Beruflich Dokumente

Kultur Dokumente

8 - Cost Allocation

Hochgeladen von

RidoOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

8 - Cost Allocation

Hochgeladen von

RidoCopyright:

Verfügbare Formate

8.

COST ALLOCATION AND DEFINITIONS

8_Cost Allocation and Difinitions

COST ALLOCATION AND DEFINITIONS

CONTRACT NO. :

IKPT WORK NO. : PD. 14037

PROJECT : DAYUNG COMPRESSION PHASE-2 (DC-2) PROJECT

PLANT : DAYUNG COMPRESSION

WORKS : PIPING & PAINTING WORK

JOBSITE LOCATION : GRISSIK, PALEMBANG, INDONESIA

8_Cost Allocation and Difinitions

INDEX

PAGE

1. GENERAL 1

2. CONCEPT OF COST ALLOCATION 2

3. DEFINITIONS OF COST ITEMS 4

3.1 Direct Work Cost 5

3.2 Indirect Work Cost 5

3.3 Overhead and Profit 6

4. CLARIFICATION AND INTERPRETATION 6

ATTACHMENT(1) TABLE OF COST ITEMS (P.1/23-23/23)

8_Cost Allocation and Difinitions

1. GENERAL

This "COST ALLOCATION AND DEFINITIONS" is prepared for both the INQUIRY and

CONTRACT purposes, and is intended to provide the BIDDERs or the CONTRACTOR, as the

case may be, with the firm interpretation of the cost structure as per IKPT's "Code of Account"

designed for adaptation to IKPT's project accounting system, by classifying various costs,

charges, expenses, taxes and similar impositions, fees and so forth for various works, services

and liabilities involved in construction works into respective cost items and work categories.

This "COST ALLOCATION AND DEFINITIONS" shall be used:

- in the INQUIRY DOCUMENTS -

as the directives to the BIDDERs how the breakdown of their offer prices should be made, in

order to ascertain that the prices quoted by the respective BIDDERs are all properly

categorized in the same manner and broken down as intended and required by IKPT, and that,

the prices and the breakdown thereof are adequately filled in to IKPT-furnished "Forms of

Proposal" which are attached to the Instruction to Bidders, and

- in the CONTRACT DOCUMENTS -

as an aid to the CONTRACTOR for the invoicing offices in order to ascertain that such

offices to be undertaken by the CONTRACTOR are made properly in accordance with

IKPT's Invoicing Procedure governing the payments to the CONTRACTOR under the

CONTRACT, which Invoicing Procedure is established for individual projects.

This "COST ALLOCATION AND DEFINITIONS" shall constitute a part of the INQUIRY

DOCUMENTS in the bidding stage, and shall eventually form an integral part of the

CONTRACT DOCUMENTS.

The terms and phases defined in the GENERAL TERMS AND CONDITIONS and in such

other documents as the SPECIAL CONDITIONS are also used in this document and, unless

specific remark is made herein, it shall be interpreted and construed that they have the

respective meanings assigned to them in such documents as referred to above.

2. CONCEPT OF COST ALLOCATION

The concept of "COST ALLOCATION" is as such that is given in Fig.-1 : "CONCEPT OF

COST ALLOCATION" which outlines the structure of the CONTRACT PRICE.

As shown in the Figure mentioned above, the CONTRACT PRICE

consists of:

8_Cost Allocation and Difinitions -1-

- Construction Cost which is divided into the two cost portions, i.e., "Direct Work Cost" and

"Indirect Work Cost and Expenses", and

- Overhead and Profit,

and the Direct Work Cost is composed of three(3) cost items and Indirect Work Cost and

Expenses consists of nine(9) cost items.

8_Cost Allocation and Difinitions -2-

Fig.-1: CONCEPT OF COST ALLOCATION

1.1 Materials

a) Materials

1. Direct b) Transportation

Work and Insurance, etc.

Cost

1.2 Direct Labor

1.3 Construction Equipment

2.1 Common Temporary

Facilities

a) Construction

Facilities

b) Camp Facilities

Construction

Cost 2.2 Transportation and Insurance,

etc.

a) Construction

Equipment

b) Common Temporary

Facilities

Contract

Price 2.3 Material Handling

2. and Storing

Indirect

Work 2.4 Supervisory and Administrative

Cost and Staff and Laborers

Expenses a) Staff

b) Laborer

2.5 Traveling Expenses

a) Staff

b) Laborer

2.6 Camp Operation

2.7 Field Office Expenses

2.8 Home Office Expenses

2.9 Insurance, Taxes

and Duties

Overhead

and 3.1 Overhead and Profit

Profit

8_Cost Allocation and Difinitions -3-

3. DEFINITIONS OF COST ITEMS

In order to define the respective cost items, the following terms and phrases are used in this

document, and which terms and phrases, mean respectively as defined below:

1) "Prime cost" means the price, at which the equipment, materials, supplies, commodities,

consumables, utilities or others of the sort are estimated to be sold or supplied to the

BIDDERs or are to be sold or supplied to the CONTRACTOR, or the works or services are

estimated to be rendered to the BIDDERs, or are to be rendered to the CONTRACTOR,

and in which price, no expenses on the part of the BIDDERs or the CONTRACTOR, as the

case may be, in respect of purchase or taking out thereof are included.

2) "Overseas purchase" means the purchase of products available in the market in such

countries or areas other than the COUNTRY and includes the activities therefor.

3) "Local purchase" means the purchase of products available in the market in the

COUNTRY and includes the activities therefor.

4) "Staff" means the such personnel of management level as Field Manager, Construction

Manager and Administration Manager plus supervisory staff and other key clerical

personnel who assist such managers as aforementioned.

5) "Laborer" or "Worker" means foreman and skilled, semi-skilled or non-skilled worker of

respective classes up to Foreman, who are engaged in physical, clerical or non-clerical

works or services other than site-management, administrative or supervisory services

undertaken by such staff as referred to in Item 4) above.

6) "Domestic packing" means such types of packing which are intended only for domestic

transportations of cargoes within the country or area of origin or purchase, and does not

mean and include any such seaworthy packing suitable for export purposes.

7) "Domestic transportation" means such transportations within the country or area of origin

or purchase, up to the port of exit or, in the event of local purchase, from the place of

purchase up to the storage area or warehouse in the SITE.

8) "Export Packing" means such types of packing which are intended for international

transportations of cargoes, whether by land, sea or air, from the port of exit in the country

origin or purchase, to the port of import in other country, and includes such containers,

whether owned, non-owned or leased, for transportations of cargoes by land, sea or air

from a country to another as aforementioned.

The respective cost items in this document represent the categories of the materials, works,

services or liabilities, and against which, the cost involved therein is respectively set forth.

The summary of the structure of each cost item and the cost involved therein are specifically

described in the Attachment "Table of Cost Items" hereto.

8_Cost Allocation and Difinitions -4-

The materials, works, services or liabilities enumerated in each of the categories are to be taken

as typical examples and are not to be considered to be limited to only those stated therein.

3.1 Direct Work Cost

"Direct Work Cost" is composed of such costs, expenses, charges, taxes and other similar

impositions, fees and so on which are respectively categorized into the following cost items,

and they are:

Cost Item 1.1 - Materials

a) Materials

b) Transportation and Insurance, Etc.

1.2 - Direct Labor, and

1.3 - Construction Equipment,

and, the summary of the structure of each cost item and the cost involved therein are

specifically described in the Attachment "Table of Cost Items" hereto.

3.2 Indirect Work Cost and Expenses

"Indirect Work Cost and Expenses" is composed of such costs, expenses, charges, taxes and

other similar impositions, fees and so on which are respectively categorized into the following

cost items, and they are:

Cost Item 2.1 - Common Temporary Facilities

a) Construction Facilities

b) Camp Facilities

2.2 - Transportation and Insurance, Etc.

a) Construction Equipment

b) Common Temporary Facilities

2.3 - Material Handling and Storing

2.4 - Supervisory and Administrative

Staff and Laborers

a) Staff

b) Laborers

2.5 - Traveling Expenses

2.6 - Camp Operation

2.7 - Field Office Expenses

2.8 - Home Office Expenses

8_Cost Allocation and Difinitions -5-

2.9 - Insurances, Taxes and Duties

and the summary of the structure of each cost item and the cost involved therein are

specifically described in the Attachment "Table of Cost Items" hereto.

3.3 Overhead and Profit

"Overhead and Profit" is composed of such costs, expenses, charges, taxes and other similar

impositions, fees, contingencies, profit and so on which are categorized into the following cost

item, and it is:

Cost Item 3.1 - Overhead and Profit

and the summary of the structure of the cost item and the cost involved therein plus profit are

specifically described Attachment "Table of Cost Items" hereto.

4. CLARIFICATION AND INTERPRETATION

IKPT reserves the right for making interpretation and/or clarification of this document or any

part hereof. Should there be any ambiguity in this document or any contradiction or

discrepancy between the respective sections of this document or between this document and

other documents forming the INQUIRY DOCUMENTS or the CONTRACT DOCUMENTS

as appropriate, the BIDDERs or the CONTRACTOR, as the case may be, shall be required to

notify IKPT thereof in order to seek for IKPT's interpretation and/or clarification. In this

connection, the BIDDER or the CONTRACTOR, as the case may be, shall observe the

relevant provisions of the INQUIRY DOCUMENTS or the CONTRACT DOCUMENTS as

appropriate.

If any BIDDER or the CONTRACTOR fails to bring to due attention of IKPT any of such

ambiguities, contradictions or discrepancies as aforementioned, and if such failure on the part

of the BIDDER or the CONTRACTOR eventually results in misinterpretation or non-

clarification thereof, and in such a case, although any necessity for adjustment or correction of

the offer price or of the CONTRACT PRICE arises, IKPT may require of such BIDDER in

question or the CONTRACTOR, as the case may be, to adjust or correct the offer price or the

CONTRACT PRICE and/or the unit rates therefor, and in such an instance, the BIDDER in

question or the CONTRACTOR shall comply therewith.

Notwithstanding the foregoing, unless such adjustment or correction is to be made in the

manner favorable to the interest of IKPT, no adjustment or correction shall be permitted.

8_Cost Allocation and Difinitions -6-

Das könnte Ihnen auch gefallen

- Company Loan PolicyDokument2 SeitenCompany Loan PolicyKaleem60% (5)

- BOQ Vs BEMEDokument11 SeitenBOQ Vs BEMEAnonymous jlLBRMAr3O94% (16)

- PWD Accounts Theory-CompressedDokument211 SeitenPWD Accounts Theory-Compressedabhishitewari75% (4)

- Inbound Email Configuration For Offline ApprovalsDokument10 SeitenInbound Email Configuration For Offline Approvalssarin.kane8423100% (1)

- Ampa Fairley Rationalisation Project Onshore Compression Plant EPICOM (Contract #980085/EAF)Dokument25 SeitenAmpa Fairley Rationalisation Project Onshore Compression Plant EPICOM (Contract #980085/EAF)Alireza entNoch keine Bewertungen

- Ampa Fairley Rationalisation Project Onshore Compression Plant EPICOM (Contract #980085/EAF)Dokument26 SeitenAmpa Fairley Rationalisation Project Onshore Compression Plant EPICOM (Contract #980085/EAF)Alireza entNoch keine Bewertungen

- 1.2 Att6 Cost Allocation & Definitions 25th SeptDokument28 Seiten1.2 Att6 Cost Allocation & Definitions 25th SeptAlireza entNoch keine Bewertungen

- T Proc Notices Notices 015 K Notice Doc 14561 608073931Dokument6 SeitenT Proc Notices Notices 015 K Notice Doc 14561 608073931guidoNoch keine Bewertungen

- GR-TWC1-7211-5202 (Cost Evaluation Summary)Dokument4 SeitenGR-TWC1-7211-5202 (Cost Evaluation Summary)Sulist N WahyudieNoch keine Bewertungen

- H - Proc Notices-Notices 035 K-Notice Doc 30184 202115913Dokument3 SeitenH - Proc Notices-Notices 035 K-Notice Doc 30184 202115913Muttaqin Bin M HasanNoch keine Bewertungen

- Cost Estimation Mannual & TemplateDokument39 SeitenCost Estimation Mannual & TemplaterezaNoch keine Bewertungen

- Exhibit II - Schedule of CompensationDokument7 SeitenExhibit II - Schedule of CompensationRedhaa .kNoch keine Bewertungen

- Cost Accounting Sybaf - 2020Dokument25 SeitenCost Accounting Sybaf - 2020Payal PolNoch keine Bewertungen

- Pages From Estimating Costing CivilDokument15 SeitenPages From Estimating Costing CivilSaurabh KadamNoch keine Bewertungen

- Standard Bill of QuantitiesDokument554 SeitenStandard Bill of QuantitiesIbrahim Mange100% (1)

- Chapter - IV Project Implementation: Table 4.1 Cost of Works Under Scope of India, Russia and Third CountriesDokument38 SeitenChapter - IV Project Implementation: Table 4.1 Cost of Works Under Scope of India, Russia and Third CountriesAvinash GokavarapuNoch keine Bewertungen

- 6M Concrete Security T-Walls U.S. Embassy Baghdad, Iraq: Contract DocumentsDokument13 Seiten6M Concrete Security T-Walls U.S. Embassy Baghdad, Iraq: Contract DocumentsAdnan NajemNoch keine Bewertungen

- List of Documents: Handover of Contract Documents by The Engineering To The Construction Department For ImplementationDokument8 SeitenList of Documents: Handover of Contract Documents by The Engineering To The Construction Department For Implementationeric maestroNoch keine Bewertungen

- Schedule of Rates: All Prices Shall Include GSTDokument11 SeitenSchedule of Rates: All Prices Shall Include GSTKailas Suresh AnandeNoch keine Bewertungen

- Feasibility Study of The Proposed Cavite Busway SystemDokument102 SeitenFeasibility Study of The Proposed Cavite Busway Systemsandy rosetteNoch keine Bewertungen

- Guideline For Estimation of Manpower RequirementsDokument21 SeitenGuideline For Estimation of Manpower RequirementstresspasseeNoch keine Bewertungen

- Chap.13 Guerrero Job Order CostingDokument40 SeitenChap.13 Guerrero Job Order CostingGeoff MacarateNoch keine Bewertungen

- Job Order Costing - Hand OutDokument6 SeitenJob Order Costing - Hand OutKorinth BalaoNoch keine Bewertungen

- Bab 3Dokument31 SeitenBab 3Langit IjungNoch keine Bewertungen

- IS 11590 (1995) - Guidelines For Working Out Unit Rate Cost of The Construction Equipment Used For River Valley ProjectsDokument13 SeitenIS 11590 (1995) - Guidelines For Working Out Unit Rate Cost of The Construction Equipment Used For River Valley ProjectsDEEPAKNoch keine Bewertungen

- Lesson 1-Contract Documents & BQ: Copy Right. ES. 2015Dokument33 SeitenLesson 1-Contract Documents & BQ: Copy Right. ES. 2015SabeoNoch keine Bewertungen

- 1 - (Rev3) Casting and Forging, PC AC BoQ Price Breakdown - CIVIL BUILDINGDokument25 Seiten1 - (Rev3) Casting and Forging, PC AC BoQ Price Breakdown - CIVIL BUILDINGMohammed Mostafa El HaddadNoch keine Bewertungen

- Appendix I Contractor ' S Overhead CostsDokument5 SeitenAppendix I Contractor ' S Overhead CostsZoki JevtićNoch keine Bewertungen

- 2009-0363 - Schedule B - 19.03.2010Dokument63 Seiten2009-0363 - Schedule B - 19.03.2010Dendukuri varmaNoch keine Bewertungen

- Edf D4finoffer enDokument11 SeitenEdf D4finoffer eneyuNoch keine Bewertungen

- Anaylsis of RatesDokument10 SeitenAnaylsis of RatesDeveshPandeyNoch keine Bewertungen

- 13-09-02a Estimate Basis TemplateDokument19 Seiten13-09-02a Estimate Basis TemplateSiampol FeepakphorNoch keine Bewertungen

- BOQ - Land Devt - CalambaDokument7 SeitenBOQ - Land Devt - CalambaSebastian AbordoNoch keine Bewertungen

- 4.QTY Presentation 4Dokument15 Seiten4.QTY Presentation 4asregidhaguNoch keine Bewertungen

- AgreementDokument16 SeitenAgreementGirma JankaNoch keine Bewertungen

- Legends: L-Lecture T - Tutorial/Teacher Guided Theory Practice P - Practical C - Credit, CADokument6 SeitenLegends: L-Lecture T - Tutorial/Teacher Guided Theory Practice P - Practical C - Credit, CABhaveshNoch keine Bewertungen

- VP1, RFP For Coal Unloading Jetty Work - PSMC - BOQDokument5 SeitenVP1, RFP For Coal Unloading Jetty Work - PSMC - BOQThai Hai LyNoch keine Bewertungen

- Bill of Engineering Measurement and Evaluation (Beme) A Case Study of CriticalDokument7 SeitenBill of Engineering Measurement and Evaluation (Beme) A Case Study of Criticalodunnahenry24Noch keine Bewertungen

- Cost Assignment: Bsba MM 1Dokument11 SeitenCost Assignment: Bsba MM 1Lara Camille CelestialNoch keine Bewertungen

- PQ - Prequalification Document PDFDokument56 SeitenPQ - Prequalification Document PDFHema Chandra IndlaNoch keine Bewertungen

- Work Descriptions Package 3BDokument41 SeitenWork Descriptions Package 3BAlireza entNoch keine Bewertungen

- IntroDokument22 SeitenIntroLovely-Lynn EvangelistaNoch keine Bewertungen

- SECTION 3: Project Execution Plan: Office, Technical, and Education BuildingDokument28 SeitenSECTION 3: Project Execution Plan: Office, Technical, and Education BuildingAziz ELNoch keine Bewertungen

- Tenshin Dorms SummaryDokument71 SeitenTenshin Dorms Summarythethird20Noch keine Bewertungen

- Celaws Quiz2Dokument2 SeitenCelaws Quiz2krizza mae ariasNoch keine Bewertungen

- QS Notes P1Dokument6 SeitenQS Notes P1Silendrina MishaNoch keine Bewertungen

- 05 - Cp02-Contract Preparation Major-Minor PDFDokument6 Seiten05 - Cp02-Contract Preparation Major-Minor PDFJustin KubulNoch keine Bewertungen

- DCM2601 PROJECT 2023 SEMESTER 2 (Due Date - 11 September)Dokument4 SeitenDCM2601 PROJECT 2023 SEMESTER 2 (Due Date - 11 September)Rachel Du PreezNoch keine Bewertungen

- Dupa Vol IiDokument858 SeitenDupa Vol IiJay Beltran100% (3)

- Long Term Construction Contracts - HODokument5 SeitenLong Term Construction Contracts - HOJymldy EnclnNoch keine Bewertungen

- Corrigendum 6Dokument3 SeitenCorrigendum 6abhishek pathakNoch keine Bewertungen

- Public Bidding SampleDokument7 SeitenPublic Bidding SampleArvin Dela CruzNoch keine Bewertungen

- C4CORRIGENDUM211Dokument134 SeitenC4CORRIGENDUM211deepak kumarNoch keine Bewertungen

- The Total Costs of Seismic Retrofits State of The ArtDokument24 SeitenThe Total Costs of Seismic Retrofits State of The ArtMacNoch keine Bewertungen

- P1 1d.0a14eb8 NotesDokument140 SeitenP1 1d.0a14eb8 Notesyahoo2008Noch keine Bewertungen

- Legends: L-Lecture T - Tutorial/Teacher Guided Theory Practice P - Practical C - Credit, CADokument7 SeitenLegends: L-Lecture T - Tutorial/Teacher Guided Theory Practice P - Practical C - Credit, CAMohammed FaizNoch keine Bewertungen

- RM of Access Road Streetlight at LGDA - 2022Dokument6 SeitenRM of Access Road Streetlight at LGDA - 2022Ace LangNoch keine Bewertungen

- Unit 14Dokument21 SeitenUnit 14Paulos John ChilemboNoch keine Bewertungen

- Evaluating The Cost of Poor Quality: A Case Study: Eng - Mahmoud Hammam (1), Prof - Dr.Refaat Abdel-RazekDokument13 SeitenEvaluating The Cost of Poor Quality: A Case Study: Eng - Mahmoud Hammam (1), Prof - Dr.Refaat Abdel-Razekroshan_lizNoch keine Bewertungen

- PG 21-916 - CANAMAN TECH NOL REVIEW NotesDokument2 SeitenPG 21-916 - CANAMAN TECH NOL REVIEW NotesJopheth RelucioNoch keine Bewertungen

- BOQ For Panel of 20 Contractors Fo Unpaved Access Roads 2020Dokument25 SeitenBOQ For Panel of 20 Contractors Fo Unpaved Access Roads 2020Carlos MakheleNoch keine Bewertungen

- Price RequisitionDokument2 SeitenPrice RequisitionRidoNoch keine Bewertungen

- Fabrication & Site Erection ProcedureDokument43 SeitenFabrication & Site Erection ProcedureRidoNoch keine Bewertungen

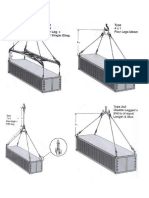

- Pad Eyes ContainerDokument2 SeitenPad Eyes ContainerRidoNoch keine Bewertungen

- JSA PaintingDokument1 SeiteJSA PaintingRidoNoch keine Bewertungen

- FSection H005 - Hot WorkDokument10 SeitenFSection H005 - Hot WorkRidoNoch keine Bewertungen

- Yz0262 92 12 02Dokument1 SeiteYz0262 92 12 02RidoNoch keine Bewertungen

- Handling & Shipping ProcedureDokument4 SeitenHandling & Shipping ProcedureRidoNoch keine Bewertungen

- Painting ProcedureDokument4 SeitenPainting ProcedureRidoNoch keine Bewertungen

- 6 - General Terms and ConditionsDokument45 Seiten6 - General Terms and ConditionsRidoNoch keine Bewertungen

- Lifting ProcedureDokument4 SeitenLifting ProcedureRidoNoch keine Bewertungen

- Dye Penetrant Inspection ProcedureDokument6 SeitenDye Penetrant Inspection ProcedureRidoNoch keine Bewertungen

- FilmDokument1 SeiteFilmRidoNoch keine Bewertungen

- Form Proposal - Piping - Steel STR FabDokument55 SeitenForm Proposal - Piping - Steel STR FabRidoNoch keine Bewertungen

- D 100 Dat PRQ 004 - D (App) Itp For PaintingDokument13 SeitenD 100 Dat PRQ 004 - D (App) Itp For PaintingRido100% (2)

- Standard Pengiriman MaterialDokument1 SeiteStandard Pengiriman MaterialRidoNoch keine Bewertungen

- Checklist ISO 22000Dokument30 SeitenChecklist ISO 22000Abdelhamid SadNoch keine Bewertungen

- Washingtons PresidencyDokument27 SeitenWashingtons PresidencyoscaryligiaNoch keine Bewertungen

- Barnacus: City in Peril: BackgroundDokument11 SeitenBarnacus: City in Peril: BackgroundEtienne LNoch keine Bewertungen

- Suffixes in Hebrew: Gender and NumberDokument11 SeitenSuffixes in Hebrew: Gender and Numberyuri bryanNoch keine Bewertungen

- IJN Minekaze, Kamikaze and Mutsuki Class DestroyersDokument11 SeitenIJN Minekaze, Kamikaze and Mutsuki Class DestroyersPeterD'Rock WithJason D'Argonaut100% (2)

- An Introduction To The "Mantra Śãstra": By: S.E. Gop ĀlāchārluDokument25 SeitenAn Introduction To The "Mantra Śãstra": By: S.E. Gop ĀlāchārluKuldeep SharmaNoch keine Bewertungen

- Femi-1020315836-The Life Styles Hotel Surabaya-HOTEL - STANDALONE-1Dokument2 SeitenFemi-1020315836-The Life Styles Hotel Surabaya-HOTEL - STANDALONE-1Deka AdeNoch keine Bewertungen

- US Internal Revenue Service: Irb04-43Dokument27 SeitenUS Internal Revenue Service: Irb04-43IRSNoch keine Bewertungen

- BINF - Individual Assignment - B6Dokument2 SeitenBINF - Individual Assignment - B6jmhdeve0% (1)

- 07 Chapter1Dokument19 Seiten07 Chapter1zakariya ziuNoch keine Bewertungen

- District Memo 2021 PPST PPSSHDokument2 SeitenDistrict Memo 2021 PPST PPSSHRosalie MarquezNoch keine Bewertungen

- Pub 505 - Estimated Tax (2002)Dokument49 SeitenPub 505 - Estimated Tax (2002)andrewh3Noch keine Bewertungen

- "Land Enough in The World" - Locke's Golden Age and The Infinite Extension of "Use"Dokument21 Seiten"Land Enough in The World" - Locke's Golden Age and The Infinite Extension of "Use"resperadoNoch keine Bewertungen

- Jazzed About Christmas Level 2-3Dokument15 SeitenJazzed About Christmas Level 2-3Amanda Atkins64% (14)

- Conceptual Art and The Politics of PublicityDokument253 SeitenConceptual Art and The Politics of PublicityAlan Eric Sanguinetti77% (13)

- Specpro 4Dokument12 SeitenSpecpro 4Venice SantibañezNoch keine Bewertungen

- Color Code Look For Complied With ECE Look For With Partial Compliance, ECE Substitute Presented Look For Not CompliedDokument2 SeitenColor Code Look For Complied With ECE Look For With Partial Compliance, ECE Substitute Presented Look For Not CompliedMelanie Nina ClareteNoch keine Bewertungen

- Tata Contact UsDokument9 SeitenTata Contact UsS K SinghNoch keine Bewertungen

- Obsa Ahmed Research 2013Dokument55 SeitenObsa Ahmed Research 2013Ebsa AdemeNoch keine Bewertungen

- Ephesians 5.32-33Dokument2 SeitenEphesians 5.32-33Blaine RogersNoch keine Bewertungen

- Understanding Culture, Society, and Politics Quarter 2 - Module 5 EducationDokument19 SeitenUnderstanding Culture, Society, and Politics Quarter 2 - Module 5 EducationMhecy Sagandilan100% (4)

- User Guide: How To Register & Verify Your Free Paxum Personal AccountDokument17 SeitenUser Guide: How To Register & Verify Your Free Paxum Personal AccountJose Manuel Piña BarriosNoch keine Bewertungen

- P 141Dokument1 SeiteP 141Ma RlNoch keine Bewertungen

- Ryterna Modul Architectural Challenge 2021Dokument11 SeitenRyterna Modul Architectural Challenge 2021Pham QuangdieuNoch keine Bewertungen

- 3.19 Passive VoiceDokument10 Seiten3.19 Passive VoiceRetno RistianiNoch keine Bewertungen

- Fill in The Blanks, True & False MCQs (Accounting Manuals)Dokument13 SeitenFill in The Blanks, True & False MCQs (Accounting Manuals)Ratnesh RajanyaNoch keine Bewertungen

- Professional Cloud Architect Journey PDFDokument1 SeiteProfessional Cloud Architect Journey PDFPraphulla RayalaNoch keine Bewertungen