Beruflich Dokumente

Kultur Dokumente

Schedule6 e

Hochgeladen von

Rheneir MoraCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Schedule6 e

Hochgeladen von

Rheneir MoraCopyright:

Verfügbare Formate

Companies Ordinance

Schedule 6 A5123

Part 1

Ord. No. 28 of 2012

Schedule 6 [ss. 664 & 911]

Information to be Contained in Annual Return

and Documents by which Annual Return

must be Accompanied

Part 1

Information to be Contained in Annual Return

1. An annual return under section 662(1) or (3) must contain the

following information in respect of the company—

(a) the company name, its registered number and business

name (if any);

(b) the type of company;

(c) the address of the registered office of the company;

(d) the date to which the company makes up the return;

(e) particulars of the total amount of the indebtedness of

the company in respect of all mortgages and charges

that—

(i) are required to be registered with the Registrar

under this Ordinance; or

(ii) would have been required to be so registered if

created after 1 January 1912;

(f) in the case of a company having a share capital—

(i) particulars relating to members and share capital

of the company; and

Companies Ordinance

Schedule 6 A5125

Part 1

Ord. No. 28 of 2012

(ii) if the company has converted any of its shares

into stock and given notice of the conversion to

the Registrar, the amount of stock held by each

of the existing members;

(g) in the case of a company not having a share capital,

except for a company registered with an unlimited

number of members, the number of members of the

company;

(h) if any company records are kept at a place other than

the company’s registered office, the address of that

place and the records that are kept there;

(i) particulars with respect to—

(i) any person who at the date of the return is a

director or reserve director of the company; and

(ii) any person who at that date is a company secretary

of the company,

that are by this Ordinance required to be contained

with respect to them in the register of directors and

register of company secretaries of a company.

2. In the case of a listed company, the particulars relating to

members as required under section 1(f)(i) of this Schedule are

limited to those relating to members who held 5% or more of

the issued shares in any class of the company’s shares as at the

date of the return.

3. If a director or reserve director is a natural person, the

particulars as required under section 1(i) of this Schedule do

not include—

(a) an address contained in the register of directors as

the usual residential address of the director or reserve

director; and

Companies Ordinance

Schedule 6 A5127

Part 2

Ord. No. 28 of 2012

(b) the full number of the identity card or passport of the

director or reserve director.

4. If a company secretary is a natural person, the particulars as

required under section 1(i) of this Schedule do not include the

full number of the identity card or passport of the company

secretary.

5. In the case of a company that keeps a branch register of

members in accordance with section 636(1), the particulars of

the entries in that register need not be included in the annual

return if copies of those entries have not been received at the

registered office of the company. Those particulars must, so far

as they relate to matters that are required to be contained in the

annual return, be included in the next annual return after copies

of those entries are received at the registered office of the

company.

Part 2

Additional Information to be Contained in

Annual Return of Private Company

6. An annual return under section 662(1) must also contain the

following information in respect of the private company—

(a) a statement that the company has not—

(i) since the date of the last return; or

(ii) in the case of a first return, since the date of the

incorporation of the company,

issued any invitation to the public to subscribe for any

shares or debentures of the company; and

Companies Ordinance

Schedule 6 A5129

Part 3

Ord. No. 28 of 2012

(b) if the annual return discloses the fact that the number

of members of the company exceeds 50, a statement

that the excess consists wholly of persons who, under

section 11(2), are excluded in the calculation of the

number of members of the company.

Part 3

Documents by which Annual Return of Public Company

or Company Limited by Guarantee must be

Accompanied

7. An annual return under section 662(3) must be accompanied

by—

(a) copies of the documents required to be sent to every

member of the company under section 430, certified

by a director or company secretary of the company to

be true copies; and

(b) if any of the documents mentioned in paragraph (a) is

in a language other than English or Chinese, a certified

translation (to be annexed to that document) in English

or Chinese of the document.

Das könnte Ihnen auch gefallen

- Session 6 - QAR Audit Methodology Manual Presentation - Review and FinalizationDokument23 SeitenSession 6 - QAR Audit Methodology Manual Presentation - Review and FinalizationRheneir MoraNoch keine Bewertungen

- Session 5 - QAR Audit Methodology Manual Presentation - Detailed ProcedureDokument18 SeitenSession 5 - QAR Audit Methodology Manual Presentation - Detailed ProcedureRheneir MoraNoch keine Bewertungen

- Session 1 - QAR Audit Methodology Manual Presentation - Fundamentals of PSA AuditDokument34 SeitenSession 1 - QAR Audit Methodology Manual Presentation - Fundamentals of PSA AuditRheneir MoraNoch keine Bewertungen

- Updated Japan Visa RequirementsDokument2 SeitenUpdated Japan Visa RequirementsRheneir MoraNoch keine Bewertungen

- Session 3 - QAR Audit Methodology Manual Presentation - Intro To The ManualDokument12 SeitenSession 3 - QAR Audit Methodology Manual Presentation - Intro To The ManualRheneir MoraNoch keine Bewertungen

- Section 248 of Companies Act, 2013 - Power of Registrar To Remove Name of Company From Register of CompaniesDokument6 SeitenSection 248 of Companies Act, 2013 - Power of Registrar To Remove Name of Company From Register of Companiesmohammed ibrahim pashaNoch keine Bewertungen

- Session 2 - QAR Audit Methodology Manual - IsQMDokument49 SeitenSession 2 - QAR Audit Methodology Manual - IsQMRheneir MoraNoch keine Bewertungen

- Session 4 - QAR Audit Methodology Manual - Pre-Engagement, Planning and Test of ControlsDokument55 SeitenSession 4 - QAR Audit Methodology Manual - Pre-Engagement, Planning and Test of ControlsRheneir Mora100% (1)

- Secretarial Practices OutlineDokument5 SeitenSecretarial Practices Outlinenaeem_shamsNoch keine Bewertungen

- Electronic Ticket Receipt 26MAR For RHENEIR PARAN MORADokument3 SeitenElectronic Ticket Receipt 26MAR For RHENEIR PARAN MORARheneir MoraNoch keine Bewertungen

- Business Law: Certificate LevelDokument10 SeitenBusiness Law: Certificate LevelRafidul IslamNoch keine Bewertungen

- Rights and Powers of An AuditorDokument5 SeitenRights and Powers of An AuditorLakshmiRengarajan92% (12)

- Presentasi Audit Part 1Dokument16 SeitenPresentasi Audit Part 1Hendry TupaiNoch keine Bewertungen

- Companies Act, 2013 ChecklistDokument50 SeitenCompanies Act, 2013 ChecklistJessica RodgersNoch keine Bewertungen

- Project ReportDokument36 SeitenProject ReportSHRIKANT DESHMUKHNoch keine Bewertungen

- Nidhi-Amendment 2019-20Dokument12 SeitenNidhi-Amendment 2019-20Manoj KumarNoch keine Bewertungen

- Ca Final Corporate and Allied Notes - Ca Punarvas Jayakumar: Section SubjectDokument11 SeitenCa Final Corporate and Allied Notes - Ca Punarvas Jayakumar: Section SubjectKushalNoch keine Bewertungen

- Extract Corp Act 2001Dokument26 SeitenExtract Corp Act 2001Kirat GillNoch keine Bewertungen

- Guidance Note On Audit of Abridged Financial StatementsDokument13 SeitenGuidance Note On Audit of Abridged Financial Statementsstarrydreams19Noch keine Bewertungen

- Auditors and Their RoleDokument10 SeitenAuditors and Their RoleKeshav DograNoch keine Bewertungen

- CAP 622 e b5fffffDokument394 SeitenCAP 622 e b5fffffwongNoch keine Bewertungen

- Circular No.2 - 51 - 12 - 2007-CL-III - 08feb2011Dokument2 SeitenCircular No.2 - 51 - 12 - 2007-CL-III - 08feb2011freefreepassNoch keine Bewertungen

- Ep Os Module 1 Dec 20Dokument93 SeitenEp Os Module 1 Dec 20Monika SinghNoch keine Bewertungen

- Solved Scanner Paper-4 Company Law 2010 - June (1) (A)Dokument8 SeitenSolved Scanner Paper-4 Company Law 2010 - June (1) (A)Shailja ShuklaNoch keine Bewertungen

- Feb 2018 AnsDokument7 SeitenFeb 2018 AnsKhalid AzizNoch keine Bewertungen

- Caro 2020Dokument11 SeitenCaro 2020Gaurav Chauhan CANoch keine Bewertungen

- CARO 2020 Book NotesDokument11 SeitenCARO 2020 Book NotesCreanativeNoch keine Bewertungen

- Lesson 1: Company Formation and Conversion: Choice of Form of Business EntityDokument13 SeitenLesson 1: Company Formation and Conversion: Choice of Form of Business EntityMamtha MNoch keine Bewertungen

- 4.03 Companies Act ChecklistDokument11 Seiten4.03 Companies Act ChecklistEdison TabakuNoch keine Bewertungen

- Yours FaithfullyDokument15 SeitenYours FaithfullyElena RaskNoch keine Bewertungen

- Companies Accounts Rules 2014Dokument40 SeitenCompanies Accounts Rules 2014srscribd10Noch keine Bewertungen

- Form AOC 4 (XBRL) 18012019 SignedDokument3 SeitenForm AOC 4 (XBRL) 18012019 Signedanmolgarg129Noch keine Bewertungen

- Applicability of Companies (Auditor'S Report) Order, 2020Dokument7 SeitenApplicability of Companies (Auditor'S Report) Order, 2020GopiNoch keine Bewertungen

- FormsDokument3 SeitenFormsOnen EmmanuelNoch keine Bewertungen

- MBA Revised Chp-12 - Final Accounts of CompaniesDokument38 SeitenMBA Revised Chp-12 - Final Accounts of CompaniesNitish rajNoch keine Bewertungen

- (As Per 117 (3) (A) For All SR, MGT-14 Is Required.)Dokument3 Seiten(As Per 117 (3) (A) For All SR, MGT-14 Is Required.)Pranzali GuptaNoch keine Bewertungen

- Chapter-04 Unit-01 Preparation of Financial StatementsDokument78 SeitenChapter-04 Unit-01 Preparation of Financial StatementsRAVIKUMAR RAVINoch keine Bewertungen

- Form AOC-4 (XBRL) - 01022020 - SignedDokument4 SeitenForm AOC-4 (XBRL) - 01022020 - SignedSaket GokhaleNoch keine Bewertungen

- UntitledDokument303 SeitenUntitledHarismithaNoch keine Bewertungen

- Auditing and Internal Review: AssignmentDokument13 SeitenAuditing and Internal Review: AssignmentStefan S. AdjeiNoch keine Bewertungen

- CBDT - Detailed POEM Guidelines - January 2017Dokument10 SeitenCBDT - Detailed POEM Guidelines - January 2017bharath289Noch keine Bewertungen

- 03 GMBHGDokument3 Seiten03 GMBHGdaraksha.passportNoch keine Bewertungen

- Frequently Asked Questions ON Companies Act, 2013Dokument24 SeitenFrequently Asked Questions ON Companies Act, 2013SureshArigelaNoch keine Bewertungen

- Suggested Answers of Company Law June 2019 Old Syl-Executive-RevisionDokument15 SeitenSuggested Answers of Company Law June 2019 Old Syl-Executive-RevisionjesurajajosephNoch keine Bewertungen

- Buy-Back of Securities: SynopsisDokument31 SeitenBuy-Back of Securities: SynopsisbharatNoch keine Bewertungen

- Guidance Note On AOC 4Dokument103 SeitenGuidance Note On AOC 4Pranoti PatilNoch keine Bewertungen

- 5 - Officers of The Company - AuditorsDokument8 Seiten5 - Officers of The Company - AuditorsAzri NaimNoch keine Bewertungen

- Guidelines For Striking Off Section 549 Revised 31032017Dokument9 SeitenGuidelines For Striking Off Section 549 Revised 31032017nuramiraabushardilNoch keine Bewertungen

- Company SecretaryDokument10 SeitenCompany SecretaryfatihahNoch keine Bewertungen

- FAQ For Company Law 2013Dokument24 SeitenFAQ For Company Law 2013Archanat07100% (1)

- Chapter One Companies and Allied Matters Act 1990 - B Meetings and Proceedings of CompaniesDokument22 SeitenChapter One Companies and Allied Matters Act 1990 - B Meetings and Proceedings of CompaniesAnfield FaithfulNoch keine Bewertungen

- S.Faisal B.Law AssignmentDokument10 SeitenS.Faisal B.Law AssignmentFaisal NaqviNoch keine Bewertungen

- 2 - Corporate Law - Lecture 05 - Memorandum of AssociationDokument7 Seiten2 - Corporate Law - Lecture 05 - Memorandum of AssociationAl BastiNoch keine Bewertungen

- Super50 Nov'23Dokument72 SeitenSuper50 Nov'23Kusuma MNoch keine Bewertungen

- Memorandum Articles of Association Under Companies Act2013Dokument6 SeitenMemorandum Articles of Association Under Companies Act2013Raj AnkitNoch keine Bewertungen

- 66495bos53751 cp4 U1Dokument77 Seiten66495bos53751 cp4 U1Navaneeth GsNoch keine Bewertungen

- Auditing BAC2664 (New), BAC2287 (Old) : Topic 2 The Requirements of Companies Act, 1965Dokument17 SeitenAuditing BAC2664 (New), BAC2287 (Old) : Topic 2 The Requirements of Companies Act, 1965sueernNoch keine Bewertungen

- Company Secretaries DutiesDokument5 SeitenCompany Secretaries DutiesLynnHanNoch keine Bewertungen

- Roll No.......................... : NoteDokument6 SeitenRoll No.......................... : Noteindia1965Noch keine Bewertungen

- Corporate Law Assignment1234Dokument4 SeitenCorporate Law Assignment1234Areej AJNoch keine Bewertungen

- 274 DisqualificationDokument8 Seiten274 DisqualificationLucknow Chapter Nirc IcsiNoch keine Bewertungen

- U74900TN2015PTC099790 ARBE 155734577 Form-AOC-4 (XBRL) - 04042022 SignedDokument4 SeitenU74900TN2015PTC099790 ARBE 155734577 Form-AOC-4 (XBRL) - 04042022 Signedshubham ranaNoch keine Bewertungen

- Week 13 Corporate Governance 3-FinanceDokument13 SeitenWeek 13 Corporate Governance 3-FinanceAnonNoch keine Bewertungen

- Luthra & Luthra: Auditor'S ReportDokument5 SeitenLuthra & Luthra: Auditor'S Reportswatis_49Noch keine Bewertungen

- Ephej28022022 GA EP MODULE I OS DEC 21Dokument96 SeitenEphej28022022 GA EP MODULE I OS DEC 21swaranjali deshapandeNoch keine Bewertungen

- S. No. Section & Rules Particular of Compliance: Annual Compliances For Small CompanyDokument4 SeitenS. No. Section & Rules Particular of Compliance: Annual Compliances For Small CompanyAmit GuptaNoch keine Bewertungen

- Annual Returns and Balance Sheet Eforms 2 Form 23AC-190608 PDFDokument6 SeitenAnnual Returns and Balance Sheet Eforms 2 Form 23AC-190608 PDFManojNoch keine Bewertungen

- Cos Bill Highlights by ICAIDokument20 SeitenCos Bill Highlights by ICAISameer HusainNoch keine Bewertungen

- What You Must Know About Incorporate a Company in IndiaVon EverandWhat You Must Know About Incorporate a Company in IndiaNoch keine Bewertungen

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisVon EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNoch keine Bewertungen

- Peach Confirmation QQ5775Dokument3 SeitenPeach Confirmation QQ5775Rheneir MoraNoch keine Bewertungen

- Fun Golf SolicitationDokument2 SeitenFun Golf SolicitationRheneir MoraNoch keine Bewertungen

- CVR-16 InviteDokument3 SeitenCVR-16 InviteRheneir MoraNoch keine Bewertungen

- Peach Confirmation EU88X5Dokument3 SeitenPeach Confirmation EU88X5Rheneir MoraNoch keine Bewertungen

- Certificate SphinxDokument1 SeiteCertificate SphinxRheneir MoraNoch keine Bewertungen

- Differences PFRSDokument11 SeitenDifferences PFRSRheneir MoraNoch keine Bewertungen

- 1MSADokument1 Seite1MSARheneir MoraNoch keine Bewertungen

- SourceTech Consultancy LLCDokument11 SeitenSourceTech Consultancy LLCRheneir MoraNoch keine Bewertungen

- Cebu Pacific Air MoraDokument4 SeitenCebu Pacific Air MoraRheneir MoraNoch keine Bewertungen

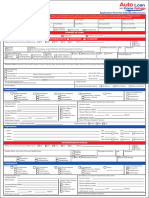

- New Auto-Loan-Application-Form - IndividualDokument2 SeitenNew Auto-Loan-Application-Form - IndividualRheneir MoraNoch keine Bewertungen

- MS Call CardsDokument3 SeitenMS Call CardsRheneir MoraNoch keine Bewertungen

- Amcham Phil. Membership SurveyDokument2 SeitenAmcham Phil. Membership SurveyRheneir Mora100% (1)

- PAREB AMLC Online Registration System GuideDokument72 SeitenPAREB AMLC Online Registration System GuideRheneir MoraNoch keine Bewertungen

- GMM ProgramDokument1 SeiteGMM ProgramRheneir MoraNoch keine Bewertungen

- Talisay Central Eagles ClubDokument5 SeitenTalisay Central Eagles ClubRheneir MoraNoch keine Bewertungen

- 49 Insights July 2022Dokument41 Seiten49 Insights July 2022Rheneir MoraNoch keine Bewertungen

- 2019notice New Forms and Pre EvaluationDokument29 Seiten2019notice New Forms and Pre EvaluationRheneir MoraNoch keine Bewertungen

- 77th ANC CebuDokument7 Seiten77th ANC CebuRheneir MoraNoch keine Bewertungen

- Implementing Rules and Regulations of The Lending Company Regulation Act of 2007 Ra9474Dokument19 SeitenImplementing Rules and Regulations of The Lending Company Regulation Act of 2007 Ra9474Lance DionelaNoch keine Bewertungen

- 04 Property PicturesDokument1 Seite04 Property PicturesRheneir MoraNoch keine Bewertungen

- Financial ManagementDokument55 SeitenFinancial ManagementRheneir MoraNoch keine Bewertungen

- 03 - List of PropertiesDokument4 Seiten03 - List of PropertiesRheneir MoraNoch keine Bewertungen

- KB3 BL Study TextDokument192 SeitenKB3 BL Study TextBuddhiPradeep88100% (2)

- Gallant Ar2006Dokument92 SeitenGallant Ar2006andredewNoch keine Bewertungen

- TFL - Annual Report 2014-15Dokument94 SeitenTFL - Annual Report 2014-15new_skgargNoch keine Bewertungen

- CS Course Brochure PDFDokument7 SeitenCS Course Brochure PDFthirupathiNoch keine Bewertungen

- Jaya Holdings Annual Report 2011Dokument100 SeitenJaya Holdings Annual Report 2011wctimNoch keine Bewertungen

- Combine Holdings 34th Annual Report 2016-17Dokument77 SeitenCombine Holdings 34th Annual Report 2016-17Poonam AggarwalNoch keine Bewertungen

- CSC V JavierDokument9 SeitenCSC V JavierKathleen Catubay SamsonNoch keine Bewertungen

- 362 1343385160Dokument72 Seiten362 1343385160Chanaka LakmalNoch keine Bewertungen

- Resume - Geena DhillonDokument12 SeitenResume - Geena DhillonGeenaNoch keine Bewertungen

- Netweb Technologies India Limited - RHPDokument506 SeitenNetweb Technologies India Limited - RHPSuraj KumarNoch keine Bewertungen

- Form NDH-3Dokument4 SeitenForm NDH-3Shobanbabu BashkaranNoch keine Bewertungen

- Sample PDF of STD 11th Secretarial Practice Smart Notes Book Commerce Maharashtra BoardDokument24 SeitenSample PDF of STD 11th Secretarial Practice Smart Notes Book Commerce Maharashtra BoardAbhishek PanditNoch keine Bewertungen

- Law T4Dokument8 SeitenLaw T4Badhrinath ShanmugamNoch keine Bewertungen

- Food & Beverage Corporate GovernanceDokument31 SeitenFood & Beverage Corporate GovernanceShanto Saiful0% (3)

- Top Glove 2018 Corporate Governance ReportDokument46 SeitenTop Glove 2018 Corporate Governance ReportChen YenNoch keine Bewertungen

- Cs. Nishant Mishra: E-Mail: Mobile: +91 8920043956Dokument3 SeitenCs. Nishant Mishra: E-Mail: Mobile: +91 8920043956Nash MarxsNoch keine Bewertungen

- Guidance Notes On General Meetings 31122020Dokument205 SeitenGuidance Notes On General Meetings 31122020CS Trainee OOLNoch keine Bewertungen

- TransDokument502 SeitenTranssandeepNoch keine Bewertungen

- SKB Ar 2017Dokument102 SeitenSKB Ar 2017DudeNoch keine Bewertungen

- Meetings and ResolutionsDokument5 SeitenMeetings and Resolutionsabhishek singh100% (1)

- BECG.l-10A.cg Committees (Contd)Dokument12 SeitenBECG.l-10A.cg Committees (Contd)abhishek fanseNoch keine Bewertungen

- Module 2 Paper 4 SACMDD BookDokument576 SeitenModule 2 Paper 4 SACMDD BookElliotNoch keine Bewertungen

- Ar 2017 2018Dokument82 SeitenAr 2017 2018Anonymous DfSizzc4lNoch keine Bewertungen

- Company Secretary Training With Exemption Registration EtcDokument7 SeitenCompany Secretary Training With Exemption Registration EtcVikram SekherNoch keine Bewertungen

- Ans 1 B: Illustration 2 - Holds Preference Shares Half of The Voting Powers, Similar To EquityDokument9 SeitenAns 1 B: Illustration 2 - Holds Preference Shares Half of The Voting Powers, Similar To EquityAbid FayazNoch keine Bewertungen

- Siemens Limited Annual Report 2013Dokument95 SeitenSiemens Limited Annual Report 2013Akshay UkeyNoch keine Bewertungen

- Company Secretary: Presented By, Khanusiya Ahetash (10) AgribusinessDokument8 SeitenCompany Secretary: Presented By, Khanusiya Ahetash (10) AgribusinessBhavesh PateNoch keine Bewertungen

- Comair AnnualReportDokument76 SeitenComair AnnualReportJanus CoetzeeNoch keine Bewertungen