Beruflich Dokumente

Kultur Dokumente

MBIE On Treasury KiwiBuild Figures

Hochgeladen von

Henry Cooke0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

61K Ansichten3 SeitenMBIE on Treasury KiwiBuild figures

Originaltitel

MBIE on Treasury KiwiBuild figures

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenMBIE on Treasury KiwiBuild figures

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

61K Ansichten3 SeitenMBIE On Treasury KiwiBuild Figures

Hochgeladen von

Henry CookeMBIE on Treasury KiwiBuild figures

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 3

MINISTRY OF BUSINESS,

INNOVATION & EMPLOYMENT

MIKINA WHAKATUTUKI

AIDE MEMOIRE

Impact of KiwiBuild on residential investment forecasts

Dat 18 May 2018 ~ [Priority [igh -

Security Unclassified ‘Tracker number:

Classification:

[oso 17-48

Purpose

Below, we provide advice on the additional residential investment that can be expected as a result

of KiwiBuild

Jo Doyle

General Manager, Housing & Urban Branch

4

Ministry of Business, Innovation and Employment

[51.31 ZQ0e

Budget economic and fiscal update

1. As part of Thursday's Budget, Treasury will publish its budget economic and fiscal update

(BEFU), which includes economic forecasts out to June 2022. One of these forecasts is the

value of investment in residential construction, which Treasury uses as an input to its forecasts.

for tax revenue.

2. You have received advice from Treasury that describes its latest assumptions regarding the

impact that KiwiBuild will have on the residential investment forecast in BEFU. Treasury is

forecasting that around $2.5 billion of additional residential investment will occur in the period

to June 2022, half of what it was forecasting six months ago (HYEFU).

3. Treasury assumes that KiwiBuild will support a similar amount of investment overall as it was

assuming six months ago, but that changes to when the Government will spend its capital

have shifted the investment profile out. In short, Treasury is still assuming that a further

$2.5 billion will stil be invested, but not until after June 2022.

4, Below, we compare Treasurys forecasts with the range of residential investment that MBIE,

estimated in its advice to Treasury, noting that our estimates did not discount for capacity

constraints or substitution:

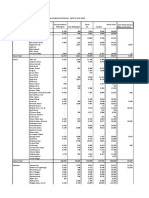

Esiimated residential investment | 2018/19 | 2019/20 | 2020/21 [2021/22 | Total 2016-22

HYEFU szam_ | s7z0m__| $2,069m | $2,620m $5,441

BEFU ‘sOm 323m) seaim [_ $1,387m $2,551m

MBIE (no substitution / constraints) | $430m_| $1.1 - $2.1b | $1.6- $4.1b | $1.6-$4.9b | $4.8-$11.66

2408 17-18

In confidence 2

Spending timetable

5. The reason Treasury based its BEFU forecast on a longer investment timeframe than it was

assuming six months ago is because of the indicative impact on net debt that Cabinet noted

when it decided the appropriations for KiwiBuild in April [CAB-18-MIN-0142]. Six months ago,

Treasury assumed that the $2 billion the Government was budgeting for KiwiBuild would be

spent in two equal halves over the next two years (and then recycled thereaffer). In contrast,

Cabinet has now noted an indicative timetable in which the impact on net debt would ramp up

to $2 billion over three years, rather than two.

Issues with Treasury's assumptions

6. Treasury makes three assumptions:

a. first, that the indicative timetable Cabinet has noted is a timetable of capital

expenditure;

b. secondly, that capital expenditure precedes residential investment (meaning there is a

delay between the two); and

c. thirdly, that only the KiwiBuild component of developments count as additional

residential investment,

7. In fact, Cabinet has approved a multi-year appropriation for KiwiBuild, which means that the

$2 billion can be spent as fast as projects can be found to invest in. Thus, the timetable

Cabinet has noted is not a timetable of capital expenditure. Itis a timetable of resulting net

debt. Concealed within the expected impact on net debt at the end of any one financial year is

higher expenditure during the year that is offset by income from sales.

8. Secondly, during the first four years of KiwiBuild, we expect that the Buying Off the Plans

programme will be the delivery method through which the majority of KiwiBuild homes are

sourced. In the case of this programme, the majority of expenditure will follow residential

investment, rather than precede it, meaning there will be no delay.

9. Thirdly, only counting KiwiBuild homes ignores the greater residential investment that

KiwiBuild will drive in non-KiwiBuild homes.

Net effect of operating expenses and sales revenue

10. Cabinet has noted that the expected impact on net debt will be $210 million in the 2018-19

financial year under a new output expense appropriation for KiwiBuild housing [CAB-18-MIN-

0142}. This is an indicative estimate of net operating expenditure for the Buying Off the Plans

programme at the end of its first year.

11. As a net figure, it conceals the potential to spend $500 million on purchasing new homes and

then on-selling more than half of them before the end of the year. In this scenario, the actual

expenditure would be $500 milion, offset by revenue of $290 milion, for net operating

expenses of $210 milion at year's end. The $500 million is the expengiture that impacts

residential investment, not the net operating expense of $210 milion.

12, The indicative expenses are also misleading because of the accounting treatment that

underpinned the timetable that Cabinet noted. Although cash flows out when the Crown first

purchases the house, for accounting purposes the expense is not incurred until the house is

on-sold, In the meantime it is simply treated as inventory.

Residential investment before expenditure

13, Buying off the plans enables the Crown to induce high levels of residential investment from low

levels of initial expenditure. If committing to actually purchase the house, the Crown can

3406 17-18

In confidence 3

expect to pay a 10% deposit up front and then not have to pay the other 90% until the home is

completed. In between, the developer actually builds the new homes. Thus, a 10% deposit is.

enough to induce 100% of the residential investment required to construct a home before the

other 90% of the purchase price is required.

14, Alternatively, the Crown can guarantee to purchase @ new home if the developer is unable to

sellit. In this case, the Crown pays nothing up front, but its guarantee still induces 100% of

the residential investment for the guaranteed homes. Even if the Crown needs to incur an

expense against the chance that the guarantee will be triggered, when spread across the total

portfolio of homes under guarantee, this provision is likely to be a relatively low proportion of

total value (e.g. 10-20%). Again, therefore, low expenses induce high residential investment.

15. As above, assume targeted expenditure of $500 million for the first year of KiwiBuild, with

$100 million allocated to the guarantee and the other $400 million to actual purchases. If we

budget for the Crown to have to purchase 20% of the homes it quarantees, a budget of

$100 million underwrites $500 million of KiwiBuild housing. Add that to the $400 million of

actual purchases and the result is $900 million worth of housing in the first year.

16. Ifwe then assume that before the end of the year the Crown on-sells $290 million of the

homes it actually buys, the result is that the $210 million of net operating expenses that

Cabinet has noted can actually conceal total sales of $900 million, If we roughly assume that

the value of the land is 40% of that total, it suggests total residential investment of

$540 milion

Leveraging investment in non-KiwiBuild homes

17. If the Crown underwrites 40% of a development for KiwiBuild, it not only accelerates the

delivery of the KiwiBuild homes, it also accelerates the delivery of the non-KiwiBuild homes.

Assuming the KiwiBuild homes are 40% of the total number of houses in each development,

‘$900 milion of KiwiBuild housing will be part of over $2 billion of total housing, suggesting over

$1 billion of residential investment.

Is it additional investment?

18. If the Crown is purchasing or guaranteeing homes in developments that the private sector was

going to deliver anyway, then the development itself is not additional. If the same value of

housing is delivered within that development then the development's residential investment is

not additional overall

19. However, the key is timing. Consider a development that will take a year to sell off the plans

‘and then a further year to build. The day it goes on sale, the Crown commits to buying half of

the homes. On the strength of that commitment, the bank releases the finance and the whole

development is built a year earlier. in this case, 100% of the residential investment is

additional to the current year, because without KiwiBuild none of that investment would have

‘occurred until the following year.

20. Thus, the extent to which the investment is additional depends on how long it would have

taken for development to ocour absent the Crown's involvement,

Conclusion

21. In light of the considerations above, and informed by the investment range we provided, we

considered that Treasury's forecasts in HYEFU remained more accurate and so

recommended to Treasury that they be retained,

04 17-18

In confidence 4

Das könnte Ihnen auch gefallen

- Executive Summary 17 December 2019 - MJ Dew QCDokument9 SeitenExecutive Summary 17 December 2019 - MJ Dew QCHenry Cooke100% (1)

- Islamic Womens Council SubmissionDokument2 SeitenIslamic Womens Council SubmissionHenry CookeNoch keine Bewertungen

- Letter To Select CommitteeDokument1 SeiteLetter To Select CommitteeHenry CookeNoch keine Bewertungen

- How Much Each School Will GetDokument35 SeitenHow Much Each School Will GetHenry Cooke0% (1)

- Federated Farmers SubmissionDokument14 SeitenFederated Farmers SubmissionHenry CookeNoch keine Bewertungen

- Rural Women of NZ SubmissionDokument2 SeitenRural Women of NZ SubmissionHenry CookeNoch keine Bewertungen

- Government Response To Tomorrow's Schools ReviewDokument52 SeitenGovernment Response To Tomorrow's Schools ReviewHenry Cooke100% (2)

- Ministerial List For Announcement On 27 June 2019Dokument6 SeitenMinisterial List For Announcement On 27 June 2019Henry CookeNoch keine Bewertungen

- Police Association SubmissionDokument6 SeitenPolice Association SubmissionHenry CookeNoch keine Bewertungen

- Tim Ashton SubmissionDokument2 SeitenTim Ashton SubmissionHenry CookeNoch keine Bewertungen

- GunCity SubmissionDokument3 SeitenGunCity SubmissionHenry CookeNoch keine Bewertungen

- Gun City SpreadsheetDokument2 SeitenGun City SpreadsheetHenry CookeNoch keine Bewertungen

- Council of Licensed Firearm OwnersDokument4 SeitenCouncil of Licensed Firearm OwnersHenry CookeNoch keine Bewertungen

- NZ Antiques & Historical Arms Association SubmissionDokument3 SeitenNZ Antiques & Historical Arms Association SubmissionHenry Cooke100% (1)

- Leak Inquiry MemoDokument1 SeiteLeak Inquiry MemoHenry CookeNoch keine Bewertungen

- Meka Whaitiri ReportDokument35 SeitenMeka Whaitiri ReportHenry CookeNoch keine Bewertungen

- KiwiBuild Advice From AprilDokument82 SeitenKiwiBuild Advice From AprilHenry CookeNoch keine Bewertungen

- Farms, Forests and Fossil Fuels - PCE FAQsDokument4 SeitenFarms, Forests and Fossil Fuels - PCE FAQsHenry CookeNoch keine Bewertungen

- Final Cab 18 Min 0556 MinuteDokument2 SeitenFinal Cab 18 Min 0556 MinuteHenry CookeNoch keine Bewertungen

- PWC Investigation Summary Report Into Bridges LeakDokument12 SeitenPWC Investigation Summary Report Into Bridges LeakHenry Cooke100% (1)

- Portfolio Resignation AttachmentsDokument9 SeitenPortfolio Resignation AttachmentsHenry CookeNoch keine Bewertungen

- Briefing Paper From MBIE On Rental ChangesDokument18 SeitenBriefing Paper From MBIE On Rental ChangesHenry CookeNoch keine Bewertungen

- Ministers Expenses Apr Jun 2018Dokument1 SeiteMinisters Expenses Apr Jun 2018Henry CookeNoch keine Bewertungen

- Disclosure of Members Expenses From 1 April To 30 June 2018Dokument2 SeitenDisclosure of Members Expenses From 1 April To 30 June 2018Henry Cooke100% (1)

- Zero Carbon Bill Economic Analysis ReportDokument39 SeitenZero Carbon Bill Economic Analysis ReportHenry CookeNoch keine Bewertungen

- Report of The Seventh Triennial Appropriations Review CommitteeDokument64 SeitenReport of The Seventh Triennial Appropriations Review CommitteeHenry Cooke100% (1)

- Letter To Trump Final With SignaturesDokument2 SeitenLetter To Trump Final With SignaturesHenry CookeNoch keine Bewertungen

- Cabinet Decision On Legal FeesDokument54 SeitenCabinet Decision On Legal FeesHenry CookeNoch keine Bewertungen

- Methamphetamine Contamination in Residential PropertiesDokument39 SeitenMethamphetamine Contamination in Residential PropertiesHenry Cooke80% (5)

- David Seymour LetterDokument1 SeiteDavid Seymour LetterHenry CookeNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)