Beruflich Dokumente

Kultur Dokumente

F 1040 Sa

Hochgeladen von

hgfed4321Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

F 1040 Sa

Hochgeladen von

hgfed4321Copyright:

Verfügbare Formate

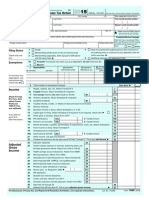

SCHEDULE A Itemized Deductions OMB No.

1545-0074

(Form 1040)

Department of the Treasury

▶ Go to www.irs.gov/ScheduleA for instructions and the latest information.

▶ Attach to Form 1040. 2017

Attachment

Internal Revenue Service (99) Caution: If you are claiming a net qualified disaster loss on Form 4684, see the instructions for line 28. Sequence No. 07

Name(s) shown on Form 1040 Your social security number

Caution: Do not include expenses reimbursed or paid by others.

Medical

1Medical and dental expenses (see instructions) . . . . . 1

and

2Enter amount from Form 1040, line 38 2

Dental

3Multiply line 2 by 7.5% (0.075). . . . . . . . . . . . 3

Expenses

4Subtract line 3 from line 1. If line 3 is more than line 1, enter -0- . . . . . . . . 4

Taxes You 5State and local (check only one box):

Paid a

b

Income taxes, or

General sales taxes }

. . . . . . . . . . . 5

6 Real estate taxes (see instructions) . . . . . . . . . 6

7 Personal property taxes . . . . . . . . . . . . . 7

8 Other taxes. List type and amount ▶

8

9 Add lines 5 through 8 . . . . . . . . . . . . . . . . . . . . . . 9

Interest 10 Home mortgage interest and points reported to you on Form 1098 10

You Paid 11 Home mortgage interest not reported to you on Form 1098. If paid

to the person from whom you bought the home, see instructions

Note: and show that person’s name, identifying no., and address ▶

Your mortgage

interest

deduction may 11

be limited (see 12 Points not reported to you on Form 1098. See instructions for

instructions). special rules . . . . . . . . . . . . . . . . . 12

13 Mortgage insurance premiums (see instructions) . . . . . 13

14 Investment interest. Attach Form 4952 if required. See instructions 14

15 Add lines 10 through 14 . . . . . . . . . . . . . . . . . . . . . 15

Gifts to 16 Gifts by cash or check. If you made any gift of $250 or more,

Charity see instructions . . . . . . . . . . . . . . . . 16

If you made a 17 Other than by cash or check. If any gift of $250 or more, see

gift and got a instructions. You must attach Form 8283 if over $500 . . . 17

benefit for it, 18 Carryover from prior year . . . . . . . . . . . . 18

see instructions.

19 Add lines 16 through 18 . . . . . . . . . . . . . . . . . . . . . 19

Casualty and 20 Casualty or theft loss(es) other than net qualified disaster losses. Attach Form 4684 and

Theft Losses enter the amount from line 18 of that form. See instructions . . . . . . . . . 20

Job Expenses 21 Unreimbursed employee expenses—job travel, union dues,

and Certain job education, etc. Attach Form 2106 or 2106-EZ if required.

Miscellaneous See instructions. ▶ 21

Deductions 22 Tax preparation fees . . . . . . . . . . . . . 22

23 Other expenses—investment, safe deposit box, etc. List type

and amount ▶

23

24 Add lines 21 through 23 . . . . . . . . . . . . 24

25 Enter amount from Form 1040, line 38 25

26 Multiply line 25 by 2% (0.02) . . . . . . . . . . 26

27 Subtract line 26 from line 24. If line 26 is more than line 24, enter -0- . . . . . . 27

Other 28 Other—from list in instructions. List type and amount ▶

Miscellaneous

Deductions 28

Total 29 Is Form 1040, line 38, over $156,900?

}

Itemized No. Your deduction is not limited. Add the amounts in the far right column

Deductions for lines 4 through 28. Also, enter this amount on Form 1040, line 40. . . 29

Yes. Your deduction may be limited. See the Itemized Deductions

Worksheet in the instructions to figure the amount to enter.

30 If you elect to itemize deductions even though they are less than your standard

deduction, check here . . . . . . . . . . . . . . . . . . . ▶

For Paperwork Reduction Act Notice, see the Instructions for Form 1040. Cat. No. 17145C Schedule A (Form 1040) 2017

Das könnte Ihnen auch gefallen

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineVon EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNoch keine Bewertungen

- Itemized Deductions: Medical and Dental ExpensesDokument1 SeiteItemized Deductions: Medical and Dental ExpensesnuseNoch keine Bewertungen

- F 1040 SaDokument2 SeitenF 1040 Saljens09Noch keine Bewertungen

- J.K. Lasser's Small Business Taxes 2012: Your Complete Guide to a Better Bottom LineVon EverandJ.K. Lasser's Small Business Taxes 2012: Your Complete Guide to a Better Bottom LineNoch keine Bewertungen

- F 1040 SaDokument1 SeiteF 1040 SaPrekelNoch keine Bewertungen

- 1040 Exam Prep Module V: Adjustments to Income or DeductionsVon Everand1040 Exam Prep Module V: Adjustments to Income or DeductionsNoch keine Bewertungen

- HTTPSWWW Irs Govpubirs-Pdff1040sa PDFDokument1 SeiteHTTPSWWW Irs Govpubirs-Pdff1040sa PDFAppaNoch keine Bewertungen

- JK Lasser's Small Business Taxes 2010: Your Complete Guide to a Better Bottom LineVon EverandJK Lasser's Small Business Taxes 2010: Your Complete Guide to a Better Bottom LineNoch keine Bewertungen

- Itemized Deductions: Medical and Dental ExpensesDokument1 SeiteItemized Deductions: Medical and Dental Expensesapi-173610472Noch keine Bewertungen

- Individual Tax Return Problem 2 Form 1040 Schedule ADokument1 SeiteIndividual Tax Return Problem 2 Form 1040 Schedule AHenry PhamNoch keine Bewertungen

- U.S. Nonresident Alien Income Tax Return: Please Print or TypeDokument5 SeitenU.S. Nonresident Alien Income Tax Return: Please Print or TypepdizypdizyNoch keine Bewertungen

- Additional Income and Adjustments To IncomeDokument1 SeiteAdditional Income and Adjustments To IncomeDean RomanNoch keine Bewertungen

- Form - 6251Dokument2 SeitenForm - 6251Anonymous JqimV1ENoch keine Bewertungen

- Profit or Loss From Business: Schedule C (Form 1040) 09Dokument2 SeitenProfit or Loss From Business: Schedule C (Form 1040) 09Dunk7Noch keine Bewertungen

- DHHSCDokument2 SeitenDHHSClrowland974Noch keine Bewertungen

- Alternative Minimum Tax IndividualsDokument2 SeitenAlternative Minimum Tax IndividualshujiNoch keine Bewertungen

- Profit or Loss From Business: Schedule C (Form 1040) 09Dokument2 SeitenProfit or Loss From Business: Schedule C (Form 1040) 09John Bean100% (1)

- Profit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09Dokument2 SeitenProfit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09Navek SmithsNoch keine Bewertungen

- Certain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax ReturnDokument6 SeitenCertain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax ReturnStephanie YatesNoch keine Bewertungen

- Exempt Organization Business Income Tax Return: (And Proxy Tax Under Section 6033 (E) )Dokument2 SeitenExempt Organization Business Income Tax Return: (And Proxy Tax Under Section 6033 (E) )lp101goldNoch keine Bewertungen

- 2022 Draft Schedule ADokument2 Seiten2022 Draft Schedule ARiley CareNoch keine Bewertungen

- Additional Income and Adjustments To IncomeDokument1 SeiteAdditional Income and Adjustments To IncomeSz. RolandNoch keine Bewertungen

- FD-Schedule C-Profit or Loss From Business (Sole Prop)Dokument2 SeitenFD-Schedule C-Profit or Loss From Business (Sole Prop)Anthony Juice Gaston BeyNoch keine Bewertungen

- Irs 6251Dokument2 SeitenIrs 6251Lincoln WebberNoch keine Bewertungen

- Profit or Loss From Business: Schedule C (Form 1040) 09Dokument2 SeitenProfit or Loss From Business: Schedule C (Form 1040) 09Skip LarsonNoch keine Bewertungen

- F1040sa 2013Dokument2 SeitenF1040sa 2013Sarah KuldipNoch keine Bewertungen

- Profit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09Dokument2 SeitenProfit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09jay wallace100% (4)

- Amended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any ChangesDokument2 SeitenAmended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any ChangesKel TranNoch keine Bewertungen

- Foreign Tax Credit: A B C D eDokument2 SeitenForeign Tax Credit: A B C D eSamer Mira BazziNoch keine Bewertungen

- Profit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09Dokument2 SeitenProfit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09Thomas LawrenceNoch keine Bewertungen

- US Internal Revenue Service: f6251 - 2000Dokument2 SeitenUS Internal Revenue Service: f6251 - 2000IRSNoch keine Bewertungen

- Alternative Minimum Tax-IndividualsDokument2 SeitenAlternative Minimum Tax-IndividualsBenjamín Varela UmbralNoch keine Bewertungen

- Profit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09Dokument2 SeitenProfit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09fortha loveof100% (5)

- Randy Thompson SCH C 2020Dokument2 SeitenRandy Thompson SCH C 2020sahilNoch keine Bewertungen

- f1040 Schedule C Expenses PDFDokument2 Seitenf1040 Schedule C Expenses PDFVallery FisherNoch keine Bewertungen

- U.S. Individual Income Tax ReturnDokument2 SeitenU.S. Individual Income Tax ReturnHamzah B ShakeelNoch keine Bewertungen

- Massachusettsschedule CDokument2 SeitenMassachusettsschedule Cmatthewbraunschweig65100% (1)

- 1040x2 PDFDokument2 Seiten1040x2 PDFolddiggerNoch keine Bewertungen

- Profit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09Dokument2 SeitenProfit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09rose ownes100% (2)

- Blackeye0-Loan-2000-Schedule CDokument2 SeitenBlackeye0-Loan-2000-Schedule Cpolaoapp3043Noch keine Bewertungen

- Child and Dependent Care Expenses: (If You Have More Than Two Care Providers, See The Instructions.)Dokument2 SeitenChild and Dependent Care Expenses: (If You Have More Than Two Care Providers, See The Instructions.)api-173610472Noch keine Bewertungen

- U.S. Individual Income Tax ReturnDokument2 SeitenU.S. Individual Income Tax Returnapi-310622354Noch keine Bewertungen

- Profit or Loss From Business: Schedule C (Form 1040) 09Dokument2 SeitenProfit or Loss From Business: Schedule C (Form 1040) 09Braeylnn bookerNoch keine Bewertungen

- f1040 - Schedule - C - 2019-00-00-ED SNIDER YOUTH HOCKEY FOUNDATIONDokument2 Seitenf1040 - Schedule - C - 2019-00-00-ED SNIDER YOUTH HOCKEY FOUNDATIONKeller Brown Jnr50% (2)

- Profit or Loss From Business: Schedule C (Form 1040) 09Dokument2 SeitenProfit or Loss From Business: Schedule C (Form 1040) 09JIMOH100% (1)

- Form6251-2021-PDF Reader ProDokument2 SeitenForm6251-2021-PDF Reader ProujehgjyiNoch keine Bewertungen

- Please Review The Updated Information Below.: For Begins After This CoversheetDokument6 SeitenPlease Review The Updated Information Below.: For Begins After This CoversheetAshutosh Singh ParmarNoch keine Bewertungen

- TaxReturn PDFDokument7 SeitenTaxReturn PDFChristine WillisNoch keine Bewertungen

- US Internal Revenue Service: f6251 - 1997Dokument2 SeitenUS Internal Revenue Service: f6251 - 1997IRSNoch keine Bewertungen

- Profit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09Dokument2 SeitenProfit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09Patty Morrarty24Noch keine Bewertungen

- Schedule C DolpheDokument2 SeitenSchedule C Dolphejyoti06ranjanNoch keine Bewertungen

- Casualties and Thefts: or Business or For Income-Producing Purposes.)Dokument2 SeitenCasualties and Thefts: or Business or For Income-Producing Purposes.)Marco Áureo ParraNoch keine Bewertungen

- F 1040 SeDokument2 SeitenF 1040 SepdizypdizyNoch keine Bewertungen

- Example Tax ReturnDokument6 SeitenExample Tax Returnapi-252304176Noch keine Bewertungen

- Casualties and TheftsDokument4 SeitenCasualties and TheftsDr Camille Belle And Jade LinkNoch keine Bewertungen

- Amended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any ChangesDokument2 SeitenAmended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any ChangesEri TakataNoch keine Bewertungen

- US Internal Revenue Service: f6251 - 1996Dokument1 SeiteUS Internal Revenue Service: f6251 - 1996IRSNoch keine Bewertungen

- Supplemental Income and Loss: Schedule E (Form 1040) 13Dokument2 SeitenSupplemental Income and Loss: Schedule E (Form 1040) 13api-253299751Noch keine Bewertungen

- I 1040 ScaDokument19 SeitenI 1040 Scahgfed4321Noch keine Bewertungen

- Weo Update July 2017 PDFDokument7 SeitenWeo Update July 2017 PDFhgfed4321Noch keine Bewertungen

- ModelingAndMeasuringInformationAsymm PreviewDokument60 SeitenModelingAndMeasuringInformationAsymm Previewhgfed4321Noch keine Bewertungen

- TimeDokument1 SeiteTimehgfed4321Noch keine Bewertungen

- TimeDokument1 SeiteTimehgfed4321Noch keine Bewertungen

- MEET2HOME Partnership DeedDokument6 SeitenMEET2HOME Partnership DeedVijay Sharath GoallaNoch keine Bewertungen

- Feasibility Report of BakeryDokument43 SeitenFeasibility Report of BakeryEdz Medina0% (1)

- Release: 2 Quarter of 2021Dokument29 SeitenRelease: 2 Quarter of 2021Rafa BorgesNoch keine Bewertungen

- SIA - Siklus Produksi Dan Buku BesarDokument4 SeitenSIA - Siklus Produksi Dan Buku BesarPutridyahNoch keine Bewertungen

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDokument1 SeiteIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageRAMBABU KURUVANoch keine Bewertungen

- Sample SM Cases CF Ross 13Dokument4 SeitenSample SM Cases CF Ross 13Daniel Alonso Ochoa GordónNoch keine Bewertungen

- FI MM OBYC ScenariosDokument29 SeitenFI MM OBYC ScenariosPawanDubeyNoch keine Bewertungen

- Marginal CostingDokument17 SeitenMarginal CostingsubhaniaqheelNoch keine Bewertungen

- Theory of Income DeterminationDokument4 SeitenTheory of Income DeterminationAbhishek SinhaNoch keine Bewertungen

- News Update Jadi ImagingDokument3 SeitenNews Update Jadi Imaginglimml63Noch keine Bewertungen

- A Mutual Fund is a Common Pool of Money in to Which Investors With Common Investment Objective Place Their Contributions That Are to Be Invested in Accordance With the Stated Investment Objective of the SchemeDokument6 SeitenA Mutual Fund is a Common Pool of Money in to Which Investors With Common Investment Objective Place Their Contributions That Are to Be Invested in Accordance With the Stated Investment Objective of the SchemeKumaran MohanNoch keine Bewertungen

- Financial Performance in Maruti Suzuki: August 2019Dokument8 SeitenFinancial Performance in Maruti Suzuki: August 2019shivam singhNoch keine Bewertungen

- MBA Decision Report-Group 1Dokument17 SeitenMBA Decision Report-Group 1DhrutiMishraNoch keine Bewertungen

- Engineering Economics - Present Worth AnalysisDokument40 SeitenEngineering Economics - Present Worth AnalysisQuach Nguyen100% (3)

- 201611111422181faq On International WorkerDokument7 Seiten201611111422181faq On International WorkerSumit JhaNoch keine Bewertungen

- Lesson 3 Sample Problem #2Dokument3 SeitenLesson 3 Sample Problem #2not funny didn't laughNoch keine Bewertungen

- Select A Company Listed On An InternationallyDokument4 SeitenSelect A Company Listed On An InternationallyTalha chNoch keine Bewertungen

- Mergers and Acquisitions A Comparative Review of LDokument22 SeitenMergers and Acquisitions A Comparative Review of LmonuNoch keine Bewertungen

- Performance AGlanceDokument1 SeitePerformance AGlanceHarshal SawaleNoch keine Bewertungen

- 2012 Dec QCF QDokument3 Seiten2012 Dec QCF QMohamedNoch keine Bewertungen

- NYSF Leveraged Buyout Model Solution Part ThreeDokument23 SeitenNYSF Leveraged Buyout Model Solution Part ThreeBenNoch keine Bewertungen

- Mondelez ReportDokument8 SeitenMondelez ReportSrivathsanVaradan100% (1)

- Submitted To: Submitted By:: Dr. Bobby B.Pandey Aniket Sao Lecturer Roshan Kumar Vijay Bharat Ravi Lal UraonDokument15 SeitenSubmitted To: Submitted By:: Dr. Bobby B.Pandey Aniket Sao Lecturer Roshan Kumar Vijay Bharat Ravi Lal Uraonales_dasNoch keine Bewertungen

- Reviewer Acctg 11Dokument9 SeitenReviewer Acctg 11ezraelydanNoch keine Bewertungen

- Committee Member StatementsDokument10 SeitenCommittee Member StatementsJohn AllisonNoch keine Bewertungen

- Madras Labour UnionDokument4 SeitenMadras Labour UnionPraneeth ProdduturuNoch keine Bewertungen

- FOREXDokument8 SeitenFOREXIvy NisorradaNoch keine Bewertungen

- 11 Economics Notes Ch16Dokument3 Seiten11 Economics Notes Ch16HackerzillaNoch keine Bewertungen

- Certificate of Incorporation 17.07.2018 LogskimDokument1 SeiteCertificate of Incorporation 17.07.2018 LogskimRamesh G LogSkiMNoch keine Bewertungen

- Assignment of AccountingDokument3 SeitenAssignment of AccountingShanida AdzkiaNoch keine Bewertungen