Beruflich Dokumente

Kultur Dokumente

Tax1a Preliminary Exam

Hochgeladen von

Charmaine Pamintuan0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

160 Ansichten7 SeitenThe document discusses various concepts in taxation law based on a preliminary exam for a Tax 1A course. It includes 16 multiple choice questions covering topics like theories of taxation, tax code vs. GAAP, requirements for a valid BIR ruling, taxable income of government educational institutions, and characteristics of internal revenue laws.

Originalbeschreibung:

g

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThe document discusses various concepts in taxation law based on a preliminary exam for a Tax 1A course. It includes 16 multiple choice questions covering topics like theories of taxation, tax code vs. GAAP, requirements for a valid BIR ruling, taxable income of government educational institutions, and characteristics of internal revenue laws.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

160 Ansichten7 SeitenTax1a Preliminary Exam

Hochgeladen von

Charmaine PamintuanThe document discusses various concepts in taxation law based on a preliminary exam for a Tax 1A course. It includes 16 multiple choice questions covering topics like theories of taxation, tax code vs. GAAP, requirements for a valid BIR ruling, taxable income of government educational institutions, and characteristics of internal revenue laws.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 7

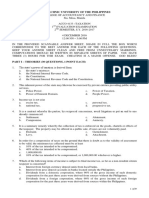

OUR LADY OF FATIMA UNIVERSITY subject to excise tax are produced or

Dela Paz Norte, City of San Fernando (P) kept.

COLLEGE OF BUSINESS AND ACCOUNTANCY

5. Which of the following statements is

Preliminary Exam in TAX 1A

Income Taxation wrong? A revenue bill:

a. May be recommended by the

President to Congress.

b. May have a House version and a

GENERAL INSTRUCTIONS: Shade the letter that Senate version approved separately

corresponds to your answer. STRICTLY NO and then consolidated with both

CHEATING. houses approving the consolidated

version.

c. May originate from the Senate and on

which same bill the House of

THEORIES: Representatives may propose

amendments.

1. Which of the following is not a scheme of

d. May originate from the House of

shifting the incidence of taxation?

Representatives and on which same

a. A manufacturer transfer tax to the

bill the Senate may propose

consumer by adding tax to the selling

amendments.

price of the goods sold.

6. This rule is not applicable on the

b. A tax forms part of the purchase price.

construction of tax laws.

c. Changing the terms of the sale like

a. If the law is repealed, taxes assessed

FOB shipping point in the Philippines

before repeal of the law may no longer

to FOB destination abroad, so that the

be collected.

title passes abroad instead of in the

b. If the intent of the tax is not clear as to

Philippines.

whether the taxpayer is covered by

d. The manufacturer transfers the sales

the tax obligation, the law shall be

tax to the distributor, then in turn to

construed against the government.

the wholesaler, in turn to the retailer,

c. Where the intent to tax is clear and the

and finally to the consumer.

taxpayer claims he is exempt from the

2. In case of conflict between the tax code

tax obligation, the tax shall be

and generally accepted accounting

construed against the taxpayer.

principles (GAAP):

d. Provisions intended for the security of

a. Both tax code and GAAP shall be

the taxpayer of to insure equality or

enforced.

uniformity of taxation are mandatory.

b. GAAP shall prevail over tax code.

7. Which of the following is not a purpose of

c. Tax code shall prevail over GAAP.

taxation?

d. The issue shall be resolved by the

a. To reduce inequalities of wealth.

courts.

b. As protective tariff on imported goods

3. What is required to make a BIR ruling first

to protect local producers against

impression a valid one, except?

foreign competitions.

a. Must be reasonable and within the

c. To encourage the growth of home

authority conferred.

industries through the proper use of

b. Must be germane to the purpose of the

tax incentives.

law.

d. To expropriate property for the

c. Must be published.

promotion of general welfare.

d. Must be prospective in application.

8. The following reasons may be given by a

4. Which of the following powers of the

taxpayer in refusing to pay his tax liability.

Commissioner of the Bureau of Internal

Which is not acceptable for legally refusing

Revenue may be delegated?

to pay the tax?

a. Enforcement of all forfeitures,

a. That he has been deprived of due

penalties, and fines in connection with

process of law.

the collection of national internal

b. That there is lack in territorial

revenue taxes.

jurisdiction.

b. The power to recommend the

c. That the prescription period for the

promulgation of rules and regulations

collection of tax has lapsed.

by the Secretary of Finance.

d. That he will derive no benefit from the

c. The power to issue rulings of first

tax.

impression of to reverse, revoke, of

9. The power to interpret the provisions of

modify any existing ruling of the

NIRC and other tax laws shall be under the

bureau.

exclusive and original jurisdiction of the:

d. The power to assign or reassign

a. The Commissioner of Internal

internal revenue officers to

Revenue, subject to the review by the

establishments where the articles

Secretary of Finance.

b. The Commissioner of Internal a. Its burden falls on those better to

Revenue, subject to the exclusive pay.

appellate jurisdiction of the Court of b. It is based on ability to pay.

Tax Appeals. c. It is based on benefits received.

c. The Court of Tax Appeals, subject to d. It is based on uniformity rule.

the exclusive appellate jurisdiction of 15. One of the characteristics of internal

the Court of Appeals. revenue laws is that they are:

d. The Regular Courts, subject to the a. Criminal in nature

review by the Court of Tax Appeals. b. Penal in nature

10. What is the rule on taxability of income c. Political in nature

that a government educational institution d. Generally prospective in

derives from its school operations? Such application.

income is: 16. Persons or things belonging to the same

a. Subject to 10% tax on its net taxable class shall be taxed at the same rate.

income as if it is a proprietary a. Simplicity in taxation

educational institution. b. Reciprocity in taxation

b. Exempt from income taxation if it is c. Equality in taxation

actually, directly, and exclusively used d. Uniformity in taxation

for educational purposes. 17. The tax should be proportional to the

c. Subject to the ordinary income tax relative value of the property to be taxed.

rates with respect to incomes derived a. Simplicity in taxation

from educational activities. b. Reciprocity in taxation

d. Exempt from income taxation in the c. Equality in taxation

same manner as government-owned d. Uniformity in taxation

and controlled corporations. 18. The tax imposed should be proportionate

11. Which statement below expresses the to the taxpayer’s ability to pay.

lifeblood theory? a. Fiscal adequacy

a. The assessed taxes must be b. Equality or theoretical justice

enforced by the government. c. Administrative feasibility

b. The underlying basis of taxation is d. Economic consisitency

government necessity for without 19. The sources of revenue as a whole, should

taxation, a government can be sufficient to meet the demands of public

neither exist nor endure. expenditures.

c. Taxation is an aribitrary method a. Fiscal adequacy

of exaction by those who are in b. Equality or theoretical justice

the seat of power. c. Administrative feasibility

d. The power of taxation is an d. Revenue generation

inherent power of the sovereign 20. The tax laws must be capable of

to impose burdens upon subjects convenient, just and effective

and objects “within its administration.

jurisdiction for the purpose of a. Fiscal adequacy

raising revenues?. b. Equality or theoretical justice

12. Which among the following concepts of c. Administrative feasibility

taxation is the basis for the situs of income d. Internal acceptability

taxation? 21. A law granting tax exemption requires

a. Lifeblood doctrine of taxation concurrence of:

b. Symbiotic relation in taxation a. Majority vote of the members of

c. Compensatory purpose of the Congress

taxation b. 2/3 vote of members of Congress

d. Sumptuary purpose of taxation c. ¾ vote of members of Congress

13. Which statement is wrong? d. Unanimous vote of members of

a. The power of taxation may be Congress

exercised by the government, its 22. Money collected from taxation shall not be

political subdivision, and public paid to any religious dignitary EXCEPT

utilities. when:

b. Generally, there is no limit on the a. The religious dignitary is assigned

amount of tax that may be to the Philippine Army.

imposed. b. It is paid by a local government

c. The money contributed as tax unit.

becomes part of the public funds. c. The payment is passed in audit by

d. The power of tax is subject to the COA.

certain constitutional limitations. d. It is part of a lawmaker’s pork

14. Taxation is equitable in all of the following, barrel.

except:

23. An escape from taxation where the tax Internal Revenue put under “preventive

burden is transferred by the one on whom embargo” said luxury items?

the tax is imposed or assessed to another. a. Yes, it is like constructive distraint.

a. Shifting b. Yes, because of anti-smuggling law.

b. Exemption c. No, violative of search and seizure

c. Transformation clause of the Constitution.

d. Capitalization d. No, violative of the due process clause

24. An escape from taxation where the of the Constitution.

producer or manufacturer pays the tax 33-34. The President of the Philippines and the

and endeavors to recoup such payment by Prime Minister of Japan entered into an

improving his process of production executive agreement of a loan facility to the

thereby turning out his units of products at Philippines from Japan whereby it is

a lower cost. stipulated that interest on loans granted by

a. Shifting private Japanese financial institutions to

b. Exemption private institutions in the Philippines shall

c. Transformation not be subject to Philippine income taxes. Is

d. Capitalization the tax exemption valid?

25. An escape from taxation where there is a. Yes, based on international comity.

areduction in the price of the taxed object b. Yes, based on executive agreements

equal to the capitalized value of future and treaties.

taxes which the taxpayer expects to be c. No, it is a violation of essential

called upon to pay. characteristics of taxation.

a. Shifting d. No, based on the doctrine of

b. Exemption territoriality.

c. Transformation 35-36. In a loan agreement between the Bangko

d. Capitalization Sentral ng Pilipinas (as borrower) and

26. A use of illegal or fraudulent means to private international banks (as lenders), it is

avoid of defeat the payment of tax. stipulated that all payments of interest by

a. Shifting the Central Bank to the lenders shall be made

b. Exemption free and clear from all Philippine taxes which

c. Avoidance may be imposed thereon. Is the stipulation

d. Evasion valid?

27. The use of legal or permissible means to a. Yes, based on international comity.

minimize or avoid taxes. b. Yes, based on the doctrine of non-

a. Shifting taxability of the government.

b. Exemption c. No, violative of the inherent

c. Avoidance limitations.

d. Evasion d. No, violative of the constitutional

28. Tax based on a fixed percentage of the limitations.

amount of property, income or other basis 37-38. An internal revenue officer (IRO), having

to be taxed. been reliably informed from unimpeachable

a. Proportional source that articles subject to excise taxes

b. Regressive were kept in the house of Aasa entered said

c. Progressive house to look for and to seize the

d. Indirect aforementioned articles over the objection of

29. Tax where the rate decreases as the tax Aasa. Since said officer was not armed with a

base increases. search warrant, Aasa invoked the sanctity of

a. Proportional his home. Is the IRO’s actuation described

b. Regressive above sanctioned by law or not?

c. Progressive a. Yes, because of primary jurisdiction of

d. Indirect the BIR over excisable goods pursuant

30. Tax where the rate increases as the tax to the lifeblood doctrine.

base increases. b. Yes, the IRO is exempted from

a. Proportional obtaining a search and seizure

b. Regressive warrant.

c. Progressive c. No, violative of search and seizure

d. Indirect clause of the Constitution.

d. No, violative of the right to privacy and

SITUATIONAL PROBLEM ANALYSIS: abode.

31-32. A store in the Umasa market in Paasa City 39-40. XXX Corporation, an export oriented

was discovered by the BIR agents selling company, was able to secure a BIR ruling in

luxury items worth P500,000.00 suspected June 2005 that exempts from tax the

to have been smuggled into the country by importation of some of its raw materials. The

the storeowner. May the Commissioner of ruling is of first impression, which means the

interpretation made by the Commissioner of

Internal Revenue is one without established a. No, because laws are intended to be

precedents. Subsequently, however, the BIR prospective, not retroactive.

issued another ruling which in effect would b. No, the law is arbitrary in that it taxes

subject to tax such kind of importation. XXX income that has already been spent.

Corporation is concerned that said ruling c. Yes, since tax laws are the lifeblood of

may have a retroactive effect, which means the nation.

that all their importations done before the d. Yes, tax laws are an exception; they

issuance of the second ruling could be can be given retroactive effect.

subject to tax. May the BIR rulings be given 47-48. The municipality of San Isidro passed an

retroactive effect? ordinance imposing a tax on installation

a. No, BIR rulings are prospective in managers. At the time, there was only one

nature. installation manager in the municipality,

b. No, BIR rulings are not retroactive if thus, only he would be liable for the tax. Is the

they are prejudicial to the taxpayer. law constitutional?

c. Yes, tax exemptions should be a. It is unconstitutional because it clearly

interpreted strictly against the discriminates against this person.

taxpayer. b. It is unconstitutional for lack of legal

d. Yes, tax must favor the government’s basis.

power to collect its revenues. c. It is constitutional as it applies to all

41-42. The Local Government Code took effect on persons in that class.

January 1, 1002. PLDT’s legislative franchise d. It is constitutional because the power

was granted sometime before 1992. Its to tax is the power to destroy.

franchise provides that PLDT will only 49-50. In 2010, Mr. Paasa sent his sister Erika

pay3% franchise tax in lieu of all taxes. The $1,000 via telegraphic transfer through the

legislative franchises of Smart and Globe Bank of PI. The bank’s remittance clerk made

Telecoms were granted in1998. Their a mistake and credited Erika with

legislative franchise state that they will pay $1,000,000 which she promptly withdrew.

only 5% franchise tax in lieu of all taxes. The The bank demanded the return of the

Province of Zamboanga del Norte passed an mistakenly credited excess, but Erika

ordinance in 1997 that imposes a local refused. The BIR entered the picture and

franchise tax on all telecommunication investigated Erika. Would the BIR be correct

companies operating within the province. if it determines that Erika earned taxable

The tax is 50% of 1% of the gross annual income under these facts?

receipts of the preceding calendar year a. No, she had no income because she

based on the incoming receipts, or receipts has no right to the mistakenly credited

realized, within its territorial jurisdiction. Is funds.

the ordinance valid? b. Yes, income is income regardless of

a. No, the ordinance in effect resulted the source.

into double taxation. c. No, it was not her fault that the funds

b. No, the Local Government Code in excess of $1,000 were credited to

prevails over ordinances. her.

c. Yes, the local government units are d. No, the funds in excess of $1,000 were

empowered by the Constitution to in effect donated to her.

raise its own revenues. 51-52. Congress passed a sin tax law that

d. Yes, autonomy of Zamboanga del increased the tax rates on cigarettes by

Norte. 1,000%. The law was thought to be sufficient

43-44. Congress passed a law which granted tax to drive many cigarette companies out of

amnesty to those who have not paid their business, and was questioned in court by a

income taxes in 2010 but did not provide for cigarette company that would go out of

the refund to those who paid. Is the law business because it would not be able to pay

valid? the increased tax. The cigarette company is:

a. No, this will encourage taxpayers not a. Wrong because taxes are the lifeblood

to pay their taxes. of the government.

b. Yes, Congress has the sole discretion b. Wrong because the law recognizes

of determining whom to tax. that the power to tax is the power to

c. No, the grant of amnesty is the ive of destroy.

the President. c. Correct because no government can

d. Yes, Congress provided for valid deprive a person of his livelihood.

classification. d. Correct because Congress, in this case,

45-46. Congress passed a law imposing taxes on exceeded its power to tax.

income earned out of particular activity that 53-54. Mr. Malas sells shoes in Makati through a

was not previously taxed. The law, however, retail store. He pays VAT on his gross sales to

taxed incomes already earned within the the BIR and the municipal license tax based

fiscal year when the law took effect. Is the on the same gross sales to the City of Makati.

law valid? He comes to you for advice because he thinks

he is being subjected to double taxation. c. She had taxable income since she

What advice will you give him? made a profit.

a. Yes, there is double taxation and it is d. She had no taxable income since moral

oppressive. damages are compensatory.

b. The City of Makati does not have this

power For items 61-90: Choose your answers from the

c. Yes, there is double taxation and this following:

is illegal in the Philippines. Shade A if both statements are false.

d. Double taxation is allowed where one Shade B if statement 1 is false

is imposed by the national and statement 2 is true.

government and the other by the local Shade C if statement 1 is true

government. and statement 2 is false.

55-56. Pheleco is a power generation and Shade D if both statements are true.

distribution company operating mainly from

the City of Taguig. It owns electric poles 61. I. Taxation without representation is not

which it rents out to other companies that tyranny.

use pole such as telephone and cable II. In the exercise of taxation, the state can

companies. Taguig passed an ordinance tax anything at anytime and at any

imposing a fee equivalent to 1% of the amount.

annual rental for these poles. Pheleco 62. I. Taxation and power of eminent

questioned the legality of the ordinance on domain may be exercised

the ground that it imposes an income tax simultaneously.

which local government units are prohibited II. Taxation and police power may be

from imposing. Rule on validity of the exercised simultaneously.

ordinance: 63. I. Estate tax is a proportional tax.

a. The ordinance is void; the fee is based II. A progressive tax is a tax, the rate of

on rental income and is therefore a tax which is directly proportional to tax base.

on income. 64. I. All of our tax laws are statutory laws.

b. The ordinance is valid as a legitimate II. The non-impairment clause is a

exercise of police power to regulate statutory law on taxation.

electric poles. 65. I. An excise tax is also called privilege

c. The ordinance is void; 1% of annual tax.

rental is excessive and oppressive. II. A tax which is neither personal nor

d. The ordinance is valid; an LGU may property, is an excise tax.

impose tax on income. 66. I. Non-payment of tax makes the

57-58. RAF Corporation secured an income tax business illegal.

holiday for 5 years as a pioneer industry. On II. The non-payment of license fee makes

the fourth year of the tax holiday, RAF the business illegal.

Corporation declared and paid cash 67. I. Provisions in the Philippine

dividends to its stockholders, all of whom are Constitution on taxation are grants of

individuals. Are the dividends taxable? power.

a. The dividends are taxable, the tax II. Due process of law in taxation in the

exemption of RAF Corporation does Constitution is a grant of power.

not extend to its stockholders. 68. I. Margin fee is a tax.

b. The dividends are tax-exempt because II. Custom’s duty is a tax.

of RAF Corporation’s income tax 69. I. The RDO is known as the alter ego of

holiday. the BIR Commissioner.

c. The dividends are taxable if they II. The BIR Commissioner is directly under

exceeded 50% of RAF Corporation’s the President’s Office.

retained earnings. 70. I. Territoriality is one of the

d. The dividends are exempt if paid constitutional limitations on the power

before the end of RAF Corporation of taxation.

fiscal year. II. International comity is an inherent

59-60. Dina Gaganda sued Dino Titino for breach limitation in taxation.

of promise to marry. Dino lost the case and 71. I. A person cannot be imprisoned for

duly paid the court’s award that included non-payment of property tax.

among others, Php100,000 as moral II. A law may be passed violating

damages for mental anguish Dina suffered. uniformity of taxation.

Did Dina earn a taxable income? 72. I. Taxes may be used for sectarian

a. She had a taxable income of P100,000 purposes if allowed by an ordinance.

since income is income from whatever II. The President can refuse to implement

source. a tax law if it appears to be

b. She had no taxable income because it unconstitutional.

was a donation. 73. I. A tax is based on law while debt is

based on contract.

II. A tax is also a custom’s duty. 88. I. To be exempt from taxation under the

74. I. There can be double taxation in the Constitution land and buildings must be

Philippines. exclusively and actually used for

II. Double taxation is illegal if it violates the religious, educational, or charitable

uniformity of taxation. purpose, even if not directly.

75. I. There can only be a tax if there is a law II. Exemptions of non-profit schools are

imposing the tax. only limited to revenue and assets derived

II. The power to tax is inherent. from strictly school operations.

76. I. A progressive system of taxation 89. I. Real property is subject to taxation in

means a tax structure where the tax base the place in which it is situated

increases as the tax rate increases. regardless of whether the owner is a

II. Tax exemption is a grant of immunity to resident or a non-resident therein.

a particular taxpayer from where others II. As far as personal property is

are obliged to pay. concerned. The ancient rule of mobilia

77. I. A state has the power to tax even if not sequntur personam applies. This means

granted by the Constitution. that the thing follows the law of the owner

II. A state cannot exercise police power if thereof.

not granted by the Constitution. 90. I. The property taken in police power is

78. I. Tax avoidance is a form of tax escape. destroyed while the property taken

II. Tax evasion is not punishable. under the power of eminent domain and

79. I. Imposition of taxes is a legislative act. power of taxation are not destroyed.

II. Collection of taxes is an administrative II. In power of taxation, the compensation

act. received is the protection afforded to the

80. I. A tax may include the power to citizens; in police power the compensation

destroy. received is the altruistic feeling that

II. A tax may be imposed violating somehow you contributed to the

uniformity of taxation. promotion of the general welfare; in

81. I. A license fee is a charged imposed power of eminent domain, the

under the police power of the state. compensation received is the just

II. Penalty is imposed by the state only. compensation paid for the property taken.

82. I. A tax may be subjected to set-off or

compensation. IDENTIFICATION:

II. A tax ordinarily includes interest. For items 91 – 95:

83. I. One of the essential characteristics of a A. Basis of taxation

tax is it is unlimited in amount. B. Theory of taxation

II. A tax is generally unlimited because it is C. Scope of taxation

based on the needs of the state. D. Situs of taxation

84. I. A tax bill may embrace more than one E. Aspects of taxation

subject.

II. Non-payment of a tax cannot result to 91. The levying or imposition of tax, and the

criminal liability on the part of the collection of the tax are processes which

taxpayer, only civil liability. constitute the taxation system.

85. I. A person may refuse to pay a tax on the 92. It literally means “place of taxation”; the

ground that he receives no personal country that has the power and

benefit from it. jurisdiction to levy and collect the tax.

II. A taxpayer has a right to question illegal 93. The reciprocal duties of support and

expenditures of public funds. protection between the people and the

86. I. The power of taxation is inherent in government.

sovereignty being essential to the 94. Subject to inherent and constitutional

existence of every government. Hence, limitations, the power of taxation is

even if not mentioned in the regarded as supreme, plenary,

Constitution the state can still exercise unlimited, and comprehensive.

the power. 95. The existence of the government is a

II. It is essentially a legislative function. necessity and that the state has the right

Even in the absence of any constitutional to compel all individuals and property

provision, taxation power falls to Congress within its limits to contribute.

as part of the general power of law-

making. For items 96 – 100:

87. I. Tax exemptions are strictly construed A. Direct tax

against the government. B. Capitation tax

II. When the law is not clear and there is C. Excise tax

doubt whether he is taxable or not, the D. Indirect tax

doubt shall be settled against the E. Property tax

government.

96. Tax which is demanded from one person Prepared by:

from one person in the expectation and

intention that he shall indemnify himself

at the expense of another. FRANCESCO RAFIEL A. MALLARI, CPA

97. Tax imposed upon the performance of FACULTY, Department of Accountancy

an act, the enjoyment of privilege, or the OLFU – Pampanga

engaging in an occupation.

98. Tax imposed on personal or real

Reviewed and Checked by:

property in proportion to its value or on

some other reasonable method of

apportionment. ALEND KERSEY Q. SAMPANG, CPA

99. Tax which is demanded from the person OIC – Department of Accountancy

whom the law intends to pay it. OLFU – Pampanga

100. Tax of a fixed amount imposed

upon all persons residing within a

specified territory without regard to

their property or occupation they may Approved by:

be engaged in.

Dr. IGNACIO C. CORDOVA Jr.

For items 101 – 105:

Dean – College of Business and Accountancy

A. National tax OLFU

D. Local tax

101. Real property tax

102. Income tax

103. Donor’s tax

104. Occupation tax

105. Estate tax

For items 106 – 120:

A. Tax

B. License

C. Special Assessment

D. Debt

E. Toll

106. Not assignable

107. Compensation charged by the

owner for the voluntary use of the

property or improvements

108. May be based on income or on the

value of the property

109. Based wholly on benefits

110. Not subject to the limitations on

taxation

111. Based on contract

112. Demand of ownership or

proprietorship

113. Exceptional both as to time and

locality

114. Payable in money, property, or

services

115. Subject to constitutional and

inherent limitations

116. Limited to the cost of regulation

117. Imposed only on property which

benefit from the improvement

118. Interest is enforced if stipulated

or if the payment is in delay

119. Largely based on the cost of the

property used, or on the cost of the

improvement used

120. Due to the government in its

sovereign capacity

Das könnte Ihnen auch gefallen

- Exercises On General Principles of TaxationDokument9 SeitenExercises On General Principles of TaxationMicah Amethyst TaguibaoNoch keine Bewertungen

- RFBTDokument34 SeitenRFBTpanicNoch keine Bewertungen

- Quizzes in Taxn 1000Dokument32 SeitenQuizzes in Taxn 1000LAIJANIE CLAIRE ALVAREZNoch keine Bewertungen

- Vat Bar ExamDokument4 SeitenVat Bar Examblue_blue_blue_blue_blueNoch keine Bewertungen

- CONSENT TO PROCESS INFORMATION - Principal - Corporate RevDokument1 SeiteCONSENT TO PROCESS INFORMATION - Principal - Corporate RevAdonis Zoleta AranilloNoch keine Bewertungen

- Income Taxation Compressed SummaryDokument190 SeitenIncome Taxation Compressed SummaryYvette RufoNoch keine Bewertungen

- 008 Francia v. IACDokument2 Seiten008 Francia v. IACLoren Bea TulalianNoch keine Bewertungen

- Tax2 TRAIN 8.5x13Dokument64 SeitenTax2 TRAIN 8.5x13Kim EstalNoch keine Bewertungen

- Tax Syllabus 2019Dokument6 SeitenTax Syllabus 2019Diding BorromeoNoch keine Bewertungen

- Common-Taxes - Income-Tax VAT OPT WT v2Dokument52 SeitenCommon-Taxes - Income-Tax VAT OPT WT v2kayelineNoch keine Bewertungen

- Income Taxation Finals ReviewerDokument10 SeitenIncome Taxation Finals ReviewerMichael SanchezNoch keine Bewertungen

- MCQDokument4 SeitenMCQJuna LinNoch keine Bewertungen

- Notes in TaxDokument50 SeitenNotes in TaxGeorge Ryan ZalanNoch keine Bewertungen

- Tax NotesDokument10 SeitenTax Notescmv mendozaNoch keine Bewertungen

- Attestation Annulment2Dokument1 SeiteAttestation Annulment2Benly BergonioNoch keine Bewertungen

- Tax Full CasesDokument189 SeitenTax Full CasesJuralexNoch keine Bewertungen

- Minimum Corporate Income TAXDokument12 SeitenMinimum Corporate Income TAXAra Bianca InofreNoch keine Bewertungen

- The Usual Modes of Avoiding Occurrence of Double Taxation AreDokument8 SeitenThe Usual Modes of Avoiding Occurrence of Double Taxation AreGIRLNoch keine Bewertungen

- TaxDokument22 SeitenTaxalphecca_adolfo25Noch keine Bewertungen

- 2007 Pre-Week Guide in TaxationDokument29 Seiten2007 Pre-Week Guide in TaxationcasieNoch keine Bewertungen

- Auto Bus Transport V BautistaDokument5 SeitenAuto Bus Transport V Bautistacha chaNoch keine Bewertungen

- Excise TaxDokument15 SeitenExcise TaxQedew ErNoch keine Bewertungen

- Republic of The Philippines vs. Sandiganbayan 407 SCRA 10 (July 21,2003)Dokument66 SeitenRepublic of The Philippines vs. Sandiganbayan 407 SCRA 10 (July 21,2003)mjpjoreNoch keine Bewertungen

- TX10 Other Percentage TaxDokument16 SeitenTX10 Other Percentage TaxAnna AldaveNoch keine Bewertungen

- TRAIN Law PDFDokument124 SeitenTRAIN Law PDFKrizel BianoNoch keine Bewertungen

- Taxation I Atty. Francisco Gonzalez General Principles of TaxationDokument45 SeitenTaxation I Atty. Francisco Gonzalez General Principles of TaxationBea Czarina NavarroNoch keine Bewertungen

- 2013 Taxation Law Exam Essay QuestionsDokument10 Seiten2013 Taxation Law Exam Essay QuestionsAimed Eiram TanNoch keine Bewertungen

- Polytechnic University of The Philippines: ST NDDokument10 SeitenPolytechnic University of The Philippines: ST NDShania BuenaventuraNoch keine Bewertungen

- TAXATIONDokument12 SeitenTAXATIONGraceNoch keine Bewertungen

- Study Note 2Dokument54 SeitenStudy Note 2naga naveenNoch keine Bewertungen

- Income TaxationDokument18 SeitenIncome TaxationKwen Zel100% (1)

- Estate Tax PDFDokument13 SeitenEstate Tax PDFAlexis Jaina TinaanNoch keine Bewertungen

- Reaction Paper - Polsci ElanoDokument1 SeiteReaction Paper - Polsci ElanoLeri IsidroNoch keine Bewertungen

- Module 3 Income Tax On IndividualsDokument77 SeitenModule 3 Income Tax On IndividualsAriza CastroverdeNoch keine Bewertungen

- GROSS INCOME Inclusions and Exclusions: Tel. Nos. (043) 980-6659Dokument24 SeitenGROSS INCOME Inclusions and Exclusions: Tel. Nos. (043) 980-6659MaeNoch keine Bewertungen

- TAX Principles (THEORIES)Dokument13 SeitenTAX Principles (THEORIES)W-304-Bautista,PreciousNoch keine Bewertungen

- Fundamentals of Income Taxation: Focus Notes On TaxationDokument38 SeitenFundamentals of Income Taxation: Focus Notes On TaxationamiNoch keine Bewertungen

- RFBT Law On Private CorporationsDokument39 SeitenRFBT Law On Private CorporationsEunice Lyafe PanilagNoch keine Bewertungen

- HQ01 General Principles of TaxationDokument12 SeitenHQ01 General Principles of TaxationRenzo RamosNoch keine Bewertungen

- Gaston v. RepublicDokument10 SeitenGaston v. RepublicBliz100% (1)

- Jurisdiction of Cta Enbanc and DivisionDokument12 SeitenJurisdiction of Cta Enbanc and DivisionJune Karl CepidaNoch keine Bewertungen

- Income Taxation-FinalsDokument14 SeitenIncome Taxation-FinalsTheaNoch keine Bewertungen

- The Regular Corporate Income TaxDokument4 SeitenThe Regular Corporate Income TaxReniel Renz AterradoNoch keine Bewertungen

- Preliminary Examination in INCOME TAXATION: Accountancy DepartmentDokument6 SeitenPreliminary Examination in INCOME TAXATION: Accountancy DepartmentKenneth Bryan Tegerero TegioNoch keine Bewertungen

- Transpo Part 2 - IIDokument66 SeitenTranspo Part 2 - IIiris galecioNoch keine Bewertungen

- Revenue Memorandum Circular No. 35-06: June 21, 2006Dokument17 SeitenRevenue Memorandum Circular No. 35-06: June 21, 2006Kitty ReyesNoch keine Bewertungen

- Income Taxation (General Principles of Taxation)Dokument10 SeitenIncome Taxation (General Principles of Taxation)Isabelle HanNoch keine Bewertungen

- Estate Tax ReviewerDokument20 SeitenEstate Tax ReviewerEller-JedManalacMendozaNoch keine Bewertungen

- Taxation Review - General PrinciplesDokument6 SeitenTaxation Review - General PrinciplesKenneth Bryan Tegerero Tegio0% (1)

- Obligations and Contracts 1Dokument298 SeitenObligations and Contracts 1J'Carlo CarpioNoch keine Bewertungen

- Notes On Stock and StockholdersDokument19 SeitenNotes On Stock and Stockholderscharmagne cuevasNoch keine Bewertungen

- RFBT-MCQ-03-Law On PartnershipDokument10 SeitenRFBT-MCQ-03-Law On PartnershipmarinNoch keine Bewertungen

- Finals Tax 2 - Answer KeyDokument3 SeitenFinals Tax 2 - Answer KeyMarvin CeledioNoch keine Bewertungen

- Prescription of Bir'S Right To Assess: (BDB Law'S "Tax Law For Business" BusinessmirrorDokument2 SeitenPrescription of Bir'S Right To Assess: (BDB Law'S "Tax Law For Business" BusinessmirrorBobby Olavides SebastianNoch keine Bewertungen

- FYCE BM1804 - Income Taxation HandoutDokument17 SeitenFYCE BM1804 - Income Taxation HandoutLisanna DragneelNoch keine Bewertungen

- Taxation 1 I. Multiple Choice Questions (Two Points Each) DIRECTIONS: Choose The Letter of The CORRECT Answer. Strictly NO ERASURES AllowedDokument5 SeitenTaxation 1 I. Multiple Choice Questions (Two Points Each) DIRECTIONS: Choose The Letter of The CORRECT Answer. Strictly NO ERASURES AllowedleahabelloNoch keine Bewertungen

- Double TaxationDokument4 SeitenDouble TaxationLou Nonoi TanNoch keine Bewertungen

- Quiz 1 - General Principles and PoliciesDokument3 SeitenQuiz 1 - General Principles and PoliciesChel EscuetaNoch keine Bewertungen

- Q1 Gen PrinciplesDokument6 SeitenQ1 Gen PrinciplesPurpleKyla RosarioNoch keine Bewertungen

- Prelim On TaxationDokument8 SeitenPrelim On Taxationsittie asmin eliasNoch keine Bewertungen

- Criteria Points 4 3 2 1 Body Language Movements SeemedDokument3 SeitenCriteria Points 4 3 2 1 Body Language Movements SeemedCharmaine PamintuanNoch keine Bewertungen

- 4.0: Results and Discussion: Are You Satisfied With The Current System?Dokument10 Seiten4.0: Results and Discussion: Are You Satisfied With The Current System?Charmaine PamintuanNoch keine Bewertungen

- Assign Final Grade Student Grade: Students Grades Grade ParameterDokument1 SeiteAssign Final Grade Student Grade: Students Grades Grade ParameterCharmaine PamintuanNoch keine Bewertungen

- Year 2 Year 3: 1 2 3 4 1 2 Budgeted Unit Sales 40,000 60,000 100,000 50,000 70,000 80,000 oDokument2 SeitenYear 2 Year 3: 1 2 3 4 1 2 Budgeted Unit Sales 40,000 60,000 100,000 50,000 70,000 80,000 oCharmaine PamintuanNoch keine Bewertungen

- Cash AR Inventory Land Building and Equipment (Net) Investment in ILC CompanyDokument1 SeiteCash AR Inventory Land Building and Equipment (Net) Investment in ILC CompanyCharmaine PamintuanNoch keine Bewertungen

- The Authority Attaching To Philippine Standards Issued by The AASC Standards ApplicationDokument10 SeitenThe Authority Attaching To Philippine Standards Issued by The AASC Standards ApplicationCharmaine PamintuanNoch keine Bewertungen

- Templates-Forms For ResearchDokument4 SeitenTemplates-Forms For ResearchCharmaine PamintuanNoch keine Bewertungen

- App Iii Summer Midterm ExamDokument9 SeitenApp Iii Summer Midterm ExamCharmaine PamintuanNoch keine Bewertungen

- Improving Productivity & QualityDokument29 SeitenImproving Productivity & QualityCharmaine PamintuanNoch keine Bewertungen

- App III Summer Final ExamDokument7 SeitenApp III Summer Final ExamCharmaine PamintuanNoch keine Bewertungen

- Answers To Cost Accounting Chapter 8Dokument4 SeitenAnswers To Cost Accounting Chapter 8Raffy Roncales54% (13)

- Family TreeDokument1 SeiteFamily TreeCharmaine PamintuanNoch keine Bewertungen

- Elements of PoetryDokument40 SeitenElements of PoetryCharmaine PamintuanNoch keine Bewertungen

- The Postal History of ICAODokument1 SeiteThe Postal History of ICAO:Oshane :PetersNoch keine Bewertungen

- Vidyanali Not Reg SchoolsDokument62 SeitenVidyanali Not Reg SchoolssomunathayyaNoch keine Bewertungen

- PAPER1Dokument2 SeitenPAPER1Rajdeep BorgohainNoch keine Bewertungen

- 2008 Cheng Marginalized MasculinitiesDokument23 Seiten2008 Cheng Marginalized MasculinitiesCURSOGERALNoch keine Bewertungen

- Gender and MediaDokument21 SeitenGender and MediaDr. Nisanth.P.M100% (1)

- Dokumen - Pub The Impossibility of Motherhood Feminism Individualism and The Problem of Mothering 0415910234 9780415910231Dokument296 SeitenDokumen - Pub The Impossibility of Motherhood Feminism Individualism and The Problem of Mothering 0415910234 9780415910231rebecahurtadoacostaNoch keine Bewertungen

- Post Reform PeriodDokument26 SeitenPost Reform PeriodIshu ChopraNoch keine Bewertungen

- Voice of Freedom 96Dokument16 SeitenVoice of Freedom 96NoTwoLiesNoch keine Bewertungen

- SRC LUC Merdeka Day Celebration ProposalDokument21 SeitenSRC LUC Merdeka Day Celebration ProposalQamariah Ibrahim60% (5)

- Watershed Management PlanDokument9 SeitenWatershed Management Planapi-316015228100% (1)

- All Articles Listed Below by Week Are Available at UCSD Electronic ReservesDokument4 SeitenAll Articles Listed Below by Week Are Available at UCSD Electronic ReservesvictorvienNoch keine Bewertungen

- The Benedict Option As PreparationDokument7 SeitenThe Benedict Option As PreparationSunshine Frankenstein100% (1)

- National Congress of Unions in The Sugar Industry Vs FerrerDokument1 SeiteNational Congress of Unions in The Sugar Industry Vs FerrerMariz GalangNoch keine Bewertungen

- Althusser Contradiction and Over DeterminationDokument8 SeitenAlthusser Contradiction and Over DeterminationMatheus de BritoNoch keine Bewertungen

- Wickham. The Other Transition. From The Ancient World To FeudalismDokument34 SeitenWickham. The Other Transition. From The Ancient World To FeudalismMariano SchlezNoch keine Bewertungen

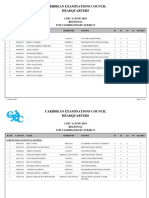

- Regionalmeritlistbysubject2019 Csec 191031164645 PDFDokument39 SeitenRegionalmeritlistbysubject2019 Csec 191031164645 PDFBradlee Singh100% (1)

- Lesson 1 Making Family Choices in A Changing SocietyDokument21 SeitenLesson 1 Making Family Choices in A Changing SocietyWally AlfecheNoch keine Bewertungen

- Misc SignalDokument74 SeitenMisc SignalAnonymous wbhG5IdmFNoch keine Bewertungen

- Law Thesis MaltaDokument4 SeitenLaw Thesis MaltaEssayHelperWashington100% (2)

- King Charles' Coronation TVDokument2 SeitenKing Charles' Coronation TV9LO JadziaNoch keine Bewertungen

- The Battle of BuxarDokument2 SeitenThe Battle of Buxarhajrah978Noch keine Bewertungen

- Emile Armand Anarchist Individualism and Amorous ComradeshipDokument84 SeitenEmile Armand Anarchist Individualism and Amorous ComradeshipRogerio Duarte Do Pateo Guarani KaiowáNoch keine Bewertungen

- Seperation of PowersDokument8 SeitenSeperation of PowersDhiman RoyalsNoch keine Bewertungen

- British Columbia Application For Change of NameDokument8 SeitenBritish Columbia Application For Change of NamecalebfriesenNoch keine Bewertungen

- Sample Certification LetterDokument3 SeitenSample Certification LetterNgan TuyNoch keine Bewertungen

- Updated Learning Modules in GeccomDokument83 SeitenUpdated Learning Modules in GeccomArielle AlontagaNoch keine Bewertungen

- DatuinMA (Activity #5 - NSTP 10)Dokument2 SeitenDatuinMA (Activity #5 - NSTP 10)Marc Alen Porlaje DatuinNoch keine Bewertungen

- The Jats of Northern India: Their Traditional Political SystemDokument4 SeitenThe Jats of Northern India: Their Traditional Political SystemSandeep BadoniNoch keine Bewertungen

- Part of Maria Bartiromo's DepositionDokument4 SeitenPart of Maria Bartiromo's DepositionMedia Matters for AmericaNoch keine Bewertungen

- The Role of Alliances in World War IDokument11 SeitenThe Role of Alliances in World War IDarien LoNoch keine Bewertungen