Beruflich Dokumente

Kultur Dokumente

Commissioner of Internal Revenue Vs

Hochgeladen von

Elaine Honrade0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

94 Ansichten2 SeitenCommissioner of Internal Revenue Vs

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCommissioner of Internal Revenue Vs

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

94 Ansichten2 SeitenCommissioner of Internal Revenue Vs

Hochgeladen von

Elaine HonradeCommissioner of Internal Revenue Vs

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

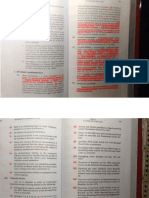

Commissioner of Internal Revenue vs.

Central 7432 deals exclusively with illegally collected or erroneously

Luzon Drug Corporation paid taxes but that there are other situations which may warrant

G.R. No. 159647 | April 15, 2005 a tax credit/refund.

The CA affirmed the decision of CTA reasoning that RA 7432

required neither a tax liability nor a payment of taxes by private

FACTS establishments prior to the availment of a tax credit. Moreover,

such credit is not tantamount to an unintended benefit from the

Central Luzon Drug Corporation (CLDC) is a domestic law, but rather a just compensation for the taking of private

corporation engaged in the retailing of medicines and other property for public use.

pharmaceutical products. In 1996 it operated six (6) drugstores

under the business name and style “Mercury Drug.” ISSUE

From January to December 1996 CLDC granted 20% sales Whether or not Central Luzon Drug Corporation, despite

discount to qualified senior citizens on their purchases of incurring a net loss, may still claim the 20 percent sales

medicines pursuant to RA 7432. discount as a tax credit

For said period CLDC granted a total of ₱ 904,769 to qualified

RULING

senior citizens. On April 15, 1997, CLDC filed its annual

Income Tax and Return for taxable year 1996 declaring therein Yes. It is clear that Sec. 4a of RA 7432 grants to senior citizens

net losses. the privilege of obtaining a 20% discount on their purchase of

medicine from any private establishment in the country. The

On January 16, 1998 CLDC filed with the Commissioner of latter may then claim the cost of the discount as a tax credit.

Internal Revenue a claim for tax refund/credit of ₱ 904,769.00 Such credit can be claimed even if the establishment operates

allegedly arising from the 20% sales discount. at a loss.

Unable to obtain affirmative response, CLDC elevated its claim Although the term is not specifically defined in our Tax Code,

to the Court of Tax Appeals via Petition for Review. tax credit generally refers to an amount that is subtracted

directly from ones total tax liability. It is an allowance against

The CTA dismissed the petition but on Motion for the tax itself or a deduction from what is owed by a taxpayer to

Reconsideration, it reversed its earlier ruling and ordered the the government. Examples of tax credits are withheld taxes,

commissioner to issue a Tax Credit Certificate in favor of payments of estimated tax, and investment tax credits.

CLDC. It was based on the May 31, 2001 decision on Central

Luzon Drug Corp. vs. CIR which ruled that Sec. 229 of RA

Tax credit should be understood in relation to other tax granted without conditions a tax credit benefit to all covered

concepts. One of these is tax deduction -- defined as a establishments.

subtraction from income for tax purposes, or an amount that is

allowed by law to reduce income prior to the application of the

tax rate to compute the amount of tax which is due. An While a tax liability is essential to the availment or use of any

example of a tax deduction is any of the allowable deductions tax credit, prior tax payments are not. On the contrary, for the

enumerated in Section 34 of the Tax Code. existence or grant solely of such credit, neither a tax liability

nor a prior tax payment is needed. The Tax Code is in fact

A tax credit differs from a tax deduction. On the one hand, a replete with provisions granting or allowing tax credits, even

tax credit reduces the tax due, including -- whenever applicable though no taxes have been previously paid. RA 7432

-- the income tax that is determined after applying the

specifically allows private establishments to claim as tax credit

corresponding tax rates to taxable income. A tax deduction, on

the amount of discounts they grant. In turn, the Implementing

the other, reduces the income that is subject to tax in order to

arrive at taxable income. To think of the former as the latter is Rules and Regulations, issued pursuant thereto, provide the

to avoid, if not entirely confuse, the issue. A tax credit is used procedures for its availment. To deny such credit, despite the

only after the tax has been computed; a tax deduction, before. plain mandate of the law and the regulations carrying out that

mandate, is indefensible.

Since a tax credit is used to reduce directly the tax that is due,

there ought to be a tax liability before the tax credit can be

applied. Without that liability, any tax credit application will be

useless. There will be no reason for deducting the latter when

there is, to begin with, no existing obligation to the

government. However, as will be presented shortly, the

existence of a tax credit or its grant by law is not the same as

the availment or use of such credit. While the grant is

mandatory, the availment or use is not.

If a net loss is reported by, and no other taxes are currently due

from, a business establishment, there will obviously be no tax

liability against which any tax credit can be applied. For the

establishment to choose the immediate availment of a tax credit

will be premature and impracticable. Nevertheless, the

irrefutable fact remains that, under RA 7432, Congress has

Das könnte Ihnen auch gefallen

- Castillo v. de Leon-CastilloDokument2 SeitenCastillo v. de Leon-CastilloElaine HonradeNoch keine Bewertungen

- Paz vs. Pavon G.R. No. 166579 18 February 2010Dokument2 SeitenPaz vs. Pavon G.R. No. 166579 18 February 2010vestiahNoch keine Bewertungen

- Wiegel v. Sempio-DyDokument1 SeiteWiegel v. Sempio-DyElaine HonradeNoch keine Bewertungen

- Tenebro v. CADokument2 SeitenTenebro v. CAElaine HonradeNoch keine Bewertungen

- Small ClaimsDokument66 SeitenSmall ClaimsarloNoch keine Bewertungen

- Magdayao vs. PeopleDokument2 SeitenMagdayao vs. PeopleElaine HonradeNoch keine Bewertungen

- Rosete vs. LimDokument2 SeitenRosete vs. LimElaine Honrade100% (1)

- Security Bank and Trust Company vs. GanDokument2 SeitenSecurity Bank and Trust Company vs. GanElaine HonradeNoch keine Bewertungen

- Regala VS SBDokument5 SeitenRegala VS SBElaine HonradeNoch keine Bewertungen

- PPL Vs SandiganbayanDokument1 SeitePPL Vs SandiganbayanElaine HonradeNoch keine Bewertungen

- Art. 41, Family Code, Judicial Declaration of Presumptive Death Manuel v. People 476 SCRA 461 2005 FactsDokument2 SeitenArt. 41, Family Code, Judicial Declaration of Presumptive Death Manuel v. People 476 SCRA 461 2005 FactsElaine HonradeNoch keine Bewertungen

- Genil vs. RiveraDokument2 SeitenGenil vs. RiveraElaine HonradeNoch keine Bewertungen

- Ocampo vs. Abando SC ruling on murder case against CPP-NPA membersDokument7 SeitenOcampo vs. Abando SC ruling on murder case against CPP-NPA membersElaine Honrade100% (1)

- Saura vs. AgdeppaDokument1 SeiteSaura vs. AgdeppaElaine HonradeNoch keine Bewertungen

- Chavez Vs PEADokument3 SeitenChavez Vs PEAElaine HonradeNoch keine Bewertungen

- Republic vs. Marcos-ManotocDokument4 SeitenRepublic vs. Marcos-ManotocElaine HonradeNoch keine Bewertungen

- Mercado vs. VitrioloDokument2 SeitenMercado vs. VitrioloElaine HonradeNoch keine Bewertungen

- National Housing Authority ordered to allocate Tatalon Estate lotsDokument4 SeitenNational Housing Authority ordered to allocate Tatalon Estate lotsElaine HonradeNoch keine Bewertungen

- BPI Vs SMPDokument1 SeiteBPI Vs SMPElaine HonradeNoch keine Bewertungen

- Roth vs. USDokument2 SeitenRoth vs. USElaine HonradeNoch keine Bewertungen

- Dissenting Opinion LeonenDokument64 SeitenDissenting Opinion LeonenRapplerNoch keine Bewertungen

- PMA Cadet Appeals Dismissal for Alleged Honor Code ViolationDokument7 SeitenPMA Cadet Appeals Dismissal for Alleged Honor Code ViolationElaine HonradeNoch keine Bewertungen

- Ra 10641Dokument6 SeitenRa 10641Sarah Jean CaneteNoch keine Bewertungen

- Sex TraffickingDokument14 SeitenSex TraffickingElaine Honrade100% (1)

- Lim vs. Court of AppealsDokument2 SeitenLim vs. Court of AppealsElaine HonradeNoch keine Bewertungen

- Other Special LawsDokument9 SeitenOther Special LawsElaine HonradeNoch keine Bewertungen

- Dissenting Opinion LeonenDokument64 SeitenDissenting Opinion LeonenRapplerNoch keine Bewertungen

- Environmental AnnotationDokument63 SeitenEnvironmental AnnotationIvan Angelo ApostolNoch keine Bewertungen

- CaguioaDokument64 SeitenCaguioaRappler100% (1)

- Separate Opinion BernabeDokument35 SeitenSeparate Opinion BernabeRapplerNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- European Exchange Report 2015Dokument29 SeitenEuropean Exchange Report 2015mariaNoch keine Bewertungen

- Government of the Phils v. El Hogar Filipino case digestDokument10 SeitenGovernment of the Phils v. El Hogar Filipino case digestvictoria4391tiangco100% (1)

- PCMM Acting For and On Behalf of The President of India Invites E-Tenders Against Tender No 80191199Dokument4 SeitenPCMM Acting For and On Behalf of The President of India Invites E-Tenders Against Tender No 80191199ANILNoch keine Bewertungen

- Power Sector Financing in India and Key IssuesDokument65 SeitenPower Sector Financing in India and Key IssuesYasir Altaf100% (19)

- Analysis AGENCY LEADER Contract ProvisionsDokument9 SeitenAnalysis AGENCY LEADER Contract ProvisionsJuan Miguel San PedroNoch keine Bewertungen

- Behavioral Biases and Investment Decision MakingDokument52 SeitenBehavioral Biases and Investment Decision MakingAhmad NaveedNoch keine Bewertungen

- Elmo Muñasque vs CA partnership disputeDokument2 SeitenElmo Muñasque vs CA partnership disputeCarlo Ilano83% (6)

- CHP 22 Business FinanceDokument6 SeitenCHP 22 Business FinanceHiNoch keine Bewertungen

- StrategicManagementReport PRAVEENDokument14 SeitenStrategicManagementReport PRAVEENPraveen Nair75% (4)

- Closing Entries and Post-Closing Trial BalanceDokument21 SeitenClosing Entries and Post-Closing Trial BalanceAL Babaran CanceranNoch keine Bewertungen

- FFS PINNSEF 30 November 2020Dokument1 SeiteFFS PINNSEF 30 November 2020teguhsunyotoNoch keine Bewertungen

- SPL AssignmentDokument2 SeitenSPL AssignmentArchana MantriNoch keine Bewertungen

- 1 - Overview of AuditingDokument13 Seiten1 - Overview of AuditingZooeyNoch keine Bewertungen

- Cost BehaviorDokument15 SeitenCost BehaviorUSO CLOTHINGNoch keine Bewertungen

- Impact Financial Literacy PDFDokument10 SeitenImpact Financial Literacy PDFberardeusNoch keine Bewertungen

- Model Question Paper RVO-IBBIDokument20 SeitenModel Question Paper RVO-IBBIBhaskar Jain100% (1)

- 142-Gamboa vs. Teves G.R. No. 176579 October 9, 2012Dokument91 Seiten142-Gamboa vs. Teves G.R. No. 176579 October 9, 2012Jopan SJNoch keine Bewertungen

- Padul Consultants Trial Balance December 31, 2020: Debit Credit 11 12 13 14 21 31 32 41 51 52 53 54 55 56Dokument8 SeitenPadul Consultants Trial Balance December 31, 2020: Debit Credit 11 12 13 14 21 31 32 41 51 52 53 54 55 56Reyner Paul B. BeringNoch keine Bewertungen

- JP Morgan DCF and Merger Model PDFDokument100 SeitenJP Morgan DCF and Merger Model PDFP WinNoch keine Bewertungen

- Different Factors Affecting The Supply and Demand of HousingDokument12 SeitenDifferent Factors Affecting The Supply and Demand of HousingKhea Micole MayNoch keine Bewertungen

- Zaini Zain (BAF2009012) Adv. Fin. Acc Group Assignment (UPDATED)Dokument23 SeitenZaini Zain (BAF2009012) Adv. Fin. Acc Group Assignment (UPDATED)Zaini ZainNoch keine Bewertungen

- Derivatives Commodity Derivatives FGLD EnglishDokument13 SeitenDerivatives Commodity Derivatives FGLD EnglishrexNoch keine Bewertungen

- Asignación 4 LSFPDokument3 SeitenAsignación 4 LSFPElia SantanaNoch keine Bewertungen

- Colin Leys Rise FallDokument17 SeitenColin Leys Rise FallAnanya Chakraborty100% (1)

- Iir 2001Dokument25 SeitenIir 2001Shikhin GargNoch keine Bewertungen

- Financial Management and Decision Making Among Micro Business in Tagum CityDokument29 SeitenFinancial Management and Decision Making Among Micro Business in Tagum CityHannah Wynzelle Aban100% (1)

- Lecture Notes in Taxation - TariffDokument3 SeitenLecture Notes in Taxation - TariffbubblingbrookNoch keine Bewertungen

- The Merchant of VeniceDokument6 SeitenThe Merchant of VeniceLeshalka SoodNoch keine Bewertungen

- Ieb gr9 Ems 2011Dokument13 SeitenIeb gr9 Ems 2011WizardcyclopcNoch keine Bewertungen

- Cerna Vs CaDokument5 SeitenCerna Vs CaBernadetteNoch keine Bewertungen