Beruflich Dokumente

Kultur Dokumente

Act No

Hochgeladen von

Tricia0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

13 Ansichten16 SeitenThis document summarizes key provisions around insurable interest from the Insurance Act of the Philippines:

1) It defines what constitutes an insurable interest, including one's own life/health, persons one depends on financially, and any property or liability that could be affected by damage or loss.

2) It specifies that any contingent event that could cause financial harm may be insured against, as long as the insured has an insurable interest that would be affected.

3) It establishes that an insurable interest must exist at the time insurance takes effect and at the time of loss, but not necessarily in between, and outlines how interest changes may impact insurance coverage.

Originalbeschreibung:

insurance

Originaltitel

ACT NO

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThis document summarizes key provisions around insurable interest from the Insurance Act of the Philippines:

1) It defines what constitutes an insurable interest, including one's own life/health, persons one depends on financially, and any property or liability that could be affected by damage or loss.

2) It specifies that any contingent event that could cause financial harm may be insured against, as long as the insured has an insurable interest that would be affected.

3) It establishes that an insurable interest must exist at the time insurance takes effect and at the time of loss, but not necessarily in between, and outlines how interest changes may impact insurance coverage.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

13 Ansichten16 SeitenAct No

Hochgeladen von

TriciaThis document summarizes key provisions around insurable interest from the Insurance Act of the Philippines:

1) It defines what constitutes an insurable interest, including one's own life/health, persons one depends on financially, and any property or liability that could be affected by damage or loss.

2) It specifies that any contingent event that could cause financial harm may be insured against, as long as the insured has an insurable interest that would be affected.

3) It establishes that an insurable interest must exist at the time insurance takes effect and at the time of loss, but not necessarily in between, and outlines how interest changes may impact insurance coverage.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 16

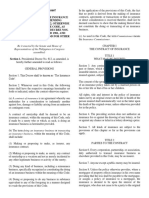

ACT NO.

2427 Insurable Interest

AN ACT REVISING THE INSURANCE LAWS SECTION 11. Every person has an insurable

AND REGULATING INSURANCE BUSINESS IN interest in the life and health.

THE PHILIPPINE ISLANDS (a) Of himself;

(b) Of any person on whom he depends wholly

PRELIMINARY CHAPTER or in part for education or support;

SECTION 1. The short title of this Act shall (c) Of any person under a legal obligation to him

be "The Insurance Act." for the payment of money, or respecting

CHAPTER 1 property or services, of which death or illness

Insurance in general might delay or prevent the performance; and

Definition of Insurance (d) Of any person upon whose life any estate or

SECTION 2. Insurance is a contract whereby interest vested in him depends.

one undertakes for a consideration to indemnify SECTION 12. Every interest in property, whether

another against loss, damage, or liability arising real or personal, or any relation thereto, or

from an unknown or contingent event. liability in respect thereof, of such a nature that

What May Be Insured a contemplated peril might directly damnify the

SECTION 3. Any contingent or unknown event, insured, is an insurable interest.

whether past or future, which may damnify a SECTION 13. An insurable interest in property

person having an insurable interest, or create a may consist in:chanroblesvirtuallawlibrary

liability against him, may be insured against (a) An existing interest;

subject to the provisions of this chapter. (b) An inchoate interest founded on an existing

SECTION 4. The preceding section does not interest; or

authorize an insurance for or against the (c) An expectancy, coupled with an existing

drawing of any lottery, or for or against any interest in that out of which the expectancy

chance or ticket in a lottery drawing a arises.

prize. robles virtual law library SECTION 14. A carrier or depository of any kind

SECTION 5. All kinds of insurance are subject to has an insurable interest in a thing held by him

the provisions of this chapter so far as the as such, to the extent of his liability but not to

provisions can apply. exceed the value thereof.

SECTION 15. A mere contingent or expectant

Parties to the Contract interest in anything, not founded on an actual

SECTION 6. The person who undertakes to right to the thing, nor upon any valid contract

indemnify another by a contract of insurance is for it, is not insurable.

called the insurer, and the person indemnified is SECTION 16. The measure of an insurable

called the insured. interest in property is the extent to which the

SECTION 7. Every person, company, insured might be damnified by loss or injury

corporation, or association who holds a thereof.

certificate of authority from the insurance SECTION 17. The sole object of insurance is the

commissioner, as else where provided in this indemnity of the insured, and if he has no

Act, may be an insurer. insurable interest the contract is void.

SECTION 8. Anyone except a public enemy may SECTION 18. An interest insured must exist

be insured. when the insurance takes effect, and when the

SECTION 9. Unless the policy otherwise loss occurs, but need not exist in the meantime.

provides, where a mortgagor of property effects SECTION 19. Except in the cases specified in the

insurance in his own name providing that the next four sections, and in the cases of life,

loss shall be payable to the mortgagee, or accident, and health insurance, a change of

assigns a policy of insurance to a mortgagee, interest in any part of a thing insured

the insurance is deemed to be upon the interest unaccompanied by a corresponding change of

of the mortgagor, who does not cease to be a interest in the insurance, suspends the

party to the original contract, and any act of his, insurance to an equivalent extent, until the

prior to the loss, which would otherwise avoid interest in the thing and the interest in the

the insurance, will have the same effect, insurance are vested in the same person. robles

although the property is in the hands of the virtual law library

mortgagee, but any act which, under the SECTION 20. A change of interest in a thing

contract of insurance, is to be performed by the insured, after the occurrence of an injury which

mortgagor, may be performed by the mortgagee results in a loss, does not affect the right of the

therein named, with the same effect as if it had insured to indemnify for the loss.

been performed by the mortgagor. SECTION 21. A change of interest in one or

SECTION 10. If an insurer assents to the more of several distinct things, separately

transfer of an insurance from a mortgagor to a insured by one policy, does not avoid the

mortgagee, and, at the time of his assent, insurance as to the others.

imposes further obligations on the assignee, SECTION 22. A change of interest, by will or

making a new contract with him, the acts of the succession, on the death of the insured, does

mortgagor cannot affect the rights of said not avoid an insurance; and his interest in the

assignee.

insurance passes to the person taking his distinctly implied in other facts of which

interest in the thing insured. information is communicated.

SECTION 23. A transfer of interest by one of SECTION 33. Information of the nature or

several partners, joint owners, or owners in amount of the interest of one insured need not

common, who are jointly insured, to the others, be communicated unless in answer to an

does not avoid an insurance, even though it has inquiry, except as prescribed by section forty-

been agreed that the insurance shall cease upon nine.

an alienation of the thing insured. SECTION 34. Neither party to a contract of

SECTION 24. Every stipulation in a policy of insurance is bound to communicate, even upon

insurance for the payment of loss whether the inquiry, information of his own judgment upon

person insured has or has not any interest in the the matters in question.

subject matter of the insurance except in the SECTION 35. A representation may be oral or

cases provided for in section one hundred and written.

sixty-six or that the policy shall be received as SECTION 36. A representation may be made at

proof of such interest, and every policy executed the same time with issuing the policy, or before

by way of gaming or wagering, is void. it.

Concealment and Representations SECTION 37. The language of a representation

SECTION 25. A neglect to communicate that is to be interpreted by the same rules as the

which a party knows and ought to communicate, language of contracts in general.

is called a concealment. SECTION 38. A representation as to the future is

SECTION 26. A concealment, whether to be deemed a promise, unless it appears that

intentional or unintentional, entitles the injured it was merely a statement of belief or

party to rescind a contract of insurance. expectation.

SECTION 27. Each party to a contract of SECTION 39. A representation cannot be

insurance must communicate to the other, in allowed to qualify an express provision in a

good faith, all facts within his knowledge which contract of insurance; but it may qualify an

are material to the contract, and which the other implied warranty.

has not the means of ascertaining, and as to SECTION 40. A representation may be altered or

which he makes no warranty. withdrawn before the insurance is effected, but

SECTION 28. An intentional and fraudulent not afterwards.

omission, on the part of one insured, to SECTION 41. A representation must be

communicate information of matters proving or presumed to refer to the date on which the

tending to prove the falsity of a warranty, contract goes into effect.

entitles the insurer to rescind. SECTION 42. When a person insured has no

SECTION 29. Neither party to a contract of personal knowledge of a fact, he may

insurance is bound to communicate information nevertheless repeat information which he has

of the matters following, except in answer to the upon the subject, and which he believes to be

inquiries of the other:chanroblesvirtuallawlibrary true, with the explanation that he does so on

(a) Those which the other knows; the information of others, or he may submit the

(b) Those which, in the exercise of ordinary information, in its whole extent, to the insurer;

care, the other ought to know, and of which the and in neither case is he responsible for its

former has no reason to suppose him ignorant; truth, unless it proceeds from an agent of the

(c) Those of which the other waives insured, whose duty it is to give the intelligence.

communication; SECTION 43. A representation is to be deemed

(d) Those which prove or tend to prove the false when the facts fail to correspond with its

existence of a risk excluded by a warranty, and assertions or stipulations.

which are not otherwise material; and SECTION 44. If a representation is false in a

(e) Those which relate to a risk excepted from material point, whether affirmative or

the policy, and which are not otherwise material. promissory, the injured party is entitled to

SECTION 30. Materiality is to be determined not rescind the contract from the time when the

by the event, but solely by the probable and representation becomes false.

reasonable influence of the facts upon the party SECTION 45. The materiality of a representation

to whom the communication is due, in forming is determined by the same rules as the

his estimate of the disadvantages of the materiality of a concealment.

proposed contract, or in making his inquiries. SECTION 46. The provisions of sections twenty-

SECTION 31. Each party to a contract of five to forty-seven, inclusive, of this chapter

insurance is bound to know all the general apply as well to a modification of a contract of

causes which are open to his inquiry, equally insurance as to its original formation. robles

with that of the other, and which may affect virtual law library

either the political or material perils SECTION 47. Whenever a right to rescind a

contemplated; and all general usages of trade. contract of insurance is given to the insurer by

SECTION 32. The right to information of any provision of this chapter, such right must be

material facts may be waived, either by the exercised previous to the commencement of an

terms of insurance or by neglect to make action on the contract.

inquiries as to such facts, where they are The Policy

SECTION 48. The written instrument, in which a SECTION 61. An agreement made before a loss,

contract of insurance is set forth, is called a not to transfer the claim of a person insured

policy of insurance. against the insurer, after the loss has happened

SECTION 49. A policy of insurance must is void.

specify:chanroblesvirtuallawlibrary Warranties

(a) The parties between whom the contract is SECTION 62. A warranty is either expressed or

made; implied.

(b) The amount to be insured except in the SECTION 63. A warranty may relate to the past,

cases of open or running policies; the present, the future, or to any or all of these.

(c) The rate of premium; SECTION 64. No particular form of words is

(d) The property or life insured; necessary to create a warranty.

(e) The interest of the insured in property SECTION 65. Every express warranty, made at

insured, if he is not the absolute owner thereof; or before the execution of a policy, must be

(f) The risks insured against; and contained in the policy itself, or in another

(g) The period during which the insurance is to instrument signed by the insured and referred to

continue. in the policy, as making a part of it.

SECTION 50. The insurance shall be applied SECTION 66. A statement in a policy, of a

exclusively to the proper interest of the person matter relating to the person or thing insured, or

in whose name it is made unless otherwise to the risk, as a fact, is an express warranty

specified in the policy. thereof.

SECTION 51. When an insurance is made by an SECTION 67. A statement in a policy, which

agent or trustee, the fact that his principal or imports that it is intended to do or not to do a

beneficiary is the person really insured may be thing which materially affects the risk, is a

indicated by describing him as agent or trustee, warranty that such act or omission shall take

or by other general words in the policy. place.

SECTION 52. To render an insurance, effected SECTION 68. When, before the time arrives for

by one partner or part owner, applicable to the the performance of a warranty relating to the

interest of his copartners, or of other part future, a loss insured against happens, or

owners, it is necessary that the terms of the performance becomes unlawful at the place of

policy should be such as are applicable to the the contract, or impossible, the omission to fulfill

joint or common interest. the warranty does not avoid the policy.

SECTION 53. When the description of the SECTION 69. The violation of a material

insured in a policy is so general that it may warranty, or other material provision of a policy,

comprehend any person or any class of persons, on the part of either party thereto, entitles the

he only can claim the benefit of the policy who other to rescind.

can show that it was intended to include him. SECTION 70. A policy may declare that a

SECTION 54. A policy may be so framed that it violation of specified provisions thereof shall

will inure to the benefit of whomsoever, during avoid it, otherwise the breach of an immaterial

the continuance of the risk, may become the provision does not avoid the policy.

owner of the interest insured. SECTION 71. A breach of warranty, without

SECTION 55. The mere transfer of a thing fraud, merely exonerates an insurer from the

insured does not transfer the policy, but time that it occurs, or where it is broken in its

suspends it until the same person becomes the inception prevents the policy from attaching to

owner of both the policy and the thing insured. the risk.

SECTION 56. A policy is either open, valued, or Premium

running. SECTION 72. An insurer is entitled to payment

SECTION 57. An open policy is one in which the of the premium soon, as the thing insured is

value of the thing insured is not agreed upon, exposed to the peril insured against.

but is left to be ascertained in case of loss. SECTION 73. A person insured is entitled to a

SECTION 58. A valued policy is one which return of premium,

expresses on its face an agreement that the (a) To the whole premium, if no part of his

thing insured shall be valued at a specified sum. interest in the thing insured be exposed to any

SECTION 59. A running policy is one which of the perils insured against;

contemplates successive insurances, and which (b) Where the insurance is made for a definite

provides that the object of the policy may be period of time and the insured surrenders his

from time to time defined, especially as to the policy, to such portion of the premium as

subjects of insurance, by additional statements corresponds with the unexpired time, at a pro-

or indorsements. rata rate, unless a short period rate has been

SECTION 60. An acknowledgment in a policy of agreed upon and appears on the face of the

the receipt of premium is conclusive evidence of policy, after deducting from the whole premium

its payment, so far as to make the policy any claim for loss or damage under the policy

binding, notwithstanding any stipulation therein which has previously accrued: Provided, That no

that it shall not be binding until the premium is holder of a life insurance policy may avail

actually paid. himself of the privileges of this paragraph

without sufficient cause as otherwise provided specify to him, without unnecessary delay, as

by law. grounds of objection, are waived.

SECTION 74. If a peril insured against has SECTION 84. Delay in the presentation to an

existed, and the insurer has been liable for any insurer of notice or proof of loss is waived, if

period, however short, the insured is not entitled caused by any act of his, or if he omits to take

to return of premiums, so far as that particular objection promptly and specifically upon that

risk is concerned. ground.

SECTION 75. A person insured is entitled to a SECTION 85. If a policy requires, by way of

return of the premium when the contract is preliminary proof of loss, the certificate or

voidable, on account of the fraud or testimony of a person other than the insured, it

misrepresentation of the insurer, or of his agent is sufficient for the insured to use a reasonable

or on account of facts, the existence of which diligence to procure it, and in case of the refusal

the insured was ignorant without his fault; or of such person to give it, then furnish

when, by any default of the insured other than reasonable evidence to the insurer that such

actual fraud, the insurer never incurred any refusal was not induced by any just grounds of

liability under the policy. disbelief in the facts necessary to be certified.

SECTION 76. In case of an over-insurance by Double Insurance

several insurers, the insured is entitled to a SECTION 86. A double insurance exists where

ratable return of the premium, proportioned to the same person is insured by several insurers

the amount by which the aggregate sum insured separately in respect to the same subject and

in all the policies exceeds the insurable value of interest.

the thing at risk, SECTION 87. Where the insured is overinsured

Loss by double insurance —

SECTION 77. An insurer is liable for a loss of (a) The insured, unless the policy otherwise

which a peril insured against was the proximate provides, may claim payment from the insurers

cause; although a peril not contemplated by the in such order as he may select, up to the

contract may have been a remote cause of the amount for which the insurers are severally

loss; but he is not liable for a loss of which the liable under their respective contracts;

peril insured against was only a remote cause. (b) Where the policy under which the insured

SECTION 78. An insurer is liable where the thing claim is a valued policy, the insured must give

insured is rescued from a peril insured against, credit as against the valuation for any sum

that would otherwise have caused a loss, if in received by him under any other policy without

the course of such rescue the thing is exposed regard to the actual value of the subject matter

to a peril not insured against, which insured;

permanently deprives the insured of its (c) Where the policy under which the insured

possession, in whole or in part; or where a loss claims is an unvalued policy he must give credit,

is caused by efforts to rescue the thing insured as against the full insurable value, for any sum

from a peril insured against. robles virtual law received by him under any other policy;

library (d) Where the insured receives any sum in

SECTION 79. Where a peril is specially excepted excess of the valuation in the case of valued

in a contract of insurance, a loss, which would policies and the insurable value in the case of

not have occurred but for such peril, is thereby unvalued policies, he must hold such sum in

excepted; although the immediate cause of the trust for the insurers, according to their right of

loss was a peril which was not excepted. contribution among themselves;

SECTION 80. An insurer is not liable for a loss (e) Each insurer is bound, as between himself

caused by the willful act or through the and the other insurers, to contribute ratably to

connivance of the insured; but he is not the loss in proportion to the amount for which

exonerated by the negligence of the insured, or he is liable under his contract.

of his agents or others. Reinsurance

Notice of Loss SECTION 88. A contract of reinsurance is one by

SECTION 81. In case of loss upon an insurance which an insurer procures a third person to

against fire, an insurer is exonerated, if notice insure him against loss or liability by reason of

thereof be not given to him by some person such original insurance.

insured, or entitled to the benefit of the SECTION 89. Where an insurer obtains

insurance, without unnecessary delay. reinsurance, he must communicate all the

SECTION 82. When preliminary proof of loss is representations of the original insured, and also

required by a policy; the insured is not bound to all the knowledge and information he possesses,

give such proof as would be necessary in a court whether previously or subsequently acquired,

of justice; but it is sufficient for him to give the which are material to the risk.

best evidence which he has in his power at the SECTION 90. A reinsurance is presumed to be a

time. contract of indemnity against liability, and not

SECTION 83. All defects in a notice of loss, or in merely against damage.

preliminary proof thereof, which the insured SECTION 91. The original insured has no

might remedy, and which the insurer omits to interest in a contract of reinsurance.

CHAPTER II SECTION 103. A concealment in a marine

Marine insurance insurance, in respect to any of the following

Definition of Marine Insurance matters, does not vitiate the entire contract, but

SECTION 92. Marine insurance is an insurance merely exonerates the insurer from a loss

against risks connected with navigation, to resulting from the risk concealed.

which a ship, cargo, freightage, profits, or other (a) The national character of the insured;

insurable interest in movable property, may be (b) The liability of the thing insured to capture

exposed during a certain voyage or a fixed and detention;

period of time. (c) The liability to seizure from breach of foreign

Insurable Interest laws of trade;

SECTION 93. The owner of a ship has in all (d) The want of necessary documents; and

cases an insurable interest in it, even when it (e) The use of false and simulated papers.

has been chartered by one who covenants to Representations

pay him its value in case of loss: Provided, That SECTION 104. If a representation, by a person

in this case the insurer shall be liable for only insured by a contract of marine insurance, is

that part of the of the loss which the insured intentionally false in any material respect, or in

cannot recover from the charterer. respect of any fact on which the character and

SECTION 94. The insurable interest of the nature of the risk depends the insurer may

owner of a ship hypothecated by bottomry is rescind the entire contract.

only the excess of its value over the amount SECTION 105. The eventual falsity of a

secured by bottomry. representation as to expectation does not, in the

SECTION 95. Freightage, in the sense of a policy absence of fraud, avoid a contract of insurance.

of marine insurances signifies all the benefit Implied Warranties

derived by the owner, either from the chartering SECTION 106. In every marine insurance upon a

of the ship or its employment for the carriage of ship or freight, or freightage, or upon anything

his own goods or those of others. which is the subject of marine insurance, a

SECTION 96. The owner of a ship has an warranty is implied that the ship is seaworthy.

insurable interest in expected freightage which SECTION 107. A ship is seaworthy, when

according to the ordinary and probable course of reasonably fit to perform the services, and to

things he would have earned but for the encounter the ordinary perils of the voyage,

intervention of a peril insured against or other contemplated by the parties to the policy.

peril incident to the voyage. SECTION 108. An implied warranty of

SECTION 97. The interest mentioned in the last seaworthiness is complied with if the ship be

section exists, in the case of a charter party, seaworthy at the time of the commencement of

when the ship has broken ground on the the risk except in the following

chartered voyage, and if a price is to be paid for cases:chanroblesvirtuallawlibrary

the carriage of goods when they are actually on (a) When the insurance is made for a specified

board, or there is some contract for putting length of time, the implied warranty is not

them on board, and both ship and goods are complied with unless the ship be seaworthy at

ready for the specified voyage. the commencement of every voyage she may

SECTION 98. One who has an interest in the undertake during that time; and

thing from which profits are expected to (b) When the insurance is upon the cargo,

proceed, has an insurable interest in the profits. which, by the terms of the policy, or the

SECTION 99. The charterer of a ship has an description of the voyage, or the established

insurable interest in it, to the extent that he is custom of the trade, is to be transshipped at an

liable to be damnified by its loss. intermediate port, the implied warranty is not

Concealment complied with, unless each vessel upon which

SECTION 100. In marine insurance each party is the cargo is shipped, or transshipped, be

bound to communicate, an addition to what is seaworthy at the commencement of its

required by section twenty-seven, all the particular voyage.

information which he possesses, material to the SECTION 109. A warranty of seaworthiness

risk, except such as is mentioned in section extends not only to the condition of the

twenty-nine, and to state the exact and whole structure of the ship itself, but requires that it be

truth in relation to all matters that he properly laden, and provided with a competent

represents, or upon inquiry discloses or assumes master, a sufficient number of competent

to disclose. officers and seamen, and the requisite

SECTION 101. In marine insurance, information appurtenances and equipment, such as ballast,

of the belief or expectation of a third person, in cables, and anchors, cordage and sails, food,

reference to a material fact, is material. water, fuel, and lights, and other necessary or

SECTION 102. A person insured by a contract of proper stores and implements for the voyage.

marine insurance is presumed to have had SECTION 110. Where different portions of the

knowledge, at the time of insuring, of a prior voyage contemplated by a policy differ in

loss, of the information might possibly have respect to the things requisite to make the ship

reached him in the usual mode of transmission, seaworthy therefor, a warranty of seaworthiness

and at the usual rate of communication. is complied with if, at the commencement of

each portion, the ship is seaworthy with (b) The loss of the thing by sinking, or by being

reference to that portion. broken up;

SECTION 111. When a ship becomes (c) Any damage to the thing which renders it

unseaworthy during the voyage to which an valueless to the owner for the purposes for

insurance relates, an unreasonable delay in which he held it; or

repairing the defect exonerates the insurer from (d) Any other event which entirely deprives the

liability from any loss arising therefrom. owner of the possession, at the port of

SECTION 112. A ship which is seaworthy for the destination, of the thing insured.

purpose of an insurance upon the ship may, SECTION 124. A constructive total loss is one

nevertheless, by reason of being unfitted to which gives to a person insured a right to

receive the cargo, be unseaworthy for the abandon, under section one hundred and thirty-

purpose of insurance upon the cargo. two.

SECTION 113. Where the nationality or SECTION 126. An actual loss may be presumed

neutrality of a ship or cargo is expressly from the continued absence of a ship without

warranted, it is implied that the ship will carry being heard of; and the length of time which is

the requisite documents to show such sufficient to raise this presumption depends on

nationality, or neutrality, and that it will not the circumstances of the case.

carry any documents which cast reasonable SECTION 126. When a ship is prevented, at an

suspicion thereon. intermediate port, from completing the voyage,

The Voyage and Deviation by the perils insured against, the master must

SECTION 114. When the voyage contemplated make every exertion to procure, in the same or

by a policy is described by the places of a contiguous port, another ship, for the purpose

beginning and ending, the voyage insured is one of conveying the cargo to its destination; and

which conforms to the course of sailing fixed by the liability of a marine insurer thereon

mercantile usage between those places. continues after they are thus reshipped.

SECTION 115. If the course of sailing is not SECTION 127. In addition to the liability

fixed by mercantile usage, the voyage insured mentioned in the last section a marine insurer is

by a policy is the way between the places bound for damages, expenses of discharging,

specified which, to a master of ordinary skill and storage, reshipment, extra freightage, and all

discretion, would seem the most natural, direct, other expenses incurred in saving cargo

and advantageous. reshipped pursuant to the last section, up to the

SECTION 116. Deviation is a departure from the amount insured.

course of the voyage insured, mentioned in the SECTION 128. Upon an actual total loss, a

last two sections, or an unreasonable delay in person insured is entitled to payment without

pursuing the voyage, or the commencement of notice of abandonment.

an entirely different voyage. SECTION 129. Where it has been agreed that an

SECTION 117. A deviation is insurance upon a particular thing, or a class of

proper:chanroblesvirtuallawlibrary things, shall be free from particular average,

(a) When caused by circumstances over which loss not depriving the insured of the possession,

neither the master nor the owner of the ship has at the port destination, of the whole of such

any control; thing, or class of things, even though it becomes

(b) When necessary to comply with a warranty, entirely worthless; but he is liable for his

or to avoid a peril whether insured against or proportion of all general average loss assessed

not; upon the thing insured.

(c) When made in good faith, and upon SECTION 130. An insurance confined in terms to

reasonable grounds of belief in its necessity to an actual total loss, does not cover a

avoid a peril; or constructive total loss, but covers any loss which

(d) When made in good faith, for the purpose of necessarily results in depriving the insured of

saving human life, or relieving another vessel in the possession, at the port of destination, of the

distress. entire thing insured.

SECTION 118. Every deviation not specified in Abandonment

the last section is improper. SECTION 131. Abandonment is the act by

SECTION 119. An insurer is not liable for any which, after a constructive total loss, a person

loss happening to a thing insured subsequently insured by contract of marine insurance declares

to an improper deviation. to the insurer that he relinquishes to him his

Loss interest in the thing insured.

SECTION 120. A loss may be either total or SECTION 132. A person insured by a contract of

partial. marine insurance may abandon the thing

SECTION 121. Every loss which is not total is insured, or any particular portion thereof

partial. separately valued by the policy, or otherwise

SECTION 122. A total loss may be either actual separately insured and recover for a total loss

or constructive. thereof, when the cause of the loss is a peril

SECTION 123. An actual total loss is caused insured against:chanroblesvirtuallawlibrary

by:chanroblesvirtuallawlibrary

(a) A total destruction of the thing insured;

(a) If more than three-fourths thereof in value is SECTION 143. The acceptance of an

actually lost, or would have to be expended to abandonment may be either express or implied

recover it from the peril; from the conduct of the insurer. The mere

(b) If it is injured to such an extent as to reduce silence of the insurer after notice is not to be

its value more than three-fourths; construed as an acceptance.

(c) If the thing insured, being a ship, the SECTION 144. The acceptance of an

contemplated voyage cannot be lawfully abandonment, whether express or implied, is

performed without incurring an expense to the conclusive upon the parties, and admits the loss

insured of more than three-fourths the value of and the sufficiency of the abandonment.

the thing abandoned, or without incurring a risk SECTION 145. An abandonment once made and

which a prudent man would not take under the accepted is irrevocable, unless the ground upon

circumstances; or which it was made proves to be unfounded.

(d) If the thing insured, being cargo or SECTION 146. On an accepted abandonment of

freightage, the voyage cannot be performed nor a ship, freightage earned previous to the loss

another ship procured by the master, within a belongs to the insurer of said freightage; but

reasonable time and with reasonable diligence, freightage subsequently earned belongs to the

to forward the cargo, without incurring the like insurer of the ship.

expense or risk. But freightage cannot in any SECTION 147. If an insurer refuses to accept a

case be abandoned, unless the ship is also valid abandonment, he is liable as upon an

abandoned. actual total loss, deducting from the amount any

SECTION 133. An abandonment must be neither proceeds of the thing insured which may have

partial nor conditional. come to the hands of the insured.

SECTION 134. And abandonment must be made SECTION 148. If a person insured omits to

within a reasonable time after receipt of reliable abandon, he may nevertheless recover his

information of the loss, but where the actual loss.

information is of a doubtful character the Measure of Indemnity

insured is entitled to a reasonable time to make SECTION 149. A valuation in a policy of marine

inquiry. insurance is conclusive between the parties

SECTION 135. Where the information upon thereto in the adjustment of either a partial or

which an abandonment has been made proves total loss, if the insured has some interest at

incorrect, or the thing insured was so far risk, and there is no fraud on his part; except

restored when the abandonment was made that that when a thing has been hypothecated by

there was then in fact no total loss, the bottomry or respondentia, before its insurance,

abandonment becomes ineffectual. and without the knowledge of the person

SECTION 136. Abandonment is made by giving actually procuring the insurance, he may show

notice thereof to the insurer, which may be the real value. But a valuation fraudulent in fact

done orally, or in writing. entitles the insurer to rescind the contract.

SECTION 137. A notice of abandonment must SECTION 150. A marine insurer is liable upon a

be explicit, and must specify the particular cause partial loss, only for such proportion of the

of the abandonment, but need state only amount insured by him as the loss bears to the

enough to show that there is probable cause value of the whole interest of the insured in the

therefor, and need not be accompanied with property insured.

proof of interest or of loss. SECTION 151. Where profits are separately

SECTION 138. An abandonment can be insured in a contract of marine insurance, the

sustained only upon the cause specified in the insured is entitled to recover, in case of loss, a

notice thereof. proportion of such profits equivalent to the

SECTION 139. An abandonment is equivalent to proportion which the value of the property lost

a transfer, by the insured of his interest, to the bears to the value of the whole.

insurer, with all the chances of recovery and SECTION 152. In case of a valued policy of

indemnity. marine insurance on freightage or cargo, if a

SECTION 140. If a marine insurer pays for a loss part only of the subject is exposed to risk the

as if it were an actual total loss, he is entitled to valuation applies only in proportion to such part.

whatever may remain of the thing insured, or its SECTION 153. When profits are valued and

proceeds or salvage, as if there had been a insured by a contract of marine insurance, a loss

formal abandonment. of them is conclusively presumed from a loss of

SECTION 141. Upon an abandonment, acts done the property out of which they were expected to

in good faith by those who were agents of the arise, and the valuation fixes their amount.

insured in respect to the thing insured, SECTION 164. In estimating a loss under an

subsequent to the loss, are at the risk of the open policy of marine insurance the following

insurer, and for his benefit. rules are to be

SECTION 142. Where notice of abandonment is observed:chanroblesvirtuallawlibrary

properly given, the rights of the insured are not (a) The value of a ship is its value at the

prejudiced by the fact that the insurer refuses to beginning of the risk including all articles or

accept the abandonment. charges which add to its permanent value, or

which are necessary to prepare it for the voyage woodwork of hull, masts, and spars, furniture,

insured; upholstery, crockery, metal and glassware, also

(b) The value of cargo is its actual cost to the sails, rigging, ropes, sheets, and hawsers (other

insured, when laden on board, or where that than wire and chain), awnings, covers and

cost cannot be ascertained, its market value at painting. One-sixth to be deducted off wire

the time and place of lading, adding the charges rigging, wire ropes, and wire hawsers, chain

incurred in purchasing and placing it on board, cables and chains, donkey engines, steam

but without reference to any losses incurred in winches and connections, steam cranes and

raising money for its purchase, or to any connections; other repairs in full.

drawback on its exportation, or to the (c) Between three and six years. — Deductions

fluctuations of the market at the port of as above under clause (b), except that one-sixth

destination, or to expenses incurred on the way be deducted off ironwork of masts and spars

or on arrival; and machinery (inclusive of boilers and their

(c) The value of freightage is the gross mountings).

freightage, exclusive of primage, without (d) Between six and ten years. — Deductions as

reference to the cost of earning it; and above under clause (c), except that one-third be

(d) The cost of insurance is in each case to be deducted off ironwork of masts and spars,

added to the value thus estimated. repairs to and renewal of all machinery

SECTION 155. If cargo insured against partial (inclusive of boilers and their mountings), and

loss arrives at the port of destination in a all hawsers, ropes, sheets, and rigging.

damaged condition, the loss of the insured is (e) Between ten and fifteen years. — One-third

deemed to be the same proportion of the value to be deducted off all repairs and renewals,

which the market price at that port, of the thing except ironwork of hull and cementing and chain

so damaged, bears to the market price it would cables, from which one-sixth to be deducted.

have brought if sound. robles virtual law library Anchors to be allowed in full.

SECTION 156. A marine insurer is liable for all (f) Over fifteen years. — One-third to be

the expenses attendant upon a loss which forces deducted off all repairs and renewals. Anchors

the ship into port to be repaired; and where it is to be allowed in full. One-sixth to be deducted

stipulated in the policy that the insured shall off chain cables.

labor for the recovery of the property, the (g) Generally. — The deductions (except as to

insurer is liable for the expense incurred provisions and stores, machinery, and boilers) to

thereby, such expense, in either case, being in be regulated by the age of the ship, and not the

addition to a total loss, if that afterwards occurs. age of the particular part of her to which they

SECTION 157. A marine insurer is liable for a apply. No painting bottom to be allowed if the

loss falling upon the insured, through a bottom has not been painted within six months

contribution in respect to the thing insured, previous to the date of accident. No deduction

required to be made by him towards a general to be made in respect of old material which is

average loss called for by a peril insured against. repaired without being replaced by new, and

SECTION 158. When a person insured by a provisions and stores which have not been in

contract of marine insurance has a demand use.

against others for contribution, he may claim the 2. In the case of wooden or composite

whole loss from the insurer, subrogating him to ships:chanroblesvirtuallawlibrary

his own right to contribution. But no such claim When a ship is under one year old from date of

can be made upon the insurer after the original register at the time of accident no

separation of the interests liable to contribution, deduction new for old shall be made. After that

nor when the insured, having the right and period a deduction of one third shall be made,

opportunity to enforce contribution from others, with the following

has neglected or waived the exercise of that exceptions:chanroblesvirtuallawlibrary

right. Anchors shall be allowed in full. Chain cables

SECTION 159. In the case of a partial loss of a shall be subject to a deduction of one-sixth

ship or its equipment, the old materials are to only. No deduction shall be made in respect of

be applied towards payment for the new, and provisions and stores which had not been in

unless other conditions are stipulated in the use. Metal sheathing shall be dealt with by

policy, a marine insurer is liable for the allowing in full the cost of a weight equal to the

remaining cost of repairs, less deductions from gross weight of metal sheathing stripped off,

such cost to be made in accordance with the minus the proceeds of the old metal. Nails, felt,

following rules:chanroblesvirtuallawlibrary and labor metalling are subject to a deduction of

1. In the case of iron or steel ships, from date of one-third.

original register to the date of CHAPTER III

accident:chanroblesvirtuallawlibrary Fire Insurance

(a) Up to one year old. — All repairs to be SECTION 160. An alteration in the use or

allowed in full, except painting or coating of condition of a thing insured from that to which it

bottom, from which one-third is to be deducted. is limited by the policy made without the

(b) Between one and three years. — One-third consent of the insurer, by means within the

to be deducted off repairs to and renewal of control of the insured, and increasing the risk,

entitles an insurer to rescind a contract of fire to any person, whether he has an insurable

insurance. interest or not, and such person may recover

SECTION 161. An alteration in the use or upon it whatever the insured might have

condition of a thing insured from that to which it recovered.

is limited by the policy, which does not increase SECTION 167. Notice to an insurer of a transfer

the risk, does not affect a contract of fire or bequest thereof is not necessary to preserve

insurance. the validity of a policy of insurance upon life or

SECTION 162. A contract of fire insurance is not health, unless thereby expressly required,

affected by any act of the insured subsequent to SECTION 168. Unless the interest of a person

the execution of the policy, which does not insured is susceptible of exact pecuniary

violate its provisions, even though it increases measurement, the measure of indemnity under

the risk and is the cause of a loss. a policy of insurance upon life or health is the

SECTION 163. If there is no valuation in the sum fixed in the policy.

policy, the measure of indemnity in an insurance CHAPTER V

against fire is the expense it would be to the Insurance Companies

insured at the time of the commencement of the SECTION 169. In addition to the duties now

fire to replace the thing lost or injured in the imposed upon him by law, the Insular Treasurer

condition in which it was at the time of the shall act as Insurance Commissioner and in

injury; but the effect of a valuation in a policy of addition to his present official title he shall

fire insurance is the same as in a policy of hereafter be designated as Insurance

marine insurance. Commissioner ex officio.

SECTION 164. Whenever the insured desires to SECTION 170. For the purposes of this chapter

have a valuation named in his policy, insuring unless the context otherwise requires the

any building or structure against fire, he may terms "company" or "insurance company" shall

require such building or structure to be include all corporations, associations,

examined by the insurer and the value of the partnerships, or individuals engaged as

insured's interest therein shall be thereupon principals in the insurance business, excepting

fixed by the parties. The cost of such fraternal and benevolent orders and

examination shall be paid for by the insured. A societies. "Domestic companies" shall include

clause shall be inserted in such policy stating companies formed, organized or existing under

substantially that the value of the insured's the laws of the Philippine Islands. "Foreign

interest in such building or structure has been companies" when used without limitation shall

thus fixed. In the absence of any change include companies formed, organized, or

increasing the risk without the consent of the existing under any laws other than those of the

insurer or of fraud on the part of the insured, Philippine Islands.

then in case of a total loss under such policy, SECTION 171. It shall be the duty of the

the whole amount so insured upon the insured's Insurance Commissioner to see that all laws

interest in such building or structure, as stated relating to insurance and insurance companies

in the policy upon which the insurers have are faith fully executed and perform the duties

received a premium, shall be paid, and in case imposed upon him by this Act.

of a partial loss the full amount of the partial He may issue such rulings, instructions, and

loss shall be so paid, and in case there are two orders as he may deem necessary to secure the

or more policies covering the insured's interest enforcement of the provisions of this Act,

therein, each policy shall contribute pro rata to subject to the approval of the Secretary of

the payment of such whole or partial loss. But in Finance and Justice.

no case shall the insurer be required to pay SECTION 172. After the becoming effective of

more than the amount thus stated in such this Act, no foreign or domestic insurance

policy. This section shall not prevent the parties company shall transact any new business in the

from stipulating in such policies concerning the Philippine Islands until after it shall have

repairing, rebuilding, or replacing buildings or obtained a certificate of authority for that

structures wholly or partially damaged or purpose from the Insurance Commissioner. No

destroyed. such certificate of authority shall be granted to

CHAPTER IV any such company until the Insurance

Life and Health Insurance Commissioner shall have satisfied himself by

SECTION 165. An insurance upon life may be such examination as he may make and such

made payable on the death of the person, or on evidence as he may require that such company

his surviving a specified period, or otherwise is qualified by the laws of the Philippine Islands

contingently on the continuance or cessation of to transact business herein. Said certificate of

life. authority shall expire on the last day of June of

Every contract or pledge for the payment of each year and shall be renewed annually if the

endowments or annuities shall be considered a company is continuing to comply with all of the

life insurance contract for the purposes of this provisions of this chapter. Before issuing such

Act. certificate of authority, the Insurance

SECTION 166. A policy of insurance upon life or Commissioner must be satisfied that the name

health may pass by transfer, will, or succession of the company is not that of any other known

company transacting a similar business, or a (a) A certified copy of the last annual statement

name so similar as to be calculated to mislead or a verified financial statement exhibiting the

the public. Every company receiving any such condition and affairs of such company.

certificate of authority shall be subject to the (b) If incorporated under the laws of the

insurance laws of the Philippine Islands and to Philippine Islands, a copy of the articles of

the jurisdiction and supervision of the Insurance incorporation and by-laws and any amendments

Commissioner. An appeal may be taken from to either, certified by the chief of the division of

any decision of the Insurance Commissioner, archives, patents, copyrights, and trademarks to

refusing to grant such certificate of authority to be a copy of that which is filed in his office.

the Secretary of Finance and Justice whose (c) If incorporated under any laws other than

decision shall be final. those of the Philippine Islands, a copy of the

SECTION 173. The Insurance Commissioner articles of incorporation and by-laws and any

shall require each insurance company to keep its amendments to either if organized or formed

books, records, accounts, and vouchers in such under any law requiring such to be filed, duly

manner that he or his authorized representatives certified by the officer having the custody of

may readily verify its annual statement and same, or if not so organized, a copy of the law,

ascertain whether the company is solvent and charter, or deed of settlement under which the

has complied with the provisions of this chapter. deed of organization is made, duly certified by

SECTION 174. The Insurance Commissioner the proper custodian thereof, or proved by

shall at least once a year and whenever he affidavit to be a copy; also, a certificate under

considers the public interest so demands, cause the hand and seal of the proper officer of such

an examination to be made into the financial state or country having supervision of insurance

condition of every domestic insurance company. business therein, if any there be, that such

Such company shall submit to the examiner all corporation or company is organized under the

such books, papers, and securities as he may laws of such state or country, with the amount

require and such examiner shall also have the of capital stock or assets and legal reserve

power to examine the officers of such required by this Act.

corporation under oath touching its business and (d) If not incorporated, a certificate setting forth

financial condition, and the authority of any such the nature and character of the business, the

company to transact business in the Philippine location of the principal office, the names of the

Islands that refuses to allow such examination, persons and of those composing the company,

shall be revoked by the Insurance firm, or association, the amount of actual capital

Commissioner, and such company shall not employed or to be employed therein, and the

thereafter be allowed to transact further names of all officers and persons by whom the

business in the Philippine Islands until it has business is or may be managed. robles virtual

fully complied with the provisions of this section. law library

SECTION 175. If the Insurance Commissioner is The certificate must be verified by the affidavit

of the opinion upon examination or other of the chief officer, secretary, agent, or manager

evidence that any foreign or domestic insurance of the company; and if there are any written

company is in an unsound condition, or that it articles of agreement or company, a copy

has failed to comply with any provision of law thereof must accompany such certificate.

obligatory upon it, or that its condition is such as SECTION 177. The Insurance Commissioner

to render its proceedings hazardous to the must require as a condition precedent to the

public or to its policy holders or that its actual transaction of insurance business in the

assets exclusive of its capital are less than its Philippine Islands by any foreign insurance

liabilities, including unearned premiums and company, that such company file in his office a

reinsurance reserve, the Insurance written power of attorney designating some

Commissioner is authorized, subject to appeal to person who shall be a resident of the Philippine

the Secretary of Finance and Justice, to revoke Islands, on whom any notice provided by law or

or suspend all certificates of authority granted to by any insurance policy, proof of loss, summons,

such insurance company, its officers or agents, and other process may be served in all actions

and no new business shall thereafter be done by or other legal proceedings against such

such company or for such company by its company, and consenting that service upon such

agents in the Philippine Islands while such agent shall be admitted and held as valid as if

revocation, suspension or disability continues or served upon the foreign company at its home

until its authority to do business is restored by office. Any such foreign company shall, as a

the Insurance Commissioner. further condition precedent to the transaction of

The decision of the Secretary of Finance and insurance business in the Philippine Islands,

Justice in all such cases shall be final. make and file with the Insurance Commissioner

SECTION 176. The Insurance Commissioner an agreement or stipulation, executed by the

must cause every company, before engaging in proper authorities of said company in form and

the business of insurance, to file in his office as substance as follow:chanroblesvirtuallawlibrary

follows:chanroblesvirtuallawlibrary "The (name of company) does hereby stipulate

and agree in consideration of the permission

granted by the Insurance Commissioner to it to

transact business in the Philippine Islands, that so deposited subject to the control of the Chief

if at any time said company shall leave the of the Bureau of Insular Affairs as the

Philippine Islands, or cease to transact business representative of the insurance commissioner of

therein, or shall be without an agent in the the Philippine Islands.

Philippine Islands on whom any notice, proof of SECTION 179. The Insurance Commissioner

loss, summons, or other legal process may be shall hold the securities deposited as aforesaid,

served, then in any action or proceeding arising for the benefit and security of all the policy

out of any business or transactions which holders of the company depositing the same,

occurred in the Philippine Islands, service of any but shall, so long as the company shall continue

notice provided by law, or insurance policy, solvent, permit the company to collect the

proof of loss, summons, or other legal process interest or dividends on the securities so

may be made upon the Insurance deposited, and, from time to time, with his

Commissioner, and that such service upon the assent, to withdraw any of such securities, upon

Commissioner shall have the same force and depositing with said commissioner other like

effect as if made upon the company." securities, the market value of which shall be

Whenever such service of notice, proof of loss, equal to the market value of such as may be

summons, or other legal process shall be made withdrawn. In the event of any company

upon the Insurance Commissioner, he must, ceasing to do business in the Philippine Islands

within ten days thereafter, transmit by mail, the securities deposited as aforesaid shall be

postage paid, a copy of such notice, proofs of returned upon the company's making application

loss, summons, or either legal process to the therefor and proving to the satisfaction of the

company at its home or principal office. The Insurance Commissioner that it has no further

sending of such copy by the commissioner shall liability under any of its policies in the Philippine

be a necessary part of the service of the notice, Islands.

proof of loss, or other legal process. SECTION 180. Every insurance company, doing

SECTION 178. No foreign insurance company business in the Philippine Islands, shall annually

shall engage in business in the Philippine Islands on or before the thirtieth day of April, of each

unless possessed of paid up unimpaired capital year, render to the Insurance Commissioner a

(or assets) and reserve not less than that herein statement signed and sworn to by the chief

required of domestic insurance companies; and officer of such company showing, in such form

no insurance company organized or existing and detail as may be prescribed by the

under the government or laws other than those Insurance Commissioner, the exact condition of

of the Philippine Islands or any state of the its affairs on the preceding thirty-first day of

United States shall engage in business in the December: Provided, That in case the fiscal year

Philippine Islands until it shall have deposited of an insurance company does not terminate

with the Insurance Commissioner for the benefit with the thirty-first day of December, it shall be

and security of its policy holders and creditors in deemed a sufficient compliance with this section

the Philippine Islands securities, satisfactory to if the report is made to coincide with the regular

the Insurance Commissioner consisting of bonds fiscal year of the company. In such case the

of the United States or of the Philippine Islands report of the company shall be filed with the

or of the city of Manila or of municipalities in the Insurance Commissioner within four months

Philippine Islands authorized by law to issue after the close of its fiscal year: And,Provided,

bonds, or of the government in which such Further, That the Insurance Commissioner may

company is organized, or other good securities in his discretion, and upon approval of the

to the actual market value of one hundred Secretary of Finance and Justice, grant an

thousand pesos: Provided, That if a company extension of not exceeding three months, to any

organized or existing under the laws of any company, upon his being satisfied that the

government outside of the United States and the period of four months granted by this section is

Philippine Islands shall have made a deposit inadequate with regard to said company.

with the insurance department of some one of SECTION 181. Immediately upon approval of

the States of the United States of securities of the annual statements by the Insurance

the character above described to the actual Commissioner, every insurance company doing

market value of at least four hundred thousand business in the Philippine Islands shall publish in

pesos, in exclusive trust for the benefit and two papers of general circulation in the city of

security of all the company's policy holders and Manila, one published in English and one in the

creditors in the United States and its Spanish language, a full synopsis of its annual

possessions, each deposit shall be held to be in financial statement showing fully the condition

lieu of the deposit required by this, of its business, and setting forth its resources

And: Provided, Further, That it shall be a and liabilities.

sufficient compliance with the provisions of this SECTION 182. Every life insurance company,

section if the deposit herein required be made doing business in the Philippine Islands, shall

with the Chief of the Bureau of Insular Affairs of annually make a valuation of all policies,

the War Department at Washington or with a additions thereto, unpaid dividends, and all

safe deposit company designated by that officer, other obligations outstanding on the thirty-first

which company shall agree to hold the securities day of December of the preceding year. All such

valuations shall be made upon the net premium said period of grace before the overdue

basis, according to the standard adopted by the premium or the deferred premiums of the

company, which standard shall be stated in its current policy year if any are paid, the amount

annual report. of such premiums, with interest on any overdue

Such standard of valuation, whether on the net premium, may be deducted from any amount

level premium, preliminary term, any modified payable under the policy in settlement.

preliminary term, or select and ultimate reserve (b) A provision that the policy shall, in the

basis, shall be according to a standard table of absence of fraud, be incontestable after five

mortality, with interest at not less than three nor years from its date of issue except for

more than six per cent compound interest. nonpayment of premiums and except for

When the preliminary term basis is used the violation of the conditions of the policy relating

term insurance shall be limited to the first policy to military or naval service in time of war.

year. (c) A provision that the policy shall constitute

The results of such valuation shall be reported the entire contract between the parties, but if

to the Insurance Commissioner on or before the the company desires to make the application a

thirtieth day of April of each year accompanied part of the contract it may do so provided a

by a sworn statement of the company's actuary copy of such application shall be indorsed upon

certifying to the figures and stating upon what or attached to the policy when issued, and in

mortality table it is based, upon what rate of such case the policy shall contain a provision

interest the valuation is made, and the methods that the policy and the application therefor shall

used in arriving at the results constitute the entire contract between the

obtained: Provided, That in case the fiscal year parties.

of a life insurance company does not terminate (d) A provision that if the age of the insured has

with the thirty-first day of December, it shall be been misstated the amount payable under the

deemed a sufficient compliance with this section policy shall be such as the premium would have

if the valuation herein required is made to purchased at the correct age.

coincide with the regular fiscal year of the (e) A provision that the policy shall participate in

company. In such case the result of such the surplus of the company.

valuation shall be reported to the Insurance (f) A provision specifying the options to which

Commissioner within four months after the close the policy-holder is entitled in the event of

of its fiscal year: And Provided, Further, That default in a premium payment after three full

the Insurance Commissioner may in his annual premiums shall have been paid.

discretion, and upon approval of the Secretary (g) A provision that after three full years'

of Finance and Justice, grant an extension of not premiums have been paid, the company at any

exceeding three months, to any company, upon time, while the policy is in force, will advance,

his being satisfied that the period of four on proper assignment or pledge of the policy

months granted by this section is inadequate and on the sole security thereof, at a specified

with regard to said company. rate of interest, a sum equal to, or at the option

SECTION 183. The aggregate net value of the of the owner of the policy less than, the reserve

policies of such company so ascertained shall be at the end of the current policy year on the

deemed its reserve liability, to provide for which policy and on any dividend additions thereto,

it shall hold funds in secure investments equal to less a sum not more than two and one-half per

such net value, above all its other liabilities; and centum of the amount insured by the policy and

it shall be the duty of the Insurance of any dividend additions thereto; and that the

Commissioner, after having verified, to such an company will deduct from such loan value any

extent as he may deem necessary, the valuation existing indebtedness on the policy and any

of all policies in force, to satisfy himself that the unpaid balance of the premium for the current

company has such amount in safe legal policy year, and may collect interest in advance

securities after all other debts and claims on the loan to the end of the current policy

against it have been provided for. year; which provision may further provide that

SECTION 184. Hereafter no policy of life or such loan may be deferred for not exceeding six

endowment insurance shall be issued or months after the application therefor is made. A

delivered within the Philippine Islands unless it company may, in lieu of the provision

shall contain in substance the following hereinabove permitted for the deduction from a

provisions:chanroblesvirtuallawlibrary loan on the policy of a sum not more than two

(a) A provision that the insured is entitled to a and one-half per centum of the amount insured

grace either of thirty days or of one month by the policy and of any dividend additions

within which the payment of any premium after thereto, insert in the policy a provision that one-

the first year may be made, subject at the fifth of the entire reserve may be deducted in

option of the company to any interest charge case of a loan under the policy, or may provide

not in excess of six per centum per annum for therein that the deduction may be the said two

the number of days of grace elapsing before the and one-half per centum or the one-fifth of the

payment of the premium, during which period of said entire reserve at the option of the

grace the policy shall continue in full force, but company.

in case the policy becomes a claim during the

(h) A table showing in figures the loan values, if premiums received on policies or risks having

any, and the options available under the policy not more than a year to run, and pro rata on all

each year upon default in premium payments, gross premiums received having more than a

during at least the first twenty years of the year to run: Provided, That for marine risks the

policy. insuring company shall be required to charge as

(i) In case the proceeds of a policy are payable the liability for reinsurance fifty per centum of

in installments or as an annuity, a table showing the premiums written in the policies upon yearly

the amounts of the installments or annuity risks, and the full amount of the premiums

payments. written in the policies upon all other marine risks

(j) A provision that the holder of a policy shall not terminated.

be entitled to have the policy reinstated at any SECTION 187. No fire or marine insurance

time within three years from the date of default corporation whether foreign or domestic shall

unless the cash value has been duly paid, or the insure on any one risk or hazard to an amount

extension period expired, upon the production of exceeding ten per cent of its net assets unless it

evidence of insurability satisfactory to the has provided for reinsurance of the excess over

company and the payment of all overdue said limit to take effect simultaneously with the

premiums and any other indebtedness to the original contract.

company upon said policy with interest at a rate SECTION 188. No policy of fire insurance shall

which shall be stipulated in the policy and not be pledged, hypothecated, or transferred to any

exceeding ten per centum per annum, payable person, firm or company who acts as agent for

annually. or otherwise represents the issuing company,

Any of the foregoing provisions or portions and any such pledge, hypothecation, or transfer

thereof not applicable to single premium or non hereafter made shall be void and of no effect in

participating or term policies shall to that extent so far as it may affect other creditors of the

not be incorporated therein; and any such policy insured.

may be issued or delivered in the Philippine Agents

Islands which in the opinion of the insurance SECTION 189. No insurance company doing

commissioner contains provisions on any one or business within the Philippine Islands, nor any

more of the several foregoing requirements agent thereof, shall pay any commission or

more favorable to the policy holder than other compensation to any person for services in

hereinbefore required. The provisions of this obtaining new insurance unless such person

section shall not apply to policies of shall have first procured from the Insurance

reinsurance. robles virtual law library Commissioner a certificate of authority to act as

SECTION 185. Every domestic life insurance an agent of such company hereinafter provided.

company, conducted on the mutual plan or a No person shall act as agent, subagent, or

plan in which policy holders are by the terms of broker, in the solicitation or procurement of

their policies entitled to share in the profits or applications for insurance, or receive for services

surplus shall, on all policies of life insurance in obtaining new insurance any commission or

heretofore or hereafter issued, under the other compensation from any insurance

conditions of which the distribution of surplus is company doing business in the Philippine

deferred to a fixed or specified time and Islands, or agent thereof, without first procuring

contingent upon the policy being in force and a certificate of authority so to act from the

the insured living at that time, annually Insurance Commissioner, which must be

ascertain the amount of the surplus to which all renewed annually on the first day of January, or

such policies as a separate class are entitled, within six months thereafter. Such certificate

and shall annually apportion to such policies as shall be issued by the Insurance Commissioner

a class the amount of the surplus so ascertained only upon the written application of persons

and carry the amount of such apportioned desiring such authority such application being

surplus, plus the actual interest earnings and approved and countersigned by the company

accretions of such fund, as a distinct and such person desires to represent, and shall be

separate liabilities of such class of policies on upon a form approved by the Insurance

and for which the same was accumulated, and Commissioner, giving such information as he

no company or any of its officers shall be many require. The Insurance Commissioner shall

permitted to use any part of such apportioned have the right to refuse to issue or renew and to

surplus fund for any purpose whatsoever other revoke any such certificate in his discretion. No

than for the express purpose for which the same such certificate shall be valid, however, in any

was accumulated. event after the first day of July of the year

SECTION 186. To determine the liability upon following the issuing of such certificate. Renewal

the contracts of insurance of any foreign or certificates may be issued upon the application

domestic insurance company, other than life, of the company.

the Insurance Commissioner shall require such Any person or company violating the provisions

companies to charge as the liabilities for of this section shall be fined in the sum of five

reinsurance of its outstanding policies, in hundred pesos. On the conviction of any person

addition to the capital stock and all outstanding acting as agent, subagent, or broker, of the

claims, a sum equal to fifty per cent of the gross commission of any offense connected with the

business of insurance, the Insurance procure policies of insurance on risks located in

Commissioner shall immediately revoke the the Philippine Islands for companies not

certificate of authority issued to him and no authorized to transact business in the Philippine

such certificate shall thereafter be issued to Islands.

such convicted person. Before the agent named in such certificate of

SECTION 190. No insurance company, engaged authority shall procure any insurance in such

in business in the Philippine Islands, or any company there shall be executed and filed in

agent thereof, shall make any contract of each case with the Insurance Commissioner by

insurance, or agreement as to policy contract, the agent and by the party desiring the

other than is plainly expressed in the policy insurance affidavits setting forth that the party

issued thereon; nor shall any such company or desiring insurance is after diligent effort unable