Beruflich Dokumente

Kultur Dokumente

2017 Residential Mortgage Banking Overview - Final

Hochgeladen von

Mohamed BadatCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

2017 Residential Mortgage Banking Overview - Final

Hochgeladen von

Mohamed BadatCopyright:

Verfügbare Formate

Aon Hewitt

McLagan

McLagan U.S. Residential Mortgage Banking

Compensation Survey

The U.S. Residential Mortgage Banking Compensation Survey data will help you stay ahead of

emerging market trends in the design and structure of compensation plans for mortgage

professionals. Our survey comes highly recommended through our long-standing partnership

with the Mortgage Bankers Association (MBA).

Our survey collects data on a granular incumbent-level basis for professionals across We’re here to

major functions and roles within the mortgage banking industry. empower results

Contact our team today to learn

Our survey benchmarks key compensation elements for sales and support functions more about McLagan’s survey

products.

Survey elements include: Survey scoping factors include:

• Base Salary • Compensation as • Number of Loans • Employee Headcount Robert Northway

• Bonus Percentage Percentage of Loan • Overtime • Geographic Regions 1.203.602.1234

of Salary Volume

• Total Cash • Production Volume rnorthway@mclagan.com

• Cash Bonus • Loan Production

• Total Compensation • Revenue Size

• Commissions • Long-term /

• Servicing Portfolio Ryan Caravella

Deferred Awards 1.203.517.3809

We focus on key roles, including: rcaravella@mclagan.com

Executive Management & Production Administration Loan Servicing / Loan Administration For more information on

• ABA / Joint Venture • FHA / VA • Secondary / Capital • Bankruptcy • Inspection McLagan, visit mclagan.com

• Affordable Lending Origination Markets Support • Business Development • Investor Relations

• Appraisal • Loan Securitization • Securitized Officer • Loan Workout

• Operations Products Research • Capacity Planning &

• Asset Sales • Loss Mitigation

• Business • Overall Origination • Strategic Planning Forecasting

• Operations

Management & Development • Collections – All

Development • Portfolio Retention

Officer • Portfolio • Telemarketing / Stages

Sales

Management Consumer Direct • Customer Service

• Construction Loan • Real Estate Owned

Origination • Pricing • Trading • Escrow & Tax Services (REO)

• Corporate • Private Mortgage • Underwriting • Executive • Special Servicing 2017 key dates

Relocation Banker • Validation Management

• Correspondent • Quantitative • Warehouse Lending Corporate Administration & Support January - March

/ Whole Loan Analysis • Wholesale Survey launch / matching calls

Acquisition • Retail • Centralized Vendor • Legal

Management • Marketing & Data collection is distributed

• Documentation / • Sales Satellite

Negotiation • Compliance / Quality Communications April

• Secondary /

• Executive Control • Office Services Data collection due

Capital Markets

Management Management • Finance • Project Management May - July

• Human Resources • Risk Management Data cleaning / questions

• Information • Support Staff August

Technology

Study results delivered

• Internal Audit

September 14th - 15th

MBA HR Symposium

Global benchmarking and advisory solutions customized to your business needs September - December

Advisory solutions: Our consulting approach is customized by project and includes functional benchmarking, pay and Review survey results

performance analysis, incentive plan review and design, cost to market analysis, and custom market practice studies. Select cut requests

Access to MBA HR Symposium: McLagan presents key talent and rewards trends as part of the complimentary Market Practice Studies

roundtable. This HR Symposium, hosted by the MBA, also serves as a forum to network with colleagues throughout the

mortgage banking industry.

Confidentiality: Reports are presented in a way that ensures that data on individual companies cannot be identified.

Reports are distributed only to participating organizations, each of which signs a reciprocal non-disclosure agreement

with McLagan.

Risk. Reinsurance. Human Resources.

Aon Hewitt

McLagan

McLagan U.S. Residential Mortgage Banking

Compensation Survey

We partner with the leading firms across the mortgage banking industry

2016 Bank participants

Ally Financial, Inc. First Citizens Bank Navy Federal Credit Union

American National Bank of Texas First Financial Bancorp New York Community Bank

Arvest First Interstate BancSystem, Inc. People’s United Bank, NA

Bank of America Merrill Lynch First Midwest Bank PNC Bank

Bank of the West First Niagara Prime Lending

Barclays First Reliance Bank Raymond, James & Associates

BBVA Compass FNB Omaha Regions Financial Corporation

Bethpage Federal Credit Union Franklin American Mortgage Santander Bank, NA

BMO Financial Group Greater Nevada Credit Union SchoolsFirst Federal Credit Union

BOK Financial Corporation Hancock Bank Sterling National Bank

Branch Banking & Trust, Co. Home State Bank SunTrust Banks

Capital One HSBC Synovus

Central Pacific Bank Huntington Bancshares, Inc. TD Securities

Citigroup Investors Bancorp, Inc The Bank of Canton

Citizens Financial Group Johnson Financial Group, Inc. The CIT Group

Citizens First Bank JPMorgan Chase The Private Bank

City National Bank KeyCorp U.S. Bancorp

Comerica Kinecta Federal Credit Union Umpqua Holding Corporation

Commonwealth Bank and Trust M&T Bank Corporation Webster Bank

Discover Financial Services MB Financial Bank Wells Fargo Bank

East West Bancorp MidFirst Bank Wright Patt Credit Union

Elevations Credit Union Midland States Bank WSECU

EverBank MUFG Union Bank Zions Bancorporation

Fifth Third Bank Mutual of Omaha

2016 Independent Mortgage Bank participants

Accenture Genpact PenFed

Aegon Genworth Financial PennyMac

Alliance Home Loans Guild Mortgage Company PHH Mortgage

Altisource Hallmark Home Mortgage Pine River Capital Management

American Pacific Mortgage Highlands Residential Mortgage Planet Financial Group, LLC.

Ameripro Funding Home Point Financial Plaza Home Mortgage, Inc.

Bayview Asset Management HomeBridge Financial Services Primary Capital Mortgage

Benchmark Mortgage HomeServices Mortgage Prospect Mortgage

Black Knight Financial Services Homestar Financial Pulte Homes, Inc.

CalAtlantic Mortgage Homestead Funding Quicken Loans

Caliber Funding IBM Radian Guaranty, Inc.

Carrington Mortgage iMortgage Redwood Trust, Inc.

Cenlar Impac Companies Residential Mortgage Services, Inc.

Centennial Lending Group, LLC. JMAC Lending Inc. Rushmore Loan Management

Colonial Savings, FA LendingHome Selene Finance

Computershare Loan Depot Seneca Mortgage Servicing, LLC.

Digital Risk Loan Pacific ServiceFirst Mortgage

Ditech Financial, LLC. Long and Foster Companies State Farm

Fairway Mortgage Movement Mortgage Stearns Lending

Fannie Mae National Mortgage Insurance Stewart Title Guaranty

First Guaranty Mortgage Nationstar Mortgage LLC Stonegate Mortgage

Freddie Mac New Penn Financial TIAA

Freedom Mortgage NVR Mortgage, Inc. Toll Brothers, Inc.

Gateway Mortgage Group Ocwen Financial Wintrust Mortgage

Risk. Reinsurance. Human Resources.

Aon Hewitt

McLagan

The firm designated below agrees to participate in and purchase the 2017 Residential Mortgage Banking Compensation Survey(s).

All McLagan products are for internal use only and a signed mutual Services Agreement must be received prior to delivery of the results. All client

data is treated as confidential and reported only in aggregate form.

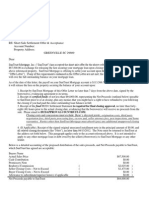

Participation Fees

Please check each of the product(s) that your firm will be participating in and subsequently purchasing for the 2017 survey program. Please check

the appropriate product fee based on your firm’s current MBA membership status. The 2016 edition of the survey is also available for purchase

with a commitment to participate in and purchase the 2017 survey. If your firm would like to purchase the 2016 edition of the survey, McLagan

will bill for the 2016 results in addition to half of the 2016 fees in advance toward 2017 survey fees as a non-refundable survey deposit.

2018 Early Registration

If your firm would like to sign up early to participate in and subsequently purchase the mortgage banking surveys for the 2018 survey program,

please contact Ryan Caravella at rcaravella@mclagan.com for information and fees.

2017 Participation

Product MBA Members* Non- Members

Executive Management & Production Administration Survey (MOU) $2,300 $3,350

Loan Servicing / Loan Administration Survey (MSU) $2,300 $3,350

Corporate Administration & Support Survey (MCU) $2,050 $3,100

Select Cut Reports (per select cut) $1,000 $1,250

2017 McLagan Mortgage Banking Market Practice Studies (Call for more info) TBD

MBA Human Resources Symposium (For more info go to www.mba.org) MBA Charge

*Please note that McLagan will confirm membership with the MBA.

Primary Data Contact

The individual identified below will act as the primary data contact for completion of all survey, study, or analysis and has the authority to release all necessary data

to McLagan. This individual will be responsible for returning a fully executed Services Agreement with McLagan prior to the release of any survey results.

Name: Title:

Company:

Address:

City: State: Zip:

Email: Phone:

Billing Contact (if different from Primary Data Contact)

Name: Title:

Company:

Address:

City: State: Zip:

Email: Phone:

Signature:

Please sign and fax this form to 203-323-9851 or email PDF form to rcaravella@mclagan.com

Risk. Reinsurance. Human Resources.

Das könnte Ihnen auch gefallen

- Case Study 2Dokument9 SeitenCase Study 2Isabella ChristinaNoch keine Bewertungen

- Tutorial 3 - SolutionDokument5 SeitenTutorial 3 - SolutionAbdul Aziz Wicaksono100% (1)

- Tax NotesDokument254 SeitenTax NotesJane100% (1)

- CertainGovernmentPayments1099G JamesSmith-654202001310815Dokument4 SeitenCertainGovernmentPayments1099G JamesSmith-654202001310815ireaditallNoch keine Bewertungen

- Mortgage Statement: Account Number 9903045785Dokument2 SeitenMortgage Statement: Account Number 9903045785amarah buckner100% (1)

- Pay StubsDokument14 SeitenPay Stubsapi-341301555Noch keine Bewertungen

- Workers CompDokument74 SeitenWorkers CompZoe GallandNoch keine Bewertungen

- Annual Tax and Interest Statement: See Reverse Side For Additional InformationDokument2 SeitenAnnual Tax and Interest Statement: See Reverse Side For Additional InformationtclippertNoch keine Bewertungen

- Checking Summary: David Johnson 8233 Tomlinson CT SEVERN MD 21144Dokument3 SeitenChecking Summary: David Johnson 8233 Tomlinson CT SEVERN MD 21144jeffery lamarNoch keine Bewertungen

- My Disability BenefitsDokument3 SeitenMy Disability BenefitsRobert P. ForestaNoch keine Bewertungen

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionVon EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionNoch keine Bewertungen

- KVS Agra XII ACC QP & MS (Pre-Board) 23-24Dokument21 SeitenKVS Agra XII ACC QP & MS (Pre-Board) 23-24ragingcaverock696Noch keine Bewertungen

- ELCD - Community OutreachDokument3 SeitenELCD - Community OutreachElliot Lake Centre for DevelopmentNoch keine Bewertungen

- Implementation of Artificial Intelligence and Its Impact On Human Auditors - Finance International ProgramDokument7 SeitenImplementation of Artificial Intelligence and Its Impact On Human Auditors - Finance International ProgramPanashe GuzhaNoch keine Bewertungen

- Corporate Governance: A Study Into Westpac's Corporate Governance PoliciesDokument15 SeitenCorporate Governance: A Study Into Westpac's Corporate Governance PoliciesMichael YuleNoch keine Bewertungen

- CFPB Mortgage Complaint DatabaseDokument718 SeitenCFPB Mortgage Complaint DatabaseSP BiloxiNoch keine Bewertungen

- Residential Mortgage Application With AddendumDokument12 SeitenResidential Mortgage Application With AddendummuaadhNoch keine Bewertungen

- ASC AMERICA'S SERVICING COMPANY SN/75326061 Wells Fargo Home Mortgage Division Wells Fargo Bank NADokument135 SeitenASC AMERICA'S SERVICING COMPANY SN/75326061 Wells Fargo Home Mortgage Division Wells Fargo Bank NAMaryEllenCochraneNoch keine Bewertungen

- Complaint - National Mortgage Settlement United States V Bank of America 12-00361Dokument99 SeitenComplaint - National Mortgage Settlement United States V Bank of America 12-00361larry-612445100% (1)

- Loan Modification/Loss Mitigation Contacts and Phone Numbers ListDokument6 SeitenLoan Modification/Loss Mitigation Contacts and Phone Numbers ListSteve Linnin100% (11)

- 1098 (Rocket Mortgage) - 20230411042534984Dokument2 Seiten1098 (Rocket Mortgage) - 20230411042534984John Zaworski100% (1)

- IRS 2566 NoticeDokument5 SeitenIRS 2566 NoticeCarl AKA Imhotep Heru ElNoch keine Bewertungen

- Pre Qual Vs Pre ApprovalDokument1 SeitePre Qual Vs Pre ApprovalBrent DeanNoch keine Bewertungen

- 2018 Top250 Mortgage Originator ReportDokument32 Seiten2018 Top250 Mortgage Originator ReportDavid PalanukNoch keine Bewertungen

- Personal Loan Application FormDokument29 SeitenPersonal Loan Application FormPabitra Kumar PrustyNoch keine Bewertungen

- Performance Audit of The Philadelphia Sheriff's Custodial AccountsDokument54 SeitenPerformance Audit of The Philadelphia Sheriff's Custodial AccountsKristina KoppeserNoch keine Bewertungen

- TYPES OF LetterDokument15 SeitenTYPES OF Letter7SxBlazeNoch keine Bewertungen

- HVAC Service InvoiceDokument6 SeitenHVAC Service Invoicesahlan kasaniNoch keine Bewertungen

- CORRECTED (If Checked)Dokument2 SeitenCORRECTED (If Checked)Dennis100% (1)

- 2020 Form 5498 IRA Contribution Information: Upendra Eduru 24032 Audubon Trail DR ALDIE VA 20105-5917Dokument2 Seiten2020 Form 5498 IRA Contribution Information: Upendra Eduru 24032 Audubon Trail DR ALDIE VA 20105-5917BindhuNoch keine Bewertungen

- Document For Your Electronic Signature From W PDFDokument4 SeitenDocument For Your Electronic Signature From W PDFORLANDONoch keine Bewertungen

- Print FormsDokument2 SeitenPrint FormsJulia DrewNoch keine Bewertungen

- Lender MCC Lender Spanish Smartbuy Phone Gold Level LendersDokument3 SeitenLender MCC Lender Spanish Smartbuy Phone Gold Level LendersRielzaruxo Ka Rioelzarux Ko XNoch keine Bewertungen

- 2019 Mortgauge PDFDokument2 Seiten2019 Mortgauge PDFSreenu GullapalliNoch keine Bewertungen

- Navy Federal Credit Union - Home Affordable Foreclosure Alternative (HAFA) MatrixDokument2 SeitenNavy Federal Credit Union - Home Affordable Foreclosure Alternative (HAFA) MatrixkwillsonNoch keine Bewertungen

- TALF PPIP v2Dokument5 SeitenTALF PPIP v2ZerohedgeNoch keine Bewertungen

- Mrs Terri Williams TynerDokument3 SeitenMrs Terri Williams Tynerapi-255253557Noch keine Bewertungen

- Wells Fargo Manuals UpdateDokument2 SeitenWells Fargo Manuals UpdateJohn ReedNoch keine Bewertungen

- Sample Preliminary ReportDokument10 SeitenSample Preliminary ReportAidyl Rain SimbulanNoch keine Bewertungen

- Department of Justice V ITS Financial RulingDokument233 SeitenDepartment of Justice V ITS Financial RulingKelly Phillips ErbNoch keine Bewertungen

- UntitledDokument10 SeitenUntitledJosh SofferNoch keine Bewertungen

- SunTrust Short Sale Approval (Fannie Mae)Dokument3 SeitenSunTrust Short Sale Approval (Fannie Mae)kwillson100% (1)

- Us 1099 2022Dokument4 SeitenUs 1099 2022mks12Noch keine Bewertungen

- MortgageDokument31 SeitenMortgagedmccallum4Noch keine Bewertungen

- CFPB Enforcement Action (Wells Fargo)Dokument26 SeitenCFPB Enforcement Action (Wells Fargo)United Press International100% (1)

- You and Wells Fargo: Questions?Dokument4 SeitenYou and Wells Fargo: Questions?Viktoria DenisenkoNoch keine Bewertungen

- 853 Title Smart Document 02-04-19Dokument5 Seiten853 Title Smart Document 02-04-19Kirsten Johnston EllesNoch keine Bewertungen

- DL 44 Eng PT 1Dokument2 SeitenDL 44 Eng PT 1Tipitaka TripitakaNoch keine Bewertungen

- Wells Fargo Mortgage Settlement DocumentsDokument314 SeitenWells Fargo Mortgage Settlement DocumentsFindLawNoch keine Bewertungen

- Instruction and Information Sheet For SF 180, Request Pertaining To Military RecordsDokument3 SeitenInstruction and Information Sheet For SF 180, Request Pertaining To Military RecordsAnthony Bonafide Dakush100% (1)

- Applicant Report: Terry James FryDokument3 SeitenApplicant Report: Terry James FryTerry FryNoch keine Bewertungen

- Notice Before Collection Action: We Have Not Received All of Your Required PaymentsDokument2 SeitenNotice Before Collection Action: We Have Not Received All of Your Required PaymentsjamalsledgeNoch keine Bewertungen

- Cardinal Lines Discharge OrderDokument3 SeitenCardinal Lines Discharge OrderCBS 11 NewsNoch keine Bewertungen

- Payment Information Summary of Account ActivityDokument3 SeitenPayment Information Summary of Account ActivityTyrone J PalmerNoch keine Bewertungen

- Confirmation: 1-888-205-8118 M-F 6:30am PST To 5:30pm PSTDokument1 SeiteConfirmation: 1-888-205-8118 M-F 6:30am PST To 5:30pm PSTKarthik SheshadriNoch keine Bewertungen

- DocumentDokument4 SeitenDocumentMichele PadillaNoch keine Bewertungen

- Summary of Account Activity Payment Information: Protecting What Matters MostDokument4 SeitenSummary of Account Activity Payment Information: Protecting What Matters MostJames BergmanNoch keine Bewertungen

- Webull Tax DocumentDokument10 SeitenWebull Tax DocumentHimer VerdeNoch keine Bewertungen

- Paycheck 20201230 001387 Pravallika 202101241910Dokument1 SeitePaycheck 20201230 001387 Pravallika 202101241910Prabhakar AenugaNoch keine Bewertungen

- Pennsylvania Insurance Department Complaint Form 2015A Re Allstate Insurance Claim October 14, 2016Dokument134 SeitenPennsylvania Insurance Department Complaint Form 2015A Re Allstate Insurance Claim October 14, 2016Stan J. CaterboneNoch keine Bewertungen

- Loan AppDokument2 SeitenLoan AppsandyolkowskiNoch keine Bewertungen

- John Wiff 40W867 Big Timber RD Hampshire Il 60140: Amount Added Date Description Amount Subtracted BalanceDokument3 SeitenJohn Wiff 40W867 Big Timber RD Hampshire Il 60140: Amount Added Date Description Amount Subtracted Balance419o1Noch keine Bewertungen

- Important Information About Your Unemployment Insurance ClaimDokument3 SeitenImportant Information About Your Unemployment Insurance ClaimSolomonNoch keine Bewertungen

- What Went Awry at Wells Fargo - The Beaten Path of A Toxic Culture - The New YorkDokument5 SeitenWhat Went Awry at Wells Fargo - The Beaten Path of A Toxic Culture - The New YorkAbhiraj SinghNoch keine Bewertungen

- Employer's Annual Federal Unemployment (FUTA) Tax ReturnDokument4 SeitenEmployer's Annual Federal Unemployment (FUTA) Tax ReturnPatriciaNoch keine Bewertungen

- 486 Asm 2 OutlineDokument2 Seiten486 Asm 2 OutlineĐoàn Thảo NguyênNoch keine Bewertungen

- Qs Documents 11010 Brand - Com and Marketplace in The Evolving Online Path To Purchase ReportDokument69 SeitenQs Documents 11010 Brand - Com and Marketplace in The Evolving Online Path To Purchase ReportDhea AgistaNoch keine Bewertungen

- Enotesofm Com2convertedpdfnotesinternationalbusiness 100330064505 Phpapp01Dokument291 SeitenEnotesofm Com2convertedpdfnotesinternationalbusiness 100330064505 Phpapp01Hari GovindNoch keine Bewertungen

- Role of Entrepreneurship in Economic DevelopmentDokument8 SeitenRole of Entrepreneurship in Economic DevelopmentHimanshu Garg100% (1)

- Creating A Model of Process Innovation For Reengineering of Business and ManufacturingDokument7 SeitenCreating A Model of Process Innovation For Reengineering of Business and Manufacturingapi-3851548Noch keine Bewertungen

- Manufacturing Accounts FormatDokument6 SeitenManufacturing Accounts Formatkerwinm6894% (16)

- BNP Paribas. The Challenge of OTC Derivarives ClearingDokument56 SeitenBNP Paribas. The Challenge of OTC Derivarives ClearingGest DavidNoch keine Bewertungen

- Option Trading Tactics With Oliver Velez PDFDokument62 SeitenOption Trading Tactics With Oliver Velez PDFhansondrew100% (1)

- Lesson 5 - New CU1.8 and CU2.12Dokument16 SeitenLesson 5 - New CU1.8 and CU2.12nightlight123Noch keine Bewertungen

- Naukri AvinashSoni (13y 0m)Dokument5 SeitenNaukri AvinashSoni (13y 0m)rocky ronNoch keine Bewertungen

- CFAP 6 Winter 2022 PDFDokument7 SeitenCFAP 6 Winter 2022 PDFAli HaiderNoch keine Bewertungen

- AD PR SyllabusDokument26 SeitenAD PR SyllabusYogesh KamraNoch keine Bewertungen

- CUEGISDokument2 SeitenCUEGISAuryn Astrawita HendroSaputri100% (1)

- Running Head: YUVA: (Name) (Institute) (Date)Dokument29 SeitenRunning Head: YUVA: (Name) (Institute) (Date)Liam GreenNoch keine Bewertungen

- Haier in India Building Presence in A Mass Market Beyond ChinaDokument14 SeitenHaier in India Building Presence in A Mass Market Beyond ChinaGaurav Sharma100% (1)

- Strasmore Contract ProposalDokument10 SeitenStrasmore Contract ProposalJuan Carlo CastanedaNoch keine Bewertungen

- INVESTMENT IN DEBT SECURITIES DiscussionDokument12 SeitenINVESTMENT IN DEBT SECURITIES DiscussionKristine Kyle AgneNoch keine Bewertungen

- Nachiket Mor Comm ReportDokument2 SeitenNachiket Mor Comm ReportPriya SunderNoch keine Bewertungen

- AR SKLT 2017 Audit Report PDFDokument176 SeitenAR SKLT 2017 Audit Report PDFAnDhi Lastfresh MuNoch keine Bewertungen

- Tariff Petition MEPCO PDFDokument170 SeitenTariff Petition MEPCO PDFahmed khanNoch keine Bewertungen

- 1.3. - Sources of Labour LawDokument36 Seiten1.3. - Sources of Labour Law21UG0740 DESHAN P.P.T.Noch keine Bewertungen

- WLB ReportDokument18 SeitenWLB ReportDr-Shefali GargNoch keine Bewertungen

- Client Needs AssessmentDokument3 SeitenClient Needs AssessmentNunoNoch keine Bewertungen

- Geoffrey Rash BrookeDokument4 SeitenGeoffrey Rash BrookeChartcheckerNoch keine Bewertungen