Beruflich Dokumente

Kultur Dokumente

Signatories of the Multilateral Competent Authority Agreement

Hochgeladen von

Juan0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

11 Ansichten4 SeitenMCAA signatories

Originaltitel

Mcaa Signatories

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenMCAA signatories

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

11 Ansichten4 SeitenSignatories of the Multilateral Competent Authority Agreement

Hochgeladen von

JuanMCAA signatories

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 4

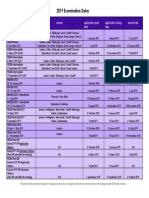

SIGNATORIES OF THE MULTILATERAL COMPETENT AUTHORITY AGREEMENT

ON AUTOMATIC EXCHANGE OF FINANCIAL ACCOUNT INFORMATION AND

INTENDED FIRST INFORMATION EXCHANGE DATE

Status as of 15 January 2018

JURISDICTION FROM WHICH THE COMPETENT INTENDED FIRST INFORMATION EXCHANGE BY:

AUTHORITY IS FROM (ANNEX F TO THE AGREEMENT)

1. ALBANIA September 2018

2. ANDORRA September 2018

3. ANGUILLA September 2017

4. ANTIGUA AND BARBUDA September 2018

5. ARGENTINA September 2017

6. ARUBA September 2018

7. AUSTRALIA September 2018

8. AUSTRIA September 2018

9. AZERBAIJAN September 2018

10. BAHAMAS September 2018

11. BAHRAIN September 2018

12. BARBADOS September 2017

13. BELGIUM September 2017

14. BELIZE September 2018

15. BERMUDA September 2017

16. BRAZIL September 2018

17. BRITISH VIRGIN ISLANDS September 2017

18. BULGARIA September 2017

19. CANADA September 2018

20. CAYMAN ISLANDS September 2017

21. CHILE September 2018

22. CHINA (PEOPLE'S REPUBLIC OF) September 2018

23. COLOMBIA September 2017

24. COOK ISLANDS September 2018

25. COSTA RICA September 2018

26. CROATIA September 2017

27. CURAÇAO September 2017

28. CYPRUS September 2017

29. CZECH REPUBLIC September 2017

30. DENMARK September 2017

More information: www.oecd.org/tax/automatic-exchange/international-framework-for-the-crs/

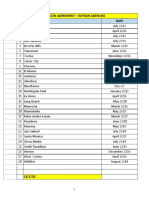

SIGNATORIES OF THE MULTILATERAL COMPETENT AUTHORITY AGREEMENT

ON AUTOMATIC EXCHANGE OF FINANCIAL ACCOUNT INFORMATION AND

INTENDED FIRST INFORMATION EXCHANGE DATE

Status as of 15 January 2018

31. ESTONIA September 2017

32. FAROE ISLANDS September 2017

33. FINLAND September 2017

34. FRANCE September 2017

35. GERMANY September 2017

36. GHANA September 2018

37. GIBRALTAR September 2017

38. GREECE September 2017

39. GREENLAND September 2017

40. GRENADA September 2018

41. GUERNSEY September 2017

42. HUNGARY September 2017

43. ICELAND September 2017

44. INDIA September 2017

45. INDONESIA September 2018

46. IRELAND September 2017

47. ISRAEL September 2018

48. ISLE OF MAN September 2017

49. ITALY September 2017

50. JAPAN September 2018

51. JERSEY September 2017

52. KOREA September 2017

53. KUWAIT September 2018

54. LATVIA September 2017

55. LEBANON September 2018

56. LIECHTENSTEIN September 2017

57. LITHUANIA September 2017

58. LUXEMBOURG September 2017

59. MALAYSIA September 2018

60. MALTA September 2017

61. MARSHALL ISLANDS September 2018

62. MAURITIUS September 2018

More information: www.oecd.org/tax/automatic-exchange/international-framework-for-the-crs/

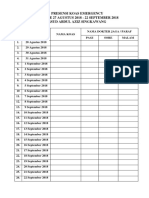

SIGNATORIES OF THE MULTILATERAL COMPETENT AUTHORITY AGREEMENT

ON AUTOMATIC EXCHANGE OF FINANCIAL ACCOUNT INFORMATION AND

INTENDED FIRST INFORMATION EXCHANGE DATE

Status as of 15 January 2018

63. MEXICO September 2017

64. MONACO September 2018

65. MONTSERRAT September 2017

66. NAURU September 2018

67. NETHERLANDS September 2017

68. NEW ZEALAND September 2018

69. NIGERIA September 2019

70. NIUE September 2017

71. NORWAY September 2017

72. PAKISTAN September 2018

73. PANAMA September 2018

74. POLAND September 2017

75. PORTUGAL September 2017

76. QATAR September 2018

77. ROMANIA September 2017

78. RUSSIAN FEDERATION September 2018

79. SAINT KITTS AND NEVIS September 2018

80. SAINT LUCIA September 2018

81. SAINT VINCENT AND THE GRENADINES September 2018

82. SAMOA September 2018

83. SAN MARINO September 2017

84. SAUDI ARABIA September 2018

85. SEYCHELLES September 2017

86. SINGAPORE September 2018

87. SINT MAARTEN September 2018

88. SLOVAK REPUBLIC September 2017

89. SLOVENIA September 2017

90. SOUTH AFRICA September 2017

91. SPAIN September 2017

92. SWEDEN September 2017

93. SWITZERLAND September 2018

94. TURKEY September 2018

More information: www.oecd.org/tax/automatic-exchange/international-framework-for-the-crs/

SIGNATORIES OF THE MULTILATERAL COMPETENT AUTHORITY AGREEMENT

ON AUTOMATIC EXCHANGE OF FINANCIAL ACCOUNT INFORMATION AND

INTENDED FIRST INFORMATION EXCHANGE DATE

Status as of 15 January 2018

95. TURKS & CAICOS ISLANDS September 2017

96. UNITED ARAB EMIRATES September 2018

97. UNITED KINGDOM September 2017

98. URUGUAY September 2018

More information: www.oecd.org/tax/automatic-exchange/international-framework-for-the-crs/

Das könnte Ihnen auch gefallen

- Jurisdiction From Which The Competent Authority Is From Intended First Information Exchange By: (Annex F To The Agreement)Dokument3 SeitenJurisdiction From Which The Competent Authority Is From Intended First Information Exchange By: (Annex F To The Agreement)Martyna GiedriauskytėNoch keine Bewertungen

- Crs Mcaa SignatoriesDokument4 SeitenCrs Mcaa SignatoriesNath DitsonNoch keine Bewertungen

- Exhibitions List FormatDokument21 SeitenExhibitions List FormatPrateek BhagatNoch keine Bewertungen

- Activities September 2016 OCTOBER 2016 November 2016 December 2016 Pre-OperatingDokument2 SeitenActivities September 2016 OCTOBER 2016 November 2016 December 2016 Pre-OperatingPCR100% (1)

- Item Contractor's Scheduled Progress (%) Contractor'sA Ctual Progress (%) Original Construction Period Original Approved Site Staff AppointmentDokument1 SeiteItem Contractor's Scheduled Progress (%) Contractor'sA Ctual Progress (%) Original Construction Period Original Approved Site Staff AppointmentjohnsonNoch keine Bewertungen

- EMNoteDokument1 SeiteEMNoteKC Dela RosaNoch keine Bewertungen

- Pelaksanaan Tes Diagnostik KPL Secara OnlineDokument1 SeitePelaksanaan Tes Diagnostik KPL Secara OnlineAHMAD HARISNoch keine Bewertungen

- Gravitas-Dusit D2 Project: As of October 15, 2018 Id No. Task NameDokument24 SeitenGravitas-Dusit D2 Project: As of October 15, 2018 Id No. Task NameJenniel CelestineNoch keine Bewertungen

- Test Date Schedule National 2017 2018Dokument1 SeiteTest Date Schedule National 2017 2018api-330837712Noch keine Bewertungen

- UML Class Diagram Explained With C++ Samples CPDokument2 SeitenUML Class Diagram Explained With C++ Samples CPPAVAN MUTALIKDESAINoch keine Bewertungen

- OpenOCD Usability Taken To A New Level - SysprogsDokument1 SeiteOpenOCD Usability Taken To A New Level - SysprogsAndrea FasatoNoch keine Bewertungen

- Home+Loans+Dataset+ (Student+Copy) .XLSB+ +Dokument2.877 SeitenHome+Loans+Dataset+ (Student+Copy) .XLSB+ +Abha JainNoch keine Bewertungen

- Tanggal Kondisi/Keluhan Tanggal Kondisi/Keluhan Minggu KE-Minggu KEDokument3 SeitenTanggal Kondisi/Keluhan Tanggal Kondisi/Keluhan Minggu KE-Minggu KEMei koNoch keine Bewertungen

- 2018-2019 Dates For CoursesDokument1 Seite2018-2019 Dates For Coursesjkd01Noch keine Bewertungen

- Events: Choir Competitions and FestivalsDokument1 SeiteEvents: Choir Competitions and FestivalsKurnia Jonathan GahNoch keine Bewertungen

- Ross Douthat - The Academic Apocalypse A... English Departments! - Tony's ThoughtsDokument5 SeitenRoss Douthat - The Academic Apocalypse A... English Departments! - Tony's ThoughtsJimmy NewlinNoch keine Bewertungen

- Reportable JurisdictionsDokument21 SeitenReportable Jurisdictionshanna kristantoNoch keine Bewertungen

- Liceul Teoretic "DecebalDokument1 SeiteLiceul Teoretic "DecebalSimonaPetrencuNoch keine Bewertungen

- TRADE FAIRS 13 08 2020 ChronologicalDokument25 SeitenTRADE FAIRS 13 08 2020 ChronologicalJoyel DsouzaNoch keine Bewertungen

- ProgramBook Calella2019Dokument96 SeitenProgramBook Calella2019pablobatuta_10151790Noch keine Bewertungen

- 2018 - 2019 Edtpa Submission and Reporting DatesDokument1 Seite2018 - 2019 Edtpa Submission and Reporting DatesSarahNoch keine Bewertungen

- Shri Jai Narain Post Graduate College: Annual Academic Calendar (2018-19)Dokument1 SeiteShri Jai Narain Post Graduate College: Annual Academic Calendar (2018-19)Max TNoch keine Bewertungen

- Congreso Congreso CongresoDokument6 SeitenCongreso Congreso CongresojoaquinemilianoNoch keine Bewertungen

- 2019 Dates For Website - Final 20181220Dokument1 Seite2019 Dates For Website - Final 20181220sameeNoch keine Bewertungen

- UntitledDokument30 SeitenUntitledmaryamNoch keine Bewertungen

- DT 2019 ColombiaDokument58 SeitenDT 2019 ColombiaRaffael A. LeonNoch keine Bewertungen

- PETA PENYAJIAN KELAS KHUSUS SEMESTER AWALDokument9 SeitenPETA PENYAJIAN KELAS KHUSUS SEMESTER AWALRifqiNoch keine Bewertungen

- Due Dates For Quarter Fee: Subject To The Sighting of The MoonDokument1 SeiteDue Dates For Quarter Fee: Subject To The Sighting of The MoonJAZAB ALINoch keine Bewertungen

- E+catalogue New Horizons MaltaDokument8 SeitenE+catalogue New Horizons MaltagnorinaNoch keine Bewertungen

- Bustat HW11111Dokument5 SeitenBustat HW11111Jay GadainganNoch keine Bewertungen

- Two Phase Gas-Liquid Pipeline Simulation - Campbell Tip of The MonthDokument5 SeitenTwo Phase Gas-Liquid Pipeline Simulation - Campbell Tip of The MonthJihan MutiahNoch keine Bewertungen

- Separator CriteriaDokument10 SeitenSeparator CriteriaOsas UwoghirenNoch keine Bewertungen

- 2017 BireyselDokument195 Seiten2017 BireyselLevent ÖztürkNoch keine Bewertungen

- Academic Calendar 2017-18 (Revised)Dokument1 SeiteAcademic Calendar 2017-18 (Revised)fnk19Noch keine Bewertungen

- ELLN and Learning Materials UpdatesDokument5 SeitenELLN and Learning Materials UpdatesTina VillaNoch keine Bewertungen

- Project Schedule StructuralDokument14 SeitenProject Schedule StructuralAlecsisRoeEstañolFrascoNoch keine Bewertungen

- Payroll for Salary Differential - Prior Years (ElementaryDokument51 SeitenPayroll for Salary Differential - Prior Years (ElementaryMirish FernandezNoch keine Bewertungen

- Core Household IndicatorsDokument13 SeitenCore Household IndicatorsOmar HerreraNoch keine Bewertungen

- Gantt Chart Shows Thesis Completion ScheduleDokument1 SeiteGantt Chart Shows Thesis Completion Scheduleal alNoch keine Bewertungen

- 01606117Dokument7 Seiten01606117anil khadeNoch keine Bewertungen

- CCW Agreements for 27 Police DepartmentsDokument2 SeitenCCW Agreements for 27 Police DepartmentsDarlene GoldmanNoch keine Bewertungen

- Hydrate Formation Sour Gas - CampbellDokument5 SeitenHydrate Formation Sour Gas - CampbellthunderNoch keine Bewertungen

- Labour Index Base Year-2016 100Dokument6 SeitenLabour Index Base Year-2016 100Vikrant DeshmukhNoch keine Bewertungen

- Academic Calendar UWI 2018 - 2019Dokument1 SeiteAcademic Calendar UWI 2018 - 2019Rhonique MorganNoch keine Bewertungen

- Itinary - Jacques CartierDokument4 SeitenItinary - Jacques CartierjauffretNoch keine Bewertungen

- Puskesmas Tanjung Batu Laporan Pelayanan Kefarmasian September 2020Dokument1 SeitePuskesmas Tanjung Batu Laporan Pelayanan Kefarmasian September 2020bojo laliNoch keine Bewertungen

- List of RCS Airports and Routes Started Under UDAN-1,2 & 3 7 June 2019Dokument7 SeitenList of RCS Airports and Routes Started Under UDAN-1,2 & 3 7 June 2019GANGA ISPAT INDUSTRIESNoch keine Bewertungen

- Calendar-2024 02Dokument1 SeiteCalendar-2024 02elultimoutNoch keine Bewertungen

- Low Temperature Methane Gas Water Content - Campbell Tip of The MonthDokument4 SeitenLow Temperature Methane Gas Water Content - Campbell Tip of The MonthAMITH OKNoch keine Bewertungen

- Presensi Koas EmergencyDokument1 SeitePresensi Koas EmergencynunungagustiaNoch keine Bewertungen

- 05-08-2020 Dispatch Calendar Ayr Xmas HalloweenDokument2 Seiten05-08-2020 Dispatch Calendar Ayr Xmas HalloweendzukaNoch keine Bewertungen

- Table 1: Fall 2016 Spring 2017 Fall 2017 Spring 2018 Fall 2018 Spring 2019 Fall 2019Dokument4 SeitenTable 1: Fall 2016 Spring 2017 Fall 2017 Spring 2018 Fall 2018 Spring 2019 Fall 2019teenwolf4006Noch keine Bewertungen

- More DOOM Monsters! - Daemons & DeathraysDokument3 SeitenMore DOOM Monsters! - Daemons & Deathraysbigkev73Noch keine Bewertungen

- Past Papers OrderDokument2 SeitenPast Papers OrderIrini DemetriouNoch keine Bewertungen

- RMDokument9 SeitenRMANSHU KUMARINoch keine Bewertungen

- Maruti Swift Monthly Car Sales - 2017-2021Dokument4 SeitenMaruti Swift Monthly Car Sales - 2017-2021Priyadharsini BalasubramanianNoch keine Bewertungen

- Central Library: Issue Report Return ReportDokument2 SeitenCentral Library: Issue Report Return ReportJaydip GhughuNoch keine Bewertungen

- List of Mission 2018-19Dokument4 SeitenList of Mission 2018-19Muhammad Ali RazaNoch keine Bewertungen

- Quality Walkdown ScheduleDokument1 SeiteQuality Walkdown SchedulesoorajNoch keine Bewertungen

- Coral New GroveDokument8 SeitenCoral New GroveJuanNoch keine Bewertungen

- Awiring PDFDokument15 SeitenAwiring PDFJuanNoch keine Bewertungen

- Vanguardias 1900-1920Dokument11 SeitenVanguardias 1900-1920JuanNoch keine Bewertungen

- 20 Minor Key Fusion Licks: Lick 20Dokument3 Seiten20 Minor Key Fusion Licks: Lick 20JuanNoch keine Bewertungen

- The History of The ViolinDokument4 SeitenThe History of The ViolinJuanNoch keine Bewertungen

- CM 20minorkey Lick10 TabDokument3 SeitenCM 20minorkey Lick10 TabBrod LenamingNoch keine Bewertungen

- Ox Grammar Basic Teachersnotes PDFDokument76 SeitenOx Grammar Basic Teachersnotes PDFTuankiet TruongNoch keine Bewertungen

- Tablas NutriciónDokument9 SeitenTablas NutriciónJuanNoch keine Bewertungen

- Operating Instructions for Double Cassette Deck DD-5080CDokument18 SeitenOperating Instructions for Double Cassette Deck DD-5080CJuanNoch keine Bewertungen

- 594 Def GeneralDokument9 Seiten594 Def GeneralJuanNoch keine Bewertungen

- On Demandware - Static Sites Timex Master Catalog Default Dw9f25cc96 Productdocs IQplusMOVE USERGUIDEDokument3 SeitenOn Demandware - Static Sites Timex Master Catalog Default Dw9f25cc96 Productdocs IQplusMOVE USERGUIDEJuanNoch keine Bewertungen

- Finale Read MeDokument6 SeitenFinale Read MeAlejandra GualdronNoch keine Bewertungen

- 20 Minor Key Fusion Licks: Lick 9Dokument3 Seiten20 Minor Key Fusion Licks: Lick 9JuanNoch keine Bewertungen

- CM 20minorkey Lick7 TabDokument3 SeitenCM 20minorkey Lick7 TabAlucardSnakeNoch keine Bewertungen

- CP Astreamofemotions TabDokument10 SeitenCP Astreamofemotions TabXDrOlAnDOxDNoch keine Bewertungen

- DG Cardiology TabDokument6 SeitenDG Cardiology Tabyiyopuga100% (1)

- CP 20suspensedrivenballadlicks Lick16 TabDokument3 SeitenCP 20suspensedrivenballadlicks Lick16 TabJuanNoch keine Bewertungen

- CM 20minorkey Lick1 TabDokument3 SeitenCM 20minorkey Lick1 TabBrod LenamingNoch keine Bewertungen

- Documents - Tips Cp20modernrocklicks Lick1 TabDokument4 SeitenDocuments - Tips Cp20modernrocklicks Lick1 TabIvanGrozniNoch keine Bewertungen

- CM 20minorkey Lick7 TabDokument3 SeitenCM 20minorkey Lick7 TabAlucardSnakeNoch keine Bewertungen

- CM 20minorkey Lick3 TabDokument3 SeitenCM 20minorkey Lick3 TabJuanNoch keine Bewertungen

- CM 20minorkey Lick6 TabDokument3 SeitenCM 20minorkey Lick6 TabBrod LenamingNoch keine Bewertungen

- Multiamp Firmware EvolutionDokument4 SeitenMultiamp Firmware EvolutionJuanNoch keine Bewertungen

- 20 Minor Key Fusion Licks: Lick 5Dokument3 Seiten20 Minor Key Fusion Licks: Lick 5JuanNoch keine Bewertungen

- 20 Minor Key Fusion Licks: Lick 2Dokument3 Seiten20 Minor Key Fusion Licks: Lick 2JuanNoch keine Bewertungen

- IMSLP06547-Bach - BGA - French Suites Band 13Dokument41 SeitenIMSLP06547-Bach - BGA - French Suites Band 13sunnycxh0Noch keine Bewertungen

- CM 20minorkey Lick4 TabDokument3 SeitenCM 20minorkey Lick4 TabJuanNoch keine Bewertungen

- CM 20minorkey Lick1 TabDokument3 SeitenCM 20minorkey Lick1 TabBrod LenamingNoch keine Bewertungen

- Avid Sibelius 7.5 Emulator Install GuideDokument1 SeiteAvid Sibelius 7.5 Emulator Install GuidethelemontreeNoch keine Bewertungen

- Handels Messiah No. 18 - Air For SopranoDokument7 SeitenHandels Messiah No. 18 - Air For SopranoJuanNoch keine Bewertungen

- Manual de Instalare Centrala de Incendiu Adresabila 1-4 Bucle Teletek IRIS PRO 250bucla 96 Zone 10000 EvenimenteDokument94 SeitenManual de Instalare Centrala de Incendiu Adresabila 1-4 Bucle Teletek IRIS PRO 250bucla 96 Zone 10000 EvenimenteAlexandra DumitruNoch keine Bewertungen

- JWCh06 PDFDokument23 SeitenJWCh06 PDF007featherNoch keine Bewertungen

- Joint Memorandum Circular (JMC) No. 2021Dokument49 SeitenJoint Memorandum Circular (JMC) No. 2021Nicey RubioNoch keine Bewertungen

- Norms and specifications for distribution transformer, DG set, street light poles, LED lights and high mast lightDokument4 SeitenNorms and specifications for distribution transformer, DG set, street light poles, LED lights and high mast lightKumar AvinashNoch keine Bewertungen

- Farmers InterviewDokument5 SeitenFarmers Interviewjay jariwalaNoch keine Bewertungen

- FC Bayern Munich Marketing PlanDokument12 SeitenFC Bayern Munich Marketing PlanMateo Herrera VanegasNoch keine Bewertungen

- Mechanical PropertiesDokument30 SeitenMechanical PropertiesChristopher Traifalgar CainglesNoch keine Bewertungen

- Presentation of The LordDokument1 SeitePresentation of The LordSarah JonesNoch keine Bewertungen

- The Study of Accounting Information SystemsDokument44 SeitenThe Study of Accounting Information SystemsCelso Jr. AleyaNoch keine Bewertungen

- Huawei 9000aDokument27 SeitenHuawei 9000aAristideKonanNoch keine Bewertungen

- Building A Computer AssignmentDokument3 SeitenBuilding A Computer AssignmentRajaughn GunterNoch keine Bewertungen

- Rust Experimental v2017 DevBlog 179 x64 #KnightsTableDokument2 SeitenRust Experimental v2017 DevBlog 179 x64 #KnightsTableIngrutinNoch keine Bewertungen

- A Dream Takes FlightDokument3 SeitenA Dream Takes FlightHafiq AmsyarNoch keine Bewertungen

- Management Reporter Integration Guide For Microsoft Dynamics® SLDokument22 SeitenManagement Reporter Integration Guide For Microsoft Dynamics® SLobad2011Noch keine Bewertungen

- Laporan Mutasi Inventory GlobalDokument61 SeitenLaporan Mutasi Inventory GlobalEustas D PickNoch keine Bewertungen

- Liability WaiverDokument1 SeiteLiability WaiverTop Flight FitnessNoch keine Bewertungen

- Guardplc Certified Function Blocks - Basic Suite: Catalog Number 1753-CfbbasicDokument110 SeitenGuardplc Certified Function Blocks - Basic Suite: Catalog Number 1753-CfbbasicTarun BharadwajNoch keine Bewertungen

- DAP FullTextIntroductionByStuartLichtman PDFDokument21 SeitenDAP FullTextIntroductionByStuartLichtman PDFAlejandro CordobaNoch keine Bewertungen

- Domestic Water Consumption in ChennaiDokument18 SeitenDomestic Water Consumption in Chennaimaaz0% (1)

- Troubleshooting Edge Quality: Mild SteelDokument14 SeitenTroubleshooting Edge Quality: Mild SteelAnonymous U6yVe8YYCNoch keine Bewertungen

- Maintenance: ASU-600 SeriesDokument54 SeitenMaintenance: ASU-600 SeriesMichael Maluenda Castillo100% (2)

- Contemporary World Prelim Exam Test DraftDokument5 SeitenContemporary World Prelim Exam Test DraftGian Quiñones93% (45)

- How To Open and Convert An .SCM FileDokument5 SeitenHow To Open and Convert An .SCM FilejackNoch keine Bewertungen

- Market Participants in Securities MarketDokument11 SeitenMarket Participants in Securities MarketSandra PhilipNoch keine Bewertungen

- Bid Document PDFDokument125 SeitenBid Document PDFAzharudin ZoechnyNoch keine Bewertungen

- HW3Dokument3 SeitenHW3Noviyanti Tri Maretta Sagala0% (1)

- Broadband BillDokument1 SeiteBroadband BillKushi GowdaNoch keine Bewertungen

- Managing operations service problemsDokument2 SeitenManaging operations service problemsJoel Christian Mascariña0% (1)

- The Basic New Keynesian Model ExplainedDokument29 SeitenThe Basic New Keynesian Model ExplainedTiago MatosNoch keine Bewertungen

- Uniform Bonding Code (Part 2)Dokument18 SeitenUniform Bonding Code (Part 2)Paschal James BloiseNoch keine Bewertungen