Beruflich Dokumente

Kultur Dokumente

Exercise - Chapter 6 7

Hochgeladen von

Nhật TânOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Exercise - Chapter 6 7

Hochgeladen von

Nhật TânCopyright:

Verfügbare Formate

EXERCISE & PROBLEM CHAPTER 6

1. A company enters into a short futures contract to sell 5,000 bushels of wheat for 250cent per bushel. The initial

margin is $3,000 and the maintenance margin is $2,000. What price change would lead to a margin call? Under

what circumstances could $1,500 be withdraw from the margin account?

2. You enter into a futures contract to buy €125,000 at $1.28 per euro. The spot exchange rate when you enter the

contract is $1.16. Your initial performance bond is $6,800 and your maintenance level is $2,700. At what settle

price will you get a margin call?

3. An investor enter into a short cotton futures contract when the futures price is 50 cents per pound. One contract

is for the delivery of 50,000 pounds. How much does the investor gain or lose if the cotton price at the end of the

contract is (a) 48.20 cents per pound and (b) 51.30 cents per pound?

4. A pig farmer expects to have 90,000 pounds of live hogs to sell in three months. The live-hogs futures contract on

the CME is for the delivery of 30,000 pounds of hog. How can the farmer use the contract for hedging? From the

farmer’s viewpoint, what are the pros and cons of hedging?

5. The forward price on DM for delivery in 45 days is quoted as 1.8204. The futures price for a contract that will be

delivered in 45 days is 0.4579. Explain these two quotes. Which is more favorable for an investor wanting to sells

marks?

6. Suppose that on October 24, 2015 you take a short in an April 2016 live-cattle futures contract. You close out your

position on January 21,1998. The futures price (per pound) is 61.20 cents when you enter into the contract, 58,30

cents when you close out your position, and 58.80 cents at the end of December 2016. One contract is for the

delivery of 40,000 pounds of cattle. What is your total profit?

7. On Monday morning, an investor takes a long position in a pound futures contract that matures on Wednesday

afternoon. The agreed-on price is $1.78 for BP62,500. At the close of trading on Monday, the futures price has

risen to $1.79. At Tuesday close, the futures price rises further to $1.80. At Wednesday close, the futures price

falls to $1.785, and the contract matures. The investor trade off the contract, detail the daily settlement process.

What will be the investor’s profit (loss)?

8. Citicorp sells a call option on Mexico peso (Contract size ps500,000) at a premium of $0.04 per peso. If the

exercise price is $0.71 and the spot price of peso at date of expiration is $0.73. What is Citicorp’s profit (loss) on

the call option?

9. A trader executes a “bear spread” on the Japanese yen consisting of a long PHLX 103 March put and a short PHLX

101 march put.

a. If the price of the 103 put is 2.81cent/yen and the price of the 101 put is 0.64 cent/yen. What is the net

cost of the bear spread?

b. What is the maximum amount the trader can make on the bear spread in the event the yen depreciates

against the dollar?

c. Redo your answer to parts a and b, assuming the trader executes a bull spread consisting of a long PHLX

101 march call prices at 1.96 cent/yen and a short PHLX 99 March call priced at 3.91 cent/yen. What is the

trader’s maximum profit? Maximum loss?

10. Three put options on a stock have the same expiration date and strike prices of 55$, 60$, and $65. The market

price are $3, $5, and $8, respectively. Explain how a butterfly spread can be created. Construct a table showing the

profit from the strategy. For what range of stock prices would the butterfly spread lead to a loss?

Das könnte Ihnen auch gefallen

- Case 3. Mass Customization in Starbucks - Faisel MohamedDokument3 SeitenCase 3. Mass Customization in Starbucks - Faisel MohamedFaisel MohamedNoch keine Bewertungen

- International Financial Management PPT MBADokument39 SeitenInternational Financial Management PPT MBABabasab Patil (Karrisatte)67% (3)

- CH07 Assessment PreparationDokument13 SeitenCH07 Assessment PreparationEthan RuppNoch keine Bewertungen

- (123doc) - Bai-Tap-On-Tap-AnswerDokument4 Seiten(123doc) - Bai-Tap-On-Tap-AnswerTrần Thị Mai AnhNoch keine Bewertungen

- Bán KemDokument7 SeitenBán Kemmagical_life96Noch keine Bewertungen

- Shiseido in ChinaDokument6 SeitenShiseido in ChinaThanh Trúc Nguyễn ĐăngNoch keine Bewertungen

- Group 6 Group Assignment Chapter 3Dokument6 SeitenGroup 6 Group Assignment Chapter 3CatnipNoch keine Bewertungen

- Group Assignment Chapter 5Dokument2 SeitenGroup Assignment Chapter 5Uyen TranNoch keine Bewertungen

- Case AnalysisDokument7 SeitenCase AnalysisRadhika ChhabraNoch keine Bewertungen

- Test Bank Financial InstrumentDokument13 SeitenTest Bank Financial InstrumentMasi100% (1)

- David TIF Ch04Dokument24 SeitenDavid TIF Ch04Jue Yasin50% (4)

- Project On Gold Loan J PDokument61 SeitenProject On Gold Loan J PJai Praksah Sharma83% (12)

- McDonald's France en CaseStudyDokument3 SeitenMcDonald's France en CaseStudyVivek KumarNoch keine Bewertungen

- DISTRIBUTION NETWORKS-Last Mile Delivery With Customer Pickup and Just in TimeDokument16 SeitenDISTRIBUTION NETWORKS-Last Mile Delivery With Customer Pickup and Just in TimeKshitij BhargavaNoch keine Bewertungen

- Nguyen Thi Mai. 19071422. INS4018.02Dokument15 SeitenNguyen Thi Mai. 19071422. INS4018.0219071422 Nguyễn Thị MaiNoch keine Bewertungen

- Group 4 - FTC01 - Case 4Dokument12 SeitenGroup 4 - FTC01 - Case 4ĐỨC NGUYỄN ÍCH MINHNoch keine Bewertungen

- Inglés ChangeDokument5 SeitenInglés ChangeLourdes G-pNoch keine Bewertungen

- Incoterms 2010Dokument3 SeitenIncoterms 2010Quỳnh AnhNoch keine Bewertungen

- Bài Tập Luyện Viết Email - Student VersionDokument5 SeitenBài Tập Luyện Viết Email - Student VersionSơn TriệuNoch keine Bewertungen

- ASSESSMENT SCOR Model (OM)Dokument3 SeitenASSESSMENT SCOR Model (OM)Rahul AgarwalNoch keine Bewertungen

- Unit 9: Trade: Total of Payments (Khong Chac)Dokument32 SeitenUnit 9: Trade: Total of Payments (Khong Chac)Đinh Thị Mỹ LinhNoch keine Bewertungen

- BT Ôn Tap - AnswerDokument4 SeitenBT Ôn Tap - AnswerThị Diệu Hương NguyễnNoch keine Bewertungen

- SCM301m Quiz 2 KeyDokument15 SeitenSCM301m Quiz 2 KeyVu Dieu LinhNoch keine Bewertungen

- GW4 - Quantity and InventoryDokument1 SeiteGW4 - Quantity and InventoryPhương TrầnNoch keine Bewertungen

- Introduction About Big CDokument12 SeitenIntroduction About Big Cblackangel707Noch keine Bewertungen

- Mini Case Chapter 8Dokument2 SeitenMini Case Chapter 8Peter PkNoch keine Bewertungen

- Toyota Thailand Consulting Case StudyDokument4 SeitenToyota Thailand Consulting Case StudySiwaporn WanveeratikulNoch keine Bewertungen

- Ifm GR.5 CH.7Dokument8 SeitenIfm GR.5 CH.7Nguyễn LâmNoch keine Bewertungen

- Nghiên Cứu Về Chiến Lược Của MixueDokument8 SeitenNghiên Cứu Về Chiến Lược Của MixuePhạm Diệu LinhNoch keine Bewertungen

- BOJ - Functions and Operations of The BOJDokument344 SeitenBOJ - Functions and Operations of The BOJ007featherNoch keine Bewertungen

- Group Assignment Chapter 2 (Pricing) - Team 4Dokument4 SeitenGroup Assignment Chapter 2 (Pricing) - Team 4Vũ Minh HằngNoch keine Bewertungen

- MKT205 Assignment 2Dokument12 SeitenMKT205 Assignment 2Phuc DinhNoch keine Bewertungen

- Bài cá nhân - Nguyễn Đức Thiện - IB008 - ST4 - A210Dokument13 SeitenBài cá nhân - Nguyễn Đức Thiện - IB008 - ST4 - A210THIEN NGUYEN DUCNoch keine Bewertungen

- Success Marketing Solution of NESTLÉ MILODokument6 SeitenSuccess Marketing Solution of NESTLÉ MILOLê Duy LươngNoch keine Bewertungen

- Case 1Dokument5 SeitenCase 1Baongoc Lephuoc0% (1)

- Hw1-Group 8Dokument7 SeitenHw1-Group 8ManhNoch keine Bewertungen

- PP VinamilkDokument26 SeitenPP VinamilkĐức Thạch NguyễnNoch keine Bewertungen

- File ôn trắc nghiệm TACN 1Dokument15 SeitenFile ôn trắc nghiệm TACN 1Giang DươngNoch keine Bewertungen

- Dell Report Official PDFDokument28 SeitenDell Report Official PDFVinh TrươngNoch keine Bewertungen

- Supplementary Exercises - Unit 1Dokument2 SeitenSupplementary Exercises - Unit 1Đức TrungNoch keine Bewertungen

- Assignment Week 5Dokument1 SeiteAssignment Week 5Thanh Thanhh100% (1)

- Brand Management Report 2Dokument33 SeitenBrand Management Report 2Al Amin50% (2)

- Chapter 15Dokument67 SeitenChapter 15umairnedNoch keine Bewertungen

- Chapter 2: The Present ValueDokument4 SeitenChapter 2: The Present ValueVân ĂnggNoch keine Bewertungen

- Lotus TeaDokument23 SeitenLotus TeaStaffany Tran0% (1)

- Impact of The UKVFTA On The Export of Vietnam's Textile and Garment To The UKDokument37 SeitenImpact of The UKVFTA On The Export of Vietnam's Textile and Garment To The UKThu Hai LeNoch keine Bewertungen

- DTTC 2Dokument44 SeitenDTTC 2ngochanhime0906Noch keine Bewertungen

- Planning Case Study D3 D4Dokument3 SeitenPlanning Case Study D3 D4Van Vien NguyenNoch keine Bewertungen

- Micro Enviroment Related To Vinamilk VietnamDokument9 SeitenMicro Enviroment Related To Vinamilk VietnamHn NguyễnNoch keine Bewertungen

- Chiến lược kinh doanh quốc tế của Viettel tại LàoDokument14 SeitenChiến lược kinh doanh quốc tế của Viettel tại LàoNam NguyễnNoch keine Bewertungen

- Practice Email - Enm301Dokument12 SeitenPractice Email - Enm301Phan Thien Nhan (K17 CT)Noch keine Bewertungen

- Maktin (ML) PDFDokument89 SeitenMaktin (ML) PDFbichlynguyenNoch keine Bewertungen

- Practice For Group Work Week 2-3Dokument4 SeitenPractice For Group Work Week 2-3ENRICH YOUR ENGLISHNoch keine Bewertungen

- TT 00051000046Dokument123 SeitenTT 00051000046langtu2011Noch keine Bewertungen

- Group 6 - Case Study OptimizationDokument17 SeitenGroup 6 - Case Study OptimizationLinh ChiNoch keine Bewertungen

- (ENG) Dongwon Systems Catalogue PDFDokument21 Seiten(ENG) Dongwon Systems Catalogue PDFhans weemaesNoch keine Bewertungen

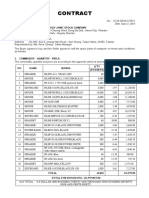

- Contract: Buyer: Silicom Technology Joint Stock CompanyDokument3 SeitenContract: Buyer: Silicom Technology Joint Stock CompanyLương Thị Mỹ DuyênNoch keine Bewertungen

- Introduce: Chuong Duong Beverages Joint Stock CompanyDokument5 SeitenIntroduce: Chuong Duong Beverages Joint Stock CompanyThu Võ ThịNoch keine Bewertungen

- Challenges in Universal BankingDokument2 SeitenChallenges in Universal BankingFreddy Savio D'souza0% (2)

- Trung Nguyên Legend Corp.: Brews Up The Perfect Plan To Support Business ExpansionDokument4 SeitenTrung Nguyên Legend Corp.: Brews Up The Perfect Plan To Support Business ExpansionTrần Thủy VânNoch keine Bewertungen

- Assignment 2 Front Sheet: Qualification BTEC Level 4 HND Diploma in BusinessDokument17 SeitenAssignment 2 Front Sheet: Qualification BTEC Level 4 HND Diploma in BusinessNguyễn AnNoch keine Bewertungen

- AC10 - Anh Van CN - KT1Dokument23 SeitenAC10 - Anh Van CN - KT1Do Ngoc NhiNoch keine Bewertungen

- Question and Problem-Sinh VienDokument4 SeitenQuestion and Problem-Sinh Vienapi-3755121Noch keine Bewertungen

- David TIF Ch06Dokument22 SeitenDavid TIF Ch06Jue Yasin33% (3)

- David TIF Ch07Dokument14 SeitenDavid TIF Ch07harlloveNoch keine Bewertungen

- David TIF Ch05Dokument23 SeitenDavid TIF Ch05Jue Yasin64% (11)

- Kaizen FullDokument117 SeitenKaizen FullNhật TânNoch keine Bewertungen

- David TIF Ch03Dokument24 SeitenDavid TIF Ch03Jue Yasin67% (9)

- Pap Wasess3a5mekongDokument10 SeitenPap Wasess3a5mekongNhật TânNoch keine Bewertungen

- Phuc ChatDokument77 SeitenPhuc ChatTringuyen215Noch keine Bewertungen

- Water Quality Report Card 2010Dokument16 SeitenWater Quality Report Card 2010Nhật TânNoch keine Bewertungen

- Diagnosis & Recommendations For AdaptationDokument75 SeitenDiagnosis & Recommendations For AdaptationNhật TânNoch keine Bewertungen

- Environment Transboundary Water Quality Issues in The Lower Mekong Basin 2Dokument77 SeitenEnvironment Transboundary Water Quality Issues in The Lower Mekong Basin 2Nhật TânNoch keine Bewertungen

- Index: A Seminar Report Presented ToDokument16 SeitenIndex: A Seminar Report Presented ToLAKHVEER SINGHNoch keine Bewertungen

- Stock Market WidgetsDokument12 SeitenStock Market WidgetsshanysunnyNoch keine Bewertungen

- AFW368Tutorial 2answerDokument6 SeitenAFW368Tutorial 2answerSiRo Wang100% (1)

- Devi Sea Foods Rs. 900 Crs IPO Prospects 060318Dokument451 SeitenDevi Sea Foods Rs. 900 Crs IPO Prospects 060318OkkishoreNoch keine Bewertungen

- Rates PDFDokument1 SeiteRates PDFkrunal24Noch keine Bewertungen

- Roxas City Revenue CodeDokument107 SeitenRoxas City Revenue CodeRichard Delos ReyesNoch keine Bewertungen

- Shasha Denims Ltd.Dokument227 SeitenShasha Denims Ltd.Gourab Kumar ChowhanNoch keine Bewertungen

- Ramco Cements AR 2018Dokument192 SeitenRamco Cements AR 2018hsk12Noch keine Bewertungen

- Introduction To Foreign ExchangeDokument80 SeitenIntroduction To Foreign ExchangeGlobalStrategyNoch keine Bewertungen

- A Trending Walk Rather Than A Random Walk?time-Series Momentum in AustraliaDokument40 SeitenA Trending Walk Rather Than A Random Walk?time-Series Momentum in AustraliaFaisal MahboobNoch keine Bewertungen

- Capital Account ConvertibilityDokument15 SeitenCapital Account Convertibilitynaveen728Noch keine Bewertungen

- Hawkins Cooker LimitedDokument19 SeitenHawkins Cooker LimitedBijoy ShahNoch keine Bewertungen

- 05 - List of Tables and ChartsDokument3 Seiten05 - List of Tables and ChartsaswinecebeNoch keine Bewertungen

- KP Hedge Funds NewsletterDokument4 SeitenKP Hedge Funds Newsletterhttp://besthedgefund.blogspot.comNoch keine Bewertungen

- Frost As An OPK Short Seller HypothesisDokument8 SeitenFrost As An OPK Short Seller HypothesisLee PedersonNoch keine Bewertungen

- Analysis On Tiga Pilar SejahteraDokument3 SeitenAnalysis On Tiga Pilar SejahteraridaNoch keine Bewertungen

- Priyankur SynopsisDokument26 SeitenPriyankur SynopsisMukesh SharmaNoch keine Bewertungen

- IPO & Its RequirmentsDokument38 SeitenIPO & Its RequirmentsAnuj GosaiNoch keine Bewertungen

- Gagan Singh Pal STRDokument63 SeitenGagan Singh Pal STRABHISHEK GUPTANoch keine Bewertungen

- Project Report On Indian Capital Market and Trading TechniquesDokument52 SeitenProject Report On Indian Capital Market and Trading TechniquesViplav Ambastha0% (2)

- Truba College of EngineeringDokument37 SeitenTruba College of Engineeringprashantgole19Noch keine Bewertungen

- Bajaj Financial Service Research ReportDokument8 SeitenBajaj Financial Service Research Reportmoneybee67% (3)

- 5805 QSL RSSA Marketing Guide NEWDokument104 Seiten5805 QSL RSSA Marketing Guide NEWs.sabapathyNoch keine Bewertungen

- (BNP Paribas) Smile TradingDokument9 Seiten(BNP Paribas) Smile TradingBernard Rogier100% (2)

- SS 12 Portfolio Management: Question #1 of 200Dokument52 SeitenSS 12 Portfolio Management: Question #1 of 200RamNoch keine Bewertungen

- Eco2004s 2014 Test 2Dokument6 SeitenEco2004s 2014 Test 2Kiran DesrajNoch keine Bewertungen

- A Market Feasibility Study On Opening of New Branches of Investment and Finance CompanyDokument64 SeitenA Market Feasibility Study On Opening of New Branches of Investment and Finance CompanyMuhammad AhmedNoch keine Bewertungen

- Coporate GovernanceDokument221 SeitenCoporate GovernanceAmandeep Singh MankuNoch keine Bewertungen