Beruflich Dokumente

Kultur Dokumente

Tax Laws and Practice 168

Hochgeladen von

Karsin Manocha0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

10 Ansichten1 Seite4. Tax Laws and Prac

Originaltitel

4. Tax Laws and Practice 168

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument melden4. Tax Laws and Prac

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

10 Ansichten1 SeiteTax Laws and Practice 168

Hochgeladen von

Karsin Manocha4. Tax Laws and Prac

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

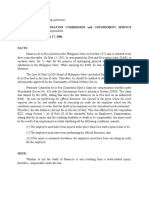

CONCLUSION

I. DIFFERENT MEANINGS OF ‘SALARY’ FOR DIFFERENT PURPOSES

For Rent-free House Rent Qualifying Entertain- Gratuity Determination Compensation

computation House or Allowance Amount of ment of ` 50,000 u/s 10(10B)

of taxable Concession Contribution Allowance regarding

income under in rent to R.P.F. taxability of

the head perquisites

salaries u/s 17(2)(iii)(c)

1. Basic 1. Basic 1. Basic Same Basic Basic Basic Salary, Salary,

salary or Salary Salary. as for Salary Salary, D.A. Dearness allowance,

wages. (excluding 2. Dearness house exclusive (if given Allowance, value of rent-

2. Advance advance or Allowance Rent of any under the All other taxable free or

salary. arrear of if the terms Allowance allowance, terms of allowances, concessional

3. Arrears of salary of as per benefit employment) benefits accommo-

salary. received). employment preceding or other and received in dation light,

4. Annuity or 2. Taxable so provide, column. perquisite. Commission cash, Bonus, water or any

pension. Allowances. i.e. it is based on Commission, other amenity

5. Gratuity. 3. Bonus. taken into fixed etc. and all and travel

6. Fees, 4. Commis- account for percentage monetary concession; but

Commission, sion or, retirement of turnover. payments does not

Bonus. 5. Any benefits, It does not included in include Bonus,

7. Allowances monetary or Dearness include gross salary Gratuity

including payment Pay. bonus, after allowing employer’s

Dearness (Excluding (Excluding other deductions contribution to

Allowance. dearness all other commission, u/s 16. For any fund for

8. Profits in allowance allowances, H.R.A. over- this purpose retirement

lieu of salary. not entering bonus or time wages salary will not benefits.

9. Perquisites. into perquisites and any include

10. Excess retirement and all other perquisites

contribution benefits of extras). allowance and not received

to R.P.F. by the 3. Commission perquisites. in cash.

employer employee, based on If the

over 12% of employer’s fixed employee is

salary. contribution percentage covered by

11. Excess to R.P.F. of turnover the Gratuity

interest allowances achieved Act, D.A.

received from exempt by the will always

R.P.F. over from tax, employee be included

9.5% rate of deductible and given in salary.

interest will amount of under terms

be taxable. value of of

12. Taxable perquisites). employment.

portion of

transferred

balance to

R.P.F.

Page 25 of 28

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Ethics Integrity and Aptitude Rau's Mains Compass 2019Dokument70 SeitenEthics Integrity and Aptitude Rau's Mains Compass 2019Karsin ManochaNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Ethics DefinitionsDokument7 SeitenEthics Definitionsronit royNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- 10 Bahane Kar Ke Le Gya DilDokument36 Seiten10 Bahane Kar Ke Le Gya DilKarsin ManochaNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- Jamia Hamdard Coaching AcademyDokument7 SeitenJamia Hamdard Coaching AcademyKarsin ManochaNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Indian Constitutional History: M. S. RAMA RAO B.SC., M.A., M.LDokument18 SeitenIndian Constitutional History: M. S. RAMA RAO B.SC., M.A., M.LSatyam PathakNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Death Before BirthDokument11 SeitenDeath Before BirthKarsin ManochaNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Indian Legal History12Dokument35 SeitenIndian Legal History12Gaurav SinghNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- CODE OF CIVIL PROCEDURE - Smart Notes PDFDokument73 SeitenCODE OF CIVIL PROCEDURE - Smart Notes PDFMeghaa Wadera100% (3)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Constitution of India - Smart NotesDokument104 SeitenConstitution of India - Smart NotesDavid Honey DiviyaNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- Law of Tort NotesDokument7 SeitenLaw of Tort NotesKarsin ManochaNoch keine Bewertungen

- 10 Chapter 3Dokument18 Seiten10 Chapter 3Karsin ManochaNoch keine Bewertungen

- 06 Chapter 2Dokument38 Seiten06 Chapter 2Karsin ManochaNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Sri S.M. DekaDokument12 SeitenSri S.M. DekaKarsin ManochaNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Set Off and Counterclaim Important Differences Under CPC - Lawnotes4u PDFDokument3 SeitenSet Off and Counterclaim Important Differences Under CPC - Lawnotes4u PDFKarsin ManochaNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- CourtRuleFile STQI6VXXDokument4 SeitenCourtRuleFile STQI6VXXKarsin ManochaNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Trial Before CourtDokument33 SeitenTrial Before CourtShivraj PuggalNoch keine Bewertungen

- Concept of A Police ReportDokument5 SeitenConcept of A Police ReportKarsin ManochaNoch keine Bewertungen

- I Summ of CriDokument38 SeitenI Summ of CriKarsin ManochaNoch keine Bewertungen

- A45 PDFDokument10 SeitenA45 PDFKarsin ManochaNoch keine Bewertungen

- CPC CoverDokument2 SeitenCPC CoverKarsin ManochaNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Nikhil Bhalla V Union of India Netflix Ors PETITIONDokument21 SeitenNikhil Bhalla V Union of India Netflix Ors PETITIONKarsin ManochaNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- PAAM - Steps in A Criminal Case PDFDokument4 SeitenPAAM - Steps in A Criminal Case PDFKarsin ManochaNoch keine Bewertungen

- Ijlpp Si - NRC PDFDokument231 SeitenIjlpp Si - NRC PDFKarsin ManochaNoch keine Bewertungen

- Rough Draft PIL PU Disability Access PDFDokument62 SeitenRough Draft PIL PU Disability Access PDFKarsin ManochaNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Fixedline and Broadband Services: Your Account Summary This Month'S ChargesDokument3 SeitenFixedline and Broadband Services: Your Account Summary This Month'S ChargesKarsin ManochaNoch keine Bewertungen

- Infocapsule 03042019Dokument5 SeitenInfocapsule 03042019Karsin ManochaNoch keine Bewertungen

- Company Law Executive Programme (Old Syllabus) : Supplement ForDokument46 SeitenCompany Law Executive Programme (Old Syllabus) : Supplement ForKarsin ManochaNoch keine Bewertungen

- Year, School of Excellence in Law, TNDALU.: Supremo AmicusDokument6 SeitenYear, School of Excellence in Law, TNDALU.: Supremo AmicusKarsin ManochaNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- BA LLB I Sem 24march18Dokument6 SeitenBA LLB I Sem 24march18Karsin ManochaNoch keine Bewertungen

- Gift DeedDokument4 SeitenGift Deedalkaadatia100% (2)

- Fixed Term ContractDokument1 SeiteFixed Term ContractTawanda Elton Makwasha MadzureNoch keine Bewertungen

- Staffing and Leading A Growing CompanyDokument12 SeitenStaffing and Leading A Growing CompanyMaroden Sanchez GarciaNoch keine Bewertungen

- Compensation Pay Structure in IndiaDokument6 SeitenCompensation Pay Structure in IndiaShruti VadherNoch keine Bewertungen

- Rational OrganizationDokument3 SeitenRational Organizationsimply_coool0% (1)

- Appointment RecieptDokument3 SeitenAppointment RecieptAbhisek DahiyaNoch keine Bewertungen

- Aligning Employees Through "Line of Sight": Presented by - Group 1Dokument14 SeitenAligning Employees Through "Line of Sight": Presented by - Group 1Raghav BhatnagarNoch keine Bewertungen

- Format of Guarantee For Mobilization AdvanceDokument1 SeiteFormat of Guarantee For Mobilization AdvanceJaydeep BhawalNoch keine Bewertungen

- Bpi Employees Union DigestDokument1 SeiteBpi Employees Union DigestAlexis ArejolaNoch keine Bewertungen

- 2010fin - MS160 (1) 7 5 10Dokument5 Seiten2010fin - MS160 (1) 7 5 10SEKHAR100% (1)

- 51 HR MetricsDokument4 Seiten51 HR Metricsnafiz100% (1)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Fidic 2010Dokument11 SeitenFidic 2010Sun BlueNoch keine Bewertungen

- Release Waiver and Quitclaim SampleDokument2 SeitenRelease Waiver and Quitclaim SampleDaniel Valdez100% (1)

- Income Taxation Chapter 9 True or False QuestionsDokument2 SeitenIncome Taxation Chapter 9 True or False Questionsfitz garlitos100% (1)

- G.R. No. L-66129 de La Rea vs. ECCDokument2 SeitenG.R. No. L-66129 de La Rea vs. ECCGieldan BulalacaoNoch keine Bewertungen

- San Miguel Corp Supervisor and Exempt Employees v. Laguesma - BUENAVENTURADokument3 SeitenSan Miguel Corp Supervisor and Exempt Employees v. Laguesma - BUENAVENTURAmarie melanie BuenaventuraNoch keine Bewertungen

- ERD Exercise (Extra)Dokument1 SeiteERD Exercise (Extra)sharmila_yusofNoch keine Bewertungen

- Aichi Forging Vs BalintosDokument7 SeitenAichi Forging Vs BalintosNasrifah LangcoNoch keine Bewertungen

- Evaluate internal control weaknesses in payroll processing and fixed assetsDokument1 SeiteEvaluate internal control weaknesses in payroll processing and fixed assetsratu shaviraNoch keine Bewertungen

- Case Study 1 - Workplace ViolenceDokument2 SeitenCase Study 1 - Workplace ViolenceMahmoud NassefNoch keine Bewertungen

- Myths and Misconceptions About People With DisabilitiesDokument4 SeitenMyths and Misconceptions About People With DisabilitiesabilitytowinNoch keine Bewertungen

- Project ReportDokument4 SeitenProject ReportRuchi KapoorNoch keine Bewertungen

- 11 Milagros Panuncillo V Cap (Done)Dokument1 Seite11 Milagros Panuncillo V Cap (Done)Climz AetherNoch keine Bewertungen

- Ppi VS NLRCDokument3 SeitenPpi VS NLRCCuddlyNoch keine Bewertungen

- Gratuity Form FDokument3 SeitenGratuity Form FAnonymous GGQDa3DNoch keine Bewertungen

- Local Conveyance PolicyDokument4 SeitenLocal Conveyance PolicyNazneen KhanNoch keine Bewertungen

- Deputy HR Manager Job DescriptionDokument2 SeitenDeputy HR Manager Job Descriptionvishal9patel-63Noch keine Bewertungen

- AMECO Assignment 1Dokument6 SeitenAMECO Assignment 1Arooj Malik100% (1)

- CH 10 StudentDokument15 SeitenCH 10 StudentKhyle AcebedoNoch keine Bewertungen

- Infosys Case StudyDokument8 SeitenInfosys Case StudyPratyaksh JainNoch keine Bewertungen

- Troublesome or Lifesaver??: Abhishek Hafila Amol Maske Pankaj Ranjan Pranab Jyoti DAS Tapas DasDokument7 SeitenTroublesome or Lifesaver??: Abhishek Hafila Amol Maske Pankaj Ranjan Pranab Jyoti DAS Tapas DasPankaj RanjanNoch keine Bewertungen