Beruflich Dokumente

Kultur Dokumente

Sample Vat Computation With Sales To Government

Hochgeladen von

Zyki Zamora Lacdao0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

48 Ansichten1 SeiteQuarterly VAT Excel Computation

Originaltitel

Sample Vat Computation With Sales to Government

Copyright

© © All Rights Reserved

Verfügbare Formate

XLSX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenQuarterly VAT Excel Computation

Copyright:

© All Rights Reserved

Verfügbare Formate

Als XLSX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

48 Ansichten1 SeiteSample Vat Computation With Sales To Government

Hochgeladen von

Zyki Zamora LacdaoQuarterly VAT Excel Computation

Copyright:

© All Rights Reserved

Verfügbare Formate

Als XLSX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

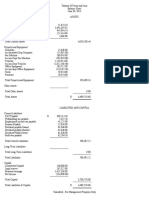

NAVARROSA

FIRST QUARTER 2018

VAT Review

Total Jan Feb March

Vatable Sales/Receipt ₱ 50,892.86 10,714.29 40,178.57 -

Sale to Government 552,555.00 284,347.10 33,089.29 235,118.61

Zero Rated Sales/Receipts -

Exempt Sales -

Total Sales ₱ 603,447.86 295,061.39 73,267.86 235,118.61

Purchase of Capital Goods Not Exceeding 1M ₱ 22,044.64 22,044.64 - -

Purchase of Capital Goods Exceeding 1M - -

Domestic Purchases of Goods Other than Capital Goods 249,485.70 119,372.86 56,078.99 74,033.85

Importation of Goods Other than Capital Goods - - - -

Domestic Purchases of Services 51,585.09 29,592.41 20,222.14 1,770.54

Services Rendered by Non-residents - -

Others -

Puchases not Qualified for Input Tax 863,936.98 306,961.17 302,177.11 254,798.70

Total Purchases ₱ 1,187,052.41 477,971.08 378,478.24 330,603.09

Output Tax ₱ 72,413.74 35,407.37 8,792.14 28,214.23

Input Tax on Current Purchases ₱ 38,773.85 20,521.19 9,156.14 9,096.53

Add: Input Tax Carried Over from Previous Quarter 10,236.56 10,236.56

Input Tax Deferred from Previous Quarter - - - -

Transitional Input Tax -

Presumptive Input Tax -

Others -

Total Available Input Tax ₱ 49,010.41 30,757.75 9,156.14 9,096.53

Less: Input Tax Deferred to Next Period ₱ - - - -

Input Tax on Purchases of Capital Goods Exceedi - - - -

Input Tax on Sale to Government closed to Expens - 3,175.06 - 128.27 1,818.85 - 7,361.78

Input Tax Allocable to Exempt Sales -

VAT Refund/TCC Claimed -

Others - - - -

Total Allowable Input Tax ₱ 52,185.47 30,886.02 7,337.28 16,458.30

VAT Payable 20,228.27 4,521.34 1,454.86 11,755.93

Less: VAT Payments - previous two months ₱ - - -

Creditable VAT Withheld -

Advance Payments for Sugar and Flour -

VAT Withheld on Sales to Government 27,627.75 14,217.36 1,654.46 11,755.93

VAT Paid - amended return -

Advance Payments made -

Others - - - -

VAT Due ₱ (7,399.48) (9,696.01) (199.61) -

Per Return/ITS -38,209.00 -1,371,977.00 -1,371,977.00 -1,371,977.00

Diff 30,809.52 (1,362,280.99) (1,371,777.39) 1,371,977.00

Total Sales to government ₱ 552,555.00 284,347.10 33,089.29 235,118.61

Multiplied by: Standard Input VAT Rate 7% 7% 7% 7%

Standard Input VAT 38,678.85 19,904.30 2,316.25 16,458.30

Actual Input VAT attributable to sales to Government 35,503.79

### 19,776.02 4,135.10 9,096.53

Income on excess of standard input tax to actual input tax. ₱ 3,175.06 128.27 -1,818.85 7,361.78

Total Sales 603,447.86 295,061.39 73,267.86 235,118.61

Total Sales to government 552,555.00 284,347.10 33,089.29 235,118.61

Ratio of Sales to government 91.57% 96.37% 45.16% 100.00%

Total Input Vat 38,773.85 20,521.19 9,156.14 9,096.53

Actual Input VAT attributable to sales to Government 35,503.79 19,776.02 4,135.10 9,096.53

11,051.10

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Science WorksheetsDokument11 SeitenScience WorksheetsZyki Zamora LacdaoNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Sample PleadingDokument3 SeitenSample PleadingZyki Zamora LacdaoNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- C92 381Dokument8 SeitenC92 381Howell Alair LabindaoNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- Roberts V Leonidas DigestDokument1 SeiteRoberts V Leonidas DigestZyki Zamora LacdaoNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Sample PleadingDokument4 SeitenSample PleadingZyki Zamora LacdaoNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Crim Presentation 21 38Dokument35 SeitenCrim Presentation 21 38Zyki Zamora LacdaoNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Sample Validation ReportDokument2 SeitenSample Validation ReportZyki Zamora LacdaoNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Effects of Penalties Under Philippine LawDokument18 SeitenEffects of Penalties Under Philippine LawKimmy Domingo0% (1)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Labor Law ReviewDokument8 SeitenLabor Law ReviewZyki Zamora LacdaoNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- Coa Dof DBM - JC4 86 ADokument15 SeitenCoa Dof DBM - JC4 86 AZyki Zamora LacdaoNoch keine Bewertungen

- Art. 25 - Marshall v. Canada Digest PDFDokument1 SeiteArt. 25 - Marshall v. Canada Digest PDFZyki Zamora LacdaoNoch keine Bewertungen

- Art. 2 - Cecsr GC No. 3Dokument5 SeitenArt. 2 - Cecsr GC No. 3Zyki Zamora LacdaoNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Tax 2 Case DigestsDokument265 SeitenTax 2 Case DigestsZyki Zamora LacdaoNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- 1 Syllabus - NIRC Remedies (1st Sem 18-19)Dokument13 Seiten1 Syllabus - NIRC Remedies (1st Sem 18-19)Zyki Zamora Lacdao100% (3)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- 2015 GN Mercantile Law - 27 July PDFDokument396 Seiten2015 GN Mercantile Law - 27 July PDFZyki Zamora LacdaoNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- 2015 GN Mercantile Law - 27 July PDFDokument396 Seiten2015 GN Mercantile Law - 27 July PDFZyki Zamora LacdaoNoch keine Bewertungen

- What Is TRAIN?: Tax ReformDokument10 SeitenWhat Is TRAIN?: Tax ReformZyki Zamora LacdaoNoch keine Bewertungen

- Bank Confirmation-SampleDokument1 SeiteBank Confirmation-SampleZyki Zamora LacdaoNoch keine Bewertungen

- People v. RosenthalDokument1 SeitePeople v. RosenthalZyki Zamora LacdaoNoch keine Bewertungen

- People Vs Rosenthal, 68 Phil 328 Case Digest (Administrative Law)Dokument1 SeitePeople Vs Rosenthal, 68 Phil 328 Case Digest (Administrative Law)AizaFerrerEbina100% (1)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Marcos Return Barred by Aquino for National SecurityDokument5 SeitenMarcos Return Barred by Aquino for National SecurityZyki Zamora LacdaoNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- Cocofed v. ComelecDokument2 SeitenCocofed v. ComelecEmir Mendoza100% (1)

- Art. 14-Ol Bahamonde v. Equatorial Guinea Digest PDFDokument1 SeiteArt. 14-Ol Bahamonde v. Equatorial Guinea Digest PDFZyki Zamora LacdaoNoch keine Bewertungen

- Cocofed v. ComelecDokument2 SeitenCocofed v. ComelecEmir Mendoza100% (1)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Art. 14-Ato Del Avellanal V Peru DigestDokument1 SeiteArt. 14-Ato Del Avellanal V Peru DigestZyki Zamora LacdaoNoch keine Bewertungen

- CCPR General Comment No. 12: Article 1 (Right To Self-Determination) The Right To Self-Determination of PeoplesDokument2 SeitenCCPR General Comment No. 12: Article 1 (Right To Self-Determination) The Right To Self-Determination of PeoplesSean YauNoch keine Bewertungen

- Cocofed v. ComelecDokument2 SeitenCocofed v. ComelecEmir Mendoza100% (1)

- Compassion in Dying v. State of WashingtonDokument2 SeitenCompassion in Dying v. State of WashingtonZyki Zamora LacdaoNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Compassion in Dying v. State of WashingtonDokument1 SeiteCompassion in Dying v. State of WashingtonZyki Zamora LacdaoNoch keine Bewertungen

- Problems Discontinued, Acctg Changes, Interim, Opseg, Correction of ErrorDokument21 SeitenProblems Discontinued, Acctg Changes, Interim, Opseg, Correction of ErrorMmNoch keine Bewertungen

- File Index GDokument31 SeitenFile Index GHooria AfreenNoch keine Bewertungen

- Internship ReportDokument48 SeitenInternship ReportIftekhar Abid FahimNoch keine Bewertungen

- Chapter 1-GL ConfigurationDokument140 SeitenChapter 1-GL ConfigurationashokNoch keine Bewertungen

- Capital Allowances: Zulkhairi@um - Edu. MyDokument35 SeitenCapital Allowances: Zulkhairi@um - Edu. MyNero ShaNoch keine Bewertungen

- Waste To Energy Business Plan: Hassaan Ajmal Zuhair Iftikhar Ahtisham Maan Ammar AhmedDokument30 SeitenWaste To Energy Business Plan: Hassaan Ajmal Zuhair Iftikhar Ahtisham Maan Ammar AhmedSheriYar KhattakNoch keine Bewertungen

- Management Accounting/Series-4-2011 (Code3024)Dokument18 SeitenManagement Accounting/Series-4-2011 (Code3024)Hein Linn Kyaw100% (2)

- Current Liabilities In-depthDokument44 SeitenCurrent Liabilities In-depthkristineNoch keine Bewertungen

- Pag Ibig 1Dokument2 SeitenPag Ibig 1Fervi Louie Jalop Bongco0% (1)

- Balance SheetDokument1 SeiteBalance Sheetolyad tesfayeNoch keine Bewertungen

- Geetha M.Com Practical RecordsDokument79 SeitenGeetha M.Com Practical Recordsgeethrk12Noch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Final Exam Key Answer FarDokument3 SeitenFinal Exam Key Answer FarComedy Royal Philippines100% (1)

- Casanovas V HordDokument11 SeitenCasanovas V HordfullpizzaNoch keine Bewertungen

- Full Download Financial Accounting 17th Edition Williams Test BankDokument35 SeitenFull Download Financial Accounting 17th Edition Williams Test Bankmcalljenaevippro100% (42)

- Facebook Financial AnalysisDokument12 SeitenFacebook Financial AnalysisKennedy Gitonga ArithiNoch keine Bewertungen

- Your College Budget AssignmentDokument8 SeitenYour College Budget Assignmentlatorrem6457100% (1)

- Lecture 6 Clarkson LumberDokument8 SeitenLecture 6 Clarkson LumberDevdatta Bhattacharyya100% (1)

- INCOME FROM LETTING OF REAL PROPERTY TAX RULINGDokument15 SeitenINCOME FROM LETTING OF REAL PROPERTY TAX RULINGTengku Rizal Tengku Mat100% (1)

- Financial Statement and Ratio Analysis of Berger Paints Bangladesh LimitedDokument41 SeitenFinancial Statement and Ratio Analysis of Berger Paints Bangladesh Limitedpaul ndhlovuNoch keine Bewertungen

- Unit 2 Promotion of A New VentureDokument19 SeitenUnit 2 Promotion of A New VentureAmish Suri100% (1)

- Annual-Report-13-14 AOP PDFDokument38 SeitenAnnual-Report-13-14 AOP PDFkhurram_66Noch keine Bewertungen

- Building Economics and Cost ControlDokument25 SeitenBuilding Economics and Cost ControlDr Sarbesh Mishra100% (1)

- Dividend Policy at FPL Group, Inc. (A)Dokument16 SeitenDividend Policy at FPL Group, Inc. (A)Aslan Alp0% (1)

- Iesco Online Billl-March 17Dokument1 SeiteIesco Online Billl-March 17Muhammad Asif HussainNoch keine Bewertungen

- Lesson Plan Income Taxation FINALDokument6 SeitenLesson Plan Income Taxation FINALRandy Magbudhi100% (2)

- CIR Appeals CTA Ruling on ICC Tax DeductionsDokument4 SeitenCIR Appeals CTA Ruling on ICC Tax DeductionsJane MarianNoch keine Bewertungen

- Structural Rates 2015Dokument3 SeitenStructural Rates 2015Raghu Ram100% (1)

- Fixed Asset and Depreciation ScheduleDokument5 SeitenFixed Asset and Depreciation ScheduleDarkchild HeavensNoch keine Bewertungen

- Working Capital ManagementDokument16 SeitenWorking Capital ManagementjcshahNoch keine Bewertungen

- Work Sheet Moises Dondoyano Information SystemDokument1 SeiteWork Sheet Moises Dondoyano Information SystemRJ DAVE DURUHA100% (5)