Beruflich Dokumente

Kultur Dokumente

Mda 2009 354608

Hochgeladen von

Harsha Dutta0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

4 Ansichten33 Seitenmda_2009

Originaltitel

MDA_2009_354608

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenmda_2009

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

4 Ansichten33 SeitenMda 2009 354608

Hochgeladen von

Harsha Duttamda_2009

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 33

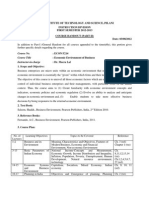

Management Discussion & Analysis

MACROECONOMIC AND

INDUSTRY OVERVIEW.

The Indian economy remains on course correction and the

real GDP growth for the Financial Year 2008.09 is

estimated at 67% per GOI advance estimates, with the

Reserve Bank of India (RBI) estimating GDP growth at 70%

with a downward bias. Though India's economic performance

has demonstrated a fair degree of reslience despite an

adverse external efivironment, the real economy will remain

stressed in the near-term and we hold our GDP estimate

at 65-67% for the Financial Year. However, the country’s

medium term fundamentals remain faiey robust and we

expect the real economy to tum-around from the current

slow growth phase by the second half of 2010.

The services sector was the key growth driver and grew by

9.2% in the Financial Year, led by subgroups viz. community

and social services, financial services, and trade, transport

and communication services. We expect community and

social services to print strong end-period growth on the

back of a huge pickup in government final consumption

expenditure. Moderation in economic activity can be traced

to slowing industrial activity with sectoral growth estimated

at 24% for the Financial Year, substantially lower than the

9.4% average growth seen in the preceding two years

The first half of the year saw the Central Bank adopting a

tight monetary policy stance in response to escalating

infation which touched an alltime high of 12.91% in

‘August 2008 on growing global commodity prices, especially

crude oil prices that peaked at $147/bb in Juy 2008, However,

the collapse of Lehman Brothers in mid-September 2008, and

the ensuing international credit crunch and high risk aversion

led to a significant reversal in capital flows exerting pressure

con domestic liquidity, Tight domestic liquidity conditions

were further exacerbated by advance tax collections and

RBI intervention in the forex markets to arrest the pace of

rupee depreciation. In response to these dramatic

developments, the RBI adopted an aggressive monetary

ceasing stance and eased prudential norms, a sharp policy

reversal. To alleviate credit constraints, the RBI enhanced

export credit refinance, special refinance for Scheduled

‘Commercial Banks (non-RRB) and refinance facilites for

SIDBI, NHB and EXIM Bank Additionally, risk weights on

banks’ exposures to all unrated claims on corporates, claims

secured by commercial real estate and claims on NBFCs-

NDSI were reduced to 100% from 150%, Commercial real

estate exposures restructured up to June 30, 2009 were

allowed to be treated as standard assets. As a one-time

measure, the second restructuring done by banks of

exposures (other than exposures to commercial real estate,

capital market exposures and personalfconsumer loans) up

to June 30, 2009 were also made eligble for concessional

regulatory treatment.

Since October 2008, the RBI has been actively cutting key

short-term rates - the Repo by 400 bps, the Reverse Repo

bby 250 bps and the Cash Reserve Ratio (CRR) by 400 bps

since October 2008, to 5.0%, 35% and 5.0% respectively,

The Reverse Repo has clearly emerged as the key policy

signal instrument in recent months over the Repo.

‘Additionally, the RBI also reduced the Statutory Liquidity

Ratio (SLR) for Scheduled Commercial Banks from 25% to

24% of their Net Demand and Time Liabilties (NTL)

effective November 2008.

Fiscal policy response to limit the slowdown and

cushion the economy too, picked up pace from the

fourth quarter. Since December 2008, the government

launched three fiscal packages to target stressed sectors

viz,, banking, auto, housing, real estate and exports and

improve and ease credit flow to prodictive sectors ike

infrastructure and rural development. Among others,

measures have included the easing of foreign currency

borrowing rules, increasing foreign investment limit for

m7

__ae lw

corporate bonds to $15 bn, sector-specific sops, and

indirect tax concessions including the reduction of

Cenvat to 8%. Government finances remained under

pressure on the back of higher expenditures (in part

also on subsidies due to peaking global crude oil

prices) coupled with lower revenues. As the sources

of funds for the government (viz. tax collections)

have tightened, fiscal deficit will likely exceed 6% of

GDP (with the consolidated deficit likely to be in:

excess of 11% of GDP), targeted as per: the: revised

estimate for the'Financial Year 2008.09.

Reflecting the moderation in economic activity, Scheduled

‘Commercial Banks’ credit growth too" softened. Bank

credit grew only by 17.3% in the Financial Year 2008-09

as compared to 223% posted in the Financial Year 2007-06.

Growth in non-food credit too slowed. considerably at.

17.8% versus 23.0% in the preceding year, rile

aggregate deposits of Scheduled Commercial Banks grew

19.8% against 22.4% in the preceding year

In tems of the overall macroeconomic contions, WPI

infason has continued to,trend downwards, fling 19 2

fistorc low of 026% at end March pray on account

ofa high base efect. However, consumer price infaton

at above 9% sil remains warnsome.Intajon ill continue

to trend downwards and is expecied to enter negate,

tenitory by early ne 2008, essential saiscal

phenomenon

We can expect the pace of growth to maderste

further in the first half f the Financial Year 2009-10

with policy stimuli providing cftca'growth support

While weak spending sentinient, and high investories

limit private business activity, some positives wil be

visible from the second half of 2010, as the réal

economy responds to policy stimuli only with a lag

However, since the current’ monetary easiig ojcle has

spanned only six months" whilé the RBI had earliér

tightened rates over a period of four years, leding

rates have been“adjustng to:this policy direction

reversal wth a measured lag, While banks wil eck to

balance higher credit flows with heightened risk of *

deterioration in asset qialty, the key question fothe

eral economy now centres around the efciency and

effectiveness of the monetaty transmission mechanism,

28

BUSINESS OVERVIEW

‘At your Bank sustainability means operating in an ethically,

and socially responsible manner, respecting and supporting

‘our communities; protecting the environment: and delivering

superior stakeholder value. By embracing sustainable growth

strategies, your Bank propels its progress and differentiates

itself from competition.

‘The sustained growth of your Bank, is based on the key pillars

of GROWTH, TRUST, TECHNOLOGY, KNOWLEDGE

DRIVEN HUMAN CAPITAL, TRANSPARENCY and

RESPONSIBLE BANKING. Your Bank is committed to offer

innovative sustainable, business solutions that are customised

‘to meet the growing and dynamic needs of customers across

‘generations. Your Bank also believes in bringing about a

sustainable transformation in banking, combining traditional and

modem ways of thinking, to give maximum. benefit tp all our

stakeholders. By continuously striving to create, innovate and

‘vansform, your Bank goes beyond the traditional realm of

banking to create long-term value for all stakeholders. Moving

forward in this direction, your Bank has evolved an innovative

business model entaling a conscious move away from

philanchropy based’ CSR to using CSR/Sustainability where

corporate self regulation is integrated in the business modal

and is a critical business driver

Inthe incresbingy conscience marketplaces of the

21° cetur, there his Been a significant increase in the

demand for ‘ior ethical Busineis processes and actions

Your Bank embraces responsibilty forthe impact ofits

activties,on the environment, consumers, employees,

communities, stakeholders and,all other members of the

public sphere. Your, Bank stives to operate in the

‘Sugganablty Zone, between pure philanthropy and pure

profits. where wider economic, environmental and socal

objectives are met.-Your. Bank, therefore focuses on

sustainably. as a, strategie dffereniator, lending

compective advantage in-a-challenging business

environment ensuring long-term sustainable growth and

development of all stakeholders, in turn creating a virtuous

yee of sustained economic prosperity

Your Bank has experts ranging from the field of banking to

specific industry sectors, each contributing their knowledge

and expertise individually and through collective thinking

thereby ensuring that every solution, product and innovation

works in tandem with your Bank's customers’ needs, at

every stage of evolution of their business

This differentiated approach has resulted in your Bank

receiving several recognitions across leading banking league

tables from independent institutions of repute and leading

media houses while winning multiple awards and accolades

‘across product and service categories both nationally and

alobally

‘Your Bank was ranked as the No. | Emerging Markets

Sustainable Bank of the Year-Asia at the FT/IFC

Washington Sustainable Banking Awards, 2008 in London,

‘Your Bank was also ranked as the No. | Bank in the

Business Today-KPMG Best Banks Annual Survey, 2008,

(Balance Sheet < 24,000 crore) and has been recognised

among the World's Top 25 ‘Unsung’ Innovative Companies

by one of the most prestigious publications - BusinessWeek.

These recognitions validate your Bank's innovative business

model that is based on the principles of sustainability

which are encapsulated within the Responsible Banking

strategy, while offering a combination of Relationship,

Product, Knowledge and Service Capital to all customers

‘through our unique ‘One-Bank Model” approach.

& s

Knowledge

Capital

Relationship

Capital

RELATIONSHIP CAPITAL

‘Your Bank has always put special focus and emphasis on

building institutional Relationship Capital, as a comersstone of,

sustainable success, and believes in building long-term, core

relationships. Your Bank's approach is buit on a 3.

dimensional structure of Relationship, Product and Knowledge

Managers, to create a differentiated proposition, and

incremental value generation, throughout the clients’ business

life-cycle, across multiple customer segments and knowledge

verticals as defined below:

ee =.

Institutional Banking i |

=o |

cay

Seo MN

CORPORATE &

INSTITUTIONAL BANKING

Your Bank has made consistent efforts in the Corporate

and Institutional Banking segment to ensure every partnership

delivers profits as well as long-lasting environmental and

social value.

The Corporate & Institutional Banking (CAIB) division at

your Bank provides comprehensive financial and risk

management solutions to clients having a tumover of over

INR 10 billion. The relationship experts across this business

Unit, provide financial solutions to the folowing categories

of institutions

7 Large Incian Corporate Groups

7 Public Sector Enterprises

7 Central’ and State Govemments

»

7 Government Bodies

7 Multinational Companies

1 Financial institutions and Banks

‘Your Bank provides a comprehensive range of client-

focused Corporate. Banking Services, including Working

Capital Finance, Term Loans, specialised Corporate Finance

products, Trade; Cash Management & Transactional

Services, Treasury Services, Investment Banking Solutions

and: Liquidity Management Solutions to name.a few. All

product. offerings: are suitably structured after in-depth

research and assessment, taking into account the client’s

risk profile and specific needs, because at your Bank

maintaining the highest asset qualty, is of utmost priority,

‘Your Bank is committed to provide innovative financial

solutions by leveraging on superior product delivery,

knowledge-based advisory, industry benchmarked service

levels and a strong client orientation. Your Bank has made

significant inroads into developing core relationships with a

umber of Indian companies while joining hands with various

Government Institutions at the central, state and city levels

Your Bank provides industry specific financial solutions by

creating tallor-made services through superior structuring to

best suit client requirements, helps lower entry barriers,

strengthens business relationships, and ensures risk mitigation

ie

/ COMMERCIAL BANKING

By. continuously evolving sector-specific products and

services, your Bank paves thé path for a sustainable future

for Emerging Corporates. Your Bank understands: the

financial needs of growth focused, fast paced enterprises that

are emerging as leaders in their respective industry domains

through YES BANK's Knowledge Banking approach, and

‘our objective of being the Bank for'the ‘Future

Businesses of India’

‘Commercial Banking (CB) dedicated to. serve this

specialised segment of companies, with an annual turnover

between INR 1,000 million and INR 10 billion, and to

provide a strong backborie af Partners to cents throughout

their lifecycle, and be a key strategic value driver

Your. Bank has institutionalised

CB targets companies in the “high octane’ middle market

segment, operating across the key emerging sectors like

Food afd Agribusiness, Life Sciences & Healthcare, Media

and Entertainment, Engineering, Telecommunications,

Information Technology and: Infrastructure, thereby laying

the foundation of long-term growth,

CB's relationship managers aim to deliver the highest

standards in service to their customers by following a

Money. Doctor approach of Diagnostic and Prescriptive

solutions through a’careful evaluation of client specific

financial needs and providing tailor-made solutions to them,

‘These include structured: products based on the customer's

risk profile and growth requirements as well as general

banking products and services like Working Capital, Term

Funding, Liabilities, Investments, Insurance, Trade Finance

and Treasury, amongst others

Empowered with CRM tools and a relationship driven

team, CB delivers financial solutions customised to address

the specific life cycle needs of the identified customers

across the above mentioned sectors, This “Life Cycle

Banking” approach has been instrumental in influencing

sustainable growth and transformation of a large number of

‘the Bank's customers, resulting in strong customer loyalty

and a mutually enriching experience,

BRANCH BANKING

‘Your Bank believes in providing a holistic banking

experience to all its customers through its high quality,

state-ofthe-art branch network, using cutting-edge

technology, a truly customer-centric offering, and

significantly differentiated marketing and branding strategies

across major towns and cities in India

Backed by aesthetic design, your Bank's retail branches

are not only strategically located at premium high-street

locations but are also benchmarked with world-class

design standards to ensure smoother and convenient

customer engagement. Your Bank's branches are highly

accessible and the various consistent and evocative touch

points facilitate warmth, coherent communication and a

consistent customer experience. The focus is not only in

providing ease of transaction but also in engaging,

informing and involving, in a personalised manner thereby

providing incremental value for the time spent inside the

branch by the customer.

Currently, your Bank’s customers are being served through

an extensive branch network, comprising of 117 branches in

fe ATMs in

Mumbai, Pune and the NCR region. Your Bank will continue

92 locations across India as well as 93 off

‘to expand its branch presence in line with its strategy of

building the highest quality branch network covering major

cities and towns across India,

‘While your Bank's branches have been designed to cater to

all segments of customers under the ‘One Bank Model

Business Banking and Retail Banking & Wealth Management

customers are the most frequent users of this world-class

infrastructure, These two segments, together constitute the

Branch Banking business, which is an area of very high focus

for your Bank and significant investments have been made to

provide an exceptional experience to its customers.

Under the aegis of Branch Banking, various innovative Liability and

Financial products re provided across both segments, including

1 Savings Accounts (with multiple variants)

1 Current Accounts (with mutiple variants)

1 Nests Accounts

7 Nonresident Accounts (with multiple variants)

1 Fixed Deposits (for various tenors)

1 5:Year Tax Eficient Fixed Deposits

1 Smart Saver Accounts: A unique proposition, which

provides high returns of a Fixed Deposit with the

Complete liquidity of a Savings Account.

1 Smart Salary Accounts: An innovative Corporate Salary

Programme, backed by superior technology that enables

convenience and direct access.

31

‘Chembur

on

oregon

aran Pent

Thane)

Vas

Vash

wert

i?

‘natn 2)

oda Road

YES BANK Branch Network Across India

JAREIU & KAREBAIR,

Etec)

enkuen a)

NeDab ~ Chatarpr, Gren Park Kapasbra, Mow Fonds

olny yaya arg Moda Yon oj Garden,

Sat Goth Etnaon Pun B09

Marana - Dharuheds, Faridabae, Garhi Warssrv,

Gurgaon} Manes, al Shakarpur Warated

~ Ata, Baghpat Ghalabd, NODA, Sup

Mohr Cente

117 Branches'| Over 200 ATMS | 2 National Operating Centres

YES COMMUNITY

‘Your Bank also believes that the branches need to play

a significant role in Community engagement in the Branch

Serving Area and be centres of social transformation, ln

line with this belief, your Bank is driving a unique

Responsible Banking initiative, called YES COMMUNITY

‘through the Bank's branches. The aim of YES COMMUNITY

is to espouse causes which are of public interest and add

long-term value to. society.

BUSINESS BANKING

Your Bank believes in generating stakeholder value

through responsible business practices. In meeting this

responsiblity, your Bank contributes significantly by

supporting Small and Medium Enterprises (SME), which in

‘turn propel a strong economy and a sustainable business

environment. Hence, your Bank has established

YES BUSINESS, 2 dedicated Business Banking segment.

driven by our unique Knowledge Banking approach, backed

by a team of experts, along with a suite of products,

services and resources. Your Bank ensures that identified

Small & Medium Businesses, with annual turnover of

INR 100 million: to INR 1000 milion, excel in the future

as they are the driving force for innovations, development

and sustainable growth of the economy..Your Bank citers

to all the service requirements of these SMEs across

various product segments like Fund based lending, Cash

Management, Payment Solutions, Direct Banking, Trade

services and Advisory through a strong branch network of

49 branches across significant SME: clusters. The

Relationship Managers at your Bank invest in understanding

the client's diverse and dynamic needs

‘The core objective of Business Banking is to easily enable

SME's access to finance (including term finance), and

thereby fostering growth, offer state-of-the-art transaction

services and a lability management proposition,

competitiveness and employment creation that are key to

achieving sustainable economic growth.

‘Your Bank's strategy to attract SME customers include:

1 Offering a customised service proposition tailor-made

for high transactional volumes in the key businesses of

ITITES, Foreign Trade, Logistics, Travel/Tourism, Media

and Entertainment, Gems and Jewellery, Trusts,

Societies & NGOs, Realty, Professional Services and

various Business associations, using a combination of

Relationship, Knowledge and Product Capital

4 Offering holistic banking solutions to customers through

the services of Business Banking Relationship Managers

and Service Managers for all their banking needs

(including business, wealth management and advisory) at

the branch level

1 Offering liability products like Cash Management

Services (CMS), Payment Solutions, Net Banking Phone

Banking and Trade Services.

>|

»

Personal Finance Aggregation’ tool in India in 2008, It

provides seamless information of the client's financial

health: by aggregating “data, frorh. over | 1,000 financial

arid related sites across the world into his YES BANK:

Interndt "Banking Account: thereby giving hima single

View across his: own and family ‘accounts! This is-»

powered in. partnership" with YODLEE.’

The wide-range: of transactions. that can-be conducted:

COniine include: . e

‘+ Real‘ time’ payments using RTGS alid NEFT payinent

systems z

© "Requests for demand drafts, cheque books, query

cheque status, stop payments, purchase fixed

deposits and TDS enquiry on fixed deposits amongst

others.

+ Pay utility bills to over 115 billers across India and

make donations to various religious and charitable

institutions

+ View and download account statements across

multiple formats.

+ View and initiate standing instructions

‘+ Set various email alerts based on transaction

thresholds and account activites

+ Integrated view across Corporate and Cash

Management services (payments and collections).

‘© Differential bulk transactions along with fie-level

encryption for corporate clients

‘© Airticket reservations and E-shopping funded by

direct debit to the customer's account.

‘+ Real time payments to various e-brokerage accounts.

‘© Foreign exchange trading for corporate clients

© Request and view real-time balances and transaction

information.

INDIAN FINANCIAL INSTITUTIONS

RELATIONSHIP MANAGEMENT

Your Bank believes in creating superior sustainable value

for its stakeholders, customers, employees and communities

through responsible partnerships with various Banks and

Financial Institutions nationally,

‘The Indian Financial Institutions (IFi) team at your Bank

spearheads relationship development efforts with various

Banks and Financial Institutions nationally. The team

achieves this by supporting product delivery while creating

and sharing industry knowledge with internal and external

stakeholders. Indian Financial Institutions (FI) Relationship

Management experts at your Bank offer an array of

services to the following set of clients

/- Domestic Banks (Govt owned, Private and Cooperatives)

7 Mutual Funds

7 Insurance Companies

7 Non: Barking Finance Companies (N8FC)

1 Private Equity Funds

/- Brokers (both Capital market and Commocity market)

The IFI team members at your Bank leverage their existing

relationships with various Banks and Financial Institutions to

raise resources, and to set up counter party limits for your

Bank, Additionally, IFI offers a wide variety of products

including Debt, Trade Finance, Guarantees, Treasury Services,

Working Capital Finance, Cash Management & Transactional

Services and Liquidity Management Solutions to your Bank's

customers by entering into partnerships with other Banks

and Financial Institutions. Your Bank has a strategic tie-up

with NABARD to offer Food and Agricuture Consultancy

Serviced and with SIDBI-to offer SME Consultancy to the

Bank's customers. This relationship with other Banks and

Financial Insttutioné is also leveraged for syndication of

loans for your Bank's Corporate & Institutional as well as

‘Commercial Banking customers, and to raise resources

through refinancing your Bank's loan portfolios. The IFI

team leads your Bank’s efforts towards raising debt capital

in the form of Tier | and Tier II bonds from various Indian

Institutions,

INTERNATIONAL BANKING

‘As a global corporate citizen, your Bank extends its

responsible partnerships to financial institutions and

‘customers across the world. Through in-depth knowledge

of growth sectors, your Bank caters to their present as

well as future needs with unmatched credibility

International Banking has augmented the network and

visibility of your Bank's brand and its presence intemationaly

International Banking continues to further strengthen its

strategy with a clear focus on servicing the correspondent

banks’ businesses in India. Additionally, the division provides

2 suite of advisory services to international corporations

which are keen to expand or enter the Indian market

under the aegis of a dedicated India Business Facilitation

Desk (IBFD), which provides advisory services to corporates

at every step of business establishment on various sectors

through Knowledge Banking initiatives, apart from providing

complete banking solutions.

‘These initiatives intend to evolve customer centric solutions

for your Bank's Intemational customers such as

7 Foreign Banks with or without any presence in India

7 Muttlateral Agencies

7 Foreign Institutions such as US-€XIM, Coface, Euler

Hermes amongst others

1 Private Equity Fund houses with a focus on India

7 NBECs registered in India and backed by foreign Banks

The Intemational Banking business offers a complete suite

of products including Debt, Trade Finance, Treasury

Services, Investment Banking solutions, Financial Advisory

37

<8 foi

and Global Indian Banking to international customers of ~

your Bark. These products are offered through partnerships /

and tie-ups with international Banks. and Institutions in the

target geographies

‘Your Bank has entered into cooperation agreements with

two international banks viz. Mashreq Bank, Dubai. and, UBI

Banca, Italy. The cooperation is envisaged across various:

bbanking products, which has provided further traction to

the International Business of your Bank.

The differentiated and innovative. Knowledge. Banking. v

approach has not only created a riche position for your.

Bank in the international market, but has also helped the

division to reach.out across multiple, geographies. while

providing specialised services to corporations eager to

enter India

The dedicated India Business Facitation Desk (BFD),.

complements international corporations at every step of

business establishment, ranging from providing sectoral

advisory to complete banking solutions including support

services like setting up of an offcelestablishment in India

‘The division also provides valye-added services including

macroeconomic analysis, trade and investment assessment,

advisory, regulatory and country specific framework,

education ‘and knowledge exchange, cultural adaptability

and exchange.

38

PRODUCT CAPITAL

Your Bank has created range of products to effectively »

service customers across differentiated market segments.

The ‘One Bank Model’ approach built on 2 3-Dimensional

organizational structure of Relationship, Product &

Knowledge enables greater cross-sell and up-sell of these

products to customers. This approach enables'to further

augment tke! existing rBatiohships by proving’ multiple

engagement opportune’, and’iniroduce’ customised

products acréss the customer's growtife cycle.

FINANCIAL MARKETS,

‘Your Bank believes in delivering, value by:striking.a healthy

balance between economic and social retums, its sustainable

approach towards the Financial Markets (FM) business

model provides effective Risk Management solutions relating

‘to foreign currency and interest rate exposures of clients

The FM team assists clients in creating a complete

understanding of: market rates faced by-them in respect ‘of

Capital Raising, Investments, Exports, Imports and any other

market risks. Your Bank provides innovative and customised

solutions to cients to hedge foreign curency and interest

rate exposures, enhance: retuns Lreduce, cost of financing

‘through a host of product offerings including Foreign

Exchange Forwards, Options and. Swaps. The cent. offerings,

are supported. by professionals, comprising of Economists and

Research, Analysts, who, provide latest analysis and tools, for

generating quality Risk Management ideas and solutions

Financial Markets conduct proprietary trading to, maximise

earings from rs taking across Key fied income, iquities and

sobal foreign exchange markets. Addtionally, the busines is

responsible for. Balance Sheet Management, Liguisty Monitoring,

maintenance. of Cash, and, Statutory Reserye, requirements

and, day-to-day fund management, of your: Bank, wile raising

subordinated and, hybrid, debt capital for the Bank, Your Bank

was amongst the first.to.implement the MUREX trading

a real time online

platform and launch Forex Solutions

foreign exchange trading solution which provides corporations

a medium to hedge their curency risks online through the

Bank's Corporate Net Banking platform. Your Bank continues

to excel as reflected hereunder

7 (CRA (Moody's afflate in India) has reafirmed your

Bank's Alt rating for its Rs. $0 billion Certificate of

Deposit programme. Alt rating indicates the highest level

Of safety in the short-term

7 FM in association with other business groups successfully

raised INR 3645 million (USD 85 million) in a

combination of Upper Tier I, 15 years Subordinated

Debt (USD 80 million) and Hybrid Tier | (Perpetual

Debt) Capital (USD 5 milion) from Rabobank 2 AAA

rated Bank, in June 2008, FM further raised INR 2000

million of Upper Tier tl Capital from Life Insurance

Corporation of India in September 2008 and INR 1,540

million of Hybrid Tier I Capital in February 2008

7 Your Bank was ranked No. 8 in the Thomson Financials

Top Lead Managers of Indian Rupee Bonds for the

period starting January 2008 to December 2008,

INVESTMENT BANKING

Your Bank sees sustainability as a key driver for economic

growth and to create a competitive advantage in the

market. Through in-depth knowledge on the emerging

sectors of the Indian economy, your Bank identifies and

hamesses untapped opportunities to deliver long-term value

to all its customers.

Your Bank has further reinforced its position as a provider

Of high quality and knowledge based advisory services in

Investment Banking. This fiscal year has witnessed several

additions to the client base, taking the total number of

deals consummated since inception to over 75 across

various product categories within the Financial Advisory

(FAylavestment Banking tear. The performance of the

9

,

product suite including term loans, loan, syndications and

rated, capital. market loan products (pool securitisation,

debentures, commercial paper and loan assignments),

your Bank aims to catalyse growth of the Indian

microfinance industry, ineréasing its access! to a wider

pool of investors, reducing ‘costs of funds through

a mix of lower cost:of funds and transaction costs to

enable scale up. ensuring .provision of affordable, fairly

priced and customised financial solutions to the

Bottom-ofithe-Pyramid, MIG thus is the primary channel

to create an enabling:macts environment through

engagements with stakeholders including MFls, investors

rating agencies, poliéymakers’ government agencies and '

the regulator. m

Direct microfinance lending.- YES SAMPANN isthe first

insttuionaly sponsored diredt intervention model for

microfinance in Inia. It provides the last mile connectivity

at the Bottom-ofthe-Pyrarid fring affordable, customised

fnancal services including credit, davings and insurance

Leveraging téchnology and sing iinovative’risthodolges

such’ credit scoring. YES SAMPANN works’ towards «

creating credit histories for an urban population that

remains excluded from formal finance. Though _

YES SAMPANN is at a pilot stage with operations out

of three urban branches serving more,than 2000+

individual cients, itis strategically positioned to be a full

fledged business group with a portfolio size. in excess of

USD 100 milion and a, client base of | millon in the

next five years

46

Agribusiness, Rural and. Social Banking. (ARSB)

Your Bi as 2 srg fgg 0 asthe bins

ee ae rer

eee eae ee

ice gout

‘ARSB is your Bank's specialised group focused on fulfilling

the financial needs of the agriculture and allied sector. It

extends a range of banking products and services to

various stakeholders across the Agribusiness value chain.

Despite a limited reach in terms of branch network in

rural areas, the group has been able to consistently

achieve Priority Sector Lending (PSL) targets and has also

generated surplus assets for selling down to other banks.

‘This has been achieved. by developing innovative financial

models, some of which have won national and international

‘acclaim at various forums. In 2008) the’ scope of the

group was expanded to Social Banking to cater to the

banking needs of the un-banked and under-banked

sections of society.

Sustainable Investment Banking (SIB)

SIB is your Bank's specialised investment advisory for

sustainable ventures commanding expertise in the areas

of: (i) Alternate Energy & Environment Advisory and (i)

Social Enterprises & Rural Advisory. The team is one of

the few specialised Investment Banking divisions actively

involved in supporting initiatives on renewable energy, clean

technology and socially sustainable sectors (broadly defined

as healthcare, education, livelihood creation, water and

sanitation etc),

The group also acts as the exclusive Country Advisor for

the Global Environment Fund, USA (GEF) one of the

largest and oldest private equity firms focused on investing

in the environmental space, and are advisors to GEF's

Emerging Market Fund

Recognising the importance of a global approach to

sustainabilty and the potential for cross border deal flow,

SIB has developed international alliances, and now acts as

the exclusive Country Advisor for clients of Cleantech

Australasia, New Equity Services (Israel) and Lahti Science

and Business Park (Finland),

SERVICE AND TECHNOLOGY CAPITAL

Your Bank's Service Capital's seamless operations is key to

enabling an environment of Service Excellence and ensures

the perpetual running of various functions across the Bank.

These critical back-end functions include Key Business

Processes, Quality Assurance, External & Internal Service

Delivery Standards, Technology Architecture, Risk

Management and Internal Audit as well as your Bank’s high

quality Human Capital Your Bank has invested significantly

in cutting-edge creative technologies to provide greater

financial efficiency and an unparallel banking experience.

/ BUSINESS PROCESS

Your Bank incorporates sustainable practices into its

business processes to drive added efficiencies and generate

long-term growth. These processes ensure an effective

maintenance mechanism through ongoing feedback and

complaint resolution from employees as well as customers.

Prudent internal and external audit policies, effective risk

management systems, state-of-the-art technology platforms

help ensure implementation of optimum business processes,

both internally and externally.

Some of the ongoing business process initiatives implemented

within your Bank include:

1 Two world-class National Operating Centres (NOC)

based out of Mumbai and Gurgaon have been established

with 2 focus on providing an immediate response to

customer requests, as also to provide Business

Continuity Planning. The NOC houses the centralised

back office functions of various businesses, including the

47

‘YES TOUCH Phone Banking Service Centre, which is

located within the NOC at Gurgaon.

Adherence to, Quality practices such as 5 5, 6 Sigma

and Sub Clauses of the ISO 9001:2000 Standards, All

business processes at both the NOCs and-five key

ioranches are ‘SO, certified

Business processes are supported by the synergised

efforts of business solutions and information technology,

to implement new methods for optimum productivity

(based on Time and Motion and Time and Material

studies)

Benchmarking and critical evaluation of all quality

parameters with competition

Robust methodology of customer feedback and data

collection suchas customer complaint registers,

customer satisfaction surveys, mystery shopping and

employee feedback

‘The Customer Query Management System (COMS) is

used as the one single touchpoint for handling, escalating

and resolving customer grievances.

The Query Resolution Unit (QRU) formed as a part of

the YES TOUCH Phone Banking Service, ensures

effective follow-up and resolution of customer queries

and complaints

End-to-End (E2E) analysis of liability and trade business

processes,

‘A favourable response has been obtained from

customers across India, through participation in the

Customer Satisfaction Survey conducted by The Gallup

Organisation, initiated by the Indian Banks’ Association.

Adherence to BCSBI, Goiporia Committee

recommendations and CPPAPS guidelines.

Quality Assurance a "

Specific Quality Goals have been classified into the

categories of "Process Management" and "External &

Internal Service Delivery, in-line. with your Bank's Quality,

Policy and Quality Objectives '

Process Management (PM) aims te, continually monitor

current processes, benchmark them, against competition,

incorporate best practices, knowledge dissemination and

introduce robust mechanisms for process improvements,

while identifying wastages to drive effective waste

management and cost control. PM-evaluates simplification

of the laid down standards ahd guidelines’ in lind with’ -

regulatory/statutorylstategic requirements, while:driving

improvements and: productivity across functions and

product sets, by rationalising, streamlining and centralsing

processes as appropriate. It also drives standardisation of

Dashboards aid MIS formats’ for contro! ‘ahd review

purposes, basis the metrics ideftified thrdugh the’ cmplaint

resolution feedback méchanism: PM also uses Gi

y fools

to facitate ease of execution f transactions through

automation of manual processes and ensures adequacy, and

eeciveness of training forthe eriployees,

‘Your Bank has been accredited with ISO 9001:2000

certification from BVQI for its back office processes and

operations, Your Bank has also established high standards

in Operational Excellence using process improvement

methodologies. ke Six, Sigma, Lean, Five § & Quality

Gircles.

The Quality Policy at your Bank states - ("YES BANK will

strive to ensure 0 Superior Service Expenence through,

Operational Excellence, Innovation Cutting-edge Technology ,

and Bestin-loss Systems & Processes in its mission to.

become the Best Quality Bark of the World in, India)

External Service Delivery

Enhancement of Customer Satisfaction levels at your Bank

is measured by Dashboards, Voice of the Customer

(VOC), Branch Service Committee Meetings and Sigma

Score Cards. These initiatives not only help forge mutualy

beneficial customer relationships but also ensure stringent

Service Level Agreements (SLAs) with relevant Operations

Units across your Bank Additional, it provides an efficient

MIS support platiorm for effective decision-making at the

management level

Internal Service Delivery

The external service delivery at your Bank, is a

manifestation of the intemal service principles instituted

Within the Bank, that seek to align and influence the

organizational behaviour of your Bank's Human Capital

towards delivering on the stated service value proposition

of providing customers with a - ‘Superior Service

Experience’

The YES SERVICE Programme - an Internal Service

proposition is disseminated through a well-defined and on-

going Service Marketing Programme and measured through

Mystery Shopping, On/Job Montoring and in Branch

Executive Leadership Team (BELT) programmes held

periodically across key branches nationally.

"NO" to NO

INFORMATION TECHNOLOGY

As a new generation Bank, your Bank has the advantage of

accessing the latest avalable technology. Your Bank

effectively uses technology in a cost effective manner to

meet its sustainability goals. To support its Responsible

Banking Intiative, your Bank uses technology as a strategic

business tool across its service arenas,

Since inception, your Bank has been at the forefront of

leveraging technology to provide better products and service

to its customers, in tun helping businesses to expand as

well as helping launch new businesses. This philosophy is

aso reflected in the five brand pilars of your Bank where

technology has been identified as a key pillar and is

considered a true differentiator. Appropriately, technology

has responded by being a true strategic partner with

business. Many frst mover implementations have provided

the business long lasting advantages and have also won

multiple awards and accolades for the Bank

All parts of your Bank use information technology to deliver

superior products and services to the customer. Innovations

like Money Monitor, Mobile payments, Two Factor

‘Authentication, Mobile Banking, Radio Frequency

Identification (RFID) in branches, One View of the customer

relationship, and the most advanced Speech Recognition

enabled IVR helps in delvering superior products and

Addtionally your Bank continues to forge strategic

partnerships with some of the best known IT majors

globally, to develop innovative system features in order

to improve process efficiencies and create sector-specific

banking solutions. Additionally the development of a robust

Busine’s Continuity Plan in your Bank addresses risks and

secures systems that are vital to business operations.

49

‘This year with special focus on Responsible Banking, the

following initiatives were undertaken:

1 Video Conferencing. was deployed in 5 key locations to,

help reduce travel costs as also helping. in reducing

‘energy consumption

Centralised Branch Sénlefs rollout leading to Ssifcént

reduction in thé nue of servers and: operating

costs, One of the key benefits & reduction in the

consumption of power by servers as well 35 cooling of

the servers (more than 8056 savings). «

Replacement of conventional monitors, with TFT

screens, further reducing the electricity consumption.

Financing opportuitiéi't3 the "unbanked! segment of

society were backed Tethnology.” 1 *

In this year, your Bank also completed the following. key

initiatives; :

+ Canomer Relaonaip Hanagement (Ca) iia

launched across the Bank to’ improve effectiveness of

sess sence

+ One View Soluion® infodictin &F "One View" 3

the entre interrelation fo he Sales nd

Service department: thas reed in "ocued” and

meaning sling both upatng and eons sting,

thereby cirecty helping the businesses. to generate

revenues and seize opportunities faster due to better

information avaiable at the Point of Sie

+ Your Bank has been at the forefront of Open Source

usage. The Knowledge portal KNET ie baséd on an

Open source platforin. The CRM systém is an opeh

souice appliition, wich is buit dh’top of the open

source platform

4 Customer Service, Complaing and Query Management

system offers one. view of, customer service request

complaints and queries, thus enhancing our employee

abiity to respond to customer needs

50

During this period your Bank was also widely recognised for.

its technology differentiation,

# The Technology team at your Bank was the fist

runner-up to’ thé prestigious ‘IT Team of the Year’

award by Indian Banks’ Association (BA),

Your Bank has adopted international best practices, the

highest standards of service quality and operational

excelence. with innovatve sate-ofthe art technology. and

offers comprehensive banking ‘and’ financial solutions to all its

valued customers."Yotir’Balk has always aimed to offer a”

‘One Bank solution” to customers across the Corporate

and Retail segments wing superior technology and Lean

processes

/ PARTNERS

A

To achieve sustainability goals, your Bank has formed

strategic relationships with eminent Indian and global

companies. These partnerships. wil, aot only widen

business platforms but will also lay the foundation for a

sustainable future

Organisation _ i Purpose |

Agriculcural Insurance Company | Agricultural insurance

Bajaj Allianz ~ | General Insurance 4

Bhare Airtel Telecom Connectivity

BillDesk Online Bill Payment Facility ~

CashTech ‘ Cash Management and Financial Supply Chain Solutions |

ome . NSDL Depository Participation (OP) -

cisco. Technology Innovation and Infrastructure |

[De La Rue Teller Automation and Cash Dispenser Machines i

eFunds ATM and Card Payments Solutions |

IBM ; Technology Hardware 7 ~

Ineel Technologies ‘Wireless Fidelity (Wi-Fi) Branch Banking Solutions =

|_| P Morgan Chase | International Pre-paid Travel Card -

MasterCard International International Gold and Siver Debit Cards

Max New York Life : |. Life insurance = ~—

| Murex Integrated Risk Management and Treasury Solution = |

Microsoft Enterprise Agreement for Servers, Desktops and other products

NABARD/NABCONS Strategic Advisory for Food and Agribusiness Sector _

NewGen Software Technologies | Cheque Truncation Solution -

NSIC Financial Solutions and Advisory for Small Scale Industries

Nuance YES TOUCH Phone Banking Service - Speech Recognition Solution

Nucleus Sofeware Retall Assets Platform

‘Obopay Mobile Payments 7 |

Oracle Financial Services Core Banking and Internet Banking Solution i

“Portwise _[__internet Banking Security Soltions

Reliance Infocomm WAN MPLS Backbone and Data Centre Hosting |

Reuters Dealing Solution and Online Forex Trading Platform

Servion Glabal [Integration Partners for the YES TOUCH Phone Banking Service

SIDBI | Financial Solutions for SMEs a

Sify Communications Redundant WAN MPLS Backbone and ATM Connectivity

VSNL Data Centre Hosting

Wipro Total Technology Outsourcing na

Wincor Nixdorf "| Self Service Solutions: Automated Teller Machines (ATM) and Financial Kiosks

| Yodlee Ine —_[__Money Moritor-Oniine Personal Finance Management ]

on

Managing and reducing business risks play @ pivotal role in

achieving long-term financial security and success. To ensure

the same, your Bank has a fullfledged risk management

department in place. Through proactive and improved risk

management practices, your Bank’s.risk management function

continuously works towards achieving financial stabilty”and

enhancing stakeholder value

Your Bank's risk management function believes jn continual

enhancement of its stakeholders! value through proactive and

improved risk management practices

‘The Risk Management Architecture, of your Bank is overseen

by The Risk Monitoring Committee (RMC), an independent

sub-committee that strives to put in place specie policies,

frameworks and systems for effectively managing various risks

‘These policies and procedures are constantly reviewed and

Updated at regular intervals

Credit Risk

Your Bank follows @ comprehensive and well-defined cregit

approval processes for all proposals to clearly outine the

quantum of risk associated with thém’ “These processés

encompass a detalled riskvassessmerit and rating of all

blgors using the Bank's rating models, These models have

bbeen developed in conjunction with 2 reputed external

credit rating agency and cover all business segments of your

Bank The rating model covers various parimeters lke

management risk, industry risk, apart from detailed financial

analysis. -

‘The credt approvals happen thrbUgh slib-cormmittees of"

RMC ike the Management Credit, Committee/internal Gredit

Committee and specified management functionaries vested

with the sanctioning power. While exercising their financial

powers, these designated domimitiees/iunctiohares exiercise

the highest level of due dligence, and ensure adherence to

the Bank's Credit policy and other regustory guidelines

Your Bank has also'taken pro-active’ measures in the’ current

economic scenario to ensure that delinquencies are: °

52

maintained at minimum level, through robust post sanction

monitoring processes. There is an independent and

dedicated team of experts-who work towards: ensuring”

compliance of the sanction terms and conditions through

an intemal deferal tacking sytem: generating portfoio,

tevél MIS, Gbvering various aspects lke overdue analjis‘of

business'segmentwise, portfolio analysis by ratingWindustry,

__ key portfolio indicators and maintaining documentation.

standards. Your Bak’ leal department and exer eg

counselors have developed a comprehensive set of”

standard’ documents for various types of credit products

“The Risk Management function of your Bank works in close

co-ordination with various business segments to periodically

review the iridividual borrower relationships, identify early

warning signalsyand assess the overall health: of borrowing

units

Your Bank hat Successfully migrated %6"BASEL H ptal

adequacy norms forthe year ending’ March. 3h 2008. +

‘Your Bank has aso formulated an extensive polcyon,

Internal Capital Adequacy Assessment Process (ICAP)

commensurate with the Bank's size, level of comply,

tsk profle andsscope of operations" "

Markee Risk

Your 'Bini’s Mirket Rsk management is governed by. &

comprehensive Market Rsk Policy, ALM Policy, gui,

Policy, Investment Policy and Customer Appropriateness

Policy, to erate consistency across business activités and

aggregite similar rks, These policies havebeen bendtirked

with industry: best practices and RBI regulations. Your- Bark

has an integated and straight-through processing, state-of

"tear weary sjstem for enabing beter risk managerent,

‘Your Bank measures iquiity, crrency, and interest, cates

through various metrics viz EWMA based Value at Risk

(VaR), Earrings at Fisk (Ea), Duration of Equity, Senstoity

‘Analysis eke. using internal risk models! YS" Bank Fegulary

conducts sires. testing to moritor is vulnerabity towards

unfavourable shocks: Your Bark has ako complied with. the

requirements of the Basel Il capital accord for Market. Risk

Your Bank monitors and controls its risk using various

internal and regulatory risk limits for its trading book and

banking book which are set according to a number of

criteria including economic scenario, business strategy,

‘management experience, peer analysis and the Bank's risk

appetite. The risk reporting mechanism of your Bank

comprises of disclosures and reporting to the various

rmanagerent committees vz. Investment Committee, Asset

Liability Committee, Risk Monitoring Committee, etc.

Operational Risk

Your Bank has in accordance with the regulatory guidelines,

implemented a comprehensive operational risk management

policy and put in place a framework to identify, assess

‘and monitor risks: strengthen controls; improve customer

service: and minimise operating losses. Your Bank has also

constituted the Operational Risk Management Committee,

which is the primary driver for implementing the best

industy practices in Operational Rise Management. Further,

to ensure full complance with the requirements of the

Basel Il capital accord and Reserve Bank'of India guidelines,

your Bank has adopted the Basic Indicator Approach for

measurement of Operational Risk

INTERNAL AUDIT

To ensure that sustainabilty principles are followed across ll

employee levels, your Bank's Internal Audit Department

performs independent and objective assessment to monitor

adequacy, effectiveness and adherence to the intemal controls,

processes and procedires instituted by the management.

This function supports your Bank's role in safeguarding its

assets. The function has adopted a Risk-based approach of

Internal Audit (RBIA). The primary focus of the audit is on

key risk areas, which are of substantial importance to the

Bank The RBIA approach, has been thoughtfully structured

taking into account RBI guidelines and international best

practices. The Internal Aucit function reports to the Managing

Director & CEO for regular activities and to the Audit and

Compliance Committee for Aucit Planning & Reporting.

‘Additionally, your Bank also subjects its operations 10

Concurrent Audit by reputable audit firms to complement its

internal audit function The Concurent Audit covers core

activities such as credit portfolio, financial markets, operations,

and branches, All audit reports are circulated to the relevant,

Management teams and the Audit and Compliance Committee

of the Board

HUMAN CAPITAL MANAGEMENT

Your Bank étvates an environment where people with

diverse backgrounds come together to create long-term

value, Your Bank has hired the finest quality Human Capital

across ail ts function® and businesses. This young and

extremely dynamic workforce has sklle to work effecively

across organisational boundaries and to build a culture that

shifts the focus from actives to outcomes, Equipped with a

team of indusuy and barking experts, your Bank continvouty

develops qualty performance while realsng customer service

objectives, creating positive employee atttuces through

effecve recognition, programs and measuring results through

consstent customer feedback

‘The aim is to build a culture and environment that supports

Professional Entrepreneurship,

The Human Capital engagement practices at your Bank are

targeted towards developing the Bank brand as the

. Your Bank continues to

focus strongly on attracting and retaining the best talent

Preferred "Employer of Cho

from India and abroad, Within a short span of time, the

Management team at your Bank has been regarded as one

of the best in the Indian Barking sector, as demonstrated

by the several recognitions and awards received over the

last five years. Some of the key features of your Bank's

policies and practices are

Talent Acquisition & Development

Your Bank aims to become an "Employer of Choice” for

the brightest and best quality Human Capital avaiable in the

market. The total employee strength of your Bank, as on

March 31, 2009 was 2671

Building superior Human Capital Management frameworks is

fone of the key objectives of your Bark This, we believe,

will be achieved through co-ordinated efforts, through high

533]

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Ye Ar Winner S Fina L Scor e Runners-Up Venue Location Attenda Nce Refere NcesDokument3 SeitenYe Ar Winner S Fina L Scor e Runners-Up Venue Location Attenda Nce Refere NcesHarsha DuttaNoch keine Bewertungen

- Seating ArrangementDokument21 SeitenSeating ArrangementHarsha DuttaNoch keine Bewertungen

- Pairs TradingDokument30 SeitenPairs TradingSwapnil KalbandeNoch keine Bewertungen

- AE Jan15 Assignment-1Dokument1 SeiteAE Jan15 Assignment-1Harsha DuttaNoch keine Bewertungen

- EEE F312 Power Systems 2014-15Dokument3 SeitenEEE F312 Power Systems 2014-15Harsha DuttaNoch keine Bewertungen

- Econ F214Dokument2 SeitenEcon F214Harsha DuttaNoch keine Bewertungen

- Advice - On Becoming A Quant PDFDokument20 SeitenAdvice - On Becoming A Quant PDFBalu MahindraNoch keine Bewertungen

- Econ-Fin Course DescriptionDokument4 SeitenEcon-Fin Course DescriptionHarsha DuttaNoch keine Bewertungen

- IT Lec 4Dokument12 SeitenIT Lec 4Harsha DuttaNoch keine Bewertungen

- ECE EEE F311 Introduction Aug 4 2014Dokument18 SeitenECE EEE F311 Introduction Aug 4 2014Harsha DuttaNoch keine Bewertungen

- Timetable Ii Sem 2014-15 PDFDokument46 SeitenTimetable Ii Sem 2014-15 PDFHarsha DuttaNoch keine Bewertungen

- NCFM BsmeDokument96 SeitenNCFM BsmeAstha Shiv100% (1)

- EBE Dummy VariablesDokument9 SeitenEBE Dummy VariablesHarsha DuttaNoch keine Bewertungen

- IT Lec 3Dokument11 SeitenIT Lec 3Harsha DuttaNoch keine Bewertungen

- EMEC 1 5th Aug 2013Dokument25 SeitenEMEC 1 5th Aug 2013Harsha DuttaNoch keine Bewertungen

- EEE F313 INSTR F313 AnalogandDigitalVLSIDesignFIrstSem 2014 15Dokument2 SeitenEEE F313 INSTR F313 AnalogandDigitalVLSIDesignFIrstSem 2014 15Harsha DuttaNoch keine Bewertungen

- EBE HeteroscedasticityDokument5 SeitenEBE HeteroscedasticityHarsha DuttaNoch keine Bewertungen

- EBE HeteroscedasticityDokument5 SeitenEBE HeteroscedasticityHarsha DuttaNoch keine Bewertungen

- ECE EEE F311 Introduction Aug 4 2014Dokument18 SeitenECE EEE F311 Introduction Aug 4 2014Harsha DuttaNoch keine Bewertungen

- EEE C371-First Semester 2013-2014 EMACDokument4 SeitenEEE C371-First Semester 2013-2014 EMACHarsha DuttaNoch keine Bewertungen

- Setlabs Briefings Business AnalysisDokument88 SeitenSetlabs Briefings Business AnalysisaustinfruNoch keine Bewertungen

- Ece Eee f311 PM and FM Sept 3 - 11 2014Dokument36 SeitenEce Eee f311 PM and FM Sept 3 - 11 2014Harsha DuttaNoch keine Bewertungen

- Random Varaibles Processes and Noise Aug 11 - 18, 2014Dokument26 SeitenRandom Varaibles Processes and Noise Aug 11 - 18, 2014Harsha DuttaNoch keine Bewertungen

- Chapter 12 Testing For Autocorrelation (EC220)Dokument81 SeitenChapter 12 Testing For Autocorrelation (EC220)Harsha DuttaNoch keine Bewertungen

- Assignment 1Dokument1 SeiteAssignment 1Krishna GhantasalaNoch keine Bewertungen

- 03a. Political Obligation and AuthorityDokument25 Seiten03a. Political Obligation and AuthorityHarsha DuttaNoch keine Bewertungen

- Box-Jenkins Analysis: Plan of SessionDokument20 SeitenBox-Jenkins Analysis: Plan of SessionAnokye AdamNoch keine Bewertungen

- Manchester United Financial StatementsDokument9 SeitenManchester United Financial StatementsHarsha DuttaNoch keine Bewertungen

- PS-1 ReportDokument40 SeitenPS-1 ReportHarsha DuttaNoch keine Bewertungen