Beruflich Dokumente

Kultur Dokumente

Answer For Exercises Online Learning 1

Hochgeladen von

Xiao Yun YapOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Answer For Exercises Online Learning 1

Hochgeladen von

Xiao Yun YapCopyright:

Verfügbare Formate

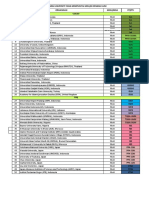

ANSWER FOR EXERCISES CHAPTER 8

QUESTION 1

a. Common equity = .65 × $3 million = $1,950,000

Debt = .35 × $3 million = $1,050,000

b. Dividends = $2,200,000 - $1,950,000 = $250,000

QUESTION 2

i.(15% x 1,000,000 shares) + 1,000,000 shares = 1,150,000 shares outstanding

ii. $10,000,000 / 1,150,000 = $8.70

QUESTION 3

a) EPS= 4,000,000/ 320,000 = $12.50 per share

P/E = $50/ $12.50 = $4

b) 320,000 shares x $4 per share = $1,280,000

Shares that can be repurchased $1,280,000/ $54 =23,704shares

c) After proposed repurchased:

Shares outstanding = 320,000 – 23,704 = 296,296 shares

EPS = $4,000,000/ 296,296 = $13.50 per share

QUESTION 4

ANSWER:

a. .40($900,000)/500,000 = $0.72

.40($1,200,000)/500,000 = $0.96

.40($850,000)/500,000 = $0.68

.40($1,350,000)/500,000 = $1.08

b. .40($1,075,000) = $430,000/500,000 = $0.86

QUESTION 5

i.

Equity Structure of Srikandi Berhad as at 30 November 2016

____________________________________________________________

Common Stock (RM1 par, 1,100,000 shares) 1,100,000

Contributed Capital in excess of par 1,000,000

Retained earnings 200,000

_________

Total Common Stockholders’ Equity 2,300,000

=========

# a total of RM500,000 is transferred from retained earnings to the other stockholders’

equity account of this RM500,000, RM100,000 is added to the common stock account

and the remaining RM400,000 is added to the Contributed Capital in Excess of Par

account.

ii. If the company decided to split the shares 2:1, what is the new structure of

equity of Srikandi Berhad?

Equity Structure of Srikandi Berhad as at 30 November 2016

____________________________________________________________

Common Stock (RM0.50 par, 2,000,000 shares) 1,000,000

Contributed Capital in excess of par 600,000

Retained earnings 700,000

_________

Total Common Stockholders’ Equity 2,300,000

=========

Answer for Individual Assignment (ONLY FOR CALCULATION PART)

a.

The net income for the company is:

NI = $80,000 – .08($300,000)

NI = $56,000

The total dividends received by the shareholder will be:

Dividends received = $56,000($30,000/$300,000)

Dividends received = $5,600

So the return the shareholder expects is:

R = $5,600/$30,000

R = .1867 or 18.67%

b.

To generate exactly the same cash flows in the other company, the shareholder needs to match the

capital structure of ABC. The shareholder should sell all shares in DEF. This will net $30,000.

The shareholder should then borrow $30,000. This will create an interest cash flow of:

Interest cash flow = .08(–$30,000)

Interest cash flow = –$2,400

The total dividends received by the shareholder will be:

Dividends received = $80,000($60,000/$600,000)

Dividends received = $8,000

The total cash flow for the shareholder will be:

Total cash flow = $8,000 – 2,400

Total cash flow = $5,600

The shareholders return in this case will be:

R = $5,600/$30,000

R = .1867 or 18.67%

c. ABC is an all equity company, so:

RE = RA = $80,000/$600,000

RE= .1333 or 13.33%

To find the cost of equity for DEF we need to use M&M Proposition II, so:

RE= RA + (RA – RD)(D/E)(1 – tC)

RE= .1333 + (.1333 – .08)(1)(1)

RE= .1867 or 18.67%

d. To find the WACC for each company we need to use the WACC equation:

WACC = (E/V)RE + (D/V)RD(1 – tC)

So, for ABC, the WACC is:

WACC = (1)(.1333) + (0)(.08)

WACC = .1333 or 13.33%

And for DEF,

WACC = (1/2)(.1867) + (1/2)(.08)

WACC = .1333 or 13.33%

When there are no corporate taxes, the cost of capital for the firm is unaffected by the capital

structure; this is M&M Proposition II without taxes.

3

. a. With the information provided, we can use the equation for calculating WACC to find the cost of

equity. The equation for WACC is:

WACC = (E/V)RE + (D/V)RD(1 – tC)

The company has a debt-equity ratio of 1.5, which implies the weight of debt is 1.5/2.5, and the

weight of equity is 1/2.5, so

WACC = .10 = (1/2.5)RE + (1.5/2.5)(.07)(1 – .35)

RE= .1818 or 18.18%

b. To find the unlevered cost of equity we need to use M&M Proposition II with taxes, so:

RE= RU + (RU – RD)(D/E)(1 – tC)

.1818 = RU + (RU – .07)(1.5)(1 – .35)

RU= .1266 or 12.66%

c. To find the cost of equity under different capital structures, we can again use M&M Proposition II

with taxes.

With a debt-equity ratio of 2, the cost of equity is:

RE= RU + (RU – RD)(D/E)(1 – tC)

RE= .1266 + (.1266 – .07)(2)(1 – .35)

RE= .2001 or 20.01%

Das könnte Ihnen auch gefallen

- Carriage of Goods by Sea PDFDokument617 SeitenCarriage of Goods by Sea PDFn1857693% (27)

- Case Study Nike Method Inventory ControlDokument6 SeitenCase Study Nike Method Inventory ControlXiao Yun Yap67% (3)

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Von EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Bewertung: 5 von 5 Sternen5/5 (1)

- Problems Chapter 11Dokument29 SeitenProblems Chapter 11Incia100% (1)

- Chapter 1 Why Are Financial Institutions Special?Dokument10 SeitenChapter 1 Why Are Financial Institutions Special?A_Students67% (6)

- Financial & Managerial Accounting For Mbas, 5Th Edition by Easton, Halsey, Mcanally, Hartgraves & Morse Practice QuizDokument3 SeitenFinancial & Managerial Accounting For Mbas, 5Th Edition by Easton, Halsey, Mcanally, Hartgraves & Morse Practice QuizLevi AlvesNoch keine Bewertungen

- Dividend Policy Q and ADokument3 SeitenDividend Policy Q and AMd. HabibullahNoch keine Bewertungen

- Solution Manual For Fundamental Financial Accounting Concepts 7th Edition by EdmondsDokument9 SeitenSolution Manual For Fundamental Financial Accounting Concepts 7th Edition by EdmondsDiane Jones100% (26)

- Problem Sets Finacc Chapter 9Dokument19 SeitenProblem Sets Finacc Chapter 9Reg LagartejaNoch keine Bewertungen

- Developing A Global Vision Through Marketing ResearchDokument32 SeitenDeveloping A Global Vision Through Marketing ResearchXiao Yun YapNoch keine Bewertungen

- Chapter 11 DrillsDokument6 SeitenChapter 11 DrillsBaderNoch keine Bewertungen

- Book Value Per ShareDokument4 SeitenBook Value Per ShareNica CezarNoch keine Bewertungen

- Final Requirement ProblemsDokument5 SeitenFinal Requirement ProblemsYoite MiharuNoch keine Bewertungen

- Diluted EPS TutorialDokument3 SeitenDiluted EPS TutorialRawan YasserNoch keine Bewertungen

- Group - I Paper - 1 Accounting V2 Chapter 2 PDFDokument56 SeitenGroup - I Paper - 1 Accounting V2 Chapter 2 PDFShrinivas GirnarNoch keine Bewertungen

- Exercise 1-3: (Assets - Liabilities Shareholders' Equity)Dokument9 SeitenExercise 1-3: (Assets - Liabilities Shareholders' Equity)Syed RaashidNoch keine Bewertungen

- Online Ass Advance Acc NEWDokument6 SeitenOnline Ass Advance Acc NEWRara Rarara30Noch keine Bewertungen

- Practice Problems, CH 11 SolutionDokument2 SeitenPractice Problems, CH 11 SolutionscridNoch keine Bewertungen

- Chapter 11 Shareholders' 2Dokument13 SeitenChapter 11 Shareholders' 2Thalia Rhine AberteNoch keine Bewertungen

- Chapter 9 - Annand, D. (2018) :: Concept Self-Check: 1 To 6Dokument6 SeitenChapter 9 - Annand, D. (2018) :: Concept Self-Check: 1 To 6Minh HuyyNoch keine Bewertungen

- Sol. Man. - Chapter 11 She 2Dokument14 SeitenSol. Man. - Chapter 11 She 2finn mertensNoch keine Bewertungen

- Exercices + Answers (Capital Structure) PDFDokument4 SeitenExercices + Answers (Capital Structure) PDFSonal RathhiNoch keine Bewertungen

- Midterm Exam ADM3350 Summer 2022 PDFDokument7 SeitenMidterm Exam ADM3350 Summer 2022 PDFHan ZhongNoch keine Bewertungen

- Dividend Practice Problems (1) Anderson Inc. Has 600,000 Shares of Common Stock Outstanding, and Its EPS AreDokument4 SeitenDividend Practice Problems (1) Anderson Inc. Has 600,000 Shares of Common Stock Outstanding, and Its EPS AreYoite MiharuNoch keine Bewertungen

- Answer Illustration 3Dokument11 SeitenAnswer Illustration 3mkesisbereket100% (1)

- ACT1106-Midterm Quiz No. 3 With AnswerDokument6 SeitenACT1106-Midterm Quiz No. 3 With AnswerPj Dela VegaNoch keine Bewertungen

- A. On November 27, The Board of Directors of India Star Company Declared A $.35 Per ShareDokument109 SeitenA. On November 27, The Board of Directors of India Star Company Declared A $.35 Per ShareChris Jay LatibanNoch keine Bewertungen

- Chapter 12 ProblemsDokument40 SeitenChapter 12 ProblemsInciaNoch keine Bewertungen

- Solution:-Inventory Conversion Period $12 / ($60/365) 73.0 DaysDokument6 SeitenSolution:-Inventory Conversion Period $12 / ($60/365) 73.0 DaysKyla Ramos DiamsayNoch keine Bewertungen

- L19 RC Problems On ROI and EVADokument8 SeitenL19 RC Problems On ROI and EVAapi-3820619100% (2)

- Work Book of Corporate Financial Accounting 23-04-2022Dokument33 SeitenWork Book of Corporate Financial Accounting 23-04-2022SWAPNIL JADHAVNoch keine Bewertungen

- Assessment Tasks Jan 5 and 7 2022 InocencioDokument8 SeitenAssessment Tasks Jan 5 and 7 2022 Inocencioalianna johnNoch keine Bewertungen

- Chapter 3 Problems - FinmgtDokument11 SeitenChapter 3 Problems - FinmgtLaisa Vinia TaypenNoch keine Bewertungen

- Answers For Workshop 13Dokument5 SeitenAnswers For Workshop 13Jeevika Basnet0% (1)

- Sample Final Exam Questions W19 March 31 With Answers - Leverage DividendsDokument3 SeitenSample Final Exam Questions W19 March 31 With Answers - Leverage Dividendsbusiness docNoch keine Bewertungen

- Solutions of ChapterDokument6 SeitenSolutions of ChapterNoshaba MaqsoodNoch keine Bewertungen

- Chap 2Dokument47 SeitenChap 2ADITYA JAIN100% (1)

- Financial Leverage - SeminarDokument4 SeitenFinancial Leverage - SeminarSwish swishNoch keine Bewertungen

- Assignment 44Dokument14 SeitenAssignment 44Khadar MaxamedNoch keine Bewertungen

- CH 4 In-Class ExerciseDokument4 SeitenCH 4 In-Class ExerciseAbdullah alhamaadNoch keine Bewertungen

- Dac 318 AssignmentDokument6 SeitenDac 318 AssignmentLenny MuttsNoch keine Bewertungen

- Review of Financial Statements and Its Analysis: Rheena B. Delos Santos BSBA-1A (FM2)Dokument12 SeitenReview of Financial Statements and Its Analysis: Rheena B. Delos Santos BSBA-1A (FM2)RHIAN B.Noch keine Bewertungen

- Corporate Finance: Dividend Theory and PolicyDokument26 SeitenCorporate Finance: Dividend Theory and PolicyFaisal IslamNoch keine Bewertungen

- 317 Midterm 1 Practice Exam SolutionsDokument9 Seiten317 Midterm 1 Practice Exam Solutionskinyuadavid000Noch keine Bewertungen

- Partnership Opration Do It YourselfDokument4 SeitenPartnership Opration Do It YourselfBC qpLAN CrOwNoch keine Bewertungen

- Chapter+2 3Dokument14 SeitenChapter+2 3kanasanNoch keine Bewertungen

- Lesson 5x Practice Exercises SolutionsDokument8 SeitenLesson 5x Practice Exercises SolutionsBEN CLADONoch keine Bewertungen

- Master Question, Additional Questions-2Dokument4 SeitenMaster Question, Additional Questions-2anshikajain3474Noch keine Bewertungen

- Solutions To End-of-Chapter Three ProblemsDokument13 SeitenSolutions To End-of-Chapter Three ProblemsAn HoàiNoch keine Bewertungen

- ShitDokument6 SeitenShitgejayan memanggilNoch keine Bewertungen

- Final RequirementDokument18 SeitenFinal RequirementZandra GonzalesNoch keine Bewertungen

- 06 Activity 1-InterAcct2Dokument2 Seiten06 Activity 1-InterAcct2Jomari EscarillaNoch keine Bewertungen

- Chapter 3 Fundamental Interpretations Made From Financial Statement Data 1) D 2) B 3) C 4) B 5) B 6) A 7) BDokument4 SeitenChapter 3 Fundamental Interpretations Made From Financial Statement Data 1) D 2) B 3) C 4) B 5) B 6) A 7) BJue WernNoch keine Bewertungen

- Quiz No. 1: Intermediate Accounting, Part 4Dokument3 SeitenQuiz No. 1: Intermediate Accounting, Part 4Paula BautistaNoch keine Bewertungen

- Scheme of Corporate AccountingDokument6 SeitenScheme of Corporate AccountingBCom 2 A RPD CollegeNoch keine Bewertungen

- Mid Term Referance4 ExplainedDokument5 SeitenMid Term Referance4 ExplainedAndy LauNoch keine Bewertungen

- Mill A N CH A Pter 1 Business Combin A Tion P A RT 3 CompressDokument5 SeitenMill A N CH A Pter 1 Business Combin A Tion P A RT 3 CompressAubrey Shaiyne OfianaNoch keine Bewertungen

- ACF 103 Tutorial 10 SolnsDokument9 SeitenACF 103 Tutorial 10 SolnsTroisNoch keine Bewertungen

- Problem Set 1 Solution 1Dokument10 SeitenProblem Set 1 Solution 1Gauri TyagiNoch keine Bewertungen

- ACF 103 - Fundamentals of Finance Tutorial 10 - SolutionsDokument9 SeitenACF 103 - Fundamentals of Finance Tutorial 10 - SolutionsThảo Trần Thị ThuNoch keine Bewertungen

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsVon EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNoch keine Bewertungen

- Slide 1 - Strategizing Around The GlobeDokument25 SeitenSlide 1 - Strategizing Around The GlobeXiao Yun YapNoch keine Bewertungen

- Q3) From An Institution-Based View, WhyDokument1 SeiteQ3) From An Institution-Based View, WhyXiao Yun YapNoch keine Bewertungen

- Chapter One: Basic Principles: Ethics and BusinessDokument19 SeitenChapter One: Basic Principles: Ethics and BusinessXiao Yun YapNoch keine Bewertungen

- Sanction For Non DisclosureDokument1 SeiteSanction For Non DisclosureXiao Yun YapNoch keine Bewertungen

- Slide 3 - LEVERAGING RESOURCES AND CAPABILITIESDokument11 SeitenSlide 3 - LEVERAGING RESOURCES AND CAPABILITIESXiao Yun YapNoch keine Bewertungen

- UUM - Universiti Utara Malaysia - The Official Portal - International Partners & Collaborations PDFDokument5 SeitenUUM - Universiti Utara Malaysia - The Official Portal - International Partners & Collaborations PDFXiao Yun YapNoch keine Bewertungen

- Senarai University MoU UUM Update April 2017 PDFDokument2 SeitenSenarai University MoU UUM Update April 2017 PDFXiao Yun Yap100% (1)

- International Negotiation and Cross-Cultural Communication: Learning ObjectivesDokument12 SeitenInternational Negotiation and Cross-Cultural Communication: Learning ObjectivesXiao Yun YapNoch keine Bewertungen

- 1.0 Company BackgroundDokument4 Seiten1.0 Company BackgroundXiao Yun YapNoch keine Bewertungen

- IB Chapter 10Dokument24 SeitenIB Chapter 10Xiao Yun YapNoch keine Bewertungen

- A162 Answer Tutorial 1 and Answer Siti NorlizaDokument13 SeitenA162 Answer Tutorial 1 and Answer Siti NorlizaXiao Yun Yap0% (2)

- Inm ADokument1 SeiteInm AXiao Yun YapNoch keine Bewertungen

- Answer On Topic 2Dokument1 SeiteAnswer On Topic 2Xiao Yun Yap100% (1)

- MCM Business & Management SDN - Bhd. (469964-T)Dokument1 SeiteMCM Business & Management SDN - Bhd. (469964-T)Xiao Yun YapNoch keine Bewertungen

- Diff Between Talent Management and Human Resource ManagementDokument2 SeitenDiff Between Talent Management and Human Resource ManagementXiao Yun YapNoch keine Bewertungen

- Aj - Surina Nayan Ji 06 PDFDokument12 SeitenAj - Surina Nayan Ji 06 PDFXiao Yun YapNoch keine Bewertungen

- Start DateDokument1 SeiteStart DateXiao Yun YapNoch keine Bewertungen

- Importance of Organizational Behaviour To ManagersDokument1 SeiteImportance of Organizational Behaviour To ManagersXiao Yun YapNoch keine Bewertungen

- Case Study 2 Dis2015Dokument3 SeitenCase Study 2 Dis2015Xiao Yun YapNoch keine Bewertungen

- Case Study Hrm2Dokument17 SeitenCase Study Hrm2Xiao Yun YapNoch keine Bewertungen

- Case Study 2 ObDokument5 SeitenCase Study 2 ObXiao Yun YapNoch keine Bewertungen

- Selection of CountriesDokument55 SeitenSelection of CountriesXiao Yun YapNoch keine Bewertungen

- Ob Reflective JournalDokument11 SeitenOb Reflective JournalXiao Yun YapNoch keine Bewertungen

- Human Resouce Management 1Dokument5 SeitenHuman Resouce Management 1Xiao Yun Yap100% (1)

- "LIC The Pride of India": 56 Years of Nation BuildingDokument3 Seiten"LIC The Pride of India": 56 Years of Nation Buildinggdhelp03Noch keine Bewertungen

- Islamic HistoryDokument44 SeitenIslamic HistoryHafiz NajeebNoch keine Bewertungen

- Measuring Project Performance Inspired by Stock Index: SciencedirectDokument8 SeitenMeasuring Project Performance Inspired by Stock Index: SciencedirectUvesh ShaikhNoch keine Bewertungen

- Industrial Engineering Objective Type Questions - Set 04 - ObjectiveBooksDokument3 SeitenIndustrial Engineering Objective Type Questions - Set 04 - ObjectiveBooksMohammed Shareef KoppilakkalNoch keine Bewertungen

- Reference BikashDokument15 SeitenReference Bikashroman0% (1)

- Exercises Accompanying The Corporate Finance Module: Pays 12% Annually?Dokument4 SeitenExercises Accompanying The Corporate Finance Module: Pays 12% Annually?Yuge FanNoch keine Bewertungen

- Goldman Sachs and The BRICs - Concept Investing and Regional HegemonyDokument78 SeitenGoldman Sachs and The BRICs - Concept Investing and Regional HegemonyTim TolkaNoch keine Bewertungen

- Fundamentals of AccountingDokument7 SeitenFundamentals of AccountingNoor FatimaNoch keine Bewertungen

- (Oxford Handbooks of Political Science) R. A. W. Rhodes, Sarah A. Binder, Bert A. Rockman-Handbook Political Institutions-Oxford University Press, USA (2006)Dokument456 Seiten(Oxford Handbooks of Political Science) R. A. W. Rhodes, Sarah A. Binder, Bert A. Rockman-Handbook Political Institutions-Oxford University Press, USA (2006)Perico de los Palotes100% (2)

- Unit1 Forms EnterprisesDokument16 SeitenUnit1 Forms EnterprisesAnkitha VardhiniNoch keine Bewertungen

- Economics Project: Expected ChecklistDokument2 SeitenEconomics Project: Expected ChecklistMùkûl RãjpütNoch keine Bewertungen

- Bonus Assignment 1Dokument4 SeitenBonus Assignment 1Zain Zulfiqar100% (2)

- Keen 1980Dokument12 SeitenKeen 1980Janaina AnicetoNoch keine Bewertungen

- ABM-APPLIED-ECO-12 Q1 W1 Mod1Dokument14 SeitenABM-APPLIED-ECO-12 Q1 W1 Mod1Miku VanceNoch keine Bewertungen

- Factors Affecting Balance of PaymentsDokument3 SeitenFactors Affecting Balance of Paymentsashu khetan100% (5)

- Effects of Inflation Rate To Carinderia Owners in BacarraDokument2 SeitenEffects of Inflation Rate To Carinderia Owners in BacarraNoelle Bagcal100% (1)

- Institutionl EconomicsDokument31 SeitenInstitutionl EconomicsC M ChaurasiyaNoch keine Bewertungen

- Unit-2 - Energy Economic AnalysisDokument20 SeitenUnit-2 - Energy Economic AnalysissharenNoch keine Bewertungen

- Incentives and BenefitsDokument58 SeitenIncentives and Benefitskamaljit kaushik100% (1)

- Ch10solution ManualDokument31 SeitenCh10solution ManualJyunde WuNoch keine Bewertungen

- Madelaine Blanchard Resume 3 25 13Dokument2 SeitenMadelaine Blanchard Resume 3 25 13Madelaine BlanchardNoch keine Bewertungen

- Module - 4 National Income Accounting: Reference: Ahuja - PG 15-35Dokument31 SeitenModule - 4 National Income Accounting: Reference: Ahuja - PG 15-35chunmaina10mbaNoch keine Bewertungen

- Chapter 1 Business Trade & Commerce SISDokument197 SeitenChapter 1 Business Trade & Commerce SISNavya JainNoch keine Bewertungen

- Economics Week 1-20Dokument65 SeitenEconomics Week 1-20Loice Gutierrez Porta100% (1)

- Economics of The Central Chin Tribes-RedDokument235 SeitenEconomics of The Central Chin Tribes-RedLTTuangNoch keine Bewertungen

- Distinguish The Relationship/difference Between Entrepreneurial and MarketingDokument3 SeitenDistinguish The Relationship/difference Between Entrepreneurial and MarketingAcua RioNoch keine Bewertungen

- New Paper Pattern As Per Revised Paper Pattern (Bbi) 75-25Dokument3 SeitenNew Paper Pattern As Per Revised Paper Pattern (Bbi) 75-25sameer_kiniNoch keine Bewertungen

- Micro Economics AssignmentDokument10 SeitenMicro Economics AssignmentsipanjegivenNoch keine Bewertungen

- Globalization and EducationDokument36 SeitenGlobalization and EducationJhez de la PeñaNoch keine Bewertungen