Beruflich Dokumente

Kultur Dokumente

Ack 1

Hochgeladen von

Vyapar Niti0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

11 Ansichten1 Seiteww

Originaltitel

ack1

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenww

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

11 Ansichten1 SeiteAck 1

Hochgeladen von

Vyapar Nitiww

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

4/9/2018 confirmation Page

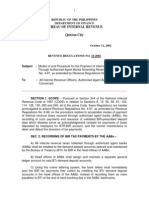

TAX INFORMATION NETWORK

Acknowledgement slip for TDS on sale of immovable property:

PAN of the Transferee DZYPS0310H

PAN of the Transferor AABPL8302M

Acknowledgement No. AF0105501

Total Payment (In Rupees) 28500

Instructions for the Transferee (Buyer) :

1. This advice slip must be presented to the bank / person who is making e-payment on your behalf.

2. All the payments have to be made to credit of the Income Tax Department through e-mode only.

3. Total Payment is rounded off to the nearest Rupee.

4. Please ensure that the payment is made of the same amount as mentioned above.

5. Please note the last date of payment. This is the date when the amount should have been credited to the

Govt. account.

6. The Acknowledgement No. generated will be valid only if the taxpayer makes a payment at Bank's site.

Taxpayer are advised to save above Acknowledgement No. for downloading Form 16B from TRACES

webiste.

7. As communicated by Income Tax Department, TDS certificate (Form 16B) will be available for download

from the TRACES website after atleast 2 days of deposit of tax amount at the respective Bank.

8. If Date of deduction is greater than Date of Payment/Credit, the same may result in Demand Notice for

late deduction.

9. If Date of deduction is less than Date of Payment/Credit, the same may result in Demand Notice for late

deduction.

10. If Date of furnishing Form 26QB is beyond prescribed due date, the same may attract late filing fee u/s

234E.

Instructions for the Bank :

1. No physical challan should be accepted from the taxpayers against TDS on sale of immovable property.

2. No date entry of challan is required against above payment as only payment mode is permissible is e-

payment.

3. Bank/ person making e-payment on behalf of the deductor shall visit www.tin-nsdl.com and click on the

menu 'TDS on Sale of Property'(e-tax payment on subsequent date )

4. The acknowledgement number has to be entered along with the amount indicated above.

5. The bank / person making e-payment should ensure that the amount entered for e-payment is same as that

reflected above.

6. The TDS amount as per Form 26QB should be entered in the field 'Basic Tax' (Income Tax) on the Bank's

web-portal as TDS certificate (Form 16B) will be based on 'Basic Tax' (Income Tax) only.

https://onlineservices.tin.egov-nsdl.com/etaxnew/ConfirmDetailsServlet?rKey=96143909 1/1

Das könnte Ihnen auch gefallen

- Instructions For The Transferee (Buyer)Dokument1 SeiteInstructions For The Transferee (Buyer)Devu GautamNoch keine Bewertungen

- Form 26QB Property Tax Payment Form13Dokument3 SeitenForm 26QB Property Tax Payment Form13JayCharleysNoch keine Bewertungen

- Rmo 40-94Dokument13 SeitenRmo 40-94Raymart SalamidaNoch keine Bewertungen

- RMO 40-94 Procedure On Processing of VAT Credit or RefundDokument10 SeitenRMO 40-94 Procedure On Processing of VAT Credit or RefundJaime II LustadoNoch keine Bewertungen

- Multiple Form 26QB For Multiple Buyers, Sellers & Other FAQSDokument5 SeitenMultiple Form 26QB For Multiple Buyers, Sellers & Other FAQSprashantgeminiNoch keine Bewertungen

- Rhinopay Is An Exciting New Quick Pay Program Offered To All Qualified NTG CarriersDokument2 SeitenRhinopay Is An Exciting New Quick Pay Program Offered To All Qualified NTG Carriers663Noch keine Bewertungen

- Guidelines and Instructions For BIR Form No. 2000 Monthly Documentary Stamp Tax Declaration/ReturnDokument1 SeiteGuidelines and Instructions For BIR Form No. 2000 Monthly Documentary Stamp Tax Declaration/ReturnJoselito III CruzNoch keine Bewertungen

- Bir Form 2000Dokument4 SeitenBir Form 2000Ricca Pearl SulitNoch keine Bewertungen

- Revenue Memorandum Order No. 34-01Dokument8 SeitenRevenue Memorandum Order No. 34-01johnnayelNoch keine Bewertungen

- 2018 EldDokument3 Seiten2018 Eldmuhammad afiqNoch keine Bewertungen

- Etutorial - TDS On Property - Etax-Immediately PDFDokument24 SeitenEtutorial - TDS On Property - Etax-Immediately PDFkunalji_jainNoch keine Bewertungen

- Tax Deduction/Collection Account Number: Meaning of TANDokument8 SeitenTax Deduction/Collection Account Number: Meaning of TANOnkar BandichhodeNoch keine Bewertungen

- b616c - MR Zamir Haider Shah Satr 2021-2022 SignedDokument14 Seitenb616c - MR Zamir Haider Shah Satr 2021-2022 SignedJaved ShahNoch keine Bewertungen

- PolicyDokument5 SeitenPolicyRichard WijayaNoch keine Bewertungen

- Ang Alamat NG UlolDokument2 SeitenAng Alamat NG UlolMaroden Sanchez GarciaNoch keine Bewertungen

- Bureau of Internal Revenue Quezon CityDokument6 SeitenBureau of Internal Revenue Quezon CityPeggy SalazarNoch keine Bewertungen

- Steps For EfpsDokument3 SeitenSteps For EfpsMarites Domingo - PaquibulanNoch keine Bewertungen

- Application For PAN Through Online Services: Tax Information NetworkDokument6 SeitenApplication For PAN Through Online Services: Tax Information NetworkGaurav GuptaNoch keine Bewertungen

- Guidance Note On TDS On Property, Payment Procedure & Points To RememberDokument6 SeitenGuidance Note On TDS On Property, Payment Procedure & Points To RememberAman VermaNoch keine Bewertungen

- RR 16-02Dokument2 SeitenRR 16-02saintkarriNoch keine Bewertungen

- Revenue Memorandum Order No. 40-94: Claims For Value-Added Tax Credit/RefundDokument17 SeitenRevenue Memorandum Order No. 40-94: Claims For Value-Added Tax Credit/RefundjohnnayelNoch keine Bewertungen

- 0605Dokument6 Seiten0605Ivy TampusNoch keine Bewertungen

- Payment ReceiptDokument1 SeitePayment ReceiptWael BouabdellahNoch keine Bewertungen

- Required Documents Bonded LicenseDokument1 SeiteRequired Documents Bonded LicenseAsif AshrafNoch keine Bewertungen

- Bir EtformDokument3 SeitenBir EtformrjgingerpenNoch keine Bewertungen

- Voluntary Assessment and Payment Program (VAPP) : Bureau of Internal Revenue Revenue Region No. 38 - North, Quezon CityDokument29 SeitenVoluntary Assessment and Payment Program (VAPP) : Bureau of Internal Revenue Revenue Region No. 38 - North, Quezon CityEdward GanNoch keine Bewertungen

- BIR JobAid EPaymentDokument19 SeitenBIR JobAid EPaymentKram Ynothna BulahanNoch keine Bewertungen

- Bir 53Dokument4 SeitenBir 53toofuuNoch keine Bewertungen

- BIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsDokument1 SeiteBIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsdreaNoch keine Bewertungen

- BIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsDokument1 SeiteBIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsdreaNoch keine Bewertungen

- TDS at A Glance 2013-14 BookDokument34 SeitenTDS at A Glance 2013-14 Bookajad babuNoch keine Bewertungen

- Tax. 23Dokument18 SeitenTax. 23RahulNoch keine Bewertungen

- PUNT Caf-DeliveryDokument5 SeitenPUNT Caf-DeliveryClive Jerison VNoch keine Bewertungen

- Please Affix Stamp HereDokument4 SeitenPlease Affix Stamp HereleomhorNoch keine Bewertungen

- 2550Q Guidelines 2023 - FinalDokument1 Seite2550Q Guidelines 2023 - Finallorenzo ejeNoch keine Bewertungen

- Who Shall File NotesDokument1 SeiteWho Shall File NotesVher Christopher DucayNoch keine Bewertungen

- Bir Form 0605Dokument2 SeitenBir Form 0605alona_245883% (6)

- Yapm 690Dokument137 SeitenYapm 690chinnaNoch keine Bewertungen

- 48451rmc No. 1-2010Dokument3 Seiten48451rmc No. 1-2010Maureen PascualNoch keine Bewertungen

- Account Information: Danielle D. PascuaDokument2 SeitenAccount Information: Danielle D. PascuaKaye AnnNoch keine Bewertungen

- RMO No. 25-2019Dokument7 SeitenRMO No. 25-2019Jhenny Ann P. SalemNoch keine Bewertungen

- RMC No. 42-03Dokument8 SeitenRMC No. 42-03Rachel Ann CastroNoch keine Bewertungen

- Tax Hand Book of KPTCL 16-02-16Dokument111 SeitenTax Hand Book of KPTCL 16-02-16Prasad IyengarNoch keine Bewertungen

- 1040 Exam Prep: Module II - Basic Tax ConceptsVon Everand1040 Exam Prep: Module II - Basic Tax ConceptsBewertung: 1.5 von 5 Sternen1.5/5 (2)

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaVon EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNoch keine Bewertungen

- Summary of Ahmed Siddiqui & Nicholas Straight's The Anatomy of the SwipeVon EverandSummary of Ahmed Siddiqui & Nicholas Straight's The Anatomy of the SwipeNoch keine Bewertungen

- 21St Century Computer Solutions: A Manual Accounting SimulationVon Everand21St Century Computer Solutions: A Manual Accounting SimulationNoch keine Bewertungen

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeVon Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeBewertung: 1 von 5 Sternen1/5 (1)

- Bookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursVon EverandBookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursNoch keine Bewertungen

- Bar Review Companion: Taxation: Anvil Law Books Series, #4Von EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Noch keine Bewertungen

- Tax Sales for Rookies: A Beginner’s Guide to Understanding Property Tax SalesVon EverandTax Sales for Rookies: A Beginner’s Guide to Understanding Property Tax SalesNoch keine Bewertungen

- Review of Some Online Banks and Visa/Master Cards IssuersVon EverandReview of Some Online Banks and Visa/Master Cards IssuersNoch keine Bewertungen

- LIC Housing Finance LTD: This Is A Computer Generated Statement Hence Does Not Require SignatureDokument1 SeiteLIC Housing Finance LTD: This Is A Computer Generated Statement Hence Does Not Require SignatureGSAINTSSANoch keine Bewertungen

- A Donor's Guide: Vehicle DonationDokument10 SeitenA Donor's Guide: Vehicle Donationriki187Noch keine Bewertungen

- Gallagher InroductionDokument16 SeitenGallagher InroductionAnkit BalapureNoch keine Bewertungen

- Dubai DatabaseDokument1.830 SeitenDubai DatabaseMIan Muzamil100% (1)

- Madoff's American Express Corporate Card StatementDokument30 SeitenMadoff's American Express Corporate Card StatementInvestor Protection100% (3)

- Rating of Indian Commercial Banks: A DEA Approach: Asish Saha, T.S. RavisankarDokument17 SeitenRating of Indian Commercial Banks: A DEA Approach: Asish Saha, T.S. RavisankarSaurabh SuryavanshiNoch keine Bewertungen

- GI Tecnnology ICASH CARDDokument12 SeitenGI Tecnnology ICASH CARDGINoch keine Bewertungen

- Accommodation Bills of ExchangeDokument5 SeitenAccommodation Bills of Exchangenaumanahmad867129Noch keine Bewertungen

- Tax DocumentDokument2 SeitenTax DocumentDutchNoch keine Bewertungen

- Financial - Education - Workbook-VIII (R) - 220924 - 083544Dokument15 SeitenFinancial - Education - Workbook-VIII (R) - 220924 - 083544No oneNoch keine Bewertungen

- Annexure A - Part C Form of Bid Security (Bank Guarantee)Dokument1 SeiteAnnexure A - Part C Form of Bid Security (Bank Guarantee)Prasenjit DeyNoch keine Bewertungen

- Treasury Regulations: For Departments, Constitutional Institutions and Public EntitiesDokument75 SeitenTreasury Regulations: For Departments, Constitutional Institutions and Public EntitiesHoward CohenNoch keine Bewertungen

- NBFC Edelweise Retail FinanceDokument14 SeitenNBFC Edelweise Retail FinancesunitaNoch keine Bewertungen

- Appraisal of Term LoanDokument13 SeitenAppraisal of Term LoanAabhash ShrivastavNoch keine Bewertungen

- Commercial Banking Management: Working Capital Requirement and Financing For Manufacturing CompanyDokument32 SeitenCommercial Banking Management: Working Capital Requirement and Financing For Manufacturing CompanySHASHANK JAINNoch keine Bewertungen

- Credit Union ResumeDokument2 SeitenCredit Union Resumeapi-459901054Noch keine Bewertungen

- M3M Corner Walk BrochureDokument14 SeitenM3M Corner Walk BrochureharshNoch keine Bewertungen

- Old Mutual International InformerDokument28 SeitenOld Mutual International InformerJohn SmithNoch keine Bewertungen

- Savings Bank/Current Account Opening Form (For Individuals and Joint Accounts)Dokument4 SeitenSavings Bank/Current Account Opening Form (For Individuals and Joint Accounts)Sri JaiNoch keine Bewertungen

- Banking Procedures and Control of CashDokument27 SeitenBanking Procedures and Control of CashMohamedNoch keine Bewertungen

- MHA - HAMP Supplemental Directive 09-01Dokument38 SeitenMHA - HAMP Supplemental Directive 09-01SoCal ForeclosuresNoch keine Bewertungen

- Borrower Loan: Promissory NoteDokument3 SeitenBorrower Loan: Promissory NoteRenielyn CabidaNoch keine Bewertungen

- 202d - Skill Based Subject - Banking Law and PracticeDokument21 Seiten202d - Skill Based Subject - Banking Law and PracticeŠ Òű VïķNoch keine Bewertungen

- BDO Credit Card Application FormDokument3 SeitenBDO Credit Card Application FormAnna Fritz Sandoval100% (1)

- Petty Cash Fund ModuleDokument7 SeitenPetty Cash Fund ModuleSecret-uploaderNoch keine Bewertungen

- Banking and InsuranceDokument4 SeitenBanking and InsuranceJaanhvi MehtaNoch keine Bewertungen

- Intermediary Code Intermediary Contact No Intermediary Name Policybazaar Insurance Web Aggregator PL 80189584 18001020333Dokument4 SeitenIntermediary Code Intermediary Contact No Intermediary Name Policybazaar Insurance Web Aggregator PL 80189584 18001020333G MadhaviNoch keine Bewertungen

- Mrs V JPMC Doc 151-17, Amended RICO Statement, March 6, 2017Dokument48 SeitenMrs V JPMC Doc 151-17, Amended RICO Statement, March 6, 2017FraudInvestigationBureau100% (2)

- Anti ChresisDokument21 SeitenAnti ChresisKaren Sheila B. Mangusan - DegayNoch keine Bewertungen

- Community Asset Management: GHD's Asset Management Group Knowledge of AssetsDokument2 SeitenCommunity Asset Management: GHD's Asset Management Group Knowledge of AssetsLTE002Noch keine Bewertungen