Beruflich Dokumente

Kultur Dokumente

Tax Alert 8D

Hochgeladen von

llcataxhelpdesk0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

17 Ansichten1 SeiteRule 8D Section 14a

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenRule 8D Section 14a

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

17 Ansichten1 SeiteTax Alert 8D

Hochgeladen von

llcataxhelpdeskRule 8D Section 14a

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

Corporate Office : A16/9, Vasant Vihar, New Delhi – 110 057, India.

T: +91.11.26151853, 42591800 F: +91.11.26145222 E: delhi@llca.net W: www.llca.net

Branch Offices : Bengaluru | Mumbai | Noida

13th June 2016

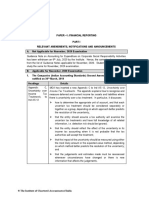

Comparison of Existing Rule 8D viz a viz Amended

Rule 8D is as under:-

CBDT NOTIFICATION

Particulars of Existing Rule Amended Rule

disallowance 8D 8D

CBDT issued Notification No. 43/2016 (F. No. Direct Disallowed Disallowed

370142/7/2016-TPL) dated 02nd June 2016 amending Expenditure in

relation to EI

Rule 8D of the Income Tax Rules, that provides for the

Interest Disallowed Clause omitted

methodology of calculating the quantum of expenses

Expenditure

relating to Income which do not form part of the total

indirectly

taxable income. In ordinary parlance, the same attributable to

relates to the computation of disallowance u/s. 14A EI

of the Income Tax Act, 1961. Amount of 0.5% 1%

disallowance

The existing sub-rule (2) and (3) of Rule 8D have been

Mode of Annual Annual average

replaced by new sub-rule (2). The new sub rule (2)

computation of average of of the monthly

provides as under:- Average opening & averages of

investments closing opening &

The expenditure in relation to income which does not balance of closing balance

form part of the total income shall be aggregate of: investment. of investment.

i. Expenditure directly related to exempt Restriction of No restriction Disallowance

income, and Disallowance restricted to

the total

Expenditure

ii. 1% of the annual average of the monthly

claimed by the

averages of the opening and closing assessee.

balances of the value of investment, income

from which does not or shall not form part of

Our Comments

total income.

Relief to assessee as no disallowance in respect to

Amended Rule shall come into force on the date of •

general interest expense.

its publication in the Official Gazette, i.e. on 2nd Full stop on widespread litigation with respect to

June 2016. cases where disallowance under the said rule

exceeded the total expenditure claimed by the

assessee.

No clarification provided w.r.t. the issue where

the disallowance exceeded the exempt income or

where no exempt income is earned during the

year

Das könnte Ihnen auch gefallen

- Icai International TaxDokument5 SeitenIcai International TaxDheeraj YadavNoch keine Bewertungen

- US Internal Revenue Service: Irb07-39Dokument72 SeitenUS Internal Revenue Service: Irb07-39IRSNoch keine Bewertungen

- What Did The Union Budget 2022 Do For Charitable Organisations?Dokument5 SeitenWhat Did The Union Budget 2022 Do For Charitable Organisations?Aakash MalhotraNoch keine Bewertungen

- 8.special Tax Rates of Companies & MATDokument22 Seiten8.special Tax Rates of Companies & MATMuthu nayagamNoch keine Bewertungen

- COMMON RULES OkDokument15 SeitenCOMMON RULES OkMuhammad ZeshanNoch keine Bewertungen

- Department of Finance v. Asia United BankDokument19 SeitenDepartment of Finance v. Asia United BankMarj BaquialNoch keine Bewertungen

- How To Compute Your Capital Gains: Tax Payers Information Series - 3Dokument55 SeitenHow To Compute Your Capital Gains: Tax Payers Information Series - 3pradeep_venkata_1Noch keine Bewertungen

- Tax Watch Bulletin Tax Amendment Bills 2023Dokument22 SeitenTax Watch Bulletin Tax Amendment Bills 2023BonnieNoch keine Bewertungen

- T Tax E Expen Nditu Ure: Ann Nex - 2Dokument3 SeitenT Tax E Expen Nditu Ure: Ann Nex - 2BilalNumanNoch keine Bewertungen

- US Internal Revenue Service: Irb01-30Dokument27 SeitenUS Internal Revenue Service: Irb01-30IRSNoch keine Bewertungen

- G.R. Nos. 240163 & 240168-69Dokument11 SeitenG.R. Nos. 240163 & 240168-69Lino MomonganNoch keine Bewertungen

- Chapter 7 Introduction-to-Regular-Income-TaxDokument20 SeitenChapter 7 Introduction-to-Regular-Income-TaxLouella CunananNoch keine Bewertungen

- Accounting V Tax TreatmentDokument3 SeitenAccounting V Tax TreatmentReena MaNoch keine Bewertungen

- Eu Anti Tax Avoidance Directive Member State Implementation OverviewDokument13 SeitenEu Anti Tax Avoidance Directive Member State Implementation OverviewFaruk CetinNoch keine Bewertungen

- Treatments, To Income Tax Treatments. The Appendix Explains How To Recognise andDokument74 SeitenTreatments, To Income Tax Treatments. The Appendix Explains How To Recognise andShyam virsinghNoch keine Bewertungen

- Article 9 Paragraph 1 of The Income Tax Law - POSITIVE FISCAL ADJUSTMENTDokument2 SeitenArticle 9 Paragraph 1 of The Income Tax Law - POSITIVE FISCAL ADJUSTMENTanggraeni_ayuNoch keine Bewertungen

- Notice 1036: Early Release Copies of The 2019 Percentage Method Tables For Income Tax Withholding Future DevelopmentsDokument4 SeitenNotice 1036: Early Release Copies of The 2019 Percentage Method Tables For Income Tax Withholding Future DevelopmentsAgr AgrNoch keine Bewertungen

- US Internal Revenue Service: Irb07-19Dokument128 SeitenUS Internal Revenue Service: Irb07-19IRSNoch keine Bewertungen

- Tax Expenditures: Tax Expenditures in The Income Tax Tax Expenditure EstimatesDokument52 SeitenTax Expenditures: Tax Expenditures in The Income Tax Tax Expenditure EstimatesSushil JindalNoch keine Bewertungen

- Specified Domestic TransactionDokument3 SeitenSpecified Domestic TransactionangeetNoch keine Bewertungen

- GCRO Top230 PG April2019Dokument223 SeitenGCRO Top230 PG April2019Edmerl AbadNoch keine Bewertungen

- US Internal Revenue Service: Irb07-20Dokument44 SeitenUS Internal Revenue Service: Irb07-20IRSNoch keine Bewertungen

- RSM India Union Budget 2021 HighlightsDokument132 SeitenRSM India Union Budget 2021 HighlightsSunil KumarNoch keine Bewertungen

- SelectionDokument27 SeitenSelectionMohammad BaratNoch keine Bewertungen

- TAX 702 - Income Tax Rates CorporationsDokument6 SeitenTAX 702 - Income Tax Rates CorporationsJuan Miguel UngsodNoch keine Bewertungen

- Tax Saving InstrumentsDokument4 SeitenTax Saving InstrumentsDinesh CNoch keine Bewertungen

- Neral Anti-Avoidance Rules (GAAR) (R) - 1Dokument32 SeitenNeral Anti-Avoidance Rules (GAAR) (R) - 1Muthu nayagamNoch keine Bewertungen

- For ReformatDokument49 SeitenFor ReformatCid Benedict PabalanNoch keine Bewertungen

- Tax2601 Lu5 2022Dokument21 SeitenTax2601 Lu5 2022Tricia MogirlNoch keine Bewertungen

- Uganda Tax Amendment Bills For 2018Dokument10 SeitenUganda Tax Amendment Bills For 2018jadwongscribdNoch keine Bewertungen

- KPMG - Newsletter Loi de Finances 2024 (English Version)Dokument6 SeitenKPMG - Newsletter Loi de Finances 2024 (English Version)boukhlefNoch keine Bewertungen

- Income Tax AmendmentsNew Provisions of Finance Act 2020Dokument26 SeitenIncome Tax AmendmentsNew Provisions of Finance Act 2020Piyush HarlalkaNoch keine Bewertungen

- US Internal Revenue Service: Irb07-17Dokument60 SeitenUS Internal Revenue Service: Irb07-17IRS100% (1)

- The Diploma in International Taxation - Relevant Treaty ArticlesDokument20 SeitenThe Diploma in International Taxation - Relevant Treaty ArticlesMAHESH JAINNoch keine Bewertungen

- Income-Taxation-Chapter-7-9 2Dokument16 SeitenIncome-Taxation-Chapter-7-9 2Milarose Ablay-MacawiliNoch keine Bewertungen

- JURNAL HARYATI - Id.enDokument3 SeitenJURNAL HARYATI - Id.enita nurlianaNoch keine Bewertungen

- SFC Dems - Possible Revenue Provisions and DescriptionsDokument4 SeitenSFC Dems - Possible Revenue Provisions and DescriptionsSahil Kapur100% (2)

- Penalties For Non-Compliance To Provisions of Income Tax ACTDokument8 SeitenPenalties For Non-Compliance To Provisions of Income Tax ACTSkk IrisNoch keine Bewertungen

- Taxation (822) XII PDFDokument158 SeitenTaxation (822) XII PDFAditya SharmaNoch keine Bewertungen

- Bir Train RR On Income Tax 20180207Dokument122 SeitenBir Train RR On Income Tax 20180207Vanesa AgootNoch keine Bewertungen

- Different Aspects of Tax PlanningDokument8 SeitenDifferent Aspects of Tax PlanningGaurav GaurNoch keine Bewertungen

- Ngos-Accounting and Legal IntricaciesDokument7 SeitenNgos-Accounting and Legal IntricaciesShrey DNoch keine Bewertungen

- CBO: Economic Effects of Policies Contributing To Fiscal Tightening in 2013Dokument16 SeitenCBO: Economic Effects of Policies Contributing To Fiscal Tightening in 2013Patricia DillonNoch keine Bewertungen

- Tax Digest Cañero PDFDokument9 SeitenTax Digest Cañero PDFGreghvon MatolNoch keine Bewertungen

- Far Eastern University: An Institute of Accounts Business and FinanceDokument5 SeitenFar Eastern University: An Institute of Accounts Business and FinanceAcademic StuffNoch keine Bewertungen

- Memphis Style Business PPT TemplatesDokument83 SeitenMemphis Style Business PPT TemplatesRei AnneNoch keine Bewertungen

- International Accounting Standard 12: Income TaxesDokument14 SeitenInternational Accounting Standard 12: Income Taxesfaraon_xxxNoch keine Bewertungen

- It (Deductions A)Dokument22 SeitenIt (Deductions A)Rein ConcepcionNoch keine Bewertungen

- Annex B - Compliance With Other Regulatory Requirements For CY2022Dokument16 SeitenAnnex B - Compliance With Other Regulatory Requirements For CY2022Cha Gamboa De LeonNoch keine Bewertungen

- Concept Map On IAS 12 - Income TaxesDokument2 SeitenConcept Map On IAS 12 - Income TaxesRey OnateNoch keine Bewertungen

- Lecture Notes - Deductions From Gross IncomeDokument18 SeitenLecture Notes - Deductions From Gross IncomeRad IsnaniNoch keine Bewertungen

- Week 12 AY2021-2022 Forensic Accounting & Insurance v2Dokument35 SeitenWeek 12 AY2021-2022 Forensic Accounting & Insurance v2Chloe NgNoch keine Bewertungen

- Ca Final FR RTP May 20Dokument74 SeitenCa Final FR RTP May 20Niharika GuptaNoch keine Bewertungen

- RTP For Group-1 For May-2020Dokument341 SeitenRTP For Group-1 For May-2020Jayendrakumar KatariyaNoch keine Bewertungen

- Icpau Tax Proposals For Fy 2023-24 BudgetDokument12 SeitenIcpau Tax Proposals For Fy 2023-24 BudgetByamukama RobertNoch keine Bewertungen

- Salient Features of Income Tax Act 2023Dokument79 SeitenSalient Features of Income Tax Act 2023Md. Abdullah Al ImranNoch keine Bewertungen

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeVon Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeBewertung: 1 von 5 Sternen1/5 (1)

- 1040 Exam Prep Module V: Adjustments to Income or DeductionsVon Everand1040 Exam Prep Module V: Adjustments to Income or DeductionsNoch keine Bewertungen

- Textbook of Urgent Care Management: Chapter 12, Pro Forma Financial StatementsVon EverandTextbook of Urgent Care Management: Chapter 12, Pro Forma Financial StatementsNoch keine Bewertungen

- India International SchoolDokument15 SeitenIndia International Schoolazimmuhammed673790Noch keine Bewertungen

- Freemason's MonitorDokument143 SeitenFreemason's Monitorpopecahbet100% (1)

- Investing in Indian Stock Markets - The 5 Minute WrapUp - EquitymasterDokument18 SeitenInvesting in Indian Stock Markets - The 5 Minute WrapUp - EquitymasterAtanu PaulNoch keine Bewertungen

- Bernini, and The Urban SettingDokument21 SeitenBernini, and The Urban Settingweareyoung5833Noch keine Bewertungen

- Gerund Infinitive ParticipleDokument4 SeitenGerund Infinitive ParticiplemertNoch keine Bewertungen

- 131RGApplication PDFDokument2 Seiten131RGApplication PDFMuhammad FarhanNoch keine Bewertungen

- 131.3 Visa Requirements General 2016 10 PDFDokument2 Seiten131.3 Visa Requirements General 2016 10 PDFDilek YILMAZNoch keine Bewertungen

- STP and Marketing MixDokument25 SeitenSTP and Marketing MixKurt canonNoch keine Bewertungen

- Mohan ResearchDokument6 SeitenMohan ResearchRamadhan A AkiliNoch keine Bewertungen

- Blockchain in ConstructionDokument4 SeitenBlockchain in ConstructionHasibullah AhmadzaiNoch keine Bewertungen

- Problem Set 1Dokument2 SeitenProblem Set 1edhuguetNoch keine Bewertungen

- Athenian Democracy DocumentsDokument7 SeitenAthenian Democracy Documentsapi-2737972640% (1)

- Kubota Utility Vehicle Rtv900 Workshop ManualDokument17 SeitenKubota Utility Vehicle Rtv900 Workshop Manualbrianwong090198pni0% (1)

- Example Research Paper On Maya AngelouDokument8 SeitenExample Research Paper On Maya Angelougw2wr9ss100% (1)

- Statutory Construction NotesDokument8 SeitenStatutory Construction NotesBryan Carlo D. LicudanNoch keine Bewertungen

- 2016-17 Georgia Hunting RegulationsDokument76 Seiten2016-17 Georgia Hunting RegulationsAmmoLand Shooting Sports NewsNoch keine Bewertungen

- Mitigate DoS Attack Using TCP Intercept On Cisco RouterDokument4 SeitenMitigate DoS Attack Using TCP Intercept On Cisco RouterAKUENoch keine Bewertungen

- Internal Assignment Applicable For June 2017 Examination: Course: Cost and Management AccountingDokument2 SeitenInternal Assignment Applicable For June 2017 Examination: Course: Cost and Management Accountingnbala.iyerNoch keine Bewertungen

- As SaaffatDokument39 SeitenAs SaaffatAyesha KhanNoch keine Bewertungen

- The Effect of Big-Data On The HEC of ChinaDokument9 SeitenThe Effect of Big-Data On The HEC of ChinaAbdulGhaffarNoch keine Bewertungen

- Introduction To NstpiiDokument15 SeitenIntroduction To NstpiiSIJINoch keine Bewertungen

- Symantec Endpoint ProtectionDokument5 SeitenSymantec Endpoint ProtectionreanveNoch keine Bewertungen

- Koalatext 4Dokument8 SeitenKoalatext 4YolandaOrduñaNoch keine Bewertungen

- The Role of Service in The Hospitality IndustryDokument24 SeitenThe Role of Service in The Hospitality IndustryhdanesanNoch keine Bewertungen

- Chapter 1 To 23 Ques-AnswersDokument13 SeitenChapter 1 To 23 Ques-AnswersRasha83% (12)

- Mark The Letter A, B, C, or D On Your Answer Sheet To Indicate The Word(s) OPPOSITE in Meaning To The Underlined Word(s) in Each of The Following QuestionsDokument10 SeitenMark The Letter A, B, C, or D On Your Answer Sheet To Indicate The Word(s) OPPOSITE in Meaning To The Underlined Word(s) in Each of The Following QuestionsPhạm Trần Gia HuyNoch keine Bewertungen

- Pyp As Model of TD LearningDokument30 SeitenPyp As Model of TD Learningapi-234372890Noch keine Bewertungen

- Marketing Case - Cowgirl ChocolatesDokument14 SeitenMarketing Case - Cowgirl Chocolatessarah_alexandra2100% (4)

- A Research Paper Submited To Department of Management For Partalfulfilment of The Requirement in Ba Degree in ManagementDokument44 SeitenA Research Paper Submited To Department of Management For Partalfulfilment of The Requirement in Ba Degree in ManagementEng-Mukhtaar CatooshNoch keine Bewertungen

- 6 Surprising Ways To Beat The Instagram AlgorithmDokument5 Seiten6 Surprising Ways To Beat The Instagram AlgorithmluminenttNoch keine Bewertungen