Beruflich Dokumente

Kultur Dokumente

A STUDY ON FINANCIAL PERFORMANCE OF STEEL INDUSTRY IN INDIA Ijariie2878 PDF

Hochgeladen von

Binod Kumar PadhiOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

A STUDY ON FINANCIAL PERFORMANCE OF STEEL INDUSTRY IN INDIA Ijariie2878 PDF

Hochgeladen von

Binod Kumar PadhiCopyright:

Verfügbare Formate

Vol-2 Issue-4 2016 IJARIIE-ISSN(O)-2395-4396

“A STUDY ON FINANCIAL

PERFORMANCE OF STEEL INDUSTRY IN

INDIA”

Dr.C.Balakrishnan1 ,

1

Head of the Department of B.Com(Banking & Insurance),Dr.N.G.P Arts & Science

College,Coimbatore,Tamilnadu,India.

ABSTRACT

Growth of any industries can be designated by the financial performance of indicators. It is true in the case

of steel industry as well. The financial performance of any organization is influenced by several factors like capital

structure, cost, revenue and the consequential profit margin. Financial performance of steel industry can be studied

with many aspects like financial facts, financial ratios, financial health, financial strength and utilization of asset s,

etc. The financial performance can be influenced by the operational and financial efficiency of the steel industry,

which are related to cost and the revenue aspects. The best indicators of the financial performance are return on

assets, sales, equity and other financial variables. Thus, the problem related to the financial performance of the steel

industry is interlinked to many aspects like cost, revenue, capital, assets and other related variables. If the analysis

made on all the aspects related to the steel industry gives a clear cut picture about the financial performance, it can

be used for policy decisions for its future development. In this connection, the researcher has analyzed the

performance of steel industry in India on the parameters such as profitability, utilization of assets, growth of

performance, financial strength and capital structure. The researcher has also attempted to identify the nature of

relationship between the various aspects of financial performance.

Keyword : - Small Tea Growers Satisfaction,Tea Growers Problems,Tea board promotion activities.

1. INTRODUCTION

Steel is considered to be the backbone for the development of modern economy and human civilization.

The level of consumption of steel is considered as a vital index to measure the socio-economic development and

standard of life of people of the country. This product is the outcome of the large and technological complex

industry poisoning in terms of material flows and incomes that are strong. The economic status of industries is

strong ended by the existence of strong steel industry and the development of these industries at the initial stage is

shaped by the steel industries. Industrial sector has made rapid steps with the help of steel industry using it as a

vanguard. The latest technology used by the green field plant has increased the output and the industry has improved

the global economy. The new plants have also brought a great regional dispersion in the western region and earned

the domestic supply position. The domestic steel industry has faced new challenges and due to the high cost of

commissioning of new projects, the developed markets face many problems. The domestic demand too has not

improved to significant level. The litmus test of the steel industry will be to surmount these difficulties and remain

globally competitive.

1.2 HISTORY OF STEEL

Even the period of Christ is termed as iron age as iron was broadly used in the nooks and corner of the

world and in 202 BC steel was discovered by the Chinese under the reign of Han dynasty. People were able to find

out a stronger and harder material than iron called steel with the changes of time and technology. The works that

2878 www.ijariie.com 252

Vol-2 Issue-4 2016 IJARIIE-ISSN(O)-2395-4396

iron could not, were achieved with steel which is in the combination of iron and c orson. Steel was invented by the

Chinese. Steel has many advantages providing ways to make weapons and sword, made of steel used by the

emporen Han. The iron made of steel was spread to India and the high quality steel was produced in south India as

early as 300 BC. About 9th century AD the smiths in the middle east developed techniques to produce strong and

flexible steel. Steel and a big part of it was exported from Asics only. The new process of cementation of steel was

popularized in Europe in 17th century and other new improved technologies were grandly developed and some

become a vital factor in which the economy of the world started depending and growing.

1.3 OBJECTIVES OF THE STUDY

The article entitled “A Study on financial performance of Steel Industry in India” has the following

objectives;

1. To study the growth of the steel industries in the world and in India.

2. To examine the short-term and long-term financial solvency, profitability and growth performance of the

steel industries in India.

1.4 HYPOTHES ES

In order to fulfill the above objectives the following hypothesis were formulated to analyse the financial

performance of steel industry in India.

There is no significant variation in liquidity ratios of steel industry;

1.5 METHODOLOGY OF THE STUDY

The study is about financial performance so it deals with the secondary data. The required data were

collected from the published and unpublished financial records of companies in steel industry in India and

Capitaline database. The further information needed for the study was also gathered through the various magazines,

books, journals and unpublished thesis.

India is one of the important steel producing countries in the world with more than 120 million tonnes

production and annual growth rate of more than

8 percent. In India based on revenue earned by the companies, top 500 companies have been ranked by the

Economics Times Magazine, from those 500 companies researcher has chosen the steel companies alone for the

study. In the year, 2012 among top 500 companies, 26 steel companies are placed, and that companies have been

taken as universe. Out of 26 steel companies due to the time constraints to the researcher only 10 companies have

been chosen randomly for the study. Accordingly the following companies were chosen for the study;

Steel Authority of India Limited (SAIL)

Tata Steel Limited (TSL)

Uttam Galva Steels Limited (UGSL)

JSW Steel Limited (JSW)

Jindal Stainless Limited (JSL)

Essar Steel Company

Bhushan Steel Ltd (BSL)

Rhastrya Steel Company

Sunflag Iron & Steel Company Limited

Surya Roshni Limited

1.5.1 Frame Work of Analysis

The secondary data have been organized and presented in the form of tables which consist of various

financial data and ratios. That is interpreted with help of multiple regressions

2878 www.ijariie.com 253

Vol-2 Issue-4 2016 IJARIIE-ISSN(O)-2395-4396

1.5.2 Multiple Regression Model

To study the impact of financial ratios on the financial performance of the steel industries in India, the log

linear multiple regression model has been used. the fitted model is shown here;

Log Y = β o + β 1 log X1 + β 2 Log X2 + β 3 log X3 + β 4 Log X4 + β 5 log X5 + β 6 Log X6 + β 7

Log X7 + β 8 Log X8 +U ….(1)

Where;

Y – Net Profit/Return on Equity

X1 = Current Ratio

X2 = Quick Ratio

X3 = Current Assets to Total Assets Ratio

X4 = Inventory Turnover Ratio

X5 = Debtors Turnover Ratio

X6 = Working Capital Ratio

X7 = Total Assets Turnover Ratio

X8 = Fixed Assets Turnover Ratio

b1, b2, ….b8 – Regression coefficients of predictor variables.

U= disturbance term and

A – Intercept

1.6 SCOPE OF THE STUDY

The present study was confined and Highlights the financial performance of the steel industry in India

through facts of published financial data. The financial performance of the steel industry was evaluated on the

parameters like profitability, utilization of assets, growth of performance, financial strength and financial health.

1.7 LIMITATIONS OF THE STUDY

The reliability of the study depends on the accuracy of data collected. The present study is based on the published

secondary data, hence the limitations of the published financial statement limitations may be applicable to this study

as well.

Proper management of working capital is most important for the success of any concern. Because the success of a

concern at great magnitude is determined by how it manages the working capital or liquidity. Therefore now-a-day’s

most of the financial managers spend their time for managing current assets and liabilities. There are many aspects

of liquidity which is an important function of the financial manager, on the one hand it maintains proper while on

the other it helps in increasing the profitability of the concern.

The firm which has inadequate and improper managed working capital cannot achieve good operating result. Hence,

Working capital should be sufficient to enable a firm to operate their business smoothly without any financial

rigidity during normal business time as well as, unpredicted losses and financial catastrophe. Conversely excessive

working capital may be unfavorable as in the earlier case because redundant funds earn nothing. For this reason,

proper management of the working capital is most essential in order to ensure that the amount invested in working

capital is neither too large nor too small. The current ratio of the selected steel companies in India has been

presented in the Table No.1.1.

2.DATA ANALYSIS & INTERPRETATION

TABLE NO.1.1

CURRENT RATIO OF SELECTED STEEL COMPANIES IN INDIA

(in Times)

Uttam Surya

Year Sail Tata JSW Jindal Essar Bhusan Rhastrya Sunflag

Galva Roshni

2003-04 0.92 0.66 1.22 1.12 1.33 1.61 2.53 1.52 2.89 6.83

2004-05 1.41 0.78 1.26 1.18 1.51 2.39 2.69 2.13 2.85 7.41

2005-06 1.46 0.82 1.56 1.20 1.51 1.55 2.21 5.45 2.36 8.09

2006-07 1.85 2.09 1.26 1.08 1.26 1.26 2.15 5.17 2.05 8.58

2007-08 1.98 4.72 1.05 0.75 1.62 1.16 1.91 4.81 2.73 9.05

2878 www.ijariie.com 254

Vol-2 Issue-4 2016 IJARIIE-ISSN(O)-2395-4396

2008-09 2.01 1.08 1.02 0.61 1.08 1.70 1.53 3.55 2.89 7.51

2009-10 2.27 1.36 1.43 0.73 1.67 1.67 2.35 2.77 2.98 6.19

2010-11 2.62 1.63 1.08 0.90 1.69 2.19 2.98 2.18 4.42 6.55

2011-12 2.01 0.97 1.05 1.07 1.59 1.29 3.37 1.86 2.88 7.00

2012-13

1.91 0.88 1.09 1.08 1.55 0.83 4.42 1.83 2.29 5.52

Mean 1.84 1.50 1.20 0.97 1.48 1.56 2.61 3.13 2.83 7.27

SD 0.48 1.21 0.18 0.21 0.20 0.47 0.82 1.51 0.64 1.09

Source: Capitaline Data base

The current ratio of Surya Roshni steel company was better than all other companies throughout the period of study.

The Current ratio of Surya Roshni steel Company has increased from 6.83 times in the year 2003-04 to 9.05 times in

the year 2007-08 and then fell down to 5.52 times in the year 2012-13. It was 9.05 times in the year 2007-08 which

was considered very high as compared to all the other years under the study. The average current ratio of Rhastrya

steel company was 3.13 times which was considered s econd higher ratio among the selected Steel companies after

Surya Roshni steel company. Rhastrya company maintained current ratio less than the standard rate (2:1) during the

years 2003-04, 2011-12 and 2012-13. Sunflag steel company is maintaining the current ratio normally above

standard current ratio in all the years under study. In the year 2007-08 and 2008-09 Bhusan steel company also

maintains current ratio less than the standard ratio but its average current ratio is above the satisfactory level.

Among the selected ten companies except Surya Roshni, Rhastrya, Sunflag and Bhusan steel companies, all the

other companies’ current ratio is less than the standard rate of current ratio. But at the same time Surya Roshni steel

company blocked their most of the financial resources as current assets, it is also the alarm for that company. It

indicated that the overall situation regarding the current ratio was better in Rhastrya, Sunflag and Bhusan steel

companies because the average current ratio of these companies were above the standard rate. This showed that the

Rhastrya, Sunflag and Bhusan steel companies were good at current assets management and other companies need

improvement in current assets management as these companies have not adopted effective curr ent assets

management programme during the period of the study. An attempt has been made to know whether any difference

between the companies current ratio. For that ANOVA test has been used and results have been given in the Table

No.1.2

Current ratio (ANOVA Test)

Null Hypothesis: There is no significant difference between current ratios of the selected steel companies

Alternative Hypothesis: There is a significant difference between current ratios of the selected steel companies

TABLE NO.1.2

SHOWING THE ANOVA (SINGLE FACTOR) OF CURRENT RATIO OF THE SELECTED

STEEL COMPANIES

Company Mean Ratio SD F Value P value

SAIL 1.84 0.48

TATA 1.50 1.21

Uttam Galva 1.20 0.18

JSW 0.97 0.21

Jindal 1.48 0.20

51.692 0.001

Essar 1.56 0.47

Bhusan 2.61 0.82

Rhastrya 3.13 1.51

Sunflag 2.83 0.64

Surya Roshni 7.27 1.09

Source: Computed Value

Since calculated P value is less than 0.01, so the null hypothesis is rejected and it is significant at 1 percent level.

Hence, it is concluded that there is a significant difference between the mean current ratios of the selected steel

companies.

Quick Ratio

Relationship between the quick assets and current liabilities is called quick ratio. This ratio is also termed as acid

test ratio or liquid ratio. This ratio widely used as tool for finding true short -term solvency position of the company.

2878 www.ijariie.com 255

Vol-2 Issue-4 2016 IJARIIE-ISSN(O)-2395-4396

In other term it reflects the quality of current assets. This ratio excludes inventory from the current assets since its

nature is slow moving. It may be expressed as:

Liquid Assets

Liquid Ratio =

Current Liabilitie s

In general, a quick ratio of 1:1 is considered as satisfactory as firm can easily meet all the current liabilities 1 . The

quick ratio is more accurate and insightful test of the liquidity position of a firm. The quick ratios of the selected

steel Companies for the period under study were presented, company wise, in the Table No.1.3.

TABLE NO.1.3

QUICK RATIO

(in Times)

Uttam Surya

Year Sail Tata JSW Jindal Essar Bhusan Rhastrya Sunflag

Galva Roshni

2003-04 0.58 0.36 0.35 0.80 0.67 1.09 1.35 0.82 1.41 3.10

2004-05 0.99 0.42 0.63 0.72 0.93 1.46 1.23 1.53 1.39 3.05

2005-06 0.87 0.40 1.05 0.77 0.91 0.96 1.34 4.21 1.27 3.77

2006-07 1.24 1.73 0.79 0.64 0.72 0.60 1.23 4.34 1.11 4.24

2007-08 1.46 4.39 0.48 0.37 0.84 0.54 1.02 4.22 1.38 4.23

2008-09 1.42 0.73 0.70 0.34 0.58 0.90 0.85 2.97 1.78 3.59

2009-10 1.74 1.02 0.87 0.39 1.02 1.12 1.13 1.99 1.67 2.70

2010-11 1.80 1.20 0.49 0.47 0.90 1.00 0.80 1.59 1.99 3.27

2011-12 1.01 0.56 0.58 0.67 0.74 0.65 1.33 1.04 1.29 3.66

2012-13 0.80 0.47 0.71 0.72 0.73 0.45 1.85 1.10 1.17 3.15

Mean 1.19 1.13 0.67 0.59 0.80 0.88 1.21 2.38 1.45 3.48

SD 0.41 1.23 0.21 0.18 0.14 0.31 0.30 1.43 0.28 0.51

Source: Computed from annual report of the respective companies

The quick ratio of Surya Roshni steel company was better than all other companies throughout the period of study.

The quick ratio of Surya Roshni steel Company has increased from 3.10 times in the year 2003-04 to 4.24 times in

the year 2006-07 and then fell down to 3.15 times in the year 2012-13. It was very high (4.24) during 2006-07 as

compared to all the other years under the study. The average quick ratio of Rhastrya steel company was 2.38 times

which was considered second higher ratio among the selected steel companies after Surya Roshni steel company.

Sunflag steel company is maintaining the quick ratio normally above the standard ratio in all the years under study.

Among the selected ten companies except Surya Roshni, Rhastrya, Sunflag steel companies, the current ratio of

other companies is less than the standard rate of quick ratio. But at the same time Surya Roshni steel company

blocked their most of the financial resources as liquid assets. It indicated that the overall situation regarding the

quick ratio was better in Rhastrya and Sunflag steel companies because the average quick ratio of these companies

was above the standard rate (1:1). This showed that Rhastrya and Sunflag steel companies were good at liquid

assets management and other companies were in need of improvement during the period of the study. An attempt

has been made to know whether there was any difference between the companies quick ratios. For that ANOVA test

has been used and results have been given in the Table No.1.3.

Quick Ratio (ANOVA Test)

Null Hypothesis: There is no significant difference between Quick Ratios of the selected steel companies

Alternative Hypothesis: There is a significant difference between Quick Ratios of the selected steel companies

1

Maheswari, S.N. Management Accounting, New Delhi: Sultan Chand Publications.

2878 www.ijariie.com 256

Vol-2 Issue-4 2016 IJARIIE-ISSN(O)-2395-4396

TABLE NO.1.4

SHOWING THE ANOVA (SINGLE FACTOR) OF QUICK RATIO OF SELECTED STEEL COMPANIES

Company Mean Ratio SD F Value P value

SAIL 1.19 0.41

TATA 1.13 1.23

Uttam Galva 0.67 0.21

JSW 0.59 0.18

Jindal 0.80 0.14

18.612 0.001

Essar 0.88 0.31

Bhusan 1.21 0.30

Rhastrya 2.38 1.43

Sunflag 1.45 0.28

Surya Roshni 3.48 0.51

Source: Computed Value

Since calculated P value is less than 0.01, the null hypothesis is rejected at

1 percent level. Hence it concludes that there is a significant difference between the mean quick ratios of the

selected steel companies.

Analysis of Activity Ratios

Profitability of the firm is based on how efficiently the assets are being used by the firm. This activity ratio is also

referred as turnover ratio or asset management ratios. Inventory tu rnover ratio, debtors turnover ratio, working

capital turnover ratio, total assets turnover ratio and fixed assets turnover ratios are the important turnover ratio for

measure the asset management efficiency of the business firm.

TABLE NO.1.5

INVENTORY TURNOVER RATIO

(in Times)

Uttam Surya

Year Sail Tata JSW Jindal Essar Bhusan Rhastrya Sunflag

Galva Roshni

2003-04 7.10 9.93 4.37 12.83 6.56 6.31 5.32 7.48 6.92 6.22

2004-05 8.80 10.17 6.22 13.02 7.03 8.03 5.80 7.42 8.27 7.41

2005-06 6.17 8.47 5.74 8.16 5.63 5.66 5.67 6.18 6.98 7.28

2006-07 5.99 8.77 6.25 9.61 5.91 4.68 6.79 7.00 6.04 7.71

2007-08 6.65 8.99 4.78 9.86 3.46 5.37 4.93 6.50 5.52 7.98

2008-09 5.62 8.82 6.72 8.43 2.73 5.96 4.57 3.95 6.31 8.23

2009-10 4.50 8.16 8.18 8.39 3.69 4.75 3.74 3.60 6.91 7.87

2010-11 4.61 9.07 5.29 7.54 3.93 3.40 2.95 3.96 6.09 7.41

2011-12 4.02 8.40 4.47 7.45 3.53 3.79 3.33 4.38 5.15 7.37

2012-13 3.32 8.37 5.89 7.79 3.72 4.14 2.66 5.58 4.84 8.38

Mean 5.68 8.92 5.79 9.31 4.62 5.21 4.58 5.61 6.30 7.59

SD 1.63 0.67 1.16 2.07 1.51 1.37 1.37 1.52 1.02 0.61

Source: Capitaline Data base

The above Table No.4.10 reveals that the inventory turnover ratio of the selected steel companies has fluctuated

significantly over the years. The average inventory turnover ratio of the selected Steel companies during the study

period was in the range between 4.58 times to 9.31 times. Among the selected Steel companies JSW Company had

registered higher average inventory ratio with 9.31 times during the study period. This showed that the company was

very efficient in converting the finished goods to sales v ery habitually as compared to other companies.

The Inventory turnover ratio of JSW steel Company had increased from 12.83 times in the year 2003-04 to 13.02

times in the year 2004-05 and then knocks down to 7.79 times in the year 2012-13. It was 13.02 times in the year

2004-05 which was considered very high as compared to all the other years under the study. The average Inventory

turnover ratio of TATA steel company was 8.92 times which was considered second higher ratio among the selected

Steel companies after JSW steel company. Bhusan steel company maintained Inventory turnover ratio very less

comparing to its average inventory turnover ratio except during the period 2003-04 to 2006-07. Sunflag steel

company is maintaining the Inventory turnover ratio normally around average Inventory turnover ratio.

Among the selected ten companies except Surya Roshni, Sunflag, JSW and TATA steel companies, the other

companies’ average Inventory turnover ratio is less than the 6 times. It indicated that the overall situ ation regarding

2878 www.ijariie.com 257

Vol-2 Issue-4 2016 IJARIIE-ISSN(O)-2395-4396

the Inventory turnover ratio was better in JSW, TATA and Surya Roshni steel companies because these companies’

average Inventory turnover ratios were above the mean value in most of the year. This showed that the JSW, TATA

and Surya Roshni steel companies were good at inventory management and other companies needed improvement in

inventory management as these companies have not adopted effective inventory management programme during the

period of the study.

IMPACT OF FINANCIAL RATIOS ON PROFITAB ILITY

The influence of selected financial ratios on return on sales (ROS) and return on equity (ROE) were separately

analyzed with the help of log linear regression model. The result of regression coefficients with its statistical

significance are presented in the following tables.

The results of SAIL steel company regression coefficient of with its statistical significance are presented in the

Table No.1.6.

TABLE NO.1.6

IMPACT OF FINANCIAL RATIOS ON PROFITAB ILITY OF

SAIL STEEL COMPANY

Dependent Variables

Independent Return on Sales Return on Equity

Variables Regression Regression

T T

Coefficient Coefficient

Current Ratio 3.170 0.275 1.054 -0.270

Quick Ratio 6.698 0.696 1.126 0.047

Inventory Turnover

2.286 1.133 15.024 0.060

Ratio

Debtors Turnover

1.563 1.524 -0.150 3.837

Ratio

Fixed Assets

-2.851 -0.228 -33.717 -0.076

Turnover Ratio

Constant -24.850 -1.363 -9.565 -1.389

R2 0.896* 0.982**

F value 6.919 21.354

DW 3.340 3.274

Source: Computed data ** - Significant at 1% level

* - Significant at 5% level

The current ratio, quick ratio, inventory and debtors’ turnover ratios were positively influenced the Return on Sales

(ROS)/ net profit margin but fixed assets turnover ratio has negatively influenced the ROS. The coefficient of

determination of performance variable of ROS was 0.896 at 5 percent significant level. It means a change in return

on sales (ROS) was explained by independent variables to the extent of 89.6 percent.

The current ratio, quick ratio and inventory turnover ratios were positively influ enced the Return on Equity (ROE)

but debtors’ and fixed assets turnover ratio has negatively influenced the ROE. The coefficient of determination of

performance variable of ROE was 0.982 at 1 percent significant level. It means a change in return on equity (ROE)

was explained by independent variables to the extent of 98.2 percent. The F statistics and Durbin Watson coefficient

were 1 percent level of significant.

The resulted regression coefficients with its statistical significance of TATA steel company are presented in the

Table No.1.7

TABLE NO.1.7

IMPACT OF FINANCIAL RATIOS ON PROFITAB ILITY OF

TATA STEEL COMPANY

Dependent Variables

Independent Return on Sales Return on Equity

Variables Regression Regression

T T

Coefficient Coefficient

Current Ratio 39.899 0.670 145.491 1.570

Quick Ratio -37.333 -0.635 -144.766 -1.582

2878 www.ijariie.com 258

Vol-2 Issue-4 2016 IJARIIE-ISSN(O)-2395-4396

Inventory Turnover

3.078 0.951 13.199 2.620

Ratio

Debtors Turnover

-0.031 -0.175 -0.719 -2.579

Ratio

Fixed Assets

10.761 0.657 -4.649 -0.182

Turnover Ratio

Constant -23.266 -0.537 -107.926 -1.602

R2 0.519 0.890*

F value 0.862 6.503

DW 1.017 1.221

Source: Computed data * - Significant at 5% level

The current ratio and inventory ratio positively influenced the Return on Sales (ROS) and Return on Equity (ROE)

but quick ratio and debtors turnover ratios were negatively influenced the ROS and ROE. Fixed assets turnover ratio

has positively influenced ROS but it had negative influence on ROE.

The coefficient of determination of performance of variables namely returns on sales and returns on equity were

0.52 and 0.89 respectively. This conveyed that the change in performance variables, namely ROS and ROE were

explained by independent variables to the magnitude of 52 percent and 89 percent respectively. The F statistics and

Durbin Watson coefficient were not significant in ROS but it’s significant at 5 percent in ROE.

The resulted regression coefficients with its statistical significance of Uttam Galva Steel Company are presented in

the Table No.1.8

TABLE NO.1.8

IMPACT OF FINANCIAL RATIOS ON PROFITAB ILITY OF

UTTAM GALVA STEEL COMPANY

Dependent Variables

Independent Return on Sales Return on Equity

Variables Regression Regression

T T

Coefficient Coefficient

Current Ratio 6.787 1.286 24.117 1.677

Quick Ratio -1.276 -0.265 -16.991 -1.297

Inventory Turnover

-0.365 -0.587 -1.427 -0.844

Ratio

Debtors Turnover

-0.041 -0.350 0.806 2.521

Ratio

Fixed Assets

1.782 0.891 9.474 1.738

Turnover Ratio

Constant -0.443 -0.077 -24.284 -1.542

R2 0.537 0.952*

F value 0.929 15.835

DW 2.159 1.968

Source: Computed data * - Significant at 5% level

The quick ratio, inventory and debtors’ turnover ratios negatively influenced the Return on Sales (ROS)/ net profit

margin but current ratio and fixed assets turnover ratio has a positive influence on the ROS. The coefficient of

determination of performance variable of ROS was 0.537. It means a change in return on sales (ROS) was explained

by independent variables to the extent of 54 percent.

The current ratio, debtors’ and fixed assets turnover ratios positively influenced the Return on Equity (ROE) but

quick ratio and inventory turnover ratio has negatively influenced the ROE. The coefficient of determination of

performance variable of ROE was 0.952 at 5 percent significant level. It means a change in return on equity (ROE)

was explained by independent variables to the extent of 95 percent. The F statistics and Durbin Watson coefficient

were 5 percent level of significant in ROE but in ROS it was insignificant.

The resulted regression coefficients with its statistical significance of JSW Steel Company are presented in the Table

No.1.9

2878 www.ijariie.com 259

Vol-2 Issue-4 2016 IJARIIE-ISSN(O)-2395-4396

TABLE NO.1.9

IMPACT OF FINANCIAL RATIOS ON PROFITAB ILITY OF

JSW STEEL COMPANY

Dependent Variables

Independent Return on Sales Return on Equity

Variables Regression Regression

T T

Coefficient Coefficient

Current Ratio 37.157 0.597 61.241 1.920

Quick Ratio -10.207 -0.109 -65.391 -1.358

Inventory Turnover

3.504 1.822 4.764 4.831

Ratio

Debtors Turnover

0.635 0.900 0.332 0.918

Ratio

Fixed Assets

-4.681 -0.176 4.820 0.353

Turnover Ratio

Constant -59.311 -1.153 -59.834 -2.269

R2 0.664* 0.926*

F value 1.580 9.981

DW 2.778 2.509

Source: Computed data * - Significant at 5% level

The current ratio, inventory ratio and debtors’ turnover ratios positively influenced the Return on Sales (ROS) and

Return on Equity (ROE) but quick ratio were negatively influenced the ROS and ROE. Fixed assets turnover ratio

has positively influenced ROE but it has a negative influence on ROS.

The coefficient of determination of performance of variables namely returns on sales and returns on equity were

0.664 and 0.926 respectively. This conveyed that the change in performance variables, such as ROS and ROE were

explained by independent variables to the magnitude of 66 percent and 93 percent respectively. The F statistics and

Durbin Watson coefficient were significant at 5 percent level in ROS and ROE. The resulted regression coefficients

with its statistical significance of Jindal Steel Company are presented in the Table No.5.15.

3. FINDINGS & SUGGESTIONS

3.1. FINDINGS

The analysis indicated that the overall situation regarding the current ratio was better in Surya Roshni

(7.27), Rhastrya (3.13), Sunflag (2.83) and Bhusan (2.61) steel companies because the average current ratio of these

companies were above the standard rate. It is concluded from the ANOVA analysis, that there is a significant

difference between the mean current ratios of the selected steel companies.

The analysis concluded that the quick ratio of Surya Roshni steel company (3.48) was better than all other

companies throughout the period of study, followed by Rhastrya (2.38), Sunflag (1.45) and SAIL (1.19). From the

ANOVA analysis, it is concluded that there is a significant difference between the mean quick ratios of the selected

steel companies.

Inventory turnover ratio of selected companies showed better in JSW (9.31) followed by Tata Steel (8.92),

Surya Roshni (7.59) and Sunflag (6.30). ANOVA analysis of Inventory turnover ratio concluded that there is a

significant difference between the mean inventory turnover ratios of the selected steel companies.

From the analysis, it is concluded that the Debtors Turnover ratio of Rhastry a steel company (63.59) was

better than all other companies throughout the period of study, followed by Tata (41.77), JSW (31.34) and Essar

(22.68). From the ANOVA analysis, it is concluded that there is a significant difference between the mean debtors

turnover ratios of the selected steel companies.

Fixed assets turnover ratio of selected steel companies showed better in Surya Roshni (2.26) followed by

Uttam Galva Steel (2.21), Sunflag (1.61) and Jindal (1.47). ANOVA analysis of Inventory turnover ratio concluded

that there is a significant difference between the mean inventory turnover ratios of the selected steel companies.

2878 www.ijariie.com 260

Vol-2 Issue-4 2016 IJARIIE-ISSN(O)-2395-4396

From the analysis, it is found that the Debt-Equity ratio of Essar steel company (3.18) was better than all

other companies throughout the period of study, followed by Jindal (3.04), Bhusan (2.66) and Uttam Galva (2.06).

From the ANOVA analysis, it is concluded that there is a significant difference between the mean debt -Equity ratios

of the selected steel companies.

Assets to Equity Ratio of selected companies showed better in Jindal (4.06) followed by Bhusan (3.72),

Essar Steel (3.66), Surya Roshni (3.16) and Uttam Galva (3.13). ANOVA analysis of Assets to equity ratio

concluded that there is a significant difference between the mean Assets to Equity ratios of the selected steel

companies.

Return on Shareholders Fund of steel Companies during the study period showed lesser average in Essar

steel company with 8.62 percentages, whereas Surya Roshni Steel Company, Sunflag steel compan y and Jindal steel

company were registered 11.81, 12.16 and 13.54 percentages respectively. SAIL achieved the highest average value

of 34.37 followed by TATA steel company with a value of 28.38 percentages. The ANOVA analysis concluded that

there is a significant difference between the mean Return on Net Worth ratios of the selected steel companies.

From the analysis, it is found that the Net profit margin ratio of Tata steel company (34.70) was higher than

all other companies throughout the period of study , followed by SAIL (22.00), Rhastrya (21.20) and JSW (18.80).

From the ANOVA analysis, it is concluded that there is a significant difference between the mean Net profit margin

ratios of the selected steel companies.

3.2. SUGGESTIONS

It was found that the total assets of the selected steel companies were increased considerably but turnover

ratio of the total assets was reduced at mean time. It resulted that correlation between these was negative.

As a result, that the selected companies utilized their assets during the study period. Hence, the selected

Indian steel companies must use their assets in fruitful manner.

In some of the selected steel companies, the current ratio, quick ratio and the inventory turnover ratio

positively influenced the return on equity. Hence, all other steel companies have to take up initiative to

increase these ratios.

3.3 CONCULSION

The present study has brought out the various facts about the financial performance of Indian steel industry.

The suggestions made in the study are of immense use for the policy makers to make appropriate decision for

mitigating the financial problems and to better financial performance. In order to compete with global economic

scenario and to sustain its place, steel industry needs to monitor its financial performance continually and take

financial decisions rationally.

REFERENCES

BOOKS

Balu.V. (2001). Financial Management. Chennai: Sri Venkateswara Publishers.

Battacharya. (2001). Working Capital Management, New Delhi: Prentice Hall of India.

Gale.V.L. Fitzzorald (1966). Analysis and Interpretation of Financial Statements. Bulter Worths.

2878 www.ijariie.com 261

Das könnte Ihnen auch gefallen

- Project Report On Tata SteelDokument9 SeitenProject Report On Tata SteelChander ShekharNoch keine Bewertungen

- Financial Analysis of Tata Steel: by Shubhank ShuklaDokument45 SeitenFinancial Analysis of Tata Steel: by Shubhank Shuklavarun rajNoch keine Bewertungen

- Managala Marine Exim India Pvt. LTDDokument50 SeitenManagala Marine Exim India Pvt. LTDnineeshkkNoch keine Bewertungen

- Tata Steel - Company Analysis - 2015Dokument28 SeitenTata Steel - Company Analysis - 2015Aditya ManchandaNoch keine Bewertungen

- Ashok LeylandDokument13 SeitenAshok LeylandDiptiNoch keine Bewertungen

- Tata Steel ReportDokument4 SeitenTata Steel ReportHARJEET KAURNoch keine Bewertungen

- Business Ethics PDFDokument222 SeitenBusiness Ethics PDFAlbin Lawrence100% (1)

- Financial Statement Analysis at Kirloskar GroupDokument89 SeitenFinancial Statement Analysis at Kirloskar GroupRajesh InsbNoch keine Bewertungen

- IDBI Bank Previous Year Question PaperDokument27 SeitenIDBI Bank Previous Year Question PaperMani KrishNoch keine Bewertungen

- Cost Analysis of Apollo Tyres: Submitted byDokument24 SeitenCost Analysis of Apollo Tyres: Submitted byNikhil AgarwalNoch keine Bewertungen

- Swot of SailDokument3 SeitenSwot of SailPavan KumarNoch keine Bewertungen

- Financial Management I Report Hindalco Nalco Group-15Dokument12 SeitenFinancial Management I Report Hindalco Nalco Group-15Madhusudan22Noch keine Bewertungen

- Sagar Cement - Financial STMT AnalysisDokument79 SeitenSagar Cement - Financial STMT AnalysisRamesh AnkathiNoch keine Bewertungen

- Steel June 2021Dokument35 SeitenSteel June 2021AmitNoch keine Bewertungen

- A Summer Training Project ReportDokument17 SeitenA Summer Training Project ReportAman Prakash0% (1)

- A Study On Working Capital Management at Sunflag Iron & Steel Co - Ltd. BhandaraDokument11 SeitenA Study On Working Capital Management at Sunflag Iron & Steel Co - Ltd. BhandaraprashantNoch keine Bewertungen

- Dissertation Report PDFDokument13 SeitenDissertation Report PDFPiyush VNoch keine Bewertungen

- BSPDokument94 SeitenBSPAchalaShrotey0% (1)

- Strategic Management SyllabusDokument2 SeitenStrategic Management SyllabuspearlinwhiteNoch keine Bewertungen

- Analysis of Financial Statements of Tata Steel: Bachelor of Business AdministrationDokument5 SeitenAnalysis of Financial Statements of Tata Steel: Bachelor of Business Administrationvarun rajNoch keine Bewertungen

- Sail 5Dokument94 SeitenSail 5Aditi ChandelNoch keine Bewertungen

- Print Himanshu, Project - 2Dokument60 SeitenPrint Himanshu, Project - 2ctlhim107723Noch keine Bewertungen

- Cera Sanitaryware - CRISIL - Aug 2014Dokument32 SeitenCera Sanitaryware - CRISIL - Aug 2014vishmittNoch keine Bewertungen

- Project Report On "Buying Behaviour of Gold With Regards To Tanisq "Dokument57 SeitenProject Report On "Buying Behaviour of Gold With Regards To Tanisq "vivekNoch keine Bewertungen

- Consumer Behavior On Iron and Steel IndustryDokument8 SeitenConsumer Behavior On Iron and Steel IndustryPadmaKhanalNoch keine Bewertungen

- A Study On Customer Satisfaction Level of Royal Enfield Bullet Ms. Ameer Asra Ahmed Dr. M.S. Ramachandra Mr. Siva Nagi ReddyDokument9 SeitenA Study On Customer Satisfaction Level of Royal Enfield Bullet Ms. Ameer Asra Ahmed Dr. M.S. Ramachandra Mr. Siva Nagi ReddyRonik PasswalaNoch keine Bewertungen

- Summer Internship Project: Sales Promotion On Tvs ScootyDokument61 SeitenSummer Internship Project: Sales Promotion On Tvs ScootyDeepu SinghNoch keine Bewertungen

- Financial Statement Analysis TATA Steel and JSW SteelDokument22 SeitenFinancial Statement Analysis TATA Steel and JSW Steelshivam kumarNoch keine Bewertungen

- Project For Mba Deepak Desai PDFDokument48 SeitenProject For Mba Deepak Desai PDFdeepakdesaia23Noch keine Bewertungen

- Ratio Analysis Bata ApexDokument28 SeitenRatio Analysis Bata Apexmahadi hasanNoch keine Bewertungen

- Ratio AnalysisDokument88 SeitenRatio Analysisgeetarathod100% (1)

- Arya Nandakumar - Week 4 Monday & Tuesday TaskDokument12 SeitenArya Nandakumar - Week 4 Monday & Tuesday TaskJaya SuryaNoch keine Bewertungen

- BEL - RatiosDokument8 SeitenBEL - RatiosVishal Kumar100% (1)

- Arunkumar ProjectDokument67 SeitenArunkumar ProjectanushwaryaNoch keine Bewertungen

- Reasearch and MethodologyDokument3 SeitenReasearch and Methodologynemik007Noch keine Bewertungen

- Tata SteelDokument8 SeitenTata SteelKamlesh TripathiNoch keine Bewertungen

- Certificate CDokument17 SeitenCertificate CSumesh PaiNoch keine Bewertungen

- Literature ReviewDokument9 SeitenLiterature Reviewsatyam dwivedi100% (1)

- Effectiveness of Performance Appraisal System in Escorts Agri-Powertrac LTD, FaridabadDokument33 SeitenEffectiveness of Performance Appraisal System in Escorts Agri-Powertrac LTD, FaridabadVivek KapoorNoch keine Bewertungen

- Business Ethics Ca1Dokument7 SeitenBusiness Ethics Ca1rekhaNoch keine Bewertungen

- A Project Report: Submitted byDokument21 SeitenA Project Report: Submitted byramNoch keine Bewertungen

- A Study On Inventory Management System in The Sreerama Scaffold Systems, PalakkadDokument13 SeitenA Study On Inventory Management System in The Sreerama Scaffold Systems, PalakkadAthira MuralidharanNoch keine Bewertungen

- Big Project (Mba)Dokument87 SeitenBig Project (Mba)Rishi RejiNoch keine Bewertungen

- Fundamental and Technical Analysis of Sharesof Automobile Industry - A Case StudyDokument6 SeitenFundamental and Technical Analysis of Sharesof Automobile Industry - A Case StudyappachuNoch keine Bewertungen

- Home Loan Portfolio-A Review of Literature: International Journal of Current Advanced Research September 2017Dokument4 SeitenHome Loan Portfolio-A Review of Literature: International Journal of Current Advanced Research September 2017Chhaya ThakorNoch keine Bewertungen

- BHEL Case StudyDokument2 SeitenBHEL Case StudyBhavesh RathiNoch keine Bewertungen

- CF ProjectDokument40 SeitenCF ProjectYatin DhallNoch keine Bewertungen

- Financial Performance Analysis Through Position Statements of Selected FMCG CompaniesDokument8 SeitenFinancial Performance Analysis Through Position Statements of Selected FMCG Companiesswati jindalNoch keine Bewertungen

- Industrial Internship Report (4) F1111Dokument27 SeitenIndustrial Internship Report (4) F1111Mainuddin M JamadarNoch keine Bewertungen

- Marketing Term Paper .... SkodaDokument18 SeitenMarketing Term Paper .... Skodarohitpatil999Noch keine Bewertungen

- Balance Sheet of Adani Power: - in Rs. Cr.Dokument7 SeitenBalance Sheet of Adani Power: - in Rs. Cr.bpn89Noch keine Bewertungen

- Inventory Tata SteelDokument9 SeitenInventory Tata SteelJaspreet SinghNoch keine Bewertungen

- Steel Authority of India Limited (SAIL) : Project Topic-Training and Development of RDCIS (SAIL), RanchiDokument52 SeitenSteel Authority of India Limited (SAIL) : Project Topic-Training and Development of RDCIS (SAIL), RanchimatchisNoch keine Bewertungen

- Ratio Analysis of Over The Last 5 Years: Power Grid Corporation of India LTDDokument10 SeitenRatio Analysis of Over The Last 5 Years: Power Grid Corporation of India LTDShubham DikshitNoch keine Bewertungen

- Ifs Cia 1Dokument12 SeitenIfs Cia 1sachith chandrasekaranNoch keine Bewertungen

- Performance Divergence and Financial Dis PDFDokument12 SeitenPerformance Divergence and Financial Dis PDFSindhu GNoch keine Bewertungen

- Financial Performance of The Steel Industry in India: A Critical AnalysisDokument6 SeitenFinancial Performance of The Steel Industry in India: A Critical AnalysisTwinkle VermaNoch keine Bewertungen

- A Study On Financial Statement Analysis of Tata Steel Odisha Project, Kalinga NagarDokument12 SeitenA Study On Financial Statement Analysis of Tata Steel Odisha Project, Kalinga Nagarwawa1303Noch keine Bewertungen

- A Study On Financial Statement Analysis of Tata Steel Odisha Project, Kalinga NagarDokument12 SeitenA Study On Financial Statement Analysis of Tata Steel Odisha Project, Kalinga Nagargmb117Noch keine Bewertungen

- New Nijam JSW-1Dokument84 SeitenNew Nijam JSW-1Bongale OmprakashNoch keine Bewertungen

- BSP Plant Performance 60th TISCO JamshedpurDokument22 SeitenBSP Plant Performance 60th TISCO JamshedpurBinod Kumar Padhi100% (1)

- POSCO Case - History of PoscoDokument5 SeitenPOSCO Case - History of PoscoBinod Kumar PadhiNoch keine Bewertungen

- SMS#1 SMS#2: PERFROMANCE DATA (Refractory & Operation)Dokument14 SeitenSMS#1 SMS#2: PERFROMANCE DATA (Refractory & Operation)Binod Kumar PadhiNoch keine Bewertungen

- SL No Wheel Id Hardness Hardness Status MPT MPT Reason Ut UT Reason Date Shift Witnessed by Rites Tested by Wheel Status RemarksDokument4 SeitenSL No Wheel Id Hardness Hardness Status MPT MPT Reason Ut UT Reason Date Shift Witnessed by Rites Tested by Wheel Status RemarksBinod Kumar PadhiNoch keine Bewertungen

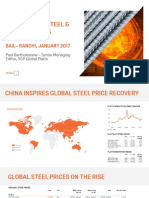

- Presentation of SP Global PlattsDokument33 SeitenPresentation of SP Global PlattsBinod Kumar PadhiNoch keine Bewertungen

- PresentationDokument17 SeitenPresentationBinod Kumar PadhiNoch keine Bewertungen

- Largest Steel Producers Since 1980Dokument38 SeitenLargest Steel Producers Since 1980Binod Kumar PadhiNoch keine Bewertungen

- NSP-2017 & Its ImpactDokument6 SeitenNSP-2017 & Its ImpactBinod Kumar PadhiNoch keine Bewertungen

- Month-Wise Phosphorous Reversal ReportDokument1 SeiteMonth-Wise Phosphorous Reversal ReportBinod Kumar PadhiNoch keine Bewertungen

- Guide Map EcoParkDokument1 SeiteGuide Map EcoParkBinod Kumar Padhi50% (2)

- GATE Mining Engineering Solved 2011Dokument13 SeitenGATE Mining Engineering Solved 2011Binod Kumar Padhi100% (1)

- Slag Analysis Report: Uploading Time Source of SampleDokument23 SeitenSlag Analysis Report: Uploading Time Source of SampleBinod Kumar PadhiNoch keine Bewertungen

- GATE Mining Engineering 2007Dokument17 SeitenGATE Mining Engineering 2007Binod Kumar Padhi100% (1)

- Improvement in Internal Soundness of Railway Wheel by Controlling De-Oxidation Practice in Steel-MakingDokument38 SeitenImprovement in Internal Soundness of Railway Wheel by Controlling De-Oxidation Practice in Steel-MakingBinod Kumar PadhiNoch keine Bewertungen

- IntroDokument24 SeitenIntroBinod Kumar PadhiNoch keine Bewertungen

- S. No. Cast No. Date Shif Sequence No. of Pcs. Grade DecisionDokument2 SeitenS. No. Cast No. Date Shif Sequence No. of Pcs. Grade DecisionBinod Kumar PadhiNoch keine Bewertungen

- 17 Total CCP Heats: CCM 1: CCM 2: CCM 3: CCM 4: 5 5 2 5Dokument4 Seiten17 Total CCP Heats: CCM 1: CCM 2: CCM 3: CCM 4: 5 5 2 5Binod Kumar PadhiNoch keine Bewertungen

- Rating Criteria For Steel IndustryDokument5 SeitenRating Criteria For Steel IndustryBinod Kumar PadhiNoch keine Bewertungen

- Caster #1 Caster #2 Caster #3 Caster #4 Analysis GradeDokument2 SeitenCaster #1 Caster #2 Caster #3 Caster #4 Analysis GradeBinod Kumar PadhiNoch keine Bewertungen

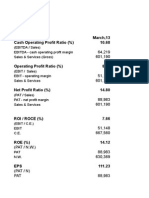

- Idirect Sail Q4fy16Dokument9 SeitenIdirect Sail Q4fy16Binod Kumar PadhiNoch keine Bewertungen

- ARC Journal of Animal and Veterinary SciencesDokument19 SeitenARC Journal of Animal and Veterinary SciencesFantahunNoch keine Bewertungen

- Latihan 1Dokument13 SeitenLatihan 1natsirNoch keine Bewertungen

- Dynamic Pricing and Consumer Fairness PerceptionsDokument8 SeitenDynamic Pricing and Consumer Fairness PerceptionsFas RrabaNoch keine Bewertungen

- Statistics and Probability For Simulation-2Dokument43 SeitenStatistics and Probability For Simulation-2Carl Edgar Ambid AyatonNoch keine Bewertungen

- CERTIFIED Quality EngineerDokument16 SeitenCERTIFIED Quality Engineeracadjournals. comNoch keine Bewertungen

- ANOVA PresentationDokument22 SeitenANOVA PresentationNeeraj GuptaNoch keine Bewertungen

- Production of Lactic Acid From Mango Peel WasteDokument7 SeitenProduction of Lactic Acid From Mango Peel WasteFiqa SuccessNoch keine Bewertungen

- Analysis of Variance (ANOVA)Dokument24 SeitenAnalysis of Variance (ANOVA)Ralph Kenneth DayritNoch keine Bewertungen

- Methods of Research Chapter 3Dokument10 SeitenMethods of Research Chapter 3Cherry Mae L. Villanueva100% (3)

- MCQ Practice With AnswersDokument6 SeitenMCQ Practice With AnswersemilyNoch keine Bewertungen

- Factors Affecting Customer'S Satisfaction of Supermarket Customer'S in HyderabadDokument17 SeitenFactors Affecting Customer'S Satisfaction of Supermarket Customer'S in HyderabadHafsa KhanNoch keine Bewertungen

- Regression Models: To AccompanyDokument75 SeitenRegression Models: To AccompanySyed Noman HussainNoch keine Bewertungen

- Effect of Rest-Pause vs. Traditional Bench Press Training On Muscle Strength, Electromyography, and Lifting Volume in Randomized Trial ProtocolsDokument6 SeitenEffect of Rest-Pause vs. Traditional Bench Press Training On Muscle Strength, Electromyography, and Lifting Volume in Randomized Trial ProtocolsAntonio DelgadoNoch keine Bewertungen

- Group 4 - Group ProjectDokument8 SeitenGroup 4 - Group ProjectIntan MashitahNoch keine Bewertungen

- Lou Shi XiongDokument14 SeitenLou Shi XiongJiajunDuNoch keine Bewertungen

- Process Optimization For Double-Cone Blender and Application of StatisticsDokument7 SeitenProcess Optimization For Double-Cone Blender and Application of StatisticsKbatu GebremariamNoch keine Bewertungen

- Design of Experiments Application, Concepts, Examples: State of The ArtDokument19 SeitenDesign of Experiments Application, Concepts, Examples: State of The ArtMeditation ChannelNoch keine Bewertungen

- Stat I CH - 1Dokument9 SeitenStat I CH - 1Gizaw BelayNoch keine Bewertungen

- Intro Phasesix SigmaDokument11 SeitenIntro Phasesix SigmaPutra BarasaNoch keine Bewertungen

- The Effects of Music Tempo On Memory Performance Using Maintenance Rehearsal and ImageryDokument19 SeitenThe Effects of Music Tempo On Memory Performance Using Maintenance Rehearsal and ImagerySunway University100% (1)

- Aldrin ResearchDokument17 SeitenAldrin ResearchJaimie Del MundoNoch keine Bewertungen

- The Digital Divide in Students' Usage ofDokument12 SeitenThe Digital Divide in Students' Usage ofChristopher BrownNoch keine Bewertungen

- Crisis Management in Cruise Tourism A Case Study of DubrovnikDokument16 SeitenCrisis Management in Cruise Tourism A Case Study of DubrovnikAleksandarNoch keine Bewertungen

- Excel Fordata AnalysisDokument37 SeitenExcel Fordata AnalysisLeah Mae AgustinNoch keine Bewertungen

- Introduction To The Practice of Statistics 9th Edition Ebook PDFDokument61 SeitenIntroduction To The Practice of Statistics 9th Edition Ebook PDFjose.waller368100% (47)

- Simple Analysis of Variance: Handout in Advanced Statistics Mrs. A. L. ReginaldoDokument3 SeitenSimple Analysis of Variance: Handout in Advanced Statistics Mrs. A. L. Reginaldorhiantics_kram11Noch keine Bewertungen

- Mutula - Effect of Electronic Accounting On The Financial Performance of Commercial State Corporations in KenyaDokument73 SeitenMutula - Effect of Electronic Accounting On The Financial Performance of Commercial State Corporations in KenyaaliNoch keine Bewertungen

- Tutorial 1-14 Student S Copy 201605Dokument27 SeitenTutorial 1-14 Student S Copy 201605文祥0% (2)

- DOE Course - Lecture #1Dokument27 SeitenDOE Course - Lecture #1Sabry S. YoussefNoch keine Bewertungen

- Comparisons For Bank VIVA - Hemal Jamiul Hasan - 2015 - BCB Group PDFDokument64 SeitenComparisons For Bank VIVA - Hemal Jamiul Hasan - 2015 - BCB Group PDFahkhan4100% (2)