Beruflich Dokumente

Kultur Dokumente

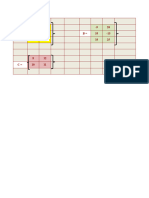

Management Services (MS) : ND ST RD

Hochgeladen von

Kindred WolfeOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Management Services (MS) : ND ST RD

Hochgeladen von

Kindred WolfeCopyright:

Verfügbare Formate

MANAGEMENT SERVICES (MS) 21.

NOTE: Ending > Beginning, P>S, Ay > Vy

1 A 25 B ∆ Income = (2,000 – 0) 64,000 ÷ 10,000

2 A 26 C

3 B 27 C 23. MS x CMR = profit MS = 1,200 ÷ 25%

4 A 28 B

5 D 29 A 26. Total relevant unit cost to make: 14 + 18 + 40% (18 x

6 D 30 A 0.75) + 60% [60% (18 x 0.75)]

7 B 31 D

8 D 32 D 27. Make: 42.26 Buy: 45

9 C 33 B

30. LRV: 83,000 (11.8 -12)

10 C 34 D

11 D 35 A

31. LEV (usage): [83,000 – 10,000 (8)] 12

12 B 36 C

13 C 37 A 32. AFOH (V): 556,100 BAAH (V): 83,000 (6)

14 C 38 B

15 D 39 B 33. BAAH (V) 83, 000 (6) BASH (V): 80,000 (6)

16 C 40 B

17 A 41 C 36. CM per hour

18 C 42 A Product A: 12 ÷ 3 hours = P 4 (2nd)

19 B 43 C Product B: 2 x (60/10) = P 12 (1st)

20 C 44 A Product C: 5 ÷ 2 hours = P 2.5 (3rd)

21 B 45 B

22 B 46 C 37. Distribution of limited 20,000 hours

23 C 47 D Product B: 4,000 hrs ← 24,000 u ÷ (60/10)

24 C 48 C Product A: 6,000 hrs ← 2,000 u x 3 hrs/u

Product C: 10,000 hrs ← 5,000 u x 2 hrs/u

2. DOL = CM ÷ profit = CMR ÷ profit ratio

DOL = 40% + 8% 38. 24,000 u (2) + 2,000 u (12) + 5,000 u (5)

4. Sell: P 340,000 40. 98% (70,000 x 60%) + (68,000 x 40%)

Process: 520,000 – 150,000 = P 370,000

6. The “sum of the squared value of costs” 41. 60,000 (60% x 98%) + 60,000 (40%)

(4,259 is not used in least-squares method.

43. MPPV: 15,000 (2 – 2.5) + 10,000 (2.1 – 2.5)

7. If closing stocks exceed opening stocks, then production

must be higher than sales. 44. MPUV: 13,000 (2 – 2.5) + 10,000 ( 2.1- 2.5)

8. Production: 100,000 + 10,000 – 20,000 Material B 45. MQV: [925,000 – 2,000) – 11,000 (2)] 2.5

Purchases:

90,000 (3) + 24,000 – 22,000 46. DM Var.: 2,500 U (MQV) + 10,500 F (MPUV)

9. Product B’s variable costs: P 155,000 48. RoI = MARgin x TURnover

= 80,000 + 50,000 + 15,000 + 10,000 24% = 15 % x Turnover

Product B’s avoidable fixed costs: P 36, 000

= 60% (35,000) + 50% (30,000) MS Quiz 3

Product B’s segment margin: Date: within 2nd week of August (earliest )

200,000 – 155,000 – 36,000 Coverage: 07, 08, 09 & El (Macroeconomics)

10. Choice A affects quantity supplied (not supply). Choices B NOTE: all problems, no theories

and D affect demand.

MS Quiz 4

11. Sales: (90,000 + 30,000) ÷ (20 – 12) Date: within 4th week of August (earliest )

∆ Coverage: 10, 11& 12

12. BEP (now): 90,000 + 8 = 11,250 units (@20) NOTE: all problems, no theories

BEP (now): 90,000 ÷ 10 = 9,000 units (@22)

MS Quiz 5

13. Residual Income = (+) → RoI > minimum RoI Date: within first week of September

Residual Income = zero → RoI = minimum RoI Coverage: 01 to 12. A to F (all topics!)

Residual Income = (-) → RoI < minimum RoI NOTE: all theories, no problems

14. Controller has no authority over the shipping clerk; Line

authority exists in choices B and D.

15. Scrap: 10% x 50,000 = P 5,000

Modify: 25,000 – 14,200 = P 10,800

18. TMC: 23,000 + 6,000 – 7,000 = 22,000

DMused: 22,000 – 16,000 – 3,000 = 3,000

DMending: 5,000 + 17,000 – 3,000 = P 19,000

20. Unit VC: (8,000 – 5,000) ÷ (3,000 – 1,500)

Annual fixed costs: [5,000 – 1,500(2)] 12

MS Final Preboard Exam solutions to selected items (October 2014 batch)

1. Sell: P 6 ( 1,000 units) = P 6,000 36. Cost of debt: 5% (1 – 0.4)

Process: P 10 (1,000 units) – 2,000 = P 8,000 Equity weight: (2M + 7M) – 1M – 4M = 50%

Joint costs are considered irrelevant. WAAC: 50% (3%) + 50% (15%)

WACC is based on equity and long-term debts.

2. Present cash OUT: cost of new machine

Present cash IN: salvage of old machine 37. EVA: 60% (1.5M) – 9% (9M – 1M)

3. Choices A & D: current ratio will decrease 39. Production: 80,000 + 18,000 – 15,000

Choice B: no effect on current ratio DM purchases: 83,000 (5) + 23,000 – 27,000

SUGGESTION: assume amounts with a current ratio

of 4 times as starting point. 40. @ IRR: NPV = 0 or probability index = 1

4. 107,000 = 50% (90,000) + 30% (80,000) + 20% 41. Weighted average CMR

(95,000) + cash sale 30% (20%) + 60% (33.33%) + 10% (50%)

Over-all BES: 18,600 ÷ 31% = P 60,000

6. Cost: 100,000 + 0.01% (3M x 360) = 208,000

Benefit: 6% (3M x 2 days) = 360,000 43. Carrying costs: 100 x (25% x 10) = 250

Stock-out costs: 15% (30x2) 20 = 180

8. VFOH: (2,150 – 1,450) ÷ (75 -40) = 20

At 80% capacity: 20(80) = P 1,600 45. Equity: 1.4 M (40÷70) = 800,000

Dividend: 2M – 6% (10M) – 800,000

10. ARR: (1,000 – 325) ÷ (6,500 ÷ 2) Dividend payout: 600,000 ÷ 2M

11. A firm is most likely to offer cash discounts when 46. Division Z5’s segment margin

competitor also offers the same and the firm is in 50,000 – 42,000 – 70% (6,400)

Need of cash (i.e., early collection).

48. MQV: 30,000 U = (215,000 – SQ) 2

12. Cost of preferred stock: 10 ÷ (107 – 5) Production: 200,000 ÷ 4

Tax effects are considered only for debts.

50. 300 v [150 days – (300 ÷ 6)]

13. Expert systems are also called “knowledge- based

systems” 52. (6,000 – 4,000) x (100,000 ÷ 5,000)

14. Breakeven pt: 247,500 ÷ 45% = 550,000 54. Investment: 7, 554 – 2,500 = 5,054

Safety margin: 900,000 – 500,000 = 350,000 Payback: 2 + 0.36*years

*(5,054 – 4,200) ÷ 2,400

15. Unit sales: (247,500 + 315,000) ÷ 22.5

Additional sales: 25,000 units – 18,000 units 55. Learning rate: 192 ÷ 240

Units Average Total

17. Depreciation, being a non-cash expense is, not 500 240 P 120,000

Considered in NPV. NPV considers its tax effect. 1,000 192 P 192,000

18. DM purchases: 95,000 + 20,000 – 15,000 57. AFOH (V): 210,000

BAAH (V): 19,000 (10)

19. TMC: 257,500 + 10,000 – 7,500 = 260,000

DL: 260,000 – 95,000 – 75,000 58. Based on labor hours: 50% vs 50%

Based on product-level: 33.3% vs. 66.7%

21. CM: 500,000 (3- 0.6) = 1.2 m

EBIT: 1.2 M – 110,000 = 1,090,000 59. Square root of: (2x 35,000 x 8) ÷ [12% (25)

DFL: 1,090,000 ÷ (1,090,000 – 60,000) + 0.50] = 400 dozens

24. AR: (7.2 M ÷ 360) x (36 – 28) = 160,000 inc. 60. 350 days ÷ (35,000 ÷ 4 dozens)

Savings: 6% x 160,000

61. Cost to make: 2 + 12 + 5+ 7 + 3 = 29

25. Residual Income: (+) → RoI > Min. RoI Cost to buy: 27

Residual Income (-) → RoI < Min. RoI

62. Dividend yield x PE ratio = Dividend Pay-out

26. Cash OUT: 30,000 – 2% (50,000 – 20,000)

Cash IN: 500,000 – (50,000 – 20,000) 63. Savings: (75-70) 1,000

Effective rate: 29,400 ÷ 470,000

64. Y = 30,500 + 8x

28. Application rate: 300,000 ÷ (25,000 x 6) = 2

Applied FOH: 162,500 x 2 = 325,000 65. Non- negativity constraint: X, Y ≥ 0

30. “High customer loyalty” applies to monopolistic 67. [(160,000 x .6) – (14% x 200,000)]

Competition rather than perfect competition.

68. Controllable (CON) Variance = Spending (5)

31. (316,000 + 144,000) ÷ (50% - 10%) Variance + Efficiency € Variance

33. Applied FOH: (4,750 x 2) x (80,000 ÷ 10,000) 69. CAPM: 9% + 0.8 (15% - 9%)

70. Non- conformance costs are composed of

internal failure and external failure costs.

Das könnte Ihnen auch gefallen

- Sol. Man. - Chapter 16 - Ppe Part 2 - Ia Part 1B 1Dokument15 SeitenSol. Man. - Chapter 16 - Ppe Part 2 - Ia Part 1B 1Rezzan Joy Camara MejiaNoch keine Bewertungen

- Property, Plant and Equipment (Part 2) : Problem 1: True or FalseDokument16 SeitenProperty, Plant and Equipment (Part 2) : Problem 1: True or FalseChrismae Monteverde SantosNoch keine Bewertungen

- Sol. Man. - Chapter 16 - Ppe Part 2 - Ia Part 1BDokument10 SeitenSol. Man. - Chapter 16 - Ppe Part 2 - Ia Part 1BMahasia MANDIGAN100% (1)

- Mas 1st PB October 2022 Suggested SolutionDokument8 SeitenMas 1st PB October 2022 Suggested SolutionAsnifah AlinorNoch keine Bewertungen

- 3rdfile MAS Module 2Dokument24 Seiten3rdfile MAS Module 2krisha hortinelaNoch keine Bewertungen

- MS Practice SetsDokument2 SeitenMS Practice SetsKindred WolfeNoch keine Bewertungen

- CA Inter FM SM A MTP 2 May 2024 Castudynotes ComDokument19 SeitenCA Inter FM SM A MTP 2 May 2024 Castudynotes ComsanjanavijjapuNoch keine Bewertungen

- P1. PRO O.L Solution CMA September 2022 ExaminationDokument6 SeitenP1. PRO O.L Solution CMA September 2022 ExaminationAwal ShekNoch keine Bewertungen

- Property, Plant and Equipment (Part 2) : Problem 1: True or FalseDokument13 SeitenProperty, Plant and Equipment (Part 2) : Problem 1: True or FalseJannelle SalacNoch keine Bewertungen

- Fim Model SolutionDokument7 SeitenFim Model Solutionhyp siinNoch keine Bewertungen

- Business & Finance Chapter-7 Part-03 PDFDokument22 SeitenBusiness & Finance Chapter-7 Part-03 PDFRafidul IslamNoch keine Bewertungen

- Final Examination: Suggested Answers To QuestionsDokument15 SeitenFinal Examination: Suggested Answers To QuestionsidealNoch keine Bewertungen

- Chapter 5 SolutionsDokument7 SeitenChapter 5 SolutionsUsaidMandviaNoch keine Bewertungen

- (BA 118.1) Mock 1st LE AKDokument6 Seiten(BA 118.1) Mock 1st LE AKAiryleenVarquezNoch keine Bewertungen

- Umipig AbbyMarileth Interim2Dokument3 SeitenUmipig AbbyMarileth Interim2abbyyyyy.mariNoch keine Bewertungen

- Chapter 22 - Teacher's Manual - Far Part 1bDokument13 SeitenChapter 22 - Teacher's Manual - Far Part 1bPacifico HernandezNoch keine Bewertungen

- Alba, Camille Joy M. MGT211: Total Cost 240,000.00Dokument4 SeitenAlba, Camille Joy M. MGT211: Total Cost 240,000.00Camille Joy AlbaNoch keine Bewertungen

- Decesion MakingDokument11 SeitenDecesion MakingShoaib NaeemNoch keine Bewertungen

- For Reg 1Dokument7 SeitenFor Reg 1Shynne MabantaNoch keine Bewertungen

- VARAIBLE COSTING (Solutions)Dokument8 SeitenVARAIBLE COSTING (Solutions)Mohammad UmairNoch keine Bewertungen

- Solutions Manual Management Accounting Sixth Canadian Edition 6th Edition HorngrenDokument33 SeitenSolutions Manual Management Accounting Sixth Canadian Edition 6th Edition HorngrenErika LanezNoch keine Bewertungen

- Sol. Man. - Chapter 7 - Notes (Part 1)Dokument13 SeitenSol. Man. - Chapter 7 - Notes (Part 1)natalie clyde matesNoch keine Bewertungen

- Team PRTC 1stPB May 2023 - Key AnswersDokument51 SeitenTeam PRTC 1stPB May 2023 - Key Answerskathryn b. fordNoch keine Bewertungen

- Cpa Review School of The Philippines Manila Advanced Financial Accounting and Reporting First Preboard Examination SolutionsDokument12 SeitenCpa Review School of The Philippines Manila Advanced Financial Accounting and Reporting First Preboard Examination SolutionsSophia PerezNoch keine Bewertungen

- Partners (Because TAC TCC PAC (New)Dokument5 SeitenPartners (Because TAC TCC PAC (New)BromanineNoch keine Bewertungen

- Accounts Assignment 104Dokument6 SeitenAccounts Assignment 104busybeefreedomNoch keine Bewertungen

- No CO Mapping (Each Should Be From The Same CO(s) )Dokument7 SeitenNo CO Mapping (Each Should Be From The Same CO(s) )Arman PaniNoch keine Bewertungen

- Notes (Part 1) : Accounting Policies, Changes in Estimates and ErrorsDokument13 SeitenNotes (Part 1) : Accounting Policies, Changes in Estimates and ErrorsPaula Bautista100% (2)

- Ea1 Probs 1Dokument6 SeitenEa1 Probs 1Kim CarreraNoch keine Bewertungen

- I. Payback Period Same CF Project A Different CF Project BDokument6 SeitenI. Payback Period Same CF Project A Different CF Project Bzh12w8Noch keine Bewertungen

- For More ACCA Study Materials, Tutor Support, Exam Tips VisitDokument2 SeitenFor More ACCA Study Materials, Tutor Support, Exam Tips VisitNeel KostoNoch keine Bewertungen

- Cost Management AssignmentDokument29 SeitenCost Management AssignmentInanda MeitasariNoch keine Bewertungen

- 281 Winter 2015 Final Exam With Key PDFDokument15 Seiten281 Winter 2015 Final Exam With Key PDFAlex HoNoch keine Bewertungen

- COST BEHAVIOR (Solution)Dokument4 SeitenCOST BEHAVIOR (Solution)Omer SiddiquiNoch keine Bewertungen

- Sevilla - Unit3 - Noncurrent Asset Held For Sale and Discontinued OperationDokument1 SeiteSevilla - Unit3 - Noncurrent Asset Held For Sale and Discontinued OperationHensel SevillaNoch keine Bewertungen

- Consignment Sales: Problem 9-1: True or FalseDokument4 SeitenConsignment Sales: Problem 9-1: True or FalseVenz LacreNoch keine Bewertungen

- Mas Solutions To Problems Solutions 2018 PDFDokument13 SeitenMas Solutions To Problems Solutions 2018 PDFMIKKONoch keine Bewertungen

- A - Mock PSPM Set 1Dokument5 SeitenA - Mock PSPM Set 1IZZAH NUR ATHIRAH BINTI AZLI MoeNoch keine Bewertungen

- 1 2 2006 Jun ADokument8 Seiten1 2 2006 Jun AcyoteditorNoch keine Bewertungen

- Chapter 9 Teachers Manual Afar Part 1Dokument9 SeitenChapter 9 Teachers Manual Afar Part 1Aimee Diaz100% (3)

- Chapter 12Dokument25 SeitenChapter 12Muhammad Umair KhalidNoch keine Bewertungen

- Problem 6 - Partnership OperationDokument5 SeitenProblem 6 - Partnership OperationShaira UntalanNoch keine Bewertungen

- Final Exam Review2aStudentDokument9 SeitenFinal Exam Review2aStudentFatima SNoch keine Bewertungen

- 93 - Final Preaboard AFAR SolutionsDokument11 Seiten93 - Final Preaboard AFAR SolutionsLeiNoch keine Bewertungen

- Accounting PoliciesDokument10 SeitenAccounting PoliciesHohohoNoch keine Bewertungen

- Solution Manual For Managerial Economics 6th Edition For KeatDokument7 SeitenSolution Manual For Managerial Economics 6th Edition For KeatBiancaNortonmtckNoch keine Bewertungen

- Matrix ExerciseDokument7 SeitenMatrix ExerciseAnkit BasetiaNoch keine Bewertungen

- Unit and Batch Homework SolutionsDokument2 SeitenUnit and Batch Homework Solutionsnikhilcoke7Noch keine Bewertungen

- Rate of Return Analysis: Multiple Alternatives: Solutions To End-Of-Chapter ProblemsDokument14 SeitenRate of Return Analysis: Multiple Alternatives: Solutions To End-Of-Chapter ProblemsenmanuelkasparianNoch keine Bewertungen

- Strama Activity 2 SolmanDokument7 SeitenStrama Activity 2 SolmanPaupauNoch keine Bewertungen

- Chapter 8 - Competitive Market SolutionsDokument10 SeitenChapter 8 - Competitive Market SolutionsenglishlessonsNoch keine Bewertungen

- Revision Question Topic 3,4-AnswerDokument5 SeitenRevision Question Topic 3,4-AnswerNur WahidaNoch keine Bewertungen

- ATI TEAS Calculation Workbook: 300 Questions to Prepare for the TEAS (2023 Edition)Von EverandATI TEAS Calculation Workbook: 300 Questions to Prepare for the TEAS (2023 Edition)Noch keine Bewertungen

- Mathematical Formulas for Economics and Business: A Simple IntroductionVon EverandMathematical Formulas for Economics and Business: A Simple IntroductionBewertung: 4 von 5 Sternen4/5 (4)

- Instructor's Manual to Accompany CALCULUS WITH ANALYTIC GEOMETRYVon EverandInstructor's Manual to Accompany CALCULUS WITH ANALYTIC GEOMETRYNoch keine Bewertungen

- Analytical Modeling of Solute Transport in Groundwater: Using Models to Understand the Effect of Natural Processes on Contaminant Fate and TransportVon EverandAnalytical Modeling of Solute Transport in Groundwater: Using Models to Understand the Effect of Natural Processes on Contaminant Fate and TransportNoch keine Bewertungen

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsVon EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNoch keine Bewertungen

- Hyrdoacoustic Ocean Exploration: Theories and Experimental ApplicationVon EverandHyrdoacoustic Ocean Exploration: Theories and Experimental ApplicationNoch keine Bewertungen

- Financial Auditor: Job Details and Average Salary - InvestopediaDokument3 SeitenFinancial Auditor: Job Details and Average Salary - InvestopediaKindred WolfeNoch keine Bewertungen

- Extra Credit-Austria, Caren I. - AT2B - Financial Accounting Part 2)Dokument1 SeiteExtra Credit-Austria, Caren I. - AT2B - Financial Accounting Part 2)Kindred WolfeNoch keine Bewertungen

- FINTWODokument8 SeitenFINTWOKindred WolfeNoch keine Bewertungen

- Mercader Cherry May LDokument8 SeitenMercader Cherry May LKindred WolfeNoch keine Bewertungen

- Extra-Fintwo-Credit-Javier - 1 - .Docx - Filename UTF-8''Extra-Fintwo-Credit-JavierDokument1 SeiteExtra-Fintwo-Credit-Javier - 1 - .Docx - Filename UTF-8''Extra-Fintwo-Credit-JavierKindred WolfeNoch keine Bewertungen

- Resa - The Review School of Accountancy Management ServicesDokument8 SeitenResa - The Review School of Accountancy Management ServicesKindred Wolfe100% (1)

- Reviewer 5Dokument8 SeitenReviewer 5Kindred Wolfe100% (1)

- MS Practice SetsDokument2 SeitenMS Practice SetsKindred WolfeNoch keine Bewertungen

- Populi - John - Nouel - B. - AT2B.docx - Filename UTF-8''Populi, John Nouel B. AT2BDokument8 SeitenPopuli - John - Nouel - B. - AT2B.docx - Filename UTF-8''Populi, John Nouel B. AT2BKindred WolfeNoch keine Bewertungen

- Reviewer 2Dokument11 SeitenReviewer 2Kindred WolfeNoch keine Bewertungen

- Morfe - Yvette - Mae - D..docx2.docx1.docx - Filename UTF-8''Morfe, Yvette Mae D..docx2.docx1Dokument8 SeitenMorfe - Yvette - Mae - D..docx2.docx1.docx - Filename UTF-8''Morfe, Yvette Mae D..docx2.docx1Kindred WolfeNoch keine Bewertungen

- MS Practice SetsDokument2 SeitenMS Practice SetsKindred WolfeNoch keine Bewertungen

- Populi - John - Nouel - B. - AT2B.docx - Filename UTF-8''Populi, John Nouel B. AT2BDokument8 SeitenPopuli - John - Nouel - B. - AT2B.docx - Filename UTF-8''Populi, John Nouel B. AT2BKindred WolfeNoch keine Bewertungen

- Morfe - Yvette - Mae - D..docx2.docx1.docx - Filename UTF-8''Morfe, Yvette Mae D..docx2.docx1Dokument8 SeitenMorfe - Yvette - Mae - D..docx2.docx1.docx - Filename UTF-8''Morfe, Yvette Mae D..docx2.docx1Kindred WolfeNoch keine Bewertungen

- Extra-Fintwo-Credit-Javier - 1 - .Docx - Filename UTF-8''Extra-Fintwo-Credit-JavierDokument1 SeiteExtra-Fintwo-Credit-Javier - 1 - .Docx - Filename UTF-8''Extra-Fintwo-Credit-JavierKindred WolfeNoch keine Bewertungen

- Resa - The Review School of Accountancy Management ServicesDokument8 SeitenResa - The Review School of Accountancy Management ServicesKindred Wolfe100% (1)

- Why Blue-Collar Workers Quit Their JobDokument4 SeitenWhy Blue-Collar Workers Quit Their Jobsiva csNoch keine Bewertungen

- 111Dokument5 Seiten111Din Rose GonzalesNoch keine Bewertungen

- Interim and Continuous AuditDokument4 SeitenInterim and Continuous AuditTUSHER147Noch keine Bewertungen

- SEBI Order On Jet-EtihadDokument17 SeitenSEBI Order On Jet-EtihadBar & BenchNoch keine Bewertungen

- Starting A Business in Germany For International StudentsDokument11 SeitenStarting A Business in Germany For International StudentsJohn AcidNoch keine Bewertungen

- Essay Dev Econ Kalihputro Fachriansyah 30112016 PDFDokument7 SeitenEssay Dev Econ Kalihputro Fachriansyah 30112016 PDFKalihNoch keine Bewertungen

- Aquaponics: Fish and Crop Plants Share The Same Recycled Water in LaosDokument1 SeiteAquaponics: Fish and Crop Plants Share The Same Recycled Water in LaosAquaponicsNoch keine Bewertungen

- Statement of Problem Social and Global StratificationDokument13 SeitenStatement of Problem Social and Global StratificationstudylesspartymoreNoch keine Bewertungen

- Project On RecruitmentDokument90 SeitenProject On RecruitmentOmsi LathaNoch keine Bewertungen

- Math ActivityDokument3 SeitenMath ActivityCristena NavarraNoch keine Bewertungen

- MAS-04 Relevant CostingDokument10 SeitenMAS-04 Relevant CostingPaupauNoch keine Bewertungen

- A Presentation On Sales Forecasting: by Prof. (DR.) J. R. DasDokument20 SeitenA Presentation On Sales Forecasting: by Prof. (DR.) J. R. DasShubrojyoti ChowdhuryNoch keine Bewertungen

- 2018 BS by ExcelDokument6 Seiten2018 BS by ExcelAnonymous IPF2SEmHNoch keine Bewertungen

- Key Result AreaDokument3 SeitenKey Result AreaVARSHANoch keine Bewertungen

- Business English Stock MarketDokument2 SeitenBusiness English Stock MarketMara CaiboNoch keine Bewertungen

- Unit 6 MANAGEMENT ACCOUNTINGDokument46 SeitenUnit 6 MANAGEMENT ACCOUNTINGSANDFORD MALULUNoch keine Bewertungen

- Dodla Dairy Limited: #8-2-293/82/A, Plot No.270-Q, Road No.10-C, Jubilee Hills Hyderabad-500033Dokument1 SeiteDodla Dairy Limited: #8-2-293/82/A, Plot No.270-Q, Road No.10-C, Jubilee Hills Hyderabad-500033yamanura hNoch keine Bewertungen

- Sohail Copied Black Book ProjectDokument84 SeitenSohail Copied Black Book ProjectSohail Shaikh64% (14)

- Kunci Jawaban P 6.5Dokument7 SeitenKunci Jawaban P 6.5Vahrul DavidNoch keine Bewertungen

- Trade Liberalisation and "Revealed" Comparative Advantage'Dokument26 SeitenTrade Liberalisation and "Revealed" Comparative Advantage'ray orquizaNoch keine Bewertungen

- DMA Case-Tean Assignment-Group4 v1Dokument8 SeitenDMA Case-Tean Assignment-Group4 v1Aissam OuazaNoch keine Bewertungen

- CommunismDokument2 SeitenCommunismhezekiahNoch keine Bewertungen

- Case Study 3 - Heldon Tool Manufacturing CaseDokument3 SeitenCase Study 3 - Heldon Tool Manufacturing CasethetinkerxNoch keine Bewertungen

- Business Finance: Basic Long-Term Financial ConceptsDokument33 SeitenBusiness Finance: Basic Long-Term Financial ConceptsAce BautistaNoch keine Bewertungen

- BCM 2104 - Intermediate Accounting I - October 2013Dokument12 SeitenBCM 2104 - Intermediate Accounting I - October 2013Behind SeriesNoch keine Bewertungen

- E-Procurement: MBA 7601 - Managing E-BusinessDokument31 SeitenE-Procurement: MBA 7601 - Managing E-BusinessPrateek Parkash100% (1)

- ETAT FINANCIER BOA MALI Exercice 2012Dokument56 SeitenETAT FINANCIER BOA MALI Exercice 2012Georges AkbannNoch keine Bewertungen

- Test Bank For Supply Chain Management A Logistics Perspective 9th Edition CoyleDokument8 SeitenTest Bank For Supply Chain Management A Logistics Perspective 9th Edition Coylea385904759Noch keine Bewertungen

- Canara BankDokument18 SeitenCanara Bankmithun mohanNoch keine Bewertungen

- ACC 307 Final Project Part IIDokument4 SeitenACC 307 Final Project Part IISalman Khalid100% (4)