Beruflich Dokumente

Kultur Dokumente

Edgewonk's Math Cheat Sheet PDF

Hochgeladen von

Prashant TomarOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Edgewonk's Math Cheat Sheet PDF

Hochgeladen von

Prashant TomarCopyright:

Verfügbare Formate

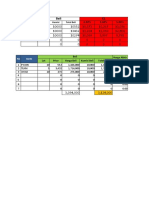

Edgewonk’s Math Cheat Sheet

R-Multiple Required Winrate Drawdown Recovery Rate

0.5 67% 5% 5.3%

1 50% 10% 11.1%

1.5 40% 20% 25%

2 33% 30% 43%

2.5 29% 40% 67%

3 25% 50% 100%

3.5 22% 60% 150%

1 70% 233%

General formula (1 + 𝑅 𝑚𝑢𝑙𝑡𝑖𝑝𝑙𝑒) 80% 400%

90% 900%

Expectancy Losing Streaks and loss of capital

(Winrate * Position size * R-multiple) -

Losers in Loss % Loss % Loss %

([1-Winrate] * Pos. Size) = Trade Expectancy

a row (1% risk) (3% risk) (5% risk)

1 1.0% 3.0% 5.0%

Example:

Winrate = 55% | Pos. Size = 2% | R-multiple = 2 2.0% 5.9% 9.8%

1.5 3 3.0% 8.7% 14.3%

4 3.9% 11.5% 18.5%

Trade Expectancy = 5 4.9% 14.1% 22.6%

(55% * 2% * 1.5) – ([1 - 55%] * 2%) = 0.75% 6 5.9% 16.7% 26.5%

7 6.8% 19.2% 30.2%

An expectancy of 0.75% indicates that each 8 7.7% 21.6% 33.7%

trade has a value of 0.75% over the long-term. 9 8.6% 24.0% 37.0%

10 9.6% 26.3% 40.1%

Exponential Growth

Consecutive Losses

Example:

Winrate: 55% | Pos. Size: 2% | R-multiple: 2 Winrate 1 2 3 4 5

Account size : $10,000

70% 30% 9% 2.7% 0.8% 0.2%

Gain per trade

60% 40% 16% 6.4% 2.6% 1.%

1. trade $ 130.00

50% 50% 25% 13% 6% 3%

10. trade $ 146.03

50. trade $ 241.66 40% 60% 36% 22% 13% 8%

100. trade $ 466.96 30% 70% 49% 34% 24% 17%

200. trade $ 1,699.12

Likelihood of consecutive losses based on winrate

500. trade $ 81,857.14

The professional trading journal Edgewonk.com

›› Discover your edge info@edgewonk.com

Das könnte Ihnen auch gefallen

- BUYING INVESTING & RENTING PROP - Sriram Vittalamurthy PDFDokument220 SeitenBUYING INVESTING & RENTING PROP - Sriram Vittalamurthy PDFPrashant Tomar100% (3)

- Disciplined Trader Trade Journal (Spread Betting)Dokument850 SeitenDisciplined Trader Trade Journal (Spread Betting)sb jazzduo50% (2)

- Apple Case ReportDokument2 SeitenApple Case ReportAwa SannoNoch keine Bewertungen

- A Primer Into Technical Analysis PDFDokument48 SeitenA Primer Into Technical Analysis PDFJayson GenozaNoch keine Bewertungen

- The Sketch GenDokument8 SeitenThe Sketch GenEd williamsonNoch keine Bewertungen

- WarzoneDokument3 SeitenWarzoneWilmar Abriol0% (1)

- TRD !!!appreciating The Risk of Ruin - Nauzer Basara (S&C Mag)Dokument6 SeitenTRD !!!appreciating The Risk of Ruin - Nauzer Basara (S&C Mag)cesarx2Noch keine Bewertungen

- John Herivel - The Background To Newton's Principia (1965, Oxford University Press) PDFDokument181 SeitenJohn Herivel - The Background To Newton's Principia (1965, Oxford University Press) PDFPrashant TomarNoch keine Bewertungen

- Elliott Wave Theory PDFDokument15 SeitenElliott Wave Theory PDFupkumara100% (1)

- Neo Wave PatternsDokument22 SeitenNeo Wave PatternsMuh Akbar Z100% (2)

- Auguste Comte - PPT PresentationDokument61 SeitenAuguste Comte - PPT Presentationmikeiancu20023934100% (8)

- Tradeciety's Math Cheat Sheet: R-Multiple Required Winrate Drawdown Recovery RateDokument1 SeiteTradeciety's Math Cheat Sheet: R-Multiple Required Winrate Drawdown Recovery RateSchumacher JuniorNoch keine Bewertungen

- Trading As BusinessDokument10 SeitenTrading As BusinesskantorNoch keine Bewertungen

- Manage Your Risk Like A Pro Trader Cheat SheetDokument18 SeitenManage Your Risk Like A Pro Trader Cheat SheetMircea Todor100% (2)

- Long Conservative Trade: Tradeonix Cheat SheetDokument5 SeitenLong Conservative Trade: Tradeonix Cheat SheetPanayiotis PeppasNoch keine Bewertungen

- A Trader CheckList - ActiveTraderIQ ArticleDokument3 SeitenA Trader CheckList - ActiveTraderIQ ArticleHussan MisthNoch keine Bewertungen

- Risk ManagementDokument20 SeitenRisk Managementmike aboladeNoch keine Bewertungen

- Analysis of Stock Market Cycles With Fbprophet Package in Python PDFDokument10 SeitenAnalysis of Stock Market Cycles With Fbprophet Package in Python PDFcidsant50% (2)

- Position Sizing and Money ManagementDokument2 SeitenPosition Sizing and Money ManagementMhd Bazzi100% (1)

- MyTradingPlan PDFDokument1 SeiteMyTradingPlan PDFSchumacher JuniorNoch keine Bewertungen

- Pencil in Profits in Any Market With A Calendar SpreadDokument13 SeitenPencil in Profits in Any Market With A Calendar SpreadRaju Roy100% (1)

- A Day Trading Strategy: The Gap System: Michael Tan, PH.D., CFADokument13 SeitenA Day Trading Strategy: The Gap System: Michael Tan, PH.D., CFAtudorNoch keine Bewertungen

- Monroe Trout - BioDokument2 SeitenMonroe Trout - BioCKachi713Noch keine Bewertungen

- Alpha Binary Team Management Plan: Account Balance Profit Per Day (%) DAY BalanceDokument5 SeitenAlpha Binary Team Management Plan: Account Balance Profit Per Day (%) DAY BalanceBoyka KirovNoch keine Bewertungen

- 02 - Class 02 - Focusing The GridDokument7 Seiten02 - Class 02 - Focusing The GridudayNoch keine Bewertungen

- 2011oct17 Foundations Class OneDokument11 Seiten2011oct17 Foundations Class OneMario Javier PakgoizNoch keine Bewertungen

- Howard Abell - Digital Day Trading. Moving From One Winning Stock Position To The NextDokument142 SeitenHoward Abell - Digital Day Trading. Moving From One Winning Stock Position To The NextNgan TrinhNoch keine Bewertungen

- GamePlan EbookDokument15 SeitenGamePlan Ebookrji58823Noch keine Bewertungen

- Trading Journal 23072019Dokument10 SeitenTrading Journal 23072019Mohamed Rizwan0% (1)

- Op Buy Harga Sekarang Op Sell Balance Free Margin Sisa Margin Level Lot Price Poin Floating Level LotDokument2 SeitenOp Buy Harga Sekarang Op Sell Balance Free Margin Sisa Margin Level Lot Price Poin Floating Level LotdaysanNoch keine Bewertungen

- DiagonalsDokument5 SeitenDiagonalsLuis FerNoch keine Bewertungen

- BinaryOptionsE BookDokument9 SeitenBinaryOptionsE BookKal MarshallNoch keine Bewertungen

- Developing An Annual Trading PlanDokument28 SeitenDeveloping An Annual Trading PlanjNoch keine Bewertungen

- 3 Chart Patterns Cheat SheetDokument7 Seiten3 Chart Patterns Cheat SheetKing of pumpNoch keine Bewertungen

- Simpleoptions Checklist PDFDokument3 SeitenSimpleoptions Checklist PDFsyNoch keine Bewertungen

- MarkDokument5 SeitenMarkShubhamSetiaNoch keine Bewertungen

- Get Your Free Covered Call CalculatorDokument5 SeitenGet Your Free Covered Call CalculatorafaefNoch keine Bewertungen

- How To Spot Trading ChannelsDokument54 SeitenHow To Spot Trading ChannelsSundaresan SubramanianNoch keine Bewertungen

- Using The Fibonacci Retracement Tool To Identify Support and ResistanceDokument26 SeitenUsing The Fibonacci Retracement Tool To Identify Support and ResistanceCoba CobaNoch keine Bewertungen

- Equity Sales and Trading Cheat SheetDokument1 SeiteEquity Sales and Trading Cheat SheetJoao ValdesNoch keine Bewertungen

- Key Takeaways: Investopedia StaffDokument6 SeitenKey Takeaways: Investopedia Staffjimmy victoriaNoch keine Bewertungen

- OptionsDokument51 SeitenOptionsKaren Hoffman100% (1)

- Trader PyramidDokument12 SeitenTrader Pyramidramji3115337Noch keine Bewertungen

- Richard Rhodes' Trading Rules: Chart SchoolDokument3 SeitenRichard Rhodes' Trading Rules: Chart SchoolSonu KumarNoch keine Bewertungen

- Disciplined Trader Trade Journal (Shares)Dokument730 SeitenDisciplined Trader Trade Journal (Shares)Krish KaraniyaNoch keine Bewertungen

- The 10 Commandments PDFDokument11 SeitenThe 10 Commandments PDFad11010010100% (1)

- PsychologyDokument9 SeitenPsychologymikoNoch keine Bewertungen

- The Trading Plan FSMDokument9 SeitenThe Trading Plan FSMDinesh CNoch keine Bewertungen

- Find and Trade Low Risk SetupsDokument6 SeitenFind and Trade Low Risk SetupsHaichuNoch keine Bewertungen

- Money Management INRDokument8 SeitenMoney Management INRhighlightsesports64Noch keine Bewertungen

- IndicatorsDokument3 SeitenIndicators'Izzad AfifNoch keine Bewertungen

- Jurnal Trading - TP - CLDokument3 SeitenJurnal Trading - TP - CLTrader Kaki LimaNoch keine Bewertungen

- Confirm Market Direction Tick by Tick With: Order Flow +Dokument12 SeitenConfirm Market Direction Tick by Tick With: Order Flow +Adolfo0% (2)

- The Top Technical Indicators For Options Trading PART 2Dokument4 SeitenThe Top Technical Indicators For Options Trading PART 2astro secretesNoch keine Bewertungen

- High Probability Strategy #1 - The 7am-9am (EST) DAX "Strudel" StrategyDokument1 SeiteHigh Probability Strategy #1 - The 7am-9am (EST) DAX "Strudel" StrategyAKSHAYA AKSHAYANoch keine Bewertungen

- Bollinger Band Keltner Cheat SheetDokument2 SeitenBollinger Band Keltner Cheat SheetMian Umar RafiqNoch keine Bewertungen

- Option VolatilityDokument50 SeitenOption VolatilityJunedi dNoch keine Bewertungen

- Trader's Checklist - : by Lance BeggsDokument17 SeitenTrader's Checklist - : by Lance BeggsNishantNoch keine Bewertungen

- 03 - The Reality of Trading - What Most Traders Will Never Find Out PDFDokument14 Seiten03 - The Reality of Trading - What Most Traders Will Never Find Out PDFextreme100% (1)

- 5 Winning Chart PatternsDokument31 Seiten5 Winning Chart PatternsnmliNoch keine Bewertungen

- 20 Rules For The Master Swing TraderDokument9 Seiten20 Rules For The Master Swing TraderAmber TajwerNoch keine Bewertungen

- Lesson 5 Protiective PutsDokument15 SeitenLesson 5 Protiective PutsDavid TieuNoch keine Bewertungen

- Bond Risks and Yield Curve AnalysisDokument33 SeitenBond Risks and Yield Curve Analysisarmando.chappell1005Noch keine Bewertungen

- The Forex Options Course: A Self-Study Guide to Trading Currency OptionsVon EverandThe Forex Options Course: A Self-Study Guide to Trading Currency OptionsNoch keine Bewertungen

- Rocking Wall Street: Four Powerful Strategies That will Shake Up the Way You Invest, Build Your Wealth And Give You Your Life BackVon EverandRocking Wall Street: Four Powerful Strategies That will Shake Up the Way You Invest, Build Your Wealth And Give You Your Life BackBewertung: 1 von 5 Sternen1/5 (1)

- Leti Arch SummaryDokument2 SeitenLeti Arch SummaryPrashant TomarNoch keine Bewertungen

- Target ChinaDokument170 SeitenTarget Chinadantevantes50% (2)

- Govt. Bank Officers Happiness SurveyDokument6 SeitenGovt. Bank Officers Happiness SurveyPrashant TomarNoch keine Bewertungen

- Specific FeaturesDokument1 SeiteSpecific FeaturesPrashant TomarNoch keine Bewertungen

- Yrf - Yrf - Micromax - Tech Micromax - Tech Partner PartnerDokument13 SeitenYrf - Yrf - Micromax - Tech Micromax - Tech Partner PartnerPrashant TomarNoch keine Bewertungen

- Watchlist Map For TradesDokument2 SeitenWatchlist Map For TradesPrashant TomarNoch keine Bewertungen

- Forex 4 UDokument25 SeitenForex 4 US N Gautam100% (2)

- Dr. Vijaya Katti Chairperson (MDPS) Indian Institute of Foreign Trade New DelhiDokument69 SeitenDr. Vijaya Katti Chairperson (MDPS) Indian Institute of Foreign Trade New DelhiPrashant TomarNoch keine Bewertungen

- The Truth About Fibonacci TradingDokument22 SeitenThe Truth About Fibonacci TradingrsvelforexNoch keine Bewertungen

- Watchlist Map For TradesDokument2 SeitenWatchlist Map For TradesPrashant TomarNoch keine Bewertungen

- Ads Create ToolDokument1 SeiteAds Create ToolPrashant TomarNoch keine Bewertungen

- Food Initiation It's Just Started: Sector UpdateDokument48 SeitenFood Initiation It's Just Started: Sector UpdatePrashant TomarNoch keine Bewertungen

- Left Wing ExtremismDokument2 SeitenLeft Wing ExtremismPrashant TomarNoch keine Bewertungen

- Approach To Writing Answers in Mains ExamDokument6 SeitenApproach To Writing Answers in Mains ExamPrashant TomarNoch keine Bewertungen

- Askqance 2008 Informal Sports Quiz AnswersDokument1 SeiteAskqance 2008 Informal Sports Quiz AnswersPrashant TomarNoch keine Bewertungen

- RPH 1Dokument2 SeitenRPH 1Amor VillaNoch keine Bewertungen

- User Guide: How To Register & Verify Your Free Paxum Personal AccountDokument17 SeitenUser Guide: How To Register & Verify Your Free Paxum Personal AccountJose Manuel Piña BarriosNoch keine Bewertungen

- Definition of ConsiderationDokument3 SeitenDefinition of ConsiderationZain IrshadNoch keine Bewertungen

- Brand Management Assignment 1 FINALDokument4 SeitenBrand Management Assignment 1 FINALbalakk06Noch keine Bewertungen

- GROUP 2 Mental Health Program and PoliciesDokument12 SeitenGROUP 2 Mental Health Program and PoliciesCantos FlorenceNoch keine Bewertungen

- Student Copy of Function OperationsDokument8 SeitenStudent Copy of Function OperationsAnoop SreedharNoch keine Bewertungen

- Barnacus: City in Peril: BackgroundDokument11 SeitenBarnacus: City in Peril: BackgroundEtienne LNoch keine Bewertungen

- Evidence Cases Feb 11Dokument45 SeitenEvidence Cases Feb 11Josh CelajeNoch keine Bewertungen

- Safe Hospitals ManualDokument43 SeitenSafe Hospitals ManualMaeDaphneYapNoch keine Bewertungen

- Processes of Word Formation - 4Dokument18 SeitenProcesses of Word Formation - 4Sarah Shahnaz IlmaNoch keine Bewertungen

- Cosmetics & Toiletries Market Overviews 2015Dokument108 SeitenCosmetics & Toiletries Market Overviews 2015babidqn100% (1)

- Republic V Encelan GR No 170022 January 9, 2013Dokument20 SeitenRepublic V Encelan GR No 170022 January 9, 2013ultra gayNoch keine Bewertungen

- Inclusive Approach For Business Sustainability: Fostering Sustainable Development GoalsDokument1 SeiteInclusive Approach For Business Sustainability: Fostering Sustainable Development Goalsaakash sharmaNoch keine Bewertungen

- Network DDoS Incident Response Cheat SheetDokument1 SeiteNetwork DDoS Incident Response Cheat SheetDizzyDudeNoch keine Bewertungen

- Part II. Market Power: Chapter 4. Dynamic Aspects of Imperfect CompetitionDokument9 SeitenPart II. Market Power: Chapter 4. Dynamic Aspects of Imperfect Competitionmoha dahmaniNoch keine Bewertungen

- ACCOUNTINGDokument2 SeitenACCOUNTINGtrixie manitoNoch keine Bewertungen

- US Internal Revenue Service: Irb04-43Dokument27 SeitenUS Internal Revenue Service: Irb04-43IRSNoch keine Bewertungen

- Ordnance Survey Business Portfolio Price ListDokument24 SeitenOrdnance Survey Business Portfolio Price ListjoebrickleyNoch keine Bewertungen

- Dharma DuraiDokument3 SeitenDharma Duraivsection managerNoch keine Bewertungen

- Tallado V. ComelecDokument3 SeitenTallado V. ComelecLorelain ImperialNoch keine Bewertungen

- Milton Friedman - The Demand For MoneyDokument7 SeitenMilton Friedman - The Demand For MoneyanujasindhujaNoch keine Bewertungen

- Cambridge IGCSE™: Information and Communication Technology 0417/12Dokument9 SeitenCambridge IGCSE™: Information and Communication Technology 0417/12Ibrahim Abdi ChirwaNoch keine Bewertungen

- Khilafat Movement 1919-1924Dokument17 SeitenKhilafat Movement 1919-1924Grane FrameNoch keine Bewertungen

- IFRS3: Business CombinationDokument56 SeitenIFRS3: Business Combinationmesfin yemerNoch keine Bewertungen

- WukolumDokument2 SeitenWukolumHammed OkusiNoch keine Bewertungen

- Chap 0023Dokument26 SeitenChap 0023yousef olabiNoch keine Bewertungen

- How I Have Experienced The 2020: LockdownDokument3 SeitenHow I Have Experienced The 2020: LockdownГеоргий КузнецовNoch keine Bewertungen

- Liquidity Risk Management Framework For NBFCS: Study NotesDokument5 SeitenLiquidity Risk Management Framework For NBFCS: Study NotesDipu PiscisNoch keine Bewertungen