Beruflich Dokumente

Kultur Dokumente

Preference Shares - May 17 2018

Hochgeladen von

Tiso Blackstar Group0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

8 Ansichten1 SeitePreference Shares - May 17 2018

Originaltitel

Preference Shares - May 17 2018

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenPreference Shares - May 17 2018

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

8 Ansichten1 SeitePreference Shares - May 17 2018

Hochgeladen von

Tiso Blackstar GroupPreference Shares - May 17 2018

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

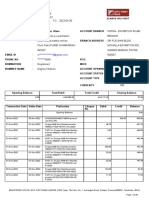

Markets and Commodity figures

17 May 2018

Company Close (cents)

Day move (cents)

Day move (%)

High Low Volume trade

12m

(000)

% move12m high 12m low Market cap Yield

(R'm) P/E ratio

KRUGER RANDS 0 0 0 0 0 0 0 0 0 0 0 0 0

KR 1625000 -20000 -1.2 1625000 1625000 0 -6.6 1940000 1600010 0 0 0 0

KRHALF 825000 0 0 0 0 0 0.6 890000 751000 0 0 0 0

KRQRTR 419000 0 0 0 0 0 4.5 445000 400000 0 0 0 0

KRTENTH 150000 0 0 0 0 0 -13.3 180000 150000 0 0 0 0

EXCHANGE TRADED PRODUCTS

0 0 0 0 0 0 0 0 0 0 0 0 0

2YRDOLLARCST 123925 1090 0.9 123925 123925 0 -13 142510 1 19.7 0 0 0

AFRICAGOLD 15995 147 0.9 15995 15892 0 -2.6 18346 15172 95.1 0 0 0

AFRICAPALLAD 12154 50 0.4 12154 12000 14 19 14392 7266 2874.7 0 0 0

AFRICAPLATIN 10998 67 0.6 10998 10908 7 -10.8 13417 10719 1617.8 0 0 0

AFRICARHODIU 26753 1086 4.2 26934 26753 0 115.9 29900 11500 387.7 0 0 0

AGLSBZ 13 -1 -7.1 13 12 275 -60.6 43 12 14 0 0 0

AMIBIG50EX-S 1290 -5 -0.4 1290 1290 0 2.8 3656 986 15.7 0 0 1.9

AMSSBP 26 0 0 26 26 0 -21.2 48 24 26 0 0 0

ANGSBR 31 0 0 31 31 0 -11.4 37 20 31 0 0 0

ASHBURTONGBL 3975 26 0.7 3996 3940 2 -2.2 4460 3550 169.8 0 0 0.6

ASHBURTONINF 2085 -1 0 2085 2076 0 0.4 2414 1812 1217.2 0 0 2.6

ASHBURTONMID 742 -4 -0.5 747 738 16 -1.1 892 695 298.4 0 0 3.8

ASHBURTONTOP 5212 -25 -0.5 5214 5195 93 9.5 5886 4222 675 0 0 1.4

ASHBURTONWOR 630 2 0.3 630 630 0 0 651 592 61.8 0 0 0

BILSBR 5 0 0 5 5 0 -83.9 43 5 5 0 0 0

BILSBS 11 0 0 11 11 0 0 37 11 11 0 0 0

CORE DIVTRAX 2855 -31 -1.1 2885 2855 14 0.4 3275 2700 296.3 0 0 1.5

CORE EWTOP40 4918 -27 -0.5 4965 4895 2 -1.3 5450 4680 164 0 0 1.7

CORE GLPROP 3126 -8 -0.3 3150 3084 26 -3.2 3855 2785 305.4 0 0 1.6

CORE LVOLTRX 2693 -7 -0.3 2693 2693 0 -1.7 2896 2530 17.3 0 0 2.8

CORE PREF 809 -1 -0.1 813 809 48 -11.9 975 765 259.2 0 0 7.5

CORE S&P500 3438 43 1.3 3455 3425 38 9.3 3998 3050 515.5 0 0 1

CORE SAPY 5725 -13 -0.2 5734 5705 7 -11.5 7345 5585 144.4 0 0 6.5

CORE TOP50 2395 -12 -0.5 2400 2384 1 12.3 2632 2008 895.9 0 0 1.1

CORESHARESGL 1029 15 1.5 1029 1023 19 8.1 1033 934 123.7 0 0 0

CORESHARESPR 1810 2 0.1 1810 1790 12 -12.3 2319 1759 270.9 0 0 6.3

DOLLARCSTDL 114255 830 0.7 114255 114255 0 -10 140850 10900 96.4 0 0 1.8

DSYSBQ 31 2 6.9 31 31 0 -3.1 48 21 29 0 0 0

ESPIBK 1535797 -1534 -0.1 1535797 1535797 0 14.5 1537331 1325679 85.5 0 0 0

ESPIBO 1422465 -1669 -0.1 1422465 1422465 0 6.2 1469937 1161496 163.6 0 0 0

EXXSBP 8 0 0 8 8 0 -75 40 8 8 0 0 0

EXXSBQ 39 0 0 39 39 0 14.7 69 34 39 0 0 0

FSRSBR 8 1 14.3 8 8 0 -52.9 22 5 7 0 0 0

FSRSBS 44 2 4.8 44 44 0 0 44 34 42 0 0 0

GFISBS 36 0 0 36 36 0 9.1 45 27 36 0 0 0

HARSBR 17 -1 -5.6 17 17 0 -45.2 33 12 18 0 0 0

IMPSBP 49 -3 -5.8 52 49 0 0 59 34 52 0 0 0

KIOSBP 6 0 0 6 6 0 -80.6 31 4 6 0 0 0

KIOSBQ 13 1 8.3 13 13 0 -60.6 33 11 12 0 0 0

KIOSBR 35 1 2.9 35 35 0 2.9 46 25 34 0 0 0

KIOSBS 31 1 3.3 31 31 0 0 39 30 30 0 0 0

KRCSTDLCRTFC 1704400 15050 0.9 1704400 1704400 0 -2.6 1954950 17255 1440.4 0 0 0

MRPSBS 8 0 0 8 8 0 -61.9 28 6 8 0 0 0

MRPSBT 38 -1 -2.6 38 38 0 0 40 27 39 0 0 0

MTNSBT 28 1 3.7 28 28 0 -17.6 39 21 27 0 0 0

NEWFUNDSEQUI 3054 -26 -0.8 3054 3046 0 3.6 3800 2700 81.6 0 0 1.2

NEWFUNDSGOVI 6045 8 0.1 6045 6020 4 10.8 6800 5374 381.8 0 0 6.2

NEWFUNDSILBI 6791 -25 -0.4 6791 6747 2 3.1 6990 6302 61.3 0 0 2.2

NEWFUNDSMAPP 2201 -12 -0.5 2201 2190 0 7.7 10000 1001 40 0 0 1.7

NEWFUNDSNEWS 5164 -46 -0.9 5164 5164 0 7.1 5636 2001 40.3 0 0 0.5

NEWFUNDSS&P 3843 8 0.2 3843 3816 0 -5.2 4070 3635 50.7 0 0 1.3

NEWFUNDSSHAR 328 1 0.3 328 328 0 7.5 420 255 50.9 0 0 2

NEWFUNDSSWIX 1788 -14 -0.8 1791 1788 0 8.4 1941 1416 18 0 0 0.6

NEWFUNDSTRAC 2352 -1 0 2356 2347 55 6.9 2356 2129 120.4 0 0 5.2

NEWGOLD 10929 45 0.4 10929 10873 7 -10.8 13327 10605 9033.7 0 0 0

NEWGOLDISSUE 15297 57 0.4 15370 15161 1073 -3.2 17677 14547 13240.2 0 0 0

NEWGOLDPLLDM 12148 70 0.6 12200 12037 191 18.9 14305 9751 1701.1 0 0 0

NFEQUITYVALU 1026 -1 -0.1 1026 1026 0 0 1064 967 34.1 0 0 0

NFLOWVLTLTY 1034 1 0.1 1034 1034 0 0 1063 978 31.2 0 0 0

NPNSBR 6 1 20 6 6 0 -80.6 31 5 5 0 0 0

NPNSBS 25 1 4.2 25 25 0 -13.8 47 17 24 0 0 0

NPNSBT 37 1 2.8 39 37 11 0 54 33 36 0 0 0

SATRIX40PRTF 5213 -18 -0.3 5238 5193 338 9.5 5592 4460 8159.9 0 0 1.1

SATRIXDIVIPL 255 1 0.4 256 253 140 20.9 274 196 1677.4 0 0 1.4

SATRIXFINI 1720 -27 -1.5 1743 1717 64 13 1905 1432 834 0 0 3.7

SATRIXILBI 584 -1 -0.2 587 584 17 4.7 644 394 23.5 0 0 2.8

SATRIXINDI 7677 -31 -0.4 7705 7621 13 4.4 8850 6907 2296.1 0 0 0.9

SATRIXMSCI 3477 36 1 3489 3430 16 6.3 3974 3080 360.3 0 0 0

SATRIXMSCIEM 3778 26 0.7 3779 3746 8 5.1 4400 3336 336.7 0 0 0

SATRIXNASDAQ 4851 55 1.1 4858 4813 3 0 4879 4410 58.6 0 0 0

SATRIXPRTFL 1914 4 0.2 1920 1900 20 -12.5 2302 1820 81.6 0 0 5.8

SATRIXQLTY 900 -12 -1.3 909 900 9 17.2 1086 763 133.5 0 0 1.1

SATRIXRAFI40 1471 -3 -0.2 1480 1464 25 15.7 1502 1171 1030 0 0 1.2

SATRIXRESI 4171 31 0.7 4186 4156 7 25.2 4186 2985 355.5 0 0 2.3

SATRIXS&P500 3320 42 1.3 3330 3267 27 7.7 3850 2881 231.9 0 0 0

SATRIXSWIXTO 1149 -8 -0.7 1149 1145 9 6 1344 1013 489.6 0 0 1.2

SBKSBS 7 2 40 7 7 0 -69.6 28 5 5 0 0 0

SBKSBT 36 3 9.1 36 34 90 0 38 26 33 0 0 0

SHPSBP 40 2 5.3 40 40 0 0 40 33 38 0 0 0

SOLSBY 5 -2 -28.6 5 5 0 -82.8 39 5 7 0 0 0

STANLIB 5794 199 3.6 5794 5560 20 -8.6 7748 5403 105.8 0 0 7.8

STANLIBG7GOV 6727 65 1 6727 6727 0 0 6900 6401 6.1 0 0 0

STANLIBGLOBA 1555 0 0 1555 1555 0 0 1641 1371 7 0 0 0.6

STANLIBMSCI 3480 43 1.3 3480 3480 0 0 3480 3080 42 0 0 0

STANLIBS&P50 16613 214 1.3 16613 16395 0 0 16613 14774 14.4 0 0 0

STANLIBSWIX4 1149 -8 -0.7 1156 1142 15 6.2 1410 958 2072.1 0 0 1.4

STANLIBTOP40 5200 -21 -0.4 5207 5178 2 9.2 5895 4425 720.9 0 0 1

SYGNIAITRIX 2154 32 1.5 2154 2136 0 -3.5 2320 1917 221.4 0 0 0

SYGNIAITRIXG 3234 15 0.5 3234 3230 2 -11.8 3898 2775 300.4 0 0 0.3

SYGNIAITRIXS 3485 44 1.3 3493 3478 2 -1.8 3838 3118 847.9 0 0 0.2

SYGNIAITRIXT 5251 -24 -0.5 5251 5251 0 -1.7 5527 4739 211 0 0 0

TOPSBX 5 1 25 5 5 0 -86.1 75 4 4 0 0 0

TOPSBY 28 2 7.7 28 28 0 -33.3 126 25 26 0 0 0

TOPSBZ 33 1 3.1 34 32 250 0 84 32 32 0 0 0

TOPSKQ 775 47 6.5 775 775 0 86.7 1554 160 728 0 0 0

TOPSKR 965 48 5.2 965 965 0 64.1 1750 333 917 0 0 0

TOPSKS 602 44 7.9 602 602 0 0 1573 495 558 0 0 0

TOPSKT 427 41 10.6 427 410 90 0 933 386 386 0 0 0

TOPSKV 252 40 18.9 252 252 0 0 640 202 212 0 0 0

TRUSBP 34 2 6.3 34 34 0 0 34 21 32 0 0 0

DEBT 0 0 0 0 0 0 0 0 0 0 0 0 0

ABSA 68301 -599 -0.9 68500 68100 33 -8.9 76500 64001 3407 34.5 0 10.6

AECI5,5% 1375 0 0 0 0 0 -22.3 1775 1300 41.3 0 0 7.2

AFRICANOVER 1052 0 0 0 0 0 -24.9 1500 1050 2.9 0 0 1.1

AFRICANPHNX 2150 0 0 0 0 0 -35.8 3400 2101 290.7 0 0 0

BARWORLD6%PR 121 0 0 0 0 0 -7.6 137 121 0.5 0 0 9.9

CAPITEC-P 8000 0 0 8000 8000 0 -13.5 9750 7361 100 0 0 10.8

CAXTON-P 19000 0 0 0 0 0 0 19000 19000 9.5 0 0 3

CULLINAN 100 0 0 0 0 0 -6.5 100 100 0.5 0 0 11

DISC-B-P 8400 0 0 8400 8400 1 -17.6 10000 7690 672 0 0 12.4

FIRSTRANDB-P 7670 -120 -1.5 7795 7670 13 -5.9 8200 6750 3505.5 0 0 10.2

FOSCHINI 124 0 0 0 0 0 -27.1 170 124 0.2 0 0 10.5

GRINDRODPREF 6900 -50 -0.7 6901 6900 3 -3.9 7821 6499 514.3 0 0 13.2

IBRDMBLPRF1 100730 0 0 0 0 0 -0.3 101960 100295 344.2 0 0 5.9

ILRDMBLPRF2 100784 0 0 0 0 0 0 101657 100326 214.6 0 0 5.7

IMPERIALPREF 6800 0 0 6800 6800 9 -9.3 7899 6650 308.7 0 0 12.6

INVESTEC 7380 130 1.8 7380 7300 3 -10.1 8605 6900 1120 0 0 11.8

INVESTECPREF 8865 0 0 0 0 0 4.3 11100 7999 244.2 0 0 2.5

INVICTA-P 8250 0 0 8251 8250 4 -13.5 9925 8002 618.8 0 0 13.9

LIBERTY11C 108 0 0 0 0 0 -1.8 150 101 16.2 0 0 10.2

NAMPAK6%PREF 125 0 0 0 0 0 -26.5 170 125 0.5 0 0 9.6

NAMPAK6,5%PR 111 0 0 0 0 0 -26 120 111 0.1 0 0 11.7

NEDBANKPREF 880 -15 -1.7 895 860 194 0.5 925 810 3206.6 0 0 9.8

NETCAREPREF 6706 0 0 6706 6702 10 -22 9000 6500 435.9 0 0 12.7

PSGSERV 6950 0 0 6980 6950 15 -8.5 8050 6400 1210.4 0 0 12.4

RECMANDCLBR 2000 0 0 2000 2000 16 -14.9 2475 1850 948 0 0 0

REXTRFRM 200 0 0 0 0 0 100 200 120 0.3 0 0 6

SASFIN-P 6750 0 0 0 0 0 -10.1 7900 6600 121.3 0 0 12.7

STANDARD-P 7960 10 0.1 7990 7960 22 -0.6 8500 7202 4212.1 0 0 10

STD 67 0 0 0 0 0 -16.3 86 67 5.4 0 0 9.7

STEINHOFF-P 4401 0 0 0 0 0 -42.2 7900 1750 660.2 0 0 9.8

ZAMBEZIRF 5950 0 0 0 0 0 9.6 6425 5300 9514.4 0 0 0

OTHER 0 0 0 0 0 0 0 0 0 0 0 0 0

DBSTBNPN 92398 0 0 92398 92398 0 0 116078 1 10788.1 0 0 0

DBSTBNPP 37869 0 0 37869 37869 3 0 57150 33500 4920 0 0 0

DBSTBNPR 36476 0 0 41717 36476 1 0 60967 30220 4234.1 0 0 0

DBSTBXX6 4903 87 1.8 4903 4903 0 0 6956 2915 240.8 0 0 33.8

INVLTD 1132796 -1437 -0.1 1132796 1132796 0 20.6 1134233 9962 12.5 0 0 0

ASSET BACKED SECURITIES

0 0 0 0 0 0 0 0 0 0 0 0 0

ADBEE(RF) 5575 35 0.6 5575 5500 3 27.4 5989 4000 1431.7 0 0 0

DBMSCIAFETN 11536 -31 -0.3 11536 11536 0 9 12250 10250 2313.4 0 0 0

DBMSCICHETN 7719 39 0.5 7719 7719 0 28.6 41275 5900 1536 0 0 0

DBMSCIEMETN 6238 0 0 6238 6238 0 10.2 47325 4237 1247.6 0 0 0

FRKBONDGOLD 1701250 15850 0.9 1701250 1701250 0 -1.5 1942200 1612300 2353.2 0 0 0

FRSFRPT9JUN1 114500 700 0.6 114500 114500 0 -9.5 138800 112350 837.2 0 0 0

GOLDCMMDTY-L 17790 154 0.9 17790 17732 0 -3.4 20534 16911 176.4 0 0 0

IBLUSDZAROCT 126694 1070 0.9 126694 126694 0 -4.3 145570 116000 439.7 0 0 1

IBSWX40TR2ET 18779 -65 -0.3 18779 18779 0 -0.1 20256 1 942.2 0 0 0

IBTOP40CLIQU 128111 895 0.7 128111 128111 0 7.9 130581 110223 1.3 0 0 0

IBTOP40TR2ET 7442 -38 -0.5 7442 7442 0 1.2 7819 1 953.7 0 0 0

ZA084 77700 0 0 0 0 0 0 0 0 108.8 0 0 0

ASSET BACKED SECURITIES

0 0 0 0 0 0 0 0 0 0 0 0 0

ADBEE(RF) 4815 -80 -1.6 4895 4815 2 45.8 5200 3100 1265 0 0 0

DBGLOBE 19739 0 0 0 0 0 0 0 0 2 0 0 0

DBHAVEN 31452 0 0 0 0 0 0 0 0 3.1 0 0 0

DBMSCIAFETN 11274 6 0.1 11274 11274 0 2.9 55585 8018 2253.6 0 0 0

DBMSCICHETN 6894 47 0.7 6894 6880 0 26.8 7497 5038 1369.4 0 0 0

DBMSCIEMETN 6027 5 0.1 6027 6005 0 16.3 6300 4237 1204.4 0 0 0

FRKBONDGOLD 1774000 -13800 -0.8 1774000 1774000 0 -5.4 1988900 1611900 2496.1 0 0 0

FRSFRPT9JUN1 132050 -400 -0.3 132050 132050 0 -12.1 155600 65901 974.4 0 0 0

GOLDCMMDTY-L 18889 -134 -0.7 18946 18889 0 13 21485 16711 190.2 0 0 0

IBETNT1CT46 1389135 0 0 0 0 0 0.1 1403037 1385563 48.6 0 0 0

IBGOLDENETN 12654 -25 -0.2 12654 12654 0 -18.6 17000 1 352.2 0 0 0

IBLUSDZAROCT 132475 -725 -0.5 132475 132475 0 -1.2 144142 125059 466.2 0 0 0

IBSWX40TRI 17697 32 0.2 17697 17697 0 5.7 17941 12618 883.3 0 0 0

SILVERCOMMOD 14894 -77 -0.5 14894 14894 0 -26.2 22935 13989 74.9 0 0 0

SBCOPPERETN 1329 -4 -0.3 1329 1329 0 8 1439 911 133.3 0 0 0

SBCORNETN 820 -46 -5.3 820 820 0 -16.2 979 765 43.3 0 0 0

SBWHEATETN 764 -41 -5.1 764 764 0 -10.7 856 618 40.3 0 0 0

SBWTIOIL 830 -1 -0.1 830 830 0 -20 1124 750 290.9 0 0 0

These figures are supplied by parties external to Business Day. Business Day will not warrant the accuracy of the figures.

Das könnte Ihnen auch gefallen

- Anti Corruption Working GuideDokument44 SeitenAnti Corruption Working GuideTiso Blackstar GroupNoch keine Bewertungen

- Anti-Money Laundering Risks To Financial InstitutionsDokument16 SeitenAnti-Money Laundering Risks To Financial InstitutionsLexisNexis Risk Division100% (7)

- Two MillionDokument19 SeitenTwo MillionFazal Ahmed100% (1)

- Money in The Nation's EconomyDokument18 SeitenMoney in The Nation's EconomyAnne Gatchalian67% (3)

- IDFCFIRSTBankstatement 10094802422Dokument33 SeitenIDFCFIRSTBankstatement 10094802422vikas jainNoch keine Bewertungen

- (Springer Finance) Dr. Manuel Ammann (Auth.) - Credit Risk Valuation - Methods, Models, and Applications-Springer Berlin Heidelberg (2001)Dokument258 Seiten(Springer Finance) Dr. Manuel Ammann (Auth.) - Credit Risk Valuation - Methods, Models, and Applications-Springer Berlin Heidelberg (2001)Amel AmarNoch keine Bewertungen

- Open Letter To President Ramaphosa - FinalDokument3 SeitenOpen Letter To President Ramaphosa - FinalTiso Blackstar GroupNoch keine Bewertungen

- Critical Skills List - Government GazetteDokument24 SeitenCritical Skills List - Government GazetteTiso Blackstar GroupNoch keine Bewertungen

- Macroeconomics 9th Edition Mankiw Solutions Manual DownloadDokument20 SeitenMacroeconomics 9th Edition Mankiw Solutions Manual DownloadEric Gaitor100% (21)

- PreferenceSharesDokument1 SeitePreferenceSharesTiso Blackstar GroupNoch keine Bewertungen

- PreferenceShares PDFDokument1 SeitePreferenceShares PDFTiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - July 25 2018Dokument1 SeitePreference Shares - July 25 2018Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - July 30 2018Dokument1 SeitePreference Shares - July 30 2018Tiso Blackstar GroupNoch keine Bewertungen

- PreferenceSharesDokument1 SeitePreferenceSharesTiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - July 12 2018Dokument1 SeitePreference Shares - July 12 2018Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - July 27 2018Dokument1 SeitePreference Shares - July 27 2018Tiso Blackstar GroupNoch keine Bewertungen

- PreferenceSharesDokument1 SeitePreferenceSharesTiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - October 3 2019Dokument1 SeitePreference Shares - October 3 2019Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - July 19 2018Dokument1 SeitePreference Shares - July 19 2018Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - June 11 2018Dokument1 SeitePreference Shares - June 11 2018Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - September 9 2019Dokument1 SeitePreference Shares - September 9 2019Lisle Daverin BlythNoch keine Bewertungen

- PreferenceSharesDokument1 SeitePreferenceSharesTiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - August 12 2019Dokument1 SeitePreference Shares - August 12 2019Tiso Blackstar GroupNoch keine Bewertungen

- PreferenceSharesDokument1 SeitePreferenceSharesTiso Blackstar GroupNoch keine Bewertungen

- PreferenceShares - March 27 2018Dokument1 SeitePreferenceShares - March 27 2018Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - July 24 2018Dokument1 SeitePreference Shares - July 24 2018Tiso Blackstar GroupNoch keine Bewertungen

- PreferenceShares PDFDokument1 SeitePreferenceShares PDFTiso Blackstar GroupNoch keine Bewertungen

- PreferenceSharesDokument1 SeitePreferenceSharesTiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - October 23 2018Dokument1 SeitePreference Shares - October 23 2018Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - October 24 2018Dokument1 SeitePreference Shares - October 24 2018Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - April 11 2018Dokument1 SeitePreference Shares - April 11 2018Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - May 10 2018Dokument1 SeitePreference Shares - May 10 2018Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - July 26 2019Dokument1 SeitePreference Shares - July 26 2019Lisle Daverin BlythNoch keine Bewertungen

- Preference Shares - June 28 2018Dokument1 SeitePreference Shares - June 28 2018Tiso Blackstar GroupNoch keine Bewertungen

- PreferenceSharesDokument1 SeitePreferenceSharesTiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - September 17 2019Dokument1 SeitePreference Shares - September 17 2019Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - July 31 2018Dokument1 SeitePreference Shares - July 31 2018Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - September 16 2019Dokument1 SeitePreference Shares - September 16 2019Lisle Daverin BlythNoch keine Bewertungen

- Preference Shares - May 28 2019Dokument1 SeitePreference Shares - May 28 2019Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - April 15 2019Dokument1 SeitePreference Shares - April 15 2019Lisle Daverin BlythNoch keine Bewertungen

- Preference Shares - October 11 2018Dokument1 SeitePreference Shares - October 11 2018Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - May 26 2019Dokument1 SeitePreference Shares - May 26 2019Lisle Daverin BlythNoch keine Bewertungen

- PreferenceSharesDokument1 SeitePreferenceSharesTiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - July 18 2018Dokument1 SeitePreference Shares - July 18 2018Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - September 11 2019Dokument1 SeitePreference Shares - September 11 2019Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - July 23 2018Dokument1 SeitePreference Shares - July 23 2018Tiso Blackstar GroupNoch keine Bewertungen

- PreferenceShares - February 22 2018Dokument1 SeitePreferenceShares - February 22 2018Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - September 15 2019Dokument1 SeitePreference Shares - September 15 2019Anonymous yid6usiNNoch keine Bewertungen

- Preference Shares - October 17 2018Dokument1 SeitePreference Shares - October 17 2018Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - July 24 2019Dokument1 SeitePreference Shares - July 24 2019Lisle Daverin BlythNoch keine Bewertungen

- Preference Shares - July 31 2019Dokument1 SeitePreference Shares - July 31 2019Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - July 16 2019Dokument1 SeitePreference Shares - July 16 2019Tiso Blackstar GroupNoch keine Bewertungen

- PreferenceSharesDokument1 SeitePreferenceSharesTiso Blackstar GroupNoch keine Bewertungen

- PreferenceShares - February 21 2018Dokument1 SeitePreferenceShares - February 21 2018Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - September 6 2019Dokument1 SeitePreference Shares - September 6 2019Anonymous ZXo7Xf4Noch keine Bewertungen

- Preference Shares - September 2 2019Dokument1 SeitePreference Shares - September 2 2019Tiso Blackstar GroupNoch keine Bewertungen

- PreferenceSharesDokument1 SeitePreferenceSharesTiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - February 27 2018Dokument1 SeitePreference Shares - February 27 2018Tiso Blackstar GroupNoch keine Bewertungen

- PreferenceShares - June 27 2018Dokument1 SeitePreferenceShares - June 27 2018Tiso Blackstar GroupNoch keine Bewertungen

- PreferenceShares - December 20 2017Dokument1 SeitePreferenceShares - December 20 2017Tiso Blackstar GroupNoch keine Bewertungen

- PreferenceShares - June 23 2017Dokument1 SeitePreferenceShares - June 23 2017Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - July 10 2018Dokument1 SeitePreference Shares - July 10 2018Tiso Blackstar GroupNoch keine Bewertungen

- PreferenceShares - April 10 2018Dokument1 SeitePreferenceShares - April 10 2018Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - July 29 2019Dokument1 SeitePreference Shares - July 29 2019Lisle Daverin BlythNoch keine Bewertungen

- Preference Shares - August 28 2019Dokument1 SeitePreference Shares - August 28 2019Lisle Daverin BlythNoch keine Bewertungen

- Preference Shares - April 11 2019Dokument1 SeitePreference Shares - April 11 2019Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - September 18 2019Dokument1 SeitePreference Shares - September 18 2019Anonymous MPsxhBNoch keine Bewertungen

- PreferenceShares PDFDokument1 SeitePreferenceShares PDFTiso Blackstar GroupNoch keine Bewertungen

- Government Publications: Key PapersVon EverandGovernment Publications: Key PapersBernard M. FryNoch keine Bewertungen

- Ramaphosa's Letter To MkhwebaneDokument1 SeiteRamaphosa's Letter To MkhwebaneTiso Blackstar GroupNoch keine Bewertungen

- Shoprite Food Index 2023Dokument19 SeitenShoprite Food Index 2023Tiso Blackstar GroupNoch keine Bewertungen

- Arena Holdings Pty LTD - BBBEE Certificate - 2023Dokument2 SeitenArena Holdings Pty LTD - BBBEE Certificate - 2023Tiso Blackstar GroupNoch keine Bewertungen

- Letter From Reuel Khoza Chairman of The Eskom Board 1999Dokument2 SeitenLetter From Reuel Khoza Chairman of The Eskom Board 1999Tiso Blackstar GroupNoch keine Bewertungen

- Collective InsightDokument10 SeitenCollective InsightTiso Blackstar GroupNoch keine Bewertungen

- Ramaphosa's Letter To MkhwebaneDokument1 SeiteRamaphosa's Letter To MkhwebaneTiso Blackstar GroupNoch keine Bewertungen

- Ramaphosa's Letter To MkhwebaneDokument1 SeiteRamaphosa's Letter To MkhwebaneTiso Blackstar GroupNoch keine Bewertungen

- JP Verster's Letter To African PhoenixDokument2 SeitenJP Verster's Letter To African PhoenixTiso Blackstar GroupNoch keine Bewertungen

- BondsDokument3 SeitenBondsTiso Blackstar GroupNoch keine Bewertungen

- Statement From The SA Tourism BoardDokument1 SeiteStatement From The SA Tourism BoardTiso Blackstar GroupNoch keine Bewertungen

- Letter From Reuel Khoza Chairman of The Eskom Board 1999Dokument2 SeitenLetter From Reuel Khoza Chairman of The Eskom Board 1999Tiso Blackstar GroupNoch keine Bewertungen

- JudgmentDokument30 SeitenJudgmentTiso Blackstar GroupNoch keine Bewertungen

- FairbairnDokument2 SeitenFairbairnTiso Blackstar GroupNoch keine Bewertungen

- LibertyDokument1 SeiteLibertyTiso Blackstar GroupNoch keine Bewertungen

- BondsDokument3 SeitenBondsTiso Blackstar GroupNoch keine Bewertungen

- Tobacco Bill - Cabinet Approved VersionDokument41 SeitenTobacco Bill - Cabinet Approved VersionTiso Blackstar GroupNoch keine Bewertungen

- Collective Insight September 2022Dokument14 SeitenCollective Insight September 2022Tiso Blackstar GroupNoch keine Bewertungen

- Fuel Prices - June 28 2022Dokument1 SeiteFuel Prices - June 28 2022Tiso Blackstar GroupNoch keine Bewertungen

- Sanlam Stratus Funds - June 1 2021Dokument2 SeitenSanlam Stratus Funds - June 1 2021Lisle Daverin BlythNoch keine Bewertungen

- Forward Rates - June 29 2022Dokument2 SeitenForward Rates - June 29 2022Tiso Blackstar GroupNoch keine Bewertungen

- Forward Rates - June 30 2022Dokument2 SeitenForward Rates - June 30 2022Tiso Blackstar GroupNoch keine Bewertungen

- The ANC's New InfluencersDokument1 SeiteThe ANC's New InfluencersTiso Blackstar GroupNoch keine Bewertungen

- Forward Rates - June 28 2022Dokument2 SeitenForward Rates - June 28 2022Tiso Blackstar GroupNoch keine Bewertungen

- Fuel Prices - June 30 2022Dokument1 SeiteFuel Prices - June 30 2022Tiso Blackstar GroupNoch keine Bewertungen

- 1 Introduction To BankingDokument8 Seiten1 Introduction To BankingGurnihalNoch keine Bewertungen

- Accounting NotesDokument6 SeitenAccounting NotesHimanshu SinghNoch keine Bewertungen

- Unit Test 5Dokument6 SeitenUnit Test 5Madalina Fira0% (1)

- 11.25.2017 Accounting For Income TaxDokument5 Seiten11.25.2017 Accounting For Income TaxPatOcampo0% (1)

- NIB Annual Report 2015Dokument216 SeitenNIB Annual Report 2015Asif RafiNoch keine Bewertungen

- Audit of Property, Plant and Equipment: Auditing ProblemsDokument5 SeitenAudit of Property, Plant and Equipment: Auditing ProblemsLei PangilinanNoch keine Bewertungen

- Fund Rankings Sovereign Wealth Fund InstituteDokument3 SeitenFund Rankings Sovereign Wealth Fund Institutelohenci_sammyNoch keine Bewertungen

- Research Paper - MN559990 - Batch35 - PDFDokument17 SeitenResearch Paper - MN559990 - Batch35 - PDFkhushboo sharmaNoch keine Bewertungen

- You Will Get Questions From This Too 1Z0-1056-21 Oracle Financials Cloud Receivables 2021 Implementation ProfessionalDokument28 SeitenYou Will Get Questions From This Too 1Z0-1056-21 Oracle Financials Cloud Receivables 2021 Implementation ProfessionalSamima KhatunNoch keine Bewertungen

- Tools and Techniques of NPADokument9 SeitenTools and Techniques of NPAPruthviraj RathoreNoch keine Bewertungen

- CLS Gathers Momentum, Rao, CCILDokument6 SeitenCLS Gathers Momentum, Rao, CCILShrishailamalikarjunNoch keine Bewertungen

- Bajaj Allianz InsuranceDokument93 SeitenBajaj Allianz InsuranceswatiNoch keine Bewertungen

- Ticks Hunter Bot GuideDokument7 SeitenTicks Hunter Bot GuideKingtayNoch keine Bewertungen

- Twelve-Month Cash Flo YEAR 1: Jan-18 Fiscal Year BeginsDokument1 SeiteTwelve-Month Cash Flo YEAR 1: Jan-18 Fiscal Year BeginsTun Izlinda Tun BahardinNoch keine Bewertungen

- Anup TransactionsDokument6 SeitenAnup TransactionsNirupam DewanjiNoch keine Bewertungen

- A Corporate BondDokument2 SeitenA Corporate BondMuhammad KhurramNoch keine Bewertungen

- Week 012-Presentation Key Concepts of Simple and Compound Interests, and Simple and General Annuities - Part 002Dokument18 SeitenWeek 012-Presentation Key Concepts of Simple and Compound Interests, and Simple and General Annuities - Part 002Alleona EmbolodeNoch keine Bewertungen

- Central Bank-Monetary Policy ReviewDokument6 SeitenCentral Bank-Monetary Policy ReviewAda DeranaNoch keine Bewertungen

- Memorandum of Association of Reliance Industries LimitedDokument4 SeitenMemorandum of Association of Reliance Industries LimitedVarsha ArunNoch keine Bewertungen

- 347Dokument2 Seiten347TarkimNoch keine Bewertungen

- Chapter 10 - Risk Response Audit Strategy Approach and Program - NotesDokument9 SeitenChapter 10 - Risk Response Audit Strategy Approach and Program - NotesSavy DhillonNoch keine Bewertungen

- SG ITAD Ruling No. 019-03Dokument4 SeitenSG ITAD Ruling No. 019-03Paul Angelo TombocNoch keine Bewertungen

- Ra 6977Dokument12 SeitenRa 6977Kobe MambaNoch keine Bewertungen

- Balance Sheet AnalysisDokument2 SeitenBalance Sheet AnalysisAishaNoch keine Bewertungen