Beruflich Dokumente

Kultur Dokumente

Notification 392016

Hochgeladen von

kshitijsaxena0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

17 Ansichten1 SeiteIT noti

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenIT noti

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

17 Ansichten1 SeiteNotification 392016

Hochgeladen von

kshitijsaxenaIT noti

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

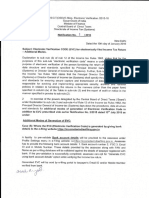

(TO BE PUBLISHED IN THE GAZETTE OF INDIA EXTRAORDINARY, PART IL,

SECTION 3, SUB-SECTION (ii)|

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

(DEPARTMENT OF REVENUE)

(CENTRAL BOARD OF DIRECT TAXES)

NOTIFICATION

New Delhi, the 31% May, 2016

INCOME-TAX

9, ‘

S.0.19%rin exercise of the powers conferred by section 200 read with section 295 of the

Income-tax Act, 1961 (43 of 1961), the Central Board of Direct Taxes, hereby, makes the

following rules further to amend the Income-tax Rules, 1962, namely:

1. (1). These rules may be called the Income-tax (13 Amendment) Rules, 2016.

(2). They shall come into forcefrom the 1" day of June, 2016...

2. In the Income-tax Rules, 1962, in rule 29B, in rule 31A, in sub-rule (4A), for the

words “seven days”, the words “thirty days”shalll be substituted;

[Notification No. 39 /2016, F. No.142/29/2015-TPL]

(R. LAKSHMI NARAYANAN)

UNDER SECRETARY, (TAX POLICY AND LEGISLATION)

Note: The principal rules were published in the Gazette of India , Extraordinary, Part II,

Section 3, sub-section (it) vide notification number S.0.96%(E), dated the 26" March,

1962 and last amended vide no! n number $.0. 1655 (E), dated 05/05/2016.

Das könnte Ihnen auch gefallen

- Circular No 65Dokument7 SeitenCircular No 65AbdulMoiz QuadriNoch keine Bewertungen

- Events After The Reporting Date: Accounting Standard For Local Bodies (ASLB) 14Dokument14 SeitenEvents After The Reporting Date: Accounting Standard For Local Bodies (ASLB) 14kshitijsaxenaNoch keine Bewertungen

- SEBI Registered Investment Adviser Application ProcessDokument14 SeitenSEBI Registered Investment Adviser Application ProcesskshitijsaxenaNoch keine Bewertungen

- Meta Stock Pro ManualDokument576 SeitenMeta Stock Pro ManualFlavio GaluppoNoch keine Bewertungen

- BCG Emerging Market Companies Up Their Game Oct 2018 Tcm9 204262Dokument26 SeitenBCG Emerging Market Companies Up Their Game Oct 2018 Tcm9 204262kshitijsaxenaNoch keine Bewertungen

- Notice: Ordinary BusinessDokument17 SeitenNotice: Ordinary BusinesskshitijsaxenaNoch keine Bewertungen

- Taxguru - in-gST On Inward Supply of Capital GoodsDokument7 SeitenTaxguru - in-gST On Inward Supply of Capital GoodskshitijsaxenaNoch keine Bewertungen

- Revised Model GST LawDokument39 SeitenRevised Model GST LawkshitijsaxenaNoch keine Bewertungen

- C&W Technical DetailsDokument37 SeitenC&W Technical DetailsAnonymous n6l2IyNoch keine Bewertungen

- Moni Subba ALVDokument29 SeitenMoni Subba ALVkshitijsaxenaNoch keine Bewertungen

- JW W ArticleDokument6 SeitenJW W ArticlekshitijsaxenaNoch keine Bewertungen

- Knowledge Level of Professional Accountants in Financial Reporting MeasurementDokument6 SeitenKnowledge Level of Professional Accountants in Financial Reporting MeasurementkshitijsaxenaNoch keine Bewertungen

- IIA Diploma: P2 Financial Risks and ControlsDokument19 SeitenIIA Diploma: P2 Financial Risks and ControlskshitijsaxenaNoch keine Bewertungen

- Bare Law On GST Edition AugustDokument465 SeitenBare Law On GST Edition AugustkshitijsaxenaNoch keine Bewertungen

- Market LiquidityDokument13 SeitenMarket LiquiditykshitijsaxenaNoch keine Bewertungen

- Full Text: Supreme Court Sabarimala Temple VerdictDokument411 SeitenFull Text: Supreme Court Sabarimala Temple VerdictThe Indian Express97% (33)

- Ravi Kant Vs Income Tax Officer On 13 July, 2007Dokument3 SeitenRavi Kant Vs Income Tax Officer On 13 July, 2007kshitijsaxenaNoch keine Bewertungen

- Notification1 2016 EvcDokument2 SeitenNotification1 2016 EvckshitijsaxenaNoch keine Bewertungen

- Notification 4 2016nDokument3 SeitenNotification 4 2016nkshitijsaxenaNoch keine Bewertungen

- Supreme Court Verdict On Section 377Dokument493 SeitenSupreme Court Verdict On Section 377The Indian Express100% (1)

- ClimaxTop BookletDokument16 SeitenClimaxTop BookletJeffrey LiuNoch keine Bewertungen

- Notification No. G.S.R. 332E Income Tax Dated 03.04.2018Dokument179 SeitenNotification No. G.S.R. 332E Income Tax Dated 03.04.2018kshitijsaxenaNoch keine Bewertungen

- Efficient Capital Markets A Review of Theory and Empirical WorkDokument36 SeitenEfficient Capital Markets A Review of Theory and Empirical WorkBerliana Anggun DewintaNoch keine Bewertungen

- Supreme Court Judgment On AdulteryDokument243 SeitenSupreme Court Judgment On AdulteryFirstpost91% (11)

- Morningstar-AdvisorGuide SimpleButNotEasy 060716Dokument37 SeitenMorningstar-AdvisorGuide SimpleButNotEasy 060716kshitijsaxenaNoch keine Bewertungen

- RECORD, Volume 24, No. 3: New York Annual Meeting October 18-21, 1998 Session 48OF Psychology of InvestingDokument26 SeitenRECORD, Volume 24, No. 3: New York Annual Meeting October 18-21, 1998 Session 48OF Psychology of InvestingkshitijsaxenaNoch keine Bewertungen

- Consequences For Option Pricing of A Long Memory in VolatilityDokument56 SeitenConsequences For Option Pricing of A Long Memory in VolatilitykshitijsaxenaNoch keine Bewertungen

- Forecasting S&P 100 Volatility: The Incremental Information Content of Implied Volatilities and High Frequency Index ReturnsDokument35 SeitenForecasting S&P 100 Volatility: The Incremental Information Content of Implied Volatilities and High Frequency Index ReturnskshitijsaxenaNoch keine Bewertungen

- Vol4 PDFDokument21 SeitenVol4 PDFkshitijsaxenaNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)