Beruflich Dokumente

Kultur Dokumente

SABESP 1Q08Update 01july2008 1

Hochgeladen von

ResearchOracleOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

SABESP 1Q08Update 01july2008 1

Hochgeladen von

ResearchOracleCopyright:

Verfügbare Formate

Tel.

+44 (0)20 7232 3090 Traded on

AIM, London

Fax +44 (0)20 7232 3099 Stock Exchange

www.iirgroup.com Regulated and

LSE: IIR authorised by

Companhia de Saneamento Basico do Estado de Sao Paulo-SABESP 01 July 2008

Update Report – 1Q 08 Results

Outlook remains positive; margins expected to improve from cost-cutting measures

Common BUY Fundamental research indicates a 22% upside in the common stock over the next 6-12 months. We

Direct

have access

calculated to theprice

the target fullbased

report free of charge

on fundamental at a weighted average of target

factors, using

Stock prices obtained by using DCF and comparative valuation methodologies.

Ticker: SBSP3.SA http://www.iirgroup.com/researchoracle/viewreport/show/20147

Target price: BRL49.84

We upgrade the SABESP common stock from a HOLD to a BUY with a 6-12 month target price of

Current price: BRL41.00 BRL49.84 per share.

ADR BUY The ADR is expected to appreciate 50% over the next 6-12 months as the 22% fundamental upside is

augmented by 28 percentage points upside attributable to the depreciation of the US dollar against

the Brazilian Real over the same period. We continue to take a 6-12 month investment horizon for

this stock as we expect a significant currency impact on the ADR over the medium term1.

Ticker: SBS

Target price: US$76.68 We reiterate the ADR (1 ADR= 2 shares) a BUY with a 6-12 month target price of US$76.68.

Current price: US$51.16

Supervisor: Nirav Shah Investment horizon - short term actionable trading strategies

Analyst: Gaurav Gupta This report addresses the needs of strategic investors with a long term investment horizon of 6-12 months. If

Editor: Matthew Bridle this report is provided to you by your broker under the Global Settlement, you may now also access (free of

Global Research Director: charge) the short term trading outlook that we publish from time to time for this issuer, looking at the coming

5-30 days for readers with a shorter trading horizon. These are available on-line only at

Satish Betadpur, CFA

www.researchoracle.com.

Next news due: 2Q 08, 09 August

2008 Report Summary

Companhia de Saneamento Basico do Estado de Sao Paulo - (SABESP) reported healthy results in 1Q

08. While revenues were marginally below our expectation, margins exceeded our expectation on

account of lower than expected operating and financial expenses during 1Q 08. Going forward, we

expect the company’s top-line to benefit from significant capital expenditure plans to increase the

number of water connections and its sewage coverage ratio in Sao Paulo between FY 2007-FY 2010.

In addition, SABESP’s margins will be aided by cost cutting initiatives which the company estimates will

save approximately BRL600 mn between FY 2007 and FY 2010. As a result, we maintain our positive

outlook for the company and continue to view the SABESP common stock as an attractive investment

opportunity at current levels.

Currency impact for US investors

The impact by itself of the anticipated currency movements on the ADR (now US$51.16), without

considering changes in the share price, is positive and is expected to be:

Over 6 months: US$51.25

Over 12 months: US$63.08

Page 1 Refer to page 4 for all footnotes

Das könnte Ihnen auch gefallen

- Fiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesVon EverandFiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesNoch keine Bewertungen

- EniSpA 1Q08Update 07july2008 1Dokument1 SeiteEniSpA 1Q08Update 07july2008 1ResearchOracleNoch keine Bewertungen

- Embraer 1Q08Update 03jul08 1Dokument1 SeiteEmbraer 1Q08Update 03jul08 1ResearchOracleNoch keine Bewertungen

- GuangshenRailway FY2007Update 1Dokument1 SeiteGuangshenRailway FY2007Update 1ResearchOracleNoch keine Bewertungen

- SanofiAventis 1Q08Update 07jul08 1Dokument1 SeiteSanofiAventis 1Q08Update 07jul08 1ResearchOracleNoch keine Bewertungen

- Smith&NephewPLC 1Q08Update 23jun08 1Dokument1 SeiteSmith&NephewPLC 1Q08Update 23jun08 1ResearchOracleNoch keine Bewertungen

- PLDT 1Q08Update 24june2008 1Dokument1 SeitePLDT 1Q08Update 24june2008 1ResearchOracleNoch keine Bewertungen

- PortugalTelecom 1Q08Update 02july2008 1Dokument1 SeitePortugalTelecom 1Q08Update 02july2008 1ResearchOracleNoch keine Bewertungen

- ACE 1Q08Update 11jul2008 1Dokument1 SeiteACE 1Q08Update 11jul2008 1ResearchOracleNoch keine Bewertungen

- PetroChina 1Q08Update 04july2008 1Dokument1 SeitePetroChina 1Q08Update 04july2008 1ResearchOracleNoch keine Bewertungen

- D - 05 Berger PaintsDokument7 SeitenD - 05 Berger PaintstanyaNoch keine Bewertungen

- Sappi 2Q08Update 09july2008 1Dokument1 SeiteSappi 2Q08Update 09july2008 1ResearchOracleNoch keine Bewertungen

- AbacusShortTakes 09082022Dokument7 SeitenAbacusShortTakes 09082022ignaciomannyNoch keine Bewertungen

- UnileverNV 1Q08Update 10jul08 1Dokument1 SeiteUnileverNV 1Q08Update 10jul08 1ResearchOracleNoch keine Bewertungen

- Vinati Organics LTD: Growth To Pick-Up..Dokument5 SeitenVinati Organics LTD: Growth To Pick-Up..Bhaveek OstwalNoch keine Bewertungen

- JM - RepcohomeDokument12 SeitenJM - RepcohomeSanjay PatelNoch keine Bewertungen

- BIMBSec - Bumi Armada Company Update - Deeper Into Caspian Sea - 20120417Dokument2 SeitenBIMBSec - Bumi Armada Company Update - Deeper Into Caspian Sea - 20120417Bimb SecNoch keine Bewertungen

- Vaibhav Global Research ReportDokument4 SeitenVaibhav Global Research ReportVikrant SadanaNoch keine Bewertungen

- Case Berkshire Hathaway Dividend Policy ParadigmDokument9 SeitenCase Berkshire Hathaway Dividend Policy ParadigmHugoNoch keine Bewertungen

- HDFC Ltd-Company Update-3 December 2021Dokument8 SeitenHDFC Ltd-Company Update-3 December 2021Abhishek SaxenaNoch keine Bewertungen

- TNT 1Q08Update 04july2008 1Dokument1 SeiteTNT 1Q08Update 04july2008 1ResearchOracleNoch keine Bewertungen

- SobhaDokument21 SeitenSobhadigthreeNoch keine Bewertungen

- Contributor Name Headline Document Document Type Analyst Primary Secondary Companies Primary Secondary IndustriesDokument10 SeitenContributor Name Headline Document Document Type Analyst Primary Secondary Companies Primary Secondary Industriesn_ashok_2020Noch keine Bewertungen

- Udita Wadhwa - 2019BB10060Dokument14 SeitenUdita Wadhwa - 2019BB10060Khushii NaamdeoNoch keine Bewertungen

- HDFC Bank: Opportunity Meets Execution!Dokument28 SeitenHDFC Bank: Opportunity Meets Execution!Priyanshu GuptaNoch keine Bewertungen

- DCB Bank Limited: Investing For Growth BUYDokument4 SeitenDCB Bank Limited: Investing For Growth BUYdarshanmadeNoch keine Bewertungen

- P.I. Industries (PI IN) : Q1FY20 Result UpdateDokument7 SeitenP.I. Industries (PI IN) : Q1FY20 Result UpdateMax BrenoNoch keine Bewertungen

- Barbeque Nation Hospitality LimitedDokument7 SeitenBarbeque Nation Hospitality Limitednayabrasul208Noch keine Bewertungen

- Market Outlook 19th December 2011Dokument5 SeitenMarket Outlook 19th December 2011Angel BrokingNoch keine Bewertungen

- Bajaj Holdings & Investments Limited: Holding A Positive GroundDokument7 SeitenBajaj Holdings & Investments Limited: Holding A Positive GroundVivek BansalNoch keine Bewertungen

- Stock Update: Divis LaboratoriesDokument3 SeitenStock Update: Divis LaboratoriesdarshanmadeNoch keine Bewertungen

- State Bank of India: CMP: INR407 TP: INR600 (+47%)Dokument12 SeitenState Bank of India: CMP: INR407 TP: INR600 (+47%)satyendragupta0078810Noch keine Bewertungen

- ChinaDTV 1Q08Update 04july2008 1Dokument1 SeiteChinaDTV 1Q08Update 04july2008 1ResearchOracleNoch keine Bewertungen

- SunLife 1Q08Update 30june2008 1Dokument1 SeiteSunLife 1Q08Update 30june2008 1ResearchOracleNoch keine Bewertungen

- Happy ForgingsDokument7 SeitenHappy ForgingsArshChandraNoch keine Bewertungen

- Medreich LimitedDokument7 SeitenMedreich LimitedAnishNoch keine Bewertungen

- IHH (4Q2019) - 02mar2020Dokument15 SeitenIHH (4Q2019) - 02mar2020surananamita99Noch keine Bewertungen

- Super Screws Private Limited: Summary of Rated InstrumentsDokument7 SeitenSuper Screws Private Limited: Summary of Rated InstrumentsAnonymous bdUhUNm7JNoch keine Bewertungen

- Financial Analysis of Divi's LaboratoriesDokument15 SeitenFinancial Analysis of Divi's LaboratoriesShivani DesaiNoch keine Bewertungen

- Case Analysis: Rohan.J.PatelDokument4 SeitenCase Analysis: Rohan.J.PatelhardikgosaiNoch keine Bewertungen

- Acumen - RBI Monetary Policy Review - December 2019Dokument4 SeitenAcumen - RBI Monetary Policy Review - December 2019mfsrajNoch keine Bewertungen

- 103 Sbi Blue Chip FundDokument21 Seiten103 Sbi Blue Chip FundsagarNoch keine Bewertungen

- CCL Products - Pick of The Week - Axis Direct - 06112021 - 08-11-2021 - 08Dokument5 SeitenCCL Products - Pick of The Week - Axis Direct - 06112021 - 08-11-2021 - 08Tanishk OjhaNoch keine Bewertungen

- RITES LTD - Management Meeting Note June 2023 - 19!06!2023 - 09Dokument7 SeitenRITES LTD - Management Meeting Note June 2023 - 19!06!2023 - 09Sanjeedeep Mishra , 315Noch keine Bewertungen

- Polycab India Limited: Business Dynamics Strong, Retain BuyDokument8 SeitenPolycab India Limited: Business Dynamics Strong, Retain Buyshankar alkotiNoch keine Bewertungen

- Can Fin Homes - IC Oct, 2017Dokument11 SeitenCan Fin Homes - IC Oct, 2017milandeepNoch keine Bewertungen

- National Securities (US) - GBDC - Initiation - GBDC Initiation 2016 11 - 26 PagesDokument26 SeitenNational Securities (US) - GBDC - Initiation - GBDC Initiation 2016 11 - 26 PagesSagar PatelNoch keine Bewertungen

- Housing Development Finance Corporation: Growth With QualityDokument5 SeitenHousing Development Finance Corporation: Growth With QualitydarshanmadeNoch keine Bewertungen

- Stock Update: Jyothy LaboratoriesDokument4 SeitenStock Update: Jyothy LaboratoriesjeetchauhanNoch keine Bewertungen

- Roha Dyechem Private Limited: Rating RationaleDokument8 SeitenRoha Dyechem Private Limited: Rating RationaleForall PainNoch keine Bewertungen

- TAM 1Q08Update 23june2008 1Dokument1 SeiteTAM 1Q08Update 23june2008 1ResearchOracleNoch keine Bewertungen

- State Bank of India: CMP: INR234 TP: INR300 (+28%)Dokument22 SeitenState Bank of India: CMP: INR234 TP: INR300 (+28%)ktyNoch keine Bewertungen

- Bojangles': Media Reports of Potential Sale May Not Be Fowl PlayDokument7 SeitenBojangles': Media Reports of Potential Sale May Not Be Fowl PlayAshokNoch keine Bewertungen

- IEA Report: 7th Dec, 2016Dokument19 SeitenIEA Report: 7th Dec, 2016narnoliaNoch keine Bewertungen

- It Governance Technology-Chapter 01Dokument4 SeitenIt Governance Technology-Chapter 01IQBAL MAHMUDNoch keine Bewertungen

- Federal Bank LTD.: PCG ResearchDokument11 SeitenFederal Bank LTD.: PCG Researcharun_algoNoch keine Bewertungen

- Stock Reco-AurobindoDokument10 SeitenStock Reco-Aurobindoanjugadu100% (1)

- Bajaj Holdings Investment 24042019Dokument3 SeitenBajaj Holdings Investment 24042019anjugaduNoch keine Bewertungen

- Esearch Eport: Riddhi Siddhi Gluco Biols LTDDokument9 SeitenEsearch Eport: Riddhi Siddhi Gluco Biols LTDanny2k1Noch keine Bewertungen

- Subros 3R Jan31 - 2024Dokument8 SeitenSubros 3R Jan31 - 2024h40280890Noch keine Bewertungen

- XLCapital NewsAlert 11july2008 1Dokument1 SeiteXLCapital NewsAlert 11july2008 1ResearchOracleNoch keine Bewertungen

- Repsol 1Q08Update 11jul2008 1Dokument1 SeiteRepsol 1Q08Update 11jul2008 1ResearchOracleNoch keine Bewertungen

- SMIC 1Q08Update 11july2008 1Dokument1 SeiteSMIC 1Q08Update 11july2008 1ResearchOracleNoch keine Bewertungen

- WNS NewsAlert 11july2008 1Dokument1 SeiteWNS NewsAlert 11july2008 1ResearchOracleNoch keine Bewertungen

- SouthernCopper NewsAlert 11jul2008 1Dokument1 SeiteSouthernCopper NewsAlert 11jul2008 1ResearchOracleNoch keine Bewertungen

- O2Micro 1Q08Update 11july2008 1Dokument1 SeiteO2Micro 1Q08Update 11july2008 1ResearchOracleNoch keine Bewertungen

- Noble 1Q08Update 11jul2008 1Dokument1 SeiteNoble 1Q08Update 11jul2008 1ResearchOracleNoch keine Bewertungen

- Advantest NewsAlert 11july2008 1Dokument1 SeiteAdvantest NewsAlert 11july2008 1ResearchOracleNoch keine Bewertungen

- Infosys 1Q09Alert 11july2008 1Dokument1 SeiteInfosys 1Q09Alert 11july2008 1ResearchOracleNoch keine Bewertungen

- Nissan 4QANDFY2008Update 11jul08 1Dokument1 SeiteNissan 4QANDFY2008Update 11jul08 1ResearchOracleNoch keine Bewertungen

- FocusMedia 1Q08Update 11july2008 1Dokument1 SeiteFocusMedia 1Q08Update 11july2008 1ResearchOracleNoch keine Bewertungen

- Covidien 2q08update 11jul08 1Dokument1 SeiteCovidien 2q08update 11jul08 1ResearchOracleNoch keine Bewertungen

- GrupoAeroCentroNorte NewsAlert 11july2008 1Dokument1 SeiteGrupoAeroCentroNorte NewsAlert 11july2008 1ResearchOracleNoch keine Bewertungen

- ACE 1Q08Update 11jul2008 1Dokument1 SeiteACE 1Q08Update 11jul2008 1ResearchOracleNoch keine Bewertungen

- Roundup 10 July 2008Dokument2 SeitenRoundup 10 July 2008ResearchOracleNoch keine Bewertungen

- Mitsui FY2008Update 10july08 1Dokument1 SeiteMitsui FY2008Update 10july08 1ResearchOracleNoch keine Bewertungen

- UnileverNV 1Q08Update 10jul08 1Dokument1 SeiteUnileverNV 1Q08Update 10jul08 1ResearchOracleNoch keine Bewertungen

- NTT FY2008Update 10july2008 1Dokument1 SeiteNTT FY2008Update 10july2008 1ResearchOracleNoch keine Bewertungen

- UnileverPLC 1Q08Update 10jul08 1Dokument1 SeiteUnileverPLC 1Q08Update 10jul08 1ResearchOracleNoch keine Bewertungen

- SiliconwarePrecisionIndustries 1Q08Update 10july2008 1Dokument1 SeiteSiliconwarePrecisionIndustries 1Q08Update 10july2008 1ResearchOracleNoch keine Bewertungen

- TokioMarine (Formerlymillea) FY2008Update 10july2008 1Dokument1 SeiteTokioMarine (Formerlymillea) FY2008Update 10july2008 1ResearchOracleNoch keine Bewertungen

- NationalGrid FY2008Update 10july2008 1Dokument1 SeiteNationalGrid FY2008Update 10july2008 1ResearchOracleNoch keine Bewertungen

- BancoBradesco 1Q08Update 10jul2008 1Dokument1 SeiteBancoBradesco 1Q08Update 10jul2008 1ResearchOracleNoch keine Bewertungen

- GrupoAeroPacifico NewsAlert 10july2008 1Dokument1 SeiteGrupoAeroPacifico NewsAlert 10july2008 1ResearchOracleNoch keine Bewertungen

- EnduranceSpecialty NewsAlert 10july2008 1Dokument1 SeiteEnduranceSpecialty NewsAlert 10july2008 1ResearchOracleNoch keine Bewertungen

- Companhia de Bebidas Das Americas 1Q08Update 10jul08 1Dokument1 SeiteCompanhia de Bebidas Das Americas 1Q08Update 10jul08 1ResearchOracleNoch keine Bewertungen

- XLCapital NewsAlert 09july2008 1Dokument1 SeiteXLCapital NewsAlert 09july2008 1ResearchOracleNoch keine Bewertungen

- AngiotechPharmaceuticalInc NewsAlert 10jul08 1Dokument1 SeiteAngiotechPharmaceuticalInc NewsAlert 10jul08 1ResearchOracleNoch keine Bewertungen

- Baidu 1Q08Update 10july2008 1Dokument1 SeiteBaidu 1Q08Update 10july2008 1ResearchOracleNoch keine Bewertungen

- Votorantim Celolose 1Q08Update 09jul08 1Dokument1 SeiteVotorantim Celolose 1Q08Update 09jul08 1ResearchOracleNoch keine Bewertungen

- JKBJDokument12 SeitenJKBJChampyNoch keine Bewertungen

- AccountingDokument4 SeitenAccountingAnimaw YayehNoch keine Bewertungen

- Module 7Dokument5 SeitenModule 7trixie maeNoch keine Bewertungen

- Business Combination Quiz Final. Todo Na ToDokument10 SeitenBusiness Combination Quiz Final. Todo Na ToKristelDeniseTansiongcoMindoro100% (1)

- Fsa 2011 15 PDFDokument253 SeitenFsa 2011 15 PDFalizaNoch keine Bewertungen

- Hoshimo Ltd/Year 1 2 3 4 5 Income StatementDokument6 SeitenHoshimo Ltd/Year 1 2 3 4 5 Income StatementSeemaNoch keine Bewertungen

- 1001 Practice QuestionsDokument95 Seiten1001 Practice QuestionsMohamad El-JadayelNoch keine Bewertungen

- Biological Assets Quizzer Problem 1Dokument5 SeitenBiological Assets Quizzer Problem 1GooJaeRiNoch keine Bewertungen

- Student SpreadsheetDokument14 SeitenStudent SpreadsheetPriyanka Agarwal0% (1)

- Governmental and Nonprofit Accounting 10th Edition Smith Test BankDokument13 SeitenGovernmental and Nonprofit Accounting 10th Edition Smith Test BankHeatherHayescwboz100% (19)

- Pas 10Dokument1 SeitePas 10Sacedon, Trishia Mae C.Noch keine Bewertungen

- In Integrative Case 10 1 We Projected FinancialDokument2 SeitenIn Integrative Case 10 1 We Projected FinancialAmit PandeyNoch keine Bewertungen

- NB Renaissance Partners S.À R.L. SICAV-RAIF - NBRP Fund III (Master)Dokument77 SeitenNB Renaissance Partners S.À R.L. SICAV-RAIF - NBRP Fund III (Master)Georgio Romani100% (1)

- M14 - Final Exam & RevisionDokument43 SeitenM14 - Final Exam & RevisionJashmine Suwa ByanjankarNoch keine Bewertungen

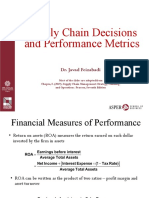

- 3-Supply Chain Decisions and Performance Metrics (A)Dokument21 Seiten3-Supply Chain Decisions and Performance Metrics (A)eeman kNoch keine Bewertungen

- List of Shariah-Compliant SecuritiesDokument26 SeitenList of Shariah-Compliant SecuritiesNurAuniNoch keine Bewertungen

- AEC MANUAL Class NotesDokument65 SeitenAEC MANUAL Class NotesManimegalai.VNoch keine Bewertungen

- Business LawDokument12 SeitenBusiness LawZHI CHING ONGNoch keine Bewertungen

- 05 Investment PropertyDokument39 Seiten05 Investment Property林義哲Noch keine Bewertungen

- Bond Issue Donald Lennon Is The President FounderDokument1 SeiteBond Issue Donald Lennon Is The President FounderDoreenNoch keine Bewertungen

- Introduction To Treasury Management: Here Is Where Your Presentation BeginsDokument25 SeitenIntroduction To Treasury Management: Here Is Where Your Presentation BeginsAngelie AnilloNoch keine Bewertungen

- Acova Radiateurs SolutionDokument14 SeitenAcova Radiateurs SolutionSarvagya Jha100% (1)

- 2012 CA ATC ListDokument26 Seiten2012 CA ATC Listardhipratomo4390Noch keine Bewertungen

- Chapter 7 Asset Investment Decisions and Capital RationingDokument31 SeitenChapter 7 Asset Investment Decisions and Capital RationingdperepolkinNoch keine Bewertungen

- Solutions - Midterms Reviewer - Q1Dokument21 SeitenSolutions - Midterms Reviewer - Q1Jack Herer100% (1)

- Fin Model of Hydro Power PlantDokument7 SeitenFin Model of Hydro Power PlantVivek SinghalNoch keine Bewertungen

- IPSAS 2011 - Uses and FeatureDokument9 SeitenIPSAS 2011 - Uses and FeatureCamEd PRESIDENTNoch keine Bewertungen

- CH 04 Review and Discussion Problems SolutionsDokument23 SeitenCH 04 Review and Discussion Problems SolutionsArman Beirami67% (3)

- DHX Media Inc Is A Halifax Based Developer Producer and DistributorDokument1 SeiteDHX Media Inc Is A Halifax Based Developer Producer and Distributorhassan taimourNoch keine Bewertungen

- المعالجة المحاسبية لمجمع الشركاتDokument384 Seitenالمعالجة المحاسبية لمجمع الشركاتSiham ThNoch keine Bewertungen