Beruflich Dokumente

Kultur Dokumente

Ericsson Telecommunications Vs City of Pasig

Hochgeladen von

AJMordenoOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Ericsson Telecommunications Vs City of Pasig

Hochgeladen von

AJMordenoCopyright:

Verfügbare Formate

ERICSSON TELECOMMUNICATIONS, INC., vs. CITY OF PASIG, represented by its City Mayor, Hon. Vicente P.

Eusebio, et

al (G.R. No. 176667; November 22, 2007)

Facts:

1. Ericsson Telecommunications, Inc. is a corporation engaged in the design, engineering, and marketing of

telecommunication facilities/system with principal address at Pasig City

2. It was assessed by the City Treasurer of Pasig City of business tax deficiency for the years 1998 and 1999 and also for

2000 and 2001 based on its gross revenues.

3. Petitioner filed a Protest arguing that that the local business tax on contractors should be based on gross receipts and not

gross revenue.

Issue: What should be the basis of the local business tax? gross receipts or gross revenue?

Held: The basis should be gross receipts

Paragraph e, Section 143 of the Local Government Code provides that

“The municipality may impose taxes on the following businesses: (e) On contractors and other independent contractors, in

accordance with the following schedule:

With gross receipts for the preceding calendar Amount of Tax Per

year in the amount of: Annum

The above provision specifically refers to gross receipts.

Section 131 of the Local Government Code defines gross sales or receipts as follows:

"Gross Sales or Receipts" - include the total amount of money or its equivalent representing the contract price, compensation or

service fee, including the amount charged or materials supplied with the services and the deposits or advance payments actually or

constructively received during the taxable quarter for the services performed or to be performed for another person excluding

discounts if determinable at the time of sales, sales return, excise tax, and value-added tax (VAT);

The law is clear. Gross receipts include money or its equivalent actually or constructively received in consideration of

services rendered or articles sold, exchanged or leased, whether actual or constructive.

“Gross Revenue” - covers money or its equivalent actually or constructively received, including the value of services rendered or

articles sold, exchanged or leased, the payment of which is yet to be received. This is in consonance with the International

Financial Reporting Standards, which defines revenue as the gross inflow of economic benefits (cash, receivables, and other

assets) arising from the ordinary operating activities of an enterprise (such as sales of goods, sales of services, interest, royalties,

and dividends), which is measured at the fair value of the consideration received or receivable

In petitioner's case, its audited financial statements reflect income or revenue which accrued to it during the taxable

period although not yet actually or constructively received or paid. This is because petitioner uses the accrual method of

accounting, where income is reportable when all the events have occurred that fix the taxpayer's right to receive the

income, and the amount can be determined with reasonable accuracy; the right to receive income, and not the actual

receipt, determines when to include the amount in gross income.

The imposition of local business tax based on petitioner's gross revenue will inevitably result in the constitutionally

proscribed double taxation – taxing of the same person twice by the same jurisdiction for the same thing– inasmuch as

petitioner's revenue or income for a taxable year will definitely include its gross receipts already reported during the

previous year and for which local business tax has already been paid.

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- California Child and Spousal Support Bench GuideDokument96 SeitenCalifornia Child and Spousal Support Bench GuideAnonymous oY5Dk8c5u100% (2)

- Moreno Vs Atty Ernesto AranetaDokument2 SeitenMoreno Vs Atty Ernesto AranetaAJMordeno100% (1)

- Practice Court Pre TrialDokument7 SeitenPractice Court Pre TrialAJMordenoNoch keine Bewertungen

- Motion For DefermentDokument3 SeitenMotion For DefermentAJMordenoNoch keine Bewertungen

- Practice Court Pre TrialDokument1 SeitePractice Court Pre TrialAJMordenoNoch keine Bewertungen

- Motion For DefermentDokument3 SeitenMotion For DefermentAJMordenoNoch keine Bewertungen

- Practice Court Pre TrialDokument1 SeitePractice Court Pre TrialAJMordenoNoch keine Bewertungen

- Sta Lucia V City of PasigDokument2 SeitenSta Lucia V City of PasigAJMordenoNoch keine Bewertungen

- People vs. TuandaDokument1 SeitePeople vs. TuandaZach Matthew GalendezNoch keine Bewertungen

- Abaigar Vs PazDokument8 SeitenAbaigar Vs PazAJMordenoNoch keine Bewertungen

- Gsis Vs Manila DigestDokument2 SeitenGsis Vs Manila DigestPatrick Tan100% (1)

- Radjae Vs AloveraDokument10 SeitenRadjae Vs AloveraAJMordenoNoch keine Bewertungen

- People vs. TuandaDokument1 SeitePeople vs. TuandaZach Matthew GalendezNoch keine Bewertungen

- Royong V OblenaDokument2 SeitenRoyong V Oblenagoma21Noch keine Bewertungen

- Case Digest: Lung Cenlungasdlkfjdsflter of The Philippines vs. Quezon City and Constantino RosasDokument1 SeiteCase Digest: Lung Cenlungasdlkfjdsflter of The Philippines vs. Quezon City and Constantino RosasAJMordenoNoch keine Bewertungen

- 05 International Express v. Ca 343 SCRA 674Dokument6 Seiten05 International Express v. Ca 343 SCRA 674avatarboychrisNoch keine Bewertungen

- Napocor Vs CBADokument1 SeiteNapocor Vs CBAAJMordenoNoch keine Bewertungen

- Case Digest: Lung Cenlungasdlkfjdsflter of The Philippines vs. Quezon City and Constantino RosasDokument1 SeiteCase Digest: Lung Cenlungasdlkfjdsflter of The Philippines vs. Quezon City and Constantino RosasAJMordenoNoch keine Bewertungen

- Citibank NA V Hon Segundino ChuaDokument15 SeitenCitibank NA V Hon Segundino ChuaAJMordenoNoch keine Bewertungen

- Cruz vs. DalisayDokument1 SeiteCruz vs. Dalisayvanessa_3Noch keine Bewertungen

- Citibank NA V Hon Segundino ChuaDokument15 SeitenCitibank NA V Hon Segundino ChuaAJMordenoNoch keine Bewertungen

- Royong V OblenaDokument2 SeitenRoyong V Oblenagoma21Noch keine Bewertungen

- Radjae Vs AloveraDokument10 SeitenRadjae Vs AloveraAJMordenoNoch keine Bewertungen

- Supreme Court: Emmanuel D. Agustin For Petitioner. Bernardo P. Concha For Private RespondentsDokument4 SeitenSupreme Court: Emmanuel D. Agustin For Petitioner. Bernardo P. Concha For Private RespondentsAJMordenoNoch keine Bewertungen

- De Silva Vs Aboitiz and CoDokument2 SeitenDe Silva Vs Aboitiz and CoAJMordenoNoch keine Bewertungen

- Edrial Vs Quilat2Dokument11 SeitenEdrial Vs Quilat2AJMordenoNoch keine Bewertungen

- Abaigar Vs PazDokument8 SeitenAbaigar Vs PazAJMordenoNoch keine Bewertungen

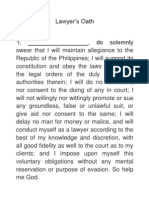

- Lawyer's OathDokument1 SeiteLawyer's OathKukoy PaktoyNoch keine Bewertungen

- Hilton Vs AnaniasDokument10 SeitenHilton Vs AnaniasAJMordenoNoch keine Bewertungen

- Manese Vs JollibeeDokument13 SeitenManese Vs JollibeeAJMordenoNoch keine Bewertungen

- Velasco V People GR No. 166479Dokument2 SeitenVelasco V People GR No. 166479Duko Alcala EnjambreNoch keine Bewertungen

- TezpurDokument16 SeitenTezpurnandini kalitaNoch keine Bewertungen

- Partnership TaxDokument24 SeitenPartnership TaxMadurikaNoch keine Bewertungen

- Lolita Enrico Vs Heirs of Spouses Eulogio Medinaceli and Trinidad MedinaceliDokument1 SeiteLolita Enrico Vs Heirs of Spouses Eulogio Medinaceli and Trinidad MedinaceliVincent Quiña PigaNoch keine Bewertungen

- River Plate and Brazil Conferences v. Pressed Steel Car Company, Inc., Federal Maritime Board, Intervening, 227 F.2d 60, 2d Cir. (1955)Dokument6 SeitenRiver Plate and Brazil Conferences v. Pressed Steel Car Company, Inc., Federal Maritime Board, Intervening, 227 F.2d 60, 2d Cir. (1955)Scribd Government DocsNoch keine Bewertungen

- 13 Stat 351-550Dokument201 Seiten13 Stat 351-550ncwazzyNoch keine Bewertungen

- Addition Worksheet2Dokument2 SeitenAddition Worksheet2JoyceNoch keine Bewertungen

- Province of Rizal v. Executive SecretaryDokument23 SeitenProvince of Rizal v. Executive SecretaryKim MontanoNoch keine Bewertungen

- Fortigate 400f SeriesDokument10 SeitenFortigate 400f SeriesDaniel MontanoNoch keine Bewertungen

- Citizens Charter 2015 EditedDokument112 SeitenCitizens Charter 2015 EditedRoyden delos CientosNoch keine Bewertungen

- EY Philippines Tax Bulletin July 2016Dokument26 SeitenEY Philippines Tax Bulletin July 2016evealyn.gloria.wat20Noch keine Bewertungen

- 6 Master Plans - ReviewerDokument2 Seiten6 Master Plans - ReviewerJue Lei0% (1)

- I. Definitions 1. "Agreement" Means This Settlement Agreement and Full and Final ReleaseDokument27 SeitenI. Definitions 1. "Agreement" Means This Settlement Agreement and Full and Final Releasenancy_sarnoffNoch keine Bewertungen

- Rental ApplicationDokument1 SeiteRental Applicationnicholas alexanderNoch keine Bewertungen

- Concall-Transcript-Q2FY22 EdelweissDokument12 SeitenConcall-Transcript-Q2FY22 EdelweissAmeya WartyNoch keine Bewertungen

- UST GOLDEN NOTES 2011-InsuranceDokument35 SeitenUST GOLDEN NOTES 2011-InsuranceAnthonette MijaresNoch keine Bewertungen

- Chapter 7Dokument24 SeitenChapter 7Ranin, Manilac Melissa SNoch keine Bewertungen

- China Banking Corporation Vs CIRDokument3 SeitenChina Banking Corporation Vs CIRMiaNoch keine Bewertungen

- Sir Arthur Helps - The Spanish Conquest in America - and Its Relation To The History of Slavery and To The Government of Colonies (Vol. 1) (1855)Dokument552 SeitenSir Arthur Helps - The Spanish Conquest in America - and Its Relation To The History of Slavery and To The Government of Colonies (Vol. 1) (1855)chyoungNoch keine Bewertungen

- ابحاث اولي اداب مادة الترجمةDokument3 Seitenابحاث اولي اداب مادة الترجمةomarNoch keine Bewertungen

- A Case Study in The Historical and Political Background of Barangay 77 Banez VillDokument7 SeitenA Case Study in The Historical and Political Background of Barangay 77 Banez VillPogi MedinoNoch keine Bewertungen

- Irr SSMDokument25 SeitenIrr SSMPaulo Edrian Dela PenaNoch keine Bewertungen

- FY22 IPEC Annual Report - FinalDokument163 SeitenFY22 IPEC Annual Report - Finallars cupecNoch keine Bewertungen

- Motion For Reconsideration Re-Implementation of Admin Case Decision # Rarmm-Nmp-15-006Dokument2 SeitenMotion For Reconsideration Re-Implementation of Admin Case Decision # Rarmm-Nmp-15-006Josep FloresNoch keine Bewertungen

- Privateer Press' PIP Codes List - BooksDokument3 SeitenPrivateer Press' PIP Codes List - BooksMarko DimitrovicNoch keine Bewertungen

- Indian Contract Act, 1872Dokument81 SeitenIndian Contract Act, 1872Anonymous jrIMYSz9Noch keine Bewertungen

- Cyber Crime PresentationDokument20 SeitenCyber Crime Presentationvipin rathi78% (9)

- Introduction To Finance: Course Code: FIN201 Instructor: Tahmina Ahmed Section: 7 Chapter: 1 and 2Dokument27 SeitenIntroduction To Finance: Course Code: FIN201 Instructor: Tahmina Ahmed Section: 7 Chapter: 1 and 2Tarif IslamNoch keine Bewertungen