Beruflich Dokumente

Kultur Dokumente

ECON 8010 Problem Set #2 Solutions Fall 2016

Hochgeladen von

Sky ShepheredCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

ECON 8010 Problem Set #2 Solutions Fall 2016

Hochgeladen von

Sky ShepheredCopyright:

Verfügbare Formate

ECON 8010 PROBLEM SET #2 SOLUTIONS FALL 2016

Due: September 15, 2016

Total Points: 40

(10) 1. Suppose the firm’s production function is

x(K,L) = 0.5K1/2 + 0.5L1/2

Derive the profit-maximizing, competitive firm’s demand function for labor L*(r,w,p),

where r is the per-unit price of capital, w is the per-unit price of labor, and p is the per-unit

price of output, and, if possible, determine the sign of ∂L*/∂w.

The profit equation is

π = pX(K,L) – rK – wL

= p[0.5K1/2 + 0.5L1/2] – rK – wL

The F.O.C.s for a profit maximum are

∂π/∂K = p(1/4)K-1/2 – r = 0

∂π/∂L = p(1/4)L-1/2 – w = 0.

Combining the F.O.Cs, we have

(K/L) -1/2 = r/w

(L/K)1/2 = r/w

K = (w/r)2L

Because X(K,L) = 0.5K1/2 + 0.5L1/2 is strongly (additively) separable in K and L, we

can obtain the demand function for labor by solving for L in the F.O.C. for labor:

L*(p,r,w) = (p/4w)2

∂L*/∂w = - 2p24-2w-3 = - (1/8)p2w-3< 0

(10) 2. Suppose that the profit function for a firm is

π*(p,w) = p[loge (p/w)] – p

where p is the per-unit price of output, and w is the per-unit price of labor. Use Hotelling’s

Lemma to derive the firm’s

a. output-supply function x*(p,w).

∂π*/∂p = loge(p/w) + p(1/p) – 1 = loge(p/w) = x*(p,w)

b. labor-demand function L*(p,w).

- ∂π*/∂w = -(-p/w) = p/w = L*(p,w)

(20) 3. Suppose that a worker-owned firm produces a single output X by combining the variable

inputs labor L and materials M according to the production function X = f(L,M), exhibiting

strictly positive and diminishing marginal products. Fixed inputs already in place, such as

office space and equipment, are ignored. The output of the firm is sold in a competitive

market at the fixed price p and materials are purchased at fixed price r. The firm’s net

earnings e = pX – rM are distributed equally among the workers as “dividends” or “profit

shares” w = e/L. The firm chooses L and M to maximize w = (pX – rM)/L subject to the

technology constraint X = f(L,M). The optimal values of the choice variables can be

expressed as the solution functions L*(p,r) and M*(p,r) which, in turn, imply solution

functions for optimal output X*(p,r), net earnings e*(p,r), and profit shares w*(p,r).

a. Derive expressions for and determine the signs of ∂w*/∂p and ∂w*/∂r.

The firm chooses L and M to maximize w = (pX – rM)/L, subject to the technology

X = f(L,M). Substituting f(L,M) for X into the maximand we have

w(L,M) = [p f(L,M) – rM)]/L

The F.O.C.s with respect to L and M are, respectively,

∂w/∂L = [LpfL – pf(L,M) + rM]/L2 = 0 ↔ LpfL – pf(L,M) + rM = 0

∂w/∂M = (pfM – r)/L = 0 ↔ pfM = r

Evaluated at the optimal values of L and M, the objective function is

w*(p,r) ≡ {pf[L*(p,r),M*(p,r)] – rM*(p,r)}/L*(p,r).

Differentiate this identity with respect to p, substituting from the F.O.C.s for a

maximum of w, noting that ∂M*/∂p[p∂f/∂M* – r] = 0, and rearranging terms, we

have

∂w*/∂p = X/L > 0.

Analogously, after differentiating the identity with respect to r, substituting from

the F.O.C.s for a maximum of w, and rearranging terms, we have

∂w*/∂r = – M/L < 0.

These results reveal that the dividend function w*(p,r) is analogous to a profit

function, expressed in per capita terms. Application of Hotelling’s Lemma to

w*(p,r) yields the desired results directly.

b. What happens to output per worker (“labor productivity”) if output price p rises?

Why?

∂2w*/∂p2= ∂(X/L)/∂p > 0

since w*(p,r) is convex in p.

c. What happens to output per worker if the price of materials r rises? Why?

∂2w*/∂p∂r = ∂(X/L)/∂r = – ∂(M/L)/∂p = ∂2w*/∂r∂p < 0

since w*(p,r) is symmetric in p and r.

Das könnte Ihnen auch gefallen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Game Theory and ApplicationsDokument46 SeitenGame Theory and ApplicationsSky ShepheredNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- ECON 8010 Final Exam Prep Fall 2016Dokument3 SeitenECON 8010 Final Exam Prep Fall 2016Sky ShepheredNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Econ 8010 Midterm No Notes, No Calculators 100 Points, 75 MinutesDokument3 SeitenEcon 8010 Midterm No Notes, No Calculators 100 Points, 75 MinutesSky ShepheredNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- ECON 8010 Final Exam Prep Solutions Fall 2016Dokument3 SeitenECON 8010 Final Exam Prep Solutions Fall 2016Sky ShepheredNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- POLI 204C D: M 22, G T: UE Arch by Noon AME HeoryDokument2 SeitenPOLI 204C D: M 22, G T: UE Arch by Noon AME HeorySky ShepheredNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- UGA ECON 8010 Midterm SolutionsDokument5 SeitenUGA ECON 8010 Midterm SolutionsSky ShepheredNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Detrended Residuals of A - T and Detrended Residuals of Real GDP Per CapitaDokument1 SeiteDetrended Residuals of A - T and Detrended Residuals of Real GDP Per CapitaSky ShepheredNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- MWG FlashcardsDokument47 SeitenMWG FlashcardsSky ShepheredNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Cost Min PDFDokument21 SeitenCost Min PDFSky ShepheredNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Philip PDFDokument21 SeitenPhilip PDFSky ShepheredNoch keine Bewertungen

- Pro-Poor Policy Options: Empowering Poor Farmers in Sri LankaDokument6 SeitenPro-Poor Policy Options: Empowering Poor Farmers in Sri LankaSky ShepheredNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Price Volatility in Agricultural Markets - FAO Dec10Dokument2 SeitenPrice Volatility in Agricultural Markets - FAO Dec10recycled mindsNoch keine Bewertungen

- Hi WorldDokument1 SeiteHi WorldSky ShepheredNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Sim Uge1Dokument62 SeitenSim Uge1ALLIAH NICHOLE SEPADANoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Arudha PDFDokument17 SeitenArudha PDFRakesh Singh100% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

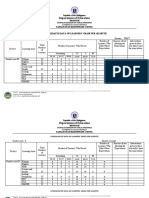

- Department of Education: Consolidated Data On Learners' Grade Per QuarterDokument4 SeitenDepartment of Education: Consolidated Data On Learners' Grade Per QuarterUsagi HamadaNoch keine Bewertungen

- Ilovepdf MergedDokument503 SeitenIlovepdf MergedHemantNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Vetoset CA541: Thickbed Cementitious Tile AdhesiveDokument2 SeitenVetoset CA541: Thickbed Cementitious Tile Adhesivemus3b1985Noch keine Bewertungen

- Amity School of Business:, Semester IV Research Methodology and Report Preparation Dr. Deepa KapoorDokument23 SeitenAmity School of Business:, Semester IV Research Methodology and Report Preparation Dr. Deepa KapoorMayank TayalNoch keine Bewertungen

- Sheet-Metal Forming Processes: Group 9 PresentationDokument90 SeitenSheet-Metal Forming Processes: Group 9 PresentationjssrikantamurthyNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Poster-Shading PaperDokument1 SeitePoster-Shading PaperOsama AljenabiNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Pam8610 PDFDokument15 SeitenPam8610 PDFRaka Satria PradanaNoch keine Bewertungen

- Design ProjectDokument60 SeitenDesign Projectmahesh warNoch keine Bewertungen

- solidworks ขั้นพื้นฐานDokument74 Seitensolidworks ขั้นพื้นฐานChonTicha'Noch keine Bewertungen

- HRM Practices in NepalDokument22 SeitenHRM Practices in NepalBodhiNoch keine Bewertungen

- There Will Come Soft RainsDokument8 SeitenThere Will Come Soft RainsEng ProfNoch keine Bewertungen

- Aashto M288-17 Product Selection GuideDokument1 SeiteAashto M288-17 Product Selection GuideDem DemNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Sprinkler Sizing en v1Dokument12 SeitenSprinkler Sizing en v1CristianDumitru0% (1)

- .IAF-GD5-2006 Guide 65 Issue 3Dokument30 Seiten.IAF-GD5-2006 Guide 65 Issue 3bg_phoenixNoch keine Bewertungen

- A Project Report ON Strategic Purchasing Procedure, Systems and Policies (Hospital Industry)Dokument20 SeitenA Project Report ON Strategic Purchasing Procedure, Systems and Policies (Hospital Industry)amitwin1983Noch keine Bewertungen

- Sensitivity of Rapid Diagnostic Test and Microscopy in Malaria Diagnosis in Iva-Valley Suburb, EnuguDokument4 SeitenSensitivity of Rapid Diagnostic Test and Microscopy in Malaria Diagnosis in Iva-Valley Suburb, EnuguSMA N 1 TOROHNoch keine Bewertungen

- Ce-Series - TK60981-ML-18 IM - Rev - 0 - 05-13Dokument96 SeitenCe-Series - TK60981-ML-18 IM - Rev - 0 - 05-13VERDADE MUNDIAL GUERRANoch keine Bewertungen

- BDokument28 SeitenBLubaNoch keine Bewertungen

- Press Statement - Book Launching Shariah Forensic 27 Oct 2023Dokument4 SeitenPress Statement - Book Launching Shariah Forensic 27 Oct 2023aNoch keine Bewertungen

- Installing Surge Protective Devices With NEC Article 240 and Feeder Tap RuleDokument2 SeitenInstalling Surge Protective Devices With NEC Article 240 and Feeder Tap RuleJonathan Valverde RojasNoch keine Bewertungen

- Understanding The Contribution of HRM Bundles For Employee Outcomes Across The Life-SpanDokument15 SeitenUnderstanding The Contribution of HRM Bundles For Employee Outcomes Across The Life-SpanPhuong NgoNoch keine Bewertungen

- Construction Project - Life Cycle PhasesDokument4 SeitenConstruction Project - Life Cycle Phasesaymanmomani2111Noch keine Bewertungen

- Probation Period ReportDokument17 SeitenProbation Period ReportMiranti Puspitasari0% (1)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Categorical SyllogismDokument3 SeitenCategorical SyllogismYan Lean DollisonNoch keine Bewertungen

- Entrepreneurial Capacity Building: A Study of Small and Medium Family-Owned Enterprisesin PakistanDokument3 SeitenEntrepreneurial Capacity Building: A Study of Small and Medium Family-Owned Enterprisesin PakistanMamoonaMeralAysunNoch keine Bewertungen

- WWW Ranker Com List Best-Isekai-Manga-Recommendations Ranker-AnimeDokument8 SeitenWWW Ranker Com List Best-Isekai-Manga-Recommendations Ranker-AnimeDestiny EasonNoch keine Bewertungen

- Naval TV SystemDokument24 SeitenNaval TV Systemsharmasandeep0010Noch keine Bewertungen

- CIPD L5 EML LOL Wk3 v1.1Dokument19 SeitenCIPD L5 EML LOL Wk3 v1.1JulianNoch keine Bewertungen