Beruflich Dokumente

Kultur Dokumente

Format. Man - Tapping A New Market Ways and Means

Hochgeladen von

Impact JournalsOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Format. Man - Tapping A New Market Ways and Means

Hochgeladen von

Impact JournalsCopyright:

Verfügbare Formate

IMPACT: International Journal of Research in

Business Management (IMPACT: IJRBM)

ISSN (P): 2347-4572; ISSN (E): 2321-886X

Vol. 6, Issue 5, May 2018, 69-74

© Impact Journals

TAPPING A NEW MARKET: WAYS AND MEANS

Rashmi Gupta

Assistant Professor, Dr. Ambedkar Institute of Management Studies and Research, Deekshabhoomi, Nagpur, India

Received: 07 May 2018 Accepted: 11 May 2018 Published: 28 May 2018

ABSTRACT

The tirupati Urban Co-operative Bank was facing a problem to establish itself in the new market. The main

reason behind this was the lack of suitable marketing Strategy and Unattractive schemes offered by the bank. After having

a bad experience in Aurangabad the bank was very much concern about taking the steps regarding penetration of the new

market. To overcome these difficulties the board of members decided to launch the new schemes. The case also highlights

the importance of market analysis and probability testing.

Teaching Objectives and Target Audience

• Our teaching objective is to develop and guide students about the Market penetration of banking products.

• To understand the importance of market analysis for cooperative banks.

• To practically demonstrate the use of probability analysis for a given situation.

• To analyze the importance of correct decision making.

The case is suitable for MBA students.

KEYWORDS: Cooperative Bank, Marketing Strategy, Market penetration

INTRODUCTION

Tirupati Urban Co-operative Bank Ltd. was one of the leading co-operative banks in Nagpur district with 17

branches in Nagpurregion and one additional in Wardha. It was running its business very well with an amount of annual

profit of Rs. 5crores and 90 lakhs. Mr. R.P. Raut CEO of the bank was contemplating about opening its branches in

Vidharbha region. The bank had opened a branch in Aurangabad, but suddenly it had to shut down its operations because

of lack of market penetration and lack of generation of day to day business. This issue was bothering Mr. Raut and he was

perplexed with the dilemma of what shall be the next step?

Backed by the Meghe Group under the Chairmanship of Dattaji Meghe, Tirupati Urban Co-operative Bank’s

biggest assets were its loyal and talented workforce for last 25 years. Mr. Raut took pride for the support and never gives

up approach of his staff. The bank was catering to all types of financial services including FDs, Home loans, Car loans,

Education loans, Startup loans etc with the minimum of 8.5% p.a. The bank had an employee-centric approach wherein

every employee was considered informally as the owner of the bank. They got monthly targets on the generation of leads,

recovery of loans, deposits which helped in increasing the business of the bank. Regular monthly reviews were taken to

Impact Factor(JCC): 3.2176 - This article can be downloaded from www.impactjournals.us

70 Rashmi Gupta

ensure that the targets were attained and the services wereprovided without any hiccups. For catering the services to

different segments of lower and middle-income groups and also to give special attention towards women empowerment,

the bank had 170 regular employees under its belt out of which 70% were women.

The attrition rate throughout the branches was very less because of its favorable HR policies. Even so much so the

bank kept its branches opened on Sundays.

Since the management of the bank was contemplating to open its branches in various parts of vidarbha as well as in parts

of western Maharashtra, the previous experience of Aurangabad was haunting them regarding its future prospects and

success. The major problem they faced that time, was to meet the day to day expenses of running a branch.

The management waited for almost 2 years to bring the branch at least to BEP level. But finally, they couldn’t succeed and

decided to shut down the branch permanently.

The major concern for the bank was opening of new branches and also penetration of new market areas where

already similar kinds of Co-operative banks along with District and State Cooperative banks along with other financial

institutions were operating in full swing. Besides this tapping, the hitherto untapped areas of those markets would be other

major challenges before the bank. Considering this the bank had decided to chalk out a plan with respect to designing one

new financial product that would suit the residents of those areas. For this purpose, the board hired a marketing agency for

conducting a market survey for analyzing the current market situation.

At the meeting, Mr. Raut, read the reports of the market analysis. He, along with the Board Members proposed

new financial schemes that would be especially tailor-made for the residents of those areas. The board members decided to

launch a new scheme named ‘Daily Deposit Schemes’. The structure of the scheme would be designed in such a manner

that it would benefit almost every stratum of the society right from lower income group to higher income group.

The Salient Features of the Scheme Were as Follows

• An individual could open a ‘Daily Deposit Account’ with the bank by depositing a minimum of Rs. 20 per day for

25 days in a month.

• The amount of deposit could be increased by multiples of Rs. 10. There was no maximum limit for the deposit

amount.

• The rate of interest would be 9% per annum and 9.5% for a senior citizen. The term for the deposit was for three

years, but the premature withdrawal was allowed after one year with an interest of 7% compounded annually.

• The additional rider to be provided by the scheme was the free life insurance having a sum assured of Rs.

50,000 to Rs. 1 lakh.

• Secondly, the loan facility would also be provided to the holder of the daily deposit scheme in the form of

business loans, especially for the person who wanted to start new ventures. The maximum amount of a loan that

could be procured was Rs. 2,00,000 in interest of 7.5% p.a.

Since the branch had to earlier shut down its operation in Aurangabad in 2 years time, due to lack of attainment

of BEP level, it was assumed that at least the bank could wait for a period of 2 years to attain or cross the level of BEP.

In order to ensure the success of the scheme, the management of the Tirupati Urban Cooperative Bank hired an agency for

NAAS Rating: 3.09- Articles can be sent to editor@impactjournals.us

Tapping a New Market: Ways and Means 71

conducting a thorough analysis of the current market situation and check the acceptability of the scheme in the market.

The result of the market analysis team was handed over to the board, so the management was contemplating on

two aspects of its marketing strategies.

The management was having Option Two Options in Front of Them

• To endorse their product through famous celebrities and also to spend huge sum in advertisements.

• To market their product with the help of local people and self-help group.

If the company goes by the first option, following possibilities can occur:

A market analysis had a 30% probability of annual openings of 5000 Daily Deposit Accounts, a 40% probability

of 4000 accounts and 30% probability of 3000 accounts. Apart from this the variable expenses that would likely to be

incurred was Rs. 9,000 and Fixed expenses Rs. 50,00,000.The revenue generated from this for each account in considering

other sources would be Rs. 11,000

If the company goes by the second option, following possibilities can occur:

A market analysis had a 30% probability of annual openings of 5000 Daily Deposit Accounts, a 40% probability

of 4000 accounts and 30% probability of 3000 accounts. Apart from this the variable expenses that would likely to be

incurred are Rs. 10,000 and Fixed expenses Rs. 8,00,000.The revenue generated from this for each account in considering

other sources would be Rs. 11,000.

Which option should the management select?

Teaching Notes

Teaching Approach and Strategy

• To solve this case in 1 & ½ hour is enough.

• This case can also be considered for examination point of view.

• Minimum 4-5 members in the group are required to solve the case.

• This case can be used to teach what the difficulties are and problems that arise while establishing a new branch

and penetrating a new market.

• After the class sessions, the teacher can discuss the solution of the problem arising in such situations and take the

feedback from the students.

• This case can give an overview to the students about certain problems which are being faced by the co-operative

banks.

Analysis

• What are the various marketing strategies which bank can adopt for penetrating a new market?

• What can be the special financial schemes to attract the local customers?

• What are the essential elements for running a branch of a co-operative bank?

Impact Factor(JCC): 3.2176 - This article can be downloaded from www.impactjournals.us

72 Rashmi Gupta

Answers

Ans 1: Be social, Get involved, Approach new market, Rebrand to be energetic younger & modern, Compete with

market

Ans 2: Daily deposit scheme, Gold loan scheme, Startup loans, Insurance plans, Pension plans

Ans 3: Land & place, Employee, Equipment/ Operating system, Security

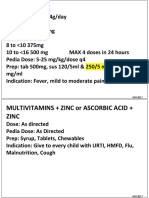

Decision tree Analysis

Figure 1

Decision Making through Expected Payoff

The probability of selecting both the options are 50 :50.Therefore the expected payoff of

Option 1 (Sales through local people)= 0.5*32lakhs=16lakhs

Option 2 ( Sale through celebrities)=0.5*30lakhs=15lakhs

Therefore the company should opt for the 1st Option as it is more profitable and has a high payback.

REFERENCES

1. Goyal, C.K. (2008). Financial inclusion in the Northeastern region of India with special reference to Assam.

The ICFAI Journal of Applied Finance, 14 (12), 54-64.

2. Gujarati, D.N. (2006). Basic econometrics (4th ed.) New Delhi: Tata McGraw Hill Publishing Company Ltd.

3. Howley, J.C., & Savage, G.P. (2007). Bank marketing in the personal sector. Managerial Finance, 5 (3),

271-276.

4. Sharma, A., & Mehta, V. (2005). Service quality perceptions in financial services – A case study of banking

services. Journal of Services Research, 4 (2), 205-222.

5. Soni, Anil Kumar, And Abhay Kapre. "Assessment Of Credit Delivery Of District Central Cooperative Bank

Rajnandgaon."

6. Shukla, S. (2016). Performance of the Indian banking industry: A comparison of public and private sector banks.

Indian Journal of Finance, 10 (1), 41-55. DOI: 10.17010/ijf/2016/v10i1/85843

NAAS Rating: 3.09- Articles can be sent to editor@impactjournals.us

Tapping a New Market: Ways and Means 73

7. Singh, B. (2011). Profitability of the Central Cooperative banks in Punjab : A decomposition analysis. Indian

Journal of Finance, 5 (8), 16-22.

8. Srivastava, S., & Ambujakshan, A. (2012). Role of financial technology in eradication of financial exclusion.

International Journal of Research in Commerce, IT and Management, 2 (6), 122-125.

9. Swamy, V. (2011). Financial inclusion in India: An evaluation of the coverage, progress and trends. The IUP

Journal of Financial Economics, 9 (2), 9-26.

Impact Factor(JCC): 3.2176 - This article can be downloaded from www.impactjournals.us

Das könnte Ihnen auch gefallen

- 19-11-2022-1668837986-6-Impact - Ijrhal-2. Ijrhal-Topic Vocational Interests of Secondary School StudentsDokument4 Seiten19-11-2022-1668837986-6-Impact - Ijrhal-2. Ijrhal-Topic Vocational Interests of Secondary School StudentsImpact JournalsNoch keine Bewertungen

- 19-11-2022-1668838190-6-Impact - Ijrhal-3. Ijrhal-A Study of Emotional Maturity of Primary School StudentsDokument6 Seiten19-11-2022-1668838190-6-Impact - Ijrhal-3. Ijrhal-A Study of Emotional Maturity of Primary School StudentsImpact JournalsNoch keine Bewertungen

- 12-11-2022-1668238142-6-Impact - Ijrbm-01.Ijrbm Smartphone Features That Affect Buying Preferences of StudentsDokument7 Seiten12-11-2022-1668238142-6-Impact - Ijrbm-01.Ijrbm Smartphone Features That Affect Buying Preferences of StudentsImpact JournalsNoch keine Bewertungen

- 28-10-2022-1666956219-6-Impact - Ijrbm-3. Ijrbm - Examining Attitude ...... - 1Dokument10 Seiten28-10-2022-1666956219-6-Impact - Ijrbm-3. Ijrbm - Examining Attitude ...... - 1Impact JournalsNoch keine Bewertungen

- 12-10-2022-1665566934-6-IMPACT - IJRHAL-2. Ideal Building Design y Creating Micro ClimateDokument10 Seiten12-10-2022-1665566934-6-IMPACT - IJRHAL-2. Ideal Building Design y Creating Micro ClimateImpact JournalsNoch keine Bewertungen

- 09-12-2022-1670567569-6-Impact - Ijrhal-05Dokument16 Seiten09-12-2022-1670567569-6-Impact - Ijrhal-05Impact JournalsNoch keine Bewertungen

- 14-11-2022-1668421406-6-Impact - Ijrhal-01. Ijrhal. A Study On Socio-Economic Status of Paliyar Tribes of Valagiri Village AtkodaikanalDokument13 Seiten14-11-2022-1668421406-6-Impact - Ijrhal-01. Ijrhal. A Study On Socio-Economic Status of Paliyar Tribes of Valagiri Village AtkodaikanalImpact JournalsNoch keine Bewertungen

- 19-09-2022-1663587287-6-Impact - Ijrhal-3. Ijrhal - Instability of Mother-Son Relationship in Charles Dickens' Novel David CopperfieldDokument12 Seiten19-09-2022-1663587287-6-Impact - Ijrhal-3. Ijrhal - Instability of Mother-Son Relationship in Charles Dickens' Novel David CopperfieldImpact JournalsNoch keine Bewertungen

- 09-12-2022-1670567289-6-Impact - Ijrhal-06Dokument17 Seiten09-12-2022-1670567289-6-Impact - Ijrhal-06Impact JournalsNoch keine Bewertungen

- 05-09-2022-1662375638-6-Impact - Ijranss-1. Ijranss - Analysis of Impact of Covid-19 On Religious Tourism Destinations of Odisha, IndiaDokument12 Seiten05-09-2022-1662375638-6-Impact - Ijranss-1. Ijranss - Analysis of Impact of Covid-19 On Religious Tourism Destinations of Odisha, IndiaImpact JournalsNoch keine Bewertungen

- 29-08-2022-1661768824-6-Impact - Ijrhal-9. Ijrhal - Here The Sky Is Blue Echoes of European Art Movements in Vernacular Poet Jibanananda DasDokument8 Seiten29-08-2022-1661768824-6-Impact - Ijrhal-9. Ijrhal - Here The Sky Is Blue Echoes of European Art Movements in Vernacular Poet Jibanananda DasImpact JournalsNoch keine Bewertungen

- 21-09-2022-1663757902-6-Impact - Ijranss-4. Ijranss - Surgery, Its Definition and TypesDokument10 Seiten21-09-2022-1663757902-6-Impact - Ijranss-4. Ijranss - Surgery, Its Definition and TypesImpact JournalsNoch keine Bewertungen

- 22-09-2022-1663824012-6-Impact - Ijranss-5. Ijranss - Periodontics Diseases Types, Symptoms, and Its CausesDokument10 Seiten22-09-2022-1663824012-6-Impact - Ijranss-5. Ijranss - Periodontics Diseases Types, Symptoms, and Its CausesImpact JournalsNoch keine Bewertungen

- 25-08-2022-1661426015-6-Impact - Ijrhal-8. Ijrhal - Study of Physico-Chemical Properties of Terna Dam Water Reservoir Dist. Osmanabad M.S. - IndiaDokument6 Seiten25-08-2022-1661426015-6-Impact - Ijrhal-8. Ijrhal - Study of Physico-Chemical Properties of Terna Dam Water Reservoir Dist. Osmanabad M.S. - IndiaImpact JournalsNoch keine Bewertungen

- 06-08-2022-1659783347-6-Impact - Ijrhal-1. Ijrhal - Concept Mapping Tools For Easy Teaching - LearningDokument8 Seiten06-08-2022-1659783347-6-Impact - Ijrhal-1. Ijrhal - Concept Mapping Tools For Easy Teaching - LearningImpact JournalsNoch keine Bewertungen

- Monitoring The Carbon Storage of Urban Green Space by Coupling Rs and Gis Under The Background of Carbon Peak and Carbon Neutralization of ChinaDokument24 SeitenMonitoring The Carbon Storage of Urban Green Space by Coupling Rs and Gis Under The Background of Carbon Peak and Carbon Neutralization of ChinaImpact JournalsNoch keine Bewertungen

- 23-08-2022-1661248432-6-Impact - Ijrhal-4. Ijrhal - Site Selection Analysis of Waste Disposal Sites in Maoming City, GuangdongDokument12 Seiten23-08-2022-1661248432-6-Impact - Ijrhal-4. Ijrhal - Site Selection Analysis of Waste Disposal Sites in Maoming City, GuangdongImpact JournalsNoch keine Bewertungen

- 23-08-2022-1661248618-6-Impact - Ijrhal-6. Ijrhal - Negotiation Between Private and Public in Women's Periodical Press in Early-20th Century PunjabDokument10 Seiten23-08-2022-1661248618-6-Impact - Ijrhal-6. Ijrhal - Negotiation Between Private and Public in Women's Periodical Press in Early-20th Century PunjabImpact JournalsNoch keine Bewertungen

- 25-08-2022-1661424544-6-Impact - Ijranss-6. Ijranss - Parametric Metric Space and Fixed Point TheoremsDokument8 Seiten25-08-2022-1661424544-6-Impact - Ijranss-6. Ijranss - Parametric Metric Space and Fixed Point TheoremsImpact JournalsNoch keine Bewertungen

- The Analysis On Tourist Source Market of Chikan Ancient Town by Coupling Gis, Big Data and Network Text Content AnalysisDokument16 SeitenThe Analysis On Tourist Source Market of Chikan Ancient Town by Coupling Gis, Big Data and Network Text Content AnalysisImpact JournalsNoch keine Bewertungen

- 24-08-2022-1661313054-6-Impact - Ijranss-5. Ijranss - Biopesticides An Alternative Tool For Sustainable AgricultureDokument8 Seiten24-08-2022-1661313054-6-Impact - Ijranss-5. Ijranss - Biopesticides An Alternative Tool For Sustainable AgricultureImpact JournalsNoch keine Bewertungen

- 08-08-2022-1659935395-6-Impact - Ijrbm-2. Ijrbm - Consumer Attitude Towards Shopping Post Lockdown A StudyDokument10 Seiten08-08-2022-1659935395-6-Impact - Ijrbm-2. Ijrbm - Consumer Attitude Towards Shopping Post Lockdown A StudyImpact JournalsNoch keine Bewertungen

- The Analysis On Environmental Effects of Land Use and Land Cover Change in Liuxi River Basin of GuangzhouDokument16 SeitenThe Analysis On Environmental Effects of Land Use and Land Cover Change in Liuxi River Basin of GuangzhouImpact JournalsNoch keine Bewertungen

- 25-08-2022-1661424708-6-Impact - Ijranss-7. Ijranss - Fixed Point Results For Parametric B-Metric SpaceDokument8 Seiten25-08-2022-1661424708-6-Impact - Ijranss-7. Ijranss - Fixed Point Results For Parametric B-Metric SpaceImpact JournalsNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Customer AnalysisDokument6 SeitenCustomer AnalysisLina LambotNoch keine Bewertungen

- Student Health Services - 305 Estill Street Berea, KY 40403 - Phone: (859) 985-1415Dokument4 SeitenStudent Health Services - 305 Estill Street Berea, KY 40403 - Phone: (859) 985-1415JohnNoch keine Bewertungen

- Hydrozirconation - Final 0Dokument11 SeitenHydrozirconation - Final 0David Tritono Di BallastrossNoch keine Bewertungen

- CRM Project (Oyo)Dokument16 SeitenCRM Project (Oyo)Meenakshi AgrawalNoch keine Bewertungen

- Zone Raiders (Sci Fi 28mm)Dokument49 SeitenZone Raiders (Sci Fi 28mm)Burrps Burrpington100% (3)

- Partnership & Corporation: 2 SEMESTER 2020-2021Dokument13 SeitenPartnership & Corporation: 2 SEMESTER 2020-2021Erika BucaoNoch keine Bewertungen

- Art of Insight PDFDokument409 SeitenArt of Insight PDF31482Noch keine Bewertungen

- Tfa Essay RubricDokument1 SeiteTfa Essay Rubricapi-448269753Noch keine Bewertungen

- Imam Zainul Abideen (RA) 'S Service To The Poor and DestituteDokument3 SeitenImam Zainul Abideen (RA) 'S Service To The Poor and DestituteShoyab11Noch keine Bewertungen

- Catibayan Reflection AR VRDokument6 SeitenCatibayan Reflection AR VRSheina Marie BariNoch keine Bewertungen

- Population Viability Analysis Part ADokument3 SeitenPopulation Viability Analysis Part ANguyễn Phương NgọcNoch keine Bewertungen

- Cloze Tests 2Dokument8 SeitenCloze Tests 2Tatjana StijepovicNoch keine Bewertungen

- Digital Electronics: Unit 1 FundamentalsDokument5 SeitenDigital Electronics: Unit 1 Fundamentalslalit_kaushish333Noch keine Bewertungen

- Read Chapter 4 Minicase: Fondren Publishing, Inc. From The Sales Force Management Textbook by Mark W. Johnston & Greg W. MarshallDokument1 SeiteRead Chapter 4 Minicase: Fondren Publishing, Inc. From The Sales Force Management Textbook by Mark W. Johnston & Greg W. MarshallKJRNoch keine Bewertungen

- Material Concerning Ukrainian-Jewish Relations (1917-1921)Dokument106 SeitenMaterial Concerning Ukrainian-Jewish Relations (1917-1921)lastivka978Noch keine Bewertungen

- Autobiography of A 2nd Generation Filipino-AmericanDokument4 SeitenAutobiography of A 2nd Generation Filipino-AmericanAio Min100% (1)

- Edward William Lane's Lexicon - Volume 7 - Page 186 To 277Dokument92 SeitenEdward William Lane's Lexicon - Volume 7 - Page 186 To 277Serge BièvreNoch keine Bewertungen

- MU151 Group Assignment 6Dokument3 SeitenMU151 Group Assignment 6Jay CadienteNoch keine Bewertungen

- Vocabulary Ladders - Grade 3 - Degree of FamiliarityDokument6 SeitenVocabulary Ladders - Grade 3 - Degree of FamiliarityfairfurNoch keine Bewertungen

- Mohd Ali 17: By:-Roll NoDokument12 SeitenMohd Ali 17: By:-Roll NoMd AliNoch keine Bewertungen

- Episode 5 The Global TeacherDokument8 SeitenEpisode 5 The Global TeacherEllieza Bauto SantosNoch keine Bewertungen

- 160 LW Bending Tester v2.0Dokument4 Seiten160 LW Bending Tester v2.0Sá StrapassonNoch keine Bewertungen

- Fail Operational and PassiveDokument1 SeiteFail Operational and PassiverobsousNoch keine Bewertungen

- What Does The Scripture Say - ' - Studies in The Function of Scripture in Early Judaism and Christianity, Volume 1 - The Synoptic GospelsDokument149 SeitenWhat Does The Scripture Say - ' - Studies in The Function of Scripture in Early Judaism and Christianity, Volume 1 - The Synoptic GospelsCometa Halley100% (1)

- Foreign Laguage Teaching - Nzjournal - 15.1wiechertDokument4 SeitenForeign Laguage Teaching - Nzjournal - 15.1wiechertNicole MichelNoch keine Bewertungen

- Faust Part Two - Johann Wolfgang Von GoetheDokument401 SeitenFaust Part Two - Johann Wolfgang Von GoetherharsianiNoch keine Bewertungen

- Berms For Stablizing Earth Retaining Structures: Youssef Gomaa Youssef Morsi B.SC., Civil EngineeringDokument212 SeitenBerms For Stablizing Earth Retaining Structures: Youssef Gomaa Youssef Morsi B.SC., Civil EngineeringChan KNoch keine Bewertungen

- Microsoft Official Course: Installing and Configuring Windows Server 2012Dokument18 SeitenMicrosoft Official Course: Installing and Configuring Windows Server 2012jttodorovNoch keine Bewertungen

- Ms Cell Theory TestDokument6 SeitenMs Cell Theory Testapi-375761980Noch keine Bewertungen

- Common RHU DrugsDokument56 SeitenCommon RHU DrugsAlna Shelah IbañezNoch keine Bewertungen