Beruflich Dokumente

Kultur Dokumente

APSL Budget Proposals 2018

Hochgeladen von

Calistus Eugene FernandoCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

APSL Budget Proposals 2018

Hochgeladen von

Calistus Eugene FernandoCopyright:

Verfügbare Formate

Budget Proposals 2018

40th Budget of Democratic Socialist Republic of Sri Lanka

Asha Phillip Securities Ltd,

321, 2nd Floor, Lakshman’s Building,

Galle Road, Colombo 03.

TP +94112429100

Fax +94112429199

ASHA PHILLIP

BUDGET PROPOSALS 2018 SECURITIES LTD

HIGHLIGHTS & REVIEW SriLanka

Introduction

The Minister of Finance and Mass Media of the Government of Sri Lanka presented the

Government’s budget proposals for the year 2018 on 9th November 2017. A snapshot of

the salient features that may have an impact on the relevant sectors and companies

listed on the CSE is presented below;

Budget Theme:

“Blue - Green Budget; the Launch of Enterprise Sri Lanka”

Targets of Budget 2018:

Support the achievement of predicted medium-term targets such as:

Per capita income of USD 5,000,

One million new jobs,

FDI inflows of USD 5 Bn

Increasing exports to USD 20 Bn.

GDP growth of 5%

Inflation of around 6%, and,

Expects to achieve for the first time in almost 6 decades primary surplus of 1% of

GDP and a Budget deficit of 4.5% of GDP.

Focus of Budget 2018:

Restrictions on foreign ownership will be removed permitting foreigners to freely

invest in the shipping and freight forwarding industry in Sri Lanka

Promote exports through the SME sector, facilitating entrepreneurship

development and Information Technology (IT) Industry.

To generate an environmentally sustainable economic growth by utilizing the

under-utilized ocean resources and adopting new sustainable technologies in the

agriculture, fisheries and manufacturing sectors

List of legislations to be revamped includes:

• Customs Ordinance Education Ordinance

• Excise Ordinance Labour laws including shop and office act

• Rent Act Bankruptcy law

APSL Research 10th November 2017 Page 2 of 10

ASHA PHILLIP

BUDGET PROPOSALS 2018 SECURITIES LTD

HIGHLIGHTS & REVIEW SriLanka

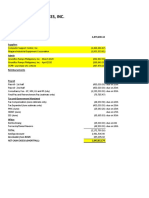

Government’s Budget at a Glance (2018)

The 2018 budget targets a reduction in the budget deficit to 4.8% of GDP in comparison to

5.2% in 2017.

Government expects to increase tax revenue (Direct and Indirect) to LKR 2,034 Bn (16.3%

YoY growth) in 2018.

LKR 375Bn is expected as income tax which is a 22% YoY growth in comparison to 2017.

LKR 1,239Bn is expected as Taxes on goods and services which is a 17.6% YoY increase.

The effective ratio between Income tax and taxes on Goods and Services is 23%:77%.

However, with the addition of Taxes on External trade, the projected effective tax ratio

between Income and other sources of indirect taxes has reached the target structure of

39%:61%.

Government expects to increase Public Investment by c.20% in 2018.

Introducing tight expense controlling mechanisms, the Government seeks to maintain

the existing “Recurring expenses to GDP ratio” at 15.8 % for 2018.

Summary of the Budget (2014-2018) Rs. Bn

Item 2014 2015 2016 2017 2018E

Total Revenue 1,264 1,534 1,774 1,997 2,326

Tax Revenue 1,050 1,356 1,464 1,749 2,034

Total Expenditure 1,855 2,363 2,414 2,677 3,001

Recurrent 1,382 1,775 1,838 2,053 2,250

Public Investment 487 603 594 633 761

Budget Deficit -591 -830 -640 -680 -675

As a % of GDP

Total Revenue 12.2 14 15 15.4 16.4

Tax Revenue 10.1 12.4 12.4 13.5 14.3

Total Expenditure 17.9 21.6 20.4 20.6 21.1

Recurrent Expenditure 13.3 16.2 15.5 15.8 15.8

Public Investment 4.7 5.5 5 4.9 5.4

Budget Deficit -5.7 -7.6 -5.4 -5.2 -4.8

Source- Department of Fiscal Policy

APSL Research 10th November 2017 Page 3 of 10

ASHA PHILLIP

BUDGET PROPOSALS 2018 SECURITIES LTD

HIGHLIGHTS & REVIEW SriLanka

2018 Budgeted Revenue and Grants (LKR Bn) 2018 Budgeted Expenditure (LKR Bn)

Grants - LKR Capital

Non-Tax - 10 Bn Expenditur

LKR 184 Bn 0% e (Net

8% Lending) -

Interest

LKR 751Bn

Payments -

Direct Tax - 26%

Goods & LKR 820 Bn

LKR 375 Bn 28%

Services -

17%

LKR 195 Bn

Indirect Tax 7%

- LKR 1,659

Bn Salaries &

Subsidies &

75% Wages -

Transfers -

LKR 630 Bn

LKR 507 Bn

22%

17%

Variance Analysis

Execution of budget proposals has not been 100% successful (ex: in 2017) and hence there

is a gap between budgeted and realized numbers.

Actual Total revenue marked c.LKR 91Bn lower than the budgeted figure for 2017

Actual Total expenses posted c.LKR 46Bn decline compared to budgeted figure for 2017

As a result, Overall Budget deficit has increased by c.LKR 55 Bn over and above the

budgeted figure for 2017

However, reflecting efficient tax collection, GDP to Tax revenue target has been

successfully achieved during 2017. Hence, lower than expected GDP growth has caused

Tax revenue variance to be negative in 2017

More government funds have been utilized over and above the budgeted levels for

Recurrent expenses during 2017. This has caused a significant decline in Growth oriented

Public Investment in both absolute and relative terms

Variance Analysis (2016-2017)

Item (LKR Bn) 2017 E 2017 A Variance

Total Revenue 2,088 1,997 -91

Tax Revenue 1,821 1,749 -72

Total Expenditure 2,723 2,677 -46

Recurrent 2,024 2,053 29

Public Investment 708 633 -75

Budget Deficit -625 -680 55

As a % of GDP

Total Revenue 15.5 15.4 -0.1

Tax Revenue 13.5 13.5 0.0

Total Expenditure 20.2 20.6 0.4

Recurrent Expenditure 15 15.8 0.8

Public Investment 5.2 4.9 -0.3

Budget Deficit -4.6 -5.2 0.6

APSL Research 10th November 2017 Page 4 of 10

ASHA PHILLIP

BUDGET PROPOSALS 2018 SECURITIES LTD

HIGHLIGHTS & REVIEW SriLanka

Proposals which may have possible impact on listed counters

Banking and Finance Sector

Debt Repayment Levy -The above levy will be imposed on all transactions entered in to by a

commercial bank. It is expected that the revenue collected from this levy will be utilized for

the repayment of the government debts. The rate of tax is LKR 0.20 per LKR 1,000 worth

transaction (0.02%). This will be applicable only for 3 years and shall not be passed on to the

customers.

Loan to value ratio for the electric buses, three wheelers, domestically assembled electric

three wheelers, cars and buses will be revised to 90/10.

A “SME Guarantee Fund” to be established to expand the borrowing capacity of SMEs. The

proposed SME Guarantee Fund will enable SME Exporters who are in the CRIB but have the

potential to export, yet has no access to finance its operations, to access financing from

Banks utilizing the SME guarantees.

Telecommunication Sector

Cellular Tower levy of LKR 200,000 per tower per month to discourage the proliferation of

such towers.

Fee on advertisements done through SMSs at a rate of LKR 0.25 per SMS with effect from 1st

April 2018

Motor Sector

Carbon Tax

Carbon tax will be imposed on motor vehicles based on the engine capacity. Rate will depend

on age and fuel type of vehicle as follows:

Type of vehicle Less than 05 years 05 to 10 years Over 10 years

Hybrid (Petrol/Diesel) 25 Cts per cm3 50 Cts per cm3 LKR 1.00 per cm3

Fuel (Petrol/Diesel) 50 Cts per cm3 LKR 1.00 per cm3 LKR 1.50 per cm3

Passenger bus LKR 1,000/- LKR 2,000/- LKR 3,000/-

Electric vehicles are exempted from the levy

APSL Research 10th November 2017 Page 5 of 10

ASHA PHILLIP

BUDGET PROPOSALS 2018 SECURITIES LTD

HIGHLIGHTS & REVIEW SriLanka

Luxury Tax on Motor Vehicles

Import taxes on an electric car will be reduced by at least LKR 1 Mn while the import tax on

the high end fossil fuelled cars will be increased by almost LKR 2.5 Mn.

Duty rates based on (petrol) engine capacity;

Engine capacity On petrol motor cars On Petrol hybrid motor cars

(LKR per cm3) (LKR per cm3)

Proposed Current Difference Proposed Current Difference

≤ 1000cm3 1,750 1750 - 1,250 1,250 -

1000cm3 < x ≤ 1300 cm3 2,750 2750 - 2,000 2,000 -

1300cm3 < x ≤ 1500 cm3 3,250 2,750 500 2,500 2,000 500

1500cm3 < x ≤ 1600 cm3 4,000 4,000 - 3,000 3,500 (500)

1600cm3 < x ≤ 1800 cm3 5,000 4,500 500 4,500 4,000 500

1800cm3 < x ≤ 2000 cm3 6,000 5,500 500 5,000 4,500 500

2000cm3 < x ≤ 2500 cm3 7,000 6,000 1,000 6,000 5,000 1,000

2500cm3 < x ≤ 2750 cm3 8,000 6,000 2,000 7,000 5,000 2,000

2750cm3 < x ≤ 3000 cm3 9,000 6,000 3,000 8,000 5,000 3,000

3000cm3 < x ≤ 4000 cm3 10,000 6,000 4,000 9,000 5,500 3,500

4000 cm3< 11,000 6,000 5,000 10,000 5,500 4,500

Duty rates based on engine capacity;

Engine capacity On Diesel motor cars On Diesel hybrid motor cars

(LKR per cm3) (LKR per cm3)

Proposed Current Different Proposed Current Different

≤ 1500cm3 4,000 3,500 500 3,000 3,000 -

1500cm3 < x ≤ 1600 cm3 5,000 4,500 500 4,000 4,000 -

1600cm3 < x ≤ 1800 cm3 6,000 5,000 1,000 5,000 4,500 500

1800cm3 < x ≤ 2000 cm3 7,000 6,000 1,000 6,000 5,000 1,000

2000cm3 < x ≤ 2500 cm3 8,000 7,000 1,000 7,000 5,000 2,000

2500cm3 < x ≤ 2750 9,000 7,000 2,000 8,000 5,000 3,000

2750cm3 < x ≤ 3000 10,000 7,000 3,000 9,000 5,000 4,000

3000cm3 < x ≤ 4000 11,000 7,000 4,000 10,000 5,000 5,000

4000 cm3< 12,000 7,000 5,000 11,000 5,000 6,000

Electric Motor Vehicles (Unregistered)

Motor power (kW) Proposed for 2018 Current Difference

(LKR per kw) (LKR per kw) (LKR per kw)

≤ 50 7,500 15,000 (7,500)

50 < x ≤ 100 12,500 25,000 (12,500)

100 < x ≤ 200 25,000 40,000 (15,000)

200 < 40,000 55,000 (15,000)

Importation of Motor Vehicles below the Emission Standard of the EURO 4 or its equivalent

will be prohibited effective from January 01, 2018 in line with the health and environmental

safeguard measures.

APSL Research 10th November 2017 Page 6 of 10

ASHA PHILLIP

BUDGET PROPOSALS 2018 SECURITIES LTD

HIGHLIGHTS & REVIEW SriLanka

Importation of Motor Vehicles, which are not complied with the safety measures namely (a)

Air Bags for driver and the front passenger, (b) Anti-Locking Breaking System (ABS) and (c)

Three Point Seat Belts for driver and the passengers travelling in the front and rear seats, will

be prohibited effective from January 01, 2018 in line with the safety of passengers / travelers.

Beverage Food and Tobacco

The liquor licensing fee structure will be rationalized. License issuance mechanism will be

revamped with a view to promoting tourism, especially in Guest houses, Boutique Hotels etc.

A tax file number will be one of the essential requirements when issuing these licenses.

o Rate structure of Liquor license fee will be simplified w.e.f. 01/01/2018

Alcohol volume based Excise Duty depending on the type of liquor will be introduced

Excise duty will be imposed on import of non-potable alcohol at LKR 15/- per Kg.

Excise Duty will be imposed on raw materials used for manufacturing of ethanol

Toddy: - LKR 5/- per litre, Molasses/Maize/Rice/Fruits: - LKR 10/- per Kg

Excise (Special Provisions) Duty applicable on canned beer will be removed.

NBT to be introduced on liquor from 1 April 2018.

Sugar tax on sweetened beverages

o Excise duty based on the quantum of sugar contained will be introduced for the

beverages with added sugar. The rate will be 50 cts per gram of sugar

Plastic resin

o Excise duty on plastic resin will be introduced at LKR 10 per Kg.

This duty will be applicable for items classified under the HS Codes 3901.10, 3901.20,

3902.10, 3903.11 and 3904.10

Construction & Engineering / Land & Property

Remove restrictions that limit the land ownership rights of listed companies with foreign

ownership together with the restrictions on foreigners’ ability to purchase condominiums

below the 4th floor.

Imposition of Value Added Tax (VAT) on sale of condominium housing units - from 1 April

2018

APSL Research 10th November 2017 Page 7 of 10

ASHA PHILLIP

BUDGET PROPOSALS 2018 SECURITIES LTD

HIGHLIGHTS & REVIEW SriLanka

Shipping & Logistics

The Sri Lanka Ports Authority Act, No. 51 of 1979 and the Merchants Shipping Act, No. 52

of 1971 will be amended to cater to the demands of the modern day logistics and marine

industry. This will also ensure healthy competition, an independent Ports regulator will be

introduced.

Restrictions on the foreign ownership on the shipping and the freight forwarding

agencies will be lifted. This will enable major international shipping lines and logistics

operators to base their operations in Sri Lanka.

Manufacturing

Supporting the use of Solar Power

o Tax benefits

The NBT and PAL will be exempted on machines and equipment including solar

panels and, storage batteries which will be imported for the establishment of solar

charging stations.

o Credit schemes

Individuals, companies incorporated under the Companies Act, No. 7 of 2007, co-

operative societies, farmers/fisheries societies engaged in agriculture, agro

processing including drip irrigation, poultry, canning, plantation and tourism industry,

that will invest in technology for the generation of solar power to be used for their

own operations, will be supported through the introduction of a loan scheme at a

subsidized interest rate of 8%.

Supporting the SME companies

o The SME companies will be companies incorporated under the Companies Act, No. 7

of 2007 and will have at least 10 shareholders each contributing at least Rs.10,000 in

equity. These companies could engage in any business from agriculture to apparels to

IT.

Imposition of Value Added Tax (VAT) on import or supply of the imported Yarn/Fabrics

with HS Codes 50.01, 50.02, 50.03, 50.04, 50.05, 50.06, 50.07, 51.11, 51.12, 51.13, 52.01,

52.03, 52.05, 52.06, 52.08, 52.09, 52.10, 52.11, 52.12, 53.09, 53.10, 54.02, 54.03, 54.07, 54.08,

55.09, 55.10, 55.12, 55.13, 55.14, 55.15, 55.16, 58.01, 58.02, 58.04.21, 58.04.29, 58.04.30,

58.06, 58.09, 58.11, 60.01, 60.02, 60.03, 60.04, 60.05, 60.06, 62.15

APSL Research 10th November 2017 Page 8 of 10

ASHA PHILLIP

BUDGET PROPOSALS 2018 SECURITIES LTD

HIGHLIGHTS & REVIEW SriLanka

Poultry Industry

The import of maize will be liberalized provided that such imports will be made only to

meet any gap created due to a lack of domestic production of maize.

Will provide on lease basis underutilized state farms or land suitable for this industry to

develop modern poultry farms with a view to increase the live birds stock from 110 million

to 500 million per year.

Tourism

VAT refund scheme for foreign passport holders will be implemented at the Airports and

Sea Ports with effect from 01st May 2018.

A tax of 1% will be imposed on the reservation commission derived or accrued in Sri Lanka

by Online Travel Agents.

Diversified Sector

Tax concessions will be granted on capital goods imported through bonding facilities

during the construction period for large scale pharmaceutical investments, dairy industry

and solid waste management ventures.

Corporate Tax Rates Proposed through the New Inland Revenue Act 2017

(Applicable from 1st April 2018)

Description Proposed rate Prevailing rate

SME * 14% 12%

Exporters ** 14% 12%

Agriculture (including poultry farming)** 14% 10% / 12%

Promotion of tourism** 14% 12%

Information technology services** 14% 0%/ 10% / 28%

Construction work 28% 12%

Healthcare services 28% 12%

Manufacture of animal feed 28% 12%

Supply of goods and services to a foreign ship 28% 12%

Alternative power generating projects 14%/ 28% 12%

Unit Trusts/Mutual Funds/Unit Trust Management Companies 24% / 28% 10%

*- As defined

** - As defined and the revised tax rate is applicable to a company predominantly (i.e. 80% or more of gross

income) engaged in the stated business activity.

APSL Research 10th November 2017 Page 9 of 10

ASHA PHILLIP

BUDGET PROPOSALS 2018 SECURITIES LTD

HIGHLIGHTS & REVIEW SriLanka

Contact Information

Head Office

Sales

Thakshila Hulangamuwa thakshi@ashaphillip.net +94 11 2429108

Upul Priyantha upul@ashaphillip.net +94 11 2429106

Shanmugam Sudhagar sudha@ashaphillip.net +94 11 2429107

Vasantha Wicramasinghe vasantha@ashaphillip.net +94 11 2429114

Research

Visahan Arumainayaham visahan@ashaphillip.net +94112429139

Nishani Ruwanpathirana nishani@ashaphillip.net +94 112429137

Sandun Kulathunga sandun@ashaphillip.net +94 112429129

Regional Offices

Colombo (H/O) Matara Jaffna

# 321, Lakshmans Building, 2nd Floor, #24-1/3A, #147, 2/3

Galle Road, Colombo 03. E.H. Cooray Tower, 2nd Floor, K.K.S. Road,

Tel - 94 112429100 Anagarika Dharmapala Mw, Jaffna.

Fax - 94 112429199 Matara. Tel: 021 2221614

Tel: 041 2235191-5

www.ashaphillip.net

Email - research@ashaphillip.net

Kiribathgoda Embilipitiya Kandy

#94, Udeshi City Shopping Complex, #62, Sampath Bank Building, # 88, Ceybank House,

2nd Floor, #2/12, Makola Road, Main Street, Dalada Vidiya,

Kiribathgoda. Embilipitiya. Kandy.

Tel. 011 2908511 Tel. 047 2261950 Tel. 081 2204750

Anuradhapura Negombo Gampaha

# 2nd floor,488/8/2, #72 A 2/1, #107,

Town hall place, Old Chilaw Road, Sanasa Ideal Complex,

Maithreepala senanayaka mawatha, Negombo. Bauddhaloka Mawatha,

Anuradhapura Tel. 031 2227474 Gampaha.

Tel. 025 2234705 Tel. 033 2234888

Important Information

This document has been prepared and issued by Asha Phillip Securities Ltd, on the basis of publicly available information, internally developed

data and other sources, believed to be reliable. Whilst all responsible care has been taken to ensure that the facts stated are accurate and the

opinions given are fair and reasonable neither Asha Phillip Securities Ltd, nor any Director Officer or employee, shall in any way be responsible for

any decisions made on its contents. Asha Phillip Securities Ltd may act as a Broker in the investments which are the subject of this document or

related investments and may have acted upon or used the information contained in this document, or the research or analysis on which it is

based, before its publication. Asha Phillip Securities Ltd., Its Directors, Officers or Employees may also have a position or be otherwise interested

in the investments referred to in this document. This is not an offer to sell or buy the investments ref erred to in this document.

APSL Research 10th November 2017 Page 10 of 10

Das könnte Ihnen auch gefallen

- MSBP Re SitDokument7 SeitenMSBP Re SitCalistus Eugene FernandoNoch keine Bewertungen

- MSBP Guid LineDokument3 SeitenMSBP Guid LineCalistus Eugene FernandoNoch keine Bewertungen

- Occupational Diseases and DisordersDokument2 SeitenOccupational Diseases and DisordersCalistus Eugene FernandoNoch keine Bewertungen

- BBSG4103 Marketing Management Strategy Assignment 1Dokument4 SeitenBBSG4103 Marketing Management Strategy Assignment 1Calistus Eugene FernandoNoch keine Bewertungen

- Budget 2018 - Budget at A GlanceDokument2 SeitenBudget 2018 - Budget at A GlanceCalistus Eugene FernandoNoch keine Bewertungen

- SBST1303 Aq Jan 2018Dokument3 SeitenSBST1303 Aq Jan 2018Calistus Eugene FernandoNoch keine Bewertungen

- Paper Royal Rainbow1Dokument25 SeitenPaper Royal Rainbow1Calistus Eugene FernandoNoch keine Bewertungen

- Local beauty business incorporationDokument2 SeitenLocal beauty business incorporationCalistus Eugene FernandoNoch keine Bewertungen

- Marketing Research Proposal GuideDokument4 SeitenMarketing Research Proposal GuideCalistus Eugene FernandoNoch keine Bewertungen

- Ÿ !!"#$ %& ' (!ÿ) ' +''ÿ $, Ÿ - ./0ÿ .Ÿ ##"1,& $, Ÿ .Ÿ %+2'& $, Ÿ %,% '3',& 4 Ÿ Ÿ 6789ÿ: Ÿ 6?@ A@@ÿ B CD Deafa G Ÿ Hÿ:Iÿ Hÿ JKKL? G Eÿ Hÿ Cdmnag EODokument4 SeitenŸ !!"#$ %& ' (!ÿ) ' +''ÿ $, Ÿ - ./0ÿ .Ÿ ##"1,& $, Ÿ .Ÿ %+2'& $, Ÿ %,% '3',& 4 Ÿ Ÿ 6789ÿ: Ÿ 6?@ A@@ÿ B CD Deafa G Ÿ Hÿ:Iÿ Hÿ JKKL? G Eÿ Hÿ Cdmnag EOCalistus Eugene FernandoNoch keine Bewertungen

- Knowledge ManagementDokument32 SeitenKnowledge ManagementadeshshivaniNoch keine Bewertungen

- SECI model of knowledge creation empirically flawedDokument10 SeitenSECI model of knowledge creation empirically flawedCalistus Eugene FernandoNoch keine Bewertungen

- Apa LegalDokument5 SeitenApa LegallanamkNoch keine Bewertungen

- BDO IFRS Summary January-2017Dokument96 SeitenBDO IFRS Summary January-2017Hafiz Mohsin Butt100% (1)

- Circular WHT On Booking CommissionDokument1 SeiteCircular WHT On Booking CommissionCalistus Eugene FernandoNoch keine Bewertungen

- Chapter 7 Pricing StrategiesDokument30 SeitenChapter 7 Pricing StrategiesCalistus Eugene FernandoNoch keine Bewertungen

- Financial RatiosDokument25 SeitenFinancial RatiosCalistus Eugene FernandoNoch keine Bewertungen

- Task 4-1Dokument1 SeiteTask 4-1Calistus Eugene FernandoNoch keine Bewertungen

- CH20Dokument71 SeitenCH20Calistus Eugene FernandoNoch keine Bewertungen

- Knowledge Management As An Important ToolDokument24 SeitenKnowledge Management As An Important ToolCalistus Eugene FernandoNoch keine Bewertungen

- 8 Property Plant Equipment LectureDokument12 Seiten8 Property Plant Equipment LectureEnusah Abdulai0% (1)

- EbitdaDokument6 SeitenEbitdaCalistus Eugene FernandoNoch keine Bewertungen

- Scei ModelDokument9 SeitenScei ModelCalistus Eugene FernandoNoch keine Bewertungen

- SECI model of knowledge creation empirically flawedDokument10 SeitenSECI model of knowledge creation empirically flawedCalistus Eugene FernandoNoch keine Bewertungen

- Guide To Time of SupplyDokument11 SeitenGuide To Time of SupplyCalistus Eugene FernandoNoch keine Bewertungen

- The Analysis of The Internal and External Environments PDFDokument12 SeitenThe Analysis of The Internal and External Environments PDFCalistus Eugene FernandoNoch keine Bewertungen

- Challenges in Managing Organization Knowledge Management PDFDokument42 SeitenChallenges in Managing Organization Knowledge Management PDFNorainah Abdul GaniNoch keine Bewertungen

- Strategic Planning in Education Some Concepts and StepsDokument23 SeitenStrategic Planning in Education Some Concepts and StepsCalistus Eugene FernandoNoch keine Bewertungen

- National Education Sector Development Plan PDFDokument111 SeitenNational Education Sector Development Plan PDFCalistus Eugene FernandoNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5783)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Bisig NG Manggagawa Sa Concrete Aggregates, Inc. vs. NLRCDokument2 SeitenBisig NG Manggagawa Sa Concrete Aggregates, Inc. vs. NLRCSarah100% (1)

- EIN Explained p1635Dokument36 SeitenEIN Explained p1635Anonymous ruUxJt7lx100% (6)

- Transfer of Property Act - Ramesh Chand Vs Suresh Chand, Delhi High CourtDokument18 SeitenTransfer of Property Act - Ramesh Chand Vs Suresh Chand, Delhi High CourtLatest Laws TeamNoch keine Bewertungen

- Electronic Payment SystemDokument23 SeitenElectronic Payment SystemSongs Punjabi ShareNoch keine Bewertungen

- Marketing Report InsightsDokument20 SeitenMarketing Report Insightsmewtoki33% (3)

- Radhakrishnan .P, Prasad .V, Gopalan .MDokument2 SeitenRadhakrishnan .P, Prasad .V, Gopalan .MPGDM IMSNoch keine Bewertungen

- Unit IDokument32 SeitenUnit Ithebrahyz0% (1)

- JetBlue Case Study SolutionDokument3 SeitenJetBlue Case Study SolutionNithin Joji Sankoorikkal100% (1)

- General Liability QuestionnaireDokument2 SeitenGeneral Liability QuestionnaireKenny LeBlancNoch keine Bewertungen

- OD125549891478426000Dokument1 SeiteOD125549891478426000अमित कुमारNoch keine Bewertungen

- LERAC M AND E Cash Forecast and Accounts Payable AgingDokument15 SeitenLERAC M AND E Cash Forecast and Accounts Payable AgingLERAC AccountingNoch keine Bewertungen

- AplDokument4 SeitenAplAmeya RegeNoch keine Bewertungen

- Income Taxation Provisions in the PhilippinesDokument11 SeitenIncome Taxation Provisions in the Philippinesroselleyap20Noch keine Bewertungen

- Paediatric Consumer Health in The Philippines PDFDokument4 SeitenPaediatric Consumer Health in The Philippines PDFMae SampangNoch keine Bewertungen

- Basic Concepts of Income Tax - Direct vs Indirect TaxesDokument33 SeitenBasic Concepts of Income Tax - Direct vs Indirect TaxesDhananjay KumarNoch keine Bewertungen

- Taxation LawDokument4 SeitenTaxation Lawvisha183240Noch keine Bewertungen

- Rhonda Resume 2009 - 10Dokument4 SeitenRhonda Resume 2009 - 10rhondabitnerNoch keine Bewertungen

- Midterm PtaskDokument4 SeitenMidterm PtaskJanine CalditoNoch keine Bewertungen

- Balance Sheet - Tata Motors Annual Report 2015-16 PDFDokument2 SeitenBalance Sheet - Tata Motors Annual Report 2015-16 PDFbijoy majumderNoch keine Bewertungen

- Sem-1 Syllabus Distribution 2021Dokument2 SeitenSem-1 Syllabus Distribution 2021Kishan JhaNoch keine Bewertungen

- Deposit AccountDokument2 SeitenDeposit AccountAnonymous ZGcs7MwsLNoch keine Bewertungen

- Co-Operative HSGDokument85 SeitenCo-Operative HSGnachiket shilotriNoch keine Bewertungen

- General Banking Laws of 2000 (RA 8791) : Banks Shall Be Classified IntoDokument9 SeitenGeneral Banking Laws of 2000 (RA 8791) : Banks Shall Be Classified IntoJoy DalesNoch keine Bewertungen

- MCQ On Negotiable Instrument ActDokument2 SeitenMCQ On Negotiable Instrument ActPraveen Makula80% (5)

- Accounting Is NiceDokument36 SeitenAccounting Is NiceYuvika BishnoiNoch keine Bewertungen

- The Procurement Alignment FrameworkDokument8 SeitenThe Procurement Alignment FrameworkZhe TianNoch keine Bewertungen

- Beeah - Annual Report 2010 (LR) - 0Dokument40 SeitenBeeah - Annual Report 2010 (LR) - 0hareb_dNoch keine Bewertungen

- 14-2-17 p2Dokument8 Seiten14-2-17 p2immadzaffNoch keine Bewertungen

- Asian Paints Bse: 500820 - Nse: Asianpaint ISIN: INE021A01018 - Paints/VarnishesDokument27 SeitenAsian Paints Bse: 500820 - Nse: Asianpaint ISIN: INE021A01018 - Paints/VarnishesGaurav ShahareNoch keine Bewertungen

- Learning Culture: Implications and ProcessDokument18 SeitenLearning Culture: Implications and ProcessSohailuddin AlaviNoch keine Bewertungen