Beruflich Dokumente

Kultur Dokumente

Capital Structure (Tata Consultancy Services)

Hochgeladen von

Rony0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

12 Ansichten6 SeitenOriginaltitel

CS.docx

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

12 Ansichten6 SeitenCapital Structure (Tata Consultancy Services)

Hochgeladen von

RonyCopyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 6

TATA CONSULTANCY SERVICES

Capital Structure (Tata Consultancy Services)

Period Instrument Authorized Capital Issued Capital -PAIDUP-

From To (Rs. cr) (Rs. cr) Shares (nos) Face Value Capital

2016 2017 Equity Share 460.05 197.04 1970427941 1 197.04

2015 2016 Equity Share 460.05 197.04 1970427941 1 197.04

2014 2015 Equity Share 420.05 195.87 1958727979 1 195.87

2013 2014 Equity Share 420.05 195.87 1958727979 1 195.87

2012 2013 Equity Share 225 195.72 1957220996 1 195.72

2011 2012 Equity Share 225 195.72 1957220996 1 195.72

2010 2011 Equity Share 225 195.72 1957220996 1 195.72

2009 2010 Equity Share 225 195.72 1957220996 1 195.72

2008 2009 Equity Share 120 97.86 978610498 1 97.86

2007 2008 Equity Share 120 97.86 978610498 1 97.86

2006 2007 Equity Share 120 97.86 978610498 1 97.86

2005 2006 Equity Share 60 48.93 489305249 1 48.93

2004 2005 Equity Share 60 48.01 480114809 1 48.01

2003 2004 Equity Share 40 36.44 36440002 10 36.44

Capital Structure (Mindtree)

Period Instrument Authorized Capital Issued Capital -PAIDUP-

From To (Rs. cr) (Rs. cr) Shares (nos) Face Value Capital

2016 2017 Equity Share 800 168.03 168025546 10 168.03

2015 2016 Equity Share 800 167.79 167786176 10 167.79

2014 2015 Equity Share 800 83.73 83732372 10 83.73

2013 2014 Equity Share 79.62 41.69 41689731 10 41.69

2012 2013 Equity Share 79.62 41.54 41535055 10 41.54

2011 2012 Equity Share 79.62 40.54 40543923 10 40.54

2010 2011 Equity Share 79.62 40.04 40035187 10 40.04

2009 2010 Equity Share 79.62 39.51 39514994 10 39.51

2008 2009 Equity Share 79.62 38 37996686 10 38

2007 2008 Equity Share 79.62 37.92 37920558 10 37.92

2006 2007 Equity Share 79.62 37.75 37752577 10 37.75

2005 2006 Equity Share 10 5.87 29362535 2 5.87

Capital Structure (Hindustan Unilever)

Period Instrument Authorized Capital Issued Capital -PAIDUP-

From To (Rs. cr) (Rs. cr) Shares (nos) Face Value

2016 2017 Equity Share 225 216.43 2164349639 1

2015 2016 Equity Share 225 216.39 2163936971 1

2014 2015 Equity Share 225 216.35 2163464851 1

2013 2014 Equity Share 225 216.27 2162696292 1

2012 2013 Equity Share 225 216.25 2162472310 1

2011 2012 Equity Share 225 216.15 2161512492 1

2010 2011 Equity Share 225 215.95 2159471968 1

2009 2010 Equity Share 225 218.17 2181686781 1

2008 2009 Equity Share 225 217.99 2179776077 1

2007 2007 Equity Share 225 217.75 2177463355 1

2006 2006 Equity Share 225 220.68 2206776097 1

2005 2005 Equity Share 225 220.12 2201243793 1

2004 2004 Equity Share 225 220.12 2201243793 1

2003 2003 Equity Share 225 220.12 2201243793 1

2002 2002 Equity Share 225 220.12 2201243793 1

2001 2001 Equity Share 225 220.12 2201243793 1

1999 2000 Equity Share 225 220.06 2200595070 1

1996 1998 Equity Share 225 199.17 199167286 10

1994 1996 Equity Share 225 145.84 145838573 10

1993 1994 Equity Share 150 145.84 145838573 10

1992 1993 Equity Share 150 139.99 139986912 10

1990 1992 Equity Share 140 139.99 139986912 10

1987 1990 Equity Share 100 93.32 93324608 10

1983 1987 Equity Share 100 93.32 93324608 10

1981 1983 Equity Share 100 93.32 93324608 10

1979 1981 Equity Share 50 46.66 46662304 10

1978 1979 Equity Share 35 29.16 29163940 10

1977 1978 Equity Share 35 21.87 21872955 10

1974 1977 Equity Share 25 18.36 16852955 10

1970 1974 Equity Share 16.85 16.85 16852955 10

1966 1970 Equity Share 14.45 14.45 14445390 10

1965 1966 Equity Share 11.56 11.56 11556312 10

1962 1965 Equity Share 9.25 9.25 9141332 10

1956 1962 Equity Share 9.09 8.24 8243600 10

1952 1956 Equity Share 5.57 5.57 5570000 10

1937 1952 Equity Share 2 2 2000000 10

1933 1937 Equity Share 2.8 0.28 280000 10

Balance Sheet of Wipro ------------------- in Rs. Cr. -------------------

Mar 17 Mar 16 Mar 15 Mar 14

12 mths 12 mths 12 mths 12 mths

EQUITIES AND LIABILITIES

SHAREHOLDER'S FUNDS

Equity Share Capital 486.10 494.10 493.70 493.20

Total Share Capital 486.10 494.10 493.70 493.20

Reserves and Surplus 46,219.50 40,411.10 34,127.90 28,862.70 2

Total Reserves and Surplus 46,219.50 40,411.10 34,127.90 28,862.70 2

Total Shareholders Funds 46,705.60 40,905.20 34,621.60 29,355.90 2

NON-CURRENT LIABILITIES

Long Term Borrowings 1,146.30 1,146.50 1,063.20 1,006.10

Deferred Tax Liabilities [Net] 139.10 72.20 56.70 137.90

Other Long Term Liabilities 952.70 46.40 28.10 62.90

Long Term Provisions 373.30 399.10 273.60 258.50

Total Non-Current Liabilities 2,611.40 1,664.20 1,421.60 1,465.40

CURRENT LIABILITIES

Short Term Borrowings 5,018.60 5,549.50 4,970.40 3,504.20

Trade Payables 3,818.60 5,993.10 5,728.80 5,390.50

Other Current Liabilities 3,696.60 2,665.20 2,551.10 2,401.30

Short Term Provisions 1,306.10 2,399.30 4,115.00 3,619.60

Total Current Liabilities 13,839.90 16,607.10 17,365.30 14,915.60 1

Total Capital And Liabilities 63,156.90 59,176.50 53,408.50 45,736.90 4

ASSETS

NON-CURRENT ASSETS

Tangible Assets 3,755.50 3,726.20 3,570.00 3,621.50

Intangible Assets 606.70 462.50 468.40 353.50

Capital Work-In-Progress 694.10 325.10 361.20 275.10

Fixed Assets 5,056.30 4,513.80 4,399.60 4,250.10

Non-Current Investments 5,999.40 5,732.80 5,579.70 5,196.80

Deferred Tax Assets [Net] 235.20 290.40 165.90 148.70

Long Term Loans And Advances 1,965.70 3,358.40 3,071.00 2,998.10

Other Non-Current Assets 1,173.20 252.40 336.80 539.00

Total Non-Current Assets 14,429.80 14,147.80 13,553.00 13,132.70 1

CURRENT ASSETS

Current Investments 29,146.70 12,730.20 5,188.80 5,839.20

Inventories 355.90 526.20 479.40 228.30

Trade Receivables 8,129.90 8,704.80 8,144.20 8,550.90

Cash And Cash Equivalents 3,516.60 12,007.80 15,667.50 10,554.90

Short Term Loans And Advances 5,836.10 5,499.50 5,256.10 2,929.30

OtherCurrentAssets 1,741.90 5,560.20 5,119.50 4,501.60

Total Current Assets 48,727.10 45,028.70 39,855.50 32,604.20 2

Total Assets 63,156.90 59,176.50 53,408.50 45,736.90 4

OTHER ADDITIONAL INFORMATION

CONTINGENT LIABILITIES, COMMITMENTS

Contingent Liabilities 3,753.70 4,385.10 3,022.20 2,793.40

CIF VALUE OF IMPORTS

Raw Materials 0.00 627.20 851.30 1,524.20

Stores, Spares And Loose Tools 0.00 5.00 16.00 14.70

Capital Goods 0.00 15.20 20.00 0.10

EXPENDITURE IN FOREIGN EXCHANGE

Expenditure In Foreign Currency 21,291.00 20,818.10 19,430.80 14,789.73 1

REMITTANCES IN FOREIGN CURRENCIES FOR DIVIDENDS

Dividend Remittance In Foreign Currency - 0.03 0.03 0.03

EARNINGS IN FOREIGN EXCHANGE

FOB Value Of Goods 40,400.00 40,412.40 36,675.90 34,440.80 2

Other Earnings - 73.80 90.60 28.00

BONUS DETAILS

Bonus Equity Share Capital 475.82 475.82 475.82 475.82

NON-CURRENT INVESTMENTS

Non-Current Investments Quoted Market Value - - - -

Non-Current Investments Unquoted Book Value 5,999.40 5,912.10 5,579.70 5,196.80

CURRENT INVESTMENTS

Current Investments Quoted Market Value 10,467.50 1,139.50 1,102.40 1,825.70

Current Investments Unquoted Book Value 18,679.20 17,364.20 4,093.80 4,037.80

Das könnte Ihnen auch gefallen

- Capital Structure ItcDokument2 SeitenCapital Structure ItcTanisha AgarwalNoch keine Bewertungen

- ICICI Bank - Capital Structure Banks - Private Sector Capital Structure of ICICI Bank - BSE: (BSE), NSE: (NSE)Dokument1 SeiteICICI Bank - Capital Structure Banks - Private Sector Capital Structure of ICICI Bank - BSE: (BSE), NSE: (NSE)r79qwkxcfjNoch keine Bewertungen

- Capital StructureDokument4 SeitenCapital StructureBindiya SinhaNoch keine Bewertungen

- Capital Structure of Bharat ForgeDokument1 SeiteCapital Structure of Bharat ForgeDeep ChotaliaNoch keine Bewertungen

- Hindustan UnileverDokument23 SeitenHindustan UnileverAbhishek YadavNoch keine Bewertungen

- Cost StructuresDokument2 SeitenCost StructureswajidsattarchNoch keine Bewertungen

- Axis Bank - Capital Structure Banks - Private Sector Capital Structure of Axis Bank - BSE: (BSE), NSE: (NSE)Dokument1 SeiteAxis Bank - Capital Structure Banks - Private Sector Capital Structure of Axis Bank - BSE: (BSE), NSE: (NSE)r79qwkxcfjNoch keine Bewertungen

- Capital StructureDokument1 SeiteCapital StructureAman SainiNoch keine Bewertungen

- Explore Axis Bank ConnectionsDokument1 SeiteExplore Axis Bank ConnectionsOmarr AminNoch keine Bewertungen

- Ranbaxy Capital Structure 1Dokument2 SeitenRanbaxy Capital Structure 1urvi gadaNoch keine Bewertungen

- Oil and Natural Gas CorporationDokument5 SeitenOil and Natural Gas CorporationSarju MaviNoch keine Bewertungen

- Dividend Per Equity Share: HUL DaburDokument8 SeitenDividend Per Equity Share: HUL DaburSuraj Singh YadavNoch keine Bewertungen

- Capital Structure of Jindal Steel and PowerDokument2 SeitenCapital Structure of Jindal Steel and PowerAshok VenkatNoch keine Bewertungen

- Sbi Capital Structure PDFDokument1 SeiteSbi Capital Structure PDFutkarsh varshneyNoch keine Bewertungen

- P Data Extract From World Development IndicatorsDokument21 SeitenP Data Extract From World Development Indicatorsanikajain006Noch keine Bewertungen

- Management of Monetary Resource of GSK: Course: Faculty: Group NameDokument27 SeitenManagement of Monetary Resource of GSK: Course: Faculty: Group Nameborn2growNoch keine Bewertungen

- Capital StructureDokument1 SeiteCapital StructureSubrat MridhaNoch keine Bewertungen

- 2006 CSL Income Statement Financial RatiosDokument15 Seiten2006 CSL Income Statement Financial RatiosUZAIR300Noch keine Bewertungen

- JK Cement Financial ManagementDokument5 SeitenJK Cement Financial ManagementashuuuNoch keine Bewertungen

- Term Paper On VIDEOCONDokument16 SeitenTerm Paper On VIDEOCONAnkurMehtaNoch keine Bewertungen

- Explore ICICI Bank ConnectionsDokument1 SeiteExplore ICICI Bank ConnectionsRavikumar PaNoch keine Bewertungen

- Infosys CAGRDokument4 SeitenInfosys CAGRNithin VNoch keine Bewertungen

- Finance Seminar 4Dokument2 SeitenFinance Seminar 4phoebe8sohNoch keine Bewertungen

- Amount in Rupees CroreDokument40 SeitenAmount in Rupees CrorePradeep MulaniNoch keine Bewertungen

- FM Asignment RealDokument6 SeitenFM Asignment RealPooja TripathiNoch keine Bewertungen

- Amount in Rupees CroreDokument31 SeitenAmount in Rupees CroreniftamNoch keine Bewertungen

- Financial PlanDokument8 SeitenFinancial PlanwajeehaNoch keine Bewertungen

- Research Presentation on ExxonMobil's Financial Performance Over 10 YearsDokument12 SeitenResearch Presentation on ExxonMobil's Financial Performance Over 10 YearsIsha GadkarNoch keine Bewertungen

- OilGas DCF NAV ModelDokument21 SeitenOilGas DCF NAV ModelbankiesoleNoch keine Bewertungen

- 6 Years at A Glance: 2015 Operating ResultsDokument2 Seiten6 Years at A Glance: 2015 Operating ResultsHassanNoch keine Bewertungen

- BIOCON Ratio AnalysisDokument3 SeitenBIOCON Ratio AnalysisVinuNoch keine Bewertungen

- Capital StructureDokument1 SeiteCapital StructureVarsha YadavNoch keine Bewertungen

- Financial Ratio Analysis of PSO and SPL (Shell) ........ TAHIR SAMIDokument35 SeitenFinancial Ratio Analysis of PSO and SPL (Shell) ........ TAHIR SAMISAM100% (1)

- Finance ProjectDokument9 SeitenFinance ProjectMujtaba HassanNoch keine Bewertungen

- Obadiah Vineyard CaseDokument3 SeitenObadiah Vineyard CaseGodfrey Macwan50% (2)

- Working Capital ManagementDokument19 SeitenWorking Capital ManagementSandeep KumarNoch keine Bewertungen

- K-Electric WordDokument11 SeitenK-Electric Wordwaqasawan914Noch keine Bewertungen

- Final Assessment: Petroleum Economics Problem SolvingDokument4 SeitenFinal Assessment: Petroleum Economics Problem SolvingSayaf SalmanNoch keine Bewertungen

- BMW Group Annual Report 2012 Highlights Record SalesDokument284 SeitenBMW Group Annual Report 2012 Highlights Record SalesElena LópezNoch keine Bewertungen

- Muh Fachrul Z Mahanggi - 071001800079 - Tugasekomig4Dokument5 SeitenMuh Fachrul Z Mahanggi - 071001800079 - Tugasekomig4Fahrul mahanggiNoch keine Bewertungen

- Keekonomian Pod Ogip2 NewDokument63 SeitenKeekonomian Pod Ogip2 NewRizky Putra GustamanNoch keine Bewertungen

- Presented D by Ankit Vardhan (10DF016) Abhishek Charaborty (10DF017) Satish Umar (10DF 018) (PDGM FC)Dokument23 SeitenPresented D by Ankit Vardhan (10DF016) Abhishek Charaborty (10DF017) Satish Umar (10DF 018) (PDGM FC)Satish KumarNoch keine Bewertungen

- Sui Southern Gas Company Limited: Analysis of Financial Statements Financial Year 2004 - 2001 Q Financial Year 2010Dokument17 SeitenSui Southern Gas Company Limited: Analysis of Financial Statements Financial Year 2004 - 2001 Q Financial Year 2010mumairmalikNoch keine Bewertungen

- Balance Sheet FormatDokument3 SeitenBalance Sheet FormatAbdullah AsifNoch keine Bewertungen

- Senia Organic Food: BSEM ProgramDokument19 SeitenSenia Organic Food: BSEM ProgramferouchiNoch keine Bewertungen

- SANIA Organic Food: BSEM ProgramDokument20 SeitenSANIA Organic Food: BSEM ProgramAristanti RetnaningNoch keine Bewertungen

- IPC, PBI and Tax Revenue 2005-2018Dokument4 SeitenIPC, PBI and Tax Revenue 2005-2018gan dhiNoch keine Bewertungen

- ARM Investor BriefingDokument65 SeitenARM Investor BriefingbnjiinuNoch keine Bewertungen

- Future Share Price ProjectionDokument9 SeitenFuture Share Price ProjectionK91BFS63Noch keine Bewertungen

- Assignment 4.1Dokument14 SeitenAssignment 4.1anuradha.chavan5Noch keine Bewertungen

- Income Statement Template: Strictly ConfidentialDokument9 SeitenIncome Statement Template: Strictly ConfidentialAnthony BenavidesNoch keine Bewertungen

- Financial Ratios and Market Performance of a Company from 2011-2017Dokument2 SeitenFinancial Ratios and Market Performance of a Company from 2011-2017alan tambunanNoch keine Bewertungen

- Ocean CarriersDokument17 SeitenOcean CarriersJuvairiaNoch keine Bewertungen

- Macroeconomía País Hungría Practica 3Dokument22 SeitenMacroeconomía País Hungría Practica 3magdalenoNoch keine Bewertungen

- Per Share Ratios: Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06 Mar ' 05Dokument4 SeitenPer Share Ratios: Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06 Mar ' 05alihayatNoch keine Bewertungen

- Modav2 Bot Problem 2Dokument1 SeiteModav2 Bot Problem 2EuniceNoch keine Bewertungen

- Boston Beer ExcelDokument6 SeitenBoston Beer ExcelNarinderNoch keine Bewertungen

- Annual-Report Eng 2008Dokument68 SeitenAnnual-Report Eng 2008TuWitYNoch keine Bewertungen

- Corporate Finance (Theory and Practice) CASE 1: Jones Electrical DistributionDokument6 SeitenCorporate Finance (Theory and Practice) CASE 1: Jones Electrical Distributionabdulla mohammadNoch keine Bewertungen

- Service Design for Six Sigma: A Roadmap for ExcellenceVon EverandService Design for Six Sigma: A Roadmap for ExcellenceNoch keine Bewertungen

- NCCS Is The New SEC-Sept 15Dokument6 SeitenNCCS Is The New SEC-Sept 15RonyNoch keine Bewertungen

- NCCS Is The New SEC-Sept 15Dokument3 SeitenNCCS Is The New SEC-Sept 15aparnaskiniNoch keine Bewertungen

- Iyengar 2 PPTDokument11 SeitenIyengar 2 PPTdaNoch keine Bewertungen

- Chapter HeadingDokument5 SeitenChapter HeadingRonyNoch keine Bewertungen

- FindingsDokument2 SeitenFindingsRonyNoch keine Bewertungen

- Role of Advertising in Brand Communication Through Television MediaDokument27 SeitenRole of Advertising in Brand Communication Through Television Mediablogdogunleashed100% (4)

- Critical Pathh MethodDokument13 SeitenCritical Pathh MethodRonyNoch keine Bewertungen

- Om ProjectDokument12 SeitenOm ProjectRonyNoch keine Bewertungen

- Venue & Schedule 10.0Dokument1 SeiteVenue & Schedule 10.0RonyNoch keine Bewertungen

- RegressionDokument4 SeitenRegressionRonyNoch keine Bewertungen

- Book 3Dokument2 SeitenBook 3RonyNoch keine Bewertungen

- Chipko' MovementDokument1 SeiteChipko' MovementRonyNoch keine Bewertungen

- Fiama Di Wills soap advertising sales experimentDokument1 SeiteFiama Di Wills soap advertising sales experimentRonyNoch keine Bewertungen

- Foundation Course PPM Course Plan 14.06.2016Dokument7 SeitenFoundation Course PPM Course Plan 14.06.2016RonyNoch keine Bewertungen

- Iyengar 2 PPTDokument11 SeitenIyengar 2 PPTdaNoch keine Bewertungen

- MA TempelateDokument1 SeiteMA TempelateRonyNoch keine Bewertungen

- Chipko' MovementDokument1 SeiteChipko' MovementRonyNoch keine Bewertungen

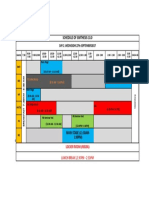

- Schedule of Simthesis 10.0: Day 2, Wednesday, 27Th September2017Dokument1 SeiteSchedule of Simthesis 10.0: Day 2, Wednesday, 27Th September2017RonyNoch keine Bewertungen

- Food ScheduleDokument1 SeiteFood ScheduleRonyNoch keine Bewertungen

- Schedule of Simthesis 10.0: Day 2, Wednesday, 27Th September2017Dokument1 SeiteSchedule of Simthesis 10.0: Day 2, Wednesday, 27Th September2017RonyNoch keine Bewertungen

- Venue & SchedulingDokument3 SeitenVenue & SchedulingRonyNoch keine Bewertungen

- Top Brands June Sales Report 2017Dokument1 SeiteTop Brands June Sales Report 2017RonyNoch keine Bewertungen

- Registration DeskDokument17 SeitenRegistration DeskRonyNoch keine Bewertungen

- Top selling personal care products reportDokument2 SeitenTop selling personal care products reportRonyNoch keine Bewertungen

- Manufacture & OutsourceDokument7 SeitenManufacture & OutsourceRonyNoch keine Bewertungen

- Registration Desk PDFDokument17 SeitenRegistration Desk PDFRonyNoch keine Bewertungen

- Fixed vs Variable Manufacturing CostsDokument2 SeitenFixed vs Variable Manufacturing CostsRonyNoch keine Bewertungen

- Trial Download WarningDokument1 SeiteTrial Download WarningRonyNoch keine Bewertungen

- Service MarketingDokument38 SeitenService MarketingRonyNoch keine Bewertungen

- CA Final Direct Tax Flow Charts May 2017 2SDMBZA2Dokument92 SeitenCA Final Direct Tax Flow Charts May 2017 2SDMBZA2Meet Mehta100% (1)

- MGMT 026 Chapter 04 HW Part 2Dokument11 SeitenMGMT 026 Chapter 04 HW Part 2Bánh Bao100% (3)

- Accounting For Fun and Profit. A Guide To Understanding Financial Statements - Lawrence A. WeissDokument209 SeitenAccounting For Fun and Profit. A Guide To Understanding Financial Statements - Lawrence A. Weisshernan covarrubiasNoch keine Bewertungen

- IAS Plus IAS 7, Statement ..Dokument4 SeitenIAS Plus IAS 7, Statement ..Buddha BlessedNoch keine Bewertungen

- PROPERTY LAW KEY TERMS AND CONCEPTSDokument9 SeitenPROPERTY LAW KEY TERMS AND CONCEPTSHirdesh kumarNoch keine Bewertungen

- Venture Capital-Group 6Dokument31 SeitenVenture Capital-Group 6Hemali PanchalNoch keine Bewertungen

- anthonyIM 09Dokument17 SeitenanthonyIM 09Ki Umbara100% (1)

- Ocm India Ltd.Dokument31 SeitenOcm India Ltd.rimpyanitaNoch keine Bewertungen

- MK - Fib Signal Eob Fib 1 2 3 Target V1.01 Input & Setup DescriptionDokument4 SeitenMK - Fib Signal Eob Fib 1 2 3 Target V1.01 Input & Setup Descriptionforex500Noch keine Bewertungen

- Build Wealth Trading Futures Vegas MethodDokument58 SeitenBuild Wealth Trading Futures Vegas MethodarthurkanNoch keine Bewertungen

- Overcoming The Fear of The UnknownDokument5 SeitenOvercoming The Fear of The UnknownBharat SahniNoch keine Bewertungen

- Edge Dated 19 JulyDokument33 SeitenEdge Dated 19 JulyRichard OonNoch keine Bewertungen

- History and Evolution of Stock Exchange in IndiaDokument16 SeitenHistory and Evolution of Stock Exchange in IndiaHemantSharmaNoch keine Bewertungen

- Richcore Report PDFDokument4 SeitenRichcore Report PDFmsn_testNoch keine Bewertungen

- Portfolio Insurance Strategies - OBPI Versus CPPIDokument16 SeitenPortfolio Insurance Strategies - OBPI Versus CPPIKaushal ShahNoch keine Bewertungen

- Stock-Trak Project Final Preparation GuidlinesDokument1 SeiteStock-Trak Project Final Preparation GuidlinesKim Yoo SukNoch keine Bewertungen

- PDFDokument240 SeitenPDFHrishabh BharatiNoch keine Bewertungen

- PC Depot CaseDokument4 SeitenPC Depot CaseAnge Buenaventura Salazar100% (2)

- Sandeepmadan: Enjoy Individual Support With Upgraded PlansDokument3 SeitenSandeepmadan: Enjoy Individual Support With Upgraded Planssandeep madanNoch keine Bewertungen

- Christensen - 12e - Chap05 - 2019 OdfDokument97 SeitenChristensen - 12e - Chap05 - 2019 OdfFilia KhansaNoch keine Bewertungen

- Report Dairy Milk Management SystemDokument44 SeitenReport Dairy Milk Management SystemSathishNoch keine Bewertungen

- HKICPA QP Exam (Module A) Feb2006 Question PaperDokument7 SeitenHKICPA QP Exam (Module A) Feb2006 Question Papercynthia tsuiNoch keine Bewertungen

- Tugas Chapter 6 - Sandra Hanania - 120110180024Dokument4 SeitenTugas Chapter 6 - Sandra Hanania - 120110180024Sandra Hanania PasaribuNoch keine Bewertungen

- Market Timing Puzzle: Adding Momentum Can Improve Contrarian StrategiesDokument16 SeitenMarket Timing Puzzle: Adding Momentum Can Improve Contrarian StrategieshaginileNoch keine Bewertungen

- Jagannathan, Wang (1996) - The Conditional CAPM and The Crosssection of Expected Returns PDFDokument52 SeitenJagannathan, Wang (1996) - The Conditional CAPM and The Crosssection of Expected Returns PDFkhrysttalexa3146Noch keine Bewertungen

- Chap 016Dokument25 SeitenChap 016Utkarsh GoelNoch keine Bewertungen

- PK04 NotesDokument24 SeitenPK04 NotesBirat Sharma100% (1)

- Chapter 2 SolutionDokument19 SeitenChapter 2 SolutionabeeraNoch keine Bewertungen

- Wharton Finance1Dokument21 SeitenWharton Finance1DaSkeptic100% (1)

- Asset Liability Management CommitteeDokument2 SeitenAsset Liability Management CommitteeRoger RogerNoch keine Bewertungen