Beruflich Dokumente

Kultur Dokumente

22nd February 201: W W W W Week Eek Eek Eek Eek

Hochgeladen von

bongoloidOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

22nd February 201: W W W W Week Eek Eek Eek Eek

Hochgeladen von

bongoloidCopyright:

Verfügbare Formate

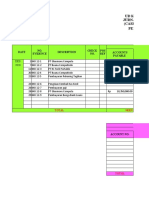

PAYMENTS RECORD

Week WORKED EXAMPLE

22nd February 201with more Guide Notes

commencing .......................................................... Ref

BY CASH

BY CHEQUE, CARD

OR DIRECT BANKING

£ p £ p

opposite

A. Jones 133 22 20

MONEY RECORD BANK RECORD

A. Supply Co. 074 87 23

Money in hand £ p Balance in Bank £ p

I.M. Quick 134 12 32

at start of Week 106 39 at start of Week 1,292 59 Brown & Son 107 24

D/B

Stock or Raw Materials

General Note

All the data in this Worked Example J. Smith & Co. D/B 156 90

is fictitious. ABCD Group 138 30 00

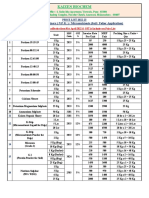

DAILY TAKINGS DAILY BANKINGS

Ref = Reference

Monday 110 88 Monday 152 37 For a cash payment you could put the

payment date in the Ref column, or you could use

Tuesday 117 71 Tuesday 1,478 59 the unique sequential number you wrote on the invoice

or receipt. For a cheque payment, use the last 3 figures of

Wednesday 224 08 Wednesday the cheque number. For a business card write “Card”.

Thursday 173 18 Thursday For Direct Banking write “D/B”, “D/D” for a Direct

Debit, or “S/O” for a Standing Order.

Friday 215 47 Friday 612 73

Saturday 246 80 Saturday 139 50 Stock or Raw Materials Sub-Totals 64 52 351 37

Sunday Sunday Staff Wages B. Good (Pt-time) 075 105 00

Employee Costs

Total Takings 1,088 12 Total Bankings 2,383 19

Allowable Expenses

OTHER MONEY COMING IN DIRECT CREDITS/DEBITS Staff PAYE/NIC Generally, costs you pay with

the sole purpose of earning business

Business Rent

Chq from private a/c 1,250 00 J. Smith 75 00 profits are allowable expenses. Hence

Direct Credits

Premises Costs

Business Rates non-business or personal costs are

A.Brown 95 00 not usually tax deductible.

Cleaning

Electric/Gas/Heat /Water D/D 33 79

Property Insurance

Any interest your bank Total Credits 170 00

pays you on your business account Repairs

enter as a “Direct Credit”. Any interest Bank Charges 34 75

the bank charges you (eg on an over- Business Insurances

draft) enter as a “Direct Debit” Bank Interest

General Admin. Expenses

under “Bank Interest”. Card Charges Postage/Couriers 137 8 48

Direct Debits

Other Charges

Stationery/Printing 136 13 50

Subscriptions

Sundries 135 & 139 7 88

Telephone/Fax/Mobile

Internet

Cash from Bank 100 00 Í Cash Withdrawn 100 00

Total 1,350 00 Total Debits 134 75 Fuel Card 29 00

Motor

Repairs/Service

No Business Account?

If you don’t have a business bank account, Other Costs (specify)

the figures below may not balance.

Travel &

WEEK’S MONEY BALANCE WEEK’S BANK BALANCE Good Practice

Subsistence When you complete a page, it’s

£ at start of week 106 39 £ at start of week 1,292 59 good practice to transfer the figures to

Advertising the “At Year End” Annual Summary pages

+ Daily Takings 1,088 12 + Daily Bankings 2,383 19 & Promotion located near the end of this book.

+ Other Money In 1,350 00 + Direct Credits 170 00 Tip: Use a pencil (lightly) to

Legal & begin with!

– Daily Bankings 2,383 19 – Direct Debits 134 75 Professional

– Cash Payments 94 38 – Chq. etc Payments 3,269 16

Other

Leaves: Balance 66 94 Leaves: Balance 441 87 Expenses

Carry these figures Self D/B 250 00

forward to next week. Drawings

& NIC

Money in hand at end of Week Monthly Bank Statement Check

Total as counted 66 89 Statement Balance 2,939 57 Van (Second-hand) 076 2,500 00

Add any bankings CAPITAL

These Balances should be

107 30 EXPENDITURE

the same, provided the business

Discrepancy +

_ 05p Less any payments

2,605 00 Bank Statement date corresponds

(Not yet on Statement)

to this week.

© P. Hingston Leaves: Balance 441 87 Total Cash & Cheque etc Payments 94 38 3,269 16

YELLOW - P2 (2015).p65 2 04/09/2015, 15:06

Black

Das könnte Ihnen auch gefallen

- November 2019 ComricaDokument4 SeitenNovember 2019 Comricaproemail632Noch keine Bewertungen

- Original Fee RecieptDokument1 SeiteOriginal Fee Reciepthonour agborNoch keine Bewertungen

- W W W W Week Eek Eek Eek Eek: Guide NotesDokument1 SeiteW W W W Week Eek Eek Eek Eek: Guide NotesbongoloidNoch keine Bewertungen

- Lgu Christmas Village November 25 December 01 2022 2Dokument32 SeitenLgu Christmas Village November 25 December 01 2022 2Mark Joseph ArellanoNoch keine Bewertungen

- Vouching SheetDokument7 SeitenVouching SheetFaizan Sheikh100% (1)

- Cash Payment JournalDokument8 SeitenCash Payment JournalEka WiraNoch keine Bewertungen

- Ud Khansa Niaga MuliaDokument60 SeitenUd Khansa Niaga MuliaFira aisyah meilaniNoch keine Bewertungen

- Angelinesmiranda : 101sanguillermost Purok6Bayanan 1772muntinlupacityDokument4 SeitenAngelinesmiranda : 101sanguillermost Purok6Bayanan 1772muntinlupacityLegna SalasNoch keine Bewertungen

- Fcfc9ab4a3 1Dokument4 SeitenFcfc9ab4a3 1juradorosendaNoch keine Bewertungen

- Analyiadobo : Zuelligpharmacorporation Whse9Fapicompderodriguez 1773tunasanmuntinlupacityDokument4 SeitenAnalyiadobo : Zuelligpharmacorporation Whse9Fapicompderodriguez 1773tunasanmuntinlupacityImari Rose AdoboNoch keine Bewertungen

- DDA Rendered Statement - 5 - 9 - 2022 - Account - 4137418 - NIELSON VERNON - VERNON G NIELSONDokument2 SeitenDDA Rendered Statement - 5 - 9 - 2022 - Account - 4137418 - NIELSON VERNON - VERNON G NIELSONKING ZeusNoch keine Bewertungen

- Adobe Scan Jun 30, 2023Dokument2 SeitenAdobe Scan Jun 30, 2023peninahkiraboNoch keine Bewertungen

- Denniceericaldavid : 8lovestremmanvillebrgy Donboscobetterlivingsubd 1711paranaqueDokument4 SeitenDenniceericaldavid : 8lovestremmanvillebrgy Donboscobetterlivingsubd 1711paranaqueDennice Erica DavidNoch keine Bewertungen

- 9a9ac6e522Dokument4 Seiten9a9ac6e522valmoria0515Noch keine Bewertungen

- March 201: Month Month Month Month MonthDokument1 SeiteMarch 201: Month Month Month Month MonthbongoloidNoch keine Bewertungen

- Amiaciaratolentinovillaluna : 203rainbowrd Camella1Talon2 1747laspinascityDokument4 SeitenAmiaciaratolentinovillaluna : 203rainbowrd Camella1Talon2 1747laspinascityAlexander Marius VillalunaNoch keine Bewertungen

- View Yemi Invoice - ReceiptDokument1 SeiteView Yemi Invoice - ReceiptOBEMBE AYODELENoch keine Bewertungen

- Recent Reliant Energy BillDokument4 SeitenRecent Reliant Energy Billtstorm202305Noch keine Bewertungen

- Sample Utility BillDokument1 SeiteSample Utility Billwassim khsibNoch keine Bewertungen

- Be 20221018Dokument6 SeitenBe 20221018jerry dela cruzNoch keine Bewertungen

- Kelvinhpataleta : Luisstcoreusebioave Sanmiguel 1 6 0 0 P A S I GDokument4 SeitenKelvinhpataleta : Luisstcoreusebioave Sanmiguel 1 6 0 0 P A S I Gkelvin pataletaNoch keine Bewertungen

- BPI credit card statement breakdownDokument4 SeitenBPI credit card statement breakdownYuson John BenedìctNoch keine Bewertungen

- NAB Classic Banking Account Balance SummaryDokument2 SeitenNAB Classic Banking Account Balance SummaryRamesh SinghNoch keine Bewertungen

- View your April 2022 bank statement for account 129744523Dokument1 SeiteView your April 2022 bank statement for account 129744523Caleb OchiengNoch keine Bewertungen

- Dominiqueishmaielshibionada : Number14 Brgyjalandoniwilson 5000iloilocityDokument4 SeitenDominiqueishmaielshibionada : Number14 Brgyjalandoniwilson 5000iloilocityDominique Ishmaielle Sumillano HibionadaNoch keine Bewertungen

- Creative Treats PoS 122Dokument1 SeiteCreative Treats PoS 122Marcus AbrahamNoch keine Bewertungen

- SampleaekananDokument3 SeitenSampleaekananAlbertoNoch keine Bewertungen

- Jovaniebbeluso : Provlengroffc Brgylawaanroxascity 5 8 0 0 C A P I ZDokument4 SeitenJovaniebbeluso : Provlengroffc Brgylawaanroxascity 5 8 0 0 C A P I ZJovanie BelusoNoch keine Bewertungen

- 0 SS13Dokument1 Seite0 SS13TradingbotdemoNoch keine Bewertungen

- Earnings Statement DetailsDokument2 SeitenEarnings Statement DetailsAlexander Weir-WitmerNoch keine Bewertungen

- Dalisaydepisioco : 2039bautistasubdsamala Marquezstbrgysamalamarquez 4104binakayankawitDokument6 SeitenDalisaydepisioco : 2039bautistasubdsamala Marquezstbrgysamalamarquez 4104binakayankawitDalisay EpisiocoNoch keine Bewertungen

- BE20230117Dokument6 SeitenBE20230117sidebyside englishpowerjpNoch keine Bewertungen

- February VATDokument1 SeiteFebruary VATChris KerorNoch keine Bewertungen

- TruworthsStatementMEmail 10101126674537 10101126674537 2140Dokument1 SeiteTruworthsStatementMEmail 10101126674537 10101126674537 2140nonjabuloNoch keine Bewertungen

- Acac5d6686 1Dokument4 SeitenAcac5d6686 1Arnel NamucoNoch keine Bewertungen

- BLH Partners Inc Chase SeptDokument5 SeitenBLH Partners Inc Chase SeptJonathan Seagull LivingstonNoch keine Bewertungen

- Print Muster Roll K Samal 02Dokument1 SeitePrint Muster Roll K Samal 02AYUSHNoch keine Bewertungen

- Í (+,oèââ Bantog Dianaâmariââââ E Çi - Oî: Statement of AccountDokument2 SeitenÍ (+,oèââ Bantog Dianaâmariââââ E Çi - Oî: Statement of AccountJ-R MERLIN CabatoNoch keine Bewertungen

- Chase Bank Statement SummaryDokument5 SeitenChase Bank Statement SummaryJonathan Seagull LivingstonNoch keine Bewertungen

- Payment receipt for undergraduate registration at ATBUDokument1 SeitePayment receipt for undergraduate registration at ATBUshalom napoleonNoch keine Bewertungen

- COMPLETE BARANGAY JOURNALDokument5 SeitenCOMPLETE BARANGAY JOURNALlexay.mangadosiervoNoch keine Bewertungen

- View Invoice - ReceiptDokument1 SeiteView Invoice - ReceiptEZEIBE CHIAMAKANoch keine Bewertungen

- Timebook Payroll 2021Dokument9 SeitenTimebook Payroll 2021Stefano Abao OyanNoch keine Bewertungen

- Record of Employment (ROE) DetailsDokument1 SeiteRecord of Employment (ROE) DetailsRyanNoch keine Bewertungen

- Acetrading 4529Dokument1 SeiteAcetrading 4529henri e ewaneNoch keine Bewertungen

- A2. Lembar KerjaDokument7 SeitenA2. Lembar KerjaIndah SafitriNoch keine Bewertungen

- 651748917-Synergy-Elec (1)Dokument3 Seiten651748917-Synergy-Elec (1)JosephNoch keine Bewertungen

- NAB Classic Banking Account Balance and Transaction DetailsDokument4 SeitenNAB Classic Banking Account Balance and Transaction DetailsAinur RahmanNoch keine Bewertungen

- 6018 p3 SPK Menyelesaikan Siklus Akuntansi 52Dokument8 Seiten6018 p3 SPK Menyelesaikan Siklus Akuntansi 52Oren LiterasiNoch keine Bewertungen

- Statement of Account SummaryDokument1 SeiteStatement of Account SummaryJohn BeanNoch keine Bewertungen

- Latihan Jurnal Khusus Praktika Akuntansi Per. DagangDokument14 SeitenLatihan Jurnal Khusus Praktika Akuntansi Per. DagangAzka Yasfa UgaNoch keine Bewertungen

- Utility Bill 20201Dokument4 SeitenUtility Bill 20201craciunvasile342Noch keine Bewertungen

- ReceiptDokument1 SeiteReceiptOlushola sholaNoch keine Bewertungen

- Be 20220810Dokument6 SeitenBe 20220810Vixen CorporalNoch keine Bewertungen

- Acctng FinalDokument3 SeitenAcctng FinalWindelyn ButraNoch keine Bewertungen

- ANZ Bank StatementDokument5 SeitenANZ Bank StatementdhakaeurekaNoch keine Bewertungen

- Bdo StatementDokument1 SeiteBdo Statementfour godsNoch keine Bewertungen

- Jannogioseppebtrinidad : B17L5Pinesvillesubd Fortdelpilarbaguiocity 2600benguetDokument6 SeitenJannogioseppebtrinidad : B17L5Pinesvillesubd Fortdelpilarbaguiocity 2600benguetJanno Gioseppe TrinidadNoch keine Bewertungen

- Dramatists Modern FormatDokument1 SeiteDramatists Modern FormatbongoloidNoch keine Bewertungen

- Apj 9Dokument109 SeitenApj 9bongoloidNoch keine Bewertungen

- Assembly Programming Journal 8Dokument80 SeitenAssembly Programming Journal 8AmineBenali100% (1)

- Mod #2Dokument2 SeitenMod #2bongoloidNoch keine Bewertungen

- Captain Beefheart 10 Commandments of Guitar PlayingDokument1 SeiteCaptain Beefheart 10 Commandments of Guitar PlayingbongoloidNoch keine Bewertungen

- Faro Booklet PDFDokument1 SeiteFaro Booklet PDFbongoloidNoch keine Bewertungen

- Atari sm124 Dead Monitor FixDokument5 SeitenAtari sm124 Dead Monitor FixbongoloidNoch keine Bewertungen

- Cmx469a DatasheetDokument18 SeitenCmx469a DatasheetbongoloidNoch keine Bewertungen

- Harmonica 030912X PDFDokument36 SeitenHarmonica 030912X PDFbongoloid100% (1)

- Olympia SG1Dokument13 SeitenOlympia SG1bongoloidNoch keine Bewertungen

- Mod #3Dokument2 SeitenMod #3bongoloidNoch keine Bewertungen

- A Chronology of Filofax: Kevin Hall April 13, 2010Dokument11 SeitenA Chronology of Filofax: Kevin Hall April 13, 2010bongoloid0% (1)

- Unix Prog DesignDokument7 SeitenUnix Prog Designirs_bNoch keine Bewertungen

- Zmap: Fast Internet-Wide Scanning and Its Security ApplicationsDokument15 SeitenZmap: Fast Internet-Wide Scanning and Its Security ApplicationsbongoloidNoch keine Bewertungen

- Harmonica 030912X PDFDokument36 SeitenHarmonica 030912X PDFbongoloid100% (1)

- Mind Machines You Can Build PDFDokument202 SeitenMind Machines You Can Build PDFbongoloidNoch keine Bewertungen

- MagnetronDokument5 SeitenMagnetronbongoloidNoch keine Bewertungen

- Lumped Element Rat Race CouplerDokument6 SeitenLumped Element Rat Race Couplerbongoloid100% (1)

- Microwave Circuit BoardsDokument10 SeitenMicrowave Circuit BoardsbongoloidNoch keine Bewertungen

- UsingAndUnderstandingMiniatureNeonLamps PDFDokument132 SeitenUsingAndUnderstandingMiniatureNeonLamps PDFbongoloidNoch keine Bewertungen

- The Art and Craft of Coil ConstructionDokument3 SeitenThe Art and Craft of Coil ConstructionbongoloidNoch keine Bewertungen

- Miniature Microwave AmplifiersDokument6 SeitenMiniature Microwave AmplifiersbongoloidNoch keine Bewertungen

- Gin Pole For Peanuts: Ever Ull o y Straps? Build His G Ea S y ToweDokument2 SeitenGin Pole For Peanuts: Ever Ull o y Straps? Build His G Ea S y TowebongoloidNoch keine Bewertungen

- Understanding Speech Inversion PDFDokument2 SeitenUnderstanding Speech Inversion PDFbongoloidNoch keine Bewertungen

- MAKING PRINTED CIRCUIT BOARDS PHOTOGRAPHICALLYDokument4 SeitenMAKING PRINTED CIRCUIT BOARDS PHOTOGRAPHICALLYbongoloidNoch keine Bewertungen

- Frequency Locking A Microwave SourceDokument4 SeitenFrequency Locking A Microwave SourcebongoloidNoch keine Bewertungen

- Tone Signaling Over Telephone Lines A Technician's PrimerDokument3 SeitenTone Signaling Over Telephone Lines A Technician's PrimerbongoloidNoch keine Bewertungen

- The Gin PoleDokument4 SeitenThe Gin PolebongoloidNoch keine Bewertungen

- A Homebrew Gin PoleDokument2 SeitenA Homebrew Gin PolebongoloidNoch keine Bewertungen

- MODERN MICROWAVE FILTER DESIGNDokument5 SeitenMODERN MICROWAVE FILTER DESIGNbongoloid100% (1)

- Kaizen Biochem WS & Fertilizer Price List 2022-23Dokument3 SeitenKaizen Biochem WS & Fertilizer Price List 2022-23surajNoch keine Bewertungen

- Service Quality Dimensions A Conceptual AnalysisDokument13 SeitenService Quality Dimensions A Conceptual Analysishannguyen90dn100% (1)

- Idt Cam SpecsDokument116 SeitenIdt Cam SpecsEletronica Repar100% (1)

- Name: . Signature: 845/1 Entrepreneurship Education TimeDokument5 SeitenName: . Signature: 845/1 Entrepreneurship Education TimeOwani JimmyNoch keine Bewertungen

- How To Pay SSS Salary Loan - 2021 Updated GuideDokument20 SeitenHow To Pay SSS Salary Loan - 2021 Updated GuideALFREDO ELACIONNoch keine Bewertungen

- Cup 1 FA 1 and FA 2Dokument16 SeitenCup 1 FA 1 and FA 2Thony Danielle LabradorNoch keine Bewertungen

- Types of Banks in IndiaDokument3 SeitenTypes of Banks in IndiaKumar NaveenNoch keine Bewertungen

- BPI Vs Lifetime Marketing CorpDokument8 SeitenBPI Vs Lifetime Marketing CorpKim ArizalaNoch keine Bewertungen

- Statement June and JulyDokument2 SeitenStatement June and JulyGregory Scarpa SnrNoch keine Bewertungen

- Money Lending Issues Before the Supreme CourtDokument9 SeitenMoney Lending Issues Before the Supreme CourtRomy Ian LimNoch keine Bewertungen

- HSBC Personal Banking Hotline GuideDokument3 SeitenHSBC Personal Banking Hotline GuideSaxon ChanNoch keine Bewertungen

- GTBDokument8 SeitenGTBRishabh WadhwaNoch keine Bewertungen

- Dissertation Topics Corporate FinanceDokument4 SeitenDissertation Topics Corporate FinanceCustomizedPaperCanada100% (1)

- Letter of Intent for Bank Guarantee PurchaseDokument28 SeitenLetter of Intent for Bank Guarantee PurchaseRaja RoyNoch keine Bewertungen

- BPI vs. Reyes, 255 SCRA 571 (1996)Dokument2 SeitenBPI vs. Reyes, 255 SCRA 571 (1996)Princess Jonas100% (2)

- FDIC Chairman McWilliams The Future of BankingDokument13 SeitenFDIC Chairman McWilliams The Future of BankingRishrisNoch keine Bewertungen

- ICICI Bank Merger With Bank of Madura (December 2000) : What Does It Reveal ?Dokument8 SeitenICICI Bank Merger With Bank of Madura (December 2000) : What Does It Reveal ?Sudheer Kumar NyathaniNoch keine Bewertungen

- Special Customer of A BankDokument10 SeitenSpecial Customer of A Bankparveen mehtaNoch keine Bewertungen

- Sheils Title Company, Inc. v. Commonwealth Land Title Insurance Co., 184 F.3d 10, 1st Cir. (1999)Dokument14 SeitenSheils Title Company, Inc. v. Commonwealth Land Title Insurance Co., 184 F.3d 10, 1st Cir. (1999)Scribd Government DocsNoch keine Bewertungen

- Capgemini - World FinTech Report 2020 PDFDokument36 SeitenCapgemini - World FinTech Report 2020 PDFMinal Kothari0% (1)

- Bupa International Claim Form: 1 Patient'S DetailsDokument4 SeitenBupa International Claim Form: 1 Patient'S DetailsRealty SolutionsNoch keine Bewertungen

- RtgsDokument13 SeitenRtgsBari Rajnish100% (2)

- Analyzing Bank Performance: Using The UbprDokument70 SeitenAnalyzing Bank Performance: Using The UbpraliNoch keine Bewertungen

- Emishaw Tefera - 2017Dokument100 SeitenEmishaw Tefera - 2017Hussen SeidNoch keine Bewertungen

- 38. Đề thi thử TN THPT 2021 Môn Tiếng anh Chuyên Hoàng Văn Thụ Hòa Bình Lần 2 File word có lời giảiDokument20 Seiten38. Đề thi thử TN THPT 2021 Môn Tiếng anh Chuyên Hoàng Văn Thụ Hòa Bình Lần 2 File word có lời giảihai anh HoangNoch keine Bewertungen

- The Impact of The Lack of Transparency On CorporatDokument8 SeitenThe Impact of The Lack of Transparency On CorporatLily ChoiNoch keine Bewertungen

- RBI Regulates Financial System & Maintains Monetary StabilityDokument66 SeitenRBI Regulates Financial System & Maintains Monetary StabilitysejalNoch keine Bewertungen

- Blowing BubblesDokument3 SeitenBlowing BubblesCyril JosNoch keine Bewertungen

- This Study Resource Was: Quiz On Receivable FinancingDokument3 SeitenThis Study Resource Was: Quiz On Receivable FinancingKez MaxNoch keine Bewertungen

- SWOT Analysis For AMUL:: StrengthDokument14 SeitenSWOT Analysis For AMUL:: StrengthISTKHAR AHAMADNoch keine Bewertungen