Beruflich Dokumente

Kultur Dokumente

IATA Economic Performance of The Industry Mid Year 2018 Report Final v1

Hochgeladen von

jadwongscribdOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

IATA Economic Performance of The Industry Mid Year 2018 Report Final v1

Hochgeladen von

jadwongscribdCopyright:

Verfügbare Formate

ECONOMIC PERFORMANCE OF THE AIRLINE INDUSTRY

This semi-annual report takes a broad look at how the airline industry is adding value for its consumers, the wider economy and

governments, as well as for its investors.

KEY POINTS

Consumers benefit from lower real travel costs, more routes, and will spend 1% of world GDP on air transport in 2018.

Economic development is a big winner from the doubling of city pairs and halving of air transport costs over the past 20 years.

Governments gain substantially from $133bn of tax in 2018 and from over 70 million ‘supply chain’ jobs.

Stronger economic growth is pushing traffic ahead of capacity growth, but breakeven loads rising as unit costs grow significantly.

Equity owners see further gains in 2018; industry ROIC falls from record 2016 levels, but remains above the cost of capital.

Credit metrics in 2018 not quite as good as 2017, but free cash flow yield is positive and balance sheet metrics are stable.

Jobs in the industry should exceed 2.8 million, and GVA/employee is over $100,000, but unit labour costs are accelerating.

N American airlines perform best with a forecast 5.8% net post-tax profit margin in 2018. Africa is the weakest with a 1% loss.

Note: extensive revisions and full year data for 2017 have caused significant changes to a number of the historic data series in this report.

CONSUMERS

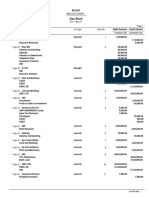

Consumers will see a substantial increase in the value they Worldwide airline Industry 2016 2017 2018F

derive from air transport in 2018, including stability in what Spend on air transport*, $billion 740 787 871

they pay airlines, after allowing for inflation. New destinations % change over year -1.6% 6.3% 10.7%

are forecast to rise further this year, with frequencies up too; % global GDP 0.9% 1.0% 1.0%

both boosting consumer benefits. We expect 1% of world GDP Return fare, $/pax. (2018$) 394 380 380

to be spent on air transport in 2018, totaling $871 billion. RPKs, Compared to 1998 -57% -59% -59%

which have been growing well above trend helped by the Freight rate, $/kg (2018$) 1.68 1.76 1.80

economic upturn, are forecast to remain strong in 2018 as Compared to 1998 -66% -64% -63%

stronger economic growth partly offsets the drag from the rise Passenger departures, million 3,815 4,093 4,358

in oil prices. Falling travel costs have been adding several % % change over year 7.0% 7.3% 6.5%

points to RPK growth over the past several years. The average RPKs, billion 7173 7754 8295

return fare (before surcharges and tax) of $380 in 2018 is % change over year 7.4% 8.1% 7.0%

forecast to be 59% lower than in 1998, after adjusting for FTKs, million 232 254 265

inflation. % change over year 3.6% 9.7% 4.0%

World GDP growth, % 2.5% 3.2% 3.4%

World trade growth, % 2.2% 5.4% 5.3%

IATA survey of airline CFOs and heads of cargo

120 Note: RPK = Revenue Passenger Km, FTK = Freight & mail Tonne Km, y-o-y = year

Passenger services growth on year change. GVA = Gross Valued Added (firm-level GDP). *Airline revenue +

expected in the next 12 months indirect taxes. Sources: IATA, ICAO, OE, Neth CPB, PaxIS, CargoIS.

100

Airline CFOs and heads of cargo reported in April that they

50 = no change

80

were very positive about future growth in air travel, and were

60

Cargo services growth

also positive about cargo. This reflects a more general

expected in the next 12 optimism amongst business worldwide about economic

40 months

prospects. Consumer confidence has risen too. Despite the

20 threats of trade war, the easing in fiscal policy as well as still

0

loose monetary policy has producing stronger economic

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 growth and a cyclical revival in world trade.

www.iata.org/economics │ 2018 Mid-year report 1

WIDER ECONOMY

Economic development worldwide is getting a significant boost Worldwide airline Industry 2016 2017 2018F

from air transport. This wider economic benefit is being Unique city pairs 18691 20032 21314

generated by increasing connections between cities - enabling Compared to 1998 82% 95% 108%

the flow of goods, people, capital, technology and ideas - and Transport cost, US$/RTK (2018$) 83.5 79.5 80.3

falling air transport costs. The number of unique city-pair Compared to 1998 -51% -53% -53%

connections is forecast to have exceed 21,000 this year, more Value of trade carried, $billion 5,480 6,060 6,863

than double the connectivity by air twenty years ago. The price % change over year -2.9% 10.6% 13.2%

of air transport for users continues to fall, after adjusting for Value of tourism spend, $billion 671 719 794

inflation. Compared to twenty years ago real transport costs % change over year 0.9% 7.2% 10.4%

have more than halved. Supply chain jobs, million 67.7 69.6 71.5

% change over year 4.1% 2.8% 2.8%

Unique city-pairs and real transport costs

4.00

Supply chain GVA, $ trillion 3.0 3.1 3.3

21000 % change over year 5.9% 4.6% 4.6%

Unique city-pairs

3.50

Number of unique city-pairs

18000 Note: RTK = Revenue Tonne Kilometers, GVA = Gross Value Added. The total

US$/RTK in 2014US$

3.00 number of ‘routes’ or airport pairs is much higher because of multiple airports

15000

in some cities and connections are counted both ways. City-pairs: jets + turbo-

12000 2.50 props larger than 19 seats, at least 1 flight a week; from SRS Analyzer database.

Supply chain jobs and GVA from ATAG 2016 report appendix.

9000 2.00

Air transport is vital for manufactures trade, particularly trade

Real transport costs

6000 1.50 in components which is a major part of cross border trade

3000 1.00 today. We forecast that the value of international trade

0 0.50

shipped by air this year will be $6.9 trillion. Tourists travelling

1995 1999 2003 2007 2011 2015 by air in 2018 are forecast to spend $794 billion.

Another impact on the wider economy comes through the

Lower transport costs and improving connectivity have influence increased airline activity has on jobs in the sector, in

boosted trade flows; trade itself has resulted from globalizing its supply chain, and the jobs generated as spending ripples

supply chains and associated investment. through the economy. These ‘supply chain’ jobs around the

world are estimated to rise to over 70 million in 2018.

GOVERNMENT

Governments have also gained substantially from the good

Worldwide airline Industry 2016 2017 2018F

performance of the airline industry. Airlines and their

Tax revenues, $billion 117 123 133

customers are forecast to generate $133 billion in tax revenues

% change over year 3.1% 5.8% 7.8%

next year. That’s the equivalent of 45% of the industry’s GVA

% GVA 45.2% 45.4% 45.8%

(Gross Value Added, which is the firm-level equivalent to GDP),

# of ticket taxes 234 236 239

paid to governments in payroll, social security, corporate and

% of countries requiring full visas 58 58 58

product taxes (Note that charges for services are excluded). In

Note: GVA = Gross Value Added (firm-level GDP).

addition the industry continues to create high value added jobs. Source: IATA, Oxford Economics.

Tax revenues and global supply chain jobs supported

But in many countries the value that aviation generates is not

75 140

130

well understood. The commercial activities of the industry

70 Tax revenues

120 remain highly constrained by bilateral and other regulations.

65

110 Moreover, regulation is far from ‘smart’, leading to

60 100 unnecessarily high costs. Visa requirements discourage inbound

$ billion

Million

55 90 tourism and business travel. Encouragingly visa openness levels

Supply chain jobs

50 80

supported are improving. Unfortunately, the number of individual ticket

70

45 taxes is expected to rise to 239 this year, while the level of

60

40 50 many existing taxes continues to ratchet upwards.

35 40

Sources: IATA, ATAG, Oxford Economics, ICAO, SRS Analyser, UNWTO, WTO.

2000 2002 2004 2006 2008 2010 2012 2014 2016 2018

www.iata.org/economics │2018 Mid-year report 2

CAPITAL PROVIDERS

Debt providers to the airline industry are well rewarded for Worldwide airline Industry 2016 2017 2018F

their capital, usually invested with the security of a very mobile ROIC, % invested capital 9.7% 9.0% 8.5%

aircraft asset to back it. On average during previous business ROIC-WACC, % invested capital 3.0% 2.0% 0.9%

cycles the airline industry has been able to generate enough Investor value, $ billion 18.1 12.3 5.9

revenue to pay its suppliers’ bills and service its debt. Credit EBIT margin, % revenue 8.5% 7.5% 6.8%

metrics have improved with recent significant free cash flows, Net post-tax profits, $billion 34.2 38.0 33.8

particularly in North America, and a decline in debt ratios. % revenues 4.8% 5.0% 4.1%

$ per passenger 8.96 9.27 7.76

Until 2015 equity owners had not been rewarded adequately

Free cash flow, % invested capital 1.0% 1.3% 0.6%

for risking their capital in most years, except at a handful of

Adjusted net debt/EBITDAR 3.8 3.8 3.8

airlines. Investors should expect to earn at least the normal

Note: ROIC = Return on Invested Capital, WACC = Weighted Average Cost of

return generated by assets of a similar risk profile, the weighted Capital, EBIT = Earnings Before Interest and Tax. Debt adjusted for operating

leases. Current year or forward-looking industry financial assessments should

average cost of capital (WACC). Such has been the intensity of not be taken as reflecting the performance of individual airlines, which can

competition, and the challenges to doing business, that average differ significantly. Source: IATA, McKinsey, ICAO.

airline returns are rarely as high as the industry’s cost of capital. Return on capital invested in airlines

12.0

Equity investors have typically seen their capital shrink. But this

Return on capital

year we forecast the industry to generate a return on invested 10.0 (ROIC)

capital (ROIC) of 8.5%, which does, for the fourth consecutive

% of invested capital

8.0

year, adequately reward equity owners. On invested capital of

over $600 billion, the industry is forecast to generate $5.9 6.0

Cost of capital

billion of value for investors next year. But it should be clear

(WACC)

4.0

that $33.8 billion net profit, while exceptional for the airline

industry, is only a little higher than a ‘normal’ return for risking 2.0

their capital. Moreover, above-WACC returns have only started

0.0

to be generated outside North America in the past year or two

2000 2002 2004 2006 2008 2010 2012 2014 2016 2018

and are still not widespread across all regions. Breakeven and achieved load factor

The decline in airline margins and ROIC in 2018 is being driven 70

Achieved

by a rise in breakeven load factors, as unit costs are now rising, 68

offset partly by a rise in achieved load factors, as capacity slows

66

more than demand growth. Nevertheless, the level of

% ATKs

profitability is still the fourth highest on record; a soft-landing 64

brought about by changes to industry structure and behavior,

62

with much more focus on generating an adequate ROIC.

Breakeven

60

AIRCRAFT

58

This year commercial airlines are expected to take delivery of 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018

over 1,900 new aircraft, a substantial investment by the Aircraft deliveries and airline industry ROIC

2000 12

industry. The trend improvement in average returns (ROIC) has

1900

Airlines ROIC

given the industry the confidence to invest on this scale.

Number of aircraft delivered

1800 10

ROIC as % invested capital

Sustained high fuel costs had also made it economic to retire 1700

Aircraft deliveries

1600 8

older aircraft at a higher rate, but that effect has weakened. 1500

Around half of this year’s deliveries will replace existing fleet, 1400 6

1300

making a significant contribution to increasing fleet fuel

1200 4

efficiency, as described below. 1100

1000 2

900

Sources for charts on this page: IATA, ICAO, McKinsey, Ascend. 800 0

2000 2002 2004 2006 2008 2010 2012 2014 2016 2018

www.iata.org/economics │ 2018 Mid-year report 3

The fleet is forecast to increase by over 1000 aircraft to end this

Worldwide airline Industry 2016 2017 2018F

year at almost 30,000 aircraft; expansion continues as markets Aircraft fleet 27,417 28,429 29,614

have expanded strongly and the outlook remains positive. The % change over year 3.4% 3.7% 4.2%

average size of aircraft in the fleet is continuing to rise slowly. Available seats, million 3.9 4.1 4.4

So by the end of 2018 there will be around 4.4 million available % change over year 6.1% 5.2% 5.8%

seats. These seats are also being used more intensively, which Average aircraft size, seats 144 146 148

is critical for profitability in a capital intensive industry – and it % change over year 2.6% 1.5% 1.6%

also reduces environmental impact. Passenger load factors are Scheduled flights, million 35.4 36.8 39.0

expected to rise from 2017 levels to 81.7% on average in 2018. % change over year 4.2% 3.9% 5.8%

Aircraft are also being flown more intensively. The number of ASKs, % change over year 7.5% 6.7% 6.7%

scheduled aircraft departures is forecast to reach 39 million this Passenger load factor, % ASK 80.5% 81.5% 81.7%

year. That’s an average of 74 aircraft departing each minute of Freight load factor, % AFTK 46.9% 49.3% 49.4%

2018. Weight load factor, % ATK 67.7% 69.2% 69.3%

Breakeven load factor, % ATK 62.0% 64.0% 64.6%

Note: ASK = Available Seat Kilometers, AFTK = Available Freight Tonne Kilometers

ATK = Available Tonne Kilometers. Sources: Ascend, ICAO, IATA.

FUEL

This year we forecast the airlines fuel bill will rise to $188 Worldwide airline Industry 2016 2017 2018F

billion, which will represent 24.2% of average operating costs. Fuel spend, $billion 135 149 188

Jet fuel prices have continued to rise with oil prices and we % change over year -22.3% 10.3% 26.1%

base our forecast on an average price of $84/b this year, and % operating costs 20.8% 21.4% 24.2%

$70/b for the Brent crude oil price. The sharp rise in prices is Fuel use, billion litres 322 341 356

being driven by OPEC cuts, and the realization that inventories % change over year 5.3% 5.9% 4.4%

need to remain higher than before now that OPEC’s buffer role Fuel efficiency, litre fuel/100atk 22.9 22.9 22.5

has gone. The impact on the industry’s fuel bill was dampened % change over year -1.1% -0.2% -1.5%

last year and to some extent this year by the impacts of fuel CO2, million tonnes 811 859 897

hedging in one or two regions. % change over year 5.3% 5.9% 4.4%

Fuel price, $/barrel 52.1 66.7 84.0

% change over year -21.9% 28.0% 25.9%

Fuel efficiency and the price of jet fuel

% spread over oil price 16.8% 21.5% 20.0%

140 55

Upstream oil profits, $billion 12 14 16

120

Litres fuel used per 100 RTK

50 Note: ATK = Available Tonne Kilometers. Sources: Ascend, ICAO, IATA.

100

US$ per barrel

45 We forecast that fuel efficiency, in terms of capacity use i.e. per

80

ATK, will improve by 1.5% in 2018 as deliveries of new aircraft

60 Jet fuel price

40 grow and as fuel prices rise sharply. The annual average per

40 RTK fuel efficiency improvement from 2009-14 stands at 2.4%,

35

20 Fuel use/100 RTK versus the 1.5% industry target.

0 30 Continued fuel efficiency gains have partially decoupled CO2

2000 2002 2004 2006 2008 2010 2012 2014 2016 2018

emissions from expanding air transport services. Without the

Fuel is such a large cost that it focuses intense effort in the expected fuel efficiency gain this year, fuel burn and CO 2

industry to improve fuel efficiency, through replacing fleet with emissions would be 1.5% higher in 2018. That represents a

new aircraft, better operations and efforts to persuade saving of over 14 million tonnes of CO2, as well as saving on

governments to remove the airspace and airport inefficiencies fuel that would have cost the industry and its consumers an

that waste around 5% of fuel burn each year. additional $2.9 billion.

Sources for charts on this page: IATA, ICAO, Platts.

www.iata.org/economics │2018 Mid-year report 4

LABOUR

Airlines are expecting to accelerate hiring over the next twelve Worldwide airline Industry 2016 2017 2018

months, as capacity and traffic are expected to grow strongly, Labour costs, $ billion 159 171 185

after a dip in hiring expectations in the middle of 2016 . % change over year 5.4% 7.4% 8.3%

We estimate that total employment by airlines will exceed 2.8 Employment, million 2.70 2.79 2.89

million in 2018, a gain of 3.4% compared to 2017. Productivity % change over year 2.3% 3.3% 3.4%

is likely to slow a little, with the average employee generating Productivity, atk/employee 492,887 506,406 519,001

just under 520,000 ATKs a year, which is a 2.5% improvement % change over year 4.0% 2.7% 2.5%

over this year. Wages and jobs will rise as employees share the Unit labour cost, $/ATK 0.119 0.121 0.123

benefits of improved performance. However, having declined % change over year -1.0% 1.2% 2.2%

or been stable in recent years, unit labour costs are now rising GVA/employee, $ 95,530 97,409 100,670

% change over year 2.6% 2.0% 3.3%

significantly and we forecast an average rise of 2.2% in 2018.

Along with rising fuel costs this is one of the major Note: ATK = Available Tonne Kilometers, GVA = Gross Value Added (firm-level

contributions to the upward pressure on unit costs this year

The jobs being created are not just productive for their airline

and the squeeze on airline profit margins.

employers; they are also highly productive for the economies

IATA survey of airline CFOs in which they are employed. We estimate that the direct GVA

90

for national economies, generated by the average airline

80 Employment change expectations for employee, will rise 3.3% next year to over $100,000 a year,

70 the next 12 months

which is well above the economy-wide average. Additional jobs

50 = no change

60

in the airline sector will raise average levels of productivity in

50

an economy.

40

30

20

10

0

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

INFRASTRUCTURE

Infrastructure partners play an important role in the service The direct cost paid for using infrastructure has increasingly

airlines provide to their customers, affecting the experience, the been transferred to the passenger. Overall the cost of using

timeliness of the journey, and its cost. airport and ANSP infrastructure has risen steeply over the past

decade, partly because competitive pressures are very weak in

this part of the supply chain. This contrasts with the relatively

Unit cost of infrastructure & airline non-fuel expenses

170 limited rise in other non-fuel airline costs.

Cost/ATK indexed to equal 100 in 2000

160 Unit cost of infrastructure use

150

140

130

120

Airline non-fuel unit cost

110

100

90

2000 2002 2004 2006 2008 2010 2012 2014 2016 2018

Sources for charts on this page: ACI (aeronautical revenues), ICAO (en-route charges), Eurocontrol, IATA.

www.iata.org/economics │ 2018 Mid-year report 5

REGIONS

The strongest financial performance is being delivered by Worldwide airline Industry 2016 2017 2018F

airlines in North America. Net post-tax profits will be the Africa

Net post-tax profit, $billion -0.4 -0.1 -0.1

highest at $15 billion this year. That represents a net profit of

Per passenger, $ -4.66 -1.66 -1.55

$15.67 per passenger, which is a marked improvement from % revenue -3.3% -1.2% -1.0%

just 5 years earlier. Net margins, forecast at 5.8%, are down RPK growth, % 9.4% 7.0% 4.5%

from the previous 3 years, though not by much. The limited ASK growth, % 8.2% 3.5% 4.3%

Load factor, % ATK 57.5% 61.5% 61.5%

downside has been underpinned by consolidation, helping to

Breakeven load factor, % ATK 56.9% 60.1% 60.4%

sustain load factors (passenger + cargo) above 63%, and

Asia-Pacific

ancillaries, which limits the impact of higher fuel costs, keeping Net post-tax profit, $billion 7.4 10.1 8.2

breakeven load factors close to 57% next year. Per passenger, $ 5.49 6.82 5.10

% revenue 3.5% 4.5% 3.2%

Breakeven load factors are highest in Europe, caused by low RPK growth, % 10.9% 10.9% 9.5%

yields due to the competitive open aviation area, and high ASK growth, % 9.9% 9.1% 8.8%

regulatory costs. Growth in this region was damaged in 2016 by Load factor, % ATK 70.7% 72.4% 72.7%

terrorist attacks, but a rebound has been seen since. Net profits Breakeven load factor, % ATK 64.8% 67.7% 68.4%

Middle East

are forecast to rise to $8.6 billion this year representing $7.58 Net post-tax profit, $billion 1.3 1.0 1.3

per passenger and a margin of 4.1%. Per passenger, $ 6.39 4.81 5.89

% revenue 2.6% 2.0% 2.3%

Airlines in Asia-Pacific have very diverse performances. Average

RPK growth, % 11.3% 6.8% 5.9%

profit per passenger next year is forecast at $5.10 as higher fuel ASK growth, % 13.1% 6.7% 4.0%

costs are partly offset by improved cargo markets, particularly Load factor, % ATK 63.1% 64.0% 64.7%

important in this manufacturing region, helping to keep net Breakeven load factor, % ATK 61.7% 61.8% 62.7%

profits to $8.2 billion and net margins at 3.2%. Latin America

Net post-tax profit, $billion 0.4 0.5 0.9

Middle Eastern airlines have one of the lower breakeven load Per passenger, $ 1.39 1.57 2.95

factors. However, the region has been challenged by the impact % revenue 1.2% 1.3% 2.3%

RPK growth, % 4.5% 7.4% 6.5%

of low oil revenues and conflict leading to a sharp slowdown in

ASK growth, % 3.4% 5.5% 6.0%

capacity growth, forecast at 4% this year. Post-tax profits are Load factor, % ATK 65.4% 66.3% 66.8%

expected to recover a little to $1.3 billion in 2018, representing Breakeven load factor, % ATK 61.8% 61.7% 62.3%

a profit of $5.89 per passenger and a net margin of 2.3%. North America

Net post-tax profit, $billion 17.0 18.4 15.0

Latin American airlines have faced a harsh environment, with Per passenger, $ 18.67 19.56 15.67

weak home markets and currencies, but that is turning around % revenue 7.6% 7.7% 5.8%

and further recovery is expected in 2018. A net profit of $0.9 RPK growth, % 4.2% 3.9% 4.0%

ASK growth, % 4.6% 3.8% 4.4%

billion is forecast this year, following losses of $1.6 billion in

Load factor, % ATK 62.9% 63.8% 63.4%

2015 and profits of $0.5 billion last year. Breakeven load factor, % ATK 54.3% 56.7% 57.1%

Africa is the weakest region, as in the past 4 years. Losses have Europe

Net post-tax profit, $billion 8.5 8.1 8.6

shrunk as commodity prices rose and load factors improved. Per passenger, $ 8.56 7.53 7.58

Breakeven load factors are relatively low, as yields are a little % revenue 4.7% 4.3% 4.1%

higher than average and costs are lower. However, few airlines RPK growth, % 5.4% 9.1% 7.0%

in the region are able to achieve adequate load factors, which ASK growth, % 5.7% 6.7% 7.3%

Load factor, % ATK 72.5% 74.3% 74.0%

average the lowest globally at 61.5% in 2018. Performance is

Breakeven load factor, % ATK 68.1% 69.2% 69.3%

improving, but only slowly.

Note: RPK = Revenue Passenger Kilometers, ASK = Available Seat Kilometers,

4th June 2018 ATK = Available Tonne Kilometers. Current year or forward-looking industry

financial assessments should not be taken as reflecting the performance of

IATA Economics, economics@iata.org

individual airlines, which can differ significantly. Sources: ICAO, IATA.

Terms and Conditions for the use of this IATA Economics Report and its contents can be found at: www.iata.org/economics-terms

By using this IATA Economics Report and its contents in any manner, you agree that the IATA Economics Report Terms and Conditions apply to you

and agree to abide by them. If you do not accept these Terms and Conditions, do not use this report.

www.iata.org/economics │2018 Mid-year report 6

Das könnte Ihnen auch gefallen

- Report On The Landlord and Tenant Bill 2021Dokument72 SeitenReport On The Landlord and Tenant Bill 2021jadwongscribdNoch keine Bewertungen

- SPGS Tree Planting Guidelines For UgandaDokument295 SeitenSPGS Tree Planting Guidelines For Ugandajadwongscribd100% (1)

- SNV Expression of Interest 2021Dokument1 SeiteSNV Expression of Interest 2021jadwongscribdNoch keine Bewertungen

- Morocco Can Still Make It 19-06-1998Dokument1 SeiteMorocco Can Still Make It 19-06-1998jadwongscribdNoch keine Bewertungen

- UBOS Statistics About Tororo As at 26th January 2019Dokument18 SeitenUBOS Statistics About Tororo As at 26th January 2019jadwongscribdNoch keine Bewertungen

- National Social Security Fund (Amendment) Bill, 2019)Dokument20 SeitenNational Social Security Fund (Amendment) Bill, 2019)The Independent Magazine100% (1)

- UNRA Half Year Performance For Fy 2020-21Dokument17 SeitenUNRA Half Year Performance For Fy 2020-21jadwongscribdNoch keine Bewertungen

- KENNETH MATOVU WORLD CUP PREVIEW - Why France Will WinDokument1 SeiteKENNETH MATOVU WORLD CUP PREVIEW - Why France Will WinjadwongscribdNoch keine Bewertungen

- Uganda Response To EU Resolution 2021Dokument10 SeitenUganda Response To EU Resolution 2021jadwongscribd100% (1)

- Uganda 2021 Elections Afrobarometer PollDokument54 SeitenUganda 2021 Elections Afrobarometer PolljadwongscribdNoch keine Bewertungen

- UGANDA Voter Count by Polling Stations 2021Dokument1.446 SeitenUGANDA Voter Count by Polling Stations 2021jadwongscribdNoch keine Bewertungen

- KATALE Mayanja LC1 - Jomayi Est ROADS COMMITTEE 6 PROJECTSDokument1 SeiteKATALE Mayanja LC1 - Jomayi Est ROADS COMMITTEE 6 PROJECTSjadwongscribdNoch keine Bewertungen

- THE Back Ground To Uganda Budget 2020Dokument276 SeitenTHE Back Ground To Uganda Budget 2020jadwongscribdNoch keine Bewertungen

- WHO 2019 NCoV Vaccine Deployment 2020Dokument89 SeitenWHO 2019 NCoV Vaccine Deployment 2020jadwongscribdNoch keine Bewertungen

- Uganda Constitution Ch4Dokument14 SeitenUganda Constitution Ch4jadwongscribdNoch keine Bewertungen

- Speech by FDC Party President Amuriat Who Is Incoming Ipod ChairpersonDokument7 SeitenSpeech by FDC Party President Amuriat Who Is Incoming Ipod ChairpersonjadwongscribdNoch keine Bewertungen

- Uganda Economic Update 16th Edition - Investing in Uganda S YouthDokument84 SeitenUganda Economic Update 16th Edition - Investing in Uganda S YouthjadwongscribdNoch keine Bewertungen

- E-Conomy Africa 2020 - Africa's $180 Billion Internet Economy FutureDokument98 SeitenE-Conomy Africa 2020 - Africa's $180 Billion Internet Economy Futurejadwongscribd100% (1)

- Analysis Sample For TJCDokument20 SeitenAnalysis Sample For TJCjadwongscribdNoch keine Bewertungen

- Uganda NSSF Annual Report 2020Dokument246 SeitenUganda NSSF Annual Report 2020jadwongscribdNoch keine Bewertungen

- The Uganda Martyrs Day Program 2020Dokument24 SeitenThe Uganda Martyrs Day Program 2020jadwongscribd0% (2)

- UGANDA POLITICS - NRM Manifesto 2021-2026Dokument294 SeitenUGANDA POLITICS - NRM Manifesto 2021-2026jadwongscribdNoch keine Bewertungen

- Ministry of Education Manifesto Week May 2020Dokument115 SeitenMinistry of Education Manifesto Week May 2020jadwongscribdNoch keine Bewertungen

- Celebrating 20 Years of TACI and Kwar Adhola Foreword by Owor Jad AdrianDokument1 SeiteCelebrating 20 Years of TACI and Kwar Adhola Foreword by Owor Jad AdrianjadwongscribdNoch keine Bewertungen

- Uganda Annual Crime Report 2019 PublicDokument180 SeitenUganda Annual Crime Report 2019 PublicjadwongscribdNoch keine Bewertungen

- Kitabo Ri Fwonji Silim PIASCYDokument38 SeitenKitabo Ri Fwonji Silim PIASCYjadwongscribdNoch keine Bewertungen

- Uganda Annual Crime Report 2019 PublicDokument180 SeitenUganda Annual Crime Report 2019 PublicjadwongscribdNoch keine Bewertungen

- History and Customs of The Jopadhola, UgandaDokument91 SeitenHistory and Customs of The Jopadhola, Ugandajadwongscribd50% (2)

- Speech by Party President FDC Ipod ChairpersonDokument7 SeitenSpeech by Party President FDC Ipod ChairpersonjadwongscribdNoch keine Bewertungen

- The TACI Cabinet in 2019Dokument2 SeitenThe TACI Cabinet in 2019jadwongscribdNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- XXX QA KPI PerformanceDokument1 SeiteXXX QA KPI Performanceamin talibinNoch keine Bewertungen

- Accounting For Developers 101Dokument7 SeitenAccounting For Developers 101farkasdanNoch keine Bewertungen

- DocumentDokument7 SeitenDocumentajarnmichaelNoch keine Bewertungen

- AR Gapura Angkasa 2018Dokument222 SeitenAR Gapura Angkasa 2018Alexius SPNoch keine Bewertungen

- Wa0023.Dokument21 SeitenWa0023.Open Sky OpportunitiesNoch keine Bewertungen

- Work Order: Department: Hapag-Lloyd Guatemala S.A. Phone: +0 Order To: Interlogic Service DistributionDokument2 SeitenWork Order: Department: Hapag-Lloyd Guatemala S.A. Phone: +0 Order To: Interlogic Service DistributionAlex MarroquinNoch keine Bewertungen

- Prospectus of A CompanyDokument6 SeitenProspectus of A CompanyRayhan Saadique100% (1)

- Responsibilities ChitfundsDokument11 SeitenResponsibilities ChitfundsRanjith ARNoch keine Bewertungen

- Bill Ackman's Letter On General GrowthDokument8 SeitenBill Ackman's Letter On General GrowthZoe GallandNoch keine Bewertungen

- 1 SM IntroductionDokument15 Seiten1 SM IntroductionAurangzeb KhanNoch keine Bewertungen

- Application Form Application Form: Bologna Bologna November NovemberDokument4 SeitenApplication Form Application Form: Bologna Bologna November NovemberKiran MalviyaNoch keine Bewertungen

- Water ManagementDokument2 SeitenWater ManagementIwan PangestuNoch keine Bewertungen

- N12 - Atulya AhujaDokument3 SeitenN12 - Atulya Ahujaanushka kashyapNoch keine Bewertungen

- This Study Resource Was: Alfresco Marketing Practice Set - Teacher'S Manual Zenaida Vera Cruz Manuel, Bba, Cpa, MbaDokument9 SeitenThis Study Resource Was: Alfresco Marketing Practice Set - Teacher'S Manual Zenaida Vera Cruz Manuel, Bba, Cpa, MbaKim Flores100% (1)

- Oral Communication - Noise Barriers To CommunicationDokument24 SeitenOral Communication - Noise Barriers To Communicationvarshneyankit1Noch keine Bewertungen

- Nike From Concept To CustomerDokument9 SeitenNike From Concept To CustomerJigyasa GautamNoch keine Bewertungen

- Test Bank For Accounting Principles 12th Edition WeygandtDokument37 SeitenTest Bank For Accounting Principles 12th Edition Weygandtdupuisheavenz100% (13)

- Part B EnglsihDokument86 SeitenPart B EnglsihLiyana AzmanNoch keine Bewertungen

- Press Release (Florida) .03.03Dokument2 SeitenPress Release (Florida) .03.03Eric LechtzinNoch keine Bewertungen

- Esp Sales Executive Needs AnalysisDokument4 SeitenEsp Sales Executive Needs AnalysisChitra Dwi Rahmasari100% (1)

- Quizzes Property Combined Questions and AnswersDokument10 SeitenQuizzes Property Combined Questions and AnswersCars CarandangNoch keine Bewertungen

- Alex FINAL BREAKEVENDokument89 SeitenAlex FINAL BREAKEVENammi890Noch keine Bewertungen

- Day Book 2Dokument2 SeitenDay Book 2The ShiningNoch keine Bewertungen

- Suit for Specific Performance of Flat Sale AgreementDokument13 SeitenSuit for Specific Performance of Flat Sale Agreementyash50% (6)

- Bharti Realty Report - FinalDokument89 SeitenBharti Realty Report - FinalArnob G MazumdarNoch keine Bewertungen

- Andersen violated auditing standards in Enron auditDokument2 SeitenAndersen violated auditing standards in Enron auditJanelAlajasLeeNoch keine Bewertungen

- Claremont Courier 6.7.13Dokument40 SeitenClaremont Courier 6.7.13Claremont CourierNoch keine Bewertungen

- Restaurant Industry Award Ma000119 Pay GuideDokument64 SeitenRestaurant Industry Award Ma000119 Pay GuidestaktikaNoch keine Bewertungen

- Ocado Annotated PP 55 and 223Dokument166 SeitenOcado Annotated PP 55 and 223lexie lexieNoch keine Bewertungen

- Dir 3BDokument2 SeitenDir 3Banon_260967986Noch keine Bewertungen