Beruflich Dokumente

Kultur Dokumente

Withholding Tax Table 1

Hochgeladen von

Elton SUico0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

19 Ansichten1 SeiteThe document outlines revised Philippine withholding tax tables that took effect on January 1, 2009. It provides daily, weekly, semi-monthly, and monthly tax tables for employees without dependents and for single or married employees with qualified dependent children. The tables list exemption amounts according to employment status, such as single, married, or those with 1-4 qualified dependent children. It also provides legends to explain the codes and qualifications for using either Table A for those without dependents or Table B for those with qualified children.

Originalbeschreibung:

Originaltitel

withholding-tax-table-1.docx

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThe document outlines revised Philippine withholding tax tables that took effect on January 1, 2009. It provides daily, weekly, semi-monthly, and monthly tax tables for employees without dependents and for single or married employees with qualified dependent children. The tables list exemption amounts according to employment status, such as single, married, or those with 1-4 qualified dependent children. It also provides legends to explain the codes and qualifications for using either Table A for those without dependents or Table B for those with qualified children.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

19 Ansichten1 SeiteWithholding Tax Table 1

Hochgeladen von

Elton SUicoThe document outlines revised Philippine withholding tax tables that took effect on January 1, 2009. It provides daily, weekly, semi-monthly, and monthly tax tables for employees without dependents and for single or married employees with qualified dependent children. The tables list exemption amounts according to employment status, such as single, married, or those with 1-4 qualified dependent children. It also provides legends to explain the codes and qualifications for using either Table A for those without dependents or Table B for those with qualified children.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

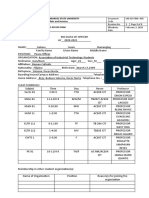

REPUBLIC OF THE PHILIPPINES

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL

REVENUE

REVISED WITHHOLDING TAX TABLES

Effective JANUARY 1, 2009

DAILY

Exemption

Status ('000P)

A. Table for employees without qualified dependent

1. Z

2. S/ME

B. Table for single/married employee with qualified dependent child(ren)

1. ME1 / S1

2. ME2 / S2 100.0

3. ME3 / S3 125.0

4. ME4 / S4 150.0

WEEKLY

Exemption

Status

A. Table for employees without qualified dependent

1. Z

2. S/ME

B. Table for single/married employee with qualified dependent child(ren)

1. ME1 / S1

2. ME2 / S2 100.0

3. ME3 / S3 125.0

4. ME4 / S4 150.0

SEMI-MONTHLY

Exemption

Status

A. Table for employees without qualified dependent

1. Z

2. S/ME

B. Table for single/married employee with qualified dependent child(ren)

1. ME1 / S1

2. ME2 / S2 100.0

3. ME3 / S3 125.0

4. ME4 / S4 150.0

MONTHLY

Exemption

Status

A. Table for employees without qualified dependent

1. Z

2. S/ME

B. Table for single/married employee with qualified dependent child(ren)

1. ME1 / S1

2. ME2 / S2 100.0

3. ME3 / S3 125.0

4. ME4 / S4 150.0

Legend: Z-Zero exemption S-Single ME-Married Employee 1;2;3;4-Number of qualified dependent children

S/ME = P50,000 EACH WORKING EMPLOYEE Qualified Dependent Child = P25,000 each but not exceeding four (4) children

USE TABLE A FOR SINGLE/MARRIED EMPLOYEES WITH NO QUALIFIED DEPENDENT

1. Married Employee (Husband or Wife) whose spouse is unemployed.

2. Married Employee (Husband or Wife) whose spouse is a non-resident citizen receiving income from foreign sources.

3. Married Employee (Husband or Wife) whose spouse is engaged in business.

4. Single with dependent father/mother/brother/sister/senior citizen.

5. Single

6. Zero Exemption for Employee with multiple employers for their 2nd,3rd. . . employers (main employer claims personal & additional exemption)

7. Zero Exemption for those who failed to file Application for Registration

USE TABLE B FOR THE FOLLOWING SINGLE/MARRIED EMPLOYEES WITH QUALIFIED DEPENDENT CHILDREN:

1. Employed husband and husband claims exemptions of children.

2. Employed wife whose husband is also employed or engaged in business; husband waived claim for dependent children in favor of the employed wife.

3. Single with qualified dependent children.

Das könnte Ihnen auch gefallen

- Withholding Tax Table 1Dokument1 SeiteWithholding Tax Table 1Jhon Karl AndalNoch keine Bewertungen

- Effective JANUARY 1, 2009 Revised Withholding Tax Tables Annex "C"Dokument1 SeiteEffective JANUARY 1, 2009 Revised Withholding Tax Tables Annex "C"Vita DepanteNoch keine Bewertungen

- 2015 BIR Withholding Tax TableDokument1 Seite2015 BIR Withholding Tax TableJonasAblangNoch keine Bewertungen

- FTP FTP - Bir.gov - PH Webadmin1 PDF 42126AnnexCDokument1 SeiteFTP FTP - Bir.gov - PH Webadmin1 PDF 42126AnnexCrupertville12Noch keine Bewertungen

- Philippines BIR Tax Rates 2009Dokument0 SeitenPhilippines BIR Tax Rates 2009kamkamtoy100% (1)

- Revised Withholding Tax TablesDokument2 SeitenRevised Withholding Tax TablesShairaCerenoNoch keine Bewertungen

- Revised Withholding Tax Tables2009Dokument1 SeiteRevised Withholding Tax Tables2009Emil A. MolinaNoch keine Bewertungen

- Withholding Tax RateDokument1 SeiteWithholding Tax RateJamie Jimenez CerreroNoch keine Bewertungen

- Payroll SystemDokument21 SeitenPayroll SystemyuunissNoch keine Bewertungen

- Revised Withholding Tax Tables 1601CDokument2 SeitenRevised Withholding Tax Tables 1601CChard San Buenaventura PerveraNoch keine Bewertungen

- Witholding TaxDokument33 SeitenWitholding TaxBfp Basud Camarines NorteNoch keine Bewertungen

- Withholding Tax From BIR WebsiteDokument37 SeitenWithholding Tax From BIR Websitepeanut47Noch keine Bewertungen

- Withholding TaxDokument46 SeitenWithholding TaxDura LexNoch keine Bewertungen

- For The Period July 6, 2008 To December 31, 2008 Revised Transitional Withholding Tax Tables Annex "D"Dokument1 SeiteFor The Period July 6, 2008 To December 31, 2008 Revised Transitional Withholding Tax Tables Annex "D"yousefNoch keine Bewertungen

- Content SheetDokument3 SeitenContent Sheetgowhar bashaNoch keine Bewertungen

- 2VAA000337A5021 en 800 Series Turbine Module Firmware Rev 5.0.2.11 Release NotesDokument11 Seiten2VAA000337A5021 en 800 Series Turbine Module Firmware Rev 5.0.2.11 Release NotesOscar Garcia100% (1)

- Pre-Enlistment Form For Irregular Students (Coecsa)Dokument1 SeitePre-Enlistment Form For Irregular Students (Coecsa)kangkongNoch keine Bewertungen

- 1st-Sem Class Schedule, Regular-FinalDokument8 Seiten1st-Sem Class Schedule, Regular-Finalhaile ethioNoch keine Bewertungen

- 41bx Remuneration 1Dokument2 Seiten41bx Remuneration 1rajeshbeheraNoch keine Bewertungen

- Dizon Byron Culannay: (To Be Accomplished by The Employer)Dokument9 SeitenDizon Byron Culannay: (To Be Accomplished by The Employer)Byron DizonNoch keine Bewertungen

- 3rd YearDokument1 Seite3rd Yearapi-351162654Noch keine Bewertungen

- Spare PartsDokument326 SeitenSpare PartsKersten Hohmann100% (1)

- Pre-Enlistment Form For Irregular Students (Coecsa) : ME 501 Mell03E 2 ME 501 Pstl01E 1 ME 501 Caml01E 3Dokument1 SeitePre-Enlistment Form For Irregular Students (Coecsa) : ME 501 Mell03E 2 ME 501 Pstl01E 1 ME 501 Caml01E 3kangkongNoch keine Bewertungen

- Embraer Training ManualDokument270 SeitenEmbraer Training ManualKent100% (1)

- University of Florida 2011 SalariesDokument572 SeitenUniversity of Florida 2011 SalariesthoushaltnotNoch keine Bewertungen

- Table of Contens: Content Page NumberDokument1 SeiteTable of Contens: Content Page NumberNaimul Haque NayeemNoch keine Bewertungen

- Actual Accomplishment / OutputDokument3 SeitenActual Accomplishment / OutputJanette Tibayan CruzeiroNoch keine Bewertungen

- ISO 90012015 Internal Audit Checklist For Project Site R0Dokument3 SeitenISO 90012015 Internal Audit Checklist For Project Site R0Nature BeautiesNoch keine Bewertungen

- Moral, Karla MaeDokument2 SeitenMoral, Karla MaeMaria Kristel L PascualNoch keine Bewertungen

- H0212 CMM 007Dokument388 SeitenH0212 CMM 007said PalaoNoch keine Bewertungen

- 04 Acknowledgement Receipt of Syllabi by Student Rev.1 (Course-Yr-Sec)Dokument13 Seiten04 Acknowledgement Receipt of Syllabi by Student Rev.1 (Course-Yr-Sec)eventories.phNoch keine Bewertungen

- School Form Checking For SHS Advisers - 1ST - 2ND - SEMDokument6 SeitenSchool Form Checking For SHS Advisers - 1ST - 2ND - SEMJean Ventura Sucuano-FraserNoch keine Bewertungen

- Afm - Atr 600Dokument404 SeitenAfm - Atr 600Gabriel FerreiraNoch keine Bewertungen

- Email Template (PDFDrive) PDFDokument243 SeitenEmail Template (PDFDrive) PDFparthasutradharNoch keine Bewertungen

- Airworthiness Limitation ScheduleDokument12 SeitenAirworthiness Limitation ScheduleJeff BernardinoNoch keine Bewertungen

- ICA IS&S AltimeterADDU With FC531Dokument72 SeitenICA IS&S AltimeterADDU With FC531Luciene OrecchioNoch keine Bewertungen

- N7-Ec135 V2-HV2 Num-E-D-04 (Installation Manual)Dokument153 SeitenN7-Ec135 V2-HV2 Num-E-D-04 (Installation Manual)Cristian OsorioNoch keine Bewertungen

- F2820-P0019-03 Att-5 Masterlist of AINDokument1 SeiteF2820-P0019-03 Att-5 Masterlist of AINHSE HerygintingNoch keine Bewertungen

- Service Record: (Surname) (Given Name) (Middle Name)Dokument10 SeitenService Record: (Surname) (Given Name) (Middle Name)Versoza NelNoch keine Bewertungen

- Revised OK Sa DepEd Forms 2019 1Dokument16 SeitenRevised OK Sa DepEd Forms 2019 1Marison GerantaNoch keine Bewertungen

- MPD Falcon PDFDokument124 SeitenMPD Falcon PDFSN OJHA100% (1)

- UBOLTDokument2 SeitenUBOLTMuhamad Sharif Bin ZainudinNoch keine Bewertungen

- Revised Rate of Remunerations For Exam DutiesDokument12 SeitenRevised Rate of Remunerations For Exam DutieskanchankonwarNoch keine Bewertungen

- Masterlist of Forms (Newest)Dokument3 SeitenMasterlist of Forms (Newest)Anna Margarett Mutia CaballarNoch keine Bewertungen

- University of Makati: Encoded Subject(s)Dokument2 SeitenUniversity of Makati: Encoded Subject(s)Heinix FrØxt WalfletNoch keine Bewertungen

- HSE Procedure Manual: Safety FormatsDokument20 SeitenHSE Procedure Manual: Safety FormatsPavan KumarNoch keine Bewertungen

- Ref: No.: To Personnel ReformsDokument8 SeitenRef: No.: To Personnel ReformsasokanNoch keine Bewertungen

- (Ex. No LBC, SF 10 Elem/JHS, Etc.) : Ma. Helena V. Alumbres, PH D., LL BDokument2 Seiten(Ex. No LBC, SF 10 Elem/JHS, Etc.) : Ma. Helena V. Alumbres, PH D., LL BWeng MendietaNoch keine Bewertungen

- DC Electrical Box (Dceb)Dokument74 SeitenDC Electrical Box (Dceb)Neo LeeNoch keine Bewertungen

- Ok Sa Deped Accomplishment ReportDokument15 SeitenOk Sa Deped Accomplishment ReportAnonymous YhZlC5AmNoch keine Bewertungen

- PF Form 3ADokument5 SeitenPF Form 3Amaria khanNoch keine Bewertungen

- Revised OK Sa DepEd Forms 2019Dokument16 SeitenRevised OK Sa DepEd Forms 2019Annielou OliveraNoch keine Bewertungen

- Form 7 TemplatesDokument4 SeitenForm 7 Templatesjunrusseltejada01Noch keine Bewertungen

- WelcomeDokument3 SeitenWelcomerashokkumarmbaNoch keine Bewertungen

- Foreign Service Institute Materiality MatrixDokument2 SeitenForeign Service Institute Materiality MatrixEmosNoch keine Bewertungen

- SB190 34 0026Dokument88 SeitenSB190 34 0026mamon113Noch keine Bewertungen

- FE Raspored Predavanja VjezbiDokument28 SeitenFE Raspored Predavanja VjezbiGwynbleiddNoch keine Bewertungen

- Biodata of OfficerDokument2 SeitenBiodata of OfficerJoselito de VeraNoch keine Bewertungen

- Example of Double Entry AccountingDokument1 SeiteExample of Double Entry AccountingElton SUicoNoch keine Bewertungen

- BREAKING DOWN 'Accounting'Dokument1 SeiteBREAKING DOWN 'Accounting'Elton SUicoNoch keine Bewertungen

- Accounting 3Dokument1 SeiteAccounting 3Elton SUicoNoch keine Bewertungen

- What Is The Meaning of Life: Long Term Satisfaction GuaranteedDokument1 SeiteWhat Is The Meaning of Life: Long Term Satisfaction GuaranteedElton SUicoNoch keine Bewertungen

- Art 1767 - Art 1809Dokument7 SeitenArt 1767 - Art 1809Elton SUicoNoch keine Bewertungen

- Design and ConstructionDokument4 SeitenDesign and ConstructionElton SUicoNoch keine Bewertungen

- The Birth of Jose RizalDokument3 SeitenThe Birth of Jose RizalElton SUicoNoch keine Bewertungen

- Aclc College of MandaueDokument1 SeiteAclc College of MandaueElton SUicoNoch keine Bewertungen

- QuestionsDokument1 SeiteQuestionsElton SUicoNoch keine Bewertungen

- Songs List For Request: Basin Pa Diay - Special Request (Composed)Dokument20 SeitenSongs List For Request: Basin Pa Diay - Special Request (Composed)Elton SUicoNoch keine Bewertungen

- Buku Petunjuk Tata Cara Berlalu Lintas Highwaycode Di IndonesiaDokument17 SeitenBuku Petunjuk Tata Cara Berlalu Lintas Highwaycode Di IndonesiadianNoch keine Bewertungen

- HQ01 - General Principles of TaxationDokument14 SeitenHQ01 - General Principles of TaxationJimmyChao100% (1)

- Mechanizing Philippine Agriculture For Food SufficiencyDokument21 SeitenMechanizing Philippine Agriculture For Food SufficiencyViverly Joy De GuzmanNoch keine Bewertungen

- Aus Tin 20105575Dokument120 SeitenAus Tin 20105575beawinkNoch keine Bewertungen

- 11980-Article Text-37874-1-10-20200713Dokument14 Seiten11980-Article Text-37874-1-10-20200713hardiprasetiawanNoch keine Bewertungen

- L&T 2017-18 Annual Report AnalysisDokument3 SeitenL&T 2017-18 Annual Report AnalysisAJAY GUPTANoch keine Bewertungen

- Readymade Plant Nursery in Maharashtra - Goa - KarnatakaDokument12 SeitenReadymade Plant Nursery in Maharashtra - Goa - KarnatakaShailesh NurseryNoch keine Bewertungen

- Ape TermaleDokument64 SeitenApe TermaleTeodora NedelcuNoch keine Bewertungen

- A Glossary of Macroeconomics TermsDokument5 SeitenA Glossary of Macroeconomics TermsGanga BasinNoch keine Bewertungen

- Clerks 2013Dokument12 SeitenClerks 2013Kumar KumarNoch keine Bewertungen

- Thai LawDokument18 SeitenThai LawsohaibleghariNoch keine Bewertungen

- Basice Micro - AssignmentDokument2 SeitenBasice Micro - AssignmentRamiah Colene JaimeNoch keine Bewertungen

- Ahmed BashaDokument1 SeiteAhmed BashaYASHNoch keine Bewertungen

- E Money PDFDokument41 SeitenE Money PDFCPMMNoch keine Bewertungen

- RBS Internship ReportDokument61 SeitenRBS Internship ReportWaqas javed100% (3)

- Percentage and Its ApplicationsDokument6 SeitenPercentage and Its ApplicationsSahil KalaNoch keine Bewertungen

- Stock-Trak Project 2013Dokument4 SeitenStock-Trak Project 2013viettuan91Noch keine Bewertungen

- Democratic Developmental StateDokument4 SeitenDemocratic Developmental StateAndres OlayaNoch keine Bewertungen

- The Global Interstate System Pt. 3Dokument4 SeitenThe Global Interstate System Pt. 3Mia AstilloNoch keine Bewertungen

- Monsoon 2023 Registration NoticeDokument2 SeitenMonsoon 2023 Registration NoticeAbhinav AbhiNoch keine Bewertungen

- Designing For Adaptation: Mia Lehrer + AssociatesDokument55 SeitenDesigning For Adaptation: Mia Lehrer + Associatesapi-145663568Noch keine Bewertungen

- Nike Pestle AnalysisDokument10 SeitenNike Pestle AnalysisAchal GoyalNoch keine Bewertungen

- Independent Power Producer (IPP) Debacle in Indonesia and The PhilippinesDokument19 SeitenIndependent Power Producer (IPP) Debacle in Indonesia and The Philippinesmidon64Noch keine Bewertungen

- Factors Affecting SME'sDokument63 SeitenFactors Affecting SME'sMubeen Shaikh50% (2)

- Sponsorship Prospectus - FINALDokument20 SeitenSponsorship Prospectus - FINALAndrea SchermerhornNoch keine Bewertungen

- Business Economics - Question BankDokument4 SeitenBusiness Economics - Question BankKinnari SinghNoch keine Bewertungen

- Rental AgreementDokument1 SeiteRental AgreementrampartnersbusinessllcNoch keine Bewertungen

- Introduction - IEC Standards and Their Application V1 PDFDokument11 SeitenIntroduction - IEC Standards and Their Application V1 PDFdavidjovisNoch keine Bewertungen

- Accounting CycleDokument6 SeitenAccounting CycleElla Acosta0% (1)

- The Possibility of Making An Umbrella and Raincoat in A Plastic WrapperDokument15 SeitenThe Possibility of Making An Umbrella and Raincoat in A Plastic WrapperMadelline B. TamayoNoch keine Bewertungen