Beruflich Dokumente

Kultur Dokumente

Art 20163236

Hochgeladen von

Mohsin JuttCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Art 20163236

Hochgeladen von

Mohsin JuttCopyright:

Verfügbare Formate

International Journal of Science and Research (IJSR)

ISSN (Online): 2319-7064

Index Copernicus Value (2015): 78.96 | Impact Factor (2015): 6.391

A Study on New Innovations in Banking Sector

Sandeep Kaur

Assistant Professor, Commerce Department, SGGS Khalsa College, Mahilpur, India

Abstract: The banking sector plays an important role in the development of one country’s economy. The development of banking

sector depends upon the services provided by them to the customers in various aspects. New entrants to the market, new business models,

changing customer expectations and fragmentation of traditional services are all contributing to put traditional banks under pressure to

launch new technology in their operations. The banking sector in India has seen a number of changes. Most of the banks start

innovative banking with object to create more value customers. ATM, RTGS, NEFT, Internet banking, Mobile banking, SMS Banking

and cheque truncation system are some existing innovations. But there are some new innovations used by the non-banking institutions

and few foreign banks. These new innovations may be grabbed by the Indian banks. So, this paper enlightens the knowledge light on

new innovations in banking sector.

Keywords: Banking Sector, New innovations, Banking products and services, Digital technologies, E-economy

1. Objective of the Study telepresence to meet fast-changing demands from customers.

Following are the some new innovations in banking sector:

The purpose of the study is to highlight the new innovations

in the banking sector at the national international level 4.1 Biometrics Technology

banks.

Biometric technology is any means by which a person can

2. Research Methodology be uniquely identified by evaluating one or more

distinguishing biological traits. Biometric authentication

The research is mainly based on secondary data. Data has includes fingerprints; DNA, face, hand, retina and ear

been collected from different sources like scholarly articles, features. Biometrics systems could end the need of password

annual reports of the selected banks, newsletters, and various and PIN code. According to the BBC, Hongkong and

web sites. Shanghai Banking Corporation (HSBC) is launching voice

and touch recognition security services in the UK. British

banking firm Barclays also upped security in 2014 – offering

3. Introduction finger vein scanning for authentication of large transactions.

The financial development in Indian banking industry

4.2 In-car apps

occurred after the nationalisation of 14 major scheduled

banks in July, 1969 and 6 in April, 1980. In the 1990s, the

Spanish financial institution Caixa Bank has created the

banking sector in India placed greater emphasis on

first mobile banking app that can be accessed while driving,

technology and innovation. At present Indian banking sector

using voice control functionality. The technology used by

is sufficiently capitalised and well-regulated. There are 26

CaixaBank app, called Línea Abierta BASIC. Drivers can

public sector banks, 25 private sector banks, 43 foreign

make balance enquiries and transfers, as well as locate

banks, 56 regional rural banks, 1,589 urban cooperative

nearby branches and ATMs, by speaking into their Android

banks and 93,550 rural cooperative banks. Central bank

device.

granted approval to 11 payments banks and 10 small finance

banks in FY 2015-16. Standard & Poor‘s (S & P) estimates

4.3 Facial recognition technology

that credit growth in India banking sector would improve to

11-13 per cent in FY17. The future of Indian bank looks not

A facial recognition system is a computer application

only exciting but also transformative. India's banking sector

capable of identifying or verifying a person from a digital

could become the fifth largest banking sector in the world by

image or a video frame from a video source. There are many

2020 and the third largest by 2025. In future, technology will

types of authentication for banks and payment firms to

make the engagement with banks more multi-dimensional

consider though, and Chinese e-commerce firm Alibaba

continue to develop and expand banking services. Indian

believes that payments could be made with a smile. HSBC is

banks deployed technology based solutions to raise revenue,

the first bank who adopt the facial recognition technology.

enhance customer experience, optimize cost structure and

manage organisation risk. However, there is a wide ch in the

4.4 Smart Watches

technology implementation capability across different

players of the banking industry.

Now banking transactions can be done on smartwatch—be

it an Apple Watch, Android Wear or Samsung Gear. It‘s not

4. New Innovations in Banking Sector only global financial institutions and banks like Scotiabank,

Barclays, Nationwide, Deutsche Bank, Stanchart and

There has been a wave of innovation in the financial sector Citigroup that have developed apps for smartwatches that

in recent years as banks realize the need of digital run on all major mobile operating systems. But some Indian

technologies such as mobile, wearable, analytics and

Volume 5 Issue 11, November 2016

www.ijsr.net

Licensed Under Creative Commons Attribution CC BY

Paper ID: ART20163236 1780

International Journal of Science and Research (IJSR)

ISSN (Online): 2319-7064

Index Copernicus Value (2015): 78.96 | Impact Factor (2015): 6.391

private sector banks like HDFC, AXIS, ICICI banks have 4.10 Cryptocurrencies

introduced smart watches apps.

A cryptocurrency is a medium of exchange like normal

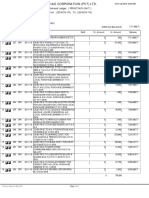

Table 1: Smartwatch apps launched by Indian banks currencies designed for the purpose of exchanging digital

Name of the bank Name of the smartwatch app information. A crypto-currency is a digital currency created

HDFC bank WatchBanking through encryption techniques. Bitcoin is the most famous.

ICICI bank iWear South Africa‘s central bank is ―open‖ to cryptocurrencies

Source: compiled from different websites and blockchain, according to new statements from its

governor. According to a recent media report, the banks that

4.5 Google Glass technology are opening cryptocurrencies includes UBS, BNY Mellon,

Deutsche Bank and Banco Santander.

Banco Sabadell in Spain became one of the first banks to

create a retail Google app that allowed users to locate the 4.11 Artificial intelligence (AI)

nearest ATM, check account balances, and use video

conferencing for technical support. Spainish financial firm, Artificial intelligence is an area of computer science that

Caixa Bank has slso already developed a Google Glass app. emphasizes the creation of intelligent machines that work

It works by super imposing directions to the nearest branch and react like humans. Computers can perform activities like

onto the Glass screen, providing information such distance speech recognition, Learning, Planning and Problem solving

and phone number of the nearest branch, all of which is with AI. Swiss banking giant UBS entered into a

accessed through the voice recognition system. commercial agreement with software vendor Sqreem, which

crunches huge volumes of information about a clients

4.6 Robotics behaviour to offer them detailed, personalised informat

Bank of Tokyo-Mitsubishi UFJ took a first step toward 4.12 Cheque Truncation

employing nonhuman staff, with the introduction of a

customer service humanoid robot at its flagship Tokyo Cheque truncation is the conversion of a physical cheque

outlet. These robots can answer basic customer service into a substitute electronic form for transmission to the

questions in 19 languages, as well as analysing customers‘ paying bank. Cheque truncation reduces the physical

facial expressions and behaviour. In India, country's leading movement, time and cost of processing the cheque clearance

private sector lender ICICI Bank has implemented robotics system. Britain with Barclays and Lloyds trialling the tech,

software . Over 200 software robots are now performing allowing payment information to be desposited digitally

over 10 lakh transactions per day for the bank which using a mobile device.

comprises 10% of its total transactions.

Table 2: Latest apps launched by Indian banks

4.7 Augmented Reality (AR) apps Name of the bank Apps launched by banks

Axis bank Airtel Money, Kisan card

Augmented Reality (AR) is a method of enhancing and SBI BOUTIQUE FINANCING SCHEME,

improving your view of the real world using different Twitter Handle account, E-KYC

technologies. It is the integration of digital information with ICICI Bank in Odisha Branch on Wheel

the user's environment in real time. Australian Bank Canara Bank M-Wallet

Westpac announced the release of an augmented reality app ICICI bank Tap and pay, ) M-Pesa, Student Travel

for mobile devices. Commonwealth Bank of Australia and Card, iwear

St George Bank Australia also adopted this technology. Hdfc Bank Chillar, watchbanking

Kotak Mahindra Bank Facebook-based funds transfer platform

―KayPay‖

4.8 Beacon technology BOI Instant money transfer

Indusuld & federal bank Video Conferencing

Bluetooth Beacons installed at banks to integrate physical Laxmi Vilas Bank LVB Mobile‘ app

and mobile channels, to create a new type of interaction and Yes Bank Yes Mobile 2.0 mobile bank app

effective commercial communication and to deliver to the

customers a positive and personal experience. Barclays is

one of the first bank to use this technology. 5. Conclusion

To conclude, Banks have to understand that survival in the

4.9 Oculus Rift

new e-economy depends on delivering all of their banking

services on the Internet with help of the latest technology.

Rift is advanced display technology combined with its

From the above discussion it is clear that most of the foreign

precise, low-latency constellation tracking system enables

banks adopted the new technology very earlier than Indian

the sensation of presence. The US bank has been testing the

banks. Some of the private banks in India like ICICI, AXIS

use of Oculus Rift virtual reality headsets at its Digital Labs

and HDFC bank has taken initiative the the field of

in San Francisco, offering customers the ability to ‗virtually‘

innovative banking. The technological advancement in

enter a branch and speak to a teller face to face.

banking sector can be made effective only when a simple,

flexible and modular approach is considered and

implemented in Indian Banks. So to meet the demands of the

Volume 5 Issue 11, November 2016

www.ijsr.net

Licensed Under Creative Commons Attribution CC BY

Paper ID: ART20163236 1781

International Journal of Science and Research (IJSR)

ISSN (Online): 2319-7064

Index Copernicus Value (2015): 78.96 | Impact Factor (2015): 6.391

growing customers public sector banks will need to upgrade

their technology and pursue digitisation with greater

willingness and enthusiasm.

References

[1] Yogini Nerkar ―Banking Industry in India: Innovations

and Challenges‖ ASM‘s INTERNATIONAL E-Journal

on Ongoing Research in Management and IT, E-ISSN-

2320-0065

[2] Aruna R. Shet ― Technological Innovations in Indian

Banking Sector‖ International Journal of Scientific

Engineering and Research (IJSER), ISSN (Online):

2347-3878

[3] .A. Surendra Kumar1, Dr. D. Venkatrama Raju ―A Study

on Banking Services of New Generation Banking‖

International Journal of Science and Research (IJSR)

ISSN (Online): 2319-7064

[4] http://www.techworld.com/picture-gallery/personal-

tech/9-technologies-that-can-change-way-we-save-

3593548/

[5] http://economictimes.indiatimes.com/industry/banking/fi

nance/banking/icici-bank-introduces-software-

robotics/articleshow/54258671.cms

[6] http://perspectives.icicibank.com/augmented-reality-in-

the-world-of-banking

[7] https://www.cryptocoinsnews.com/cryptocurrency/

[8] www.livemint.com

Volume 5 Issue 11, November 2016

www.ijsr.net

Licensed Under Creative Commons Attribution CC BY

Paper ID: ART20163236 1782

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Quantum mechanics solution manual downloadDokument3 SeitenQuantum mechanics solution manual downloadMohsin Jutt17% (6)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- 2-Eagan Model of CounsellingDokument23 Seiten2-Eagan Model of CounsellingVijesh V Kumar100% (4)

- Assignment 1 - Tiered LessonDokument15 SeitenAssignment 1 - Tiered Lessonapi-320736246Noch keine Bewertungen

- Chapter 3 - Basic Logical Concepts - For Students PDFDokument65 SeitenChapter 3 - Basic Logical Concepts - For Students PDFTiên Nguyễn100% (1)

- FPSC Senior Auditor Past Paper 2018 PDFDokument6 SeitenFPSC Senior Auditor Past Paper 2018 PDFIrfan RasheedNoch keine Bewertungen

- Uvvis 1Dokument4 SeitenUvvis 1AlejandraNoch keine Bewertungen

- Store Stock Report Arshad Corporation (PVT) Ltd. : GarmentsDokument2 SeitenStore Stock Report Arshad Corporation (PVT) Ltd. : GarmentsMohsin JuttNoch keine Bewertungen

- Bae 2012Dokument24 SeitenBae 2012Mohsin JuttNoch keine Bewertungen

- Pakistan's Cotton and Textile IndustryDokument119 SeitenPakistan's Cotton and Textile IndustryNajeeb KhanNoch keine Bewertungen

- MohsinDokument18 SeitenMohsinMohsin JuttNoch keine Bewertungen

- Teacher Accountant CV 40 CharactersDokument3 SeitenTeacher Accountant CV 40 CharactersMohsin JuttNoch keine Bewertungen

- HamdanDokument17 SeitenHamdanMohsin JuttNoch keine Bewertungen

- Sampling DistributionsDokument18 SeitenSampling DistributionsYuleta Puspa MelatiNoch keine Bewertungen

- Teacher Accountant CV 40 CharactersDokument3 SeitenTeacher Accountant CV 40 CharactersMohsin JuttNoch keine Bewertungen

- Honda Alts CarDokument37 SeitenHonda Alts CarMohsin JuttNoch keine Bewertungen

- Monthly Report Dec-19 (Printing, Dying & Garment UnitsDokument21 SeitenMonthly Report Dec-19 (Printing, Dying & Garment UnitsMohsin JuttNoch keine Bewertungen

- Transcript Scan ImageDokument1 SeiteTranscript Scan ImageMohsin JuttNoch keine Bewertungen

- Rana Adil CVDokument2 SeitenRana Adil CVMohsin JuttNoch keine Bewertungen

- Bae 2012Dokument24 SeitenBae 2012Mohsin JuttNoch keine Bewertungen

- CBVCBDokument2 SeitenCBVCBMohsin JuttNoch keine Bewertungen

- Sdarticle 2Dokument34 SeitenSdarticle 2OKS BANGETNoch keine Bewertungen

- Garments (Cash) PDFDokument1 SeiteGarments (Cash) PDFMohsin JuttNoch keine Bewertungen

- Cash (Printing) 22 NOV 19Dokument1 SeiteCash (Printing) 22 NOV 19Mohsin JuttNoch keine Bewertungen

- Punjab Group of Colleges: Recruitments 2017Dokument1 SeitePunjab Group of Colleges: Recruitments 2017ehsanNoch keine Bewertungen

- 11 - Chapter 3 Research MethodologyDokument54 Seiten11 - Chapter 3 Research MethodologyMohsin JuttNoch keine Bewertungen

- 1.4 Orthogonality of Sines and CosinesDokument1 Seite1.4 Orthogonality of Sines and CosinesShinaolordNoch keine Bewertungen

- 11 - Chapter 3 Research MethodologyDokument10 Seiten11 - Chapter 3 Research MethodologypradeepNoch keine Bewertungen

- Lecture 14Dokument3 SeitenLecture 14Mohsin JuttNoch keine Bewertungen

- KSE data sample for ownership-capital structure studyDokument1 SeiteKSE data sample for ownership-capital structure studyMohsin JuttNoch keine Bewertungen

- Application FormDokument34 SeitenApplication FormMohsin JuttNoch keine Bewertungen

- 1.4 Orthogonality of Sines and CosinesDokument2 Seiten1.4 Orthogonality of Sines and CosinesMohsin JuttNoch keine Bewertungen

- 5 Tahir Saleem I ArshadDokument9 Seiten5 Tahir Saleem I ArshadMohsin JuttNoch keine Bewertungen

- Corporate Risk-taking and Firm Performance in Pakistan (35Dokument13 SeitenCorporate Risk-taking and Firm Performance in Pakistan (35Mohsin JuttNoch keine Bewertungen

- COS1512 202 - 2015 - 1 - BDokument33 SeitenCOS1512 202 - 2015 - 1 - BLina Slabbert-van Der Walt100% (1)

- The Basics of Hacking and Pen TestingDokument30 SeitenThe Basics of Hacking and Pen TestingAnonNoch keine Bewertungen

- PLC 2 Ladder DiagramDokument53 SeitenPLC 2 Ladder DiagramAnkur GuptaNoch keine Bewertungen

- Nektar Impact LX25 (En)Dokument32 SeitenNektar Impact LX25 (En)Camila Gonzalez PiatNoch keine Bewertungen

- 1-7 Least-Square RegressionDokument23 Seiten1-7 Least-Square RegressionRawash Omar100% (1)

- L16 CRE II Heterogeneous Catalysis: Prof. K.K.Pant Department of Chemical Engineering IIT DelhiDokument25 SeitenL16 CRE II Heterogeneous Catalysis: Prof. K.K.Pant Department of Chemical Engineering IIT DelhiMehul VarshneyNoch keine Bewertungen

- Tutor Marked Assignment (TMA) SR Secondary 2018 19Dokument98 SeitenTutor Marked Assignment (TMA) SR Secondary 2018 19kanna2750% (1)

- SYS600 - Visual SCIL Application DesignDokument144 SeitenSYS600 - Visual SCIL Application DesignDang JinlongNoch keine Bewertungen

- Mitchell 1986Dokument34 SeitenMitchell 1986Sara Veronica Florentin CuencaNoch keine Bewertungen

- Backup 2Dokument59 SeitenBackup 2Fabiola Tineo GamarraNoch keine Bewertungen

- Identifying Research ProblemsDokument29 SeitenIdentifying Research ProblemsEdel Borden PaclianNoch keine Bewertungen

- Agricultural Typology Concept and MethodDokument13 SeitenAgricultural Typology Concept and MethodAre GalvánNoch keine Bewertungen

- Servo Magazine 01 2005Dokument84 SeitenServo Magazine 01 2005dangtq8467% (3)

- C code snippets with answersDokument14 SeitenC code snippets with answersqwerty6327Noch keine Bewertungen

- (MCQ) - Arithmetic ProgressionDokument5 Seiten(MCQ) - Arithmetic Progressionrahul aravindNoch keine Bewertungen

- Watershed Management A Case Study of Madgyal Village IJERTV2IS70558Dokument5 SeitenWatershed Management A Case Study of Madgyal Village IJERTV2IS70558SharadNoch keine Bewertungen

- Roadmap For SSC CGLDokument11 SeitenRoadmap For SSC CGLibt seoNoch keine Bewertungen

- Cellulose StructureDokument9 SeitenCellulose Structuremanoj_rkl_07Noch keine Bewertungen

- Dasha TransitDokument43 SeitenDasha Transitvishwanath100% (2)

- Navier-Stokes EquationsDokument395 SeitenNavier-Stokes EquationsBouhadjar Meguenni100% (7)

- Science 10 3.1 The CrustDokument14 SeitenScience 10 3.1 The CrustマシロIzykNoch keine Bewertungen

- Capitalism Communism Socialism DebateDokument28 SeitenCapitalism Communism Socialism DebateMr. Graham Long100% (1)

- Appointment Letter JobDokument30 SeitenAppointment Letter JobsalmanNoch keine Bewertungen

- Career DevelopmentDokument23 SeitenCareer DevelopmentHaris Khan100% (1)

- Blank Character StatsDokument19 SeitenBlank Character Stats0114paolNoch keine Bewertungen

- Upstream Color PDFDokument16 SeitenUpstream Color PDFargentronicNoch keine Bewertungen

- DCinv V6 Rev2 CleanDokument38 SeitenDCinv V6 Rev2 Cleanyasirarafat91Noch keine Bewertungen