Beruflich Dokumente

Kultur Dokumente

The Single Family Office Funds in India

Hochgeladen von

gandhiannex0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

195 Ansichten4 SeitenThe Single Family Office Funds in India

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThe Single Family Office Funds in India

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

195 Ansichten4 SeitenThe Single Family Office Funds in India

Hochgeladen von

gandhiannexThe Single Family Office Funds in India

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 4

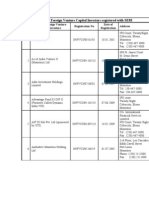

The single family office funds in India:

1. Aarin Capital (Dr. Ranjan Pai, Mohandas Pai)

Aarin Capital was started by Dr. Ranjan Pai, CEO & MD of Manipal Education and Medical Group

(MEMG) and Mohandas Pai, former CFO of Infosys.

Key Investments: inc42

Contact: +91 80 3078 9100 / info@aarincapital.com

2. Ajay Piramal SFO

Ajay Piramal is the Chairman of Piramal Group & Shriram Group who have activities in pharma, financial

services, real estate, information services, glass packaging etc. Ajay’s family office acts as an anchor

investor in Montane Venture who plan on investing in technology and consumer startups.

Key Investments: Mavin

3. Artha India Ventures (Anirudh Damani)

Anirudh Damani is the CEO of Artha India Ventures who invest in next generation business models. AIV is

backed by Damani’s family office K. Damani Group, which he’s also the Director of.

Key Investments: OYO Rooms, Coutloot.

Contact: 022 61048900 / +91 9699 308 910 / info@artha.ventures

4. Burman Family Office (Gaurav Burman)

The Burman Family Office is led by Gaurav Burman and is a private investment arm of Dabur India, which

was founded by Dr. S. K. Burman.

Key Investments: Easypolicy

5. Catamaran Ventures (NR Narayana Murthy)

Catamaran Ventures is the family office of Infosys founder NR Narayana Murthy. It was founded in 2010

and invests in early stage and growing companies in India and overseas. They are sector agnostic and have

invested in 6 companies so far.

Key Investments: Paper Boat, Yebh, Lookup

Contact: 080 2664 9440

Get end-to-end payroll outsourcing services all

over India with sumHR.

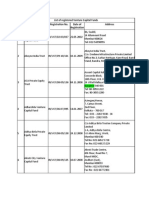

6. Sharrp Ventures (Harsh Mariwala)

Harsh Mariwala founded his family office named Sharrp Ventures after being urged by his son Rishabh.

They invest in seed, venture and private equity funds, and also indulge in co-investment activities.

7. JSW Venture Fund (Sajjan Jindal)

JSW Venture Fund was launched by Sajjan Jindal from the Jindal Group. They invest in early stage startups

that are in sectors like SaaS, Fintech, Consumer Internet, Mobile, E-commerce, Health Tech, Analytics,

Education, IoT etc.

Key Investments: Overcart, Purplle, Indus OS.

Contact: +91 22 4286 1000 / +91 22 4286 3000 / contact@jsw.in

8. Lodha Group’s Startup Investment Fund (Mangal Prabhat Lodha)

Mangal Prabhat Lodha, founder of Lodha Group, launched his family office fund. Lodha Group’s Startup

Investment Fund is focused on startups providing smart city solutions and real estate. They invest in startups

at all stages.

9. Murugappa Family Group

Murugappa Family Group is a leading Chennai-headquartered family-owned business which is investing in

startups India.

Key Investments: Industrybuying.com

Contact: +91 (44) 25306789 / 25306222 / mailgcc@corp.murugappa.com

10. RAAY (Amit Patni)

RAAY is the single family office of the Amit Patni Group. It was established in 2002. They have a family-

centric approach to their investments that allow them to align it with their family’s vision.

Key Investments: Velvetcase.com

Contact: +91 22 6742 3815 / info@raayinvestments.com

11. PremjiInvest (Azim Premji)

PremjiInvest is an investment firm led by Azim Premji, The Chairman of Wipro. Founded in 2006, it has

invested in 14 companies so far.

Key Investments: Lenskart.com, Snapdeal

12. RNT Associates (Ratan Tata)

RNT Associates is Ratan Tata’s personal family office. It was established in 2009.

Key Investments: Cardekho

13. Innovations Investment Management (SD Shibulal)

Former Infosys Co-Founder SD Shibulal oversees his family office, Innovations Investment Management,

since he stepped down at CEO in 2014.

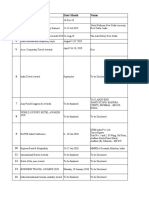

14. Soma Capital (Aneel Ranadive)

Soma Capital, founded by Aneel Ranadive who works with his father Vivek Ranadive, is a family office

fund that invests in technology startups. They make seed and early stage venture investments.

Key Investments: Supr Daily, WaystoCap

Contact: info@somacapital.io / aneel@somacapital.io

15. The Three Sisters (Rana Kapoor)

The Three Sisters manages the family wealth of Yes Bank CEO Rana Kapoor. The name derives from a

reference to his daughters – Radha, Raakhe and Roshini. Their areas of interest are education, tourism,

family entertainment centres, and agri-logistics among sectors.

Key Investments: Presto

16. Unilazer Ventures (Ronnie Screwvala)

Unilazer Ventures is the Indian family office of business tycoon, Ronnie Screwvala. It was founded in 2010

and invests in early and late stage investments.

Key Investments: EasyPolicy

Contact: 022 6109 3730

17. YouWeCan Ventures (Yuvraj Singh)

YouWeCan Ventures was founded by Yuvraj Singh and provides seed funding to entrepreneurs. He aims to

empower them to build brands and successful business ventures.

Key Investments: Startup Buddy, Vyomo, EduKart

Contact: proposal@youwecanventures.com

Das könnte Ihnen auch gefallen

- The Common-Sense Path To Financial FreedomDokument20 SeitenThe Common-Sense Path To Financial Freedomclarkpd6100% (3)

- Discounted Cash Flow Analysis - Uber Technologies, Inc. (Unlevered DCF)Dokument9 SeitenDiscounted Cash Flow Analysis - Uber Technologies, Inc. (Unlevered DCF)Haysam TayyabNoch keine Bewertungen

- Nubank: A Brazilian FinTech Worth $10 Billion - MEDICIDokument25 SeitenNubank: A Brazilian FinTech Worth $10 Billion - MEDICIKay BarnesNoch keine Bewertungen

- Blume Ventures Edtech Report OptDokument77 SeitenBlume Ventures Edtech Report OptRajan GulatiNoch keine Bewertungen

- Venture Capital Funding, Fourth Quarter 2015Dokument10 SeitenVenture Capital Funding, Fourth Quarter 2015BayAreaNewsGroupNoch keine Bewertungen

- India Investors List 2020 PDFDokument157 SeitenIndia Investors List 2020 PDFshashank katariya33% (3)

- GameDev Friendly Investors List From ACHIEVERS HUBDokument7 SeitenGameDev Friendly Investors List From ACHIEVERS HUBSarahNoch keine Bewertungen

- Angel ChennaiDokument34 SeitenAngel ChennaiData InfobankNoch keine Bewertungen

- Mudit Saxena - Genpact SeedDokument2 SeitenMudit Saxena - Genpact SeedParas SatijaNoch keine Bewertungen

- Map of Active VCs in Southeast AsiaDokument175 SeitenMap of Active VCs in Southeast AsiaAnonymous iA90mve4rNoch keine Bewertungen

- Blume - VCDokument38 SeitenBlume - VCArjun VaradrajNoch keine Bewertungen

- Venture Capital Firms in IndiaDokument3 SeitenVenture Capital Firms in Indiausf69Noch keine Bewertungen

- Ebook Top 58 Venture Capital Firms PDFDokument61 SeitenEbook Top 58 Venture Capital Firms PDFPratyutpanna DasNoch keine Bewertungen

- Pre Qualifying ExamDokument14 SeitenPre Qualifying ExamGelyn CruzNoch keine Bewertungen

- Project Report On 2008 Financial CrisisDokument33 SeitenProject Report On 2008 Financial CrisisAakarsh ShuklaNoch keine Bewertungen

- 2016 FRM Part I Practice ExamDokument129 Seiten2016 FRM Part I Practice ExamSiddharth JainNoch keine Bewertungen

- A91 Partners JDDokument2 SeitenA91 Partners JDJohn DoeNoch keine Bewertungen

- Gaju HumairaDokument431 SeitenGaju Humairagaju619Noch keine Bewertungen

- International Lounges - DreamfolksDokument45 SeitenInternational Lounges - DreamfolksgandhiannexNoch keine Bewertungen

- Startup VCDokument105 SeitenStartup VCSangram SabatNoch keine Bewertungen

- Venture CapitalDokument71 SeitenVenture CapitalSmruti VasavadaNoch keine Bewertungen

- Ecommerce & Marketplace VC Panels & Pitches HandoutDokument6 SeitenEcommerce & Marketplace VC Panels & Pitches HandoutAndrew BottNoch keine Bewertungen

- IVCA Bain India VC Report 2018Dokument50 SeitenIVCA Bain India VC Report 2018ishan66666Noch keine Bewertungen

- Venture Capitalists of IndiaDokument17 SeitenVenture Capitalists of IndiaShaantanu GaurNoch keine Bewertungen

- CONNECT WITH INVESTORS IN OUR NETWORKDokument110 SeitenCONNECT WITH INVESTORS IN OUR NETWORKbhavikNoch keine Bewertungen

- 47 Most Active Venture Capital Firms in India For StartupsDokument21 Seiten47 Most Active Venture Capital Firms in India For StartupsfinvistaNoch keine Bewertungen

- Zodius Capital II Fund Launch 070414Dokument2 SeitenZodius Capital II Fund Launch 070414avendusNoch keine Bewertungen

- VC Funds in IndiaDokument30 SeitenVC Funds in IndiaVishal ThakurNoch keine Bewertungen

- A-List of Foreign Venture Capital Investors Registered With SEBIDokument24 SeitenA-List of Foreign Venture Capital Investors Registered With SEBIVipul ParekhNoch keine Bewertungen

- MeetFounders UK EU August 2021 HandoutDokument13 SeitenMeetFounders UK EU August 2021 HandoutAndrew BottNoch keine Bewertungen

- Venture Capital Q2 2016Dokument1 SeiteVenture Capital Q2 2016BayAreaNewsGroup100% (2)

- Finalbeauty Techlonglist1527854448862 180606060808 PDFDokument188 SeitenFinalbeauty Techlonglist1527854448862 180606060808 PDFSuriNoch keine Bewertungen

- ListofstartupsDokument53 SeitenListofstartupsAppu AkNoch keine Bewertungen

- List of Registered Venture Capital FundsDokument11 SeitenList of Registered Venture Capital FundsMushtakh Ahmed MussuNoch keine Bewertungen

- List of VCFsDokument3 SeitenList of VCFspoddar_ruchitaNoch keine Bewertungen

- Startup FundingDokument89 SeitenStartup Fundingbada donNoch keine Bewertungen

- Investors ContactDokument9 SeitenInvestors Contactsavaliyaparesh1Noch keine Bewertungen

- Aibi Summit 2016Dokument48 SeitenAibi Summit 2016Anonymous KRErbYM7Noch keine Bewertungen

- Inc42's Annual Indian Startup Funding Report 2021Dokument91 SeitenInc42's Annual Indian Startup Funding Report 2021Ritik MehtaNoch keine Bewertungen

- Capital Expenditures: Payback Period MethodDokument23 SeitenCapital Expenditures: Payback Period MethodJane PadayNoch keine Bewertungen

- Series A-C funding rounds for 15 startups in Oct 2015Dokument15 SeitenSeries A-C funding rounds for 15 startups in Oct 2015qwertyNoch keine Bewertungen

- Dr. Mahalee's Meeting with Sophia CostaDokument22 SeitenDr. Mahalee's Meeting with Sophia CostaManoj Kumar100% (3)

- Fintech VC Panels & Pitches HandoutDokument7 SeitenFintech VC Panels & Pitches HandoutAndrew BottNoch keine Bewertungen

- Europes Most Active Business Angels 2018.compressedDokument100 SeitenEuropes Most Active Business Angels 2018.compressedEnrique SobriniNoch keine Bewertungen

- Indian Tech Start Up Ecosystem 2019 Report PDFDokument106 SeitenIndian Tech Start Up Ecosystem 2019 Report PDFNileshNoch keine Bewertungen

- List of Registered Venture Capital FundsDokument25 SeitenList of Registered Venture Capital FundsjvreddiNoch keine Bewertungen

- 50fintech Companies in IndiaDokument9 Seiten50fintech Companies in IndiaKarthikeyan GanesanNoch keine Bewertungen

- Venture Capital Funds in IndiaDokument17 SeitenVenture Capital Funds in IndialipsaNoch keine Bewertungen

- Seed Funding CompaniesDokument4 SeitenSeed Funding Companieskirandasi123Noch keine Bewertungen

- Tracxn Research EdTech Landscape February 2016Dokument9 SeitenTracxn Research EdTech Landscape February 2016HarishPratabhccNoch keine Bewertungen

- Venture CapitalDokument42 SeitenVenture CapitalKrinal ShahNoch keine Bewertungen

- List of registered Venture Capital Funds in IndiaDokument17 SeitenList of registered Venture Capital Funds in Indiamaheshtech76Noch keine Bewertungen

- PonyUp StablesDokument5 SeitenPonyUp StablesNatalie DaguiamNoch keine Bewertungen

- VC ListDokument4 SeitenVC ListSaaf suthraNoch keine Bewertungen

- Saif PartnersDokument17 SeitenSaif Partnerspranav sarawagiNoch keine Bewertungen

- Top 25 Venture Capital Firms in IndiaDokument8 SeitenTop 25 Venture Capital Firms in IndiaRavi Singh BishtNoch keine Bewertungen

- Hurun India Future Unicorn 2021 Fina Press ReleaselDokument14 SeitenHurun India Future Unicorn 2021 Fina Press ReleaselnikunjbubnaNoch keine Bewertungen

- List of Hospitality and Travel Awards 2019 - National & InternationalDokument6 SeitenList of Hospitality and Travel Awards 2019 - National & InternationalDiksha SinghNoch keine Bewertungen

- Startup Ecosytem Survey PuneDokument32 SeitenStartup Ecosytem Survey Punepavan reddyNoch keine Bewertungen

- Unicorn Indian StartupsDokument2 SeitenUnicorn Indian Startupsshivam kumarNoch keine Bewertungen

- Strong ER&D demand to aid Tata Elxsi growthDokument10 SeitenStrong ER&D demand to aid Tata Elxsi growthJayNoch keine Bewertungen

- Accelerators: List of Start-Up Incubators and AcceleratorsDokument2 SeitenAccelerators: List of Start-Up Incubators and AcceleratorsnamanNoch keine Bewertungen

- Pitch Deck MSD LVDokument13 SeitenPitch Deck MSD LVBharat GoelNoch keine Bewertungen

- Corporate Governance and Finance Department: List of Investment Companies/Mutual Funds (71) As of June 30 2019Dokument3 SeitenCorporate Governance and Finance Department: List of Investment Companies/Mutual Funds (71) As of June 30 2019Sui KixNoch keine Bewertungen

- 2Q 15 Vcsurvey PDFDokument11 Seiten2Q 15 Vcsurvey PDFBayAreaNewsGroupNoch keine Bewertungen

- Indian Unicorns With Chinese InvestorsDokument1 SeiteIndian Unicorns With Chinese InvestorsThe WireNoch keine Bewertungen

- Firstcry Startup by PrasanthDokument9 SeitenFirstcry Startup by PrasanthSrilaya GudlaNoch keine Bewertungen

- YSf PX XJW Wupb 1627408405774Dokument4 SeitenYSf PX XJW Wupb 1627408405774Yuddhaveer Singh SuryavanshiNoch keine Bewertungen

- Infosys Case StudyDokument2 SeitenInfosys Case StudySumit Chopra100% (1)

- Poem-Praful ThakkarDokument1 SeitePoem-Praful ThakkargandhiannexNoch keine Bewertungen

- Medical Fundraising Appeal: Rajesh Kumar RamaniDokument1 SeiteMedical Fundraising Appeal: Rajesh Kumar RamanigandhiannexNoch keine Bewertungen

- Catalog 2017-18 (Corporate)Dokument57 SeitenCatalog 2017-18 (Corporate)gandhiannexNoch keine Bewertungen

- ISES Newsletter NewDokument9 SeitenISES Newsletter NewgandhiannexNoch keine Bewertungen

- Sme Directors Summit: ConnectDokument8 SeitenSme Directors Summit: ConnectgandhiannexNoch keine Bewertungen

- Sme Connect - Media KitDokument4 SeitenSme Connect - Media KitgandhiannexNoch keine Bewertungen

- District CoopDokument53 SeitenDistrict CoopRichard OrtizNoch keine Bewertungen

- Agro Food ProcessingDokument2 SeitenAgro Food ProcessinggandhiannexNoch keine Bewertungen

- Borcure - Packaging ConferenceDokument5 SeitenBorcure - Packaging ConferencegandhiannexNoch keine Bewertungen

- PoemsDokument2 SeitenPoemsgandhiannexNoch keine Bewertungen

- 20101211majmudar Tech Transfer AgreementsDokument9 Seiten20101211majmudar Tech Transfer AgreementsRubi FlavianoNoch keine Bewertungen

- UntitledDokument1 SeiteUntitledgandhiannexNoch keine Bewertungen

- Gujarat Activity ReportDokument15 SeitenGujarat Activity ReportgandhiannexNoch keine Bewertungen

- Fin333 Secondmt04w Sample QuestionsDokument10 SeitenFin333 Secondmt04w Sample QuestionsSara NasNoch keine Bewertungen

- Solutions To Further Problems: John C. HullDokument4 SeitenSolutions To Further Problems: John C. HullAA BB MMNoch keine Bewertungen

- NISM Sample Question-1Dokument7 SeitenNISM Sample Question-1nanda100% (1)

- 7th Economic Summit - UpdateDokument40 Seiten7th Economic Summit - Updateadmin866100% (2)

- IAS 37 ProvisionsDokument9 SeitenIAS 37 ProvisionsfurqanNoch keine Bewertungen

- HSY Hershey CAGNY 2018Dokument76 SeitenHSY Hershey CAGNY 2018Ala BasterNoch keine Bewertungen

- Ar KCL 2018-19Dokument120 SeitenAr KCL 2018-19Harshana NadeeshanNoch keine Bewertungen

- Loma 357 C3Dokument18 SeitenLoma 357 C3May ThirteenthNoch keine Bewertungen

- Interim Order in Respect of Ambitious Diversified Projects Management LimitedDokument15 SeitenInterim Order in Respect of Ambitious Diversified Projects Management LimitedShyam SunderNoch keine Bewertungen

- Guest Lecture On Startup Fundraising by Herman Kienhuis at JADSDokument34 SeitenGuest Lecture On Startup Fundraising by Herman Kienhuis at JADSHerman Kienhuis100% (1)

- Nationalised Banks Number SeriesDokument72 SeitenNationalised Banks Number Seriesপ্ৰকাশ বড়াNoch keine Bewertungen

- Incremental Concept From The Marginal ConceptDokument2 SeitenIncremental Concept From The Marginal Conceptsambalikadzilla6052Noch keine Bewertungen

- FEMA - Direct Investment by Residents in JV & Wholly Owned Subs. Abroad PDFDokument56 SeitenFEMA - Direct Investment by Residents in JV & Wholly Owned Subs. Abroad PDFNidhi SinglaNoch keine Bewertungen

- Course ContentsDokument11 SeitenCourse ContentsYidersal DagnawNoch keine Bewertungen

- CVMA PracticeDokument14 SeitenCVMA PracticeRandhir ShahNoch keine Bewertungen

- Chap 010Dokument23 SeitenChap 010Qasih IzyanNoch keine Bewertungen

- Loque, Mark Ivan Magno, Joseph Emmanuel Mangalino, John Michael Marco, Marc Jayron Miclat, Kenneth Andrian Mintay, Ralph ChristianDokument19 SeitenLoque, Mark Ivan Magno, Joseph Emmanuel Mangalino, John Michael Marco, Marc Jayron Miclat, Kenneth Andrian Mintay, Ralph ChristianJericho LindoNoch keine Bewertungen

- Applications of Behavioral Finance To Entrepreneurs and Venture CapitalistsDokument17 SeitenApplications of Behavioral Finance To Entrepreneurs and Venture Capitalistsbhanu.chanduNoch keine Bewertungen

- Case Study FinalDokument34 SeitenCase Study Finalfaithladeras100% (1)

- Auditing Real Issues Cases 8thDokument11 SeitenAuditing Real Issues Cases 8thindrisjamsuliNoch keine Bewertungen

- FM - Tamboli Casting - BhavnagarDokument90 SeitenFM - Tamboli Casting - Bhavnagarjagrutisolanki01Noch keine Bewertungen