Beruflich Dokumente

Kultur Dokumente

Public Accounting

Hochgeladen von

Jil MacasaetCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Public Accounting

Hochgeladen von

Jil MacasaetCopyright:

Verfügbare Formate

1. What is public accounting?

Public accounting is a field of accounting where accountants offer

their services to the public for a fee, and are not limited to

working, as in an employer-employee relationship, for a single

business entity only. The services offered usually pertain to

bookkeeping, auditing, tax and financial planning.

2. What are the college programs that are required to become a public

accountant?

To become a public accountant in the Philippines, one must be a

holder of a degree of Bachelor of Science in Accountancy, as well as

a board passer of the CPA licensure examination given by the

Professional Regulation Commission.

3. What is auditing?

Auditing, as defined by the American Accounting Association, is “a

systematic process of objectively obtaining and evaluation

evidence regarding assertions about economic actions and events

to ascertain the degree of correspondence between these

assertions and established criteria and communicating the results

to interested users.”

Simply put, it is a process of assessing the degree by which the

statements and claims made by an entity regarding their financial

statements, operations or compliance with certain regulations

actually conform to the established criteria.

4. Why do we need to audit?

We need to audit for the following reasons:

-as regards financial statements audit, to lend credibility to and

enhance the value and usefulness of the financial statements

prepared by an entity;

-as regards compliance audit, to determine whether entities

comply with government rules and regulations

-as regards operational audit, to assess the performance and areas

of improvement of an entity

5. What are the types of auditing?

There are three major types of audit: financial statement audit,

compliance audit and operational audit.

Financial statement audit is conducted to determine whether the

financial statements of a company are fairly stated in accordance

with a financial reporting framework.

A compliance audit reviews the entity’s procedures, and

determines whether or not these comply with the recognized

regulations set by an authoritative body.

An operational audit, also known as performance or management

audit, studies a unit of an organization to measure its performance.

6. What are the types of auditor?

The types of auditor are external, internal or government auditors. They

are classified according to their affiliation with the entity being examined.

When auditors offer their professional services to different clients on a

contractual basis, they are called external auditors. Meanwhile, when auditors

are the entity’s own employees who appraise the internal controls and

performance of a company, they are considered internal auditors. Finally, when

an audit is conducted by government employees to determine whether there is

compliance with the law, they are known as government auditors.

6. How do you report an audit?

Usually, to complete an audit, written reports are extended by the auditor.

These reports contain the auditor’s opinion as to the relationship between

the assertions made and the corresponding criteria.

Das könnte Ihnen auch gefallen

- Affid of Occupancy (Tagalog)Dokument1 SeiteAffid of Occupancy (Tagalog)Jil MacasaetNoch keine Bewertungen

- Erlin OptionsDokument2 SeitenErlin OptionsJil MacasaetNoch keine Bewertungen

- Affidavit of UndertakingDokument2 SeitenAffidavit of UndertakingJil MacasaetNoch keine Bewertungen

- Affidavit OsmilloDokument1 SeiteAffidavit OsmilloJil MacasaetNoch keine Bewertungen

- Certificate of Good Standing - Teresita MacasaetDokument1 SeiteCertificate of Good Standing - Teresita MacasaetJil MacasaetNoch keine Bewertungen

- GuidelinesDokument2 SeitenGuidelinesJil MacasaetNoch keine Bewertungen

- Restatement SourcesDokument12 SeitenRestatement SourcesNeil RiveraNoch keine Bewertungen

- Motion To Release Confiscated ItemsDokument3 SeitenMotion To Release Confiscated ItemsJil MacasaetNoch keine Bewertungen

- Sworn Statement-Affidavit No Pending Admin Case or Criminal CaseDokument1 SeiteSworn Statement-Affidavit No Pending Admin Case or Criminal Caseangelo doceoNoch keine Bewertungen

- Secretary's Certificate for Renewable Energy Project RegistrationDokument1 SeiteSecretary's Certificate for Renewable Energy Project RegistrationAnne Marielle MendozaNoch keine Bewertungen

- Republic of The Philippines Municpal Trial Court in Cities Fourth Judicial RegionDokument2 SeitenRepublic of The Philippines Municpal Trial Court in Cities Fourth Judicial RegionJil MacasaetNoch keine Bewertungen

- Palencia Vs LingasanDokument2 SeitenPalencia Vs LingasanJil Macasaet100% (2)

- Persons 9.3.12Dokument14 SeitenPersons 9.3.12Jil MacasaetNoch keine Bewertungen

- Thesis Writing Guide From San BedaDokument8 SeitenThesis Writing Guide From San BedaAlen Joel PitaNoch keine Bewertungen

- 10? Cannot Use 10. Maybe Just Rent Fans?: Asking Nap o Ko Sa Fans. Update Ko Po Kayo. 8 UNITSDokument2 Seiten10? Cannot Use 10. Maybe Just Rent Fans?: Asking Nap o Ko Sa Fans. Update Ko Po Kayo. 8 UNITSJil MacasaetNoch keine Bewertungen

- Thesis Writing Guide From San BedaDokument8 SeitenThesis Writing Guide From San BedaAlen Joel PitaNoch keine Bewertungen

- The Law On Alternative Dispute Resolution: Private Justice in The PhilippinesDokument13 SeitenThe Law On Alternative Dispute Resolution: Private Justice in The PhilippinesJane Garcia-Comilang94% (18)

- Partnership Operations QuizDokument3 SeitenPartnership Operations QuizJil Macasaet50% (2)

- Draft Motion To Release Cash Bond 2 - Marlon GonzalesDokument2 SeitenDraft Motion To Release Cash Bond 2 - Marlon GonzalesJil Macasaet100% (2)

- Secretary's CertificateDokument1 SeiteSecretary's CertificateJil MacasaetNoch keine Bewertungen

- NCR CommentDokument7 SeitenNCR CommentJil MacasaetNoch keine Bewertungen

- CONSOLIDATED PUBLIC ATTORNEY%u2019S OFFICE LEGAL FORMS v1 - 0Dokument196 SeitenCONSOLIDATED PUBLIC ATTORNEY%u2019S OFFICE LEGAL FORMS v1 - 0ErrolJohnFaminianoFopalanNoch keine Bewertungen

- Engagement LetterDokument1 SeiteEngagement LetterJil MacasaetNoch keine Bewertungen

- Consti CasesDokument150 SeitenConsti CasesJil MacasaetNoch keine Bewertungen

- Petition for Custody and Equal Parental RightsDokument5 SeitenPetition for Custody and Equal Parental RightsJil Macasaet100% (1)

- Inter Tax FinalDokument4 SeitenInter Tax FinalJil Macasaet0% (1)

- 10 Bureaucy and Public Management in Democracy Development and Governance in The Philippines PDFDokument17 Seiten10 Bureaucy and Public Management in Democracy Development and Governance in The Philippines PDFJil MacasaetNoch keine Bewertungen

- Batching Plant - Management ContractingDokument4 SeitenBatching Plant - Management ContractingJil MacasaetNoch keine Bewertungen

- Terms AuditDokument8 SeitenTerms AuditJil MacasaetNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Product Placement in Movies- Impact on SalesDokument3 SeitenProduct Placement in Movies- Impact on SalesBhavya DiddeeNoch keine Bewertungen

- Automotive Relay PDFDokument3 SeitenAutomotive Relay PDFSimon MclennanNoch keine Bewertungen

- The CardiacDokument7 SeitenThe CardiacCake ManNoch keine Bewertungen

- Currency Exchnage FormatDokument1 SeiteCurrency Exchnage FormatSarvjeet SinghNoch keine Bewertungen

- Noor Hafifi Bin Jalal: Operating Code 1: Demand ForecastDokument47 SeitenNoor Hafifi Bin Jalal: Operating Code 1: Demand ForecastGopalakrishnan SekharanNoch keine Bewertungen

- Service ManualDokument14 SeitenService ManualOlegNoch keine Bewertungen

- Admission Form BA BSC Composite PDFDokument6 SeitenAdmission Form BA BSC Composite PDFKhurram ShahzadNoch keine Bewertungen

- Syllabus: Android Training Course: 1. JAVA ConceptsDokument6 SeitenSyllabus: Android Training Course: 1. JAVA ConceptsVenkata Rao GudeNoch keine Bewertungen

- BL ListDokument8 SeitenBL ListStraña Abigail Alonsabe Villacis100% (1)

- List of Steel Products Made in The UK PDFDokument120 SeitenList of Steel Products Made in The UK PDFAntonio MarrufoNoch keine Bewertungen

- Case Study Series by Afterschoool - The Great Hotels of BikanerDokument24 SeitenCase Study Series by Afterschoool - The Great Hotels of BikanerKNOWLEDGE CREATORSNoch keine Bewertungen

- Manual Cisco - DPC3925Dokument106 SeitenManual Cisco - DPC3925HábnerTeixeiraCostaNoch keine Bewertungen

- Lembar Kerja Lap Keu - Tahap 1Dokument4 SeitenLembar Kerja Lap Keu - Tahap 1Safana AuraNoch keine Bewertungen

- A Light Sculling Training Boat PDFDokument8 SeitenA Light Sculling Training Boat PDFLuis BraulinoNoch keine Bewertungen

- Strategies and Methods For Cloud MigrationDokument10 SeitenStrategies and Methods For Cloud MigrationVel_stNoch keine Bewertungen

- The NF and BNF Charts from the Trading RoomDokument23 SeitenThe NF and BNF Charts from the Trading RoomSinghRaviNoch keine Bewertungen

- High Performance, Low Cost Microprocessor (US Patent 5530890)Dokument49 SeitenHigh Performance, Low Cost Microprocessor (US Patent 5530890)PriorSmartNoch keine Bewertungen

- Volume Meters Models 962 and 963 Series CDokument8 SeitenVolume Meters Models 962 and 963 Series CVictor Edy Facundo DelzoNoch keine Bewertungen

- March 17, 2017 - Letter From Dave Brown and Megan McCarrin Re "Take Article Down" - IRISH ASSHOLES TODAY!Dokument459 SeitenMarch 17, 2017 - Letter From Dave Brown and Megan McCarrin Re "Take Article Down" - IRISH ASSHOLES TODAY!Stan J. CaterboneNoch keine Bewertungen

- Manual For Master Researchpproposal - ThesisDokument54 SeitenManual For Master Researchpproposal - ThesisTewfic Seid100% (3)

- 10 Questions About Independent ReadingDokument4 Seiten10 Questions About Independent ReadingdewiNoch keine Bewertungen

- The Minecraft Survival Quest ChallengeDokument4 SeitenThe Minecraft Survival Quest Challengeapi-269630780100% (1)

- SteroidsDokument2 SeitenSteroidsShawn FreemanNoch keine Bewertungen

- Alpacon Degreaser BIO GENDokument2 SeitenAlpacon Degreaser BIO GENFahmi Ali100% (1)

- PESU BTech Jan2017 6thsemCourseInfoDokument51 SeitenPESU BTech Jan2017 6thsemCourseInforakshithrajNoch keine Bewertungen

- Nothophytophthora Gen. Nov., A New Sister Genus of Phytophthora From Natural and Semi-Natural Ecosystems in Europe, Chile and VietnamDokument32 SeitenNothophytophthora Gen. Nov., A New Sister Genus of Phytophthora From Natural and Semi-Natural Ecosystems in Europe, Chile and VietnamChi Nguyen MinhNoch keine Bewertungen

- Gas Turbine MaintenanceDokument146 SeitenGas Turbine MaintenanceMamoun1969100% (8)

- Procurement of Railway Infrastructure Projects - ADokument15 SeitenProcurement of Railway Infrastructure Projects - ADan NanyumbaNoch keine Bewertungen

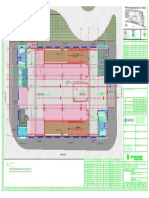

- Key plan and area statement comparison for multi-level car park (MLCPDokument1 SeiteKey plan and area statement comparison for multi-level car park (MLCP121715502003 BOLLEMPALLI BINDU SREE SATYANoch keine Bewertungen

- Next-Generation Widebody Conversion: in Service From 2017 ONWARDSDokument6 SeitenNext-Generation Widebody Conversion: in Service From 2017 ONWARDSAgusNoch keine Bewertungen