Beruflich Dokumente

Kultur Dokumente

Oplan Kandado

Hochgeladen von

Herzl HermosaOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Oplan Kandado

Hochgeladen von

Herzl HermosaCopyright:

Verfügbare Formate

Oplan Kandado

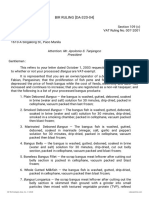

In line with the government’s effort to boost collections, the Bureau of Internal Revenue (BIR) is

invoking the power of the Commissioner under the National Internal Revenue Code to suspend the

business operations of an erring taxpayer.

In Revenue Memorandum Order 3-2009, BIR set the guidelines for the implementation of Oplan

Kandado, a program that provides for the suspension and temporary closure of businesses due to non-

compliance with the necessary value-added tax (VAT) requirements. Since its inception, a considerable

number of establishments have been closed as the Bureau classifies Oplan Kandado as one of its priority

programs.

Despite this stern rule, taxpayers are not left without protection from undue arbitrariness. The

memorandum order fairly provides for guidelines on upholding the right of taxpayers to due process of

law. This is where we, as professional tax lawyers, can offer our services to the taxpayers.

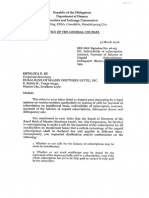

The business establishment cannot automatically be closed down by BIR simply because of failure to pay

VAT. The taxpayer must be given ample time to rebut the findings of the BIR and explain his own

arguments. RMO 3-2009 provides that a taxpayer shall receive two notices: the 48-hour notice and the

five-day VAT compliance notice (VCN).

A 48-hour notice is issued to the taxpayer when a revenue officer recommends the suspension or

closure of the business. The taxpayer will then be required to explain why he should not be sanctioned

administratively, by suspension of his business or temporary closure of his establishment, and,

criminally, for violation of the Tax Code. At this point, we can extend our assistance to the taxpayers by

helping them file an “explanation under oath” within 48 hours from receipt of the notice. We could

attack the notice by contesting the factual and legal bases therein stated.

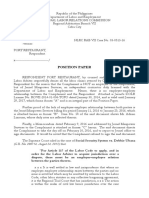

If upon submission of the said explanation, the BIR still decides to pursue administrative or criminal

action, the five-day VCN shall be issued to the taxpayer. At this point, we could assist the client by filing

a “response” or “protest” within two days from receipt of the five-day VCN. The notice can be assailed if

it does not provide the particular provision of the Tax Code that was allegedly violated. It is very

important to argue that the notice must not only contain the results of the surveillance by the BIR but

must also clearly indicate the basis of the findings. The BIR must give specific details as to how they

conducted their surveillance and explain the methods used in arriving at their estimates. Without these

explanations, the notices can be declared void.

Should the protest be denied, the taxpayer still has an available recourse by way of an appeal to the

Court of Tax Appeals. Unfortunately, our services are limited to representing the client in the

administrative proceedings before the BIR and do not extend to proceedings in the CTA.

Das könnte Ihnen auch gefallen

- Pbcom V CirDokument9 SeitenPbcom V CirAbby ParwaniNoch keine Bewertungen

- Oplan Kandado Web ProgramDokument1 SeiteOplan Kandado Web ProgramMark Lord Morales BumagatNoch keine Bewertungen

- Pagong BagalDokument1 SeitePagong Bagaljuliet_emelinotmaestroNoch keine Bewertungen

- 209890-2017-Opulent Landowners Inc. v. Commissioner of PDFDokument29 Seiten209890-2017-Opulent Landowners Inc. v. Commissioner of PDFJobar BuenaguaNoch keine Bewertungen

- Guidelines On Land AcquisitionDokument3 SeitenGuidelines On Land Acquisitionirwinariel mielNoch keine Bewertungen

- Tax Law for BusinessDokument3 SeitenTax Law for BusinessJianSadakoNoch keine Bewertungen

- Penalties - Expired AtpDokument1 SeitePenalties - Expired AtpCherry ChaoNoch keine Bewertungen

- 4 - Rizal Provincial Government v. BIRDokument17 Seiten4 - Rizal Provincial Government v. BIRCarlota VillaromanNoch keine Bewertungen

- Cover Sheet: For Audited Financial StatementsDokument4 SeitenCover Sheet: For Audited Financial StatementsAlea Mae Therese BermejoNoch keine Bewertungen

- 2004 BIR - Ruling - DA 320 04 - 20180419 1159 Ho7dm4Dokument2 Seiten2004 BIR - Ruling - DA 320 04 - 20180419 1159 Ho7dm4Yya Ladignon100% (2)

- Sample ResolutionDokument2 SeitenSample ResolutionKevin0% (1)

- Year-End Tax Requirements and ProceduresDokument164 SeitenYear-End Tax Requirements and ProceduresDarioNoch keine Bewertungen

- Cta 2D CV 09224 M 2019feb12 AssDokument17 SeitenCta 2D CV 09224 M 2019feb12 AssMelan YapNoch keine Bewertungen

- Series AA Board ConsentDokument11 SeitenSeries AA Board ConsentY Combinator100% (1)

- Rmo 3-2009Dokument29 SeitenRmo 3-2009sheena100% (2)

- CTA JurisdictionDokument11 SeitenCTA JurisdictionShekinah GalunaNoch keine Bewertungen

- BIR Ruling No. 453-2018 Interest Income On Individual Loans Obtained From Banks That Are Not Securitized, Assigned or Participated OutDokument4 SeitenBIR Ruling No. 453-2018 Interest Income On Individual Loans Obtained From Banks That Are Not Securitized, Assigned or Participated Outliz kawiNoch keine Bewertungen

- Receipts InvoicesDokument9 SeitenReceipts InvoicesDu Baladad Andrew MichaelNoch keine Bewertungen

- Deed of Sole HeirDokument1 SeiteDeed of Sole HeirLuisa LopezNoch keine Bewertungen

- Bir Ruling 332-12Dokument3 SeitenBir Ruling 332-12Neil MayorNoch keine Bewertungen

- 2016OpinionNo16-05 (On Delinquent Shares and Sale)Dokument8 Seiten2016OpinionNo16-05 (On Delinquent Shares and Sale)dppascuaNoch keine Bewertungen

- 33-CIR v. Wander Philippines, Inc. G.R. No. L-68375 April 15, 1988Dokument4 Seiten33-CIR v. Wander Philippines, Inc. G.R. No. L-68375 April 15, 1988Jopan SJNoch keine Bewertungen

- 1903 January 2018 ENCS FinalDokument4 Seiten1903 January 2018 ENCS FinalJames E. NogoyNoch keine Bewertungen

- Tax Bulletin by SGV As of Oct 2014Dokument18 SeitenTax Bulletin by SGV As of Oct 2014adobopinikpikanNoch keine Bewertungen

- Sworn Statement For Application of Permit To Use Loose Leaf Books of AccountsDokument1 SeiteSworn Statement For Application of Permit To Use Loose Leaf Books of AccountsTesston BullionNoch keine Bewertungen

- Compilation of Relevant Court of Tax AppDokument30 SeitenCompilation of Relevant Court of Tax Appcy legaspiNoch keine Bewertungen

- Revenue Audit Memorandum 1-98Dokument5 SeitenRevenue Audit Memorandum 1-98Nikos CabreraNoch keine Bewertungen

- Board Resolution-Commonwealth Rural Bank (Gangan)Dokument6 SeitenBoard Resolution-Commonwealth Rural Bank (Gangan)Gaspar ascoNoch keine Bewertungen

- Affidavit of AccidentDokument2 SeitenAffidavit of AccidentGillian Caye Geniza BrionesNoch keine Bewertungen

- Affidavit of Non-Operation2Dokument1 SeiteAffidavit of Non-Operation2Mayett Manalo MendozaNoch keine Bewertungen

- Section 2.57.4 of RR No. 2-98Dokument2 SeitenSection 2.57.4 of RR No. 2-98fatmaaleahNoch keine Bewertungen

- Order On Presentation and Offer of Sur-Rebuttal Evidence of The AccusedDokument1 SeiteOrder On Presentation and Offer of Sur-Rebuttal Evidence of The AccusedGabrielNoch keine Bewertungen

- Revenue Code - Isabela City - Ordinance 15-438Dokument237 SeitenRevenue Code - Isabela City - Ordinance 15-438imranNoch keine Bewertungen

- HOME - PSE - SEC Form 17C - Board Resolution - New Directors and Officers - AGM 2021Dokument6 SeitenHOME - PSE - SEC Form 17C - Board Resolution - New Directors and Officers - AGM 2021kjcnawkcna calkjwncaNoch keine Bewertungen

- ITAD BIR Ruling No. 311-14Dokument9 SeitenITAD BIR Ruling No. 311-14cool_peachNoch keine Bewertungen

- Secretary CertificateDokument3 SeitenSecretary CertificateAnnina IlasNoch keine Bewertungen

- Secretary's Certificate of MinutesDokument4 SeitenSecretary's Certificate of MinutesSuzanne Pagaduan CruzNoch keine Bewertungen

- Template - Treasurer's Affidavit - SampleDokument1 SeiteTemplate - Treasurer's Affidavit - SamplePaola Krista RodriguezNoch keine Bewertungen

- PEZA Vat-Zero Rating Application & RequirementsDokument8 SeitenPEZA Vat-Zero Rating Application & RequirementsUnicargo Int'l ForwardingNoch keine Bewertungen

- ABC STOCK ISSUANCEDokument2 SeitenABC STOCK ISSUANCEfightingmaroonNoch keine Bewertungen

- Tax Deadlines in January-May 2018Dokument40 SeitenTax Deadlines in January-May 2018Md PrejulesNoch keine Bewertungen

- Corporation-Bylaws - More FunctionalDokument12 SeitenCorporation-Bylaws - More Functionalstada0Noch keine Bewertungen

- Special Power of AttorneyDokument3 SeitenSpecial Power of AttorneyalaricelyangNoch keine Bewertungen

- BIR Ruling No. 392-14Dokument4 SeitenBIR Ruling No. 392-14Francis ArvyNoch keine Bewertungen

- Decision: Second DivisionDokument13 SeitenDecision: Second DivisionGilbert John LacorteNoch keine Bewertungen

- Court Telephone DirectoryDokument2 SeitenCourt Telephone DirectoryBryan Paolo Ramos DabuNoch keine Bewertungen

- Transfer Land TitleDokument8 SeitenTransfer Land TitleEmariel CuarioNoch keine Bewertungen

- Withholding Tax Remittance Return: Kawanihan NG Rentas InternasDokument4 SeitenWithholding Tax Remittance Return: Kawanihan NG Rentas InternasArlyn De Las AlasNoch keine Bewertungen

- Ethical and Technical Standards-CpaDokument1 SeiteEthical and Technical Standards-CpaLuis Porras Jr.Noch keine Bewertungen

- Procedure For Land AcquisitionDokument25 SeitenProcedure For Land AcquisitionRob ClosasNoch keine Bewertungen

- Yabes V FlojoDokument5 SeitenYabes V FlojoanailabucaNoch keine Bewertungen

- Notes To Financial StatementsDokument9 SeitenNotes To Financial StatementsCheryl FuentesNoch keine Bewertungen

- BIR Ruling No. 232-13 Donation Tax ExemptionDokument10 SeitenBIR Ruling No. 232-13 Donation Tax ExemptionDenise Capacio LirioNoch keine Bewertungen

- Cta 1D CV 08726 D 2017sep14 AssDokument115 SeitenCta 1D CV 08726 D 2017sep14 AssdoookaNoch keine Bewertungen

- BIR Ruling 63-2018Dokument6 SeitenBIR Ruling 63-2018Glory PerezNoch keine Bewertungen

- AMLCFT and TFS For DNFBPs and NBFIsDokument176 SeitenAMLCFT and TFS For DNFBPs and NBFIssitiamera razaliNoch keine Bewertungen

- Verification and certification against forum shoppingDokument1 SeiteVerification and certification against forum shoppingRita Therese SantiagoNoch keine Bewertungen

- Sample Deed of Absolute Sale of SharesDokument3 SeitenSample Deed of Absolute Sale of SharesGela Bea BarriosNoch keine Bewertungen

- POSITION PAPER - Limsuan Vs PortDokument3 SeitenPOSITION PAPER - Limsuan Vs PortIan QuisadoNoch keine Bewertungen

- TAX 2 Group 1 Handout PDFDokument6 SeitenTAX 2 Group 1 Handout PDFMi-young SunNoch keine Bewertungen

- Certificatied TrueDokument1 SeiteCertificatied TrueHerzl HermosaNoch keine Bewertungen

- Kit Checklist Sec40c2Dokument1 SeiteKit Checklist Sec40c2Herzl HermosaNoch keine Bewertungen

- Itinerary PDFDokument5 SeitenItinerary PDFHerzl HermosaNoch keine Bewertungen

- RP-Thailand Tax TreatyDokument38 SeitenRP-Thailand Tax TreatyHerzl HermosaNoch keine Bewertungen

- Bar certificates requestDokument1 SeiteBar certificates requestHerzl HermosaNoch keine Bewertungen

- Fuel (Per Liter) 2018 2019 2020 Diesel LPG Regular and Unleaded Premium GasolineDokument3 SeitenFuel (Per Liter) 2018 2019 2020 Diesel LPG Regular and Unleaded Premium GasolineHerzl HermosaNoch keine Bewertungen

- Required Document ChecklistDokument3 SeitenRequired Document ChecklistFrederick Xavier LimNoch keine Bewertungen

- Cta 1D CV 08319 D 2013nov07 AssDokument15 SeitenCta 1D CV 08319 D 2013nov07 AssHerzl HermosaNoch keine Bewertungen

- Velarde Vs Social Justice Society - G.R. No. 159357Dokument19 SeitenVelarde Vs Social Justice Society - G.R. No. 159357Fatzie MendozaNoch keine Bewertungen

- A Project On Doctrine of Ultra Vires Submitted To: MR - Mukesh Kumar Ghosh (Assistant Professor) Company LawDokument17 SeitenA Project On Doctrine of Ultra Vires Submitted To: MR - Mukesh Kumar Ghosh (Assistant Professor) Company Lawshubham BajpayeeNoch keine Bewertungen

- Montoya vs. VarillaDokument21 SeitenMontoya vs. VarillaSharmen Dizon GalleneroNoch keine Bewertungen

- 14-556 The Mattachine Society of Washington DCDokument48 Seiten14-556 The Mattachine Society of Washington DCDowning Post NewsNoch keine Bewertungen

- Reaction Paper - Justice CarpioDokument1 SeiteReaction Paper - Justice CarpioPerry YapNoch keine Bewertungen

- Dr. Phylis Rio v. Colegio de Sta. Rosa-Makati And/or Sr. Marilyn Gustilo G.R. No. 189629, August 06, 2014Dokument2 SeitenDr. Phylis Rio v. Colegio de Sta. Rosa-Makati And/or Sr. Marilyn Gustilo G.R. No. 189629, August 06, 2014mrlouiemabalotNoch keine Bewertungen

- Chorzow Factory CaseDokument1 SeiteChorzow Factory CaseRon DecinNoch keine Bewertungen

- Civil Remedy - No Bar - Criminal ProsecutionDokument21 SeitenCivil Remedy - No Bar - Criminal ProsecutionSudeep Sharma100% (1)

- First Set Prelim Case PoolDokument16 SeitenFirst Set Prelim Case PoolJefferson G. NuñezaNoch keine Bewertungen

- Tan Vs SabandalDokument7 SeitenTan Vs SabandalMar Joe100% (1)

- Taxation ReviewerDokument53 SeitenTaxation ReviewerDave A ValcarcelNoch keine Bewertungen

- Alonzo V PaduaDokument2 SeitenAlonzo V PaduaUriko LabradorNoch keine Bewertungen

- Julia Haart v. Silvio Scaglia, Exhibits 40-53 To Amended and Supplemental Verified PetitionDokument136 SeitenJulia Haart v. Silvio Scaglia, Exhibits 40-53 To Amended and Supplemental Verified PetitionDebbie MolloyNoch keine Bewertungen

- Head Injury Case Award UpheldDokument4 SeitenHead Injury Case Award UpheldCkey ArNoch keine Bewertungen

- MENDOZA - Paras Versus Paras A.C. No. 5333, March 13, 2017Dokument2 SeitenMENDOZA - Paras Versus Paras A.C. No. 5333, March 13, 2017Joseph II MendozaNoch keine Bewertungen

- APC Smart-UPS: User Manual EnglishDokument25 SeitenAPC Smart-UPS: User Manual EnglishLentiNonajNoch keine Bewertungen

- 1943 Memorial Park Deed, City of Beacon, NYDokument4 Seiten1943 Memorial Park Deed, City of Beacon, NYAntony TNoch keine Bewertungen

- 50.cerilla v. Lezama PDFDokument9 Seiten50.cerilla v. Lezama PDFRaynin MendozaNoch keine Bewertungen

- PNB vs. GonzalesDokument2 SeitenPNB vs. GonzalesRaymarc Elizer AsuncionNoch keine Bewertungen

- Important Information For Using This Exported File From Quicken WillmakerDokument23 SeitenImportant Information For Using This Exported File From Quicken WillmakerAndrea HoffmanNoch keine Bewertungen

- P-1. &. I Clubs Law and Practice - CHAPTER 2 Structure of A Modern P&I ClubDokument1 SeiteP-1. &. I Clubs Law and Practice - CHAPTER 2 Structure of A Modern P&I ClublostnfndNoch keine Bewertungen

- Caniza Vs CA DIGESTDokument3 SeitenCaniza Vs CA DIGESTAbbot ReyesNoch keine Bewertungen

- Chapter - 1: Why Do We Have Laws?Dokument7 SeitenChapter - 1: Why Do We Have Laws?amarsoankar1234Noch keine Bewertungen

- 12 - Comm of Customs v. CloribelDokument12 Seiten12 - Comm of Customs v. CloribelEmary GutierrezNoch keine Bewertungen

- Case StudyDokument50 SeitenCase StudyJaypee BallesterosNoch keine Bewertungen

- Code of Commerce On TransportationDokument14 SeitenCode of Commerce On TransportationKelsey Olivar Mendoza100% (1)

- United States v. Bell, 4th Cir. (1998)Dokument2 SeitenUnited States v. Bell, 4th Cir. (1998)Scribd Government DocsNoch keine Bewertungen

- Foreclosure Answer Counter Complaint Third Party + Exhibit A-F IllinoisDokument789 SeitenForeclosure Answer Counter Complaint Third Party + Exhibit A-F IllinoisC. Adam Jansen100% (5)

- Santiago Alcantara, JR., Petitioner, vs. The Court of Appeals and The PENINSULA MANILA, INC., Respondents. G.R. No. 143397, August 6, 2002. FactsDokument2 SeitenSantiago Alcantara, JR., Petitioner, vs. The Court of Appeals and The PENINSULA MANILA, INC., Respondents. G.R. No. 143397, August 6, 2002. FactsTiff DizonNoch keine Bewertungen

- Microsoft Corporation v. Ronald Alepin Morrison & Foerster Et Al - Document No. 21Dokument2 SeitenMicrosoft Corporation v. Ronald Alepin Morrison & Foerster Et Al - Document No. 21Justia.comNoch keine Bewertungen

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesVon EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesBewertung: 4 von 5 Sternen4/5 (9)

- Tax Accounting: A Guide for Small Business Owners Wanting to Understand Tax Deductions, and Taxes Related to Payroll, LLCs, Self-Employment, S Corps, and C CorporationsVon EverandTax Accounting: A Guide for Small Business Owners Wanting to Understand Tax Deductions, and Taxes Related to Payroll, LLCs, Self-Employment, S Corps, and C CorporationsBewertung: 4 von 5 Sternen4/5 (1)

- Deduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesVon EverandDeduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesBewertung: 3 von 5 Sternen3/5 (3)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesVon EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNoch keine Bewertungen

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyVon EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNoch keine Bewertungen

- The Payroll Book: A Guide for Small Businesses and StartupsVon EverandThe Payroll Book: A Guide for Small Businesses and StartupsBewertung: 5 von 5 Sternen5/5 (1)

- How to get US Bank Account for Non US ResidentVon EverandHow to get US Bank Account for Non US ResidentBewertung: 5 von 5 Sternen5/5 (1)

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProVon EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProBewertung: 4.5 von 5 Sternen4.5/5 (43)

- The Hidden Wealth Nations: The Scourge of Tax HavensVon EverandThe Hidden Wealth Nations: The Scourge of Tax HavensBewertung: 4.5 von 5 Sternen4.5/5 (40)

- What Everyone Needs to Know about Tax: An Introduction to the UK Tax SystemVon EverandWhat Everyone Needs to Know about Tax: An Introduction to the UK Tax SystemNoch keine Bewertungen

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessVon EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessBewertung: 5 von 5 Sternen5/5 (5)

- Owner Operator Trucking Business Startup: How to Start Your Own Commercial Freight Carrier Trucking Business With Little Money. Bonus: Licenses and Permits ChecklistVon EverandOwner Operator Trucking Business Startup: How to Start Your Own Commercial Freight Carrier Trucking Business With Little Money. Bonus: Licenses and Permits ChecklistBewertung: 5 von 5 Sternen5/5 (6)

- Invested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Von EverandInvested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Bewertung: 4.5 von 5 Sternen4.5/5 (43)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Reduce Taxes for Business, Investing, & More.Von EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Reduce Taxes for Business, Investing, & More.Noch keine Bewertungen

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingVon EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingBewertung: 5 von 5 Sternen5/5 (3)

- How To Get IRS Tax Relief: The Complete Tax Resolution Guide for IRS: Back Tax Problems & Settlements, Offer in Compromise, Payment Plans, Federal Tax Liens & Levies, Penalty Abatement, and Much MoreVon EverandHow To Get IRS Tax Relief: The Complete Tax Resolution Guide for IRS: Back Tax Problems & Settlements, Offer in Compromise, Payment Plans, Federal Tax Liens & Levies, Penalty Abatement, and Much MoreNoch keine Bewertungen

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyVon EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyBewertung: 4 von 5 Sternen4/5 (52)

- Preparing Tax Returns for Ministers: An Easy Reference GuideVon EverandPreparing Tax Returns for Ministers: An Easy Reference GuideNoch keine Bewertungen

- Streetwise Incorporating Your Business: From Legal Issues to Tax Concerns, All You Need to Establish and Protect Your BusinessVon EverandStreetwise Incorporating Your Business: From Legal Issues to Tax Concerns, All You Need to Establish and Protect Your BusinessNoch keine Bewertungen