Southern Oregon Education Service District 0.3460

Code 7; Illinois Valley RFPD; 3Rivers School Dist; Library Dist 4H/Extension Service District 0.0451

Josephine County 1.7372 Josephine Community Library District 0.3829

Illinois Valley Rural Fire Protection District #1 2.5957 Grants Pass Urban Renewal Plan-2016 0.1293

Three Rivers School District 4.2514 Total Tax Rate: 13.6514

Rogue Community College 0.5683 Code 18; Illinois Vly RFPD; Kerby Water Dist; Library District

Southern Oregon Education Service District 0.3524 Josephine County 1.7372

4H/Extension Service District 0.0459 Illinois Valley Rural Fire Protection District #1 2.5957

Josephine Community Library District 0.3900 Three Rivers School District 4.2514

Total Tax Rate: 9.9409 Rogue Community College 0.5683

Code 8; Josephine County; 3Rivers School Dist; Library Dist Southern Oregon Education Service District 0.3524

Josephine County 1.7372 4H/Extension Service District 0.0459

Three Rivers School District 4.2514 Kerby Water District 1.8281

Rogue Community College 0.5683 Josephine Community Library District 0.3900

Southern Oregon Education Service District 0.3524 Total Tax Rate: 11.7690

4H/Extension Service District 0.0459 Code 19; Josephine Co; Kerby Water Dist; Library District

Josephine Community Library District 0.3900 Josephine County 1.7372

Total Tax Rate: 7.3452 Three Rivers School District 4.2514

Code 9; Williams RFPD; 3Rivers School District Rogue Community College 0.5683

Josephine County 1.7372 Southern Oregon Education Service District 0.3524

Williams Rural Fire Protection District 1.7052 4H/Extension Service District 0.0459

Three Rivers School District 4.2514 Kerby Water District 1.8281

Rogue Community College 0.5683 Josephine Community Library District 0.3900

Southern Oregon Education Service District 0.3524 Total Tax Rate: 9.1733

4H/Extension Service District 0.0459

Total Tax Rate: 8.6604

LOCAL OPTION LEVIES

District Final Year Purpose rate

Josephine County 2021-2022 Animal Control $0.08

Josephine County 2021-2022 Adult Jail; Juvenile Detention $0.93

Grants Pass 2017-2018 Public Safety $1.79

Applegate RFPD #9 2018-2019 operation of the fire district $0.92

Illinois Valley RFPD #1 2021-2022 hire firefighter/EMTs $0.50

Williams RFPD 2021-2022 operation of the fire district $0.65

Wolf Creek RFPD 2020-2021 operation of the fire district $0.59

**Amount raised by Local Option Levies may only be used for

the purpose stated in the ballot measure that was submitted to & approved by voters.

BONDS

District Purpose of Bond *Bond Final Year

Josephine County Construction of Adult Jail 2017-2018

City of Grants Pass Fire & Police Facilities 2019-2020

Three Rivers School District Replace/renovate school buildings 2022-2023

Rogue Community College Capitial Improvements 2037-2038

Illinois Valley Rural Fire Protection District #1 Capitial Construction, Improvements & Fire Equip 2023-2024

Kerby Water District Water distribution system 2035-2036

*Bond final year subject to change; for more information contact taxing district directly.

**Amount raised by Bonds may only be used for the purpose stated in the ballot measure that was submitted to and approved by voters.

Tax rates are BILLING RATES; not to be confused with Measure 50 Permanent Rates. Application of billing rates

to individual accounts assessed value may not produce the actual tax amount billed under Measure 5.

Das könnte Ihnen auch gefallen

- Reprinted Tax Receipt for Wilson PropertiesDokument2 SeitenReprinted Tax Receipt for Wilson PropertiesChelsea KayeNoch keine Bewertungen

- FY 2020 Approved BudgetDokument12 SeitenFY 2020 Approved BudgetIvana HrynkiwNoch keine Bewertungen

- Pag-IBIG 2016 Annual Procurement PlanDokument322 SeitenPag-IBIG 2016 Annual Procurement PlanDiogilyn QuiraoNoch keine Bewertungen

- LMU Board August 2, 2017 Agenda PacketDokument13 SeitenLMU Board August 2, 2017 Agenda PacketOaklandCBDsNoch keine Bewertungen

- He & She NX Naudra Bridge, JabalpurDokument6 SeitenHe & She NX Naudra Bridge, JabalpurRakesh TejvaniNoch keine Bewertungen

- SSPOFADVDokument1 SeiteSSPOFADVKaren OHareNoch keine Bewertungen

- COVID-19 OT Hours Pay Run Through 04.11.2020 04.22.2020Dokument119 SeitenCOVID-19 OT Hours Pay Run Through 04.11.2020 04.22.2020Gwen FilosaNoch keine Bewertungen

- Payroll Sheet QuizDokument5 SeitenPayroll Sheet QuizJoneric RamosNoch keine Bewertungen

- Appropriation Ordinance No. 2020-005Dokument13 SeitenAppropriation Ordinance No. 2020-005Emily BondadNoch keine Bewertungen

- Go Go International-3Dokument2 SeitenGo Go International-3sahil.goelNoch keine Bewertungen

- Diamond Bank PLC (Access Bank PLC) Taraba State Summary of Tax Liability For 2013-2018Dokument9 SeitenDiamond Bank PLC (Access Bank PLC) Taraba State Summary of Tax Liability For 2013-2018Alabi OlamideNoch keine Bewertungen

- University of Caloocan City Payroll AccountingDokument4 SeitenUniversity of Caloocan City Payroll AccountingJHUSTINE MHAY LEDESMANoch keine Bewertungen

- Statement of ReceiptsDokument1 SeiteStatement of ReceiptseabandejasNoch keine Bewertungen

- 02475792798Dokument1 Seite02475792798Edwin Zamora PastorNoch keine Bewertungen

- Terraceincomestatement 16Dokument3 SeitenTerraceincomestatement 16api-354468897Noch keine Bewertungen

- Amount Actually Spent. 207k Over Budget!Dokument1 SeiteAmount Actually Spent. 207k Over Budget!Jessica OlsonNoch keine Bewertungen

- Sample 35 1MLife With 500T AccCIBDokument2 SeitenSample 35 1MLife With 500T AccCIBRon CatalanNoch keine Bewertungen

- Belmont International School (P) .LTDDokument7 SeitenBelmont International School (P) .LTDJunu MainaliNoch keine Bewertungen

- Ap 2010-1Dokument35 SeitenAp 2010-1api-295670688Noch keine Bewertungen

- Project Report Va Tika ProjectionsDokument37 SeitenProject Report Va Tika Projectionsprateek goyalNoch keine Bewertungen

- OT Assignment Subham 2Dokument19 SeitenOT Assignment Subham 2S SubhamNoch keine Bewertungen

- Parcial2 - Actividades de La Semana 4Dokument23 SeitenParcial2 - Actividades de La Semana 4Luis Eduardo Meunier MendezNoch keine Bewertungen

- Received With Thanks ' 9,680.00 Through Payment Gateway Over The Internet FromDokument1 SeiteReceived With Thanks ' 9,680.00 Through Payment Gateway Over The Internet FromShashi PrasadNoch keine Bewertungen

- Ringkasan Lra Per 14 Nov 2023 Aceh TenggaraDokument2 SeitenRingkasan Lra Per 14 Nov 2023 Aceh Tenggarabudi teknikNoch keine Bewertungen

- Parcial2 - Actividades de La Semana 4 KevvDokument23 SeitenParcial2 - Actividades de La Semana 4 KevvLuis Eduardo Meunier MendezNoch keine Bewertungen

- Sbi Banlce SheetDokument1 SeiteSbi Banlce SheetANIKET VISHWANATH KURANENoch keine Bewertungen

- Terracebudget 17Dokument3 SeitenTerracebudget 17api-354468897Noch keine Bewertungen

- Balanta de Verificare: Solduri Initiale An Sume Precedente Rulaje Perioada Sume Totale Solduri FinaleDokument3 SeitenBalanta de Verificare: Solduri Initiale An Sume Precedente Rulaje Perioada Sume Totale Solduri FinaleLila MonicaNoch keine Bewertungen

- RenewalPremium 8738222Dokument1 SeiteRenewalPremium 8738222Shiva KumarNoch keine Bewertungen

- Budget ExpenditureDokument33 SeitenBudget ExpenditureLan So NessNoch keine Bewertungen

- A C C Ltd Cash Flow Summary 2010-2019 Non-Annualised Rs CroreDokument3 SeitenA C C Ltd Cash Flow Summary 2010-2019 Non-Annualised Rs Crorehardik aroraNoch keine Bewertungen

- 2220 San Jacinto Rent Roll (2023)Dokument1 Seite2220 San Jacinto Rent Roll (2023)Juan Real (Juan)Noch keine Bewertungen

- FianlsDokument1 SeiteFianlsdan.nics19Noch keine Bewertungen

- RoughDokument3 SeitenRoughbalvant.darshnaNoch keine Bewertungen

- APS Group Balance Sheet AnalysisDokument3 SeitenAPS Group Balance Sheet AnalysisWajahat MazharNoch keine Bewertungen

- Financial Analysis Test Project 2Dokument5 SeitenFinancial Analysis Test Project 2Pattee QuiambaoNoch keine Bewertungen

- Wo Rbiii21 - BalangaDokument1 SeiteWo Rbiii21 - BalangaCristina BialaNoch keine Bewertungen

- Peta 01-13 Juli 2023Dokument509 SeitenPeta 01-13 Juli 2023ciciNoch keine Bewertungen

- PaymentReceipt 22971746Dokument5 SeitenPaymentReceipt 22971746amdesale97Noch keine Bewertungen

- OLC Salary Loan Summary for January 2022Dokument150 SeitenOLC Salary Loan Summary for January 2022Rush RushNoch keine Bewertungen

- State Bank of India: Balance SheetDokument9 SeitenState Bank of India: Balance SheetKatta AshishNoch keine Bewertungen

- Dallas County Briefing and Court Order PDFDokument3 SeitenDallas County Briefing and Court Order PDFThe TexanNoch keine Bewertungen

- Untitled 1Dokument2 SeitenUntitled 1Oka ArtawanNoch keine Bewertungen

- Realisasi Penyaluran Pupuk di Provinsi Kepulauan Bangka Belitung TA 2019Dokument2 SeitenRealisasi Penyaluran Pupuk di Provinsi Kepulauan Bangka Belitung TA 2019Lasimin LasiminNoch keine Bewertungen

- Pemerintah Kota Batam: Tahun Anggaran 2014Dokument2 SeitenPemerintah Kota Batam: Tahun Anggaran 2014Sihombing GidyonNoch keine Bewertungen

- ACT2Dokument4 SeitenACT2ima.delbarrioNoch keine Bewertungen

- Financials Plaza Del PradoDokument14 SeitenFinancials Plaza Del PradoSteve WilliamNoch keine Bewertungen

- BacklogAcumulado - 06.04.2023Dokument4.187 SeitenBacklogAcumulado - 06.04.2023mpaulosantNoch keine Bewertungen

- Edited 014 Payroll Sargen July 02-15, 2023Dokument12 SeitenEdited 014 Payroll Sargen July 02-15, 2023Adolf OdaniNoch keine Bewertungen

- 2023 Schedule of FeesDokument2 Seiten2023 Schedule of FeesjoussenelisiweNoch keine Bewertungen

- Taxes For County Paid by Cities & Rural Areas 2010-2011Dokument3 SeitenTaxes For County Paid by Cities & Rural Areas 2010-2011The GazetteNoch keine Bewertungen

- Tax and Salary Computation For Quest MediaDokument7 SeitenTax and Salary Computation For Quest MediaDavid OlanrewajuNoch keine Bewertungen

- 1007315292000-1(1)Dokument2 Seiten1007315292000-1(1)Maria Isabelle RiveraNoch keine Bewertungen

- JrumberDokument32 SeitenJrumberapi-465017200Noch keine Bewertungen

- AprilDokument3 SeitenAprilKSP.REDJEKI MANDIRI JAYANoch keine Bewertungen

- Property Tax Strategic Session: Mobilizing Revenue for Kwara State DevelopmentDokument15 SeitenProperty Tax Strategic Session: Mobilizing Revenue for Kwara State DevelopmentOloruntobaNoch keine Bewertungen

- KP District WiseDokument2 SeitenKP District WisejanggodanxdNoch keine Bewertungen

- Bonus Calculation July 31 2017 (Dire Dawa) FinalDokument6 SeitenBonus Calculation July 31 2017 (Dire Dawa) FinalAnonymous FAlrXF0% (1)

- 6798 FillDokument1 Seite6798 FillJohnny LolNoch keine Bewertungen

- CFPB Truth in Lending ActDokument317 SeitenCFPB Truth in Lending ActTerrellTamari BeyAllRightsReservedNoch keine Bewertungen

- Oregon Foreclosures - The Mess That MERS MadeDokument5 SeitenOregon Foreclosures - The Mess That MERS MadeQuerpNoch keine Bewertungen

- INVALIDATING JUDGMENTS FOR FRAUD: UNDERSTANDING RULE 60(BDokument11 SeitenINVALIDATING JUDGMENTS FOR FRAUD: UNDERSTANDING RULE 60(B2Plus100% (2)

- Oregon Code of Judicial Conduct: Effective December 1, 2013Dokument25 SeitenOregon Code of Judicial Conduct: Effective December 1, 2013JohnnyLarsonNoch keine Bewertungen

- 7024 FillDokument1 Seite7024 FillJohnny LolNoch keine Bewertungen

- 1-Bedroom Homes in Eagle Point or For SaleDokument1 Seite1-Bedroom Homes in Eagle Point or For SaleJohnnyLarsonNoch keine Bewertungen

- Bleeding Newholland l785 New Holland - Snowplow ForumsDokument3 SeitenBleeding Newholland l785 New Holland - Snowplow ForumsJohnnyLarsonNoch keine Bewertungen

- 1 Recording Requested byDokument1 Seite1 Recording Requested byJohnnyLarsonNoch keine Bewertungen

- 1 Recording Requested byDokument1 Seite1 Recording Requested byJohnnyLarsonNoch keine Bewertungen

- My New Job Has A New Holland L-785 Skid Steer. It Wouldn't Start Last Week Until I Tightned The Hot Wire To TheDokument4 SeitenMy New Job Has A New Holland L-785 Skid Steer. It Wouldn't Start Last Week Until I Tightned The Hot Wire To TheJohnnyLarsonNoch keine Bewertungen

- What Can You Do If A Judge Is UnfairDokument3 SeitenWhat Can You Do If A Judge Is UnfairJohnnyLarsonNoch keine Bewertungen

- Oregon Code of Judicial Conduct: Effective December 1, 2013Dokument25 SeitenOregon Code of Judicial Conduct: Effective December 1, 2013JohnnyLarsonNoch keine Bewertungen

- Memorandum Opinion and Order: Alabama Health Care Authority D/b/a East Alabama Medical Center and Terry AndrusDokument13 SeitenMemorandum Opinion and Order: Alabama Health Care Authority D/b/a East Alabama Medical Center and Terry AndrusJohnnyLarsonNoch keine Bewertungen

- What Is Fraud On The CourtDokument5 SeitenWhat Is Fraud On The CourtJohnnyLarsonNoch keine Bewertungen

- Govbanknotes Wordpress Com 2017-06-19 Cell Phone Tower RadiaDokument6 SeitenGovbanknotes Wordpress Com 2017-06-19 Cell Phone Tower RadiaJohnnyLarsonNoch keine Bewertungen

- Uncovering Fraud in the CourtDokument36 SeitenUncovering Fraud in the CourtMichelle Gomes100% (6)

- INVALIDATING JUDGMENTS FOR FRAUD: UNDERSTANDING RULE 60(BDokument11 SeitenINVALIDATING JUDGMENTS FOR FRAUD: UNDERSTANDING RULE 60(B2Plus100% (2)

- Proving Fraud on the Court: Majority and Minority StandardsDokument7 SeitenProving Fraud on the Court: Majority and Minority StandardsRodolfo BecerraNoch keine Bewertungen

- Oregon Code of Judicial Conduct: Effective December 1, 2013Dokument25 SeitenOregon Code of Judicial Conduct: Effective December 1, 2013JohnnyLarsonNoch keine Bewertungen

- Rights, Roles, and Responsibilities: A Handbook For Fraud Victims Participating in The Federal Criminal Justice SystemDokument44 SeitenRights, Roles, and Responsibilities: A Handbook For Fraud Victims Participating in The Federal Criminal Justice SystemJohnnyLarsonNoch keine Bewertungen

- Fraud On The Court As A Basis For Dismissal With Prejudice or Default - An Old Remedy Has New Teeth - The Florida BarDokument7 SeitenFraud On The Court As A Basis For Dismissal With Prejudice or Default - An Old Remedy Has New Teeth - The Florida BarJohnnyLarson100% (1)

- INVALIDATING JUDGMENTS FOR FRAUD: UNDERSTANDING RULE 60(BDokument11 SeitenINVALIDATING JUDGMENTS FOR FRAUD: UNDERSTANDING RULE 60(B2Plus100% (2)

- Healthandmed Com Collections Vitamins Minerals Products NanoDokument8 SeitenHealthandmed Com Collections Vitamins Minerals Products NanoJohnnyLarsonNoch keine Bewertungen

- Oregon Code of Judicial Conduct: Effective December 1, 2013Dokument25 SeitenOregon Code of Judicial Conduct: Effective December 1, 2013JohnnyLarsonNoch keine Bewertungen

- WWW Todayswoundclinic Com Articles Treating Diabetic Foot UlDokument18 SeitenWWW Todayswoundclinic Com Articles Treating Diabetic Foot UlJohnnyLarsonNoch keine Bewertungen

- Proving Fraud on the Court: Majority and Minority StandardsDokument7 SeitenProving Fraud on the Court: Majority and Minority StandardsRodolfo BecerraNoch keine Bewertungen

- WWW Youtube Com Watch V TZf0yhe4B80Dokument6 SeitenWWW Youtube Com Watch V TZf0yhe4B80JohnnyLarsonNoch keine Bewertungen

- WWW Todayswoundclinic Com Articles Diabetic Foot Ulcers andDokument12 SeitenWWW Todayswoundclinic Com Articles Diabetic Foot Ulcers andJohnnyLarsonNoch keine Bewertungen

- WWW Todayswoundclinic Com Articles Diabetic Wound Healing THDokument10 SeitenWWW Todayswoundclinic Com Articles Diabetic Wound Healing THJohnnyLarsonNoch keine Bewertungen

- Introduction To Oil Company Financial Analysis - CompressDokument478 SeitenIntroduction To Oil Company Financial Analysis - CompressRalmeNoch keine Bewertungen

- Ds 3 ZJG PFA8 VV 0 Uhb Itzm K2 ARl EGBc 82 SQB 9 ZHC 4 PDokument1 SeiteDs 3 ZJG PFA8 VV 0 Uhb Itzm K2 ARl EGBc 82 SQB 9 ZHC 4 PprabindraNoch keine Bewertungen

- Management Discussion & Analysis highlights key developments in Indian economy, housing finance industry and company's progressDokument136 SeitenManagement Discussion & Analysis highlights key developments in Indian economy, housing finance industry and company's progressVritika JainNoch keine Bewertungen

- MEFADokument4 SeitenMEFABangi Sunil KumarNoch keine Bewertungen

- Customer Experience Department: Daily Incentive Program "Mcrewards"Dokument4 SeitenCustomer Experience Department: Daily Incentive Program "Mcrewards"Cedie Gonzaga AlbaNoch keine Bewertungen

- The Green Register - Spring 2011Dokument11 SeitenThe Green Register - Spring 2011EcoBudNoch keine Bewertungen

- AmazonianDokument19 SeitenAmazonianbapt100% (1)

- The Customer and Car Rental Service RelationshipDokument3 SeitenThe Customer and Car Rental Service RelationshipAbhimanyu GuptaNoch keine Bewertungen

- Advantage and Disadvantages of Business OrganizationDokument3 SeitenAdvantage and Disadvantages of Business OrganizationJustine VeralloNoch keine Bewertungen

- Cambridge Igcse Enterprise CoursebookDokument10 SeitenCambridge Igcse Enterprise CoursebookAnsko 30010% (1)

- Calculate Simple Interest Future and Present ValuesDokument21 SeitenCalculate Simple Interest Future and Present ValuesアンジェロドンNoch keine Bewertungen

- Balaji Wafers (FINAL)Dokument38 SeitenBalaji Wafers (FINAL)Urja BhavsarNoch keine Bewertungen

- Wholesale Juice Business PlanDokument25 SeitenWholesale Juice Business PlanKiza Kura CyberNoch keine Bewertungen

- Chapter 4 ExerciseDokument7 SeitenChapter 4 ExerciseJoe DicksonNoch keine Bewertungen

- Consolidated Balance Sheet of Steel Authority of India (In Rs. Crores) Mar-17 Mar-16 Mar-15 Equity and Liabilities Shareholder'S FundDokument4 SeitenConsolidated Balance Sheet of Steel Authority of India (In Rs. Crores) Mar-17 Mar-16 Mar-15 Equity and Liabilities Shareholder'S FundPuneet GeraNoch keine Bewertungen

- ResourceResourceADokument322 SeitenResourceResourceASergey PostnykhNoch keine Bewertungen

- Review LeapFrogDokument2 SeitenReview LeapFrogDhil HutomoNoch keine Bewertungen

- Umang PDF Fo MathDokument24 SeitenUmang PDF Fo MathAlok RajNoch keine Bewertungen

- TDS On Real Estate IndustryDokument5 SeitenTDS On Real Estate IndustryKirti SanghaviNoch keine Bewertungen

- Taxation: Far Eastern University - ManilaDokument4 SeitenTaxation: Far Eastern University - ManilacamilleNoch keine Bewertungen

- Far-1 Revaluation JE 2Dokument2 SeitenFar-1 Revaluation JE 2Janie HookeNoch keine Bewertungen

- Case Study On Customary Land in PNGDokument349 SeitenCase Study On Customary Land in PNGPeterson MathiusNoch keine Bewertungen

- Unnat Bharat Abhiyan 2.0: PPT Presentation On Aim and Objective of UBADokument15 SeitenUnnat Bharat Abhiyan 2.0: PPT Presentation On Aim and Objective of UBAManoj KumarNoch keine Bewertungen

- UPS, Inc. Strategy FormulationDokument16 SeitenUPS, Inc. Strategy FormulationSusan Arrand100% (1)

- NitDokument475 SeitenNitJakka LakshmikanthNoch keine Bewertungen

- Construction Management OverviewDokument16 SeitenConstruction Management OverviewAnarold Joy100% (2)

- Short Iron Condor Spread - FidelityDokument8 SeitenShort Iron Condor Spread - FidelityanalystbankNoch keine Bewertungen

- ECONTWO: EXERCISE 1 KEYDokument6 SeitenECONTWO: EXERCISE 1 KEYIrvinne Heather Chua GoNoch keine Bewertungen

- Executive Order No. 398: DteiacDokument2 SeitenExecutive Order No. 398: DteiacDanNoch keine Bewertungen

- From Beds, To Burgers, To Booze - Grand Metropolitan and The Creation of A Drinks GiantDokument13 SeitenFrom Beds, To Burgers, To Booze - Grand Metropolitan and The Creation of A Drinks GiantHomme zyNoch keine Bewertungen