Beruflich Dokumente

Kultur Dokumente

Long Term Construction Contracts

Hochgeladen von

JBCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Long Term Construction Contracts

Hochgeladen von

JBCopyright:

Verfügbare Formate

LONG TERM CONSTRUCTION CONTRACTS

PAS 11 defines construction contracts as contract specifically negotiated for the

construction of an asset or a combination of assets that are closely interrelated or

interdependent in terms of their design, technology or their ultimate purpose or

use.

Construction contract may be classified into:

1. Fixed Price Contract – a construction contract in which the contractor

agrees to a fixed contract price, or a fixed rate per unit of output, which in

some cases is subject to cost escalation clauses.

2. Cost Plus Contract – a construction contract in which the contractor is

reimbursed for allowable or otherwise defined costs, plus a percentage of

these costs or a fixed fee.

Contract Revenue

Revenue from long-term construction contracts is measured at the fair value of

the consideration received or receivable which includes the initial amount of

revenue agreed in the contract.

Contract Costs

Contract Costs are costs that relate directly to the specific contract; are

attributable to contract activity in can be allocated to the contract; and are

specifically chargeable to the customer under the terms of the contract.

Types of Contract Costs

1. Cost incurred to date

These include precontract costs and costs incurred after contract

acceptance.

The criteria for recognition for recognition of such costs are:

o They are capable of being identified separately.

o They can be measured reliably.

o It is probable that the contract will be obtained.

2. Estimated costs to complete

These are the anticipated costs of materials, labor, subcontracting

costs, and indirect costs required to complete a project at a

scheduled time.

Accounting for contract costs is similar to accounting for inventory. Costs as

incurred would be recorded in the Construction in Progress (CIP) account. CIP

account would include both direct and indirect costs but would usually not

include general and administrative expenses or selling expenses since they are not

normally identifiable with a particular contract and should therefore be expensed.

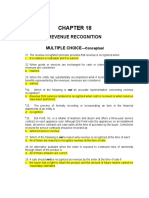

COMPUTATION AND RECOGNITION OF CONSTRUCTION REVENUE

Two General Methods

1. Percentage of Completion (POC) Method

Recognizes revenue based on the percentage of work done or

completed for the contract date.

Two methods to measure the progress of the construction

o Input Measures - made in relation to the costs of efforts devoted

to a contract. They are based on an established or assumed

relationship between a unit of input and productivity.

Cost-to-cost method - the proportion that contract costs

incurred for work performed to date bear to the

estimated total contract costs.

Efforts-expended method - based on surveys of work

performed.

o Output Measures - made in terms of results achieved. It is

based on the completion of a physical proportion of the

contract work.

2. Zero Profit Method (Cost Recovery Method)

Revenue should be recognized only up to the extent of contract

cost incurred that is probable to be recovered.

Contract costs should be recognized as an expense in the period in

which they are incurred.

Construction in Progress

Serve as the dumping ground account for cumulative costs incurred and

cumulative gross profit earned.

CIP > Progress Billings – Due from customers

CIP < Progress Billings – Due to customers

Pro-forma Computation of Gross Profit earned using POC Method

Contract price XX

Less: Cost incurred to date xx

Estimated Cost to Complete xx

Estimated Total Cost at Completion XX

Gross Profit (Initial) XX

Multiply by POC (% of Completion) %

Gross Profit earned to date XX

Less: Gross Profit earned to date (prior years) (XX)

Gross Profit earned, current XX

POC = Cost incurred to date

Estimated Total Cost at Completion

Recognition of Expected or Anticipated Losses

When it is probable that total contract costs will exceed total contract revenue,

the expected loss should be recognized as an expense immediately.

The amount of the loss is determined irrespective of:

whether or not work has commenced on the contract;

the stage of completion of contract activity; or

the amount of profits expected to arise on other contracts which are not

treated as a single construction contract.

Contract Retention

Retentions are amounts of progress billings which are not paid until the satisfaction

of conditions specified in the contract for the payment of such amounts or until

defects have been rectified. Progress billings are amounts billed for work

performed on a contract whether or not they have been paid by the customer.

Advances are amounts received by the contractor before the related work is

performed.

Financial Statement Presentation

1. An enterprise should present:

The gross amount due from customers for contract work as an asset;

and

The gross amount due to customers for contract work as a liability.

2. The gross amount due from customers for contract work is the net amount

of:

Costs incurred plus recognized profits; less

The sum of recognized losses and progress billings for all contracts in

progress for which costs incurred plus recognized profits (less

recognized losses) exceeds progress billings.

3. The gross amount due to customers for contract work is the net amount of:

Costs incurred plus recognized profits; less

The sum of recognized losses and progress billings for all contracts in

progress for which progress billings exceed costs incurred plus

recognized profits (less recognized losses).

Das könnte Ihnen auch gefallen

- B-Kay Tech SolutionDokument3 SeitenB-Kay Tech SolutionDevangana100% (4)

- A Feasibility Study On The Conversion of Iloilo Central Market Into A Five-Storey Multi Purpose FacilityDokument46 SeitenA Feasibility Study On The Conversion of Iloilo Central Market Into A Five-Storey Multi Purpose FacilityJohn Vincent Evio100% (1)

- 3.042 Set B - Mock Exam ReaDokument15 Seiten3.042 Set B - Mock Exam Reabhobot rivera100% (1)

- Instalment/Consignment Sales: Partl: Theory of AccountsDokument5 SeitenInstalment/Consignment Sales: Partl: Theory of AccountsFeliz Victoria CañezalNoch keine Bewertungen

- Long-Term Construction QuizDokument4 SeitenLong-Term Construction QuizCattleyaNoch keine Bewertungen

- PAS 11: Long-term construction contractsDokument5 SeitenPAS 11: Long-term construction contractsLester John Mendi0% (1)

- Forex Joint ArrangementsDokument36 SeitenForex Joint ArrangementsflorNoch keine Bewertungen

- Afar 2 Module CH 7Dokument12 SeitenAfar 2 Module CH 7KezNoch keine Bewertungen

- E-Journal 2005 The New Global Society - Globalization, Language and Culture - Richard Lee PDFDokument147 SeitenE-Journal 2005 The New Global Society - Globalization, Language and Culture - Richard Lee PDFAdesti KomalasariNoch keine Bewertungen

- Problems On Accept or Reject Special of Er DecisionDokument9 SeitenProblems On Accept or Reject Special of Er DecisionJBNoch keine Bewertungen

- Chapter 8 Solution Manual of Managerial Accounting Ronald HiltonDokument46 SeitenChapter 8 Solution Manual of Managerial Accounting Ronald HiltonMuhammad Sadiq50% (8)

- TFA - Chapter 36 - Property, Plant and EquipmentDokument9 SeitenTFA - Chapter 36 - Property, Plant and EquipmentAsi Cas Jav0% (1)

- 7 - Long-Term Construction ContractsDokument6 Seiten7 - Long-Term Construction ContractsDarlene Faye Cabral RosalesNoch keine Bewertungen

- Accounting For Long Term Construction ContractsDokument34 SeitenAccounting For Long Term Construction Contracts수지100% (1)

- Chapter 34 PFRS 15 Revenue From Contracts With CustomersDokument3 SeitenChapter 34 PFRS 15 Revenue From Contracts With Customersjeanette lampitocNoch keine Bewertungen

- Installment Sales ReviewerDokument3 SeitenInstallment Sales ReviewerErika78% (9)

- Franchise AccountingDokument25 SeitenFranchise AccountingKaren Sing Balibalos100% (2)

- Learning Advancement Cpa Review Center: Revenue From Contracts With CustomersDokument4 SeitenLearning Advancement Cpa Review Center: Revenue From Contracts With CustomersCPANoch keine Bewertungen

- ACC16 - HO 2 Installment Sales 11172014Dokument7 SeitenACC16 - HO 2 Installment Sales 11172014Marvin James Cho0% (2)

- LongTermConstructionContractsDokument2 SeitenLongTermConstructionContractsRes GosanNoch keine Bewertungen

- Long-Term Construction ContractsDokument12 SeitenLong-Term Construction Contractsblackphoenix303Noch keine Bewertungen

- Topic 3 Long-Term Construction Contracts ModuleDokument20 SeitenTopic 3 Long-Term Construction Contracts ModuleMaricel Ann BaccayNoch keine Bewertungen

- Long-Term Construction Contracts and FranchisingDokument16 SeitenLong-Term Construction Contracts and FranchisingAlexis SosingNoch keine Bewertungen

- TOA Quizzer 18 PFRS 15 Revenue From Contracts With Customers RevisedDokument7 SeitenTOA Quizzer 18 PFRS 15 Revenue From Contracts With Customers RevisedSheena Oro100% (1)

- Franchise Accounting - NotesDokument2 SeitenFranchise Accounting - NotesBrunxAlabastro100% (6)

- AFAR - Income Recognition: Installment Sales, Franchise, Long-Term ConstructionDokument9 SeitenAFAR - Income Recognition: Installment Sales, Franchise, Long-Term ConstructionJohn Mahatma Agripa93% (15)

- Revenue Recognition for Consignment SalesDokument2 SeitenRevenue Recognition for Consignment SalesPau SantosNoch keine Bewertungen

- Long-Term Construction Contracts (Special Revenue Recognition) JLM Illustrative Problems Problem 1Dokument5 SeitenLong-Term Construction Contracts (Special Revenue Recognition) JLM Illustrative Problems Problem 1Divine Cuasay100% (1)

- T05 - Long-Term Construction-Type Contracts PDFDokument11 SeitenT05 - Long-Term Construction-Type Contracts PDFriver garciaNoch keine Bewertungen

- Lesson 15 Home Office, Branch and Agency AccountingDokument11 SeitenLesson 15 Home Office, Branch and Agency AccountingMark TaysonNoch keine Bewertungen

- Cost Accounting SystemsDokument24 SeitenCost Accounting SystemsQueenie ValleNoch keine Bewertungen

- AFAR Installment Sales PDFDokument9 SeitenAFAR Installment Sales PDFArah OpalecNoch keine Bewertungen

- Mas 02 - Variable Absorption Costing & BudgetingDokument11 SeitenMas 02 - Variable Absorption Costing & BudgetingCriane DomineusNoch keine Bewertungen

- Cfas Revenue Recognition - StudentsDokument41 SeitenCfas Revenue Recognition - StudentsMiel Viason CañeteNoch keine Bewertungen

- T04 - Long-Term Construction-Type ContractsDokument11 SeitenT04 - Long-Term Construction-Type ContractsAl Cariaga Velasco100% (1)

- Installment Sales ReviewerDokument5 SeitenInstallment Sales ReviewerJymldy EnclnNoch keine Bewertungen

- Long-Term Construction Contracts (Pfrs 15) : Start of DiscussionDokument3 SeitenLong-Term Construction Contracts (Pfrs 15) : Start of DiscussionErica DaprosaNoch keine Bewertungen

- AFAR - FINAL EXAMINATION - 03.22.2019 Wo ANSWERSDokument5 SeitenAFAR - FINAL EXAMINATION - 03.22.2019 Wo ANSWERSrain suansingNoch keine Bewertungen

- Afar Franchise Accounting PDFDokument6 SeitenAfar Franchise Accounting PDFArah OpalecNoch keine Bewertungen

- Accounting for Special TransactionsDokument7 SeitenAccounting for Special TransactionsMiles SantosNoch keine Bewertungen

- AfarDokument3 SeitenAfarDanielle Nicole MarquezNoch keine Bewertungen

- Joint Arrangement HandoutDokument5 SeitenJoint Arrangement HandoutClyde SaulNoch keine Bewertungen

- 08 Joint ArrangementDokument3 Seiten08 Joint ArrangementMelody Gumba0% (1)

- Revenue Recognition: Multiple ChoiceDokument16 SeitenRevenue Recognition: Multiple ChoiceMajoy BantocNoch keine Bewertungen

- Corporate Liquidation SettlementDokument9 SeitenCorporate Liquidation SettlementPrincess SagreNoch keine Bewertungen

- AFAR PartnershipDokument3 SeitenAFAR PartnershipClyde RamosNoch keine Bewertungen

- Govacc Chapters 1 3Dokument2 SeitenGovacc Chapters 1 3Bianca CarandangNoch keine Bewertungen

- Practice Problem Absorptionvariable Costing With Solutions PDFDokument5 SeitenPractice Problem Absorptionvariable Costing With Solutions PDFOne DozenNoch keine Bewertungen

- Long Problems For Prelim'S Product: Case 1Dokument7 SeitenLong Problems For Prelim'S Product: Case 1Mae AstovezaNoch keine Bewertungen

- Afarq 2 Corporate LiquidationDokument4 SeitenAfarq 2 Corporate LiquidationCPANoch keine Bewertungen

- Palmones, Jayhan Grace M. QuizDokument6 SeitenPalmones, Jayhan Grace M. QuizjayhandarwinNoch keine Bewertungen

- Advanced Accounting Quiz 9 - Installment Sales (Part 2 of 2)Dokument6 SeitenAdvanced Accounting Quiz 9 - Installment Sales (Part 2 of 2)guardian saintsNoch keine Bewertungen

- IFRS 15 Revenue RecognitionDokument18 SeitenIFRS 15 Revenue RecognitionHamza JavaidNoch keine Bewertungen

- Toaz - Info Afar PRDokument95 SeitenToaz - Info Afar PRMiraflor Sanchez BiñasNoch keine Bewertungen

- Activity 1 Home Office and Branch Accounting - General ProceduresDokument4 SeitenActivity 1 Home Office and Branch Accounting - General ProceduresDaenielle EspinozaNoch keine Bewertungen

- Ho and Branch and Agency AcctgDokument38 SeitenHo and Branch and Agency AcctgNiño Dwayne TuboNoch keine Bewertungen

- LTCC - ExamDokument5 SeitenLTCC - ExamLouise Anciano100% (1)

- Partnership Accounting ReviewerDokument10 SeitenPartnership Accounting ReviewerJEFFERSON CUTENoch keine Bewertungen

- Franchise IFRS 15 2020Dokument13 SeitenFranchise IFRS 15 2020Divine Victoria100% (1)

- IFRS 15 Revenue Recognition GuideDokument8 SeitenIFRS 15 Revenue Recognition GuideCleofe Jane PatnubayNoch keine Bewertungen

- Partnership HandoutsDokument4 SeitenPartnership Handoutsrose anne0% (1)

- Installment Sales - ReportDokument50 SeitenInstallment Sales - ReportDanix Acedera100% (1)

- Installment SalesDokument5 SeitenInstallment SalesMarianne LanuzaNoch keine Bewertungen

- P2 103 Special Revenue Recognition Installment Sales Construction Contracts Franchise 1Dokument12 SeitenP2 103 Special Revenue Recognition Installment Sales Construction Contracts Franchise 1Kate Alvarez100% (2)

- MAS Quizzers Problems and Theories (Special Handouts)Dokument62 SeitenMAS Quizzers Problems and Theories (Special Handouts)RodNoch keine Bewertungen

- Audit ReviewDokument9 SeitenAudit ReviewephraimNoch keine Bewertungen

- General de Jesus CollegeDokument12 SeitenGeneral de Jesus CollegeErwin Labayog MedinaNoch keine Bewertungen

- Globalization: 1. Globalization 1 (1492-1800) "Globalization of Countries"Dokument5 SeitenGlobalization: 1. Globalization 1 (1492-1800) "Globalization of Countries"JBNoch keine Bewertungen

- Transformation of Cultural OrganizationsDokument2 SeitenTransformation of Cultural OrganizationsJBNoch keine Bewertungen

- (Transcript) The Role of Arts & Culture in An Open SocietyDokument2 Seiten(Transcript) The Role of Arts & Culture in An Open SocietyJBNoch keine Bewertungen

- Partnership Liquidatio1 LumpsumDokument3 SeitenPartnership Liquidatio1 LumpsumJBNoch keine Bewertungen

- Globalization's Effects on Organizational Management TransformationDokument6 SeitenGlobalization's Effects on Organizational Management TransformationJBNoch keine Bewertungen

- The Professional StandardsDokument6 SeitenThe Professional StandardsJBNoch keine Bewertungen

- The Auditor's ReportDokument2 SeitenThe Auditor's ReportJBNoch keine Bewertungen

- PARTNERSHIP LIQUIDATION INSTALLMENTDokument3 SeitenPARTNERSHIP LIQUIDATION INSTALLMENTJBNoch keine Bewertungen

- Franchise AccountingDokument4 SeitenFranchise AccountingJBNoch keine Bewertungen

- Completing The Audit and Post Audit ResponsibilitiesDokument8 SeitenCompleting The Audit and Post Audit ResponsibilitiesJBNoch keine Bewertungen

- Corporate LiquidationDokument6 SeitenCorporate LiquidationJBNoch keine Bewertungen

- This Type of Audit Risk Affects Audit EfficiencyDokument12 SeitenThis Type of Audit Risk Affects Audit EfficiencyJBNoch keine Bewertungen

- Introduction Accounting Information SystemsDokument84 SeitenIntroduction Accounting Information SystemsJulius Antonio GopitaNoch keine Bewertungen

- RBV2013 Conceptual FrameworkDokument32 SeitenRBV2013 Conceptual FrameworkhemantbaidNoch keine Bewertungen

- CO Distribution CycleDokument10 SeitenCO Distribution CyclePrateekNoch keine Bewertungen

- How To Audit Payroll Expense and Fixed AssetsDokument11 SeitenHow To Audit Payroll Expense and Fixed AssetsAngie MagnayeNoch keine Bewertungen

- Definition of Barter SystemDokument10 SeitenDefinition of Barter Systemzeeshan 3240Noch keine Bewertungen

- CFAS Quiz 1 Final ADokument5 SeitenCFAS Quiz 1 Final ADesiree Angelique RebonquinNoch keine Bewertungen

- Customer Value PDFDokument6 SeitenCustomer Value PDFsaajan shresthaNoch keine Bewertungen

- Calculating Contribution Margin and Percent for Innscor Africa LimitedDokument2 SeitenCalculating Contribution Margin and Percent for Innscor Africa LimitedKonanRogerKouakouNoch keine Bewertungen

- Sippican Case ReviewDokument9 SeitenSippican Case ReviewDavid KijadaNoch keine Bewertungen

- Qualifying Asset: Qualifying Asset Is An Asset That Necessarily Takes A Substantial Period ofDokument12 SeitenQualifying Asset: Qualifying Asset Is An Asset That Necessarily Takes A Substantial Period ofRITZ BROWNNoch keine Bewertungen

- Manufacturing Cost Data For Copa Company: Case A Case B Case CDokument5 SeitenManufacturing Cost Data For Copa Company: Case A Case B Case Cyogi fetriansyahNoch keine Bewertungen

- The Effective Theory of Producer and Consumer Surplus: Positive Demand, Negative SupplyDokument7 SeitenThe Effective Theory of Producer and Consumer Surplus: Positive Demand, Negative SupplyCentral Asian StudiesNoch keine Bewertungen

- Job Order Costing: Process Cost SystemDokument11 SeitenJob Order Costing: Process Cost SystemShiv AchariNoch keine Bewertungen

- Chapter-1 2022Dokument36 SeitenChapter-1 2022Makai CunananNoch keine Bewertungen

- TYBCOM - Sem 6 - Cost AccountingDokument40 SeitenTYBCOM - Sem 6 - Cost AccountingKhushi PrajapatiNoch keine Bewertungen

- Define product cost componentsDokument5 SeitenDefine product cost componentsKatrina DeveraNoch keine Bewertungen

- Decision Making by Individuals and FirmsDokument37 SeitenDecision Making by Individuals and FirmsAhmed MahmoudNoch keine Bewertungen

- Fixed Assets: Determining Cost of AcquisitionDokument2 SeitenFixed Assets: Determining Cost of AcquisitionSarim Saleheen LariNoch keine Bewertungen

- 7ps of Auto KingDokument62 Seiten7ps of Auto KingjehanNoch keine Bewertungen

- Principles Ofengineehng Economy and Present Economy Studies: 1.1 Ofenginæing EmnomyDokument16 SeitenPrinciples Ofengineehng Economy and Present Economy Studies: 1.1 Ofenginæing Emnomy다나Noch keine Bewertungen

- 4.0 Life Cycle CostDokument7 Seiten4.0 Life Cycle CostAmirul Hafizi Mohd MidhalNoch keine Bewertungen

- 7 Pricing DecisionsDokument14 Seiten7 Pricing DecisionsZenCamandangNoch keine Bewertungen

- 002 Rpab 02Dokument125 Seiten002 Rpab 02AmitNoch keine Bewertungen

- Case Study On Master BudgetDokument8 SeitenCase Study On Master BudgetMusaib Ansari100% (1)

- Allama Iqbal Open University, Islamabad: (Department of Commerce)Dokument5 SeitenAllama Iqbal Open University, Islamabad: (Department of Commerce)ilyas muhammadNoch keine Bewertungen

- Problems On Cost SheetDokument4 SeitenProblems On Cost SheetAnand Dabasara0% (1)

- Chapter 1-Conceptual FrameworkDokument11 SeitenChapter 1-Conceptual FrameworkDavid JosephNoch keine Bewertungen