Beruflich Dokumente

Kultur Dokumente

Addition 03.2013. TS LSFA BS PDF

Hochgeladen von

mr12323Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Addition 03.2013. TS LSFA BS PDF

Hochgeladen von

mr12323Copyright:

Verfügbare Formate

Addition 03.2013. TS LSFA BS (Banking system).

EUR. Cypriot financial crisis.

In periods of news on the expectation of default in Cyprus or any other country outside the European Union, do

not trade on the 00 (000), because the reaction of the levels will be absent or very weak, and, as a rule, on the

background of these events, one of the largest banks and hedge funds are not available on the 00 (000).

On Sunday, March 24 immediately made the decision to get out of the situation in Cyprus, as early

as Monday and Tuesday March 25-26to declare a default.

Eurogroup on Monday night removed threat of default of Cyprus decided to grant financial assistance to

Nicosia from the EU and the IMF in the amount of 10 billion EUR. Brussels no longer requires self-assemble

Cyprus 5.8 billion EUR . Decided to completely preserve the country's bank deposits amounting to 100

thousand EUR , but larger deposits be subject to write-downs.

Country's largest bank - Bank of Cyprus - in addressing the financial problems of Cyprus will be subjected to a

complete restructuring and recapitalization of the Central Bank of Cyprus said. Bank of Cyprus will get a

healthy portfolio of serviced assets and loans of the second largest bank of the island - Cyprus Popular Bank,

which will be divided into "good" and "bad" banks, followed by the elimination of the latter.

First, the trade of the 00 (000) draw attention to the following news:

- Armed conflicts (JPY - Asia).

- Out of any of the countries with the EU.

- The Central Bank of the working currency (interest rate).

- Default.

Example: eurjpy25.03.2013

Das könnte Ihnen auch gefallen

- Cyprus: Do You Understand What Has Really Happened?: Tuesday, April 2, 2013 4:26Dokument20 SeitenCyprus: Do You Understand What Has Really Happened?: Tuesday, April 2, 2013 4:26spaw1108Noch keine Bewertungen

- Herexamen Voor Troika in CyprusDokument5 SeitenHerexamen Voor Troika in CyprusKBC EconomicsNoch keine Bewertungen

- Cyprus & The Euro by Martin ArmstrongDokument6 SeitenCyprus & The Euro by Martin ArmstrongmomentumtraderNoch keine Bewertungen

- Europe Does It AgainDokument6 SeitenEurope Does It AgainMohd Shafri ShariffNoch keine Bewertungen

- Bull in China ShopDokument3 SeitenBull in China ShophansvdhoofNoch keine Bewertungen

- Tyler Durden - 2013 - Cyprus - Crisis - The World's Biggest Poker GameDokument6 SeitenTyler Durden - 2013 - Cyprus - Crisis - The World's Biggest Poker GameTREND_7425Noch keine Bewertungen

- TIE Sp13 EurozoneDepositsSympDokument11 SeitenTIE Sp13 EurozoneDepositsSymprichardck61Noch keine Bewertungen

- The Haircut of Cypriot Deposits and The PDFDokument26 SeitenThe Haircut of Cypriot Deposits and The PDFPetras LopasNoch keine Bewertungen

- 2012-2013 Cypriot Financial Crisis - Wikipedia, The Free EncyclopediaDokument9 Seiten2012-2013 Cypriot Financial Crisis - Wikipedia, The Free EncyclopediaakurilNoch keine Bewertungen

- Get Your Assets Out of The BanksDokument3 SeitenGet Your Assets Out of The BanksMohd Shafri ShariffNoch keine Bewertungen

- Eur/Chf Spot: WKN: Eurchf ISIN: EU0009654078Dokument4 SeitenEur/Chf Spot: WKN: Eurchf ISIN: EU0009654078Josh2002Noch keine Bewertungen

- Economic Updates 27032023Dokument2 SeitenEconomic Updates 27032023Shubham jainNoch keine Bewertungen

- Cityam 2011-09-16Dokument40 SeitenCityam 2011-09-16City A.M.Noch keine Bewertungen

- Turkish Republic of Northern Cyprus: GreeceDokument3 SeitenTurkish Republic of Northern Cyprus: GreeceMarNoch keine Bewertungen

- Charity Appeal Reaches 200,000: Rating Agency Drops Eurozone BombshellDokument32 SeitenCharity Appeal Reaches 200,000: Rating Agency Drops Eurozone BombshellCity A.M.Noch keine Bewertungen

- Timeline Banking Crisis CNN 10-18-08Dokument3 SeitenTimeline Banking Crisis CNN 10-18-08Rokr125Noch keine Bewertungen

- A House Built On Sand? The ECB and The Hidden Cost of Saving The EuroDokument20 SeitenA House Built On Sand? The ECB and The Hidden Cost of Saving The EuroAzhar HeetunNoch keine Bewertungen

- March 22nd, Just Amazing by Martin ArmstrongDokument4 SeitenMarch 22nd, Just Amazing by Martin ArmstrongmomentumtraderNoch keine Bewertungen

- Issuesbrief Eurozone 2Dokument9 SeitenIssuesbrief Eurozone 2api-217665635Noch keine Bewertungen

- Let The Buyers Be WarnedDokument5 SeitenLet The Buyers Be WarnedARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanNoch keine Bewertungen

- JPF Lessons FTD 260907Dokument2 SeitenJPF Lessons FTD 260907BruegelNoch keine Bewertungen

- Debt Crisis in GreeceDokument9 SeitenDebt Crisis in GreeceHải TrầnNoch keine Bewertungen

- Cyprus ... A Test Case For Future European Banking Policy: John BrutonDokument2 SeitenCyprus ... A Test Case For Future European Banking Policy: John BrutonNasef MohdNoch keine Bewertungen

- Update 25-03-13 - 12-04-13Dokument18 SeitenUpdate 25-03-13 - 12-04-13Jo RandallNoch keine Bewertungen

- Global Market Outlook May 2011Dokument7 SeitenGlobal Market Outlook May 2011IceCap Asset ManagementNoch keine Bewertungen

- Why Europe Planned The Great Bank RobberyDokument2 SeitenWhy Europe Planned The Great Bank RobberyRakesh SimhaNoch keine Bewertungen

- Ranges (Up Till 11.45am HKT) : Currency CurrencyDokument3 SeitenRanges (Up Till 11.45am HKT) : Currency Currencyapi-290371470Noch keine Bewertungen

- Brexit: La Banque de Maurice Suit de Près La Situation Et Les Effets Éventuels Sur Notre PaysDokument1 SeiteBrexit: La Banque de Maurice Suit de Près La Situation Et Les Effets Éventuels Sur Notre PaysTOPFMNoch keine Bewertungen

- The European Union and The Global Financial CrisisDokument37 SeitenThe European Union and The Global Financial CrisisHamza AbbasiNoch keine Bewertungen

- Global Market Outlook August 2012Dokument12 SeitenGlobal Market Outlook August 2012IceCap Asset ManagementNoch keine Bewertungen

- Eurozone Crisis 2.0Dokument1 SeiteEurozone Crisis 2.0mrwonkishNoch keine Bewertungen

- European Council, December 2010 - The Questions That Need AnswersDokument8 SeitenEuropean Council, December 2010 - The Questions That Need AnswersFranquelim AlvesNoch keine Bewertungen

- Engleza - 2014 IunieDokument1 SeiteEngleza - 2014 IunieAlexandra NNoch keine Bewertungen

- Danske Research EndgameDokument5 SeitenDanske Research EndgameZerohedgeNoch keine Bewertungen

- Greece Debt Crisis: Biif Vikas Mittal S. JoshiDokument20 SeitenGreece Debt Crisis: Biif Vikas Mittal S. JoshiShivgan JoshiNoch keine Bewertungen

- Documents On Eurozone Banking CrisisDokument67 SeitenDocuments On Eurozone Banking CrisisbaddeoNoch keine Bewertungen

- Mauldin July 13Dokument10 SeitenMauldin July 13richardck61Noch keine Bewertungen

- 2010 June What You Get For 750bn JSDokument7 Seiten2010 June What You Get For 750bn JSmanmohan_9Noch keine Bewertungen

- Week in Focus: Sovereign Debt Crisis: What Can Be Done If It Escalates?Dokument16 SeitenWeek in Focus: Sovereign Debt Crisis: What Can Be Done If It Escalates?timurrsNoch keine Bewertungen

- CS GrexitDokument6 SeitenCS Grexitjavier geNoch keine Bewertungen

- The Lost Science of Money. Cap. 23Dokument22 SeitenThe Lost Science of Money. Cap. 23A L SNoch keine Bewertungen

- Eurozone Crisis: Impacts: Prepared ForDokument24 SeitenEurozone Crisis: Impacts: Prepared ForAkif AhmedNoch keine Bewertungen

- Timeline: The Unfolding Eurozone Crisis: Global EconomyDokument6 SeitenTimeline: The Unfolding Eurozone Crisis: Global EconomyPiyush ChaharNoch keine Bewertungen

- European Sovereign Debt Crisis: PiigsDokument11 SeitenEuropean Sovereign Debt Crisis: PiigsBismahqNoch keine Bewertungen

- Default and Exit From The Eurozone: A Radical Left Strategy - LapavitsasDokument10 SeitenDefault and Exit From The Eurozone: A Radical Left Strategy - Lapavitsasziraffa100% (1)

- Efsf EsmDokument48 SeitenEfsf Esmshobu_iujNoch keine Bewertungen

- Cityam 2011-07-22Dokument28 SeitenCityam 2011-07-22City A.M.Noch keine Bewertungen

- Shin BCFalumni Euro CrisisDokument39 SeitenShin BCFalumni Euro CrisisMatthew LeeNoch keine Bewertungen

- Le Crédit Crunch Isn't OverDokument2 SeitenLe Crédit Crunch Isn't Overfranka4100Noch keine Bewertungen

- New Msdicrosoft Office PowerPoint PresentationDokument24 SeitenNew Msdicrosoft Office PowerPoint PresentationbkaaljdaelvNoch keine Bewertungen

- Economist 2Dokument2 SeitenEconomist 2Elena ButicaNoch keine Bewertungen

- Euro Zone Crisis and Its Implications in IndianDokument15 SeitenEuro Zone Crisis and Its Implications in IndianSarasij SarkarNoch keine Bewertungen

- Why Is Greece in Debt?Dokument5 SeitenWhy Is Greece in Debt?yatz24Noch keine Bewertungen

- Eurozone Analysis 01-29-2012Dokument21 SeitenEurozone Analysis 01-29-2012Alexander BanhNoch keine Bewertungen

- European Doom and GloomDokument6 SeitenEuropean Doom and GloomjaiswaniNoch keine Bewertungen

- Ukraine EU Agrees To Exclude Key Russian Banks From SWIFTDokument1 SeiteUkraine EU Agrees To Exclude Key Russian Banks From SWIFTStone pobeeNoch keine Bewertungen

- Pro Finance Group Inc.: GraphDokument1 SeitePro Finance Group Inc.: Graphmr12323Noch keine Bewertungen

- Chifbaw Oscillator User GuideDokument12 SeitenChifbaw Oscillator User GuideHajar Aswad KassimNoch keine Bewertungen

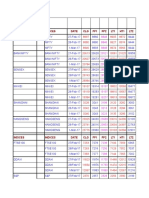

- Indices Indices Date CLG FP1 FP2 LT1 HT1 LT2Dokument34 SeitenIndices Indices Date CLG FP1 FP2 LT1 HT1 LT2mr12323Noch keine Bewertungen

- Tims Trading MaximsDokument1 SeiteTims Trading Maximsmr12323Noch keine Bewertungen

- Revision of Pension (c116063)Dokument1 SeiteRevision of Pension (c116063)mr12323Noch keine Bewertungen

- Details of Daily Margin Applicable For F&O Segment (F&O) For 18.07.2018Dokument5 SeitenDetails of Daily Margin Applicable For F&O Segment (F&O) For 18.07.2018mr12323Noch keine Bewertungen

- GN 5 41Dokument1 SeiteGN 5 41mr12323Noch keine Bewertungen

- Chart Pattern Dashboard Indicator User Guide: Chartpatterndashboard - Ex4Dokument4 SeitenChart Pattern Dashboard Indicator User Guide: Chartpatterndashboard - Ex4mr12323100% (1)

- BitcoinsDokument45 SeitenBitcoinsSwadhin Sonowal100% (1)

- Chart Pattern Dashboard Indicator User Guide: Chartpatterndashboard - Ex4Dokument4 SeitenChart Pattern Dashboard Indicator User Guide: Chartpatterndashboard - Ex4mr12323100% (1)

- WolfeWaveDashboard UserGuideDokument4 SeitenWolfeWaveDashboard UserGuidemr12323Noch keine Bewertungen

- Scope of AnatomyDokument25 SeitenScope of Anatomymr12323Noch keine Bewertungen

- Trading Manual PDFDokument24 SeitenTrading Manual PDFmr12323Noch keine Bewertungen

- 14th Dec 2015 Chin MaoDokument8 Seiten14th Dec 2015 Chin Maomr12323Noch keine Bewertungen

- Bertrand Russell's 10 Commandments of Teaching by Maria PopovaDokument2 SeitenBertrand Russell's 10 Commandments of Teaching by Maria Popovamr12323Noch keine Bewertungen

- Advantages of Monitoring Open InterestDokument1 SeiteAdvantages of Monitoring Open Interestmr12323Noch keine Bewertungen