Beruflich Dokumente

Kultur Dokumente

Bill 12

Hochgeladen von

Tanzeel Ur Rahman GazdarOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Bill 12

Hochgeladen von

Tanzeel Ur Rahman GazdarCopyright:

Verfügbare Formate

E

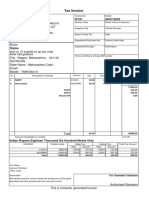

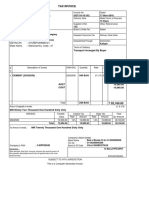

GSTIN/UIN :

GST INVOICE

ORIGINAL FOR RECIPIENT

Bill To : Refrence :

Name : Invoice No : GST/17-18/001 Dated : 10-Jul-2017

Address : Challan No. : 17-18/0030 Due Date : 10-Jul-2017

City : Ahmedabad State : Gujarat Transport : L.R No :

GSTIN/UIN : State Code : 24 Broker Name :

No. Of Particulars HSN/SAC Tax Nett Rate Amount

Chest Rate Kgs.

2 Bags Black Pepper (Mari) D.Munna 0904 5% 98.90 kgs 610.00 60,329.00

50.5 , 50.6 Kgs.

Gross Wt : 101.10 Kgs.

less : 2.20 Kgs.

Net Wt : 98.90 Kgs.

Sub Total : 60,329.00

Terms & Conditions : Packing Charges 60.00

1. Payment to be made by A/c Payee's Cheque / DD only, Payable at Ahmedabad Labour Charges 30.00

2. Payment should be made within 7 days from the date of invoice SGST 1,510.48

3. Interest @24 % per annum will be charged after due date CGST 1,510.48

Round Off 0.04

Sixty Three Thousand Four Hundred Forty Only. Grand Total 63,440.00

Taxable Central Tax State Tax

HSN/SAC Value Rate Amount Rate Amount

0904 60,419.00 2.50% 1,510.48 2.50% 1,510.48

Total 60,419.00 1,510.48 1,510.48

Tax Amount (in words): Indian Rupees Three Thousand Twenty and Ninety Six paise Only

Declaration

* To be sold for Human consumption only after through wash.

* Goods got Processed to your specifications no Quality Responsibility Accepted.

For

Bank Details :

Kotak Mahendra Bank

A/c No. :

Branch Name : Ghantakarna Market IFSCode : KKBK0000811

* Subject to Ahmedabad Jurisdiction Authorised Signatory

E. & O. E.

Das könnte Ihnen auch gefallen

- AJPL1302Dokument1 SeiteAJPL1302shrungar.ornament1Noch keine Bewertungen

- Apple Energy Pvt Ltd tax quotation for battery tester and freightDokument1 SeiteApple Energy Pvt Ltd tax quotation for battery tester and freightSeshagiri DeenadayaluNoch keine Bewertungen

- H 191styleDokument1 SeiteH 191stylebhayupawar96Noch keine Bewertungen

- 84 - PR - Jenish RibbonDokument1 Seite84 - PR - Jenish RibbonPinkesh NakawalaNoch keine Bewertungen

- Alloy steel invoiceDokument1 SeiteAlloy steel invoiceomkar sawantNoch keine Bewertungen

- Tax Invoice: Purani Bazar Jamui-811307 (Bihar) GSTIN/UIN: 10AIIPB8433E1ZV State Name: Bihar, Code: 10Dokument1 SeiteTax Invoice: Purani Bazar Jamui-811307 (Bihar) GSTIN/UIN: 10AIIPB8433E1ZV State Name: Bihar, Code: 10Randhir SinghNoch keine Bewertungen

- Markazu UloomDokument1 SeiteMarkazu UloomYoonus VallatNoch keine Bewertungen

- 66 - PW - Karan RibbonDokument1 Seite66 - PW - Karan RibbonPinkesh NakawalaNoch keine Bewertungen

- Day AlanDokument1 SeiteDay AlanTechnetNoch keine Bewertungen

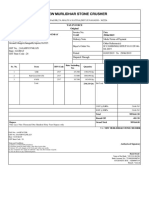

- NEW MURLIDHAR STONE CRUSHER TAX INVOICEDokument1 SeiteNEW MURLIDHAR STONE CRUSHER TAX INVOICErajendranrajendranNoch keine Bewertungen

- Tax Invoice: Adapur Gstin/Uin: 10BZBPK5993F1ZH State Name: Bihar, Code: 10Dokument3 SeitenTax Invoice: Adapur Gstin/Uin: 10BZBPK5993F1ZH State Name: Bihar, Code: 10aaditya rajNoch keine Bewertungen

- AJPL0602Dokument1 SeiteAJPL0602shrungar.ornament1Noch keine Bewertungen

- Si No Item Gross Amt PDP Dis% Rebate Rate Qty GST Hsn/Sac: Date: 9-Mar-23 Salesman: BTMDokument1 SeiteSi No Item Gross Amt PDP Dis% Rebate Rate Qty GST Hsn/Sac: Date: 9-Mar-23 Salesman: BTMVishnu VNoch keine Bewertungen

- Ruby Hall InvoiceDokument3 SeitenRuby Hall InvoiceRanvir RajputNoch keine Bewertungen

- Accounting Voucher 14Dokument1 SeiteAccounting Voucher 14Woven FabricNoch keine Bewertungen

- Screenshot 2023-07-26 at 11.30.53 AMDokument1 SeiteScreenshot 2023-07-26 at 11.30.53 AMKumaresan JilluNoch keine Bewertungen

- 83 - PW - Karan RibbonDokument1 Seite83 - PW - Karan RibbonPinkesh NakawalaNoch keine Bewertungen

- TAX INVOICEDokument1 SeiteTAX INVOICEAnjani KumariNoch keine Bewertungen

- Medplus 2119Dokument1 SeiteMedplus 2119Moseen AliNoch keine Bewertungen

- Mobile Services: Your Account Summary This Month'S ChargesDokument11 SeitenMobile Services: Your Account Summary This Month'S ChargessubhroNoch keine Bewertungen

- Sanat Enterprises Tax InvoiceDokument1 SeiteSanat Enterprises Tax Invoiceomkar sawantNoch keine Bewertungen

- Bbe 6Dokument2 SeitenBbe 6Sanjay LoyalkaNoch keine Bewertungen

- Ajio FN7474407898 1693217649474Dokument1 SeiteAjio FN7474407898 1693217649474Varu NayanNoch keine Bewertungen

- Accounting VoucherDokument1 SeiteAccounting VoucherkysydsNoch keine Bewertungen

- Sales_TEL_017_24-25Dokument1 SeiteSales_TEL_017_24-25purchase.tel18Noch keine Bewertungen

- Credit Invoice for Satguru EnterprisesDokument1 SeiteCredit Invoice for Satguru Enterprisesjatin100% (1)

- 62 - PW - Karan RibbonDokument1 Seite62 - PW - Karan RibbonPinkesh NakawalaNoch keine Bewertungen

- Sales - 1Dokument1 SeiteSales - 1rk63747464Noch keine Bewertungen

- Order FL0181258412: Mode of Payment: NONCODDokument1 SeiteOrder FL0181258412: Mode of Payment: NONCODAnnapurna HirematNoch keine Bewertungen

- Excise Superintendent, Bhabua KaimurDokument1 SeiteExcise Superintendent, Bhabua KaimurBittu SinghNoch keine Bewertungen

- Accounting VoucherDokument1 SeiteAccounting VoucherUttam PurohitNoch keine Bewertungen

- Invoice DI102305154 RDF52626464Dokument1 SeiteInvoice DI102305154 RDF52626464Harbans LalNoch keine Bewertungen

- Accounting VoucherDokument1 SeiteAccounting Voucheradposting wNoch keine Bewertungen

- GoodDokument1 SeiteGoodEntertain with musicNoch keine Bewertungen

- Tax Invoice: Edutech Mentor Mangrodih, Giridih 815302Dokument2 SeitenTax Invoice: Edutech Mentor Mangrodih, Giridih 815302Sonu Kumar SinghNoch keine Bewertungen

- Accounting VoucherDokument1 SeiteAccounting VoucherAlkaif MemonNoch keine Bewertungen

- Pdf&rendition 1 6Dokument1 SeitePdf&rendition 1 6lkhrawatNoch keine Bewertungen

- Bbe 7Dokument2 SeitenBbe 7Sanjay LoyalkaNoch keine Bewertungen

- ACT Fibernet invoice titleDokument3 SeitenACT Fibernet invoice titleAmarnath PanigrahiNoch keine Bewertungen

- ACT Invoice Summary for June 2016 chargesDokument1 SeiteACT Invoice Summary for June 2016 chargeskrselvakumar8398Noch keine Bewertungen

- Output CGST 14% Output SGST 14% Round Off Fright Charge: 1 Kit Front SuspensionDokument1 SeiteOutput CGST 14% Output SGST 14% Round Off Fright Charge: 1 Kit Front SuspensionmadhurNoch keine Bewertungen

- RohitDokument1 SeiteRohitadminNoch keine Bewertungen

- Invoice No.1197Dokument2 SeitenInvoice No.1197LL Lawwise Consultech India Pvt LtdNoch keine Bewertungen

- Tax Invoice: Medplus Hospital Solutions (Laxmi Nagar)Dokument1 SeiteTax Invoice: Medplus Hospital Solutions (Laxmi Nagar)Moseen AliNoch keine Bewertungen

- Ajio 1663051014725Dokument1 SeiteAjio 1663051014725Pain FreeFireNoch keine Bewertungen

- Order FL0369625242: Mode of Payment: CODDokument1 SeiteOrder FL0369625242: Mode of Payment: CODBaba TataNoch keine Bewertungen

- Tax InvoiceDokument1 SeiteTax Invoiceojasprajapati6Noch keine Bewertungen

- Tax Invoice: Neo Structo Construction Pvt. LTDDokument1 SeiteTax Invoice: Neo Structo Construction Pvt. LTDnithinNoch keine Bewertungen

- Tax Invoice for Refrigeration ChartsDokument1 SeiteTax Invoice for Refrigeration ChartsMohan KumarNoch keine Bewertungen

- NSD EnterpriseDokument1 SeiteNSD EnterpriseParminder SinghNoch keine Bewertungen

- Tax Invoice for Video Editing ChargesDokument1 SeiteTax Invoice for Video Editing Chargeskuldeep singhNoch keine Bewertungen

- InvoiceDokument1 SeiteInvoiceRough MailNoch keine Bewertungen

- Ajio 1706695192988Dokument1 SeiteAjio 1706695192988shaelkmr550Noch keine Bewertungen

- GH4070Dokument1 SeiteGH4070Amman store IrumathurNoch keine Bewertungen

- Sales 3742Dokument1 SeiteSales 3742momskitchen.storeNoch keine Bewertungen

- GST InvoiceDokument1 SeiteGST InvoiceSrmc InfratechNoch keine Bewertungen

- Tax Invoice: Infinitytwins and Ropes 105 25/02/2023Dokument1 SeiteTax Invoice: Infinitytwins and Ropes 105 25/02/2023Sanjay GotiNoch keine Bewertungen

- VBSS SampleDokument44 SeitenVBSS SampleTanzeel Ur Rahman GazdarNoch keine Bewertungen

- Start and Run A Business From Home - How To Turn Your Hobby or Interest Into A Business (Small Business Start-Ups) PDFDokument256 SeitenStart and Run A Business From Home - How To Turn Your Hobby or Interest Into A Business (Small Business Start-Ups) PDFLiam LagwedNoch keine Bewertungen

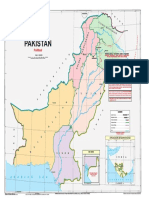

- Political Map PakistanDokument1 SeitePolitical Map PakistanTanzeel Ur Rahman GazdarNoch keine Bewertungen

- Bus Route KarachiDokument39 SeitenBus Route KarachiAsif HussainNoch keine Bewertungen

- Practical Approach of E-Filing Income Tax Return & Wealth StatementDokument1 SeitePractical Approach of E-Filing Income Tax Return & Wealth StatementTanzeel Ur Rahman GazdarNoch keine Bewertungen

- Family Sehat ENGDokument1 SeiteFamily Sehat ENGTanzeel Ur Rahman GazdarNoch keine Bewertungen

- Dirbs Frequently Asked Questions (Faqs) : Page 1 of 14Dokument14 SeitenDirbs Frequently Asked Questions (Faqs) : Page 1 of 14sajjad aliNoch keine Bewertungen

- Tanzeel Ghazdar@Dokument6 SeitenTanzeel Ghazdar@Tanzeel Ur Rahman GazdarNoch keine Bewertungen

- Protecting Yourself From Identity TheftDokument3 SeitenProtecting Yourself From Identity TheftTanzeel Ur Rahman GazdarNoch keine Bewertungen

- Bus Route KarachiDokument39 SeitenBus Route KarachiAsif HussainNoch keine Bewertungen

- Comparision of Revised 3rd 4th and 5th Schedules 2Dokument32 SeitenComparision of Revised 3rd 4th and 5th Schedules 2Tanzeel Ur Rahman GazdarNoch keine Bewertungen

- EngineeringDokument5 SeitenEngineeringTanzeel Ur Rahman GazdarNoch keine Bewertungen

- Karachi's Violence: Duality and NegotiationDokument18 SeitenKarachi's Violence: Duality and NegotiationTanzeel Ur Rahman GazdarNoch keine Bewertungen

- PSTonServices (WH) Rules 2015Dokument9 SeitenPSTonServices (WH) Rules 2015TaahaijazNoch keine Bewertungen

- Bulk Upload ReportDokument1 SeiteBulk Upload ReportTanzeel Ur Rahman GazdarNoch keine Bewertungen

- Marks Sheet IBTDokument5 SeitenMarks Sheet IBTTanzeel Ur Rahman GazdarNoch keine Bewertungen

- PHP, MySQL in Urdu by Shakeel Muhammad Khan PDFDokument250 SeitenPHP, MySQL in Urdu by Shakeel Muhammad Khan PDFpdfebooks67% (6)

- Meezan Investment Pvt Ltd payroll check for Rs. 450,528 in 2017Dokument1 SeiteMeezan Investment Pvt Ltd payroll check for Rs. 450,528 in 2017Tanzeel Ur Rahman GazdarNoch keine Bewertungen

- Advanced Microsoft Excel 2013Dokument84 SeitenAdvanced Microsoft Excel 2013Norberto O. YamuganNoch keine Bewertungen

- CFAP05Advanced Taxation2016Dokument188 SeitenCFAP05Advanced Taxation2016Tanzeel Ur Rahman Gazdar100% (1)

- Excel 2Dokument86 SeitenExcel 2kforkota100% (3)

- The Ultimate Vlookup Guide PDFDokument16 SeitenThe Ultimate Vlookup Guide PDFTanzeel Ur Rahman GazdarNoch keine Bewertungen

- Excel AdvancedDokument19 SeitenExcel Advancedpraba19Noch keine Bewertungen

- Balance Sheet ReportDokument1 SeiteBalance Sheet ReportTanzeel Ur Rahman GazdarNoch keine Bewertungen

- 10 Tips Excel2007Dokument15 Seiten10 Tips Excel2007Ravi ThapliyalNoch keine Bewertungen

- Aasaan Rizq by Sufi Abdur RahmanDokument72 SeitenAasaan Rizq by Sufi Abdur Rahmansaif ur rehmanNoch keine Bewertungen

- Commentary On Withholding RulesDokument6 SeitenCommentary On Withholding RulesTanzeel Ur Rahman GazdarNoch keine Bewertungen

- 10 Things Office2007 ElementsDokument6 Seiten10 Things Office2007 ElementsTanzeel Ur Rahman GazdarNoch keine Bewertungen

- 10 Office TipsDokument15 Seiten10 Office TipsLuisLicarosNoch keine Bewertungen

- Thomasina Connell NewsletterDokument2 SeitenThomasina Connell NewsletterJohn HayesNoch keine Bewertungen

- Local Banana Business Executive SummaryDokument18 SeitenLocal Banana Business Executive SummaryNivea Pamela Tidoy (Yhang)Noch keine Bewertungen

- Silk BankDokument15 SeitenSilk BankHafizUmarArshadNoch keine Bewertungen

- Chapter 4 - Accounting For DisbursementsDokument12 SeitenChapter 4 - Accounting For DisbursementsErika Villanueva Magallanes0% (1)

- Linda Wall Wins Over IRSDokument12 SeitenLinda Wall Wins Over IRSJeff Anderson89% (9)

- Lectures of Atty. Japar B. Dimampao: Tax Notes (Legal Ground)Dokument106 SeitenLectures of Atty. Japar B. Dimampao: Tax Notes (Legal Ground)Zaira Gem GonzalesNoch keine Bewertungen

- Cottage IndustryDokument51 SeitenCottage Industrydipak_pandey_007Noch keine Bewertungen

- Go DutiesDokument16 SeitenGo DutiesSpecial DRONoch keine Bewertungen

- Mazor Robotics - Corp - Web - 0817 PDFDokument18 SeitenMazor Robotics - Corp - Web - 0817 PDFmedtechyNoch keine Bewertungen

- Brotherhood V ZamoraDokument2 SeitenBrotherhood V ZamoraTon Ton CananeaNoch keine Bewertungen

- SGLGB Form 1 Barangay Profile 1Dokument3 SeitenSGLGB Form 1 Barangay Profile 1Tabuco Barangay Hall100% (2)

- Direction For StudentsDokument6 SeitenDirection For StudentsRitik SinghalNoch keine Bewertungen

- Hidden Rules of Race Are Embedded in The New Tax LawDokument16 SeitenHidden Rules of Race Are Embedded in The New Tax LawRoosevelt Institute100% (1)

- Glossary of Procurement TerminologyDokument16 SeitenGlossary of Procurement TerminologyMan DenzoNoch keine Bewertungen

- 2018091800024Dokument3 Seiten2018091800024Gunjan ShahNoch keine Bewertungen

- Recent Public Financial Management Publications and Other ResourcesDokument16 SeitenRecent Public Financial Management Publications and Other ResourcesInternational Consortium on Governmental Financial ManagementNoch keine Bewertungen

- Unit 01 Introduction To Business FinanceDokument10 SeitenUnit 01 Introduction To Business FinanceRuthira Nair AB KrishenanNoch keine Bewertungen

- Blue Ridge Bank 2017 Annual ReportDokument48 SeitenBlue Ridge Bank 2017 Annual ReportFauquier NowNoch keine Bewertungen

- Bukit Darmo Property TBKDokument4 SeitenBukit Darmo Property TBKIndoplacesNoch keine Bewertungen

- Testbanks FADokument7 SeitenTestbanks FAStela Marie CarandangNoch keine Bewertungen

- Business Valuation Methods and TechniquesDokument43 SeitenBusiness Valuation Methods and TechniquesJunaid IqbalNoch keine Bewertungen

- Consulting Rate SheetDokument2 SeitenConsulting Rate SheetDas Ankita100% (1)

- Enb FinalDokument11 SeitenEnb Finalkevin kipkemoiNoch keine Bewertungen

- Sniders Corporate Tax Notes OUTLINEDokument166 SeitenSniders Corporate Tax Notes OUTLINEMaggie ZalewskiNoch keine Bewertungen

- Travel Management ProcessDokument2 SeitenTravel Management Processkalkikali100% (1)

- Corporate Securites Classes of Corporate Securities: Ownership Securities and Creditor Ship SecuritiesDokument11 SeitenCorporate Securites Classes of Corporate Securities: Ownership Securities and Creditor Ship SecuritiesSanjeev KumarNoch keine Bewertungen

- Chapter 4 Income StatementDokument6 SeitenChapter 4 Income StatementRos MiiaaNoch keine Bewertungen

- IAS8-Summary Notes PDFDokument8 SeitenIAS8-Summary Notes PDFWaqas Younas BandukdaNoch keine Bewertungen

- Go Up To Table of ContentsDokument183 SeitenGo Up To Table of ContentsIzo SeremNoch keine Bewertungen

- CAF8 CMA QuestionbankDokument228 SeitenCAF8 CMA QuestionbankMohsin Akbar100% (3)