Beruflich Dokumente

Kultur Dokumente

Holder J Hasbro Rawdata 2017 09 19

Hochgeladen von

Jacquelyn Holder 'student'0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

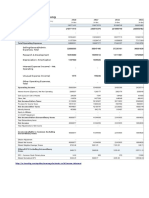

9 Ansichten10 SeitenHasbro reported higher revenues and net earnings in 2016 compared to 2015. Revenues increased over $500 million to $5.01 billion while net earnings grew by over $50 million to $551 million. Expenses also increased across most categories including cost of sales, royalties, advertising, and administration. Hasbro saw growth in both US and international earnings before taxes. The company reported higher earnings per share for both basic and diluted calculations in 2016 compared to 2015.

Originalbeschreibung:

Originaltitel

holder_j_hasbro_rawdata_2017_09_19.xls

Copyright

© © All Rights Reserved

Verfügbare Formate

XLS, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenHasbro reported higher revenues and net earnings in 2016 compared to 2015. Revenues increased over $500 million to $5.01 billion while net earnings grew by over $50 million to $551 million. Expenses also increased across most categories including cost of sales, royalties, advertising, and administration. Hasbro saw growth in both US and international earnings before taxes. The company reported higher earnings per share for both basic and diluted calculations in 2016 compared to 2015.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als XLS, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

9 Ansichten10 SeitenHolder J Hasbro Rawdata 2017 09 19

Hochgeladen von

Jacquelyn Holder 'student'Hasbro reported higher revenues and net earnings in 2016 compared to 2015. Revenues increased over $500 million to $5.01 billion while net earnings grew by over $50 million to $551 million. Expenses also increased across most categories including cost of sales, royalties, advertising, and administration. Hasbro saw growth in both US and international earnings before taxes. The company reported higher earnings per share for both basic and diluted calculations in 2016 compared to 2015.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als XLS, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 10

Hasbro, Inc.

(NMS: HAS)

Exchange rate used is that of the Year End reported date

As Reported Annual Income Statement

Report Date 12/25/2016 12/27/2015

Currency USD USD

Audit Status Not Qualified Not Qualified

Consolidated Yes Yes

Scale Thousands Thousands

Net revenues 5019822 4447509

Cost of sales 1905474 1677033

Gross profit - -

Royalties 409522 379245

Product development expenses 266375 242944

Advertising expenses 468940 409388

Amortization of intangibles 34763 43722

Program production cost amortization 35931 42449

Selling, distribution & administration expenses 1110769 960795

Research & product development expense - -

Total expenses - -

Total expenses 4231774 3755576

Operating profit (loss) 788048 691933

Interest expense 97405 97122

Interest income 9367 3145

Other income (expense), net -7521 5959

Total non-operating income (expense), net -95559 -88018

Earnings (loss) before income taxes - United States 146103 155120

Earnings (loss) before income taxes - international 546476 448795

Earnings (loss) before income taxes 692489 603915

Current income tax expense (benefit) - United States 78958 101591

Current income tax expense (benefit) - state & local 3208 3352

Current income tax expense (benefit) - international 77834 71054

Total current income tax expense (benefit) 160000 175997

Deferred income tax expense (benefit) - United States 11989 -13771

Deferred income tax expense (benefit) - state & local 411 -472

Deferred income tax expense (benefit) - international -13062 -4711

Total deferred income tax expense (benefit) -662 -18954

Income taxes 159338 157043

Earnings (loss) before cumulative effect of accounting changes - -

Cumulative effect of accounting change, net of tax - -

Net earnings (loss) 533151 446872

Net loss (earnings) attributable to noncontrolling interests 18229 4966

Net earnings (loss) attributable to Hasbro, Inc. 551380 451838

Weighted average shares outstanding - basic 124927 125006

Weighted average shares outstanding - diluted 126699 126688

Year end shares outstanding 124486.953 124795.43

Earnings (loss) per share - continuing operations - basic - -

Net earnings (loss) per share - basic 4.4 3.61

Earnings (loss) per share - continuing operations - diluted - -

Net earnings (loss) per share - diluted 4.34 3.57

Cash dividends declared 2.04 1.84

Total number of employees 5400 5000

Number of common stockholders 8340 8500

Foreign currency translation adjustments -5033 -95694

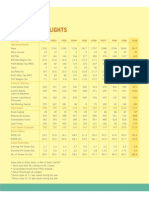

12/28/2014 12/29/2013 12/30/2012

USD USD USD

Not Qualified Not Qualified Not Qualified

Yes Yes Yes

Thousands Thousands Thousands

4277207 4082157 4088983

1698372 1672901 1671980

- - -

305317 338919 302066

222556 207591 201197

420256 398098 422239

52708 78186 50569

47086 47690 41800

895537 871679 847347

- - -

- - -

3641832 3615064 3537198

635375 467093 551785

93098 105585 91141

3759 4925 6333

-6048 -14611 -13575

-95387 -115271 -98383

190769 54424 113893

349219 297398 339509

539988 351822 453402

70390 12760 64076

3134 1677 1587

62909 72640 67826

136433 87077 133489

-15448 -10751 -8832

-530 -368 -303

6223 -8064 -6951

-9755 -19183 -16086

126678 67894 117403

- - -

- - -

413310 283928 335999

2620 2270 -

415930 286198 -

128411 130186 130067

129886 131788 131926

124526.152 131054.402 128940.213

- - -

3.24 2.2 2.58

- - -

3.2 2.17 2.55

1.72 1.6 1.44

5200 5000 5500

8600 8800 6000

- - -

12/25/2011 12/26/2010 12/27/2009 12/28/2008

USD USD USD USD

Not Qualified Not Qualified Not Qualified Not Qualified

Yes Yes Yes Yes

Thousands Thousands Thousands Thousands

4285589 4002161 4067947 4021520

1836263 1712126 1676336 1692728

- - 2391611 2328792

339217 248570 330651 312986

197638 201358 - -

413951 420651 412580 454612

46647 50405 85029 78265

35798 - - -

822094 781192 793558 797209

- - 181195 191424

- - 1803013 1834496

3691608 3414302 - -

593981 587859 588598 494296

89022 82112 61603 47143

6834 5649 2858 17654

-25400 -3676 -156 -23752

-107588 -80139 -58901 -53241

132255 168436 248654 208125

354138 339284 281043 232930

486393 507720 529697 441055

49233 35232 87053 68514

2538 1931 4142 251

52176 47633 44436 40530

103947 84796 135631 109295

-1973 26269 17387 22917

-68 901 993 1964

-880 -1998 756 113

-2921 25172 19136 24994

101026 109968 154767 134289

- - - -

- - - -

385367 397752 374930 306766

- - - -

- - - -

133823 139079 139487 140877

136697 145670 152780 155230

128633.257 137416.115 137097.49 139229.414

- - - -

2.88 2.86 2.69 2.18

- - - -

2.82 2.74 2.48 2

1.2 1 0.8 0.8

5900 5800 5800 5900

9100 9100 9300 9288

- - - -

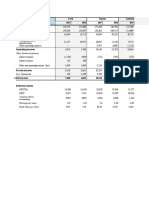

12/30/2007 12/31/2006 12/25/2005

USD USD USD

Not Qualified Not Qualified Not Qualified

Yes Yes Yes

Thousands Thousands Thousands

3837557 3151481 3087627

1576621 1303885 1286271

2260936 1847596 1801356

316807 169731 247283

- - -

434742 368996 366371

67716 78934 102035

- - -

755127 682214 624560

167194 171358 150586

1741586 1471233 1490835

- - -

519350 376363 310521

34618 27521 30537

29973 27609 -

-52323 -34977 30929

-56968 -34889 392

165274 113761 98180

297108 227713 212733

462382 341474 310913

34443 34049 76642

5497 3203 7147

51861 49200 39081

91801 86452 122870

33707 24912 -20611

2889 2135 -1767

982 -2080 -1654

37578 24967 -24032

129379 111419 98838

- - 212075

- - -

333003 230055 212075

- - -

- - -

156054 167100 178303

171205 181043 197436

145207.014 160620.415 177949.67

- - 1.19

2.13 1.38 1.19

- - 1.09

1.97 1.29 1.09

0.64 0.48 0.36

5900 5800 5900

9300 9400 9400

- - -

12/26/2004 12/28/2003 12/29/2002

USD USD USD

Not Qualified Not Qualified Not Qualified

Yes Yes Yes

Thousands Thousands Thousands

2997510 3138657 2816230

1251657 1287962 1099162

1745853 1850695 1717068

223193 248423 296152

- - -

387523 363876 296549

70562 76053 94576

- - -

614401 674544 656725

157162 143183 153775

1452841 1506079 1497777

- - -

293012 344616 219291

31698 52462 77499

- - -

-1226 -48090 -37704

-32924 -100552 -115203

71759 101135 10415

188329 142929 93673

260088 244064 104088

3786 21198 -2774

-497 3229 -1390

26198 21848 27753

29487 46275 23589

28019 27909 5693

2402 2392 488

4203 -7527 -740

34624 22774 5441

64111 69049 29030

195977 175015 75058

- -17351 -245732

195977 157664 -170674

- - -

- - -

176540 173748 172720

196048 178484 185063

177315.261 175499.329 173169.51

1.11 1.01 0.43

1.11 0.91 -0.99

0.96 0.98 0.43

0.96 0.88 -0.98

0.24 0.12 0.12

6000 6900 7200

9500 9500 9400

- - -

Das könnte Ihnen auch gefallen

- Holder J Hasbro Withcalcs 2017 09 19Dokument9 SeitenHolder J Hasbro Withcalcs 2017 09 19Jacquelyn Holder 'student'Noch keine Bewertungen

- Netflix Inc. (NMS: NFLX)Dokument2 SeitenNetflix Inc. (NMS: NFLX)Jimmy DoreNoch keine Bewertungen

- Supreme Annual Report 16 17Dokument152 SeitenSupreme Annual Report 16 17adoniscalNoch keine Bewertungen

- Business Analysis and Valuation (BAV) : Assignment OnDokument6 SeitenBusiness Analysis and Valuation (BAV) : Assignment OnDaniel2341Noch keine Bewertungen

- Business Analysis and Valuation (BAV) : Assignment OnDokument6 SeitenBusiness Analysis and Valuation (BAV) : Assignment OnDaniel2341Noch keine Bewertungen

- L&T Standalone FinancialsDokument4 SeitenL&T Standalone FinancialsmartinajosephNoch keine Bewertungen

- Netflix Inc. (NMS: NFLX)Dokument4 SeitenNetflix Inc. (NMS: NFLX)Jimmy DoreNoch keine Bewertungen

- Hinopak MotorsDokument8 SeitenHinopak MotorsShamsuddin SoomroNoch keine Bewertungen

- Federal Urdu University of Arts, Science and Technology, Islamabad Department of Business Administration Final Project Bba-3 SEMESTER Autumn-2020Dokument7 SeitenFederal Urdu University of Arts, Science and Technology, Islamabad Department of Business Administration Final Project Bba-3 SEMESTER Autumn-2020Qasim Jahangir WaraichNoch keine Bewertungen

- Industry AvaragesDokument81 SeitenIndustry Avaragessandeep kumarNoch keine Bewertungen

- Result Statement SamsungDokument1 SeiteResult Statement SamsungmariaNoch keine Bewertungen

- Group 14 - Bata ValuationDokument43 SeitenGroup 14 - Bata ValuationSUBHADEEP GUHA-DM 20DM218Noch keine Bewertungen

- Financial HighlightsDokument1 SeiteFinancial HighlightsAnushka SinhaNoch keine Bewertungen

- ST ND RD TH THDokument4 SeitenST ND RD TH THSanam ShresthaNoch keine Bewertungen

- Atlas Honda: Financial ModellingDokument19 SeitenAtlas Honda: Financial ModellingSaqib NasirNoch keine Bewertungen

- Statement of Financial Performance: Profit and Loss AccountDokument26 SeitenStatement of Financial Performance: Profit and Loss AccountMamun RashidNoch keine Bewertungen

- FIN ProjectDokument6 SeitenFIN ProjectEduardo VillarrealNoch keine Bewertungen

- 2017 18 PDFDokument244 Seiten2017 18 PDFthirsheel balajiNoch keine Bewertungen

- AnalysisDokument34 SeitenAnalysisIndraneel MahantiNoch keine Bewertungen

- ATH Case CalculationDokument4 SeitenATH Case CalculationsasNoch keine Bewertungen

- Apple Model - FinalDokument32 SeitenApple Model - FinalDang TrangNoch keine Bewertungen

- MRF Limited: (Rs. in Lakhs)Dokument2 SeitenMRF Limited: (Rs. in Lakhs)danielxx747Noch keine Bewertungen

- Beximco Pharmaceuticals LTDDokument14 SeitenBeximco Pharmaceuticals LTDIftekar Hasan SajibNoch keine Bewertungen

- Students Name: Faculty of Business and EconomicsDokument25 SeitenStudents Name: Faculty of Business and EconomicsEhab photographyNoch keine Bewertungen

- Report F.MDokument12 SeitenReport F.MMuhammad Waseem Anjum Muhammad Waseem AnjumNoch keine Bewertungen

- Profit and Loss Account: Budget 2007-2008: (Rs. in Lakhs)Dokument8 SeitenProfit and Loss Account: Budget 2007-2008: (Rs. in Lakhs)grimm312Noch keine Bewertungen

- Gagandeep Financial StatementDokument3 SeitenGagandeep Financial StatementRajveer deepNoch keine Bewertungen

- Project AnalysisDokument10 SeitenProject AnalysisJawad FarooqNoch keine Bewertungen

- Crescent Fibres Income Statement For Years 2005-2009Dokument54 SeitenCrescent Fibres Income Statement For Years 2005-2009Aaima SarwarNoch keine Bewertungen

- Total Operating Expenses Operating Income or Loss: BreakdownDokument9 SeitenTotal Operating Expenses Operating Income or Loss: BreakdownAhmed EzzNoch keine Bewertungen

- Anwal Gas TradersDokument9 SeitenAnwal Gas TraderskarimNoch keine Bewertungen

- Ten Year HighlightsDokument1 SeiteTen Year HighlightssharanfordNoch keine Bewertungen

- BEXimco RenataDokument14 SeitenBEXimco RenataMahiNoch keine Bewertungen

- Kohat Cement Company LTD: Profit and Loss Account For The Year Ended On . Rupees in (''000'') Gross Sales 1958321 2800130Dokument54 SeitenKohat Cement Company LTD: Profit and Loss Account For The Year Ended On . Rupees in (''000'') Gross Sales 1958321 2800130Sohail AdnanNoch keine Bewertungen

- Section B Group 4 Assignment BNL StoresDokument3 SeitenSection B Group 4 Assignment BNL StoresMohit VermaNoch keine Bewertungen

- Part-2 Cash Flow Apex Footwear Limited Growth RateDokument11 SeitenPart-2 Cash Flow Apex Footwear Limited Growth RateRizwanul Islam 1912111630Noch keine Bewertungen

- Beneish M ScoreDokument11 SeitenBeneish M ScorePuneet SahotraNoch keine Bewertungen

- Ford Case Study (LT 11) - Jerry's Edit v2Dokument31 SeitenFord Case Study (LT 11) - Jerry's Edit v2JerryJoshuaDiazNoch keine Bewertungen

- Ratio AnalysisDokument8 SeitenRatio AnalysisEngy SabryNoch keine Bewertungen

- JP Morgan Financial StatementsDokument8 SeitenJP Morgan Financial StatementsTamar PirtskhalaishviliNoch keine Bewertungen

- Persistent KPIT - Merger ModelDokument86 SeitenPersistent KPIT - Merger ModelAnurag JainNoch keine Bewertungen

- Amount in Rupees CroreDokument31 SeitenAmount in Rupees CroreniftamNoch keine Bewertungen

- Keerthika Case StudiesDokument9 SeitenKeerthika Case StudiesAarti SaxenaNoch keine Bewertungen

- Financial AccountingDokument15 SeitenFinancial AccountingPoojith KumarNoch keine Bewertungen

- MGMT90226 Business Acumen For Entrepreneurs Class 1: Use in Conjunction With Text Book Slides Albeb@unimelb - Edu.auDokument28 SeitenMGMT90226 Business Acumen For Entrepreneurs Class 1: Use in Conjunction With Text Book Slides Albeb@unimelb - Edu.auRafael KusumaNoch keine Bewertungen

- Solution KPITDokument28 SeitenSolution KPITsuryasandeepc111Noch keine Bewertungen

- The Discounted Free Cash Flow Model For A Complete BusinessDokument1 SeiteThe Discounted Free Cash Flow Model For A Complete BusinessKhalil LaamiriNoch keine Bewertungen

- InfosysDokument19 SeitenInfosysKetan JajuNoch keine Bewertungen

- Manor Sir Cost AnalysisDokument4 SeitenManor Sir Cost AnalysisSunielNoch keine Bewertungen

- ForecastingDokument9 SeitenForecastingQuỳnh'ss Đắc'ssNoch keine Bewertungen

- Performance AGlanceDokument1 SeitePerformance AGlanceHarshal SawaleNoch keine Bewertungen

- Amount in Rupees CroreDokument40 SeitenAmount in Rupees CrorePradeep MulaniNoch keine Bewertungen

- Profit For The Year: Income Statement 2019 - DG CementDokument10 SeitenProfit For The Year: Income Statement 2019 - DG CementHAMMAD AliNoch keine Bewertungen

- DCF 2 CompletedDokument4 SeitenDCF 2 CompletedPragathi T NNoch keine Bewertungen

- 05-03-22 Focal Cma DataDokument6 Seiten05-03-22 Focal Cma DataShivam SharmaNoch keine Bewertungen

- John M CaseDokument10 SeitenJohn M Caseadrian_simm100% (1)

- Balance Sheet of Instrumentation LimitedDokument8 SeitenBalance Sheet of Instrumentation Limited94629Noch keine Bewertungen

- Nishat Chunian Limited Balance Sheet: Equities and LiabilitiesDokument6 SeitenNishat Chunian Limited Balance Sheet: Equities and Liabilities3795Noch keine Bewertungen

- Performance at A GlanceDokument7 SeitenPerformance at A GlanceLima MustaryNoch keine Bewertungen

- Hasbro, Inc.: General Company InformationDokument10 SeitenHasbro, Inc.: General Company InformationJacquelyn Holder 'student'Noch keine Bewertungen

- Market Sizes - Historical: Geography Category Data Type UnitDokument3 SeitenMarket Sizes - Historical: Geography Category Data Type UnitJacquelyn Holder 'student'Noch keine Bewertungen

- Market Sizes - Historical: Geography Category Data Type UnitDokument3 SeitenMarket Sizes - Historical: Geography Category Data Type UnitJacquelyn Holder 'student'Noch keine Bewertungen

- Holder J Hasbro Comparison 2017 09 19Dokument10 SeitenHolder J Hasbro Comparison 2017 09 19Jacquelyn Holder 'student'Noch keine Bewertungen

- Team Case Study - Responses.5:21:18.2pmDokument2 SeitenTeam Case Study - Responses.5:21:18.2pmJacquelyn Holder 'student'Noch keine Bewertungen

- Local Media271226407970108268Dokument17 SeitenLocal Media271226407970108268Jana Rose PaladaNoch keine Bewertungen

- Acc423 Final Exam 100+ Questions Included 2 ExamsDokument102 SeitenAcc423 Final Exam 100+ Questions Included 2 ExamsMaria Aguilar0% (1)

- FAR04-13 - Income TaxesDokument6 SeitenFAR04-13 - Income TaxesAi NatangcopNoch keine Bewertungen

- Ia2 16 Accounting For Income TaxDokument55 SeitenIa2 16 Accounting For Income TaxJoyce Anne Garduque100% (1)

- Accounting For Taxes & Employee BenefitsDokument5 SeitenAccounting For Taxes & Employee BenefitsAveryl Lei Sta.Ana100% (1)

- AICPA Newly Released MCQs July'20Dokument60 SeitenAICPA Newly Released MCQs July'20Daljeet Singh100% (1)

- Prelim Exam - ACTG6257 Intermediate Accounting 3Dokument22 SeitenPrelim Exam - ACTG6257 Intermediate Accounting 3Kitchie Rose Dala CruzNoch keine Bewertungen

- Sherrod, Inc., Reported Pretax Accounting Income of $88 Million For 2018Dokument15 SeitenSherrod, Inc., Reported Pretax Accounting Income of $88 Million For 2018laale dijaanNoch keine Bewertungen

- Self Test 9 - LiabilitiesDokument4 SeitenSelf Test 9 - LiabilitiesLennier ArvinNoch keine Bewertungen

- Amaysim Australia LimitedDokument9 SeitenAmaysim Australia LimitedMahnoor NooriNoch keine Bewertungen

- Accounting For Deferred TaxDokument14 SeitenAccounting For Deferred TaxDeepan MarxNoch keine Bewertungen

- Psab LK TW Ii 2022Dokument114 SeitenPsab LK TW Ii 2022Sitti HardiyantiNoch keine Bewertungen

- Morris - Breann - 343 - White - Fall2020 Exam #2Dokument3 SeitenMorris - Breann - 343 - White - Fall2020 Exam #2Breann MorrisNoch keine Bewertungen

- Solution To Problem 1-3: Liability For BonusesDokument16 SeitenSolution To Problem 1-3: Liability For BonusesNaddieNoch keine Bewertungen

- Toaz - Info Cfas Quiz PRDokument9 SeitenToaz - Info Cfas Quiz PRASHERAH ENGKONGNoch keine Bewertungen

- Taxable Income and Tax DueDokument13 SeitenTaxable Income and Tax DueSheena Gane Esteves100% (1)

- IAS 12 Class Tutorial CCP CemenDokument4 SeitenIAS 12 Class Tutorial CCP CemenJames MutarauswaNoch keine Bewertungen

- Deferred TaxDokument6 SeitenDeferred TaxJayson Manalo GañaNoch keine Bewertungen

- Kế Toán Quốc Tế: Select oneDokument8 SeitenKế Toán Quốc Tế: Select oneLoki Luke100% (1)

- Chapter 14Dokument27 SeitenChapter 14IstikharohNoch keine Bewertungen

- Problems Discontinued, Acctg Changes, Interim, Opseg, Correction of ErrorDokument21 SeitenProblems Discontinued, Acctg Changes, Interim, Opseg, Correction of ErrorMmNoch keine Bewertungen

- Chinese English Translation of Accounting SubjectsDokument89 SeitenChinese English Translation of Accounting SubjectsdanielNoch keine Bewertungen

- CFA L1 Recall - FRADokument23 SeitenCFA L1 Recall - FRAchangyong leeNoch keine Bewertungen

- Income Taxation - Tabag & Garcia Income Taxation - Tabag & GarciaDokument34 SeitenIncome Taxation - Tabag & Garcia Income Taxation - Tabag & GarciaShaira Villaflor100% (20)

- Statement of Comprehensive Income: Problem 1: True or FalseDokument17 SeitenStatement of Comprehensive Income: Problem 1: True or FalsePaula Bautista100% (3)

- MFRS 112 042015 PDFDokument44 SeitenMFRS 112 042015 PDFAisyah JaafarNoch keine Bewertungen

- Accounting For Income TaxDokument6 SeitenAccounting For Income TaxRyll BedasNoch keine Bewertungen

- Chapter 9 - Interim Financial ReportingDokument8 SeitenChapter 9 - Interim Financial ReportingXiena0% (1)

- Income Taxes: Basic ConceptsDokument7 SeitenIncome Taxes: Basic ConceptsTrisha Mae Mendoza MacalinoNoch keine Bewertungen

- Manny Company: Required: Compute For The Balances of The Following On December 31, 2X14Dokument4 SeitenManny Company: Required: Compute For The Balances of The Following On December 31, 2X14MauiNoch keine Bewertungen