Beruflich Dokumente

Kultur Dokumente

(Cpar2016) Far-6183 (Statement of Financial Position and Comprehensive Income)

Hochgeladen von

Irene ArantxaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

(Cpar2016) Far-6183 (Statement of Financial Position and Comprehensive Income)

Hochgeladen von

Irene ArantxaCopyright:

Verfügbare Formate

Jaypaul Ocampo Acidera, CPA 2016

CPA REVIEW SCHOOL OF THE PHILIPPINES

Manila

FINANCIAL ACCOUNTING PROBLEM VALIX SIY VALIX FERRER LAW

STATEMENT OF FINANCIAL POSITION AND COMPREHENSIVE INCOME

1.. Allyssa Company reported the following current assets onbecember 31, 2016:

Cash in bank, including P500,000 bank overdraft in another ban. 4,000,000

Accounts receivable 7,000,000

Notes receivable 2,500,000

Note receivable discounted ( 400,000)

Inventory 4,500,000

Financial asset - FVPL 1 ,000,000

Financial asset - FVOCI 1,500,000

Prepaid expenses 200,000

Deferred tax asset 2,500,000

Equipment classified as "held for sale" ' 2,000,000

Total 24 800 000

Customers' accounts, net of customers' credit balances P1,000,000 5,000„000

Allowance for doubtful accounts ' ( 500,000)

Sale price of unsold goods out on consignment at 125% of cost and excluded

from ending inventory 1,500,000

Net accounts receivable ZOOM)

What amount should be reported as total current assets on December 31, 2016?

a. 21,800,000

b. 21,300,000

c. 23,300,000

d. 19,800,000

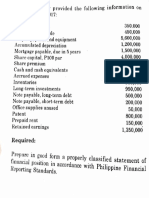

2. Gerald Company provided the following information on December 31, 2016:

Accounts payable, net of creditors' debit balances P200,000 5 2,000„000

Accrued expenses 800,000

Bonds payable due December 31, 2017 2.500,000

Discount on bonds payable 300,000

Deferred tax liability 500,000

Income tax payable 1,100,000

Cash dividend payable

•

600,000

Stock dividend payable 400,000

Note payable — 6%, due March 1, 2017 1,500,000

Note payable — 8%, due October 1, 2017 1,000,000

The financial statements for 2016 were issued on March 31, 2017. On December 31, 2016,

the 6% note payable was refinanced on a long-term basis. Under the loan agreement for the

8% note payable, the entity has the discretion to refinance the obligation for at least twelve

months after December 31, 2016. What amount should be reported as total current liabilities?

a. 7,500,000

b. 6,900,000

C. 8,400,000

cl. 7,300,000

• On January 1, 2013, Therese Company purchased a machine for P5,280,000 and depreciated it

by the straight line method using an estimated useful life of eight years with no residual value.

On January 1, 2016, the entity determined that the machine had a useful life of six years from

the date of acquisition with a residual value of P480,000. What is the accumulated depreciation

on December 31, 2016?

a. 2,920,000

b. 3,080,000

c. -3,200,000

d. 3,520,000

6183

FINANCIAL ACCOUNTING PROBLEM Page 2

4. During 2016, Grachel Company decided to change from the 'TWO method of inventory

valuation to the weighted average method. Inventory balances under each method ere:

FIFO Weigh ed Average

December 31, 2013 4,500,000 5,401,000

December 31, 2014 7,800,000 7,101,000

December 31, 2015 8,300,000 7,801,000

Before income tax, what amount should be reported as the effect of this account ng change in

the statement of retained earnings for 2016?

a. 500,000 decrease

b. 500,000 increase

c. 700,000 decrease

d. 700,000 increase

5. The financial statements of Stephen Company were authorized for issue on Mai -eh 31., 2017

and the end of the reporting period is December 31, 2016.

On December 31, 2016, the entity had an account receivable of P1,000,000 frorti a customer.

On February 1, 2017, the liquidator of the said customer advised the entity ih writing that

the customer was insolvent and that no amount woukthe paid.

The entity had reported a contingent liability on December 31, 2016 related to a court case.

On March 1, 2017, the judge handed down a decision against the entity , for damages

amounting to P1,500,000.

What total amount should be reported as "adjusting events" on December 31, 2016?

a. 1,000,000

b. 1,500,000

c. 2,500,000

d.

6. Maria Company provided the following information for the current year

Income from continuing operations 4,000,000

Income from discontinued operation ,500,000

Unrealized gain on financial 'asset - FVPL 800,000

Unrealized loss on equity investment - FVOCI 1,000,000

Unrealized gain on debt investment - FVOCI 1 200 000

Unrealized gain on futures contract designated as a cash flow hedge 400,000

Translation loss on foreign operation '200,000

Net remeasurement 51- -gam on defined benefit plan cturing_thayear

• • •

600.000,

Loss on credit risk of a financial liability designated at FVPL 300,000

Rkwaluation surplus during the year ^ 2,500,000

I. What amount should be reported as net income for the current year?

a. 4,000,000

b. 4 500 5 000

5

C. 5,300,000

cl. 4,800,000

2. What net amount should be reported as OCI for the current year?

a. 4,000,000

b. 3,500,000

C. 3,200,000

d. 700,000

3. What amount should be reported as comprehensive income for the current year?

a. 5,200,000

b. 7,700,000 J. O. A.

C . 8,500,000

d. 7 20-0 000

EN D

6183

Das könnte Ihnen auch gefallen

- Schaum's Outline of Principles of Accounting I, Fifth EditionVon EverandSchaum's Outline of Principles of Accounting I, Fifth EditionBewertung: 5 von 5 Sternen5/5 (3)

- Corporation True or FalseDokument2 SeitenCorporation True or FalseAllyza Magtibay50% (2)

- Essential Real AnalysisDokument459 SeitenEssential Real AnalysisPranay Goswami100% (2)

- Fabled 6Dokument75 SeitenFabled 6joaamNoch keine Bewertungen

- Security Information and Event Management (SIEM) - 2021Dokument4 SeitenSecurity Information and Event Management (SIEM) - 2021HarumNoch keine Bewertungen

- Statement of Financial Position Basic Problems Problem 1-1 (IFRS)Dokument18 SeitenStatement of Financial Position Basic Problems Problem 1-1 (IFRS)student80% (5)

- P1 Cash FlowDokument2 SeitenP1 Cash FlowBeth Diaz LaurenteNoch keine Bewertungen

- Chapter 1 - Statement of Financial Position: Problem 1-1 (IFRS)Dokument38 SeitenChapter 1 - Statement of Financial Position: Problem 1-1 (IFRS)Asi Cas Jav0% (1)

- AWS PowerPoint PresentationDokument129 SeitenAWS PowerPoint PresentationZack Abrahms56% (9)

- Act1111 Final ExamDokument7 SeitenAct1111 Final ExamHaidee Flavier SabidoNoch keine Bewertungen

- PRACTICAL FINANCIAL ACCOUNTING - Volume 1Dokument33 SeitenPRACTICAL FINANCIAL ACCOUNTING - Volume 1KingChryshAnneNoch keine Bewertungen

- Statement of Cash FlowsDokument6 SeitenStatement of Cash FlowsLuiNoch keine Bewertungen

- 6727 Statement of Financial PositionDokument3 Seiten6727 Statement of Financial PositionJane ValenciaNoch keine Bewertungen

- W4 - SW1 - Statement of Financial PositionDokument2 SeitenW4 - SW1 - Statement of Financial PositionJere Mae MarananNoch keine Bewertungen

- Basic Accounting - With AnswersDokument12 SeitenBasic Accounting - With AnswersMarie MeridaNoch keine Bewertungen

- Soal Passive VoiceDokument1 SeiteSoal Passive VoiceRonny RalinNoch keine Bewertungen

- Cannon Ball Review With Exercises PART 1Dokument11 SeitenCannon Ball Review With Exercises PART 1Genelyn Langote100% (1)

- Statement of Financial PositionDokument3 SeitenStatement of Financial Positionlyka0% (1)

- Treinamento DENSODokument65 SeitenTreinamento DENSOjoao mariaNoch keine Bewertungen

- P1 Quali 2017Dokument13 SeitenP1 Quali 2017Red Christian PalustreNoch keine Bewertungen

- Financial StatementsDokument6 SeitenFinancial StatementsLuiNoch keine Bewertungen

- P1 QuestionsDokument31 SeitenP1 QuestionsWillen Christia M. MadulidNoch keine Bewertungen

- Cfas Pfa 01Dokument194 SeitenCfas Pfa 01Kimberly Claire Atienza100% (1)

- Financial Accounting and Reporting Final ExaminationDokument13 SeitenFinancial Accounting and Reporting Final ExaminationBernardino PacificAce100% (1)

- 5 6294322980864393322Dokument10 Seiten5 6294322980864393322CharlesNoch keine Bewertungen

- Statement of Financial Position Basic Problems Problem 1-1 (IFRS)Dokument7 SeitenStatement of Financial Position Basic Problems Problem 1-1 (IFRS)Corina Mamaradlo CaragayNoch keine Bewertungen

- December-12Dokument3 SeitenDecember-12Kathleen MarcialNoch keine Bewertungen

- Quiz - SFP With AnswersDokument4 SeitenQuiz - SFP With Answersjanus lopezNoch keine Bewertungen

- Seatwork Far3Dokument3 SeitenSeatwork Far3Mansour HamjaNoch keine Bewertungen

- Exerc5se 2313Dokument5 SeitenExerc5se 2313Chris tine Mae MendozaNoch keine Bewertungen

- Review Notes #2 - Comprehensive Problem PDFDokument3 SeitenReview Notes #2 - Comprehensive Problem PDFtankofdoom 4Noch keine Bewertungen

- 162 PresummativeDokument5 Seiten162 PresummativeMeichigo SwadeeNoch keine Bewertungen

- AsdasdDokument3 SeitenAsdasdMark Domingo MendozaNoch keine Bewertungen

- FAR MaterialDokument25 SeitenFAR MaterialJerecko Ace ManlangatanNoch keine Bewertungen

- Statement of Financial Position Basic Problems Problem 1-1 (IFRS)Dokument18 SeitenStatement of Financial Position Basic Problems Problem 1-1 (IFRS)Marjorie PalmaNoch keine Bewertungen

- Review - SFP To Interim ReportingDokument3 SeitenReview - SFP To Interim ReportingAna Marie IllutNoch keine Bewertungen

- Statement of CashflowDokument2 SeitenStatement of CashflowAna Marie IllutNoch keine Bewertungen

- ACCTG 16 FAR W2 Problems PDFDokument5 SeitenACCTG 16 FAR W2 Problems PDFLabLab ChattoNoch keine Bewertungen

- ACC203 - AssignmentDokument2 SeitenACC203 - AssignmentHailsey WinterNoch keine Bewertungen

- Qualifying FarDokument11 SeitenQualifying FarMae Ann RaquinNoch keine Bewertungen

- 162 003Dokument5 Seiten162 003Alvin John San Juan33% (3)

- Assignment 1 Statement of Financial Position-Compressed - Compressed - Compressed-Min-CompressedDokument10 SeitenAssignment 1 Statement of Financial Position-Compressed - Compressed - Compressed-Min-CompressedJason MablesNoch keine Bewertungen

- 7017 - Preweek Lecture FAR ProblemsDokument8 Seiten7017 - Preweek Lecture FAR ProblemsJohn Paul ArrozaNoch keine Bewertungen

- Intacc - PrelimDokument10 SeitenIntacc - PrelimRenalyn ParasNoch keine Bewertungen

- 162 PreSummative2Dokument4 Seiten162 PreSummative2Alvin John San JuanNoch keine Bewertungen

- 7160 - FAR Preweek ProblemDokument14 Seiten7160 - FAR Preweek ProblemMAS CPAR 93Noch keine Bewertungen

- ACC 101 - 3rd QuizDokument3 SeitenACC 101 - 3rd QuizAdyangNoch keine Bewertungen

- 162 003Dokument4 Seiten162 003Angelli LamiqueNoch keine Bewertungen

- Summative Assessment Test 1-APPLIED AUDITDokument5 SeitenSummative Assessment Test 1-APPLIED AUDITChristine Rey RocoNoch keine Bewertungen

- Chapter 1Dokument20 SeitenChapter 1Coursehero PremiumNoch keine Bewertungen

- 6937 - Statement of Cash FlowsDokument2 Seiten6937 - Statement of Cash FlowsAljur SalamedaNoch keine Bewertungen

- Use The Following Information For Nos. 1 and 2: Classroom Exercise For Financial Reporting in HyperinflationaryDokument3 SeitenUse The Following Information For Nos. 1 and 2: Classroom Exercise For Financial Reporting in HyperinflationaryalyssaNoch keine Bewertungen

- Financial Accounting Part 3 PDFDokument6 SeitenFinancial Accounting Part 3 PDFFiona Mirasol P. BeroyNoch keine Bewertungen

- Statement of Financial PositionDokument5 SeitenStatement of Financial PositionJane GavinoNoch keine Bewertungen

- Cash Flow Online April 6 2024 For StudentsDokument5 SeitenCash Flow Online April 6 2024 For Studentsraven.jumaoas.eNoch keine Bewertungen

- Audit of Financial StatementsDokument3 SeitenAudit of Financial StatementsGwyneth TorrefloresNoch keine Bewertungen

- Drill 4 FSUU AccountingDokument6 SeitenDrill 4 FSUU AccountingRobert CastilloNoch keine Bewertungen

- Cbea FAR 01 Lecture 02Dokument16 SeitenCbea FAR 01 Lecture 02Osirisheen Aizle CubacubNoch keine Bewertungen

- Instructions: Write TRUE, If The Statement Is Correct, and FALSE, If Otherwise On The Space Provided. No ErasuresDokument3 SeitenInstructions: Write TRUE, If The Statement Is Correct, and FALSE, If Otherwise On The Space Provided. No ErasuresRizhelle CunananNoch keine Bewertungen

- Audit of Financial StatementsDokument4 SeitenAudit of Financial StatementsBrit NeyNoch keine Bewertungen

- 04 Accounts Receivable - (M.C)Dokument2 Seiten04 Accounts Receivable - (M.C)kyle mandaresioNoch keine Bewertungen

- Intermediate Accounting 3 Second Grading Quiz: Name: Date: Professor: Section: ScoreDokument2 SeitenIntermediate Accounting 3 Second Grading Quiz: Name: Date: Professor: Section: ScoreGrezel NiceNoch keine Bewertungen

- 150.curren and Non Current Assets and Liabilities 2Dokument3 Seiten150.curren and Non Current Assets and Liabilities 2Melanie SamsonaNoch keine Bewertungen

- Cpa Review School of The Philippines ManilaDokument2 SeitenCpa Review School of The Philippines ManilaKyrie Gwynette OlarveNoch keine Bewertungen

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionVon EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNoch keine Bewertungen

- (Cpar2016) Far-6182 (Conceptual Framework)Dokument3 Seiten(Cpar2016) Far-6182 (Conceptual Framework)Irene ArantxaNoch keine Bewertungen

- (Cpar2016) Far-6181 (Accounting Process)Dokument3 Seiten(Cpar2016) Far-6181 (Accounting Process)Irene ArantxaNoch keine Bewertungen

- Advent Season - : Violet? VioletDokument4 SeitenAdvent Season - : Violet? VioletIrene ArantxaNoch keine Bewertungen

- Statistics vs. ProbabilityDokument26 SeitenStatistics vs. ProbabilityIrene ArantxaNoch keine Bewertungen

- Shell Aviation: Aeroshell Lubricants and Special ProductsDokument12 SeitenShell Aviation: Aeroshell Lubricants and Special ProductsIventNoch keine Bewertungen

- Art CriticismDokument3 SeitenArt CriticismVallerie ServanoNoch keine Bewertungen

- Annex E - Part 1Dokument1 SeiteAnnex E - Part 1Khawar AliNoch keine Bewertungen

- Pod HD500X SMDokument103 SeitenPod HD500X SMerendutekNoch keine Bewertungen

- Answer To FIN 402 Exam 1 - Section002 - Version 2 Group B (70 Points)Dokument4 SeitenAnswer To FIN 402 Exam 1 - Section002 - Version 2 Group B (70 Points)erijfNoch keine Bewertungen

- Thesis ClarinetDokument8 SeitenThesis Clarinetmeganjoneshuntsville100% (2)

- V and D ReportDokument3 SeitenV and D ReportkeekumaranNoch keine Bewertungen

- Anp 203 Group4Dokument8 SeitenAnp 203 Group4ultimate legendNoch keine Bewertungen

- Econ 281 Chapter02Dokument86 SeitenEcon 281 Chapter02Elon MuskNoch keine Bewertungen

- KULT Divinity Lost - Scenario - An Echo From The Past (28-29)Dokument2 SeitenKULT Divinity Lost - Scenario - An Echo From The Past (28-29)Charly SpartanNoch keine Bewertungen

- Two Dimensional Flow of Water Through SoilDokument28 SeitenTwo Dimensional Flow of Water Through SoilMinilik Tikur SewNoch keine Bewertungen

- Computer Education in Schools Plays Important Role in Students Career Development. ItDokument5 SeitenComputer Education in Schools Plays Important Role in Students Career Development. ItEldho GeorgeNoch keine Bewertungen

- Business Law Term PaperDokument19 SeitenBusiness Law Term PaperDavid Adeabah OsafoNoch keine Bewertungen

- Becg Unit-1Dokument8 SeitenBecg Unit-1Bhaskaran Balamurali0% (1)

- Local Media7963636828850740647Dokument7 SeitenLocal Media7963636828850740647Trishia FariñasNoch keine Bewertungen

- Ozone Therapy - A Clinical Review A. M. Elvis and J. S. EktaDokument5 SeitenOzone Therapy - A Clinical Review A. M. Elvis and J. S. Ektatahuti696Noch keine Bewertungen

- 1 Mile.: # Speed Last Race # Prime Power # Class Rating # Best Speed at DistDokument5 Seiten1 Mile.: # Speed Last Race # Prime Power # Class Rating # Best Speed at DistNick RamboNoch keine Bewertungen

- Elevex ENDokument4 SeitenElevex ENMirko Mejias SotoNoch keine Bewertungen

- Chapter One: China Civil Engineering Construction Coorperation (Ccecc) WasDokument24 SeitenChapter One: China Civil Engineering Construction Coorperation (Ccecc) WasMoffat KangombeNoch keine Bewertungen

- CFJ Seminars TrainingGuide L1EnglishDokument136 SeitenCFJ Seminars TrainingGuide L1EnglishAttila AygininNoch keine Bewertungen

- Peer Pressure and Academic Performance 1Dokument38 SeitenPeer Pressure and Academic Performance 1alnoel oleroNoch keine Bewertungen

- Prelim Examination Purposive CommunicationDokument2 SeitenPrelim Examination Purposive CommunicationDaisy AmazanNoch keine Bewertungen

- Moonage Daydream From Ziggy StardustDokument18 SeitenMoonage Daydream From Ziggy StardustTin SmajlagićNoch keine Bewertungen