Beruflich Dokumente

Kultur Dokumente

Double Irish vs. Single Irish Post The Tax Cuts and Jobs Act (GILTI) Leglislation

Hochgeladen von

Anonymous 8bjIB0fbMOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Double Irish vs. Single Irish Post The Tax Cuts and Jobs Act (GILTI) Leglislation

Hochgeladen von

Anonymous 8bjIB0fbMCopyright:

Verfügbare Formate

© 2018 Tax Analysts. All rights reserved.

Tax Analysts does not claim copyright in any public domain or third party content.

SPECIAL REPORTS

tax notes international®

Reassessing the Beloved Double Irish Structure in Light of GILTI

by Lewis J. Greenwald, Witold Jurewicz, and John Wei

GILTI is any excess of that U.S. shareholder’s

Lewis Greenwald and Witold Jurewicz are

with DLA Piper in New York, and John Wei is net CFC tested income, over that shareholder’s net

with DLA Piper in Boston. deemed tangible income return. The term “net

CFC tested income” means any excess of the

In this article, the authors discuss the new aggregate of the shareholder’s pro rata share of

global intangible low-taxed income provisions the tested income of each CFC, over the aggregate

of the Tax Cuts and Jobs Act and reassess the

of that shareholder’s pro rata share of the tested

double Irish structure and whether it continues

to deliver tax savings. loss of each CFC for which that shareholder is a

U.S. shareholder for the tax year. The term “net

Copyright 2018 Lewis Greenwald, Witold deemed tangible income” means the excess of 10

Jurewicz, and John Wei. percent of the aggregate of the shareholder’s pro

rata share of the qualified business asset

Not only did the Tax Cuts and Jobs Act of 2017 investment of each CFC, over the amount of

(P.L. 115-97) retain subpart F in its entirety, it interest expense used in determining the

added a new anti-deferral rule — global shareholder’s net CFC tested income to the extent

intangible low-taxed income (GILTI) — in new the interest income attributable to that expense is

section 951A. In light of GILTI, U.S. multinationals not used in determining the shareholder’s net CFC

are reassessing their international deferral tested income.

structures.

The term “qualified business asset

In this article, we review the new GILTI investment” means a CFC’s average aggregate

provisions and reassess the double Irish structure adjusted bases (as of the close of each quarter of

using a case study that compares it with a single the tax year) in specified tangible property.

2

Irish structure. We conclude that the double Irish “Specified tangible property” means property

continues to deliver tax savings, albeit not quite as used in the CFC’s trade or business that is of a type

well as before GILTI. for which a deduction is allowable under section

167.

The GILTI Provisions

The term “tested income” means any excess of

New section 951A generally provides that a the gross income of a CFC determined without

1

U.S. shareholder of any controlled foreign regard to:

corporation must include in gross income its • U.S.-source gross income that is effectively

GILTI for each tax year. connected with the conduct by such

corporation with a trade or business within

1

Before the TCJA, section 951(b) provided that the term “U.S.

shareholder” meant, for any foreign corporation, a U.S. person as

defined in section 957(c) that owned (under section 958(a) and (b)) at 2

least 10 percent of the total combined voting power of all classes of that For section 951A(d), the adjusted basis in any property is

corporation’s stock entitled to vote. TCJA section 14214 amended the determined by (i) using the alternative depreciation system under section

definition of U.S. shareholder by inserting at the end of section 951(b) “or 168(g) and (ii) allocating the depreciation deduction ratably to each day

10 percent or more of the total value of shares of all classes of stock of of the period. Special rules apply to property owned by a partnership

such foreign corporation.” As amended, a U.S. shareholder is a U.S. owned by a CFC. Finally, section 951A(d)(4) directs Treasury to issue

person that owns at least 10 percent of the vote or value of any foreign regulations or other guidance to prevent the avoidance of section

corporation. The amendment is effective for tax years beginning after 951A(d), including regulations or other guidance that provides for the

December 31, 2017. treatment of property transferred or held temporarily.

TAX NOTES INTERNATIONAL, APRIL 23, 2018 523

For more Tax Notes International content, please visit www.taxnotes.com.

SPECIAL REPORTS

© 2018 Tax Analysts. All rights reserved. Tax Analysts does not claim copyright in any public domain or third party content.

the United States and that is not exempt The TCJA amended section 904(d) to create a

from U.S. tax; new FTC limitation basket for non-passive GILTI

• any gross income used in determining the (with no carryforward or carryback of excessive

subpart F income of that corporation; FTCs), and amended section 78 to provide that the

• any gross income excluded from the foreign gross-up equals 100 percent of the deemed paid

base company income (as defined in section foreign taxes (except for sections 245 and 245A).

954) and the insurance income (as defined in

section 953) of the corporation under section Case Study

3

954(b)(4); XYZ Technology Corp. (XYZ US), a U.S.

• any dividend received from a related person publicly traded company, produces software and

(as defined in section 954(d)(3)); and distributes it globally. Several years ago, XYZ US

• any foreign oil and gas extraction income (as formed XYZ International, a nonresident Irish

defined in section 907(c)(1)) of the company that is tax resident in Malta. XYZ US

corporation, transferred the non-U.S. rights to its IP to XYZ

over the deductions (including taxes) properly International through a license agreement (the

allocable to that gross income under rules similar buy-in). Coterminous with the buy-in, XYZ US

to section 954(b)(5) (or to which those deductions and XYZ International entered into a cost-sharing

would be allocable if there were that kind of gross agreement to jointly fund the continuing and

income). future development of the XYZ IP. (See Figure 1.)

The term “tested loss” means any excess of Table 1. Inputs and Assumptions

such deductions (including taxes), over such

gross income. 1. U.S. Tax Rate 21.0%

In general, any GILTI that is in gross income is 2. Irish Tax Rate 12.5%

treated the same as an amount included in gross

income under section 951(a)(1)(A) — that is, like 3. Maltese Tax Rate 0.0%

an item of subpart F income. 4. Allowed Return on QBAI 10.0%

Finally, the TCJA also amended section 960 Investment

(regarding deemed paid foreign tax credits for

5. Deemed Paid Credit 80.0%

subpart F inclusions) by adding new subsection Proportion

(d). The new section provides that a U.S.

shareholder that is a domestic corporation is 6. Deduction for GILTI 50.0%

Amount Through 2025

deemed to have paid foreign taxes equal to 80

percent of the corporation’s inclusion percentage4

multiplied by the aggregate tested foreign income

5

taxes paid or accrued by CFCs.

3

Section 954(b)(4) excludes from foreign base company income and

insurance income any item of income of a CFC that was subject to an

effective rate of foreign income tax greater than 90 percent of the

maximum rate of tax specified in section 11 (commonly referred to as the

high-tax kick-out). Before the TCJA, the highest rate of corporate income

tax under section 11 was 35 percent; after, the highest rate under section

11 is 21 percent.

4

A domestic corporation’s inclusion percentage is equal to its GILTI

divided by its pro rata shares of the tested income of its CFCs.

5

The term “tested foreign income taxes” means the foreign income

taxes paid or accrued by a CFC that are properly attributable to the

tested income of that foreign corporation taken into account by the

domestic corporation under section 951A.

524 TAX NOTES INTERNATIONAL, APRIL 23, 2018

For more Tax Notes International content, please visit www.taxnotes.com.

SPECIAL REPORTS

© 2018 Tax Analysts. All rights reserved. Tax Analysts does not claim copyright in any public domain or third party content.

Thereafter, XYZ International formed XYZ Table 2. P&L Statement

Ireland, a resident Irish company that was (Amounts in US $ (thousands)) (Continued)

checked to be treated as a disregarded entity for

U.S. International Ireland*

U.S. federal tax purposes. XYZ International

licensed its IP (the non-U.S. rights to the XYZ IP) Profit 600 2,700 880

to XYZ Ireland, which sells its IP and software Income Taxes 126 - 110

through various wholly owned cost-plus

*For simplicity, it is assumed that all profits from

marketing subsidiaries located throughout

distribution are earned in Ireland.

Europe and the Pacific Rim (the distributors). The

distributors were all checked to be treated as

Table 3. GILTI Calculation

disregarded entities for U.S. federal tax purposes.

(Amounts in US $ (thousands))

Table 2 provides the P&L statement for the

double Irish structure. For the sake of simplicity, it Foreign Operating Profits 3,580

is assumed that all profits from distribution are

Foreign Income Taxes 110

earned in Ireland. Table 3 then calculates the

GILTI, taxes attributable to the GILTI, and Net CFC Tested Income 3,470

deemed paid credit available under this structure. (Loss)

Table 4 calculates the worldwide income tax and PP&E 2,300

effective tax rate under the double Irish structure.

Depreciation <450>

Table 2. P&L Statement

(Amounts in US $ (thousands)) Qualified Business Asset 1,850

Investment (QBAI)

U.S. International Ireland*

Interest Expense 20

Revenue

Net Deemed Tangible 10.0% 165

Sales - - 23,000 Income Return

Royalty 400 3,300 - Global Intangible Low- 3,305

CSA Payment 200 - - Taxed Income (GILTI)

Total Revenue 600 3,300 23,000 Inclusion Percentage 95.24%

Total COGS - - 2,700 Taxes Attributable to GILTI 105

OPEX Deemed Paid Credit 80.0% 84

Available (FTC)

Bad Debt - - 200

G&A - - 3,000

CSA Payment - 200 -

Marketing - - 2,200

Sales - - 7,500

OPEX - D&A - - 2,500

Royalty - 400 3,300

Total OPEX - 600 18,700

Other Expenses

Interest & - - 20

Other Expense

Sales Tax - - 700

Other - - 720

Expenses

TAX NOTES INTERNATIONAL, APRIL 23, 2018 525

For more Tax Notes International content, please visit www.taxnotes.com.

SPECIAL REPORTS

© 2018 Tax Analysts. All rights reserved. Tax Analysts does not claim copyright in any public domain or third party content.

Table 4. Post-TCJA Tax Liability Table 5 provides the P&L statement for the

(Amounts in US $ (thousands)) single Irish structure. For the sake of simplicity, it

is assumed that all profits are earned in Ireland.

U.S. International Ireland Table 6 then calculates the GILTI, taxes

Total Revenue 600 3,300 23,000 attributable to the GILTI, and deemed paid credit

under this structure. Table 7 calculates the

Total Expenses - <600> <22,120>

worldwide income tax and effective tax rate

Net Profit 600 2,700 880 under the single Irish structure.

Local Income 21% 0% 12.5% Table 5. P&L Statement

Tax Rate (Amounts in US $ (thousands))

Income Taxes 126 - 110 U.S. Ireland*

Due Pre-GILTI

Revenue

GILTI Inclusion 3,305

Sales - 23,000

Section 78 105

Gross-Up Royalty 400 -

Section 250 <1,705> CSA Payment 200 -

Deduction

Total Revenue 600 23,000

Adjusted 1,705

Income Total COGS - 2,700

U.S. Tax on 358 OPEX

GILTI (21%)

Bad Debt - 200

FTC Against 84

G&A - 3,000

GILTI

CSA Payment - 200

Total U.S. Tax 400

After FTC* Marketing - 2,200

Maltese Income - Sales - 7,500

Tax

OPEX - D&A - 2,500

Irish Income 110

Tax Royalty - 400

Worldwide 510 Total OPEX - 16,000

Income Tax

Other Expenses

Effective Tax 12.21%

Rate** Interest & Other Expense - 20

Sales Tax - 700

*400 (Total U.S. Tax After FTC) = 126 (U.S. Income Taxes Other Expenses - 720

Due Pre-GILTI) + 358 (U.S. Tax on GILTI) - 84 (FTC Profit 600 3,580

Against GILTI)

**ETR = 510/4,180 Income Taxes 126 448

*For the sake of simplicity, it is assumed that all profits

The single Irish structure is basically the same from distribution are earned in Ireland.

as the double Irish structure, except that XYZ

International has been eliminated. The buy-in and

CSA are now between XYZ US and XYZ Ireland.

(See Figure 2.)

526 TAX NOTES INTERNATIONAL, APRIL 23, 2018

For more Tax Notes International content, please visit www.taxnotes.com.

SPECIAL REPORTS

© 2018 Tax Analysts. All rights reserved. Tax Analysts does not claim copyright in any public domain or third party content.

Table 6. GILTI Calculation Table 7. Post-TCJA Tax Liability

(Amounts in US $ (thousands)) (Amounts in US $ (thousands))

Foreign Operating Profits 3,580 U.S. Ireland

Foreign Income Taxes 448 Total Revenue 600 23,000

Net CFC Tested Income 3,133 Total Expenses - 19,420

(Loss)

Net Profit 600 3,580

PP&E 2,300

Local Tax Rate 21% 12.5%

Depreciation <450>

Income Taxes Due 126 448

Qualified Business Asset 1,850 Pre-GILTI

Investment (QBAI)

GILTI Inclusion 2,968

Interest Expense 20

Section 78 Gross-Up 424

Net Deemed Tangible 10.0% 165

Income Return Section 250 Deduction <1,696>

Global Intangible Low- 2,968 Adjusted Income 1,696

Taxed Income (GILTI)

U.S. Tax on GILTI (21%) 356

Inclusion Percentage 94.7%

FTC Against GILTI 339

Taxes Attributable to GILTI 424

Total U.S. Tax After FTC* 143

Deemed Paid Credit 80.0% 339

Irish Income Tax 448

Available (FTC)

Worldwide Income Tax 590

Effective Tax Rate** 14.13%

*143 (Total U.S. Tax After FTC) = 126 (U.S. Income Taxes

Due Pre-GILTI) + 356 (U.S. Tax on GILTI) - 339 (FTC

Against GILTI)

**ETR = (590/4,180)

Table 8. Comparison – Double vs. Single Irish

Double

Irish Single Irish

Structure Structure Difference

Worldwide 510 590 80

Tax

Worldwide 4,180 4,180 -

Operating

Profit

Worldwide 12.21% 14.13% 1.92%

ETR

Table 8 compares the worldwide tax and

effective tax rates under the double Irish and

single Irish structures. On these facts, the double

Irish continues to deliver tax savings over a single

Irish structure.

TAX NOTES INTERNATIONAL, APRIL 23, 2018 527

For more Tax Notes International content, please visit www.taxnotes.com.

Das könnte Ihnen auch gefallen

- IBUS2001 Individual Journal - T319Dokument8 SeitenIBUS2001 Individual Journal - T319ZhiSingH'ng100% (1)

- MolyCorp WACC FrameworkDokument3 SeitenMolyCorp WACC FrameworkSaraQureshiNoch keine Bewertungen

- ACCT3302 Financial Statement Analysis Tutorial 1: Introduction To Financial Statement AnalysisDokument3 SeitenACCT3302 Financial Statement Analysis Tutorial 1: Introduction To Financial Statement AnalysisDylan AdrianNoch keine Bewertungen

- Case 1 - Financial Statements 2014 Using Financial Ratios To Identify Companies PDFDokument3 SeitenCase 1 - Financial Statements 2014 Using Financial Ratios To Identify Companies PDFFarhanie NordinNoch keine Bewertungen

- Foam Glass Data SheetDokument2 SeitenFoam Glass Data SheetMohamed KareemNoch keine Bewertungen

- Fracking in ColoradoDokument7 SeitenFracking in ColoradoAli Khan100% (1)

- June 2017 - Answer To Q1 by Sir HamzaDokument4 SeitenJune 2017 - Answer To Q1 by Sir HamzaHamza Abdul haqNoch keine Bewertungen

- BlackstoneJTH Credit Suisse Presentation Final WEB PDFDokument31 SeitenBlackstoneJTH Credit Suisse Presentation Final WEB PDFMikeNoch keine Bewertungen

- Country Report On The State of Plant Genetic Resources For Food and AgricultureDokument72 SeitenCountry Report On The State of Plant Genetic Resources For Food and Agriculturerhianreign estudilloNoch keine Bewertungen

- Bogan Road DistilleryDokument109 SeitenBogan Road DistilleryThe ExaminerNoch keine Bewertungen

- Avianca Prospective DIP Lender Presentation (13AUG) - PUBLICDokument46 SeitenAvianca Prospective DIP Lender Presentation (13AUG) - PUBLICAlejandro Arias100% (1)

- Glycerinization of Foliages For Dry Flower Products MakingDokument6 SeitenGlycerinization of Foliages For Dry Flower Products MakingAndreaNoch keine Bewertungen

- Theory Questions of Advance Management Accounting (CA Final)Dokument7 SeitenTheory Questions of Advance Management Accounting (CA Final)Lawrence Maretlwa33% (3)

- Sison Vs AnchetaDokument8 SeitenSison Vs AnchetaJoshua Erik MadriaNoch keine Bewertungen

- Nike Bag InvoiceDokument1 SeiteNike Bag InvoiceAshish MishraNoch keine Bewertungen

- 2015 AtcDokument27 Seiten2015 Atcmilanfan1984Noch keine Bewertungen

- Basic Accounting For Non-AccountantsDokument514 SeitenBasic Accounting For Non-AccountantsLuciano Jeffries100% (1)

- 21-61 - IR - Upper Hunter Futures Report - For Release 6 August 2021Dokument180 Seiten21-61 - IR - Upper Hunter Futures Report - For Release 6 August 2021Matthew KellyNoch keine Bewertungen

- Orchard Projections (Imperial Units)Dokument11 SeitenOrchard Projections (Imperial Units)Chandler OrchardsNoch keine Bewertungen

- Conservation Agriculture-1Dokument19 SeitenConservation Agriculture-1fakhar latif100% (1)

- 1.november 2020 Oil Market Report PDFDokument78 Seiten1.november 2020 Oil Market Report PDFJuan José M RiveraNoch keine Bewertungen

- Business Combination Case StudyDokument3 SeitenBusiness Combination Case StudyHuỳnh Minh Gia HàoNoch keine Bewertungen

- Macadamia Plant Protection Guide 2020Dokument18 SeitenMacadamia Plant Protection Guide 2020quang phamNoch keine Bewertungen

- Esia Erm LNGDokument374 SeitenEsia Erm LNGshanjanaNoch keine Bewertungen

- INTERNSHIP REPORT ON TMSS NewDokument35 SeitenINTERNSHIP REPORT ON TMSS NewTanvir ShuvoNoch keine Bewertungen

- Chapter16 CorporateGovernanceintheUKDokument13 SeitenChapter16 CorporateGovernanceintheUKzee abadillaNoch keine Bewertungen

- SCPS Emergency Response GuideDokument1 SeiteSCPS Emergency Response GuideWFTVNoch keine Bewertungen

- Index: Initiating CoverageDokument13 SeitenIndex: Initiating CoveragecchascashcNoch keine Bewertungen

- 09 Activity 1 8 Logistics ManagementDokument2 Seiten09 Activity 1 8 Logistics ManagementKatelyn Mae SungcangNoch keine Bewertungen

- Member of The Lusaka Stock ExchangeDokument20 SeitenMember of The Lusaka Stock Exchangelinda zyongweNoch keine Bewertungen

- VCS - Tool For AFOLU Non-Permanence Risk Analysis and Buffer DeterminationDokument16 SeitenVCS - Tool For AFOLU Non-Permanence Risk Analysis and Buffer DeterminationgruporeddperuNoch keine Bewertungen

- Cover Crops: P.R. Nicholas, R. Porter and G. SandersonDokument13 SeitenCover Crops: P.R. Nicholas, R. Porter and G. Sandersonzockybeshla100% (1)

- UMB Claims EG Defrauded ItDokument133 SeitenUMB Claims EG Defrauded ItLee SanderlinNoch keine Bewertungen

- United Grain GrowersDokument4 SeitenUnited Grain GrowersBoris SiraitNoch keine Bewertungen

- Research Report Bajaj Finance LTDDokument8 SeitenResearch Report Bajaj Finance LTDvivekNoch keine Bewertungen

- Rex Offer Document (Clean)Dokument732 SeitenRex Offer Document (Clean)Invest StockNoch keine Bewertungen

- FINA 615 Islamic Financial Contracts - IjarahDokument22 SeitenFINA 615 Islamic Financial Contracts - IjarahFBusinessNoch keine Bewertungen

- 2021 10 14 CAC Meeting PresentationDokument105 Seiten2021 10 14 CAC Meeting PresentationLuke ParsnowNoch keine Bewertungen

- Drilling ResolutionDokument3 SeitenDrilling ResolutionRep. Fred KellerNoch keine Bewertungen

- Manisha MinorDokument24 SeitenManisha MinorNatasha kumariNoch keine Bewertungen

- 2021 Unit 8 Tutorial QuestionsDokument7 Seiten2021 Unit 8 Tutorial Questions日日日Noch keine Bewertungen

- Enabling Long Term Infrastructure Finance in Local Currency GuarantCoDokument13 SeitenEnabling Long Term Infrastructure Finance in Local Currency GuarantCoMohammed BusariNoch keine Bewertungen

- Household Finance in India Approaches and ChallengesDokument46 SeitenHousehold Finance in India Approaches and ChallengesMohit GuptaNoch keine Bewertungen

- Arnab Roy Abhishek Mukherjee Anurag Rai Shauvik Ghosh Soumya C Pulak JainDokument15 SeitenArnab Roy Abhishek Mukherjee Anurag Rai Shauvik Ghosh Soumya C Pulak JainArnab RoyNoch keine Bewertungen

- Philippine Dragon Fruit 2 S ' M: ND Takeholder S EetingDokument52 SeitenPhilippine Dragon Fruit 2 S ' M: ND Takeholder S EetingMark Jay BaclaanNoch keine Bewertungen

- Botswana Horticulture Impact Accelarator Subsidy Guideline IASDokument2 SeitenBotswana Horticulture Impact Accelarator Subsidy Guideline IASkoxewon749Noch keine Bewertungen

- Pests of CitrusDokument29 SeitenPests of CitrusPalash MondalNoch keine Bewertungen

- Truspread Dry Silo Mortar Data SheetDokument4 SeitenTruspread Dry Silo Mortar Data SheetNguyễn QuânNoch keine Bewertungen

- International BusinessDokument19 SeitenInternational BusinessUmesh PanchalNoch keine Bewertungen

- Impact of Climate Change On The Extent of Favorable Areas For The Future Distribution of Multipurpose Agro Forestry Species in Niger: The Case of Vitellaria Paradoxa C.F. GaertnDokument8 SeitenImpact of Climate Change On The Extent of Favorable Areas For The Future Distribution of Multipurpose Agro Forestry Species in Niger: The Case of Vitellaria Paradoxa C.F. GaertnInternational Journal of Innovative Science and Research TechnologyNoch keine Bewertungen

- Chapter 3. Credit Risk Transfer MechanismsDokument16 SeitenChapter 3. Credit Risk Transfer MechanismsBelle AnnaNoch keine Bewertungen

- Commodity Trade FinanceDokument19 SeitenCommodity Trade FinanceRichard LiaoNoch keine Bewertungen

- Risk Management Process of United Grain GrowersDokument2 SeitenRisk Management Process of United Grain GrowersHenny ZahranyNoch keine Bewertungen

- Jyoti Kalra: Professional SynopsisDokument5 SeitenJyoti Kalra: Professional SynopsisJyoti Sanjay KalraNoch keine Bewertungen

- 21MBA13 Accounting For Managers: Topic: Financial Analysis of Indian OilDokument29 Seiten21MBA13 Accounting For Managers: Topic: Financial Analysis of Indian OilNikshith HegdeNoch keine Bewertungen

- Treeprint Report 2021Dokument29 SeitenTreeprint Report 2021Xx Xx100% (1)

- Tutorial 5 - Sols - Modeling System RequirementsDokument6 SeitenTutorial 5 - Sols - Modeling System RequirementsChand Divnesh100% (1)

- Primary Cluster Sub Cluster PercentageDokument17 SeitenPrimary Cluster Sub Cluster PercentageVan TraNoch keine Bewertungen

- Ecological ImbalanceDokument8 SeitenEcological ImbalanceNarendra Singh PlahaNoch keine Bewertungen

- Manual - QualiPoc Freerider IIIDokument301 SeitenManual - QualiPoc Freerider IIINdeye Fatou SyNoch keine Bewertungen

- HDFC Merger Financial ModelDokument16 SeitenHDFC Merger Financial ModelHomo SapienNoch keine Bewertungen

- Pillar 2Dokument30 SeitenPillar 2Joel IsabiryeNoch keine Bewertungen

- Finance Act 2018Dokument41 SeitenFinance Act 2018usman aliNoch keine Bewertungen

- BA 127 CorporationsDokument1 SeiteBA 127 CorporationscarlacauntayNoch keine Bewertungen

- Certificate of Indian Exemption For Certain Property or Services Delivered On A ReservationDokument2 SeitenCertificate of Indian Exemption For Certain Property or Services Delivered On A Reservationvikas_ojha54706Noch keine Bewertungen

- Sources of Data (2) Purposes of Financial Analysis (For Making Decisions) How To Analyze Financial DataDokument5 SeitenSources of Data (2) Purposes of Financial Analysis (For Making Decisions) How To Analyze Financial DataĐinh AnhNoch keine Bewertungen

- Fundamental Powers of The StateDokument15 SeitenFundamental Powers of The StateJoanne Alyssa Hernandez Lascano100% (3)

- Coca-Cola Bottlers v. Cir DigestDokument4 SeitenCoca-Cola Bottlers v. Cir DigestkathrynmaydevezaNoch keine Bewertungen

- 89.mapping Exercise ExplainedDokument8 Seiten89.mapping Exercise ExplainedTeguh Bagus SuryaNoch keine Bewertungen

- Reviewer English7Dokument3 SeitenReviewer English7Allen Hendryx PangilinanNoch keine Bewertungen

- Tds On Provison of Expenses (Tax Gls Open For Direct Manual Posting On 17.04.23 & 18.04.23 Only by Corporate Office) Urgent & Statuary ComplianceDokument1 SeiteTds On Provison of Expenses (Tax Gls Open For Direct Manual Posting On 17.04.23 & 18.04.23 Only by Corporate Office) Urgent & Statuary ComplianceArvind Kumar GuptaNoch keine Bewertungen

- FAC 3764 - Assessment 9 - QP - Final - 10 October 2023Dokument9 SeitenFAC 3764 - Assessment 9 - QP - Final - 10 October 2023mandisanomzamo72Noch keine Bewertungen

- Lecture Notes Financial Decision Making-1Dokument95 SeitenLecture Notes Financial Decision Making-1Pomri EllisNoch keine Bewertungen

- Politicas Publicas EnergeticasDokument38 SeitenPoliticas Publicas EnergeticasRodrigo Arce RojasNoch keine Bewertungen

- ESG Cheat Sheet!Dokument1 SeiteESG Cheat Sheet!Josue VargasNoch keine Bewertungen

- Chapter No.51psDokument12 SeitenChapter No.51psKamal SinghNoch keine Bewertungen

- Dabistan-e-Ijtihaad - 99 Names of Holy Prophet Muhammad (Saw)Dokument2 SeitenDabistan-e-Ijtihaad - 99 Names of Holy Prophet Muhammad (Saw)Salman MirzaNoch keine Bewertungen

- Declaration en Douane: Sender Customs Reference (If Any)Dokument1 SeiteDeclaration en Douane: Sender Customs Reference (If Any)NUR SAIDNoch keine Bewertungen

- Uber-Tax SummaryDokument1 SeiteUber-Tax SummaryKevin ValaniNoch keine Bewertungen

- FINANCE ManualDokument123 SeitenFINANCE ManualcakotyNoch keine Bewertungen

- Cbi Myanmar Garment Sector Value Chain AnalysisDokument43 SeitenCbi Myanmar Garment Sector Value Chain AnalysisWint Wah HlaingNoch keine Bewertungen

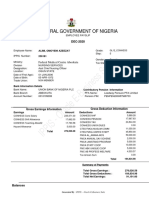

- IPPIS - Oracle E-Business Suite: Federal Government of NigeriaDokument1 SeiteIPPIS - Oracle E-Business Suite: Federal Government of NigeriaAlimi kehinde100% (1)

- GGSR (Chapter 2-Organizations-Their Political, Structural and Economic Environment)Dokument17 SeitenGGSR (Chapter 2-Organizations-Their Political, Structural and Economic Environment)Princess Alay-ay100% (2)

- PEDRO DA MOTTA VEIGA (Foreign Direct Investment in Brazil Regulation, Flows and Contribution To Development, 2004)Dokument55 SeitenPEDRO DA MOTTA VEIGA (Foreign Direct Investment in Brazil Regulation, Flows and Contribution To Development, 2004)apto123100% (1)

- Topic 7 WITHOLDING TAX Shah AlamDokument46 SeitenTopic 7 WITHOLDING TAX Shah Alamanis izzatiNoch keine Bewertungen

- Real Estate TaxesDokument5 SeitenReal Estate TaxesJorgeNoch keine Bewertungen

- Agenda Packet For Caddo Commission Meeting Dec. 9, 2021Dokument224 SeitenAgenda Packet For Caddo Commission Meeting Dec. 9, 2021Curtis HeyenNoch keine Bewertungen

- Chikita PoultryDokument14 SeitenChikita PoultryCristine Jane Moreno CambaNoch keine Bewertungen

- 2208238376Dokument1 Seite2208238376NEW GENERATIONSNoch keine Bewertungen

- BLTDokument30 SeitenBLTJemson Yandug0% (1)