Beruflich Dokumente

Kultur Dokumente

2018 March B.com 4th Sem SH College Autonomous March Corporate Accounting Question Paper Goodwill Tuition Centre Thevara 9846710963 9567902805

Hochgeladen von

Rainy GoodwillCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

2018 March B.com 4th Sem SH College Autonomous March Corporate Accounting Question Paper Goodwill Tuition Centre Thevara 9846710963 9567902805

Hochgeladen von

Rainy GoodwillCopyright:

Verfügbare Formate

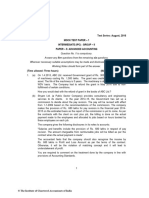

Reg. N o...... ..F..l.3..(. Name.... ..Ct!s a.Ll. f.dep-d.t..

)4:6 u422

B.COM. DEGREE END SEMESTER EXAMINATION MARCH 2OL8

SEMESTER - 4: COMMERCE (coRE coURsE)

COURSE: U4CRCOM11: CORPORATE ACCOUNTING

(For Supplementory - 2074 Admission)

Time:Three Hours Max. Marks: 75

PART A

Answer oll questions. Each question carries I mark

1. What is profit prior to incorporation?

2. Who is a contributory according to Companies Act, 1956?

3. What is a bonus share?

4. What is net worth?

5. What is unmarked application?

6. What is Capital Redemption Reserve?

7. What is deficiency account?

8. What is contingent liability?

9. What do you mean by Firm Underwriting

10. What is Time Ratio? (1x 10 = 10)

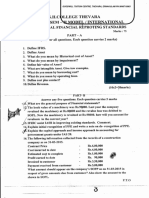

PART B

Answer ony eight questions. Each question carries 2 marks

11. What is Vertical Balance Sheet?

12. X Ltd acquires the business of Y Ltd for which X Ltd pays 10,00,000 in equity shares of Rs.10/-

each, Rs.7,0O,OOO in L5% debentures of X Ltd and Rs.4,50,000 in cash. Creditors for

Rs.1,50,000 and employees security deposit of Rs.30,000 are also assumed by X Ltd.

Calculate purchase consideration.

1-3. XYZ Ltd. has 50,000 equity shares of Rs.10 each, Rs.8 paid up. lt is resolved to make the

shares fully paid up by bonus issue. The company has General Reserve Rs.2,00,000. Give

journal entries.

14. Explain the treatment of profit prior to incorporation?

15. Who are dissenting shareholders? How their claims are settled?

16. What are the profits available for buyback of shares?

1-7. Differentiate between internal reconstruction and external reconstruction?

18. What is 'Liquidator's Final Statement of Account'?

19. Who are preferential creditors?

20. What do you'mean by interim dividend and final dividend? (2 x 8 = 16)

SacreC liec:,. Cc!ies? lAui:

? 1) i i ;

'-_-;=

-1

; ,L J

GOODWILL TUITION CENTRE, THEVARA 9567902805, 9846710963

[-fr

PART C

Answer ony five questions. Each question carries 5 marks

21. What are the different methods of calculating Purchase Consideration?

22. Differentiate between capital alteration and capital reduction

23. Differentiate Amalgamation from External Reconstruction'

P&L A/c from the year ended 31-03-

24. A company carried forward balance of Rs.40,000 f rom

before providing

2013. During the year 2O13-L4 it made a further profit of Rs.3,10,000/-

out :

taxation. lt was decided that the following decisions were carried

Provision for taxation Rs.1,50,000

Dividend equalization Reserve Rs' 25,000

Dividend on 8% Preference Shares of Rs'2,00,000

paid up

Dividend at til%on 30,000 equity shares of Rs.10/- each fully

General Reserve Rs'35,000

Development Rebate Reserve Rs'35,000

Prepare P&L Appropriation Account and journal entries for the above

5o,ooo shares were bought back

25. Lal Ltd. issued 2,oo,ooo equity shares of Rs.10 each, of which

Rs.110 each' The com

per share. The company issued 4,ooo, 6% preference shares of Rs'100 at

general reserve' Give jot

had Rs.2,00,000 in security premium account and Rs'2,40,000 in

entries.

paid-up. Resolution is passed to declare b

26. AB Ltd. has 3o,ooo equity shares of Rs.10 each, Rs.7

to make the shares fully paid-up and to issue bonus shares in the ratlo 1:3

The compan'

books of the company'

surf,cient amount of genenal reserye. Give journal entries in the

joint stock company under the name of "A

27. Aril and Sunil \.,'orking in partnership, registered a

S,;:r l Ltd." On l,,Septennber, 2OO6 to take the business

with effect from 1't April, 2006'

Profit and Loss Account for the year ending 31-3-2007

Pc1,'culors Rs. Po rticu lo rs Rs.

Salaries and wages 5000 Gross profit b/d 42000

Debenture interest 2500

Depreciation 1000

lnterest on purchase consideration

(U p to 30- 9-7006) 5400

Director's fees 400

Preliminary exp. Written off 500

Selling commission 6000

Provision for taxes 2500

Dividend on equitY shares at 5qt 3000

N et prof it 15700

42,000 47,000

- -- 'tr'i :;'s

LJor- l:,ieqe {Autcncrncus) : nD..tfi

it"--/Ji

r7

-J

):,qr? Z ai t:i

GOODWILL TUITION CENTRE, THEVARA 9567902805, 9846710963

u422

Salesfor the year totaled Rs. 112500, out of which Rs. 75000 related to the period from 1't

September,2006 to 31't March 2OO7. You are required to prepare a statement apportioning the

profits between post and pre incorporation period indicating your basis of allocation.

(5x5=25)

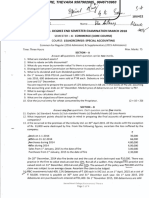

PART D

Answer ony two of the following questions. Each question carries 12 marks

28. Explain briefly the procedure for implementing capital reduction

29. From the following trial balance and the adjoining information prepare the final accounts

of JOHRI Co. Ltd as on 31 March 2015

DEBIT CREDIT

P re m ises I 30, 7 2,000 Sha re ca pita I 40,00,000

Pla nt { 33,00.000 12% Debentures.Y 30,00,000

Stock P&L Account 2,62,500

Debto rs; 8,70,000 i Bills Payable 3,70,000

Goodwill 2,50,000 rCreditors 4,00,000

Cash ln Bank 4,06,500 Sales 41,,50,000

Ca lls arrear 75,000 General Reserve 2,50,000

lnterim Dividend Paid 3,92,500 Bac oeots provisions on

Pu rchases L8,50,000 L-O4-20L4 35,000

Preli minary expenses \,/ 50,000

Wages 9,79,900

Genera I Expenses 68,350

Sa la ries 2,02,250

Ba d debts 2L,100

Debentu re lnterest Paid .r L,80,000

Total I

t,24,67,500 Tota I L,24,67,500

a. Depreciate Plant by 15%

b. Write off Rs.5000 from Preliminary Expenses

c. Half years Debenture lnterest Due

4CC

d. Credit 5% Provision on Debtors for douotful debts +'f

e. Provide for Income Tax at 50% *i1r,.r>,"

f. Stock on 31-3 -2015 was Rs.9,50,000

g. A claim of Rs.25,000 for Workmens Compensation is being disputed by the Co.

30. Prepare the Balance Sheet of a Company in vertical form with imaginary figures.

GOODWILL TUITION CENTRE, THEVARA 9567902805, 9846710963

u422

31. Following was the Balance sheet of Minerva Ltd., as on 31st March 2oL5.

Lia bilities Amount Assets Amou nt

(Rs.) (Rs.)

4,000 equity shares of Rs.100 4,00,000 Goodwill 50,000

each

2,000 7% Preference Shares 2,00,000 Land and Building L,40,000

of Rs.100 each

6% Debentures 2,00,000 Plant and Machinery 1,50,000

Sundry Creditors 2,00,000 Pate nts 40,000

Stock L,60,000

I o.btors I z, 1 5,000 i

Cash in hand ' 5,000

Preliminary expenses 25,000

Discount on issue of 15,000

De be ntu res

Profit and Loss account 2,00,000

Total LO,00,ti00 Tota I L0,00,000

The following scheme of reconstruction was duly accepted and implemented.

a. Equity shares are to be reduced to equal number of fully paid shares of Rs.50 each

b. 7Yo Pref erence Shares are to be reduced bV 30% and the rate of dividend is to be

increased to 97o

c. The value of Land and Building is to be increased by L0%

d. The Debentures are to be reducedbV 20%

e. All nominal and fictitious assets are to be eliminated and the balance is to be used

to write off patents

f. Further equity shares are tu be issued for Rs.50,000 for cash

Give necessary journal entries and prepare the Balance sheet afterthe reconstruction is

implemented

(I2x2=24)

*t*+******

D.5t'

loiiege {Autcnor:c;s'; i,': ,.

;;;rt n?

GOODWILL TUITION CENTRE, THEVARA 9567902805, 9846710963

.

-,5*

L:.

' v i Li.

Das könnte Ihnen auch gefallen

- Equity Valuation Toolkit Additional Valuation Resources PDFDokument156 SeitenEquity Valuation Toolkit Additional Valuation Resources PDFViet Linh Vu0% (1)

- Get Rich with Dividends: A Proven System for Earning Double-Digit ReturnsVon EverandGet Rich with Dividends: A Proven System for Earning Double-Digit ReturnsNoch keine Bewertungen

- Ocean Manufacturing, Inc.: The New-Client Acceptance DecisionDokument7 SeitenOcean Manufacturing, Inc.: The New-Client Acceptance Decisionbanana100% (1)

- Cost of CapitalDokument15 SeitenCost of CapitalrosdicoNoch keine Bewertungen

- Teacher's Manual - Aa Part 2 (2015ed)Dokument271 SeitenTeacher's Manual - Aa Part 2 (2015ed)PutmehudgJasd88% (8)

- Case 27 Emi Group PLCDokument18 SeitenCase 27 Emi Group PLCRendy Mardiansyah ArsyavinNoch keine Bewertungen

- BookDokument190 SeitenBookAnonymous e4KPPyl100% (1)

- India Healthcare Market Potential Opportunities For Market EntryDokument21 SeitenIndia Healthcare Market Potential Opportunities For Market EntryTikki sharmaNoch keine Bewertungen

- Valuation of Goodwill and SharesDokument40 SeitenValuation of Goodwill and Sharesakshata100% (2)

- Dissertation TopicsDokument24 SeitenDissertation Topicsdineshlutya50% (2)

- Ice Cream Factory Final ReportDokument35 SeitenIce Cream Factory Final Reportss8888100% (1)

- Notes To FSDokument3 SeitenNotes To FSdhez10Noch keine Bewertungen

- Statement of Changes in Equity (SCE)Dokument3 SeitenStatement of Changes in Equity (SCE)Angel Padilla100% (2)

- Corporate Accounting Question Paper March 2015 MG (CBCSS)Dokument4 SeitenCorporate Accounting Question Paper March 2015 MG (CBCSS)Sharon sharoNoch keine Bewertungen

- Gujarat Technological UniversityDokument3 SeitenGujarat Technological UniversityRenieNoch keine Bewertungen

- Sample Question Paper IN AccountancyDokument7 SeitenSample Question Paper IN AccountancyRahul TyagiNoch keine Bewertungen

- Advanced Accounting exam questionsDokument4 SeitenAdvanced Accounting exam questionsAbdul MalikNoch keine Bewertungen

- Karnataka II PUC Accountancy Sample Question Paper 16Dokument5 SeitenKarnataka II PUC Accountancy Sample Question Paper 16Kishu KishoreNoch keine Bewertungen

- OCTOBER 2019: Reg. No.Dokument6 SeitenOCTOBER 2019: Reg. No.Selvi SelviNoch keine Bewertungen

- 2018 April MGU Cbcss 4th Semester Corporate Accounting Question Paper Goodwill Tuition Centre 9846710963 9567902805Dokument4 Seiten2018 April MGU Cbcss 4th Semester Corporate Accounting Question Paper Goodwill Tuition Centre 9846710963 9567902805Rainy Goodwill0% (1)

- Alpha Arts College Corporate Accounting ExamDokument3 SeitenAlpha Arts College Corporate Accounting Exammahabalu123456789Noch keine Bewertungen

- Debentures & Financial StatementsDokument11 SeitenDebentures & Financial StatementsShreyas PremiumNoch keine Bewertungen

- Corporate ACDokument4 SeitenCorporate ACElavarasan NNoch keine Bewertungen

- Dwaraka Doss Goverdhan Doss Vaishnav College (Autonomous) Arumbakkam, Chennai - 600 106. Department of Corporate Secretaryship Core Paper V-Corporate AccountingDokument4 SeitenDwaraka Doss Goverdhan Doss Vaishnav College (Autonomous) Arumbakkam, Chennai - 600 106. Department of Corporate Secretaryship Core Paper V-Corporate AccountingNeeraj DNoch keine Bewertungen

- 2BBL311 SEE IR Financial Accounting Dec 2017Dokument3 Seiten2BBL311 SEE IR Financial Accounting Dec 2017Akshay SharmaNoch keine Bewertungen

- Advanced Financial Accounting Degree Question Paper Free Download Goodwill Tuition Centre, Kochi, Kerala PH: 9567902805, 9846710963Dokument7 SeitenAdvanced Financial Accounting Degree Question Paper Free Download Goodwill Tuition Centre, Kochi, Kerala PH: 9567902805, 9846710963Rainy GoodwillNoch keine Bewertungen

- Acounts Papaer II Preliminary Examination 2008 - 09Dokument5 SeitenAcounts Papaer II Preliminary Examination 2008 - 09AMIN BUHARI ABDUL KHADERNoch keine Bewertungen

- Corporate Accounting Practice Exam QuestionsDokument5 SeitenCorporate Accounting Practice Exam Questions19BCS531 Nisma FathimaNoch keine Bewertungen

- Gujarat Technological UniversityDokument6 SeitenGujarat Technological UniversitymansiNoch keine Bewertungen

- 5238 - Year - M.Com. (With Credits) - Regular-Semester 2012 Sem IV (Old) Subject - MCOM241 - Advanced Management Accounting PDFDokument5 Seiten5238 - Year - M.Com. (With Credits) - Regular-Semester 2012 Sem IV (Old) Subject - MCOM241 - Advanced Management Accounting PDFUnplanned VideosNoch keine Bewertungen

- Sem-5 10 BCOM HONS DSE-5.2A CORPORATE-ACCOUNTING-0758Dokument5 SeitenSem-5 10 BCOM HONS DSE-5.2A CORPORATE-ACCOUNTING-0758hussain shahidNoch keine Bewertungen

- Bcom 3 Sem Corporate Accounting 1 21100518 Mar 2021Dokument5 SeitenBcom 3 Sem Corporate Accounting 1 21100518 Mar 2021abin.com22Noch keine Bewertungen

- ECO-14 - ENG-J18 - Compressed-1Dokument6 SeitenECO-14 - ENG-J18 - Compressed-1YzNoch keine Bewertungen

- 5th Sem Accounts Previous Year PapersDokument25 Seiten5th Sem Accounts Previous Year PapersViratNoch keine Bewertungen

- CA Inter Advanced Accounting Full Test 1 May 2023 Unscheduled Test Paper 1674112111Dokument20 SeitenCA Inter Advanced Accounting Full Test 1 May 2023 Unscheduled Test Paper 1674112111pari maheshwariNoch keine Bewertungen

- Corporate AccountingDokument2 SeitenCorporate AccountingArun SankarNoch keine Bewertungen

- r7 Mba Financial Accounting and Analysis Set1Dokument3 Seitenr7 Mba Financial Accounting and Analysis Set1Sunil RaparthiNoch keine Bewertungen

- Ghss Koduvayur Higher Secondary Model Examination 2011 Accountancy With Computerised AccountingDokument3 SeitenGhss Koduvayur Higher Secondary Model Examination 2011 Accountancy With Computerised Accountingsharathk916Noch keine Bewertungen

- Internal ReconstructionDokument8 SeitenInternal Reconstructionsmit9993Noch keine Bewertungen

- Corporate Accounting - I Semester ExaminationDokument7 SeitenCorporate Accounting - I Semester ExaminationVijay KumarNoch keine Bewertungen

- Corrporate ModelDokument10 SeitenCorrporate Modelnithinjoseph562005Noch keine Bewertungen

- Ca-Ii May 2022Dokument6 SeitenCa-Ii May 2022Gayathri V GNoch keine Bewertungen

- 1e710c6f-4b3e-4b03-943f-11430d867f0e-Dokument30 Seiten1e710c6f-4b3e-4b03-943f-11430d867f0e-angela antoniaNoch keine Bewertungen

- 2018 March B.com 4th Sem SH College Autonomous March Accounting For Managerial Decision Question Paper Goodwill Tuition Centre Thevara 9846710963 9567902805Dokument3 Seiten2018 March B.com 4th Sem SH College Autonomous March Accounting For Managerial Decision Question Paper Goodwill Tuition Centre Thevara 9846710963 9567902805Rainy GoodwillNoch keine Bewertungen

- Jaya College of Arts and Science Department of ManagDokument4 SeitenJaya College of Arts and Science Department of ManagMythili KarthikeyanNoch keine Bewertungen

- Cbse Class XII Accountancy Sample Paper 1: Time:3 Hrs Max. Marks: 80Dokument6 SeitenCbse Class XII Accountancy Sample Paper 1: Time:3 Hrs Max. Marks: 80Sukhman DhillonNoch keine Bewertungen

- Accounting AndFinancial Management 2015-16Dokument4 SeitenAccounting AndFinancial Management 2015-16Ashish AgarwalNoch keine Bewertungen

- MAY 15 ADV ACC Merged - Document - 2mtps PDFDokument43 SeitenMAY 15 ADV ACC Merged - Document - 2mtps PDFMohit KaundalNoch keine Bewertungen

- Valuation of GoodwillDokument15 SeitenValuation of Goodwillbtsa1262013Noch keine Bewertungen

- 1 20MAY201420ACCOUNTS20 (420files20merged) Mtps PDFDokument45 Seiten1 20MAY201420ACCOUNTS20 (420files20merged) Mtps PDFDipen AdhikariNoch keine Bewertungen

- CBSE Class 12 Accountancy Sample Papers 2014 - 15Dokument7 SeitenCBSE Class 12 Accountancy Sample Papers 2014 - 15Karthick KarthickNoch keine Bewertungen

- Sem5 Acyg CC9Dokument3 SeitenSem5 Acyg CC9Amrita RoyNoch keine Bewertungen

- Corporate Accounting IIDokument5 SeitenCorporate Accounting II2vj77sn8x5Noch keine Bewertungen

- Important Que Advanced Cor AccDokument18 SeitenImportant Que Advanced Cor Accvineethaj2004Noch keine Bewertungen

- Class 12 - Quarterly Examination Q FINALDokument11 SeitenClass 12 - Quarterly Examination Q FINALsubbuNoch keine Bewertungen

- Question Bank - Third Sem B.com Computer Applications & TaxationDokument47 SeitenQuestion Bank - Third Sem B.com Computer Applications & TaxationsnehaNoch keine Bewertungen

- Test Series: March, 2019 Mock Test Paper - 1 Intermediate (Ipc) : Group - Ii Paper - 5: Advanced AccountingDokument7 SeitenTest Series: March, 2019 Mock Test Paper - 1 Intermediate (Ipc) : Group - Ii Paper - 5: Advanced AccountingPiyush AmbastaNoch keine Bewertungen

- Hsslive-march-2023-qn-SY-549 (Accounts With AFS) - Pages-DeletedDokument8 SeitenHsslive-march-2023-qn-SY-549 (Accounts With AFS) - Pages-DeletednadidawaunionthekkekadNoch keine Bewertungen

- 1 VJP 0 LTVX WHN RV ZUCj NLDokument10 Seiten1 VJP 0 LTVX WHN RV ZUCj NLVanshika BhatiNoch keine Bewertungen

- MTP Nov 16 Grp-2 (Series - I)Dokument58 SeitenMTP Nov 16 Grp-2 (Series - I)keshav rakhejaNoch keine Bewertungen

- Company Account SuggestionDokument34 SeitenCompany Account SuggestionAYAN DATTANoch keine Bewertungen

- Co 2101Dokument3 SeitenCo 2101PRIYA LAKSHMANNoch keine Bewertungen

- Part - A Partnership, Share Capital and Debentures: General InstructionsDokument7 SeitenPart - A Partnership, Share Capital and Debentures: General InstructionsGaurav JaiswalNoch keine Bewertungen

- Accountancy Assignment Grade 12Dokument4 SeitenAccountancy Assignment Grade 12sharu SKNoch keine Bewertungen

- Screenshot 2023-11-27 at 1.48.32 PMDokument9 SeitenScreenshot 2023-11-27 at 1.48.32 PManupriyakapil85Noch keine Bewertungen

- Rohit TestDokument9 SeitenRohit TestRohitNoch keine Bewertungen

- Advanced Accounts MTP M21 S2Dokument19 SeitenAdvanced Accounts MTP M21 S2Harshwardhan PatilNoch keine Bewertungen

- Test Series: April, 2021 Mock Test Paper - 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingDokument6 SeitenTest Series: April, 2021 Mock Test Paper - 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingOcto ManNoch keine Bewertungen

- Accounts Home Test 2Dokument7 SeitenAccounts Home Test 2Ashish RaiNoch keine Bewertungen

- CA Inter Adv. Accounting Top 50 Question May 2021Dokument117 SeitenCA Inter Adv. Accounting Top 50 Question May 2021Sumitra yadavNoch keine Bewertungen

- 4 CO4CRT11 - Corporate Accounting II (T) (1)Dokument5 Seiten4 CO4CRT11 - Corporate Accounting II (T) (1)emildaraisonNoch keine Bewertungen

- CBSE Class 12 Accountancy Question Paper 2012 With SolutionsDokument38 SeitenCBSE Class 12 Accountancy Question Paper 2012 With SolutionsRavi AgrawalNoch keine Bewertungen

- October 22 Semester 3 Corporate Accounting S H College, Thevara Question PaperDokument4 SeitenOctober 22 Semester 3 Corporate Accounting S H College, Thevara Question PaperRainy GoodwillNoch keine Bewertungen

- MGU B.com 1st Semester Financial Accounting Question Paper 2022 FebruaryDokument6 SeitenMGU B.com 1st Semester Financial Accounting Question Paper 2022 FebruaryRainy GoodwillNoch keine Bewertungen

- Income Tax 1 B.com St. Alberts College Mgu 5th Semester Question Paper Free Download October 2022Dokument4 SeitenIncome Tax 1 B.com St. Alberts College Mgu 5th Semester Question Paper Free Download October 2022Rainy GoodwillNoch keine Bewertungen

- Second Semester October 2022 Financial Accounting 2 Question Paper MGUDokument5 SeitenSecond Semester October 2022 Financial Accounting 2 Question Paper MGURainy GoodwillNoch keine Bewertungen

- Cusat Question Paper Mba Accounting For Managers 2022 MarchDokument3 SeitenCusat Question Paper Mba Accounting For Managers 2022 MarchRainy GoodwillNoch keine Bewertungen

- 6 Semester MGU Cost Accounting 2016 March Question PaperDokument4 Seiten6 Semester MGU Cost Accounting 2016 March Question PaperRainy GoodwillNoch keine Bewertungen

- Degree (CBCSS) Examination - Model Question Paper 2016 Applied Costing MG UniversityDokument4 SeitenDegree (CBCSS) Examination - Model Question Paper 2016 Applied Costing MG UniversityRainy GoodwillNoch keine Bewertungen

- Income Tax 5th Sem B.com November 2022 Question Paper Rajagiri College MGUDokument3 SeitenIncome Tax 5th Sem B.com November 2022 Question Paper Rajagiri College MGURainy GoodwillNoch keine Bewertungen

- Agriculture Income - Income TaxDokument5 SeitenAgriculture Income - Income TaxRainy GoodwillNoch keine Bewertungen

- Accounting For Management SCMS Question PapersDokument7 SeitenAccounting For Management SCMS Question PapersRainy GoodwillNoch keine Bewertungen

- MGU CBCSS Sixth Sem Applied Cost Accounting Question Paper March 2018 Free Download Goodwill Tuition Centre For Accountancy 9846710963 9567902805Dokument4 SeitenMGU CBCSS Sixth Sem Applied Cost Accounting Question Paper March 2018 Free Download Goodwill Tuition Centre For Accountancy 9846710963 9567902805Rainy GoodwillNoch keine Bewertungen

- 6 Semester MGU Cost Accounting 2016 March Question PaperDokument4 Seiten6 Semester MGU Cost Accounting 2016 March Question PaperRainy GoodwillNoch keine Bewertungen

- Cost Accounting 5th Sem October 2018 Goodwill Tuition Centre Thevara Question Paper CbcssDokument4 SeitenCost Accounting 5th Sem October 2018 Goodwill Tuition Centre Thevara Question Paper CbcssRainy GoodwillNoch keine Bewertungen

- MGU CBCSS March 2018 Sixth Sem Question Paper Applied Cost Accounting CBCSS Goodwill Tuition Centre 9846710963 9567902805Dokument4 SeitenMGU CBCSS March 2018 Sixth Sem Question Paper Applied Cost Accounting CBCSS Goodwill Tuition Centre 9846710963 9567902805Rainy GoodwillNoch keine Bewertungen

- Calicut Sreelaxmi QP 2022 March 23Dokument4 SeitenCalicut Sreelaxmi QP 2022 March 23Rainy GoodwillNoch keine Bewertungen

- Goodwill Tuition Centre, Ernakulam For Online Tuition: 9846710963, 9567902805Dokument4 SeitenGoodwill Tuition Centre, Ernakulam For Online Tuition: 9846710963, 9567902805Rainy GoodwillNoch keine Bewertungen

- MGU B.Com Syllabus 2017 Onward Free Download Goodwill Tuition Centre 9846710963 9567902805 PDFDokument62 SeitenMGU B.Com Syllabus 2017 Onward Free Download Goodwill Tuition Centre 9846710963 9567902805 PDFRainy GoodwillNoch keine Bewertungen

- Final Accounts AdjustmentsDokument7 SeitenFinal Accounts AdjustmentsRainy GoodwillNoch keine Bewertungen

- MGU B.Com Syllabus 2017 Onward Free Download Goodwill Tuition Centre 9846710963 9567902805 PDFDokument62 SeitenMGU B.Com Syllabus 2017 Onward Free Download Goodwill Tuition Centre 9846710963 9567902805 PDFRainy GoodwillNoch keine Bewertungen

- Advanced Financial Accounting Degree Question Paper Free Download Goodwill Tuition Centre, Kochi, Kerala PH: 9567902805, 9846710963Dokument7 SeitenAdvanced Financial Accounting Degree Question Paper Free Download Goodwill Tuition Centre, Kochi, Kerala PH: 9567902805, 9846710963Rainy GoodwillNoch keine Bewertungen

- MGU CBCSS March 2018 Sixth Sem Question Paper Income Tax Assessment and Procedure.Dokument4 SeitenMGU CBCSS March 2018 Sixth Sem Question Paper Income Tax Assessment and Procedure.Rainy GoodwillNoch keine Bewertungen

- IGNOU Elements of Income Tax Question Paper Free Download B.com June 2017Dokument4 SeitenIGNOU Elements of Income Tax Question Paper Free Download B.com June 2017Rainy GoodwillNoch keine Bewertungen

- IFRS B.com SH College Model Question Paper 2017 March 2Dokument2 SeitenIFRS B.com SH College Model Question Paper 2017 March 2Rainy GoodwillNoch keine Bewertungen

- Defence Accounts Department SAS Examination Question Paper Accountancy 2016 AugustDokument10 SeitenDefence Accounts Department SAS Examination Question Paper Accountancy 2016 AugustRainy GoodwillNoch keine Bewertungen

- 2018 April MGU Cbcss 4th Semester Corporate Accounting Question Paper Goodwill Tuition Centre 9846710963 9567902805Dokument4 Seiten2018 April MGU Cbcss 4th Semester Corporate Accounting Question Paper Goodwill Tuition Centre 9846710963 9567902805Rainy Goodwill0% (1)

- 2018 March B.com Special Accounting Question Paper 4th Smester SH College Autonomous Goodwill Tuition Centre 9846710963 9567902805Dokument4 Seiten2018 March B.com Special Accounting Question Paper 4th Smester SH College Autonomous Goodwill Tuition Centre 9846710963 9567902805Rainy GoodwillNoch keine Bewertungen

- MGU CBCSS March 2018 Sixth Sem Question Paper Applied Cost Accounting CBCSS Goodwill Tuition Centre 9846710963 9567902805Dokument4 SeitenMGU CBCSS March 2018 Sixth Sem Question Paper Applied Cost Accounting CBCSS Goodwill Tuition Centre 9846710963 9567902805Rainy GoodwillNoch keine Bewertungen

- 2018 March B.com CBCSS Fifth Sem Special Accounting Question Paper Goodwill Tuition Centre Thevara 9846710963 9567902805Dokument4 Seiten2018 March B.com CBCSS Fifth Sem Special Accounting Question Paper Goodwill Tuition Centre Thevara 9846710963 9567902805Rainy GoodwillNoch keine Bewertungen

- CBCSS March 2018 Sixth Sem Accounting For Managerial Decisions QUESTION PAPER Goodwill Tuition Centre 9846710963 9567902805Dokument4 SeitenCBCSS March 2018 Sixth Sem Accounting For Managerial Decisions QUESTION PAPER Goodwill Tuition Centre 9846710963 9567902805Rainy Goodwill75% (4)

- ACAD - EDGE Edition 1 (Ratio Analysis)Dokument13 SeitenACAD - EDGE Edition 1 (Ratio Analysis)Sarthak GuptaNoch keine Bewertungen

- Senior 12 FABM2 Q1 - M7Dokument20 SeitenSenior 12 FABM2 Q1 - M7Sitti Halima Amilbahar AdgesNoch keine Bewertungen

- Rashed Hossen. Final Project ReportDokument37 SeitenRashed Hossen. Final Project ReportSadia PressNoch keine Bewertungen

- Financial Management 2E: Solutions To Numerical Problems Rajiv Srivastava - Dr. Anil MisraDokument8 SeitenFinancial Management 2E: Solutions To Numerical Problems Rajiv Srivastava - Dr. Anil Misramanisha sonawaneNoch keine Bewertungen

- 02 NBFC - Tata CapitalDokument354 Seiten02 NBFC - Tata CapitalNaeem FastNoch keine Bewertungen

- ARZ Company ProfileDokument31 SeitenARZ Company ProfileDominique MulumbaNoch keine Bewertungen

- FUN ACC Elements of The FInancial StatementsDokument4 SeitenFUN ACC Elements of The FInancial StatementsFranchesca CalmaNoch keine Bewertungen

- Business Plan - PUZZADokument14 SeitenBusiness Plan - PUZZARaquel Sibal Rodriguez100% (1)

- Solution To Right Issue CA FINAL SFM by PRAVINN MAHAJANDokument15 SeitenSolution To Right Issue CA FINAL SFM by PRAVINN MAHAJANPravinn_Mahajan100% (1)

- Elements of Financial StatementDokument33 SeitenElements of Financial StatementKertik Singh100% (1)

- ACCO 2026 2nd Sem 2011 Finals SW2016 BlankDokument5 SeitenACCO 2026 2nd Sem 2011 Finals SW2016 BlankSarah Quijan BoneoNoch keine Bewertungen

- Financial Ratio Analysis ReportDokument8 SeitenFinancial Ratio Analysis ReportJeff AtuaNoch keine Bewertungen

- Accounting TermsDokument25 SeitenAccounting TermsLavina NachlaniNoch keine Bewertungen

- Module #03 - Financial Statements, Cash Flow, and TaxesDokument19 SeitenModule #03 - Financial Statements, Cash Flow, and TaxesRhesus UrbanoNoch keine Bewertungen

- ACCN2 June 2018 MSDokument19 SeitenACCN2 June 2018 MSoliverjdimarcelloNoch keine Bewertungen

- Equity Risk Premium ERP InsightsDokument57 SeitenEquity Risk Premium ERP InsightsSaurav VidyarthiNoch keine Bewertungen

- Accountancy QP 3 (A) 2023Dokument5 SeitenAccountancy QP 3 (A) 2023mohammedsubhan6651Noch keine Bewertungen

- Ey Good Company Fta India PDFDokument164 SeitenEy Good Company Fta India PDFyasinNoch keine Bewertungen