Beruflich Dokumente

Kultur Dokumente

Circular1 PDF

Hochgeladen von

Sanjeev KumarOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Circular1 PDF

Hochgeladen von

Sanjeev KumarCopyright:

Verfügbare Formate

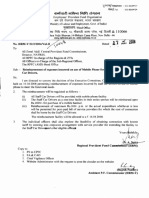

Telegram: “KENDRIYA NIDHI” New Delhi Telephone: (011)26172677

E-Mail:cpfc@alpha.nic.in

FAX : (011)26168431

Employees’ Provident Fund Organisation

(Ministry of Labour, Govt. Of India)

Head Office

Bhavishya Nidhi Bhawan, 14-Bhikaji Cama Place, New Delhi-110066

No Pension/Misc./2005 Dated:

To

All Regional Provident Fund Commissioners

Regional Offices/ Sub Regional Offices.

Subject:- Contribution on salary exceeding the statutory limit (Para 11(3)) of

EPS’95

Attention is invited to the following circulars:-

1. Circular No.Pen/4(2)96/SLP/Vol.V/16598 dated 26.6.2004.

2. Letter No. Pen.4 (38).96/WB/59867 dated 1.12.2004.

3. Circular No.Pen/Misc/2006/Vol.I dated 25.4.2006.

Instructions have already been issued by this office on the issue of contributing

on a pay exceeding the statutory limit under Para 11(3) of the Employees’ Pension

Scheme, 1995. However, the field offices are finding it difficult to take decisions. As a

result this office has been receiving a number of references from field offices, not to

speak of the volley of grievances being aired by the members through various channels.

Therefore it has become necessary for this office to issue guidelines in a more clear term.

While deciding the issue the following provisions may be kept in mind:

1) Under EPS there is no contribution payable separately. Under Para 3 of the

EPS, from and out of the contributions payable by the employer in each month

under Section 6 of the Act, the employer shall remit a part of contribution

representing 8.33 percent of the Employees pay to the EPS. Therefore, it is

only the employer’s share of contribution payable under Employees Provident

Fund Scheme, 1952 that is being diverted to EPS to the extent as aforesaid.

2) Accordingly, the option to contribute on a pay exceeding statutory limit is

available to a member only under Para 26(6) of the Employees Provident

Fund Scheme, 1952 and not under Para 11(3) of the EPS.

3) In fact Para 11(3) clarifies the methodology of determination of pensionable

salary only.

2

4) Since opting to contribute on higher pay to EPS means a contribution on

higher pay to Provident Fund as well, Para 11(3) provision will apply to only

such of those employees who have been contributing on a higher pay under

Para 26(6) of the Employees Provident Fund Scheme, 1952.

Accordingly the grievances may be classified into the following categories and

the issues be decided.

1. In all such cases where the employee has contributed over and above the

statutory limit either from 16.3.1996 or from the month in which his salary

exceeded the limit after having exercised his option and the same having been

accepted by the Office, the pensionable salary will be based on such salary.

2. If the option was not exercised at the time of salary crossing the statutory limit

or on 16.3.1996, as the case may be and the contribution was deposited on

salary exceeding the limit after receiving instructions from the Office before

the date of issue of circular dated 22.6.2004, the department has the vicarious

liability (restricted to the specific case only) of honouring such a commitment

and hence the pensionable salary shall be on the actual salary i.e. on the salary

(exceeding the statutory limit) on which the contribution was paid. However,

this is subject to i) a satisfactory explanation to be obtained and taken on

record from the officer who made such a commitment. ii) the employer having

remitted the administration charges and other contributions on such higher

salary.

3. In the cases where no option was given or no commitment was made by the

concerned Office, but the contribution on higher pay was deposited by the

establishment/ employee, on their own such excess contributions will be

considered as erroneous contributions and the pensionable salary will be

restricted to the statutory ceiling existing from time to time.

So all field offices are requested to consider the grievances voiced under Para

11(3) in accordance with the above clarification and decide the issues at their level

without referring them to the Head Office unnecessarily.

(This issues with the approval of CPFC)

Yours faithfully,

(RAJESH BANSAL)

ADDL. CENTRAL P.F. COMMISSIONER (PENSION)

C:\Documents and Settings\Administrator\Desktop\circular1.doc

3

Copy to:

1. PS to CPFC

2. FA & CAO

3. All Addl. CPFCs, Zone/ Head Office.

4. Director (NATRSS)

5. CVO

6. Director/Deputy Directors (Vig.)

7. All RPFCs (Pension)

8. All Zonal Training Institutes.

9. All Zonal Audit Offices.

(K.V.SARVESWARAN)

REGIONAL P.F. COMMISSIONER (PENSION)

C:\Documents and Settings\Administrator\Desktop\circular1.doc

Das könnte Ihnen auch gefallen

- Rejection Letter PDFDokument1 SeiteRejection Letter PDFkrishancafegmailcomNoch keine Bewertungen

- Setting up, operating and maintaining Self-Managed Superannuation FundsVon EverandSetting up, operating and maintaining Self-Managed Superannuation FundsNoch keine Bewertungen

- FAQ S For Application For POHW 20230513Dokument6 SeitenFAQ S For Application For POHW 20230513Ayush BhattNoch keine Bewertungen

- GenLetters PDFDokument1 SeiteGenLetters PDFSanjeev KumarNoch keine Bewertungen

- Higher Pension FAQs EngDokument8 SeitenHigher Pension FAQs EngSrimannarayana NandamNoch keine Bewertungen

- Pension2022 55893 15785Dokument3 SeitenPension2022 55893 15785Pramod BeheraNoch keine Bewertungen

- ONGC CircularEPS - Feb2023Dokument6 SeitenONGC CircularEPS - Feb2023Honey singhNoch keine Bewertungen

- EPFO Higher Pension Option Form 11 Retired EmployeeDokument3 SeitenEPFO Higher Pension Option Form 11 Retired Employeekasarmama7Noch keine Bewertungen

- Additional Charge ClarificationDokument3 SeitenAdditional Charge ClarificationkuththanNoch keine Bewertungen

- Short Title and CommencementDokument10 SeitenShort Title and CommencementRaj KrNoch keine Bewertungen

- PF & Pension Fund Deptt. Circular No. PF & Pension Fund Deptt. Circular No.05/2021Dokument4 SeitenPF & Pension Fund Deptt. Circular No. PF & Pension Fund Deptt. Circular No.05/2021Amit SinghNoch keine Bewertungen

- Fin e 63305 2 2010Dokument3 SeitenFin e 63305 2 2010venkatasubramaniyanNoch keine Bewertungen

- Office of The Principal CDADokument3 SeitenOffice of The Principal CDADeepak Pandey DeepsNoch keine Bewertungen

- Reply - EPFO Apex Court Contempt Petition - HPTDC Union PDFDokument22 SeitenReply - EPFO Apex Court Contempt Petition - HPTDC Union PDFSudha100% (1)

- Signature Not VerifiedDokument9 SeitenSignature Not VerifiedMoshe Sawyer WeinbergNoch keine Bewertungen

- Contributory Medical Attendance Rules - BELDokument64 SeitenContributory Medical Attendance Rules - BELVeda PrakashNoch keine Bewertungen

- Stepping Up Dopt Order 26.10.2018Dokument4 SeitenStepping Up Dopt Order 26.10.2018rakeshambasanaNoch keine Bewertungen

- Borromeo v. Civil Service Commission (1991) DoctrineDokument3 SeitenBorromeo v. Civil Service Commission (1991) Doctrinepoppy2890Noch keine Bewertungen

- Compendium For RetireCompendium For Retirees - PdfesDokument64 SeitenCompendium For RetireCompendium For Retirees - PdfesGujuNoch keine Bewertungen

- Higher Wager Form 26Dokument2 SeitenHigher Wager Form 26White knight 209 gamingNoch keine Bewertungen

- JD Under para 26 (6) of EPF SchemeDokument2 SeitenJD Under para 26 (6) of EPF SchemeSkillTree PayrollNoch keine Bewertungen

- On Labour Laws & Labour Codes by CA Darshan Balai Held On 16.3.2023Dokument25 SeitenOn Labour Laws & Labour Codes by CA Darshan Balai Held On 16.3.2023vramu_caNoch keine Bewertungen

- Offer Letter - Nafisa 1Dokument9 SeitenOffer Letter - Nafisa 1surinder sangarNoch keine Bewertungen

- Finance (PGC) Department: Sl. No. Points Raised ClarificationDokument3 SeitenFinance (PGC) Department: Sl. No. Points Raised Clarificationrajkumar_k_99Noch keine Bewertungen

- 1 2Dokument4 Seiten1 2Robin DeyNoch keine Bewertungen

- Commission On Audit Circular No. 86-259 April 14, 1986Dokument5 SeitenCommission On Audit Circular No. 86-259 April 14, 1986bolNoch keine Bewertungen

- On "Provident Fund & MP Act 1952" of India.Dokument14 SeitenOn "Provident Fund & MP Act 1952" of India.Anshu Shekhar Singh100% (4)

- RECOVERY OF EXCESS PAYMENTS FROM GOVERNMENT EMPLOYEES Dated 2nd Mar 2016Dokument3 SeitenRECOVERY OF EXCESS PAYMENTS FROM GOVERNMENT EMPLOYEES Dated 2nd Mar 2016Heartwin Amaladhas PushpadassNoch keine Bewertungen

- RKTZR WET: Employees' Provident Fund OrganisationDokument6 SeitenRKTZR WET: Employees' Provident Fund Organisationswan4uNoch keine Bewertungen

- All India Cantoment FedreationDokument5 SeitenAll India Cantoment FedreationRavi SolankiNoch keine Bewertungen

- To The Under: DelhilDokument4 SeitenTo The Under: DelhilKabul DasNoch keine Bewertungen

- Government of Andhra PradeshDokument3 SeitenGovernment of Andhra PradeshRDO ONGOLENoch keine Bewertungen

- DL0001Dokument6 SeitenDL0001Kurshida SattigeriNoch keine Bewertungen

- Epfo Circular On Applications For Validation of Option or Joint OptionDokument5 SeitenEpfo Circular On Applications For Validation of Option or Joint OptionOvertoyou worldNoch keine Bewertungen

- TSPIC Corp. Vs TSPIC Employees UnionDokument2 SeitenTSPIC Corp. Vs TSPIC Employees UnionArnold Jr AmboangNoch keine Bewertungen

- RR GuidelinesDokument35 SeitenRR Guidelinesamnpavan100% (1)

- Retirement BenefitsDokument14 SeitenRetirement BenefitsAnupNoch keine Bewertungen

- Dr. Shahnawaz Letter of IntentDokument2 SeitenDr. Shahnawaz Letter of Intentamukherjee84Noch keine Bewertungen

- MahilaDokument20 SeitenMahilasushant3333Noch keine Bewertungen

- SC Order On EPS-95 Dt. 04-11-2022Dokument3 SeitenSC Order On EPS-95 Dt. 04-11-2022Santosh KumarNoch keine Bewertungen

- PF & Miscellaneous Provisions ActDokument19 SeitenPF & Miscellaneous Provisions Actpriya_ammuNoch keine Bewertungen

- GO MS No.29Dokument5 SeitenGO MS No.29kvjraghunathNoch keine Bewertungen

- Bonus Act, 2030 (1974) Last AmendmentsDokument11 SeitenBonus Act, 2030 (1974) Last AmendmentsDeep JoshiNoch keine Bewertungen

- YDokument4 SeitenYBernadette RajNoch keine Bewertungen

- Guidelines) : Exemption: Provisions of Act/SchemesDokument14 SeitenGuidelines) : Exemption: Provisions of Act/Schemes2009a003Noch keine Bewertungen

- Summary of Pensionary BenefitsDokument3 SeitenSummary of Pensionary BenefitsAnonymous uFqb94BGzNoch keine Bewertungen

- Cash Handling AllowanceDokument3 SeitenCash Handling AllowanceJennifer RaiNoch keine Bewertungen

- Downloadfile 34Dokument5 SeitenDownloadfile 34eehousing mplNoch keine Bewertungen

- Eps - Clarification - 22ND Feb 2023Dokument2 SeitenEps - Clarification - 22ND Feb 2023infoNoch keine Bewertungen

- RC Gupta Vs Epfo Eps Pension Case 399027Dokument9 SeitenRC Gupta Vs Epfo Eps Pension Case 399027Manish SahuNoch keine Bewertungen

- Bonus Act AmendmentDokument2 SeitenBonus Act AmendmentgopalakrishnanNoch keine Bewertungen

- UGC Extension NoticeDokument6 SeitenUGC Extension NoticeRAMAKRISHNA VNoch keine Bewertungen

- E4-E5 - Text - Chapter 7. DOT Cell FunctionsDokument9 SeitenE4-E5 - Text - Chapter 7. DOT Cell Functionssmita kujurNoch keine Bewertungen

- Artifact 5a - Guidelines For Filling PF Withdrawal Form TCSDokument3 SeitenArtifact 5a - Guidelines For Filling PF Withdrawal Form TCSAmy Brady100% (3)

- Compilation Off Instructions On Trade Union Facilities Admissible To Unions.50105313Dokument27 SeitenCompilation Off Instructions On Trade Union Facilities Admissible To Unions.50105313Raz Tulagapu100% (1)

- JD Form IiDokument2 SeitenJD Form Iiredminote7s098Noch keine Bewertungen

- Interloop IA Report Dec-Feb 2008Dokument35 SeitenInterloop IA Report Dec-Feb 2008Abdul WahabNoch keine Bewertungen

- Procedure of Approval of Gratuity Funds Under Income Tax Act, 1961 - Taxguru - inDokument15 SeitenProcedure of Approval of Gratuity Funds Under Income Tax Act, 1961 - Taxguru - inJay SharmaNoch keine Bewertungen

- November 2019Dokument93 SeitenNovember 2019Pratyusha ReddyNoch keine Bewertungen

- PensionCalculationMadeEasy PDFDokument2 SeitenPensionCalculationMadeEasy PDFzigzagzodiacNoch keine Bewertungen

- Pension LCRC PDFDokument3 SeitenPension LCRC PDFSanjeev KumarNoch keine Bewertungen

- StaffQtrs CompAllot PDFDokument1 SeiteStaffQtrs CompAllot PDFSanjeev KumarNoch keine Bewertungen

- Posting ProfileDokument2 SeitenPosting ProfileSanjeev KumarNoch keine Bewertungen

- Notification Schemes PDFDokument10 SeitenNotification Schemes PDFSanjeev KumarNoch keine Bewertungen

- OneDayPay PDFDokument1 SeiteOneDayPay PDFSanjeev KumarNoch keine Bewertungen

- MobStaffCarDrivr PDFDokument1 SeiteMobStaffCarDrivr PDFSanjeev KumarNoch keine Bewertungen

- OfficersDBF PDFDokument2 SeitenOfficersDBF PDFSanjeev KumarNoch keine Bewertungen

- Particulars For Grant of Relaxation PDFDokument7 SeitenParticulars For Grant of Relaxation PDFSanjeev KumarNoch keine Bewertungen

- NFMS PDFDokument2 SeitenNFMS PDFSanjeev KumarNoch keine Bewertungen

- NATRSS TrgCal2008 PDFDokument4 SeitenNATRSS TrgCal2008 PDFSanjeev KumarNoch keine Bewertungen

- Natrss TRGCLR PDFDokument5 SeitenNatrss TRGCLR PDFSanjeev KumarNoch keine Bewertungen

- IntWorker PDFDokument3 SeitenIntWorker PDFSanjeev KumarNoch keine Bewertungen

- List PDFDokument11 SeitenList PDFSanjeev KumarNoch keine Bewertungen

- Employees Providen Und Organisation: If FRRRDokument2 SeitenEmployees Providen Und Organisation: If FRRRSanjeev KumarNoch keine Bewertungen

- IntProc Cover PDFDokument2 SeitenIntProc Cover PDFSanjeev KumarNoch keine Bewertungen

- Higher Wages PDFDokument3 SeitenHigher Wages PDFSanjeev KumarNoch keine Bewertungen

- IT Act Changes PDFDokument7 SeitenIT Act Changes PDFSanjeev KumarNoch keine Bewertungen

- orilt: (Ministry of Labour, Go/!I. of India)Dokument2 Seitenorilt: (Ministry of Labour, Go/!I. of India)Sanjeev KumarNoch keine Bewertungen

- HRM DEO Hire PDFDokument1 SeiteHRM DEO Hire PDFSanjeev KumarNoch keine Bewertungen

- HarraWomenWP PDFDokument2 SeitenHarraWomenWP PDFSanjeev KumarNoch keine Bewertungen

- EarlyPen Calri PDFDokument1 SeiteEarlyPen Calri PDFSanjeev KumarNoch keine Bewertungen

- FWD BelatCredit PDFDokument2 SeitenFWD BelatCredit PDFSanjeev KumarNoch keine Bewertungen

- FileSLP PDFDokument2 SeitenFileSLP PDFSanjeev KumarNoch keine Bewertungen

- DateofBirth PDFDokument7 SeitenDateofBirth PDFSanjeev KumarNoch keine Bewertungen

- DetailsDEO PDFDokument1 SeiteDetailsDEO PDFSanjeev KumarNoch keine Bewertungen

- DelePower IT PDFDokument5 SeitenDelePower IT PDFSanjeev KumarNoch keine Bewertungen

- Details DEO PDFDokument2 SeitenDetails DEO PDFSanjeev KumarNoch keine Bewertungen

- THE RISE OF BUSINESS USE TWO-WHEELERS IN ASIA by Roland BergerDokument8 SeitenTHE RISE OF BUSINESS USE TWO-WHEELERS IN ASIA by Roland BergerJoanna SantosoNoch keine Bewertungen

- 4a - Pre-Release Material For 2011Dokument6 Seiten4a - Pre-Release Material For 2011Ahmed HamzaNoch keine Bewertungen

- GDR Global Depository ReceiptsDokument28 SeitenGDR Global Depository Receiptssrk_pk_sunnyNoch keine Bewertungen

- Global Marketing and R&DDokument43 SeitenGlobal Marketing and R&Djosiah9_5100% (1)

- Noble Group 15th Nov 2013Dokument39 SeitenNoble Group 15th Nov 2013VarshneyaSridharanNoch keine Bewertungen

- GPAC Purple Roadshow Presentation 01.07.18Dokument41 SeitenGPAC Purple Roadshow Presentation 01.07.18Ala BasterNoch keine Bewertungen

- Nptel: TopicDokument104 SeitenNptel: TopicRAJAT . 20GSOB1010459Noch keine Bewertungen

- Aashish Tyagi - Resume UpdatedDokument3 SeitenAashish Tyagi - Resume UpdatedRajul BajpaiNoch keine Bewertungen

- Capturing Marketing Insights: 1. Collecting Information and Forecasting DemandDokument64 SeitenCapturing Marketing Insights: 1. Collecting Information and Forecasting DemandNandan Choudhary100% (1)

- TB21 PDFDokument33 SeitenTB21 PDFJi WonNoch keine Bewertungen

- Sarthee Consultancy - Corporate PresentationDokument11 SeitenSarthee Consultancy - Corporate PresentationSarthee ConsultancyNoch keine Bewertungen

- Chapter Three Golis UniversityDokument40 SeitenChapter Three Golis UniversityCabdixakiim-Tiyari Cabdillaahi AadenNoch keine Bewertungen

- Organization of Production: Test IiDokument7 SeitenOrganization of Production: Test IiKamarul NizamNoch keine Bewertungen

- Subcontractor PrequalificationsDokument2 SeitenSubcontractor PrequalificationsMike KarlinsNoch keine Bewertungen

- Ia04E01 - International Accounting - Elective Course Semester IV Credit - 3 - 1Dokument11 SeitenIa04E01 - International Accounting - Elective Course Semester IV Credit - 3 - 1mohanraokp2279Noch keine Bewertungen

- Examples SMART GOALSDokument1 SeiteExamples SMART GOALSMinh TranNoch keine Bewertungen

- The Relationship Between Corporate Social Responsibility and Financial Performance of Listed Isurance Firms in KenyaDokument3 SeitenThe Relationship Between Corporate Social Responsibility and Financial Performance of Listed Isurance Firms in Kenyajohn MandagoNoch keine Bewertungen

- Angel OneDokument139 SeitenAngel OneReTHINK INDIANoch keine Bewertungen

- Comparative Analysis of Mutual Funds With Special Reference To Bajaj CapitalDokument13 SeitenComparative Analysis of Mutual Funds With Special Reference To Bajaj Capitalpankajbhatt1993Noch keine Bewertungen

- Quality Principles of Deming Juran & CrosbyDokument1 SeiteQuality Principles of Deming Juran & CrosbyStephen De GuzmanNoch keine Bewertungen

- Logical DWDesignDokument5 SeitenLogical DWDesignbvishwanathrNoch keine Bewertungen

- Report Sales Periode 23, OktDokument5 SeitenReport Sales Periode 23, OktgarnafiqihNoch keine Bewertungen

- 10.4324 9781315796789 PreviewpdfDokument124 Seiten10.4324 9781315796789 Previewpdftranminhquan08102003Noch keine Bewertungen

- QWERTY On GamesDokument10 SeitenQWERTY On GamesPradipta DashNoch keine Bewertungen

- Catalyst Brochure - Chairman Zia Q QureshiDokument39 SeitenCatalyst Brochure - Chairman Zia Q QureshiZiaNoch keine Bewertungen

- CH 16Dokument10 SeitenCH 16Daniel Caesar PanjaitanNoch keine Bewertungen

- Weston Corporation Has An Internal Audit Department Operating OuDokument2 SeitenWeston Corporation Has An Internal Audit Department Operating OuAmit PandeyNoch keine Bewertungen

- ITC PSPD, Kovai (Coimbatore) : QuestionnairesDokument4 SeitenITC PSPD, Kovai (Coimbatore) : QuestionnairesJohn LukoseNoch keine Bewertungen

- Case Study On LakmeDokument3 SeitenCase Study On LakmeSudhir KakarNoch keine Bewertungen

- SEIU-UHW's Contract With Pacifica Hospital of The Valley 4-22-09Dokument3 SeitenSEIU-UHW's Contract With Pacifica Hospital of The Valley 4-22-09Anonymous iC9QziKNoch keine Bewertungen

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassVon EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNoch keine Bewertungen

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsVon EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNoch keine Bewertungen

- Money Made Easy: How to Budget, Pay Off Debt, and Save MoneyVon EverandMoney Made Easy: How to Budget, Pay Off Debt, and Save MoneyBewertung: 5 von 5 Sternen5/5 (1)

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantVon EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantBewertung: 4 von 5 Sternen4/5 (104)

- Budget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Von EverandBudget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Bewertung: 5 von 5 Sternen5/5 (89)

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsVon EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsNoch keine Bewertungen

- Personal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationVon EverandPersonal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationBewertung: 4.5 von 5 Sternen4.5/5 (18)

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsVon EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsBewertung: 4 von 5 Sternen4/5 (4)

- The Best Team Wins: The New Science of High PerformanceVon EverandThe Best Team Wins: The New Science of High PerformanceBewertung: 4.5 von 5 Sternen4.5/5 (31)

- Sacred Success: A Course in Financial MiraclesVon EverandSacred Success: A Course in Financial MiraclesBewertung: 5 von 5 Sternen5/5 (15)

- Improve Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouVon EverandImprove Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouBewertung: 5 von 5 Sternen5/5 (5)

- The 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)Von EverandThe 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)Bewertung: 3.5 von 5 Sternen3.5/5 (9)

- Altcoins Coins The Future is Now Enjin Dogecoin Polygon Matic Ada: blockchain technology seriesVon EverandAltcoins Coins The Future is Now Enjin Dogecoin Polygon Matic Ada: blockchain technology seriesBewertung: 5 von 5 Sternen5/5 (1)

- How to Save Money: 100 Ways to Live a Frugal LifeVon EverandHow to Save Money: 100 Ways to Live a Frugal LifeBewertung: 5 von 5 Sternen5/5 (1)

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesVon EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesBewertung: 4.5 von 5 Sternen4.5/5 (30)

- How To Budget And Manage Your Money In 7 Simple StepsVon EverandHow To Budget And Manage Your Money In 7 Simple StepsBewertung: 5 von 5 Sternen5/5 (4)

- Money Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayVon EverandMoney Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayBewertung: 3.5 von 5 Sternen3.5/5 (2)

- Happy Go Money: Spend Smart, Save Right and Enjoy LifeVon EverandHappy Go Money: Spend Smart, Save Right and Enjoy LifeBewertung: 5 von 5 Sternen5/5 (4)

- The New York Times Pocket MBA Series: Forecasting Budgets: 25 Keys to Successful PlanningVon EverandThe New York Times Pocket MBA Series: Forecasting Budgets: 25 Keys to Successful PlanningBewertung: 4.5 von 5 Sternen4.5/5 (8)

- Buy the Milk First: ... and Other Secrets to Financial Prosperity, Regardless of Your IncomeVon EverandBuy the Milk First: ... and Other Secrets to Financial Prosperity, Regardless of Your IncomeNoch keine Bewertungen

- Minding Your Own Business: A Common Sense Guide to Home Management and IndustryVon EverandMinding Your Own Business: A Common Sense Guide to Home Management and IndustryBewertung: 5 von 5 Sternen5/5 (1)

- Swot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessVon EverandSwot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessBewertung: 4.5 von 5 Sternen4.5/5 (4)

- Smart, Not Spoiled: The 7 Money Skills Kids Must Master Before Leaving the NestVon EverandSmart, Not Spoiled: The 7 Money Skills Kids Must Master Before Leaving the NestBewertung: 5 von 5 Sternen5/5 (1)

- Bitcoin Secrets Revealed - The Complete Bitcoin Guide To Buying, Selling, Mining, Investing And Exchange Trading In Bitcoin CurrencyVon EverandBitcoin Secrets Revealed - The Complete Bitcoin Guide To Buying, Selling, Mining, Investing And Exchange Trading In Bitcoin CurrencyBewertung: 4 von 5 Sternen4/5 (4)

- The Complete Strategy Guide to Day Trading for a Living in 2019: Revealing the Best Up-to-Date Forex, Options, Stock and Swing Trading Strategies of 2019 (Beginners Guide)Von EverandThe Complete Strategy Guide to Day Trading for a Living in 2019: Revealing the Best Up-to-Date Forex, Options, Stock and Swing Trading Strategies of 2019 (Beginners Guide)Bewertung: 4 von 5 Sternen4/5 (34)

- Summary of You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You Want by Jesse MechamVon EverandSummary of You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You Want by Jesse MechamBewertung: 5 von 5 Sternen5/5 (1)