Beruflich Dokumente

Kultur Dokumente

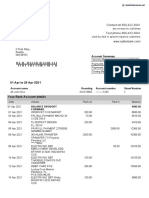

Single Intra Model GST INVOICE

Hochgeladen von

stubar25Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Single Intra Model GST INVOICE

Hochgeladen von

stubar25Copyright:

Verfügbare Formate

Tax invoice

Name & address of the Supplier Serial No……………………………...

(Odisha) (consecutive, not exceeding 16 characters alphabets, numerals, special

characters)

Date-

GSTIN – 21 …………

Name of the recipient / purchaser Address of the recipient / purchaser (place of Address of delivery, if

supply) different from the place of

…………………………. supply

(Village / Town / City) ……………………………..

GSTIN - State - Odisha …………………….

PIN ……………………

Sl. No. Description in HSN / SAC Code of the Qty. Unit Unit price Total value

case of goods / goods / service

services

01 Cement 2523 300 Bags each 50 kg 300 90000/-

Insurance (if any) 100/-

Packing & Forwarding charges (if 1000/-

any)

Total 91100/-

CGST @14% 12754

OGST @14% 12754

IGST @28% -

Grand Total 116608

Total (in words): One Lakh Sixteen Thousand Six Hundred Eight Only

For

Signature /Digital signature of the supplier or

his authorized signatory

Explanation for Better Understanding

• The recipient address is Odisha. Hence it is an Intra-State Supply. So, CGST + OGST are charge (Not IGST).

• The annual turnover of a registered person is within 1.5 crore then it is not required to mention the digits

of (HSN) Codes in the tax invoice issued by him.

- If the annual turnover of a registered person is in between 1.5 crore to 5 crore then it is required

to mention first 2 digits of (HSN) Codes in the tax invoice issued by him, for example “25”.

• If the annual turnover of a registered person is above 5 crore then it is required to mention first 4 digits of

(HSN) Codes in the tax invoice issued by him, for example “2523”.

Das könnte Ihnen auch gefallen

- KD Basics PDFDokument9 SeitenKD Basics PDFstubar25Noch keine Bewertungen

- Garibay 2003 Market Study India PDFDokument38 SeitenGaribay 2003 Market Study India PDFstubar25Noch keine Bewertungen

- Lecture at NMBU September 8, 2014 PJH300 - Sustainable Production SystemsDokument50 SeitenLecture at NMBU September 8, 2014 PJH300 - Sustainable Production Systemsstubar25Noch keine Bewertungen

- Examples: Thermal GeneraionDokument7 SeitenExamples: Thermal Generaionstubar25Noch keine Bewertungen

- A Method To Detect Photovoltaic Array Faults and Partial Shading in PV SystemsDokument34 SeitenA Method To Detect Photovoltaic Array Faults and Partial Shading in PV Systemsstubar25Noch keine Bewertungen

- Live BiddingDokument15 SeitenLive Biddingstubar25Noch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Economic System and BusinessDokument51 SeitenEconomic System and BusinessJoseph SathyanNoch keine Bewertungen

- Meaning of Responsibility CenterDokument20 SeitenMeaning of Responsibility CenterSuman Preet KaurNoch keine Bewertungen

- Dokumen - Tips - Copy of GrandeuraparkDokument22 SeitenDokumen - Tips - Copy of GrandeuraparkSachin RaiNoch keine Bewertungen

- China in Africa Research ProposalDokument20 SeitenChina in Africa Research ProposalFrancky VincentNoch keine Bewertungen

- Aggregate Demand and Aggregate Supply PDFDokument18 SeitenAggregate Demand and Aggregate Supply PDFAsif WarsiNoch keine Bewertungen

- Registration of PropertyDokument13 SeitenRegistration of PropertyambonulanNoch keine Bewertungen

- Market Visit Ing ReportDokument3 SeitenMarket Visit Ing ReportMr. JahirNoch keine Bewertungen

- Tender Waiver Form 2015Dokument6 SeitenTender Waiver Form 2015ahtin618Noch keine Bewertungen

- Tata Vistara - Agency PitchDokument27 SeitenTata Vistara - Agency PitchNishant Prakash0% (1)

- Sutton Bank StatementDokument2 SeitenSutton Bank StatementNadiia AvetisianNoch keine Bewertungen

- JournalsDokument6 SeitenJournalsharmen-bos-9036Noch keine Bewertungen

- Apollo Tyre Company: A Project Report ONDokument55 SeitenApollo Tyre Company: A Project Report ONMOHITKOLLI100% (1)

- Day Trading StrategiesDokument3 SeitenDay Trading Strategiesswetha reddy100% (2)

- HR PoliciesDokument129 SeitenHR PoliciesAjeet ThounaojamNoch keine Bewertungen

- BFSI Chronicle 3rd Annual Issue (14th Edition) September 2023Dokument132 SeitenBFSI Chronicle 3rd Annual Issue (14th Edition) September 2023amanchauhanNoch keine Bewertungen

- AP Macro 2008 Audit VersionDokument24 SeitenAP Macro 2008 Audit Versionvi ViNoch keine Bewertungen

- ch07 Godfrey Teori AkuntansiDokument34 Seitench07 Godfrey Teori Akuntansiuphevanbogs100% (2)

- 2019 Marking Scheme Account PDFDokument287 Seiten2019 Marking Scheme Account PDFsaba alamNoch keine Bewertungen

- Double Taxation Relief: Tax SupplementDokument5 SeitenDouble Taxation Relief: Tax SupplementlalitbhatiNoch keine Bewertungen

- 8531Dokument9 Seiten8531Mudassar SaqiNoch keine Bewertungen

- AssignmentDokument13 SeitenAssignmentabdur RahmanNoch keine Bewertungen

- S.B. No. 824: First Regular SessionDokument5 SeitenS.B. No. 824: First Regular SessionKevin TayagNoch keine Bewertungen

- "Training and Action Research of Rural Development Academy (RDA), Bogra, Bangladesh." by Sheikh Md. RaselDokument101 Seiten"Training and Action Research of Rural Development Academy (RDA), Bogra, Bangladesh." by Sheikh Md. RaselRasel89% (9)

- Prem BahadurDokument3 SeitenPrem BahadurAditya RajNoch keine Bewertungen

- CookBook 08 Determination of Conformance - 09-2018Dokument4 SeitenCookBook 08 Determination of Conformance - 09-2018Carlos LópezNoch keine Bewertungen

- ToC - Smart Hospitality Market - Global Industry Analysis, Size, Share, Gr...Dokument14 SeitenToC - Smart Hospitality Market - Global Industry Analysis, Size, Share, Gr...PalawanBaliNoch keine Bewertungen

- Salary Slip (31920472 October, 2017) PDFDokument1 SeiteSalary Slip (31920472 October, 2017) PDFMuhammad Ishaq SonuNoch keine Bewertungen

- Industrialisation in RajasthanDokument4 SeitenIndustrialisation in RajasthanEditor IJTSRDNoch keine Bewertungen

- Travel and Expense Policy: PurposeDokument9 SeitenTravel and Expense Policy: Purposeabel_kayelNoch keine Bewertungen