Beruflich Dokumente

Kultur Dokumente

018 Chapter3

Hochgeladen von

Chloe Gabriel Evangeline ChaseOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

018 Chapter3

Hochgeladen von

Chloe Gabriel Evangeline ChaseCopyright:

Verfügbare Formate

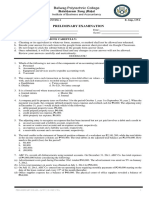

Chapter 3—The Adjusting Process

MULTIPLE CHOICE

36.The supplies account has a balance of $1,200 at the beginning of the year and was debited during the year for

$2,300, representing the total of supplies purchased during the year. If $650 of supplies are on hand at the

end of the year, the supplies expense to be reported on the income statement for the year is

a $650

.

b $1,750

.

c $4,150

.

d $2,850

.

ANS: D PTS: 1 DIF: Moderate OBJ: 03-02

NAT: AACSB Analytic | AICPA FN-Measurement | ACBSP-APC-07-Adjusting Entries

37. A company purchases a one-year insurance policy on June 1 for $1,260. The adjusting entry on

December 31 is

a debit Insurance Expense, $630 and credit Prepaid Insurance, $630.

.

b debit Insurance Expense, $525 and credit Prepaid Insurance, $525.

.

c debit Insurance Expense, $735, and credit Prepaid Insurance, $735.

.

d debit Prepaid Insurance, $630, and credit Cash, $630.

.

ANS: C PTS: 1 DIF: Difficult OBJ: 03-02

NAT: AACSB Analytic | AICPA FN-Measurement | ACBSP-APC-07-Adjusting Entries

38. Austin, Inc. made a Prepaid Rent payment of $2,800 on January 1st. The company’s monthly rent is

$700. The amount of Prepaid Rent that would appear on the January 31 balance sheet after adjustment is:

a $2,100

.

b $700

.

c $3,500

.

d $1,400

.

ANS: A PTS: 1 DIF: Moderate OBJ: 03-02

NAT: AACSB Analytic | AICPA FN-Measurement | ACBSP-APC-07-Adjusting Entries

39. Depreciation Expense and Accumulated Depreciation are classified, respectively, as

a expense, contra asset

.

b asset, contra liability

.

c revenue, asset

.

d contra asset, expense

.

ANS: A PTS: 1 DIF: Easy OBJ: 03-02

NAT: AACSB Analytic | AICPA FN-Measurement

40. The type of account and normal balance of Accumulated Depreciation is

a asset, credit

.

b asset, debit

.

c contra asset, credit

.

d contra asset, debit

.

ANS: C PTS: 1 DIF: Easy OBJ: 03-02

NAT: AACSB Analytic | AICPA FN-Measurement

Das könnte Ihnen auch gefallen

- Chapter 3-The Adjusting Process: Multiple ChoiceDokument2 SeitenChapter 3-The Adjusting Process: Multiple ChoiceChloe Gabriel Evangeline ChaseNoch keine Bewertungen

- Chapter 1 - Multiple Choice Part 33Dokument7 SeitenChapter 1 - Multiple Choice Part 33Chloe Gabriel Evangeline ChaseNoch keine Bewertungen

- 2017 Far Aicpa Q-ADokument58 Seiten2017 Far Aicpa Q-AEvita Faith Leong100% (1)

- Chapter No-09Dokument8 SeitenChapter No-09MUHAMMAD ARIF BASHIRNoch keine Bewertungen

- Case 2 Adjusting Entries F 18Dokument6 SeitenCase 2 Adjusting Entries F 18rcbcsk csk0% (1)

- Quiz 1Dokument3 SeitenQuiz 1White LeafNoch keine Bewertungen

- Test Bank For Financial Accounting in An Economic Context 10th by PrattDokument38 SeitenTest Bank For Financial Accounting in An Economic Context 10th by Pratttiffanybuckdtoexpmnbz100% (26)

- Financial Accounting in An Economic Context 9th Edition Pratt Test BankDokument38 SeitenFinancial Accounting in An Economic Context 9th Edition Pratt Test Bankcarolmarshallnxeoaikszj100% (26)

- Concepts in Federal Taxation 2014 21st Edition Murphy Test Bank DownloadDokument43 SeitenConcepts in Federal Taxation 2014 21st Edition Murphy Test Bank DownloadRandy Divine100% (22)

- Chapter 3 Practice Materials-1Dokument17 SeitenChapter 3 Practice Materials-1Freddie Yuan50% (2)

- Intermediate Accounting 19th Edition Stice Test BankDokument25 SeitenIntermediate Accounting 19th Edition Stice Test BankBarbaraSosayobpr100% (56)

- Financial Accounting in An Economic Context 9th Edition Pratt Test Bank 1Dokument38 SeitenFinancial Accounting in An Economic Context 9th Edition Pratt Test Bank 1john100% (36)

- Financial Accounting in An Economic Context 8th Edition Pratt Test BankDokument38 SeitenFinancial Accounting in An Economic Context 8th Edition Pratt Test Bankindocileexothecawtoy100% (14)

- Financial Accounting in An Economic Context 8Th Edition Pratt Test Bank Full Chapter PDFDokument59 SeitenFinancial Accounting in An Economic Context 8Th Edition Pratt Test Bank Full Chapter PDFthomasowens1asz100% (10)

- Financial Accounting in An Economic Context 8th Edition Pratt Test BankDokument38 SeitenFinancial Accounting in An Economic Context 8th Edition Pratt Test Bankharveyhuypky0u100% (29)

- Intermediate Accounting 19th Edition Stice Test BankDokument35 SeitenIntermediate Accounting 19th Edition Stice Test Bankslokekrameriabfofb1100% (19)

- Dwnload Full Intermediate Accounting 19th Edition Stice Test Bank PDFDokument35 SeitenDwnload Full Intermediate Accounting 19th Edition Stice Test Bank PDFspitznoglecorynn100% (7)

- Midterm 2022 - v1Dokument6 SeitenMidterm 2022 - v1JF FNoch keine Bewertungen

- 104Dokument8 Seiten104Magdy Kamel100% (1)

- Quizzer (Cash To Inventory Valuation) KeyDokument10 SeitenQuizzer (Cash To Inventory Valuation) KeyLouie Miguel DulguimeNoch keine Bewertungen

- Test Bank For Intermediate Accounting 19Th Edition Stice 1133957919 978113395791 Full Chapter PDFDokument36 SeitenTest Bank For Intermediate Accounting 19Th Edition Stice 1133957919 978113395791 Full Chapter PDFwayne.serge848100% (14)

- Test Bank For Fundamental Financial Accounting Concepts 10th by EdmondsDokument53 SeitenTest Bank For Fundamental Financial Accounting Concepts 10th by Edmondschompbowsawpagb8Noch keine Bewertungen

- ACT15 Prelim ExamDokument8 SeitenACT15 Prelim ExamPaw VerdilloNoch keine Bewertungen

- Financial 2019 Aicpa Newly Released Mcqs and SimsDokument40 SeitenFinancial 2019 Aicpa Newly Released Mcqs and SimskimtakgooNoch keine Bewertungen

- Midterm 2022 - v2Dokument6 SeitenMidterm 2022 - v2JF FNoch keine Bewertungen

- Chapter No - 10Dokument9 SeitenChapter No - 10MUHAMMAD ARIF BASHIRNoch keine Bewertungen

- Kimmel Excersice 9Dokument11 SeitenKimmel Excersice 9Jay LazaroNoch keine Bewertungen

- Intermediate Accounting 1 First Grading Examination: Name: Date: Professor: Section: ScoreDokument20 SeitenIntermediate Accounting 1 First Grading Examination: Name: Date: Professor: Section: ScoreJulia Andrea Yting100% (2)

- Acc 300 - Revision 1Dokument10 SeitenAcc 300 - Revision 1KUEBOVE WHILIEMNoch keine Bewertungen

- Reviewer For Mid Term ExamDokument12 SeitenReviewer For Mid Term ExamJannelle SalacNoch keine Bewertungen

- Accounting in Action: 97. The Partners' Capital Statement Includes Each of The Following ExceptDokument10 SeitenAccounting in Action: 97. The Partners' Capital Statement Includes Each of The Following ExceptElaiza RegaladoNoch keine Bewertungen

- Chapter 7-The Revenue/Receivables/Cash Cycle: Multiple ChoiceDokument32 SeitenChapter 7-The Revenue/Receivables/Cash Cycle: Multiple ChoiceLeonardoNoch keine Bewertungen

- Accounts Recievable, Bank Recon EtcDokument115 SeitenAccounts Recievable, Bank Recon EtcKylie Luigi Leynes Bagon100% (1)

- Chapter 3-The Adjusting Process: Multiple ChoiceDokument2 SeitenChapter 3-The Adjusting Process: Multiple ChoiceChloe Gabriel Evangeline ChaseNoch keine Bewertungen

- FAR1 50 Multiple Choice QuestionaDokument24 SeitenFAR1 50 Multiple Choice Questionajmv26100% (1)

- 37 FA I WorksheetDokument5 Seiten37 FA I WorksheetBereket DesalegnNoch keine Bewertungen

- Introductory Financial Accounting For Business 1st Edition Edmonds Test BankDokument38 SeitenIntroductory Financial Accounting For Business 1st Edition Edmonds Test Bankduongvalerie9rkb3100% (29)

- CH 12Dokument39 SeitenCH 12Allen KateNoch keine Bewertungen

- MODEL EXAM (Dessie)Dokument19 SeitenMODEL EXAM (Dessie)tame kibruNoch keine Bewertungen

- Survey of Accounting 5th Edition Edmonds Test BankDokument69 SeitenSurvey of Accounting 5th Edition Edmonds Test Bankenochtuyenuydxeq100% (21)

- Acct2 Managerial Asia Pacific 2nd Edition Sivabalan Test Bank Full Chapter PDFDokument42 SeitenAcct2 Managerial Asia Pacific 2nd Edition Sivabalan Test Bank Full Chapter PDFclergypresumerb37al7100% (15)

- ACCT 501-Midterm FlashcardsDokument17 SeitenACCT 501-Midterm FlashcardscarterkddNoch keine Bewertungen

- Chapter 7-The Revenue/Receivables/Cash Cycle: Multiple ChoiceDokument33 SeitenChapter 7-The Revenue/Receivables/Cash Cycle: Multiple Choicemisssunshine112Noch keine Bewertungen

- Study Session 11 - ReceivablesDokument8 SeitenStudy Session 11 - ReceivablesRuwani RathnayakeNoch keine Bewertungen

- MCQS Sample Questions For FinalDokument3 SeitenMCQS Sample Questions For FinalMahmoud OkashaNoch keine Bewertungen

- Survey of Accounting 5th Edition Edmonds Test Bank 1Dokument63 SeitenSurvey of Accounting 5th Edition Edmonds Test Bank 1melody100% (43)

- BA3 Special Revision MockDokument17 SeitenBA3 Special Revision MockSanjeev JayaratnaNoch keine Bewertungen

- Af101 MST S1 2019Dokument12 SeitenAf101 MST S1 2019Malia i Lutu Leonia Kueva Losalu100% (2)

- Intermediate Accounting 18th Edition Stice Test BankDokument25 SeitenIntermediate Accounting 18th Edition Stice Test BankBrettFreemanrefc100% (50)

- Chapter 3Dokument15 SeitenChapter 3clara2300181Noch keine Bewertungen

- Classifications by Due Date Balance in Category Estimated % Uncollectible Estimated Uncollectible AmountDokument4 SeitenClassifications by Due Date Balance in Category Estimated % Uncollectible Estimated Uncollectible AmountallyssajabsNoch keine Bewertungen

- CH 12Dokument39 SeitenCH 12Saeym SegoviaNoch keine Bewertungen

- Mock-2, Sec-ADokument19 SeitenMock-2, Sec-AmmranaduNoch keine Bewertungen

- Tai Lieu Ke Toan - Docx Khanh.Dokument20 SeitenTai Lieu Ke Toan - Docx Khanh.copmuopNoch keine Bewertungen

- ACC 557 Week 2, QuizDokument3 SeitenACC 557 Week 2, QuizacurashahNoch keine Bewertungen

- Intermediate Accounting 18Th Edition Stice Test Bank Full Chapter PDFDokument54 SeitenIntermediate Accounting 18Th Edition Stice Test Bank Full Chapter PDFDebraWhitecxgn100% (10)

- Intermediate Accounting 18th Edition Stice Test BankDokument33 SeitenIntermediate Accounting 18th Edition Stice Test Bankcolonizeverseaat100% (35)

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Von EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Bewertung: 4.5 von 5 Sternen4.5/5 (5)

- Economic & Budget Forecast Workbook: Economic workbook with worksheetVon EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNoch keine Bewertungen

- Accounting for Goodwill and Other Intangible AssetsVon EverandAccounting for Goodwill and Other Intangible AssetsBewertung: 4 von 5 Sternen4/5 (1)

- 1702Dokument1 Seite1702Chloe Gabriel Evangeline ChaseNoch keine Bewertungen

- Financial Statement Analysis: True/FalseDokument2 SeitenFinancial Statement Analysis: True/FalseChloe Gabriel Evangeline ChaseNoch keine Bewertungen

- Financial Statement Analysis: True/FalseDokument2 SeitenFinancial Statement Analysis: True/FalseChloe Gabriel Evangeline ChaseNoch keine Bewertungen

- Financial Statement Analysis: True/FalseDokument1 SeiteFinancial Statement Analysis: True/FalseChloe Gabriel Evangeline ChaseNoch keine Bewertungen

- Financial Statement Analysis: True/FalseDokument2 SeitenFinancial Statement Analysis: True/FalseChloe Gabriel Evangeline ChaseNoch keine Bewertungen

- Financial Statement Analysis: True/FalseDokument1 SeiteFinancial Statement Analysis: True/FalseChloe Gabriel Evangeline ChaseNoch keine Bewertungen

- Chapter 3-The Adjusting Process: True/FalseDokument2 SeitenChapter 3-The Adjusting Process: True/FalseChloe Gabriel Evangeline ChaseNoch keine Bewertungen

- Financial Statement Analysis: True/FalseDokument1 SeiteFinancial Statement Analysis: True/FalseChloe Gabriel Evangeline ChaseNoch keine Bewertungen

- Financial Statement Analysis: True/FalseDokument2 SeitenFinancial Statement Analysis: True/FalseChloe Gabriel Evangeline ChaseNoch keine Bewertungen

- Chapter 3-The Adjusting Process: True/FalseDokument2 SeitenChapter 3-The Adjusting Process: True/FalseChloe Gabriel Evangeline ChaseNoch keine Bewertungen

- Financial Statement Analysis: True/FalseDokument1 SeiteFinancial Statement Analysis: True/FalseChloe Gabriel Evangeline ChaseNoch keine Bewertungen

- Chapter 3-The Adjusting ProcessDokument2 SeitenChapter 3-The Adjusting ProcessChloe Gabriel Evangeline ChaseNoch keine Bewertungen

- Financial Statement Analysis: True/FalseDokument2 SeitenFinancial Statement Analysis: True/FalseChloe Gabriel Evangeline ChaseNoch keine Bewertungen

- Chapter 3-The Adjusting Process: True/FalseDokument2 SeitenChapter 3-The Adjusting Process: True/FalseChloe Gabriel Evangeline ChaseNoch keine Bewertungen

- 016 Chapter3Dokument2 Seiten016 Chapter3Chloe Gabriel Evangeline ChaseNoch keine Bewertungen

- 010 Chapter3Dokument2 Seiten010 Chapter3Chloe Gabriel Evangeline ChaseNoch keine Bewertungen

- 005 Chapter3Dokument2 Seiten005 Chapter3Chloe Gabriel Evangeline ChaseNoch keine Bewertungen

- Chapter 3-The Adjusting Process: Multiple ChoiceDokument2 SeitenChapter 3-The Adjusting Process: Multiple ChoiceChloe Gabriel Evangeline ChaseNoch keine Bewertungen

- Chapter 3-The Adjusting Process: True/FalseDokument1 SeiteChapter 3-The Adjusting Process: True/FalseChloe Gabriel Evangeline ChaseNoch keine Bewertungen

- 006 Chapter3Dokument2 Seiten006 Chapter3Chloe Gabriel Evangeline ChaseNoch keine Bewertungen

- Chapter 3-The Adjusting Process: Multiple ChoiceDokument2 SeitenChapter 3-The Adjusting Process: Multiple ChoiceChloe Gabriel Evangeline ChaseNoch keine Bewertungen

- Chapter 3-The Adjusting Process: Multiple ChoiceDokument2 SeitenChapter 3-The Adjusting Process: Multiple ChoiceChloe Gabriel Evangeline ChaseNoch keine Bewertungen

- 013 Chapter3Dokument2 Seiten013 Chapter3Chloe Gabriel Evangeline ChaseNoch keine Bewertungen

- 009 Chapter3Dokument2 Seiten009 Chapter3Chloe Gabriel Evangeline ChaseNoch keine Bewertungen

- Chapter 3-The Adjusting Process: Multiple ChoiceDokument2 SeitenChapter 3-The Adjusting Process: Multiple ChoiceChloe Gabriel Evangeline ChaseNoch keine Bewertungen

- 017 Chapter3Dokument2 Seiten017 Chapter3Chloe Gabriel Evangeline ChaseNoch keine Bewertungen

- Chapter 1 - Matching Part 1Dokument2 SeitenChapter 1 - Matching Part 1Chloe Gabriel Evangeline ChaseNoch keine Bewertungen

- Chapter 1 - Matching Part 4Dokument1 SeiteChapter 1 - Matching Part 4Chloe Gabriel Evangeline ChaseNoch keine Bewertungen