Beruflich Dokumente

Kultur Dokumente

20k MJ41PegasPS Portfolio

Hochgeladen von

maison6579Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

20k MJ41PegasPS Portfolio

Hochgeladen von

maison6579Copyright:

Verfügbare Formate

Striker Securities, Inc. (800) 669-8838 / (312) 987-0043 www.Striker.

com

Past performance is not indicative of future results. Trade only with risk capital.

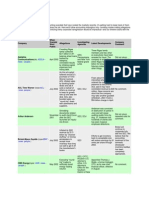

The $20,000 Portfolio Report

(MJ41 LH 1 unit, Pegas 1 CL 1 unit & PS ES 1 unit intraday/ swing Portfolio)

$20,000 Portfolio (Actual trading results, commissions & lease fees included)

Equity curve chart & Performance Tables

Important statistics $20k portfolio Equity Growth

(based on $20,000 initial capital)

Life Return (start 01/2017) 64.31% Portf olio (ending value: $32,863.05)

Max. Drawdown (m/m)* -21.74% $35,000.00

$30,000.00

Average Annual Return 51.45%

$25,000.00

$20,000.00

1.73

$15,000.00

Sharpe Ratio $10,000.00

$5,000.00

Sterling Ratio 1.62 $0.00

Nov, 2017

Jan, 2017

Jun, 2017

Jan, 2018

Jul, 2017

Feb, 2017

Mar, 2017

Apr, 2017

May, 2017

Oct, 2017

Feb, 2018

Mar, 2018

Aug, 2017

Sep, 2017

Dec, 2017

* month over month (closed equity)

Rates of return & dollar composition chart

Rates of Return Table

Simple

Jan, 2017 -13.23%

Feb, 2017 -8.51%

Mar, 2017 2.81%

Apr, 2017 8.89%

May, 2017 -8.67%

Jun, 2017 6.40% $5,000 $5,000

Jul, 2017 8.16%

9.19% MJ40 LH

Aug, 2017

Sep, 2017 19.58% Pegas 1 CL

Oct, 2017 12.72% PS ES

$10,000

Nov, 2017 5.55%

Dec, 2017 3.23%

Jan, 2018 7.52%

Feb, 2018 4.02%

Mar, 2018 6.63%

Life 64.31%

Call us for more information. (800)669-8838 / (312) 9870043

The CFTC requires the following disclosure statement in reference to results:

This trading system, like any other, may involve an inappropriate level of risk for prospective investors. THE RISK OF LOSS IN TRADING COMMODITY FUTURES AND OPTIONS CAN BE

SUBSTANTIAL AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prior to purchasing a trading system from this or any other system vendor or investing in a trading system with a

registered commodity trading representative, investors need to carefully consider whether such trading is suitable for them in light of their own specific financial condition. In some cases, futures

accounts are subject to substantial charges for commission, management, incentive or advisory fees. It may be necessary for accounts subject to these charges to make substantial trading profits to

avoid depletion or exhaustion of their assets. In addition, one should carefully study the accompanying prospectus, account forms, disclosure documents and/or risk disclosure statements required by

the CFTC or NFA, which are provided directly by the system vendor and/or CTA's.

The information contained in this report is provided with the objective of "standardizing" trading systems performance measurements, and it is intended for educational /informational purposes only.

All information is offered with the understanding that an investor considering purchasing or leasing a system must carry out his/her own research and due diligence in deciding whether to purchase

or lease any trading system noted within or without this report. Past performance is not necessarily indicative of future results. INTELLIGENT FINANCIAL MARKETS MAKES NO

ENDORSEMENT OF THIS OR ANY OTHER TRADING SYSTEM NOR WARRANTS ITS PERFORMANCE.

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Payment, Clearing and Settlement Systems in The United States (BIS)Dokument38 SeitenPayment, Clearing and Settlement Systems in The United States (BIS)Ji_y100% (2)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- ICT Monthly Mentorship: Study NotesDokument121 SeitenICT Monthly Mentorship: Study NotesEjide Omolara82% (17)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Senate Hearing, 111TH Congress - Financial Services and General Government Appropriations For Fiscal Year 2010Dokument238 SeitenSenate Hearing, 111TH Congress - Financial Services and General Government Appropriations For Fiscal Year 2010Scribd Government DocsNoch keine Bewertungen

- Using The COT Report To Trade The FX Market - Kevin BarryDokument69 SeitenUsing The COT Report To Trade The FX Market - Kevin BarryBảo Khánh100% (3)

- Virtual Currency As Crypto Collateral Under Article 9 of The UCCDokument38 SeitenVirtual Currency As Crypto Collateral Under Article 9 of The UCCCr CryptoNoch keine Bewertungen

- MTPredictor Trading Course - Part 2 (v6)Dokument179 SeitenMTPredictor Trading Course - Part 2 (v6)Sam Farizo50% (2)

- The Prime Brokerage Business PDFDokument20 SeitenThe Prime Brokerage Business PDFmart2xipecoNoch keine Bewertungen

- MTPredictor Trading Course Part 1 (180209) v6Dokument118 SeitenMTPredictor Trading Course Part 1 (180209) v6Sam Farizo100% (1)

- Price Action (Strat's Stress Free Trading) - ActiverDokument11 SeitenPrice Action (Strat's Stress Free Trading) - Activerrsousa1Noch keine Bewertungen

- Hedge Funds. A Basic OverviewDokument41 SeitenHedge Funds. A Basic OverviewBilal MalikNoch keine Bewertungen

- Bollinger Band Manual - Mark DeatonDokument31 SeitenBollinger Band Manual - Mark DeatonYagnesh Patel100% (2)

- BNY Mellon Resolution PlanDokument24 SeitenBNY Mellon Resolution PlanMohan ArumugamNoch keine Bewertungen

- The Financial System and The Economy - Éric Tymoigne PDFDokument258 SeitenThe Financial System and The Economy - Éric Tymoigne PDFAfonso d'EcclesiisNoch keine Bewertungen

- BitMEX Consent OrderDokument22 SeitenBitMEX Consent OrderMike McSweeneyNoch keine Bewertungen

- OCR Portal Client Quick Start Guide 7.12.2021Dokument17 SeitenOCR Portal Client Quick Start Guide 7.12.2021jangbaangNoch keine Bewertungen

- MFATADokument7 SeitenMFATARODRIGO TROCONISNoch keine Bewertungen

- Iron Ore: Product GuideDokument11 SeitenIron Ore: Product GuideAbdul SamadNoch keine Bewertungen

- CFTC and Jason AmadaDokument2 SeitenCFTC and Jason AmadaJason AmadaNoch keine Bewertungen

- 55 Ga LRev 499Dokument95 Seiten55 Ga LRev 499Shivam MishraNoch keine Bewertungen

- IECA ISDA DF Protocol Amendment (11!30!12)Dokument10 SeitenIECA ISDA DF Protocol Amendment (11!30!12)davidooNoch keine Bewertungen

- Tradovate Customer AgreementDokument17 SeitenTradovate Customer AgreementFORTUNE MAFUYANoch keine Bewertungen

- Report-Role of Derivative in Economic DevelopmentDokument22 SeitenReport-Role of Derivative in Economic DevelopmentKanika AnejaNoch keine Bewertungen

- Senate Hearing, 107TH Congress - Nomination Hearing For Phyllis K. Fong, Walter Lukken, Sharon Brown - Hruska and Douglas L. FloryDokument130 SeitenSenate Hearing, 107TH Congress - Nomination Hearing For Phyllis K. Fong, Walter Lukken, Sharon Brown - Hruska and Douglas L. FloryScribd Government DocsNoch keine Bewertungen

- The Corporate Scandal SheetDokument4 SeitenThe Corporate Scandal SheetAngelo LincoNoch keine Bewertungen

- 2020 CFTC Whistleblower Practice GuideDokument14 Seiten2020 CFTC Whistleblower Practice GuideBen TugendsteinNoch keine Bewertungen

- Stuart KaswellDokument12 SeitenStuart KaswellMarketsWikiNoch keine Bewertungen

- Chris Whalen On CDSDokument26 SeitenChris Whalen On CDSZerohedge100% (1)

- Is Bitcoin Money (And What That Means)Dokument24 SeitenIs Bitcoin Money (And What That Means)Iot SalineNoch keine Bewertungen

- LiborDokument28 SeitenLiborRupesh ShahNoch keine Bewertungen

- Oginsky v. Paragon Properties of Costa Rica Amended Class ActionDokument54 SeitenOginsky v. Paragon Properties of Costa Rica Amended Class ActionMatthew Seth SarelsonNoch keine Bewertungen