Beruflich Dokumente

Kultur Dokumente

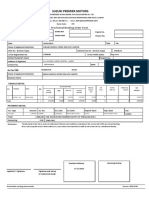

E-tax Acknowledgement for Form 26QB TDS Submission

Hochgeladen von

Vyapar NitiOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

E-tax Acknowledgement for Form 26QB TDS Submission

Hochgeladen von

Vyapar NitiCopyright:

Verfügbare Formate

4/9/2018 confirmation Page

Form 26QB

Your E-tax Acknowledgement Number is AF0105512

The Acknowledgement No. generated will be valid only if the taxpayer makes a payment at Bank’s site. Taxpayers are advised to save above Acknowledgement

No. for downloading Form 16B from TRACES website.

As communicated by Income Tax Department, TDS certificate (Form 16B) will be available for download from the TRACES website after atleast 2 days of deposit

of tax amount at the respective Bank.

The TDS amount as per Form 26QB should be entered in the field ‘Basic Tax’ (Income Tax) on the Bank’s web-portal as TDS certificates (Form 16B) will be

based on ‘Basic Tax’ (Income Tax) only.

If Date of deduction is greater than Date of Payment/Credit, the same may result in Demand Notice for late deduction

If Date of deduction is less than Date of Payment/Credit, the same may result in Demand Notice for late deduction

If Date of furnishing Form 26QB is beyond prescribed due date, the same may attract late filing fee u/s 234E

Tax Applicable 0021 Assessment Year 2019-20

Minor Head Code 800 Financial Year 2018-19

Permanent Account No. (PAN) of Permanent Account No. (PAN) of Transferor

DZYPS0310H ALQPL0913J

Transferee(Payer/Buyer) (Payee/Seller)

YACXXX XANUBHAI SABX XXXAL

Full Name (Masked) of the Transferee Full Name (Masked) of the Transferor

SHAH LATIF

Category of Transferee on the basis of PAN Individual Category of Transferor on the basis of PAN Individual

Status of PAN as per ITD PAN Master Active PAN Status of PAN as per ITD PAN Master Active PAN

Complete Address of the Property Transferee Complete Address of the Property Transferor

Name of premises/Building/ Village Angita CHS Name of premises/Building/ Village

Flat/Door/Block No. Flat/Door/Block No.

Road/Street/Lane Pragatinagar, Naranpura Road/Street/Lane

City/District Ahmedabad City/District mumbai

State GUJARAT State MAHARASHTRA

Pin Code 380015 Pin Code 400001

Email ID yachitshah@gmail.com Email ID

Mobile No. 9998040800 Mobile No.

Whether more than one

Date of Agreement/Booking 09/04/2018 No

Transferee/Buyer

Whether more than one

Date of Payment/Credit 09/04/2018 Yes

Transferor/Seller

Date of Tax Deduction 09/04/2018 Payment Type Lumpsum

Complete Address of the Property Transferred Tax Deposit Details

Rate (in %) 1

Type of Property Building Total Amount Paid/Credited 2850000

Name of premises/Building/ Village orchard-a godrej g.city TDS Amount to be paid 28500

Flat/Door/Block No. 9th floor 902 Interest 0

Road/Street/Lane jagatpur, dascroi Fee 0

City/District ahmedabad Total payment 28500.00

State GUJARAT Twenty Eight Thousand Five

Value in words

Pin Code 380008 Hundred Rupees and paise

Total Value of Consideration (Property Value) 5700000

Mode of Payment Offline

Note

This Acknowledgment is only for the information regarding TDS on sale of property submitted to Tax Information Network (TIN). This cannot be

construed as proof of payment of taxes.

https://onlineservices.tin.egov-nsdl.com/etaxnew/ConfirmDetailsServlet?rKey=-211493647 1/1

Das könnte Ihnen auch gefallen

- Complete Address of The Prope Rty Transferee Complete Address of The Prope Rty TransferorDokument1 SeiteComplete Address of The Prope Rty Transferee Complete Address of The Prope Rty TransferorDevu GautamNoch keine Bewertungen

- New Property TDSDokument2 SeitenNew Property TDSHariKrishnaNoch keine Bewertungen

- Form 26QCDokument2 SeitenForm 26QCPrashant Garg100% (1)

- Form 26QB: Your E-Tax Acknowledgement Number Is AG5312381Dokument2 SeitenForm 26QB: Your E-Tax Acknowledgement Number Is AG5312381anon_275845789Noch keine Bewertungen

- Your E-tax Acknowledgement Form 26QBDokument2 SeitenYour E-tax Acknowledgement Form 26QBClient 1Noch keine Bewertungen

- Manju PDFDokument2 SeitenManju PDFharshit gargNoch keine Bewertungen

- Form 26QB E-tax Acknowledgement for Property Sale TDSDokument2 SeitenForm 26QB E-tax Acknowledgement for Property Sale TDSPATAN ELAKATHNoch keine Bewertungen

- Form 26QB: Complete Address of The Property Transferee Complete Address of The Property TransferorDokument2 SeitenForm 26QB: Complete Address of The Property Transferee Complete Address of The Property TransferorRabindra SinghNoch keine Bewertungen

- Form 26QB: Complete Address of The Property Transferee Complete Address of The Property TransferorDokument2 SeitenForm 26QB: Complete Address of The Property Transferee Complete Address of The Property TransferorRabindra SinghNoch keine Bewertungen

- Ghisulalji JainDokument2 SeitenGhisulalji JainManish HedaNoch keine Bewertungen

- D D MM Y Y Yy: (Separate Forms Need To Be Filled For Each Tax Type)Dokument3 SeitenD D MM Y Y Yy: (Separate Forms Need To Be Filled For Each Tax Type)nikhil kumarNoch keine Bewertungen

- Parking Pass For Canteen Internal 123Dokument2 SeitenParking Pass For Canteen Internal 123Rabindra SinghNoch keine Bewertungen

- It 000136741219 2023 05Dokument1 SeiteIt 000136741219 2023 05wali khelNoch keine Bewertungen

- slbwd143 Invoice PDFDokument1 Seiteslbwd143 Invoice PDFnareshkumharNoch keine Bewertungen

- Income Tax Payment Challan: PSID #: 30308134Dokument1 SeiteIncome Tax Payment Challan: PSID #: 30308134Azam mughalNoch keine Bewertungen

- Mushtaq & IshfaqDokument1 SeiteMushtaq & IshfaqAʌĸʌsʜ AƴʌŋNoch keine Bewertungen

- Income Tax Payment Challan: PSID #: 37536860Dokument1 SeiteIncome Tax Payment Challan: PSID #: 37536860Mohsin Ali Shaikh vlogsNoch keine Bewertungen

- IT-000132223866-2023-01Dokument1 SeiteIT-000132223866-2023-01mazharehsan08Noch keine Bewertungen

- Abdul Ghaffar 14-10-19 PDFDokument1 SeiteAbdul Ghaffar 14-10-19 PDFAyan BNoch keine Bewertungen

- It 000151339382 2023 00Dokument1 SeiteIt 000151339382 2023 00shaheenmagamartNoch keine Bewertungen

- 2306 Jan 2018 ENCS v4Dokument2 Seiten2306 Jan 2018 ENCS v4Analyn DomingoNoch keine Bewertungen

- Income Tax Payment Challan: PSID #: 148473028Dokument1 SeiteIncome Tax Payment Challan: PSID #: 148473028Haseeb RazaNoch keine Bewertungen

- TAHIR HUSSAIN SHAH 236 K 12000Dokument1 SeiteTAHIR HUSSAIN SHAH 236 K 12000mazharehsan08Noch keine Bewertungen

- Income Tax Payment Challan: PSID #: 146916470Dokument1 SeiteIncome Tax Payment Challan: PSID #: 146916470Madiah abcNoch keine Bewertungen

- Income Tax Payment Challan: PSID #: 48471182Dokument1 SeiteIncome Tax Payment Challan: PSID #: 48471182Haseeb RazaNoch keine Bewertungen

- Income Tax Payment Challan: PSID #: 141441493Dokument1 SeiteIncome Tax Payment Challan: PSID #: 141441493Syed Mudassar GillaniNoch keine Bewertungen

- It 000144914729 2024 11Dokument1 SeiteIt 000144914729 2024 11MUHAMMAD TABRAIZNoch keine Bewertungen

- Income Tax Payment Challan: PSID #: 35235957Dokument1 SeiteIncome Tax Payment Challan: PSID #: 35235957Ayan BNoch keine Bewertungen

- Certificate of Final Tax WithheldDokument18 SeitenCertificate of Final Tax WithheldMaria RinaNoch keine Bewertungen

- Income Tax Payment Challan: PSID #: 42079719Dokument1 SeiteIncome Tax Payment Challan: PSID #: 42079719gandapur khanNoch keine Bewertungen

- Income Tax Payment Challan: PSID #: 145879823Dokument1 SeiteIncome Tax Payment Challan: PSID #: 145879823farhan aliNoch keine Bewertungen

- Income Tax Payment Challan: PSID #: 43320237Dokument1 SeiteIncome Tax Payment Challan: PSID #: 43320237gandapur khanNoch keine Bewertungen

- Income Tax Payment ChallanDokument1 SeiteIncome Tax Payment Challangandapur khanNoch keine Bewertungen

- MUMTAZ KHAN 236 K 6000Dokument1 SeiteMUMTAZ KHAN 236 K 6000mazharehsan08Noch keine Bewertungen

- It 000147370616 2024 12Dokument1 SeiteIt 000147370616 2024 12Revenue sectionNoch keine Bewertungen

- It 000147370507 2024 12Dokument1 SeiteIt 000147370507 2024 12Revenue sectionNoch keine Bewertungen

- ECS 792 (Aurangzeb) DLDokument1 SeiteECS 792 (Aurangzeb) DLاورنگزیب ملکNoch keine Bewertungen

- Vasu Vaccines &speciality Drugs Private Limited Invoice-310520Dokument1 SeiteVasu Vaccines &speciality Drugs Private Limited Invoice-310520sadiq shaikNoch keine Bewertungen

- Income Tax Payment ChallanDokument1 SeiteIncome Tax Payment ChallanzeshanNoch keine Bewertungen

- It 000144418085 2024 10Dokument1 SeiteIt 000144418085 2024 10Sheeraz AhmedNoch keine Bewertungen

- Certificate of Final Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)Dokument2 SeitenCertificate of Final Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)RapRalph GalagalaNoch keine Bewertungen

- Certificate of Creditable Tax Withheld at Source: PLDT Inc.Dokument1 SeiteCertificate of Creditable Tax Withheld at Source: PLDT Inc.Iway SheenaNoch keine Bewertungen

- Income Tax Payment ChallanDokument1 SeiteIncome Tax Payment Challangandapur khanNoch keine Bewertungen

- It 000147370452 2024 12Dokument1 SeiteIt 000147370452 2024 12Revenue sectionNoch keine Bewertungen

- It 000134579920 2022 00 PDFDokument1 SeiteIt 000134579920 2022 00 PDFMuhammad AslamNoch keine Bewertungen

- It 000130629196 2021 00Dokument1 SeiteIt 000130629196 2021 00muhammad faiqNoch keine Bewertungen

- Trade Zone Account ApplicationDokument7 SeitenTrade Zone Account Applicationzimmermanjonas1Noch keine Bewertungen

- Income Tax Payment Challan DetailsDokument1 SeiteIncome Tax Payment Challan DetailsAsif JavidNoch keine Bewertungen

- It 000144378527 2022 00Dokument1 SeiteIt 000144378527 2022 00حنفیت اور شیعت مقلدNoch keine Bewertungen

- Income Tax Payment Challan: PSID #: 148473407Dokument1 SeiteIncome Tax Payment Challan: PSID #: 148473407Haseeb RazaNoch keine Bewertungen

- It 000134800902 2023 03Dokument1 SeiteIt 000134800902 2023 03AbbasNoch keine Bewertungen

- Indra BillDokument1 SeiteIndra Billarthagarwal09Noch keine Bewertungen

- BIR Form 2307 PDFDokument1 SeiteBIR Form 2307 PDFAizhel Villegas ArcipeNoch keine Bewertungen

- BIR Form 2307Dokument1 SeiteBIR Form 2307Aizhel Villegas ArcipeNoch keine Bewertungen

- BIR Form 2307 PDFDokument1 SeiteBIR Form 2307 PDFAizhel Villegas ArcipeNoch keine Bewertungen

- Income Tax Payment Challan: PSID #: 40277624Dokument1 SeiteIncome Tax Payment Challan: PSID #: 40277624shoaiba1Noch keine Bewertungen

- Certificate of Creditable Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)Dokument32 SeitenCertificate of Creditable Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)Sakura AvhrynNoch keine Bewertungen

- It 000144384093 2024 10Dokument1 SeiteIt 000144384093 2024 10Sheeraz AhmedNoch keine Bewertungen

- Everthing You Need To Know To Start An Auto DealershipVon EverandEverthing You Need To Know To Start An Auto DealershipBewertung: 5 von 5 Sternen5/5 (1)

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesVon EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNoch keine Bewertungen

- AccountStatement 3455587770 Nov02 112625Dokument2 SeitenAccountStatement 3455587770 Nov02 112625Vyapar NitiNoch keine Bewertungen

- SpecialDokument22 SeitenSpecialVyapar NitiNoch keine Bewertungen

- E - Forms MappingDokument3 SeitenE - Forms MappingSheetal IyerNoch keine Bewertungen

- Tax Information NetworkDokument1 SeiteTax Information NetworkVyapar NitiNoch keine Bewertungen

- Tax Information NetworkDokument1 SeiteTax Information NetworkVyapar NitiNoch keine Bewertungen

- 164 100 78Dokument3 Seiten164 100 78Vyapar NitiNoch keine Bewertungen

- Tax Information NetworkDokument1 SeiteTax Information NetworkVyapar NitiNoch keine Bewertungen

- Intellectual Property RightsDokument24 SeitenIntellectual Property RightsVyapar NitiNoch keine Bewertungen

- BL TestbankDokument47 SeitenBL TestbankTrixie de LeonNoch keine Bewertungen

- The Law On Obligations and Contracts Midterms ExamDokument3 SeitenThe Law On Obligations and Contracts Midterms ExamFrancis Ray Arbon Filipinas100% (1)

- Articles of Association 1774Dokument8 SeitenArticles of Association 1774Jonathan Vélez-BeyNoch keine Bewertungen

- Partnership Liability for Debts IncurredDokument12 SeitenPartnership Liability for Debts IncurredDennis VelasquezNoch keine Bewertungen

- RKMFiles Study Notes on Criminal Identification and InvestigationDokument168 SeitenRKMFiles Study Notes on Criminal Identification and InvestigationTfig Fo EcaepNoch keine Bewertungen

- War, Peace and International Relations in Contemporary IslamDokument7 SeitenWar, Peace and International Relations in Contemporary IslamJerusalemInstitute100% (1)

- Sentencing Practice PDFDokument14 SeitenSentencing Practice PDFamclansNoch keine Bewertungen

- Quotation Eoi/Rfp/Rft Process Checklist Goods And/Or ServicesDokument7 SeitenQuotation Eoi/Rfp/Rft Process Checklist Goods And/Or ServicesTawanda KurasaNoch keine Bewertungen

- Module 2 (B) - Social Contract TheoryDokument6 SeitenModule 2 (B) - Social Contract TheoryupendraNoch keine Bewertungen

- FIT EdoraDokument8 SeitenFIT EdoraKaung MyatToeNoch keine Bewertungen

- CIS Union Access Update 2021Dokument6 SeitenCIS Union Access Update 2021Fernando Manholér100% (3)

- Carrier Liability for Passenger DeathDokument256 SeitenCarrier Liability for Passenger DeathLouie EllaNoch keine Bewertungen

- X-000009-1603383942652-50963-BBE - Assignment 01Dokument66 SeitenX-000009-1603383942652-50963-BBE - Assignment 01PeuJp75% (4)

- Bwff1013 Foundations of Finance Quiz #3Dokument8 SeitenBwff1013 Foundations of Finance Quiz #3tivaashiniNoch keine Bewertungen

- Impact of Pop Culture On PoliticsDokument3 SeitenImpact of Pop Culture On PoliticsPradip luitelNoch keine Bewertungen

- In Re: Armando Pons V., 4th Cir. (2014)Dokument2 SeitenIn Re: Armando Pons V., 4th Cir. (2014)Scribd Government DocsNoch keine Bewertungen

- Module 2 - Part III - UpdatedDokument38 SeitenModule 2 - Part III - UpdatedDhriti NayyarNoch keine Bewertungen

- Cloud Control Basic Installation GuideDokument184 SeitenCloud Control Basic Installation GuidesoftdesireNoch keine Bewertungen

- Fillet Weld Moment of Inertia Equations - Engineers EdgeDokument2 SeitenFillet Weld Moment of Inertia Equations - Engineers EdgeSunil GurubaxaniNoch keine Bewertungen

- Jazz - Score and PartsDokument44 SeitenJazz - Score and PartsMaanueel' Liizaamaa'Noch keine Bewertungen

- MELENDEZ Luis Sentencing MemoDokument9 SeitenMELENDEZ Luis Sentencing MemoHelen BennettNoch keine Bewertungen

- Both Sides NowDokument3 SeitenBoth Sides Nowd-railNoch keine Bewertungen

- Reset NVRAM or PRAM On Your Mac - Apple SupportDokument1 SeiteReset NVRAM or PRAM On Your Mac - Apple SupportRudy KurniawanNoch keine Bewertungen

- 18 - Carvana Is A Bad BoyDokument6 Seiten18 - Carvana Is A Bad BoyAsishNoch keine Bewertungen

- Trinity College - Academic Calendar - 2009-2010Dokument3 SeitenTrinity College - Academic Calendar - 2009-2010roman_danNoch keine Bewertungen

- Offer LetterDokument2 SeitenOffer LetterIpe ClosaNoch keine Bewertungen

- Fdas Quotation SampleDokument1 SeiteFdas Quotation SampleOliver SabadoNoch keine Bewertungen

- LPB Vs DAR-DigestDokument2 SeitenLPB Vs DAR-DigestremoveignoranceNoch keine Bewertungen

- Lonzanida Vs ComelecDokument2 SeitenLonzanida Vs ComelectimothymarkmaderazoNoch keine Bewertungen

- JIRA Issue-Bug March OnwardsDokument10 SeitenJIRA Issue-Bug March OnwardsMoses RashidNoch keine Bewertungen